EVS reports first half 2024 results

Publication on August 13, 2024 at 18:30 CEST after market

closing

Regulated / Inside information

EVS Broadcast Equipment S.A.: Euronext Brussels (EVS.BR), Bloomberg

(EVS BB), Reuters (EVSB.BR)

EVS reports first half 2024 results

Liège, Belgium, August 13th, 2024 – Today EVS

(Euronext Brussels: EVS.BR; Bloomberg: EVS BB; Reuters: EVSB.BR)

announced results for the six-month period ended 30 June

20241.

Half year results confirm profitable growth ambition for

2024

The financial performance of the first semester

of 2024 confirms the growth track set out by EVS.

First half financial performance highlights

- Order intake of

EUR 87.0 million, including EUR 7.8 million for 2024 Big Event

Rental, demonstrating a growth of 7.1%. The overall pipeline for

the year is strong (+44%), supporting growth of order intake at

full year level, securing long-term growth perspectives.

- Revenue in the

first six months of the year amounts to EUR 98.1 million, growing

+12.2% YoY, including EUR 4.5 million Big Event Rental

revenue.

- Gross margin

performance remains strong at 71.9%, partly influenced by a change

in accounting treatment of internal assets (+1.2Pts vs. 1H23 post

adjustment).

- Net profit

amounts to EUR 21.8 million, leading to a diluted earnings per

share of EUR 1.54 (an improvement of EUR 0.02 compared to 1H23

results).

Outlook

- The secured

revenue for 2024 is at EUR 172.2 million at the end of June,

providing a solid base to confirm our growth ambition for the year

2024. Out of this total secured revenue number, EUR 14.4 million is

linked to Big Event Rental revenue.

- Based on the

secured revenue for 2024 and the solid pipeline, but also taking

into account the M&A transaction signed, the revenue guidance

is increased from an initial range of EUR 180-195 million to EUR

190-200 million.

- The long-term

order book - beyond 2024 - is growing to EUR 67.6 million, an

increase of EUR 14.9 million compared to the beginning of the year

2024.

- The full-year

EBIT guidance is increased from the initial range of EUR 38-45

million to EUR 40-46 million.

- Overall pipeline

is strong, growing by 44% compared to last year, and confirms our

ability to capture further growth in order intake in 2H24 as to

prepare the year 2025.

Key figures

| EUR millions, except

earnings per share expressed in EUR |

1H24 |

1H23 |

1H23 |

Variance |

| |

Reviewed |

Reviewed |

Adjusted (1) |

|

|

Revenue |

98.1 |

87.4 |

87.4 |

10.7 |

|

Gross profit |

70.6 |

61.2 |

61.8 |

8.8 |

|

Gross margin % |

71.9% |

70.1% |

70.7% |

+1.2 Pts |

|

Operating profit – EBIT |

23.9 |

25.0 |

25.0 |

-1.1 |

|

Operating margin – EBIT % |

24.3% |

28.6% |

28.6% |

-4.3 Pts |

|

Net profit (Group share) |

21.8 |

21.2 |

21.2 |

0.6 |

|

Fully diluted earnings per share (Group share) |

1.54 |

1.52 |

1.52 |

0.02 |

(1) Retrospective

adjustment related to the change in accounting policy on the

presentation of materials produced for internal purposes from

inventory to other tangible assets, to allow comparability with

1H24. See additional details in the Half-Year Financial Report

Comments

Serge Van Herck, CEO,

comments:

“I am proud to announce that 1H24 has marked

a new milestone for EVS, with revenues reaching a newhigh of EUR

98.1 million. Our net profit has further grown to EUR 21.8 million,

reflecting the continued success and execution of our PlayForward

strategy that focuses on profitable and sustainable growth.

Positive customer feedback on our latest solution launches like VIA

MAP, has significantly contributed to the expansion of our total

pipeline, reinforcing our confidence in achieving yet another

record-breaking year.

A notable highlight of this period is our

successful support of key customers in delivering major sporting

events earlier this year in Europe, contributing close to EUR 4.5

million to our Big Event Rental business. This achievement

underscores our capability to handle large-scale, high-profile

projects and further solidifies our reputation in the live

production industry. Additionally, we are proud to announce the

successful support and live production of another major

international sporting event in Europe during this summer viewed by

billions of people around the world, which will further boost our

Big Event Rental business in the second half of the year.

Our growth in H1 has been primarily driven

by the expansion of our Live Audience Business and Big Event

Rental. We are also pleased to see strong revenue growth in two of

our main markets, EMEA and NALA, which continue to drive our

overall business expansion.

Furthermore, our Generative AI solutions,

such as XtraMotion, are being increasingly utilized to enhance the

emotional impact of slow-motion replays. These advanced solutions

allow any type of broadcast camera to generate high-quality

slow-motion footage, adding a new dimension to the viewing

experience.

Our operational costs remain under control

and are mainly increasing due to inflation, the expansion of our

teams, and the depreciation of the capex investments we made over

the past two years to develop our VIA MAP solution. We are

committed to maintaining a balanced approach to cost management

while continuing to invest in key areas that drive our growth.

While we are optimistic about our long-term prospects, we recognize

the importance of being prudent in our financial and operational

planning. Our focus remains on profitable and sustainable growth,

ensuring operational efficiency, and maintaining a strong balance

sheet to weather any potential disruptions.

This remarkable performance would not have

been possible without the unwavering support of our customers, the

dedication of our team members, the crucial contributions of our

channel partners, and the expertise of EVS operators around the

world. Each of these actors plays a vital role in our

success.

Our recent announcement of the acquisition

of MOG Technologies and our investment in Tinkerlist, will help us

to further expand and support our future revenue

ambitions.

Given our robust performance in the first

half, we are confident that we will deliver a new revenue record

this year. Consequently, we are increasing our revenue guidance for

2024 to a range of EUR 190 million to EUR 200 million. This

optimistic outlook is a testament to the collective effort and

commitment of everyone involved in our journey.”

Commenting on the results and the

outlook, Veerle De Wit, CFO, said:

“The results of the

1st half of 2024 continue to underpin

our growth trajectory. We confirm our continued growth track and

this is reflected in our upgraded guidance.

We continue to optimize our financial

discipline by enhancing the transparency of our reporting. We have

implemented new ways of working, that will improve the comparison

of our financial data. In this context, we have implemented a new

accounting treatment to follow up on our internal assets and are

improving our reporting when it comes to project revenue (see

further comments).

Our gross profit evolution continues to be

balanced, with nearly all solutions gaining ground in terms of

profitability, demonstrating our ability to balance price

increases, taking into account macro-economic challenges.

Our costs demonstrate a growing pattern, but

are well controlled: we keep monitoring the balance of a company

with growing needs and profitability. Our growing cost base is

primarily invested in additional team members to ensure we capture

the opportunities we see in the market. Our cost base is also

influenced by the depreciation of past intangibles (IAS38), whilst

we are closely monitoring the return of these investments. After

the official commercial launch of the VIA-MAP on July

1st of 2024, we are currently

deploying the first on-air installations of this new solution. We

also identified multiple strategic must win opportunities, that we

will be working on over the next few months.

We have started the development of one new

intangible project, with a limited impact in 1H24 of EUR 0.5

million, linked to evolution of technology foundations balancing HW

with SW capabilities.

Finally, our balance sheet remains strong

with a very solid cash position and open receivables that

demonstrate a very sound composure in terms of current versus aged

receivables.

All these promising results lead to an

upgrade of our guidance both in revenue and EBIT: the revenue

guidance is set at EUR 190-200 million with an associated EBIT

guidance of EUR 40-46 million. The acquisition of MOG technology is

expected to contribute to our revenue performance in 4Q24 for

approximately EUR 0.9 million, with a neutral contribution at EBIT

level.”

Technology

EVS continues to further develop its 3 solutions

(LiveCeption, MediaCeption and MediaInfra) with continuous

improvements in terms of production efficiency and flexibility.

Beyond XTRAMOTION, EVS will present at IBC new

AI based effects that will be integrated as part of LiveCeption

workflows. Thanks to these effects (cinematic & zoom), the Live

Service Providers and the Live Audience Business customers will

enhance the images from any camera.

VIA-MAP is bridging the gap between production

and distribution: the workflows become more efficient and can be

more automated. MediaHub benefits from new advanced search

capabilities for the right-holders to retrieve faster the content

they are looking for, allowing optimal monetization of their

content.

MediaInfra proposes new capabilities in the form

of Neuron View and Neuron Bridge to increase the level of

flexibility. Thanks to a new Cerebrum module dedicated to resource

management, customers can better and dynamically manage their

resources as part of the workflows, again improving the overall

efficiency.

The new pricing model supported by XT-VIA makes

the replay server more relevant for budget productions at the same

time allowing full flexibility to use different tiers of the same

product later for a premium production.

Corporate topics

Earlier in August, EVS announced two

transactions that will strengthen the EVS solutions:

- acquisition of

100% of the shares of MOG Technologies – a Portugal based company

with around 50 highly skilled team members - renowned for its cloud

and SW digital media and video production tools. Thanks to this

acquisition, EVS will strengthen MediaCeption and MediaHub

solutions. EVS will also have access to a pool of highly skilled

talent and experts in the industry. The transaction closing still

requires formal confirmations in the coming months, and the

expected close date is set for 4Q24. MOG Technologies is expected

to contribute to our revenue performance in 4Q24.

- acquisition of a

minority stake position in the Belgian Company TinkerList, a

leading innovator in the media production industry, having

developed Cuez – the World’s First Cloud-Based Rundown Management

System – as a cutting-edge web application and automation system

designed to connect seamlessly with a wide variety of production

devices. TinkerList products will be enhancing the EVS Flexible

Control Room and MediaCeption solutions through a strategic

partnership in addition to the M&A transaction.

Beyond these M&A transactions, EVS continues

to broaden the number of technology partners in its ecosystem to

either ensure interoperability with 3rd-party systems or

to include new capabilities in its solutions to simplify the

operation of the ever more complex content factories.

EVS initiated a new evolution of its HW

technology foundations for mid-term smooth evolutions of its

products and solutions as a new IAS-38 intangible asset

project.

Supply chain of electronic components remains a

point of attention for the company, though the market is gradually

stabilizing, considering the evolutions of the economy and the

current geo-political tensions.

During the first part of the year, many EVS team

members have been involved in various kinds of support (development

of cutting-edge features, integration of 3rd-party

systems, Quality Assurance, project management, local support,

etc…) of the major summer events, helping the host broadcasters to

broadcast the best images, continuously creating return on

emotion.

In terms of governance, the leadership team has

evolved with strategic promotions for Quentin Grutman and Nicolas

Bourdon and the nomination of Oscar Teran, the 3 of them bringing a

wealth of experience and deep understanding of our industry to

deliver cutting-edge solutions and exceptional service to our

global customer base. The rational for the evolution of the

leadership team is to allow specific focus on strategic customer

relationships, whilst driving global sales and marketing, and

advancing product innovation.

Ecovadis, a renowned provider of business

sustainability ratings, has granted EVS a Silver medal in

acknowledgment of its top sustainability performance for the year

2023.

First half revenue

Revenue reached EUR 98.1 million in 1H24,

representing an increase of EUR 10.7 million or 12.2% compared to

1H23.

The impact of exchange rate conversions was

minimal, resulting in a growth of revenue at constant currency of

12.2% YoY. Taking out the seasonal impact of the Big Event Rental,

the growth of 1H24 was of 7.2%.

|

Revenue – EUR millions |

1H24 |

1H23 |

Variance |

|

Total reported |

98.1 |

87.4 |

12.2% |

|

Total at constant currency |

98.1 |

87.4 |

12.2% |

|

Total at constant currency and excluding Big Event

Rentals |

93.6 |

87.3 |

7.2% |

Currency fluctuations primarily impact EVS

revenues by the EUR/USD conversion, which can have a significant

impact on our results even if EUR/USD fluctuations also impact the

cost of our US operations and partially our cost of goods sold.

In the first half of the year, excluding Big

Event Rentals, LSP represented 48% of the revenue (56% in 1H23) and

LAB 52% (44% in 1H23). The trend demonstrated by this performance

is reflecting the long-term growth patterns laid out in our

PLAYForward strategic plan.

Geographically, revenues are distributed as

follows in 1H24 (excl. Big Event Rentals):

- Europe,

Middle East and Africa (EMEA): EUR 49.2 million (EUR 41.8

million in 1H23), growing 17.7% and reconfirming the strong growth

in the region.

- Americas

(NALA): EUR 34.1 million (EUR 28.6 million in 1H23),

growing 19.2% continuing the strong performance since multiple

quarters.

- Asia

& Pacific (APAC): EUR 10.3 million (EUR 17.0 million

in 1H23), decreasing -39.4%, impacted by the timing for the

completion of major customers projects in the Region (large order

delivered in 1H23 vs. similar project expected to be delivered in

2H24).

First half earnings

Consolidated gross margin was 71.9% for 1H24,

compared to 70.7% in 1H23. This increase is a combination of

changes in the presentation of certain elements, which were

previously included in our inventory and are now classified as

other tangible assets, an overall improvement in our Bill Of

Material cost and the fact that 2024 is a Big events rental year,

which has a positive impact on our consolidated gross margin.

Operating expenses increased by 23% YoY as a

consequence of investments in resources (+42 FTE on average) made

in the past 12 months as well as some transformation projects we

are running as a company. All these investments are done to support

our long term ambition. In addition to the impact related to team

members, the increase in operating expenses is explained by the

depreciation of internally developed intangible assets.

Furthermore, as 2024 is a Big events rental year, additional

expenses are required to support these events and ensure their

success.

In terms of intangible assets, EVS continues to

invest: a new intangible asset project was launched that should

fuel our future growth. This investment representsEUR 0.5 million

in 1H24. The projected spend is of EUR 5.9 million over a period of

3 years, with planned return on invest as of 2027.

The 1H24 EBIT margin remains strong at 24.3%,

compared to 28.5% in 1H23: the strong revenue performance is coming

with an increased cost base as a result of the hirings done over

the past 9 months. The balance remains strong though and is in line

with expectations.

Financial result in the period amounts to EUR

1.1 million, mainly driven by EUR/USD foreign exchange gains

realized and unrealized, interest revenue and valuation gains on

short term deposits, and interests on leases to customers,

partially offset by interest expenses mainly on office and car

leases.

Income taxes are at EUR 3.1 million, compared to

EUR 3.7 million last year: this decrease is driven by a reduction

in current tax expenses linked to the change in the Transfer

Pricing profile of our entity in the Netherlands, leading to a

decrease in its profit before taxes and current tax provision, and

by a reduction in the deferred tax expenses linked to the

consumption of the tax latencies from previous years in Belgium

over the last 3 years, resulting in a reduced amount of deferred

tax assets that can be utilized against future taxable profit

compared to the same period last year.

The group net profit amounted to EUR 21.8

million in 1H24, compared to EUR 21.2 million in 1H23. Fully

diluted earnings per share amounted to EUR 1.54 in 1H24,

compared to EUR 1.52 in 1H23.

Second half outlook

Based on the secured revenue on June 30, 2024 at

EUR 172.2 million (+8.5% growth compared to EUR 158.7 million last

year at the same date), and based on the strong profit performance,

we are confident to achieve our ambitions of profitable growth for

the year 2024.

The results of the first semester, together with

our perspectives for the following months, lead to an upgrade of

our revenue guidance from an initial range of EUR 180-195 million

towards a range EUR 190-200 million. At the same time, the EBIT

range is also reviewed towards EUR 40-46 million (compared to an

initial range of EUR 38-45 million)

Next to our progress on 2024, we also continue

to build the future. In addition to secured revenue for 2024, EVS

has secured a long-term order book worth EUR 67.6 million (EUR

+14.9 million compared to the situation at the beginning of the

year). Our pipeline is also promising, demonstrating a strong

growth and allowing us to continue increasing our order intake on

the full year basis.

Glossary

|

Term |

Definition |

|

Secured revenue |

Revenue already recognized as well as open orders on hand that will

be recognized as revenue in the fiscal year. |

|

Order book <date> |

Revenues planned to be recognized after the <date> based on

current orders. |

|

LAB market pillar |

LAB – Live Audience Business

Revenue from customers leveraging EVS products and solutions to

create content for their own purpose.

This market pillar covers the following types of customers:

Broadcasters, Stadium, House of Worship, Corporate Media Centers,

Sports organizations, Government & institutions, University

& Colleges. |

|

LSP market pillar |

LSP – Live Service Providers

Revenue from customers leveraging EVS products and solutions to

serve “LAB customers”

This market pillar covers the following types of customers: Rental

& facilities companies, Production companies, Freelance

operators, Technology partners & system integrators buying for

their own purpose. |

|

BER market pillar |

BER – Big Events Rental

Revenue from major non-yearly big events rental.

This market pillar covers the following types of customers: host

broadcasters for major events. |

|

Bill of material cost |

The bill of material cost includes all components and parts

required to produce the revenue. It does not include labor. |

|

Days of sales outstanding |

Days sales outstanding (DSO) is the average number of days it takes

a company to receive payment for a sale. |

|

Working capital |

Working capital, also known as net working capital (NWC), is the

difference between a company's current assets—such as cash,

accounts receivable/customers' unpaid bills, and inventories of raw

materials and finished goods—and its current liabilities, such as

accounts payable and debts. |

In case of discrepancies between the English and

the French Version, the English Version prevails.

Conference call

EVS will hold a conference call in English

tomorrow, August 14th 2024 at 10.00 am CET for financial

analysts and institutional investors. Other interested parties may

join the call in a listen-only mode. The presentation used during

the conference call will be available shortly before the call on

the EVS website.

Participants must register for the conference

using the link provided below. Upon registering, each participant

will be provided with Participant Dial In Numbers, Direct Event

Passcode and unique Registrant ID.

- Online

registration:

https://register.vevent.com/register/BIb5d20e576e17478f9c9f8342c104fde5

- Webcast Player

URL: https://edge.media-server.com/mmc/p/3hiwaw5v

Corporate Calendar

November

14th , 2024:

3Q24 Trading update (post market closing)

For more information, please contact:

Veerle De Wit, CFO*

EVS Broadcast Equipment S.A., Liege Science Park, 13 rue Bois

Saint-Jean, B-4102 Seraing, Belgium

Tel: +32 4 361 70 04. E-Mail:corpcom@evs.com; www.evs.com

* representing a SRL |

Forward Looking Statements

This press release contains forward-looking statements with respect

to the business, financial condition, and results of operations of

EVS and its affiliates. These statements are based on the current

expectations or beliefs of EVS's management and are subject to a

number of risks and uncertainties that could cause actual results

or performance of the Company to differ materially from those

contemplated in such forward-looking statements. These risks and

uncertainties relate to changes in technology and market

requirements, the company’s concentration on one industry, decline

in demand for the company’s products and those of its affiliates,

inability to timely develop and introduce new technologies,

products and applications, and loss of market share and pressure on

pricing resulting from competition which could cause the actual

results or performance of the company to differ materially from

those contemplated in such forward-looking statements. EVS

undertakes no obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events.

|

About us

We create return on emotion

EVS is globally recognized as a leading provider in live video

technology for broadcast and new media productions. Spanning the

entire production process, EVS solutions are trusted by production

teams worldwide to deliver the most gripping live sports images,

buzzing entertainment shows and breaking news to billions of

viewers every day – and in real-time. As we continue to expand our

footprint, our dedication to sustainable growth for both our

business and the industry is clearly demonstrated though our ESG

strategy. This commitment is not only reflected in our results, but

also in our high ratings from different agencies.

Headquartered in Liège, Belgium, the company has a global presence

with offices in Australia, Asia, the Middle East, Europe, North and

Latin America, employing over 600 team members and ensuring sales,

training and technical support to more than 100 countries.

EVS is a public company traded on Euronext Brussels: EVS, ISIN:

BE0003820371. EVS is, amongst others, part of the Euronext Tech

Leaders and Euronext BEL Mid indices.

For more information, please visit www.evs.com.

|

1 Please refer to our Half-Year Financial Report for

detailed financials and auditor’s review report

- Press release in PDF format

- EVS Half-Year Financial Report 2024

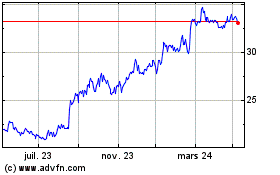

EVS Broadcast Equipment (EU:EVS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

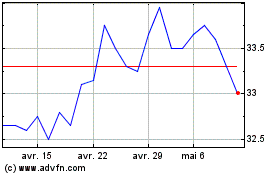

EVS Broadcast Equipment (EU:EVS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024