Regulatory News:

This announcement is not an offer, whether directly or

indirectly, in Australia, Hong Kong, Japan, New Zealand or South

Africa or in any other jurisdiction where such offer pursuant to

legislation and regulations in such relevant jurisdiction would be

prohibited by applicable law. Shareholders not resident in Sweden

who wish to accept the Offer (as defined below) must make inquiries

concerning applicable legislation and possible tax consequences.

Shareholders should refer to the offer restrictions included in the

section titled “Important information” at the end of this

announcement and in the offer document which will be published

shortly before the beginning of the acceptance period for the

Offer. Shareholders in the United States should also refer to the

section titled “Important notice to shareholders in the United

States of America” at the end of this announcement.

La Française des Jeux SA (“FDJ”) (Paris:FDJ), hereby

announces a recommended public offer to the holders of Swedish

Depository Receipts (the “SDRs”) in Kindred Group plc

(together with its subsidiaries “Kindred” or the

“Company”) to tender all their SDRs in Kindred at a price of

SEK 130 in cash per SDR (the “Offer”). The SDRs in Kindred

are admitted to trading on Nasdaq Stockholm, Large Cap. For the

sake of simplicity and because each SDR represents a share in

Kindred, the SDRs will also be referred to as “Shares” and

the holders as “shareholders”.

The Company’s shareholders, Corvex Management LP, Premier

Investissement SAS, Eminence Capital, Veralda Investment and

Nordea, representing in aggregate approximately 27.9 percent of the

outstanding Shares in Kindred, have irrevocably undertaken to

accept the Offer. The Board of Directors of Kindred has unanimously

resolved to recommend that shareholders accept the Offer.1 The

Offer will enable Kindred to deliver its full potential and provide

significant investment and support for further growth.

Key highlights and summary of the Offer

- FDJ offers SEK 130 in cash per Kindred Share (the “Offer

Price”). The total value of the Offer is approximately SEK 27,951

million. 2

- The Offer Price represents a premium of:3

- approximately 24.4 percent compared to the closing share price

of SEK 104.50 of Kindred’s Shares on Nasdaq Stockholm on 19 January

2024, which was the last trading day prior to the announcement of

the Offer;

- approximately 34.9 percent compared to the volume-weighted

average trading price of SEK 96.34 of Kindred’s Shares on Nasdaq

Stockholm during the last 30 trading days prior to the announcement

of the Offer; and

- approximately 36.3 percent compared to the volume-weighted

average trading price of SEK 95.35 of Kindred’s Shares on Nasdaq

Stockholm during the last 90 trading days prior to the announcement

of the Offer.

- Following conclusion of the strategic review announced by the

Company on 26 April 2023 and a competitive process, the Board of

Directors of Kindred unanimously recommends that the Company’s

shareholders accept the Offer. The recommendation is supported by a

fairness opinion provided by Jefferies International GmbH

(“Jefferies”).

- The Company’s shareholders, Corvex Management LP, Premier

Investissement SAS, Eminence Capital and Nordea representing in

total approximately 25.7 percent of the outstanding Shares4 in

Kindred, have entered into undertakings to accept the Offer,

irrespective of whether a higher competing offer is made, and to

vote5 in favor of an amendment of the articles of association in

accordance with condition (vi) of the Offer.

- Furthermore, Veralda Investment, representing in approximately

2.3 percent of the outstanding Shares6 in Kindred, has entered into

an undertaking to accept the Offer, irrespective of whether a

higher competing offer is made, and to vote in favor of an

amendment of the articles of association in accordance with

condition (vi) of the Offer. Veralda Investment may, after the

latest of (i) one month from the date of announcement of the Offer

and (ii) a general meeting in Kindred resolving to amend the

articles of association in accordance with condition (vi) of the

Offer, sell 50% of its Shares, for a price not higher than the

Offer Price. Furthermore, Veralda Investment may sell all of its

Shares, for a price not higher than the Offer Price, after three

months from the date of the announcement of the Offer. If Veralda

Investment wants to sell its Shares, it has undertaken to first

offer FDJ the possibility to buy the Shares at a price not higher

than the Offer Price. Veralda Investment has undertaken to tender

any Shares held at the last day of the acceptance period in the

Offer.

- The Offer is conditional upon the Offer being accepted to such

extent that FDJ becomes the owner of Shares representing more than

90 percent of the total number of outstanding Shares in Kindred. In

addition, the Offer is made on the terms and subject to the

conditions (ii)–(viii) set out below in this announcement.

- The acceptance period is expected to commence on or around 20

February 2024 and expire on or around 19 November 2024 to allow for

receipt of customary regulatory approvals. Should such customary

regulatory approvals be received earlier, the acceptance period may

be shortened.

Stéphane Pallez, Chairwoman and CEO of FDJ Group,

said:

“I am pleased to announce today the proposed acquisition of

Kindred. Fully aligned with our strategy, it will give the Group a

diversified and balanced profile, based on several pillars: the

monopoly activities, mainly the lottery, on our French historical

market and, since November, in Ireland, with the acquisition of the

Irish lottery operator PLI; and online sports betting and gaming

activities open to competition in Europe. In this market, Kindred

is one of the leading operators, combining strong brands,

best-in-class technology platforms, an attractive growth profile

and a committed approach to responsible gaming. Given their

respective histories, strategic strengths and core values, FDJ and

Kindred are highly complementary, and I will be delighted to

welcome Kindred's management team and many talented individuals

into the combined Group following this transaction. The combination

will result in a stronger strategic positioning and significant

value creation for the benefit of our shareholders and broader

stakeholders.”

Nils Andén, CEO of Kindred, said:

“I’m delighted with today’s transaction announcement between FDJ

and Kindred, creating a leading European gaming operator with the

financial and strategic capabilities to further expand its global

footprint. I believe that combining with FDJ, Kindred can

accelerate the delivery of long-term strategic projects, continue

to grow in core markets, and provide a trusted source of

entertainment to customers. It will also speed up our path towards

100% locally regulated revenue. I’m excited to bring Kindred’s

extensive experience and know-how into FDJ’s organisation,

contributing to the development of a leading online gaming

business. I’m also very proud that FDJ acknowledges and values the

skilled employees and strong assets within Kindred.”

Background to and strategic rationale for the Offer

Kindred is a leading European online betting & gaming

operator, benefitting from a diversified portfolio covering all

gaming verticals and best in-class brand awareness. Across its

portfolio of iconic brands, Kindred is a trusted source of safe,

fair, and sustainable entertainment for 1.6 million active

customers. Kindred employs over 2,400 people and is listed on

Nasdaq Stockholm Large Cap.

The acquisition of Kindred fits FDJ’s ambition to i) expand

internationally as an online betting & gaming operator, and to

ii) develop its activities in the French online & betting

markets opened to competition.

The transaction will create a European gaming champion with

increased scale, technology and content capabilities and greater

diversification. The combined group will benefit from:

- Operating at higher scale in the European gaming markets – with

combined 2023 Gross Gaming Revenues of c. €8bn

- Strong positions in scaled fast-growing European markets

- Coverage of all 4 online betting & gaming verticals

- Proven technology assets and access to proprietary content

- Enhanced diversification across geographies, verticals and

channels

- The creation of a top 3 online betting & gaming player in

France on markets opened to competition, stronger challenger to

incumbents

The transaction is also consistent with best-in-class

sustainability and responsible gaming approach

- The Transaction further accelerates convergence of Kindred’s

and FDJ’s approach to locally regulated markets and sustainable

gaming

- As the offeror is not in a position to operate in locally

unregulated markets without an ongoing path to regulation, Kindred

will exit from the Norwegian market and those other non-regulated

markets with no ongoing path to regulation after completion of the

Offer

The combined group will benefit from significantly stronger

revenue and earnings growth, as well as increased operating

leverage

- Accretive impact on growth (>50 bps Gross Gaming Revenue

acceleration) and margin profile (>50 bps yearly EBITDA margin

accretion)

- Double-digit earnings per share accretion; starting from year 1

post integration

- Solid pro forma balance sheet, with reiterated target of Net

Debt / EBITDA ≤ 2.0x

- Combined group aiming at solid Investment Grade rating

profile

FDJ believes that the combination of FDJ and Kindred is highly

compelling, and would create significant value leading to enhanced

shareholder returns:

- Commitment to pay-out ratio at 75% of adjusted net income

- Double-digit accretive impact on dividend per share

- Optimized capital structure

Management and employees

FDJ values the skills and talents of Kindred’s management and

employees and intends to continue to safeguard the excellent

relationship that Kindred has with its employees. Based on FDJ’s

current operations and the current regulatory environment FDJ does

not intend to materially alter the operations of Kindred following

the implementation of the Offer, other than the exit from the

Norwegian market and those other non-regulated markets with no

ongoing path to regulation. Other than relating to such exit, there

are currently no decisions on any material changes to Kindred’s or

FDJ’s employees and management or to the existing organization and

operations, including the terms of employment and locations of the

business.

The Offer

Consideration

FDJ offers SEK 130 in cash per Kindred Share.

Should Kindred, prior to settlement of the Offer, distribute

dividends or in any other way distribute or transfer value to its

shareholders, the Offer Price will be reduced accordingly.

In order to comply with applicable U.S. federal securities laws

(including Rule 14e-1 under the U.S. Exchange Act), the Offer must

remain open for at least ten U.S. Business Days following a

decrease of the Offer Price under the adjustment described in the

preceding sentence.

The total value of the Offer is approximately SEK 27,951

million.7

No commission will be charged in connection with settlement of

the Offer.

The Offer Price represents a premium of: 8

- approximately 24.4 percent compared to the closing share price

of SEK 104.50 of Kindred’s Shares on Nasdaq Stockholm on 19 January

2024, which was the last trading day prior to the announcement of

the Offer;

- approximately 34.9 percent compared to the volume-weighted

average trading price of SEK 96.34 of Kindred’s Shares on Nasdaq

Stockholm during the last 30 trading days prior to the announcement

of the Offer;

- approximately 36.3 percent compared to the volume-weighted

average trading price of SEK 95.35 of Kindred’s Shares on Nasdaq

Stockholm during the last 90 trading days prior to the announcement

of the Offer.

FDJ’s shareholding in Kindred

Neither FDJ nor any closely related companies or closely related

parties own any Shares or other financial instruments in Kindred

that give financial exposure to Kindred Shares at the time of this

announcement, nor has FDJ acquired or agreed to acquire any Kindred

Shares or any financial instruments that give financial exposure to

Kindred Shares during the six months preceding the announcement of

the Offer.

FDJ may acquire, or enter into agreements to acquire, Shares in

Kindred (or any securities that are convertible into, exchangeable

for or exercisable for such Shares) outside the Offer, but in any

event, at a price per Share not higher than the Offer Price. Any

purchases made or agreed will be in accordance with Swedish and

Maltese law and Nasdaq Stockholm’s Takeover Rules (the “Takeover

Rules”) and will be disclosed in accordance with applicable

rules.

Recommendation from the Board of Directors of Kindred and

fairness opinion

The Board of Directors of Kindred unanimously recommends that

the shareholders of Kindred accept the Offer.9 The Board of

Directors of Kindred has obtained a fairness opinion from Jefferies

regarding the Offer stating that the Offer Price is fair from a

financial point of view to the shareholders of Kindred.

Undertakings from shareholders of Kindred

FDJ has obtained irrevocable undertakings to accept the Offer

from the Company’s shareholders, Corvex Management LP, Premier

Investissement SAS and Eminence Capital representing in total

approximately 24.2 percent of the outstanding Shares10 in Kindred,

irrespective of whether a higher competing offer is made, and to

vote11 in favor of an amendment of the articles of association in

accordance with condition (vi) of the Offer.

The irrevocable undertakings from Corvex Management LP, Premier

Investissement SAS and Eminence Capital will terminate if the Offer

is not declared unconditional before 31 December 2024, however this

date will be automatically extended up until and including 22

January 2025 if the acceptance period in the Offer is extended.

Furthermore, FDJ has obtained irrevocable undertakings to accept

the Offer from the Company’s shareholder Nordea, representing

approximately 1.5 percent of the outstanding Shares12 in Kindred,

irrespective of whether a higher competing offer is made, and to

vote in favor of an amendment of the articles of association in

accordance with condition (vi) of the Offer.

Lastly, FDJ has obtained irrevocable undertakings to accept the

Offer from the Company’s shareholder Veralda Investment,

representing approximately 2.3 percent of the outstanding Shares13

in Kindred, irrespective of whether a higher competing offer is

made, and to vote in favor of an amendment of the articles of

association in accordance with condition (vi) of the Offer. Veralda

Investment may, after the latest of (i) one month from the date of

announcement of the Offer and (ii) a general meeting in Kindred

resolving to amend the articles of association in accordance with

condition (vi) of the Offer, sell 50% of its Shares, for a price

not higher than the Offer Price. Furthermore, Veralda Investment

may sell all of its Shares, for a price not higher than the Offer

Price, after three months from the date of the announcement of the

Offer. If Veralda Investment wants to sell its Shares, it has

undertaken to first offer FDJ the possibility to buy the Shares at

a price not higher than the Offer Price. Veralda Investment has

undertaken to tender any Shares held at the last day of the

acceptance period in the Offer.

Accordingly, irrevocable undertakings to accept the Offer from

shareholders representing in total approximately 27.914 percent of

the outstanding Shares15 in Kindred have been obtained.

Conditions for completion of the Offer

The completion of the Offer is conditional upon:

- the Offer being accepted to such an extent that FDJ becomes the

owner of Shares in Kindred representing more than 90 percent of the

total number of Shares in Kindred (on a fully diluted

basis)16;

- the receipt of all regulatory, governmental or similar

clearances, approvals and decisions that are necessary for the

Offer and the acquisition of Kindred in each case on terms which,

in FDJ’s opinion, are acceptable;

- no circumstances having occurred which have a material adverse

effect or could reasonably be expected to have a material adverse

effect on Kindred’s financial position, prospects or operations,

including Kindred’s licenses and permits, revenues, results,

liquidity, solidity, equity or assets;

- neither the Offer nor the acquisition of Kindred being rendered

wholly or partially impossible or significantly impeded as a result

of legislation or other regulation, any decision of a court or

public authority, or any similar circumstance;

- Kindred not taking any action that is likely to prevent or

frustrate the Offer or impair the prerequisites for making or

completing the Offer;

- Kindred’s articles of association having been amended to allow

for an owner of shares, representing not less than 90 percent of

the outstanding capital of Kindred carrying voting rights, to

require all the other shareholders of Kindred to transfer all of

their shares in Kindred to the owner; and the terms and conditions

for the SDRs having been amended in a way which allows FDJ, having

become the owner of not less than 90 percent of the total number of

outstanding SDRs in Kindred, to require all other holders of SDRs

to transfer all of their SDRs in Kindred to FDJ for the same price

as in the Offer;

- no information made public by Kindred or disclosed by Kindred

to FDJ being materially inaccurate, incomplete or misleading, and

Kindred having made public all information which should have been

made public by Kindred; and

- no other party announcing an offer to acquire shares or SDRs in

Kindred on terms more favourable to the shareholders of Kindred

than the Offer.

FDJ reserves the right to withdraw the Offer in the event that

it becomes clear that any of the above conditions is not satisfied

or cannot be satisfied. However, with regard to conditions

(ii)–(viii) above, the Offer may only be withdrawn where the

non-satisfaction of such condition is of material importance to

FDJ’s acquisition of Kindred or if otherwise approved by the

Swedish Securities Council.

FDJ reserves the right to waive, in whole or in part, one or

more of the conditions above, including, with respect to condition

(i) above, to complete the Offer at a lower level of

acceptance.

In order to comply with applicable U.S. federal securities laws

(including Rule 14e-1 under the U.S. Exchange Act), the Offer may

need to be extended following a material change or waiver of

condition, including the acceptance threshold in condition (i)

above.

Information regarding FDJ

FDJ is France’s national lottery and leading betting &

gaming operator, the #2 lottery in Europe and #4 worldwide. FDJ

offers responsible gaming to the general public in the form of

lottery games (draw games and instant-win games), sports betting

and poker, available from physical outlets and online. FDJ’s

performance is driven by an extensive portfolio of iconic brands,

France’s leading local sales network, a growing market and

recurring investments. The group is aiming at enhancing the appeal

of its range of games and services open to competition across all

distribution channels while offering a responsible customer

experience.

In recent years FDJ has developed a strategy focused on organic

and external growth, and announced or closed several acquisitions

in 2022 and 2023. This strategy was reaffirmed in FDJ’s November

2022 investor day where FDJ flagged its ambition to become a truly

international player. FDJ is trading on the Euronext Paris market

since 21 November 2019. As of 31 December 2022, its share ownership

structure is as follows: the French State (20 percent), War

veterans’ associations (15 percent), Employee Share investment

funds (4 percent), Predica (5 percent) and other holdings of less

than 5 percent, including French and international institutional

investors and private individual shareholders. As of February 2023,

the group has nearly 400,000 individual shareholders.

For more information, please visit www.groupefdj.com.

Financing of the Offer

The consideration payable in respect of the Offer is financed in

full by a combination of cash resources of FDJ and financing

provided by BNP Paribas and Société Générale pursuant to a facility

agreement, on terms which are customary for the financing of public

offers on the Swedish market.

The above-mentioned financing will provide FDJ with sufficient

cash resources to satisfy in full the consideration payable in

respect of the Offer and, accordingly, completion of the Offer is

not subject to any financing condition.

Rights under Kindred’s incentive programs

The Offer does not include any rights granted by Kindred to its

employees under Kindred’s incentive programs. FDJ intends to

procure reasonable treatment for participants in such programs.

Due diligence in connection with the Offer

FDJ has, in connection with the preparations of the Offer,

conducted a due diligence review of Kindred and has, in connection

with the due diligence review, received preliminary financial

information regarding Kindred’s fourth quarter 2023. This

information will be disclosed by Kindred in a separate press

release today. With the exception of such preliminary financial

information regarding Kindred’s fourth quarter 2023, Kindred has

confirmed that FDJ has not been provided with any inside

information regarding Kindred in connection with the due diligence

review.

Approvals from authorities

The completion of the Offer is conditional upon, inter alia, the

receipt of all regulatory, governmental or similar clearances,

approvals and decisions that are necessary for the Offer and the

acquisition of Kindred in each case on terms which, in FDJ’s

opinion, are acceptable. Such clearances, approvals and decisions

are expected to have been received by the end of the acceptance

period for the Offer.

According to FDJ’s assessment, the Offer will require customary

regulatory approvals, including, inter alia, merger control

approvals in France and Poland. FDJ has initiated the work on

filings relevant for the Offer. FDJ expects relevant clearances to

be obtained prior to the end of the acceptance period.

Statement from the Swedish Securities Council

The Swedish Securities Council has in its ruling AMN 2024:05

granted an exemption from Rule II.7 of the Takeover Rules and

allowed FDJ to set the initial acceptance period in the Offer to up

to 39 weeks.

AMN 2024:05 will be available in its entirety, in Swedish, on

the Swedish Securities Council’s website

(www.aktiemarknadsnamnden.se).

Preliminary timetable

Publication of the offer document

19 February 2024

Acceptance period

20 February 2024 – 19 November 2024

Commencement of settlement

28 November 2024

As set out above, the completion of the Offer is conditional

upon, inter alia, the receipt of all regulatory, governmental or

similar clearances, approvals and decisions that are necessary for

the Offer and the acquisition of Kindred. Such clearances,

approvals and decisions are expected to have been received by the

end of the acceptance period for the Offer. If all relevant

clearances, approvals and decisions are received in such time that

the acceptance period can be closed before 19 November 2024, FDJ

may announce an earlier end date of the acceptance period, provided

that such announcement can be made not less than two weeks prior to

the new date of expiry of the acceptance period.

FDJ further reserves the right to extend the acceptance period

for the Offer, one or several times, as well as to postpone the

time for settlement.

Compulsory redemption proceedings and delisting

If FDJ, whether in connection with the Offer or otherwise,

acquires shares representing not less than 90 percent of the

outstanding capital of Kindred carrying voting rights, FDJ intends

to initiate an acquisition of the remaining shares in accordance

with Kindred’s amended articles of association and the amended

terms and conditions for the SDRs. In connection therewith, FDJ

intends to promote a delisting of Kindred’s SDRs from Nasdaq

Stockholm.

Governing law and disputes

The Offer and the agreements entered into between FDJ and

Kindred’s shareholders in relation to the Offer, shall be governed

by and be interpreted in accordance with Swedish law. Disputes

concerning, or arising in connection with the Offer, shall be

settled exclusively by Swedish courts, with the Stockholm District

Court as first instance.

The Takeover Rules and the Swedish Securities Council’s rulings

and statements on the interpretation and application of the

Takeover Rules are applicable to the Offer. FDJ has undertaken to

Nasdaq Stockholm to comply with the Takeover Rules and to submit to

any sanctions that can be imposed on FDJ by Nasdaq Stockholm in the

event of a breach of the Takeover Rules.

Advisors

FDJ has retained Goldman Sachs Bank Europe SE, Succursale de

Paris, and Valens Partners SAS as financial advisors and

Freshfields Bruckhaus Deringer LLP, Advokatfirman Vinge KB and

Mayer Brown Selas as legal advisors in connection with the

Offer.

La Française des Jeux SA

The Board of Directors

Information about the Offer

Information about the Offer is made available at:

https://www.groupefdj.com/en/fdj-launches-a-tender-offer-for-kindred-to-create-a-european-gaming-champion/

The information was submitted for publication on 22 January

2024, 07.00 a.m. CET.

Important information

This press release has been published in Swedish and English.

In the event of any discrepancy in content between the two language

versions, the Swedish version shall prevail.

This announcement is not an offer, whether directly or

indirectly, in Australia, Hong Kong, Japan, New Zealand or South

Africa or in any other jurisdictions where such offer pursuant to

legislation and regulations in such relevant jurisdictions would be

prohibited by applicable law (the “Restricted

Jurisdictions”).

The release, publication or distribution of this press

release in or into jurisdictions other than Sweden may be

restricted by law and therefore any persons who are subject to the

laws of any jurisdiction other than Sweden should inform themselves

about, and observe any applicable requirements. In particular, the

ability of persons who are not resident in Sweden to accept the

Offer may be affected by the laws of the relevant jurisdictions in

which they are located. Any failure to comply with the applicable

restrictions may constitute a violation of the securities laws of

any such jurisdiction. To the fullest extent permitted by

applicable law, the companies and persons involved in the Offer

disclaim any responsibility or liability for the violation of such

restrictions by any person.

This announcement has been prepared for the purpose of

complying with Swedish law, the Takeover Rules and the Swedish

Securities Council’s rulings regarding interpretation and

application of the Takeover Rules and the information disclosed may

not be the same as that which would have been disclosed if this

press release had been prepared in accordance with the laws of

jurisdictions other than Sweden.

Unless otherwise determined by FDJ or required by Swedish

law, the Takeover Rules and the Swedish Securities Council’s

rulings regarding interpretation and application of the Takeover

Rules, and permitted by applicable law and regulation, the Offer

will not be made available, directly or indirectly, in, into or

from a Restricted Jurisdiction or any other jurisdiction where to

do so would violate the laws in that jurisdiction and no person may

accept the Offer by any use, means or instrumentality (including,

but not limited to, facsimile, e-mail or other electronic

transmission, telex or telephone) of interstate or foreign commerce

of, or of any facility of a national, state or other securities

exchange of any Restricted Jurisdiction or any other jurisdiction

where to do so would constitute a violation of the laws of that

jurisdiction and the Offer may not be capable of acceptance by any

such use, means, instrumentality or facilities. Accordingly, copies

of this press release and any formal documentation relating to the

Offer are not being, and must not be, directly or indirectly,

mailed or otherwise forwarded, distributed or sent in or into or

from any Restricted Jurisdiction or any other jurisdiction where to

do so would constitute a violation of the laws of that jurisdiction

and persons receiving such documents (including custodians,

nominees and trustees) must not mail or otherwise forward,

distribute or send them in or into or from any Restricted

Jurisdiction or any other jurisdiction where to do so would

constitute a violation of the laws of that jurisdiction.

The availability of the Offer to shareholders of Kindred who

are not resident in and citizens of Sweden may be affected by the

laws of the relevant jurisdictions in which they are located or of

which they are citizens. Persons who are not resident in or

citizens of Sweden should inform themselves of, and observe, any

applicable legal or regulatory requirements of their

jurisdictions.

The Offer, the information and documents contained in this

press release are not being made and have not been approved by an

authorized person for the purposes of section 21 of the UK

Financial Services and Markets Act 2000 (the “FSMA”). Accordingly,

the information and documents contained in this press release are

not being distributed to, and must not be passed on to, the general

public in the United Kingdom, unless an exemption applies. The

communication of the information and documents contained in this

press release is exempt from the restriction on financial

promotions under section 21 of the FSMA on the basis that it is a

communication by or on behalf of a body corporate which relates to

a transaction to acquire day to day control of the affairs of a

body corporate; or to acquire 50 percent or more of the voting

shares in a body corporate, within article 62 of the UK Financial

Services and Markets Act 2000 (Financial Promotion) Order

2005.

Statements in this press release relating to future status or

circumstances, including statements regarding future performance,

growth and other trend projections and their underlying

assumptions, statements regarding plans, objectives, intentions and

expectations with respect to future financial results, events,

operations, services, product development and potential and other

effects of the Offer, are forward-looking statements. These

statements may generally, but not always, be identified by the use

of words such as “anticipates”, “intends”, “expects”, “believes”,

“estimates”, “plans”, “will be” or similar expressions. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to events and depend on circumstances that will

occur in the future. Actual results and developments may differ

materially from those expressed in, or implied or projected by

these forward-looking statements due to many factors, many of which

are outside the control of FDJ. Forward-looking statements appear

in a number of places throughout this announcement and the

information incorporated by reference into this announcement and

may include statements regarding the intentions, beliefs or current

expectations of FDJ or Kindred concerning, amongst other things:

(i) future capital expenditures, expenses, revenues, earnings,

synergies, economic performance, indebtedness, financial condition,

dividend policy, losses and future prospects; (ii) business and

management strategies, the expansion and growth of FDJ’s or

Kindred’s business operations and potential synergies resulting

from the Offer; and (iii) the effects of government regulation and

industry changes on the business of FDJ or Kindred. Any

forward-looking statements made herein speak only as of the date on

which they are announced. Except as required by the Takeover Rules

or applicable law or regulations, FDJ expressly disclaims any

obligation or undertaking to publicly announce updates or revisions

to any forward-looking statements contained in this announcement to

reflect any change in expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based. The reader should, however, consult any

additional disclosures that FDJ or Kindred have made or may

make.

Important notice to shareholders in the United States of

America

This offer announcement has not been submitted to or reviewed

by the SEC or any U.S. state securities commission and neither the

SEC nor any such U.S. state securities commission has approved or

disapproved or determined whether this offer announcement is

truthful or complete. Any representation to the contrary is a

criminal offence in the U.S.

The Offer is being made for the Shares in the Company, whose

SDRs are listed on Nasdaq Stockholm, and is subject to the Takeover

Rules, the Swedish Securities Council’s (Sw. Aktiemarknadsnämnden)

rulings and statements on the interpretation and application of the

Takeover Rules applicable to the Offer and the Swedish Takeover Act

(Sw. lag (2006:451) om offentliga uppk�pserbjudanden på

aktiemarknaden) and Swedish disclosure and procedural requirements,

which are different from those of the U.S. It is important for U.S.

Shareholders to be aware that this offer announcement is subject to

disclosure and takeover laws and regulations in Sweden that are

different from those in the U.S. In addition, U.S. Shareholders

should be aware that this offer announcement has been prepared in

accordance with Swedish format and style, which differs from the

U.S. format and style. In particular the financial information of

the Company included or incorporated by reference herein has been

prepared in accordance with generally accepted accounting

principles in Sweden and International Financial Reporting

Standards, as applicable, and thus may not be comparable to

financial information of U.S. companies whose financial statements

are prepared in accordance with generally accepted accounting

principles in the United States. The Offer is being made in the

U.S. in reliance on, and in compliance with, Section 14(e) of, and

Regulation 14E under, the U.S. Exchange Act and the “Tier II”

exemption provided by Rule 14d-1(d) under the U.S. Exchange Act and

otherwise in accordance with the requirements of Swedish law.

Accordingly, the Offer is subject to disclosure and other

procedural requirements, including with respect to withdrawal

rights, settlement procedures and timing of payments that are

different from those applicable under U.S. domestic tender offer

procedures and laws. U.S. Shareholders are urged to read this offer

announcement, which is available via

https://www.groupefdj.com/en/fdj-launches-a-tender-offer-for-kindred-to-create-a-european-gaming-champion/.

U.S. Shareholders may also call the following number: +33 (0)1 41

04 19 74 or email invest@lfdj.com to request a copy of the offer

document.

To the extent permissible under applicable Swedish and U.S.

securities laws, rules and regulations and pursuant to exemptive

relief granted by the SEC from Rule 14e-5 under the U.S. Exchange

Act, the offeror and its subsidiaries and affiliates or their

respective nominees or brokers (acting as agents for the offeror)

may from time to time after the date of this offer announcement,

and other than pursuant to the Offer, directly or indirectly,

purchase or arrange to purchase Shares or any securities that are

convertible into, exchangeable for or exercisable for Shares from

Shareholders who are willing to sell their Shares outside the

Offer, including purchases in the open market at prevailing prices

or in private transactions at negotiated prices. Any such purchases

will be made outside the U.S. and will be made in accordance with

applicable law, including that they will not be made at prices

higher than the Offer Price or on terms more favourable than those

offered pursuant to the Offer unless the Offer Price is increased

accordingly. Any information about such purchases or arrangements

to purchase will be publicly disclosed in the U.S. at the website

https://www.groupefdj.com/en/fdj-launches-a-tender-offer-for-kindred-to-create-a-european-gaming-champion/

to the extent that such information is made public in accordance

with the applicable laws and regulations of Sweden. In addition,

the financial advisors to the Company and, to the extent

permissible under applicable Sweden and U.S. securities laws, rules

and regulations and pursuant to exemptive relief granted by the SEC

from Rule 14e-5 under the U.S. Exchange Act, the financial advisors

to the FDJ may also engage in ordinary course trading activities in

securities of the Company, which may include purchases or

arrangements to purchase such securities.

It may be difficult for U.S. Shareholders to enforce their

rights and any claim arising out of U.S. securities laws, since the

offeror and the Company are located in a non-U.S. jurisdiction, and

some or all of their officers and directors may be residents of a

non-U.S. jurisdiction. U.S. Shareholders may not be able to sue a

non-U.S. company or its officers or directors in a U.S. or nonU.S.

court for violations of U.S. securities laws. Further, it may be

difficult to compel a nonU.S. company and its affiliates to subject

themselves to a U.S. court’s judgment. The receipt of cash pursuant

to the Offer by a U.S. Shareholder may be a taxable transaction for

U.S. federal income tax purposes and under applicable U.S. state

and local laws, as well as foreign and other tax laws. Each U.S.

Shareholder of Shares is urged to consult his or her independent

professional advisor immediately regarding the U.S. tax

consequences of an acceptance of the Offer. Neither the SEC nor any

securities commission of any State of the U.S. has (a) approved or

disapproved of the Offer; (b) passed upon the merits or fairness of

the Offer; or (c) passed upon the adequacy or accuracy of the

disclosure in this offer announcement. Any representation to the

contrary is a criminal offence in the U.S.

Goldman Sachs Bank Europe SE, Succursale de Paris (“Goldman

Sachs”), which is authorised and regulated by the European Central

Bank and the Federal Financial Supervisory Authority (Die

Bundesanstalt für Finanzdienstleistungsaufsicht) and Deutsche

Bundesbank in Germany, and Valens Partners SAS (“Valens Partners”)

are acting exclusively for FDJ and no-one else in connection with

the matters referred to in this offer announcement and will not be

responsible to anyone other than FDJ for providing the protections

afforded to clients of Goldman Sachs and Valens Partners or for

providing advice in connection with the matters referred to in this

offer announcement.

1 The board members James Gemmel and Cédric Boireau,

representing shareholders on Kindred’s Board of Directors who have

provided an undertaking to accept the Offer (i.e. Corvex Management

LLP and Premier Investissement SAS), have not participated in the

Kindred Board of Directors’ handling of or decisions concerning

matters relating to the Offer due to a conflict of interest.

2 Based on 215,008,190 outstanding Shares in Kindred, which

excludes 15,117,946 treasury Shares held by Kindred.

3 Source for Kindred’s share prices: Bloomberg.

4 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

5 Due to its holding structure, Premier Investissement SAS’

undertaking to vote in favor of an amendment of the articles of

association in accordance with condition (vi) of the Offer

includes: (i) procuring the exercise of voting rights attaching to

4,602,928 of its Shares, and (ii) to use its best endeavours to

procure the exercise of voting rights attaching to the remaining

4,081,172 of its Shares, in favor of an amendment of the articles

of association in accordance with condition (vi) of the Offer.

6 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

7 Based on 215,008,190 outstanding Shares in Kindred, which

excludes 15,117,946 treasury Shares held by Kindred.

8 Source for Kindred’s share prices: Bloomberg.

9 The board members James Gemmel and Cédric Boireau,

representing shareholders on Kindred’s Board of Directors who have

provided an undertaking to accept the Offer (i.e. Corvex Management

LLP and Premier Investissement SAS), have not participated in the

Kindred Board of Directors’ handling of or decisions concerning

matters relating to the Offer due to a conflict of interest.

10 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

11 Due to its holding structure, Premier Investissement SAS’

undertaking to vote in favor of an amendment of the articles of

association in accordance with condition (vi) of the Offer

includes: (i) procuring the exercise of voting rights attaching to

4,602,928 of its Shares, and (ii) to use its best endeavours to

procure the exercise of voting rights attaching to the remaining

4,081,172 of its Shares, in favor of an amendment of the articles

of association in accordance with condition (vi) of the Offer.

12 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

13 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

14 Corvex Management LP, 16.6%. Premier Investissement SAS,

4.0%. Eminence Capital, 3.5%. Veralda Investment, 2.3%. Nordea,

1.5%.

15 Excluding 15,117,946 SDRs held in treasury by Kindred. Each

SDR represents a share in Kindred which entitles the holder to one

vote at general meetings.

16 Excluding any treasury Shares held by Kindred (currently

15,117,946).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240121731624/en/

For enquiries:

Investor Relations Marc Willaume Telephone: +33

(0)1 41 04 19 74 Email: invest@lfdj.com

Media Relations Sabine Wacquez Telephone: +33 (0)1 41 10

33 82 Email: servicedepresse@lfdj.com

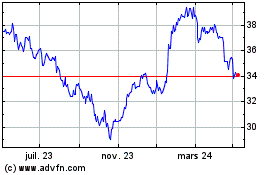

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

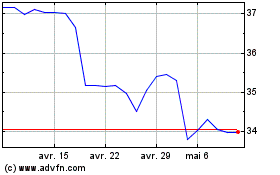

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024