- Leading independent proxy advisor says cash offer provides

“meaningful 69.3 percent premium”

- Act Now. Vote Today. Deadline is 10 a.m. (Montreal time) on

Friday, November 24, 2023.

- Need help voting or have questions? Call Kingsdale Advisors on

1-866-581-1489 (toll free), text 1-416-623-2516,

email contactus@kingsdaleadvisors.com or visit

www.H2OVote.com

All amounts are in Canadian dollars.

(TSX: HEO) – H2O Innovation Inc. (“H2O Innovation” or the

“Corporation”) is pleased to announce that Institutional

Shareholder Services (“ISS”) and Glass, Lewis & Co. (“Glass

Lewis”) have recommended shareholders to Vote FOR the previously

announced acquisition by Ember SPV I Purchaser Inc. (the

“Purchaser”), an entity controlled by funds managed by Ember

Infrastructure Management, LP, a New York-based private equity

firm, of all of the issued and outstanding common shares in the

capital of H2O Innovation (the “Shares”), other than the Shares to

be rolled over by Investissement Québec, Caisse de dépôt et

placement du Québec and certain key executives of the Corporation,

for C$4.25 in cash per Share, pursuant to a statutory plan of

arrangement (the “Arrangement”) under the Canada Business

Corporations Act.

ISS and Glass Lewis are leading independent proxy voting and

corporate governance advisory firms whose recommendations influence

how pension funds, investment managers, mutual funds, and other

institutional shareholders vote.

In its report, ISS said the “valuation appears credible” while

highlighting how “reasonable procedural safeguards” were

implemented and cautioning about the “downside risks” if the

Arrangement is not approved.

The report from ISS further recognized that the cash offer

provides “a meaningful 69.3 percent premium” to the unaffected

closing price of the Shares on the Toronto Stock Exchange on

October 3, 2023, and that H2O Innovation’s “go-shop” process with

its financial advisor Scotia Capital Inc., which contacted 11

strategic parties and 18 financial sponsors, was “unable to

generate a superior proposal.”

In its report, Glass Lewis says it believes the proposed

transaction represents “a favourable outcome for public

shareholders at this time” and an attractive opportunity through

which “shareholders can realize full and certain value and

immediate liquidity.”

Both independent proxy advisors concluded that shareholder

approval of the Arrangement is warranted.

VOTE TODAY

Don’t Delay. Shareholders are encouraged to vote FOR the

Arrangement well in advance of the 10 a.m. (Montreal time) deadline

on Friday, November 24, 2023.

Completion of the Arrangement is subject to customary closing

conditions, including obtaining the required approvals from the

holders of Shares (the “Shareholders”) at the special meeting of

Shareholders to consider the Arrangement to be held virtually on

November 28, 2023 (the “Meeting”) and receiving the final order of

the Superior Court of Québec. It is anticipated that the

Arrangement will be completed in the fourth quarter of 2023.

The Management Information Circular (the “Circular”) and related

materials for the Meeting are available under the Corporation’s

profile on SEDAR+ at www.sedarplus.ca, www.H2OVote.com and on

www.h2oinnovation.com.

Shareholder Questions and Assistance

If you have any questions or need assistance voting, contact

Kingsdale Advisors using your preferred method of

communication:

- Call 1-866-581-1489 (toll free)

- Text 1-416-623-2516

- Email contactus@kingsdaleadvisors.com

- Chat www.H2OVote.com

H2O Innovation has retained Kingsdale Advisors as its strategic

shareholder and communications advisor.

Cautionary Note and Forward-Looking Statements

The Corporation’s oral and written public communications may

include forward-looking statements. These statements are included

in this press release, the Circular and may be included in other

filings or communications from the Corporation. The forward-looking

statements are made pursuant to the applicable securities

legislation. Forward-looking statements may include, but are not

limited to, statements and comments with respect to the holding of

the Meeting, the anticipated timing and the various steps to be

completed in connection with the Arrangement, including receipt of

Shareholder and court approvals, and the anticipated timing of

closing of the Arrangement. Forward-looking information also

relates to, among other things, the Corporation’s strategies to

achieve its objectives, as well as information with respect to

management’s beliefs, plans, expectations, anticipations,

estimations and intentions, and may also include other statements

that are predictive in nature, or that depend upon or refer to

future events or conditions. The management of H2O Innovation would

like to point out that forward-looking statements involve a number

of uncertainties, known and unknown risks and other factors which

may cause the actual results, performance or achievements of the

Corporation to materially differ from any future results,

performance or achievements expressed or implied by such

forward-looking statements. In preparing its outlook, the

Corporation made assumptions that do not consider extraordinary

events or circumstances beyond its control. When used in this press

release, words such as “anticipate”, “continue”, “could”,

“estimate”, “expect”, “forecast”, “future”, “intend”, “may”,

“objective”, “outlook”, “plan”, “predict”, “project”, “should”,

“will”, “would” or the negative or comparable terminology as well

as terms usually used in the future and the conditional are

generally intended to identify forward-looking statements, although

not all forward-looking statements include such words.

The information contained in forward-looking statements is based

upon certain material assumptions that were applied in drawing a

conclusion or making expectations, forecasts, projections,

predictions, or estimations, including, without limitation: that

the Arrangement will be completed on the terms currently

contemplated, and in accordance with the timing currently expected;

that all conditions to the completion of the Arrangement will be

satisfied or waived; and that the arrangement agreement entered

into on October 3, 2023 between the Corporation and the Purchaser

regarding the Arrangement (the “Arrangement Agreement”) will not be

terminated prior to the completion of the Arrangement. A change

affecting an assumption can also have an impact on other

interrelated assumptions, which could increase or diminish the

effect of the change. Forward-looking statements are presented for

the purpose of assisting investors and others in understanding

certain key elements of the Corporation’s current objectives,

strategic priorities, expectations and plans, and in obtaining a

better understanding of the Corporation’s business and anticipated

operating environment.

Forward-looking statements are necessarily based on a number of

opinions, assumptions and estimates that, while considered

reasonable by the Corporation as of the date of this press release,

are subject to inherent uncertainties, risks and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements. Moreover, the proposed Arrangement

could be modified or the Arrangement Agreement terminated in

accordance with its terms. Several factors, risks or uncertainties

could cause the actual results to differ materially from the

results discussed in the forward-looking statements. Should one or

more of these factors, risks or uncertainties materialize or should

the assumptions underlying those forward-looking statements prove

incorrect, actual results may vary materially from those described

herein. Such factors include, without limitation: (a) the failure

of the parties to obtain any necessary regulatory approvals or the

required Shareholder and court approvals or to otherwise satisfy

the conditions to the completion of the Arrangement, and failure of

the parties to obtain such approvals or satisfy such conditions in

a timely manner; (b) significant costs or unknown liabilities

related to the Arrangement; (c) litigation relating to the

Arrangement may be commenced which may prevent, delay or give rise

to significant costs or liabilities; (d) the Arrangement Agreement

may be terminated prior to its consummation; (e) the Corporation

may be required to pay a termination fee to the Purchaser in

certain circumstances if the Arrangement is not completed; (f) the

focus of management’s time and attention on the Arrangement may

detract from other aspects of the Corporation’s business; (g)

general economic conditions; (h) the market price of the Shares may

be materially adversely affected if the Arrangement is not

completed or its completion is materially delayed; and (i) failure

to realize the expected benefits of the Arrangement.

Failure to obtain any necessary regulatory approvals or the

required Shareholder and court approvals, or such approvals being

obtained subject to conditions that are not anticipated, or failure

of the parties to otherwise satisfy the conditions to the

completion of the Arrangement may result in the Arrangement not

being completed on the proposed terms, or at all. If the

Arrangement is not completed, and the Corporation continues as a

publicly-traded entity, there are risks that the announcement of

the Arrangement and the dedication of substantial resources of the

Corporation to the completion of the Arrangement could have an

impact on its business and strategic relationships (including with

future and prospective employees, customers, suppliers and

partners), operating results and activities in general, and could

have a material adverse effect on its current and future

operations, financial condition and prospects. Furthermore,

pursuant to the terms of the Arrangement Agreement, the Corporation

may, in certain circumstances, be required to pay a fee to the

Purchaser, the result of which could have an adverse effect on its

financial position. The Corporation cautions that the foregoing

list of factors is not exhaustive. Additional information about the

risk factors to which the Corporation is exposed to is provided in

the Annual Information Form dated September 27, 2023, which is

available on SEDAR+ (www.sedarplus.ca).

The forward-looking statements set forth herein reflect the

Corporation’s expectations as of the date hereof, and are subject

to change after this date. The Corporation may, from time to time,

make oral forward-looking statements. The Corporation advises that

the above paragraphs and the risk factors described herein should

be read for a description of certain factors that could cause the

actual results of the Corporation to differ materially from those

in the oral forward-looking statements. Unless required to do so

pursuant to applicable securities legislation, H2O Innovation

assumes no obligation to update or revise forward-looking

statements contained in this press release or in other

communications as a result of new information, future events, and

other changes.

About H2O Innovation

Innovation is in our name, and it is what drives the

organization. H2O Innovation is a complete water solutions company

focused on providing best-in-class technologies and services to its

customers. The Corporation’s activities rely on three pillars: i)

Water Technologies & Services (WTS) applies membrane

technologies and engineering expertise to deliver equipment and

services to municipal and industrial water, wastewater, and water

reuse customers, ii) Specialty Products (SP) is a set of businesses

that manufacture and supply a complete line of specialty chemicals,

consumables and engineered products for the global water treatment

industry, and iii) Operation & Maintenance (O&M) provides

contract operations and associated services for water and

wastewater treatment systems. Through innovation, we strive to

simplify water. For more information, visit

www.h2oinnovation.com.

Source: H2O Innovation Inc. www.h2oinnovation.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231120981306/en/

Marc Blanchet +1 418-688-0170

marc.blanchet@h2oinnovation.com

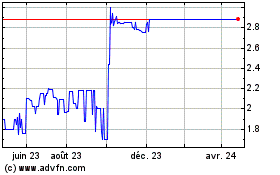

H2O Innovation (EU:ALHEO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

H2O Innovation (EU:ALHEO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024