MAIN TRANSACTION TERMS

- Subscription price: EUR 0.0601 per new share

- Subscription ratio: 999 new shares for 1 existing

share

- Trading period for preferential subscription rights: from

November 14th to November 23rd, 2023 inclusive

- Subscription period: from November 16th to November 27th,

2023 inclusive

- Capital increase backstopped by the unsecured creditors of

the Company subscribing, if applicable, by way of set-off against

their claims

Not to be published, distributed or circulated

directly or indirectly in the United States, Canada, Australia or

Japan.

This press release is an advertisement and not

a prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017

Under the Accelerated Safeguard Plan

Approved by the Specialized Commercial Court of Nanterre on July

24Th, 2023, Orpea Announces the Launch of a Share Capital Increase

With Shareholders’ Preferential Subscription Rights for an Amount

of Approximately Eur 3.9 Billion Backstopped by the Unsecured

Creditors of the Company Subscribing by Way of Set-off Against

Their Unsecured Claims

Regulatory News:

ORPEA S.A (Paris:ORP) (The « Company »), announces today

the launch of a share capital increase with shareholders’

preferential subscription rights for an amount of approximately EUR

3.9 billion (the “Equitization Capital Increase”)

The Capital Increase is carried out in the context of the

accelerated safeguard plan adopted by the Nanterre Specialised

Commercial Court on July 24th, 2023 (the “Accelerated Safeguard

Plan”) and aims at equitizing (by conversion and/or redemption)

the entire unsecured indebtedness of the Company, amounting to

approximately EUR 3.9 billion.

In a ruling handed down on November 9, 2023, the Paris Court of

Appeal rejected the appeals lodged by certain ORPEA shareholders

and minority creditors against the decision of the Autorité des

marchés financiers to grant the groupement comprising Caisse des

dépôts et consignations, CNP Assurances, MAIF and MACSF an

exemption from their obligation to file a public offer for the

Company's shares.

The Groupement having made their investment conditional on the

Paris Court of Appeal rejecting any appeal against the waiver

decision granted by the Autorité des marchés financiers, this

condition has now been met, enabling the accelerated safeguard plan

for ORPEA to continue to be implemented.

REMINDER ON THE ACCELERATED SAFEGUARD PLAN

The Accelerated Safeguard Plan, provides for the implementation

of three capital increases, namely (i) the Equitization Capital

Increase as detailed in this press release, (ii) a capital increase

without preferential subscription rights reserved to Caisse des

Dépôts et Consignations, Mutuelle Assurance Instituteurs de France

(MAIF), CNP Assurances and MACSF Epargne Retraite (or companies

affiliated with them), with a priority right granted to the

Existing Shareholders (as defined below) of the Company, allowing

them to subscribe by preference to the shares so issued, in an

amount (including the issue premium) of EUR 1,160,080,551.59, by

way of issuance of 65,173,064,696 new shares at an issue price of

EUR 0.0178 per new share (the “Groupement Capital Increase”)

and (iii) a capital increase with shareholders' preferential

subscription right in an amount (including the issue premium) of

EUR 390,019,672.62, by issuing 29,324,787,415 new shares at an

issue price of EUR 0.0133 per new share, to which the members of

the Groupement have committed to subscribe in the amount of

approximately EUR 196 million, the balance, i.e. EUR 194 million,

being backstopped by five institutions holding a significant

portion of the Company's unsecured debt (the “Rights Issue”

and together with the Equitization Capital Increase and the

Groupement Capital Increase, the “Capital Increases”, all

three Capital Increases forming an indivisible whole).

In addition, in accordance with the terms of the Accelerated

Safeguard Plan, the Company's Board of Directors decided on

November 10, 2023 to reduce the Company's share capital, based on

losses, by reducing the par value of the Company's shares from 1.25

euro to 0.01 euro per share (the "First Capital

Reduction").

The amount of the First Capital Reduction, motivated by losses

(in accordance with the provisions of article L. 225-204 of the

French Commercial Code), is 80,220,375.24 euros and has been

allocated to a special unavailable reserves account.

As a result of the First Capital Reduction, on the date of this

press release, the Company's share capital stood at 646,938.51

euros, comprising 64,693,851 shares with a par value of 0.01 euro

each.

IMPORTANT

Shareholders' attention is drawn to the fact that the

subscription price of the New Shares to be issued as part of the

Equitization Capital Increase is 3.38 times higher than the

subscription price of the new shares to be issued as part of the

Groupement Capital Increase, which stands at €0.0178 per share,

which was determined by reference to the pre-money valuation (i.e.

€1,151.6 million) retained by the parties to the Lock-Up Agreement

for all the shares comprising the Company's share capital after

completion of the Equitization Capital Increase and before issue of

the new shares under the Groupement Capital Increase.

On this basis, assuming that the post-Equitization Capital

Increase share price would be at the level of the subscription

price of the Groupement Capital Increase (i.e. €0.0178 per share),

an Existing Shareholder who decides to subscribe to the

Equitization Capital Increase by exercising his preferential

subscription rights would be exposed to a potential loss of market

value of the shares thus subscribed of 70% on the amount invested.

Existing Shareholders are therefore invited to consider carefully

whether or not to subscribe to the Equitization Capital Increase,

in view of the significant potential loss of value to which they

would be exposed.

INDEPENDENT EXPERTISE

The Company appointed on a voluntary basis the firm Sorgem

Evaluation, located at 11 rue Leroux, 75116 Paris, and represented

by Mr. Maurice Nussenbaum, as independent expert, in accordance

with Article 261-3 of the Autorité des marchés financiers’

(“AMF”) General Regulations, in order to give an opinion on

the fairness of the terms and conditions of the Company’s

restructuring from the current shareholders’ standpoint.

This independent expert’s report, together with its addendum,

provided at the Company’s request, are available in extenso, in the

Annex A of the securities note related to the Equitization Capital

Increase, with the consent of Sorgem Evaluation which has approved

its content and allowed the Company to report the conclusion of

this expertise in publicly available documents.

MAIN TERMS OF THE EQUITIZATION CAPITAL INCREASE

The Equitization Capital Increase will be carried out with

shareholders’ preferential subscription rights (the

“Rights”), pursuant to the 2nd resolution attached to the

Accelerated Safeguard Plan, and will result in the issue of

64,629,157,149 new shares (the “New Shares”), at a

subscription price of €0.0601 per New Share (i.e. EUR 0.01 nominal

value and EUR 0.0501 issue premium), to be fully paid up upon

subscription, representing gross proceeds, including the issue

premium, of EUR 3,884,212,344.65.

Each of the Company’s shareholders will receive one (1) Right

for each share registered on his securities account as of November

15th, 2023. In order to allow the registration in securities

accounts as of such date, the execution of purchases in the market

of existing shares must occur on November 13rd, 2023 at the latest.

Each Right will entitle its holder to subscribe for 999 New Shares

on an irreducible basis (à titre irréductible). Subscriptions on a

reducible basis (à titre réductible) will not be accepted.

New Shares not subscribed on an irreducible basis (à titre

irréductible) will be subscribed by the unsecured creditors under

their backstop commitment, by way of set-off against their

claims.

On the basis of the closing price of the Company share on the

regulated market of Euronext in Paris (“Euronext Paris”) on

November 9th, 2023, i.e. EUR 1.4045, the theoretical value of one

(1) Right is EUR 1.3431 and the theoretical ex-right price of the

share is EUR 0.0614.

For information purposes, the issue price reflects a discount of

2.19% compared to the theoretical value of the Company ex-right

share, calculated on the basis of the closing price on November

9th, 2023, and a discount of 95.72% compared to the closing price

on November 9th, 2023.

Investors' attention is however drawn to the fact that this

value must be considered of little relevance, in particular to the

extent that the current market price of the Company share is

significantly uncorrelated with the theoretical value of a share

post-Capital Increases. Using as a reference price the subscription

price of the Groupement Capital Increase (i.e. 0.0178€), which is

more than three times less than the issue price of the Equitization

Capital Increase (EUR 0.0601 per share), hence removing any

interest, for an Existing Shareholder (as defined hereafter), to

participate in the Equitization Capital Increase, the value of a

Right would be null.

These values do not necessarily reflect the value of the Rights

during their trading period, the ex-right price of an existing

share of the Company or the discounts, as determined in the

market.

The Equitization Capital Increase will be open to the public in

France only.

INDICATIVE TIMETABLE FOR THE EQUITIZATION CAPITAL

INCREASE

The Rights will be detached on November 14th, 2023 and tradeable

from November 14th, 2023 until November 23rd, 20231 inclusive on

the regulated market of Euronext Paris under the ISIN code

FR001400LAA6. The subscription period for the New Shares will be

open from November 16th, 2023 until close of trading on November

27th, 2023. Unexercised Rights will automatically lapse at the end

of the subscription period, i.e. on November 27th, 2023 at the

close of trading.

The issuance, settlement and delivery of the New Shares and

commencement of trading on Euronext Paris are expected to take

place on December 4th, 2023. The New Shares will immediately

entitle their holders to receive dividends declared by the Company

as from the date of issuance. They will be immediately fungible

with existing shares of the Company and will be traded on the same

trading line under the same ISIN code FR0000184798.

USE OF PROCEEDS

The estimated maximum gross proceeds of the capital increase are

approximately EUR 3.9 billion.

Any amount in cash received by the Company in respect of the

subscription by the shareholders for New Shares in the context of

the Equitization Capital Increase resulting from the exercise of

their Rights will be entirely allocated to the repayment of the

unsecured indebtedness at par and pro rata, being reminded that the

unsubscribed amount of the Equitization Capital Increase will be

entirely subscribed for by the unsecured creditors by way of

set-off against their unsecured claims.

DILUTION

The implementation of the Equitization Capital Increase, and

more broadly of the Capital increases contemplated as part of the

Accelerated Safeguard Plan, will result in a massive dilution for

the Existing Shareholders (as defined hereafter).

For illustrative purposes only, following the issue of the New

Shares, an Existing Shareholder holding (as defined hereafter) 1.0%

of the Company’s share capital on October 31st, 2023, and not

subscribing to the Equitization Capital Increase, would hold

0.0010% of the share capital.

Should Existing Shareholders (as defined hereafter) decide to

sell their preferential subscription rights received as part of the

Equitization Capital Increase and the Rights Issue, proceeds from

such sale might prove insufficient to offset the aforementioned

dilution.

Besides, Existing Shareholders willing to maintain their current

shareholding level post Capital Increases through subscription

would need to invest significant amounts to subscribe for new

shares issued, and may suffer a very significant loss in market

value of their investment, given that the issue price of the New

Shares issued through the Equitization Capital Increase (EUR 0.0601

per share) is significantly higher than the issue price of the new

shares to be issued through the Groupement Capital Increase and the

Rights Issue (EUR 0.0178 and EUR 0.0133 per share

respectively).

Illustrative example - Investments to be made by an Existing

Shareholder holding 75 Shares on November 15, 2023 and wishing to

maintain its current stake post-Capital Increases; loss of

corresponding value estimated on the basis of a share price

post-Capital Increases which would align with the theorical price

of the share post Capital Increases (EUR 0.0170).

Equitization Capital Increase

The Existing Shareholder holding 75 shares of the Company on

November 15, 2023, if it wishes not to be diluted as a result of

the Equitization Capital Increase, should subscribe to the

Equitization Capital Increase by exercising all of its Rights on an

irreducible basis for up to 74,925 New Shares, corresponding to a

total subscription price of EUR 4,503.

On this basis, and assuming that the share price after the

Equitization Capital Increase would align with the subscription

price of the Groupement Capital increase (for illustrative

purposes), the value of the shares held by the Existing Shareholder

would amount to EUR 1,335, with an investment thus corresponding to

a potential loss of market value of the shares of EUR 3,168 (-70%

of the invested amount).

Groupement Capital Increase

The Existing Shareholder having subscribed via the exercise of

all its rights to the Equitization Capital Increase, if it wishes

not to be subsequently diluted as a result of the Groupement

Capital Increase, should exercise its priority right and subscribe

on an irreducible basis to the Groupement Capital Increase up to

its full priority. The number of shares retained for the priority

right would be equal to: 75 shares (i.e. the number of shares held

on November 15, 2023) + 74,925 New Shares (i.e. the number of New

Shares subscribed as part of the Equitization Capital increase,

provided that the Existing Shareholder holds its shares in the pure

registered form on November 15, 2023) = 75,000 shares. The Existing

Shareholder could therefore place an irreducible priority

subscription order for 75,555 new shares2 issued as part of the

Groupement Capital increase, for a total subscription price of EUR

1,345.

Thus, in order to maintain its percentage of participation

unchanged following the Equitization Capital Increase and the

Groupement Capital Increase, the Existing Shareholder holding 75

shares should subscribe for 150,480 new shares in aggregate and

invest a total of EUR 5,848.

On this basis, and assuming that the share price after the

Groupement Capital Increase would align with the subscription price

of the Groupement Capital increase (for illustrative purposes), the

value of the shares held by the Existing Shareholder would amount

to EUR 2,680, corresponding to a potential loss of market value of

the shares of EUR 3,168 (-54% of the cumulative invested

amount).

Rights Issue

The Existing Shareholder having subscribed up to its full

entitlements in the Equitization Capital Increase and the

Groupement Capital Increase, if it wishes not to be subsequently

diluted as a result of the Rights Issue, should exercise all of its

preferential subscription rights on an irreducible basis for up to

33,992 new shares3 issued as part of the Rights Issue, i.e. a total

subscription price of EUR 452.

Thus, in order to maintain its percentage of interest unchanged

following the three Capital Increases, the Existing Shareholder

holding 75 shares before the launch of the Equitization Capital

Increase would have to invest a total of EUR 6,300.

On this basis, and assuming that the share price after the

Capital Increases would align with the theorical share price post

Capital Increases, i.e. EUR 0.0170 (for illustrative purposes), the

value of the securities held by the Existing Shareholder would

amount to EUR 3,132, corresponding to a potential loss of market

value of EUR 3,168 (-50% of the cumulative invested amount).

GUARANTEE / BACKSTOP COMMITMENT

The issue of the New Shares is neither guaranteed by a banking

syndicate nor underwritten.

Nonetheless, under the terms of the Safeguard Plan, the issue of

the News Shares is the subject of backstop commitments by the

unsecured creditors of the Company subscribing by way of set-off

against their claims, up to the portion of the issue that would

have not been subscribed through the exercise of Rights and in

proportion to the principal amount of unsecured debt that they hold

individually in relation to the total principal amount of unsecured

debt of the Company (rounded down to the lower integer).

These backtop commitments cover the entire issue.

These backstop commitments do not constitute a “garantie de

bonne fin” within the meaning of article L.225-145 of the French

Code de commerce

AVAILABILITY OF THE PROSPECTUS

The prospectus (the « Prospectus ») approved by the AMF

under number 23-465 on November 10, 2023 and comprised of (i) ORPEA

S.A. 2022 universal registration document filed with the AMF on

June 7, 2023 under number D. 23-0461 (the “Universal Registration

Document” or “URD”), (ii) an amendment to the URD filed with the

AMF on November 10, 2023 under number D.23-0461-A01 (the “Amendment

to the URD”), (iii) the securities note dated November 10, 2023

(the “Securities Note”) and (iv) the summary of the Prospectus

(included in the Securities Note and attached hereafter) is

available on the websites of the AMF (www.amf-france.org) and the

Company (www.orpea-group.com). Copies of the Prospectus are

available free of charge at the Company’s registered office (12,

rue Jean Jaurès, 92813 Puteaux).

Potential investors are advised to read the Prospectus before

making an investment decision in order to fully understand the

potential risks and rewards associated with the decision to invest

in the New Shares. The approval of the Prospectus by the AMF should

not be understood as an endorsement of the offer or admission to

trading on Euronext Paris of the New Shares.

RISK FACTORS

Investors’ attention is drawn to the risk factors relating to

the Company included in chapter 2 « Internal Control and Risk

Factors » of the URD as updated in chapter 2 of the Amendment to

the URD and the risk factors relating to the transaction and the

New Shares mentioned in chapter 2 “Risk Factors” of the Securities

Note, in particular risk factor 2.1 related to the massive dilution

implied by the Capital Increases and the need for Existing

Shareholders to invest significant amounts if they want to maintain

their stakes unchanged.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 21 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https ://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, MSCI Small Cap Europe and CAC Mid 60

indices

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any State or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the European Economic Area

(others than France) and the United Kingdom (each a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any Relevant State. As a

result, the securities may and will be offered in any Relevant

State only (i) to qualified investors within the meaning of the

Prospectus Regulation, for any investor in a Member State of the

European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set forth in Article 1 (4)

of the Prospectus Regulation or under any other circumstances which

do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation, of the UK

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused

to be communicated (all such persons together being referred to as

“Relevant Persons”). Any investment or investment activity

to which this document relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

document or any of its contents.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company does not intend to register all or any

portion of the securities in the United States under the Securities

Act or to conduct a public offering of the securities in the United

States.

____________________________

1 Due to processing delays, custodians may

bring forward the cut-off dates and hours for receiving their

clients’ instructions in respect of their Rights. In this regard,

custodians must inform their clients through corporate event

notices and the relevant investors are invited to contact their

custodians.

2 The Existing Shareholder may subscribe

to the Groupement Capital Increase (65,173,064,696 shares to issue)

up to the share of its eligible shares in the capital of the

Company post Equitization Capital Increase, being specified that if

the exercise of the right of priority results in a number of shares

other than a whole number, then the number of shares to which this

Existing Shareholder can subscribe will be rounded down to the

lower integer. On this basis, in the example, the Existing

Shareholder will therefore be able to subscribe to

(75,000/64,693,851,000) x 65,173,064,696 = 75,555 new shares under

his priority right.

3 The Existing Shareholder will be granted

a preferential subscription right per share held, with 31

preferential subscription rights giving the right to subscribe to 7

new shares as part of the Rights Issue.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231112182178/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net Toll-free number for

shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel. :

01 44 71 94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Investor Relations Director Tel. : 07 70 29 53 74

i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 – 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

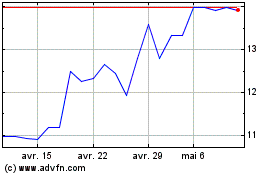

Orpea (EU:ORP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Orpea (EU:ORP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024