Vopak reports strong Q1 2024 results and increases FY 2024 outlook

24 Avril 2024 - 7:00AM

Vopak reports strong Q1 2024 results and increases FY 2024 outlook

The Netherlands, 24 April 2024

Vopak reports strong Q1 2024 results and increases FY

2024 outlook

Key highlights Q1 2024

Improve

- Increased net profit -including exceptional items1- in Q1 2024

to EUR 106 million, an improvement of 3% year-on-year, driven by

favorable storage demand across different geographies and

markets

- Increased proportional EBITDA -excluding exceptional items1- in

Q1 2024 to EUR 298 million, an improvement of 9% year-on-year when

adjusted for divestment impacts of EUR 21 million

- Further strengthened balance sheet, good progress on share

buyback program

- Increased FY 2024 outlook for proportional EBITDA and

EBITDA

Grow

- Strengthened our leading position in India with the acquisition

of a new terminal in Mangalore

- Good progress in developing a greenfield LPG-export terminal

project in Western-Canada

Accelerate

- Commissioned repurposed infrastructure in Singapore for

low-carbon transportation fuels, good progress in repurposing

existing capacity in Alemoa, Brazil and Vlaardingen, the

Netherlands

|

In EUR millions |

Q1 2024 |

Q4 2023 |

Q1 2023 |

| |

|

|

|

|

IFRS Measures -including exceptional items- |

|

|

|

|

Revenues |

328.2 |

352.8 |

361.8 |

|

Net profit / (loss) attributable to holders of ordinary shares |

105.8 |

87.4 |

103.1 |

|

Earnings per ordinary share (in EUR) |

0.85 |

0.69 |

0.82 |

|

Cash flows from operating activities (gross) |

278.8 |

219.7 |

227.0 |

|

Cash flows from investing activities (including derivatives) |

-111.1 |

247.4 |

-103.1 |

| |

|

|

|

| Alternative

performance measures -excluding exceptional items-

1,2 |

|

|

|

|

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

235.0 |

228.8 |

249.0 |

|

Net profit / (loss) attributable to holders of ordinary shares |

105.8 |

109.0 |

103.1 |

|

Earnings per ordinary share (in EUR) |

0.85 |

0.87 |

0.82 |

|

Proportional revenues |

477.9 |

494.1 |

486.1 |

|

Proportional group operating profit / (Loss) before depreciation

and amortization (EBITDA) |

297.8 |

282.3 |

294.1 |

|

|

|

|

|

|

Business KPIs |

|

|

|

|

Storage capacity end of period (in million cbm) |

34.8 |

35.2 |

36.6 |

|

Proportional storage capacity end of period (in million cbm) |

20.2 |

20.6 |

22.1 |

|

Subsidiary occupancy rate |

92% |

91% |

92% |

|

Proportional occupancy rate |

93% |

91% |

92% |

|

|

|

|

|

|

Financial KPIs 2 |

|

|

|

|

Proportional operating cash return |

17.0% |

12.8% |

15.4% |

|

Net interest-bearing debt |

2,223.4 |

2,286.4 |

2,946.5 |

|

Total net debt : EBITDA |

1.76 |

1.99 |

2.69 |

1 No exceptional items were recorded in Q1 2024 and Q1 20232 See

enclosure 2 of the press release for reconciliation to the most

directly comparable subtotal or total specified by IFRS Accounting

Standards

CEO statement

“In the first quarter of 2024, we continued to deliver on our

strategy to improve our financial and sustainability performance,

to grow our business in industrial and gas terminals, and to

accelerate towards new energies and sustainable feedstocks. The

demand for our infrastructure services remained robust, resulting

in an increased proportional occupancy of 93%. Oil and gas markets

were strong, driven by a higher demand for energy, and rerouting of

supply chains. Chemical markets remain under pressure, having a

limited impact on our chemical distribution terminals so far, while

industrial terminals maintained solid results, backed by long-term

take-or-pay contracts. We continue to grow our footprint in India

and acquired a new terminal in Mangalore. Our strong performance

and strategy execution coupled with favorable market conditions

positions us well to revise our outlook for FY 2024 upwards. We are

committed to grow our business in industrial and gas infrastructure

and accelerate towards new energies and sustainable

feedstocks.”

Financial Highlights for Q1 2024

IFRS Measures -including exceptional items-

- Revenues were EUR

328 million (Q1 2023: EUR 362 million), adjusted for divestment

impacts of EUR 44 million revenues increased by 3% year-on-year.

The positive performance was driven by favorable storage demand

across different geographies and markets.

- Demand for our services continued

to be robust during the first quarter of 2024. In the hub

locations, storage demand was strong, primarily driven by the

continued rise in demand for oil and the rerouting of trade flows.

Demand in the distribution oil terminals remained firm as well.

Chemical markets continued to be characterized by oversupply which

put pressure on end-product prices and production margins. In

chemical distribution terminals, the impact on demand for storage

infrastructure was limited, but remains uncertain for the rest of

the year. Throughput levels in our industrial terminals were solid.

Gas terminals showed firm throughput levels, backed by growing

energy demand and energy security considerations.

- Operating expenses

were EUR 155 million in Q1 2024 (Q1 2023: EUR 175 million),

adjusted for divestment impacts of EUR 24 million these expenses

increased by EUR 4 million mainly due to an increase in personnel

expenses.

- Cash flows from operating

activities increased by EUR 52 million to EUR 279

million compared to Q1 2023 EUR 227 million, a 23% increase

year-on-year, mainly related to increased dividends received from

joint ventures (EUR 80 million) partly offset by lower EBITDA due

to divestment impacts and negative working capital

movements.

- Net profit attributable to

holders of ordinary shares increased to EUR 106 million

(Q1 2023: EUR 103 million). Earnings per share (EPS) continued to

improve, Q1 2024 EPS were EUR 0.85 (4% year-on-year) compared to

EUR 0.82 in Q1 2023.

- Share buyback

program of up to EUR 300 million announced on 14 February

2024, is progressing well. Since the start, around 30% of the

program has been executed per April 19th, and will run until the

end of 2024, barring unforeseen circumstances. For the progress of

our share buyback program please visit our website.

Alternative performance measures -excluding exceptional

items-1

- Proportional

EBITDA increased to EUR 298 million (Q1 2023: EUR 294

million). Adjusted for divestment impacts of EUR 21 million,

proportional EBITDA increased by EUR 25 million (9% year-on-year).

Proportional EBITDA margin in Q1 2024 was 60% (Q1 2023: 58%)

reflecting good business conditions and our commercial ability to

pass on inflationary and exceptional energy costs.

- EBITDA was EUR 235

million (Q1 2023: EUR 249 million) adjusted for divestment impacts

of EUR 21 million. EBITDA increased by EUR 7 million (3%

year-on-year) as a result of favorable storage demand across the

various markets and geographies. Compared to Q4 2023 (EUR 229

million), EBITDA increased due to the lower operating expenses and

slightly higher results from joint ventures which more than offset

divestment impacts of EUR 12 million.

- Growth capex in

the first quarter was EUR 64 million (Q1 2023: EUR 54 million)

reflecting growth investments in India, Belgium, the United States,

and Canada, among others. Proportional growth investments in Q1

2024 were EUR 83 million (Q1 2023: EUR 64 million).

- Operating capex,

which includes sustaining and IT capex, decreased to EUR 40 million

(Q1 2023: EUR 50 million) due to divestment impacts.

- Proportional operating cash

flow in Q1 2024 increased by EUR 6 million (3%

year-on-year) to EUR 228 million (Q1 2023 EUR 222 million) driven

mainly by improved proportional EBITDA performance. Proportional

operating cash flow per share in Q1 2024 increased to EUR 1.83 per

share from EUR 1.77 in Q1 2023.

Business KPIs

- Proportional

occupancy rate at Q1 2024 increased to 93% (Q1 2023: 92%)

mainly related to increased occupancy in the Netherlands Business

Unit due to reduced available capacity. In Europoort, we have

reduced the base capacity by ~380 thousand cbm in line with our

previously announced ambition to gradually reduce oil capacity in

Europoort, to accelerate towards new energies and sustainable

feedstocks.

Financial KPIs

- Proportional operating cash

return in Q1 2024 was 17% compared to 15% in Q1 2023. The

increase was mainly due to a lower average capital employed due

to divestments and positive contribution from new growth

projects.

- Total net debt :

EBITDA ratio is 1.76x at the end of Q1 2024 compared to

2.69x at the end of Q1 2023 and 1.99x at the end of Q4 2023. Our

ambition is to keep Total net debt to EBITDA in the range of around

2.50-3.00x.

For more information please contact:

Vopak Press: Liesbeth Lans - Manager External Communication,

e-mail: global.communication@vopak.comVopak Analysts and Investors:

Fatjona Topciu - Head of Investor Relations, e-mail:

investor.relations@vopak.com

The analysts’ presentation will be given via an on-demand audio

webcast on Vopak’s corporate website, starting at 08:45 AM CEST on

24 April 2024.

This press release contains inside information as meant in

clause 7 of the Market Abuse Regulation. The content of this report

has not been audited or reviewed by an external auditor.

1. To supplement Vopak’s financial information presented

in accordance with IFRS, management periodically uses certain

alternative performance measures to clarify and enhance

understanding of past performance and future outlook. For further

information please refer to page 7of the press release.

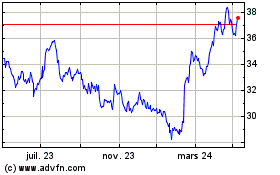

Koninklijke Vopak (EU:VPK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

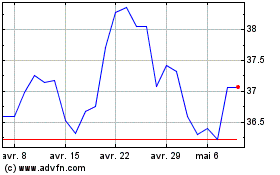

Koninklijke Vopak (EU:VPK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024