EXEL Industries : Second quarter 2023–2024 sales: up 1.8%

24 Avril 2024 - 7:55AM

EXEL Industries : Second quarter 2023–2024 sales: up 1.8%

|

Second quarter 2023-2024 sales: down 1.8% Varying

sales performance across activities |

|

Q2 sales(January 2024–March 2024) |

2022-2023 |

2023-2024 |

Change (reported) |

Change (LFL*) |

|

Reported |

Reported |

€m |

% |

€m |

% |

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

147.7 |

157.4 |

+9.7 |

+6.5% |

+12.0 |

+8.1% |

| SUGAR BEET

HARVESTERS |

34.3 |

17.1 |

-17.2 |

-50.1% |

-17.1 |

-49.9% |

| LEISURE

|

48.4 |

47.4 |

-1.0 |

-2.0% |

-4.4 |

-9.0% |

| INDUSTRY

|

67.6 |

70.7 |

+3.1 |

+4.7% |

+3.3 |

+4.9% |

| |

|

|

|

|

|

|

|

EXEL Industries Group |

297.9 |

292.6 |

-5.3 |

-1.8% |

-6.2 |

-2.1% |

|

6-monthsales(October 2023–March

2024) |

2022-2023 |

2023-2024 |

Change (reported) |

Change (LFL*) |

|

Reported |

Reported |

€m |

% |

€m |

% |

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

236.8 |

248.3 |

+11.6 |

+4.9% |

+17.0 |

+7.2% |

| SUGAR BEET

HARVESTERS |

53.8 |

44.2 |

-9.6 |

-17.8% |

-8.5 |

-15.9% |

| LEISURE

|

62.1 |

58.5 |

-3.6 |

-5.9% |

-8.8 |

-14.1% |

| INDUSTRY

|

130.4 |

141.7 |

+11.3 |

+8.7% |

+14.4 |

+11.0% |

| |

|

|

|

|

|

|

|

EXEL Industries Group |

483.1 |

492.7 |

+9.7 |

+2.0% |

+14.1 |

+2.9% |

* Like-for-like (LFL) = at constant

consolidation scope and foreign exchange rates

Second quarter

2023-2024 sales

The EXEL Industries Group posted revenue of

€292.6 million for the second quarter of the

2023-2024 fiscal year, down 1.8%, mainly impacted

by declining sales volumes in sugar beet harvesting and the leisure

business. At constant consolidation scope and foreign exchange

rates, revenue was down 2.1%.

The change in consolidation scope arising from

the Devaux group acquisition in June 2023

contributed €4.0 million to second quarter

revenue.

-

AGRICULTURAL SPRAYING UP

6.5%

Agricultural Spraying revenue remains in a good

dynamic, up 8.1% at constant consolidation scope and foreign

exchange rates. However, the situation varies across regions, with

sales declining in France due to production difficulties but stable

across the rest of Europe. In the USA and Australia, sales rose

significantly despite lengthened delivery times to Australia since

the beginning of the 2023-2024 fiscal year. In North America and

Europe, distributor inventory levels remain high, thereby slowing

order renewals. Furthermore, a number of factors are prompting

caution among farmers: high interest rates, discontinued subsidy

programs in some Eastern European countries, delayed planting and

initial spraying due to high spring precipitation levels, and

falling agricultural prices affecting farmers’ income.

- SUGAR

BEET HARVESTING DOWN 50.1%

As expected at the end of the previous fiscal

year, the Sugar Beet Harvesting activity suffers from an adverse

basis of comparison following an excellent first quarter. During

the second and third quarters of FY 2022-2023, the Group posted

exceptional revenues in Eastern Europe. However, sales have been

steadily declining in this region since the start of 2024.

Meanwhile, spare part sales remained satisfactory during the second

quarter. New machines revenue is not representative of annual

performance, as sales are generally concentrated towards the end of

the third quarter and in the fourth quarter. On the other hand,

sales of the Terra Variant range decreased in Western Europe during

the first half.

While pre-season Garden sales proved a little

disappointing, the activity picked up during the second quarter

across all regions after two years of decline in the various

European markets (UK, France, Italy). The Devaux group integration

continues, and the first commercial synergies are beginning to kick

in. The Nautical activity is hampered by a sluggish market in which

dealers still hold extensive inventories. In addition, surging

interest rates over the past two years may have discouraged

potential new customers.

After an excellent first quarter, the Industrial

Spraying activity returned to more moderate but still significant

growth. The activity is stabilizing in Asia and the USA after two

years of strong acceleration. Meanwhile, sales in Europe continue

to hold up very well. The Technical Hoses activity has been

gradually recovering over the past few months after reaching a low

point in 2023.

2023-2024 outlook

-

AGRICULTURAL SPRAYING

- After a continuous decline over

several months, agricultural commodity prices have stabilized,

returning to relatively low levels.

- The economic environment over the

last three years has fueled an increase in agricultural machinery

costs exacerbated by inflation and rising interest rates, thereby

curbing farmers’ funding capacity and reducing the number of orders

for these machines.

- Order intake fell sharply in the

second quarter compared to the same period last year and is

expected to remain at these levels in the coming months.

- SUGAR

BEET HARVESTERS

- Continuing high sugar prices are

expected to continue to bolster the new machines market, giving

farmers visibility for replacing their machinery.

- 2024 promises to be a good year

driven by growth in new machine sales across all regions except

Eastern Europe.

- EXEL Industries continues to reduce

its inventory of used machines in line with the significant effort

carried out in 2023.

- The Group has duly anticipated the

decline in Eastern Europe business after two exceptional years and

is adapting its production accordingly.

-

LEISURE

- In view of the unfavorable weather

conditions, a late garden season is expected in 2024.

- The latest innovations offered by

the Garden activity have been well received and have won awards at

specialized trade fairs.

- Commercial synergies between

Hozelock, G.F. and Devaux continue to bear fruit, expanding the

product offering and promoting brand commercial development across

an increasingly broad geographical network, including Italy.

- In the nautical industry, the plan

to launch the new Wauquiez 55 by the end of the fiscal year is

pursuing its course, with no expected impact on this fiscal

year.

- High distributor inventory levels

and interest rates, albeit falling slightly, are curbing new boat

purchases.

-

INDUSTRY

- Despite the healthy order book

outlook for the rest of the 2023-2024 fiscal year, the Group

remains cautious regarding Asia, particularly China.

- The Technical Hoses activity seems

to be recovering, even if visibility is low.

Daniel Tragus, Chief Executive Officer of the EXEL

Industries Group

|

|

“After an excellent first quarter, EXEL Industries posted a less

consistent growth pattern this quarter including the expected

decline in the Sugar Beet Harvesting activity. Given the seasonal

nature of our business, the second half is more significant for the

Group's annual performance and, in 2024, will be faced with a

challenging basis of comparison, especially in the fourth quarter.

In the agricultural sector, the downward trend in the order book

amid a sluggish business climate is confirmed. However, sales

remained solid during the first half.” |

Upcoming events

- May 24,

2024, before market opening: H1 2023-2024 results and

investor presentation

- July 23,

2024, before market opening: Q3 2023-2024 revenue

About EXEL Industries

EXEL Industries is a French family-owned group

that designs, manufactures and markets capital equipment and

provides associated services that enable its customers to improve

efficiency and productivity or enhance their well-being while

achieving their CSR objectives.Driven by an innovation strategy for

over 70 years, EXEL Industries has based its development on

innovative ideas designed to offer customers unique, efficient,

competitive, and user-friendly products.Since its inception, the

Group has recorded significant growth in each of its markets

through both organic growth and corporate acquisitions, underpinned

by a stable shareholder base guided by a long-term development

strategy.EXEL Industries employs approximately 3,931 permanent

employees spread across 33 countries and five continents. The Group

posted FY 2022–2023 revenue of €1.1 billion.Euronext Paris, SRD

Long only – compartment B (Mid Cap) EnterNext© PEA-PME 150 index

(symbol: EXE/ISIN FR0004527638)

Press release available on

www.exel-industries.com

|

Daniel TRAGUSChief Executive Officer |

Thomas GERMAINGroup Chief Financial Officer / Investor

relations |

|

direction.communication@exel-industries.com |

- EXEL Industries_Press release_Q2-2023-2024_EN

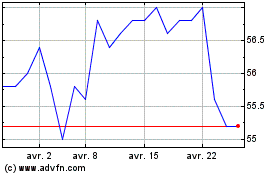

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024