EXEL Industries : First quarter 2023–2024 sales: up 8.1%

25 Janvier 2024 - 7:59AM

EXEL Industries : First quarter 2023–2024 sales: up 8.1%

|

First quarter 2023–2024 sales: up 8.1% 11.0%

organic growth in line with last fiscal year |

The EXEL Industries Group posted revenue of

€200.1 million for the first quarter of the

2023–2024 fiscal year, up 8.1%, driven mainly by

organic growth in sugar beet harvesting and industry.

Growth at constant consolidation scope and

foreign exchange rates was 11.0%.

The change in consolidation scope arising from

the Devaux group acquisition in June 2023 contributed €1.3

million to first quarter revenue.

|

3-monthsales(October

2023-December 2023) |

2022–2023 |

2023–2024 |

Change (reported) |

Change (LFL*) |

|

Reported |

Reported |

€m |

% |

€m |

% |

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

89.0 |

90.9 |

+1.9 |

+2.1% |

+5.6 |

+6.3% |

| SUGAR BEET

HARVESTING |

19.5 |

27.1 |

+7.6 |

+39.0% |

+8.1 |

+41.3% |

| LEISURE

|

13.7 |

11.1 |

(2.6) |

(19.2)% |

(3.9) |

(28.6)% |

| INDUSTRY

|

62.9 |

71.0 |

+8.1 |

+12.9% |

+10.6 |

+16.8% |

| |

|

|

|

|

|

|

|

EXEL Industries Group |

185.1 |

200.1 |

+15.0 |

+8.1% |

+20.3 |

+11.0% |

* Like-for-like (LFL) = at constant consolidation

scope and foreign exchange rates

First quarter 2023–2024

sales

-

AGRICULTURAL SPRAYING UP

2.1%

Sales remained strong, up 6.3% at constant

consolidation scope and foreign exchange rates, boosted by regular

price increases incorporated since 2022, albeit undergoing an

unfavorable basis of comparison versus 2023: first quarter

2022–2023 was marked by a strong catch-up in deliveries following a

slowdown in component deliveries. First quarter 2023–2024 saw

renewed disruptions to logistics, which lengthened delivery times

to Australia and North America.

- SUGAR

BEET HARVESTING UP 39.0%

While the first quarter remains non-material in

terms of seasonal sales patterns, the Sugar Beet Harvesting

business continued to grow, driven by strong demand across all

segments: new machines, fueled in particular by the previous year’s

deferrals, used machinery and spare parts. In geographical terms,

while last year’s sales were mainly generated by Eastern Europe,

this year first quarter revenue mainly came from Western Europe

(France, Germany, Poland).

Although listings remain satisfying, the Garden

division saw its sales volumes shrink in the first quarter of

2023–2024. There is a certain sense of caution among the

distributors as the market has declined compared to recent years,

coupled with unfavorable weather conditions for sales in 2023 and

purchasing power under strain. At this stage, distributor

inventories are no larger than in previous years.

In the nautical industry, while distributors

hold substantial inventories, the latest product innovations from

the various brands are enjoying an excellent reception.

In Industrial Spraying, the Group posted an

excellent first quarter driven by strong business growth in Asian

markets, following the delivery of major high-viscosity and

electrostatic projects for the automotive industry. Western Europe

and North America continued to record brisk sales over the

quarter.

Technical hoses remained in decline, in line

with the 2022–2023 trend.

2023–2024 outlook

-

AGRICULTURAL SPRAYING

- Despite the continuous decline in

agricultural commodity prices, the order book remains stable,

offering clear visibility across all brands and regions for the

2023–2024 fiscal year. The recent agricultural trade fairs in

Europe enabled the Group to maintain order intake during the first

quarter.

- In addition, agricultural income in

the United States, albeit down compared to the beginning of

2022–2023, nevertheless remains well above the previous years’

performances.

- Moreover, the recent stabilization

of interest rates could make it easier for farmers to finance

purchases of agricultural equipment, even though they remain

cautious.

- Recent events in

the Red Sea could affect logistics costs and the availability of

certain components.

- SUGAR

BEET HARVESTING

- Enduringly high sugar prices are

expected to continue to bolster the new machines market, giving

farmers visibility for replacing their machinery.

- Order intake for the new sugar beet

harvester model is in line with Group expectations.

- Last year’s

exceptional volume of machine replacements in Eastern Europe is

unlikely to recur to the same extent in 2023–2024.

-

LEISURE

- The Garden division companies

continued to reorganize, mainly in order to integrate and develop

the products of the Devaux group acquired near the end of fiscal

year 2022–2023.

- The Group continues to launch new

products for the upcoming season and to develop commercial and

geographical synergies.

- In the nautical

industry, the new Wauquiez 55, a model combining performance and

elegance, was launched at the Düsseldorf trade fair.

-

INDUSTRY

- The order book offers clear

visibility over the coming months of the 2023–2024 fiscal year

thanks to a large number of major projects in Europe, Asia and

North America.

- Few changes are expected in the

hoses market, where the B2B business continues to face

challenges.

Daniel Tragus, Chief Executive Officer of the EXEL

Industries Group

|

“EXEL Industries achieved a good first quarter against a

challenging basis of comparison, pursuing growth momentum

particularly in the agricultural and industrial sectors. Sustained

demand for our products allows us to maintain a well-stocked order

book, albeit shorter than last year’s. Given the current

macro-economic conditions, the uncertain geopolitical situation and

the downturn in agricultural commodity prices, the Group remains

attentive to developments in its markets.” |

Upcoming events

- February

6, 2024: Annual General Meeting of Shareholders

- April

24, 2024, before market opening: Q2 2023–2024 revenue

- May 24,

2024, before market opening: H1 2023–2024 results and

investor presentation

About EXEL Industries

EXEL Industries is a French family-owned group

that designs, manufactures, and markets capital equipment and

provides associated services that enable its customers to improve

efficiency and productivity or enhance their well-being while

achieving their CSR

objectives. Driven

by an innovation strategy for over 70 years, EXEL Industries has

based its development on innovative ideas designed to offer

customers unique, efficient, competitive, and user-friendly

products. Since its

inception, the Group has recorded significant growth in each of its

markets through both organic growth and corporate acquisitions,

underpinned by a stable shareholder base guided by a long-term

development strategy. EXEL Industries employs approximately 3,931

permanent employees spread across 33 countries and five continents.

The Group posted FY 2022–2023 sales of €1.1 billion.

Euronext Paris, SRD Long only – compartment B

(Mid Cap) EnterNext© PEA-PME 150 index (symbol: EXE/ISIN

FR0004527638)

Press release available onsite

www.exel-industries.com

|

Daniel TRAGUSChief Executive Officer |

Thomas GERMAINGroup Chief Financial Officer / Investor

relations |

|

direction.communication@exel-industries.com |

- EXEL Industries_Press release_Q1-2023-2024_EN

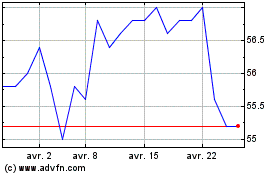

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024