AltaGas and Vopak reach positive final investment decision on

Ridley Island Energy Export Facility

AltaGas and Vopak reach positive final investment

decision on Ridley Island Energy Export Facility

World class export facility will strengthen Canada’s

position as a growing global energy exporter

Calgary and Prince Rupert, Canada; Rotterdam, The

Netherlands

29 May 2023 – 6:30pm Mountain Standard Time / 30 May 2023 – 3:30

Central European Time. All figures contained in the press

release are in Canadian dollars unless otherwise stated.

AltaGas Ltd. (“AltaGas”) (TSX:

ALA) and Royal Vopak (“Vopak”) (XAMS:

VPK) (together the “Joint Venture”, “Partners” or

“Partnership”) are pleased to announce a positive final investment

decision (FID) on the Ridley Island Energy Export Facility (REEF),

a large-scale liquefied petroleum gas (LPG) and bulk liquids

terminal with rail, logistics and marine infrastructure on Ridley

Island, British Columbia, Canada. Following a five-year

environmental preparation and review process, extensive engagement

with multiple stakeholders including Indigenous rights holders and

local communities, the Joint Venture is set to deliver a world

class export facility that will operate with industry-leading

environmental stewardship.

KEY HIGHLIGHTS

- The Joint Venture has completed all major gating items,

including front-end engineering design (FEED) and a detailed Class

III capital estimate.

- Site clearing work is more than 95 percent complete and with

required permits in hand, the project is expected to come online

near 2026 year-end.

- Projected gross Joint Venture capital cost of $1.35 billion,

excluding governmental incentives and support, with annual

Partnership EBITDA of $185 million - $215 million are in-line with

the Partners’ expectations.

- Onsite work will be minimized to reduce capital cost risk and

community impacts, with 90 percent of equipment, packaging and

pipes expected to be prefabricated offsite in controlled operating

environments.

- The Joint Venture expects to lock-in more than 60 percent of

the Phase 1 capital costs through fixed-price, lump-sum

engineering, procurement and fabrication contracts prior to

construction.

- Vopak and AltaGas expect to fund their 50 percent pro-rata

ownership through each company’s respective financial capacity with

no leverage at the Partnership level.

- REEF will enhance Canada’s role as a growing global energy

exporter, strengthen Canadian and Asia Pacific energy connectivity

and provide Canadian producers and aggregators with access to the

premium global markets for LPGs.

- With only ten shipping days to the fastest growing demand

markets in Northeast Asia, REEF has a structural advantage in

delivering LPGs to Asia with the shortest shipping time

globally.

- The project has First Nations support agreements in place and

will drive further economic benefits to local communities in

Northwestern B.C. through construction activities, long-term job

creation and community investment focused on delivering positive

outcomes for all stakeholders.

- REEF will be constructed and operate under AltaGas and Vopak’s

existing exclusive rights granted by the Prince Rupert Port

Authority (PRPA) to develop LPG, methanol and other bulk liquids

exports on Ridley Island.

“This positive FID enables AltaGas to continue

connecting Canadian energy to Asian markets and drive valuable

outcomes for all our customers,” said Vern Yu, President and CEO of

AltaGas. “Canada has a structural advantage in delivering LPGs to

Asia with the shortest shipping time and lowest maritime emissions

footprint. AltaGas delivers more than 19 percent of Japan’s propane

and 13 percent of South Korea’s LPG imports, connecting our

upstream customers with customers in Asia. We look forward to

working with our partners to drive more long-term value creation

with REEF.”

“We are excited to be able to execute on our

growth strategy and invest in export infrastructure on this highly

strategic location” said Dick Richelle, Chairman of the Executive

Board and CEO of Royal Vopak. “Prince Rupert, with the shortest

shipping distances between North America and Asia, gives the

opportunity to drive progress by increasing the trade between

Canada and the Asia Pacific region. We are proud to contribute to

this development and are thankful for the good collaboration with

our partner AltaGas and other key stakeholders. The trust and

support of local First Nations and communities makes this

envisioned terminal a reality.”

Capital Cost, Economics, Funding and Delivery

Schedule

Projected gross capital cost of $1.35 billion,

excluding governmental incentives and support, and annual

Partnership EBITDA of $185 million - $215 million are in-line with

the Joint Venture’s expectations. Vopak and AltaGas are expected to

fund their pro-rata 50 percent ownership through each

organization’s respective financial capacity with no leverage at

the Partnership level.

The capital cost breakdown of Phase 1 includes

approximately $875 million for construction of the facility,

balance of the plant and LPG storage tanks and $475 million for

construction of the new dedicated jetty and extensive rail and

logistics infrastructure. The infrastructure includes additional

redundancies to provide operational flexibility that benefits the

Joint Venture and customers over the long term.

AltaGas will minimize onsite work to reduce

capital cost risk, with approximately 90 percent of equipment,

packaging and pipes being prefabricated offsite in controlled

operating environments. In addition, AltaGas expects to lock-in

more than 60 percent of the Phase 1 estimated capital cost through

fixed-price, lump-sum engineering, procurement and construction

contracts, prior to the start of construction of individual

phases.

The bulk of REEF’s construction activities are

planned to take place over 2025 and 2026 with select workstreams

beginning in 2024. This includes plans for the Partners to incur

approximately $200 million of incremental gross capital

expenditures in 2024. As part of the positive FID, AltaGas is

increasing its 2024 capital expenditure guidance from $1.2 billion

to $1.3 billion. AltaGas maintains a disciplined approach to

capital allocation and plans to fund its portion of the project

using internally generated cash flows and its annual investment

capacity. During construction, AltaGas will leverage the benefit of

operating a diversified platform by adjusting capital spending

across other parts of the business to ensure the company is

balancing its three long-term objectives of financial strength and

flexibility, continued organic growth, and long-term dividend

growth.

Vopak’s disciplined capital allocation policy is

driving value through accretive growth investments that will

deliver attractive operating cash return. Vopak’s growth capex

guidance for FY 2024 remains unchanged. The long-term commitment to

invest EUR 1 billion to grow in industrial and gas by 2030 and EUR

1 billion to accelerate towards new energies by 2030 remains

unchanged. Vopak plans to fund its portion of the project using the

strong balance sheet position. The efficient use of the capital

structure will further support cash flow generation at Vopak

level.

REEF has strong community support following extensive

stakeholder engagement

Vopak and AltaGas have been working closely with

First Nations rights holders and key stakeholders, including the

local communities in Northwestern British Columbia, as well as the

PRPA, and Federal and Provincial regulators for more than five

years to deliver a project that will operate with industry-leading

environmental and community stewardship. AltaGas and Vopak have

developed strong relationships with local Indigenous communities

through its existing operations, where the partners have worked

collaboratively on economic and social development opportunities,

including skills training, emergency response preparedness and

other community-identified priorities. REEF will drive strong

economic benefits to these local communities in the region through

construction activities, long-term job creation, and community

investment targeted at driving positive economic outcomes across

all stakeholders.

Vopak Conference Call

Vopak will host an analysts’ presentation with

Vopak’s CFO, Michiel Gilsing via an on-demand audio webcast on

Vopak’s corporate website, details as follows:

- Date: 30 May 2024

- Time: 08:30 CEST

- Webcast

Link: https://channel.royalcast.com/vopakinvestors/#!/vopakinvestors/20240530_1

APPENDIX:

Project Overview

REEF will be developed on a 190-acre (77

hectare) site adjacent to AltaGas and Vopak’s existing Ridley

Island Propane Export Terminal (RIPET), on lands administered by

the Port of Prince Rupert (PRPA) for which the Joint Venture has

executed a long-term lease. REEF has been granted the key Federal

and Provincial permits to construct storage tanks, a new dedicated

jetty, rail and other infrastructure required to operate a

state-of-the-art facility.

The project will have the capability to

facilitate the export of LPGs, methanol and other bulk liquids that

are vital for everyday life. The project will be developed and

brought online in phases. This approach will provide the most

capital efficient buildout of the project, match energy export

supply with throughput capacity, mitigate impacts on local

communities and provide local construction and employment

opportunities that will extend over longer time horizons.

Phase 1 will include approximately 55,000

barrels a day of initial LPG export capacity, including propane and

butane, 600,000 barrels of LPG storage (95 thousand cbm

equivalent), a new dedicated multi-product jetty, and extensive

rail and logistics infrastructure. The infrastructure will include

10 dual sided rail offloading slots and 25 kilometers of

multi-track infrastructure that is unit-train capable and will

provide flexibility to overcome congestion and outages. More than

80 percent of Phase 1 capital investments will be able to be

leveraged in future REEF phases, providing capital efficient

buildout of subsequent expansions. The REEF project design has

multiple additional advantages compared to other recent large

energy infrastructure projects in Canada, including being a single

site and operating jurisdiction, having all major regulatory

approvals in place, utilizing proven technologies and being aligned

with the Partners’ core competencies.

As disclosed in the first quarter of 2024,

AltaGas has made considerable contracting progress across its

global exports’ platform, including tolling levels increasing to 56

percent starting in the second quarter of 2024. AltaGas is in

active negotiations with several long-term counterparties, which

would move the company to its long-term tolling target of 60

percent of total export volumes, for the beginning of the 2027

natural gas liquids (NGL) year, starting on April 1.

REEF will be constructed under the Joint Venture’s

exclusive rights for LPG exports on Ridley Island

REEF will be constructed and operate under

AltaGas and Vopak’s existing exclusive rights granted by the PRPA

to develop LPG, methanol and other bulk liquids exports on Ridley

Island. The provision of these exclusive rights was important to

ensure the certainty needed to advance large capital projects

through long and fulsome development periods and ensure developers

advance projects with comprehensive environmental and community

stewardship.

REEF will have optionality for alternative

fuels

In subsequent phases, the Joint Venture will

have the option to progress evaluation work on fuels of the future,

such as hydrogen, which has growing customer interest in Asia,

particularly Japan and South Korea. The Joint Venture has strong

core competencies in this area with Vopak offering one of the

preeminent third-party hydrogen storage platforms globally, with

multiple terminals in operation across several countries. Through

this deep experience, the Partners will consider participation in

hydrogen exports from Canada with evaluation work expected to be

done methodically with a critical emphasis on safety and

stewardship.

REEF benefits from structural west coast advantage to

Asian markets

With only 10 shipping days to the fastest

growing demand markets in Northeast Asia, REEF will be able to

efficiently connect Canada's vital energy products to the

world. This includes having an approximate 60 percent base time

savings over the U.S. Gulf Coast, which requires a minimum 25-day

shipping time to Northeast Asia, and approximately 45 percent

base time savings over the Arabian Gulf, which requires a minimum

18-day shipping time. This geographic advantage expands when there

is significant congestion in the Panama Canal, as has recently

been experienced or when other global shipping pinch points

experience disruptions.

AltaGas and Vopak are pleased to move forward

with REEF. The REEF project advances Canada’s growing role in

connecting Canadian energy, vital to everyday life, to global

markets. We are thankful to all stakeholders for their continued

support and ongoing partnership.

About AltaGas

AltaGas is a leading North American

infrastructure company that connects customers and markets to

affordable and reliable sources of energy. The Company operates a

diversified, lower-risk, high-growth Energy Infrastructure business

that is focused on delivering resilient and durable value for its

stakeholders.

From wellhead to tidewater, AltaGas’ Midstream

business is focused on providing its customers with safe and

reliable service and connectivity that facilitates the best

outcomes for their businesses. This includes global market access

for North American LPGs, which provides North American producers

and aggregators with the best netbacks for LPGs while delivering

diversity of supply and stronger energy security to its downstream

customers in Asia.

Throughout AltaGas’ operations, the company is

playing a vital role within the larger energy ecosystem that keeps

the global economy moving forward and is powering the possible

within our society, and in a safe, reliable, and affordable manner.

For more information, please visit www.altagas.ca.

About Royal Vopak

Royal Vopak helps the world flow forward. At

ports around the world, we provide storage and infrastructure

solutions for vital products that enrich everyday life. These

products include liquids and gases that provide energy for homes

and businesses, chemicals for manufacturing products, and edible

oils for cooking. For all of these, our worldwide network of

terminals supports the global flow of supply and demand. For more

than 400 years, Vopak has been at the forefront of fundamental

transformations. With a focus on safety, reliability, and

efficiency, we create new connections and opportunities that drive

progress. Now more than ever, our talented people are applying this

mindset to support the energy transition. Together with our

partners and customers, we are accelerating the development of

infrastructure solutions for hydrogen, ammonia, CO₂, long-duration

energy storage, and low-carbon fuels & feedstocks – paving the

way to a more sustainable future. Vopak is listed on the Euronext

Amsterdam and is headquartered in Rotterdam, the Netherlands. For

more information, please visit www.vopak.com.

For more information please contact:

AltaGas:

- Analysts and Investors: Jon

Morrison, Senior Vice President, Corporate Development and

Investor Relations (Jon.Morrison@altagas.ca) or Aaron

Swanson, Vice President, Investor Relations

(Aaron.Swanson@altagas.ca)

- Media Inquiries: Bryn

Lukowiak, Senior Communications Advisor

(media.relations@altagas.ca).

Vopak:

- Analysts and Investors: Fatjona

Topciu - Head of Investor Relations

(investor.relations@vopak.com)

- Press: Liesbeth Lans -

Manager External Communication

(global.communication@vopak.com)

- REEF illustration 1

- REEF illustration 2

- REEF illustration 3

- REEF illustration 4

- REEF Press Release May 2024

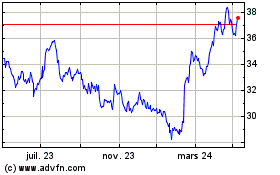

Koninklijke Vopak (EU:VPK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

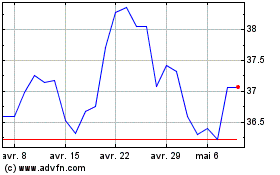

Koninklijke Vopak (EU:VPK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025