Rubis: H1 2024 Results

Paris, 05 September 2024, 5:45pm

- Solid

operating performance after a record H1 2023, underpinned by a

continued high level of activity in the Caribbean

- High cash

flow generation: Operating cash

flow1 at €352m, up 6%

vs H1 2023

- EBITDA at

€358m, stable yoy on a comparable

basis2, -12% vs H1

2023

- Net income

Group share at €130m, -4% on a comparable basis, -24% vs H1

2023

- Healthy

balance sheet: 1.6x corporate net financial

debt/EBITDA3

- 2024

Guidance reiterated – renewed confidence in dividend

growth

On 5 September 2024, Clarisse Gobin-Swiecznik,

Managing Partner, commented: “Following a record-breaking 2023,

we have delivered strong operational results in the first half of

this year. We achieved strong performance in the Caribbean hampered

by challenges in Kenya and Nigeria. Photosol development is

progressing as planned. These investments, which are crucial for

securing future growth are underway. Our robust cash flow

generation reflects the strength of our Group and supports our

growing dividend policy. Despite a few exceptional items affecting

our bottom line, I am confident that we will meet our full-year

guidance and remain optimistic about the Company’s continued growth

and future development.”

H1 2024

results4

highlights

- Energy

Distribution:

- Retail

& Marketing - Volume up 4%, gross margin at €416m down 7% (+0%

LFL5),

- Continued strong

performance of Retail, C&I and Aviation businesses in the

Caribbean, driven by the booming development of Guyana, the

increase in airlines frequencies in Barbados and the dynamism of

Jamaica.

- Eastern Africa:

Kenya saw a very dynamic first-half on the aviation side, with

increased flights combined with superior customer service. This

significant uptake was not sufficient to absorb the headwinds to

the retail business over this first-half (protests, floods,

economic downturn and FX volatility), leading to an overall

lacklustre performance.

- The Bitumen

activity was particularly strong in South Africa but continued to

be dragged on by the political context in Nigeria. Margins stood at

a comfortable level.

- Support

& Services - Gross margin down 8%, after a

very high H1 2023

- Bitumen supply

volume showed lower levels in Q2 vs Q2 2023 with low demand for

bitumen trading in the US.

- H1 2023 saw

important crude deliveries, generating a time lag with 2024, which

should catch up over the year.

- Renewable

Electricity Production:

- Secured portfolio

at 1GWp, up 55% yoy.

- EBITDA at €11m, up

12% yoy .

- Acceleration of

development costs to support Photosol’s future growth.

KEY FIGURES

CONSOLIDATED FINANCIAL STATEMENTS AS OF 30 JUNE

2024

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

Revenue |

3,339 |

3,324 |

0% |

|

EBITDA |

358 |

409 |

-12% |

|

o/w Energy Distribution |

371 |

416 |

-11% |

|

o/w Renewable Electricity Production |

11 |

10 |

12% |

|

EBIT |

257 |

323 |

-20% |

|

o/w Energy Distribution |

284 |

341 |

-17% |

|

o/w Renewable Electricity Production |

-3 |

-1 |

158% |

|

Net income, Group share |

130 |

171 |

-24% |

|

EPS (diluted), in euros |

1.25 |

1.66 |

-25% |

|

Cash flow before cost of net financial debt and tax |

352 |

331 |

6% |

|

Cash flow from operations |

286 |

241 |

18% |

|

Capital expenditure |

103 |

132 |

-22% |

|

o/w Energy Distribution |

68 |

108 |

-37% |

|

o/w Renewable Electricity Production |

35 |

24 |

48% |

|

(in million euros) |

Jun-2024 |

Dec-2023 |

Var % |

|

Net financial debt (NFD) |

1,491 |

1,360 |

10% |

|

NFD/EBITDA |

2.1x |

1.8x |

0.2x |

|

Corporate net financial debt(1)

(corporate NFD) |

1,079 |

992 |

9% |

|

Corporate NFD/EBITDA |

1.6x |

1.4x |

0.2x |

(1) Corporate net financial

debt – excluding non-recourse debt – see Appendix for further

detail.

H1 2024 FINANCIAL

PERFORMANCE

H1 2024 has seen a 12% decrease in EBITDA to

€358m and EBIT to €257m (-20% yoy).

At Group level, financial charges have increased

to reach €50m in H1 2024 vs €36m in H1 2023. This variation is

explained by the increase in interest rates, and a higher debt at

Photosol consistent with capacity in operation increase. As regards

FX financial charges, they reached €32m over the first-half, vs a

very high €80m (gross) in H1 2023. Main contributors were Kenya

(€14m) and Nigeria (€11m) where the currency was stable after the

devaluation observed in January.

Profit before tax decreased by 15% and Net

income Group share by 24% at €130m.

Focus on elements to be taken into

account to analyse variations on a comparable basis (see Appendix

for further detail)

At EBITDA level, H1 2024 includes:

-

Compensation-related impacts (IFRS2, among others): €15m

- Advisory fees

(strategy and M&A): €3m

H1 2023 included:

-

Compensation-related impacts (IFRS2, among others): €6m

- FX passthrough in

Nigeria: €(25)m

- Refund by the State

of the 2022 revenue shortfall in Madagascar: €(11)m

When adjusted for these elements, EBITDA

decreased by 1% yoy.

At EBIT level, two large bitumen vessels have

seen their life expectancy reduced from 28 to 25 years due to more

restrictive vetting policies, leading to an additional depreciation

expense of €4m for H1 2024 as compared to H1 2023.

EBIT decrease on a comparable basis reduces to

-5%.

For H1 2024, the impact of the OECD Global

Minimum Tax first-time application reached approximately €12m.

Further to the announcement of the divestment of

Rubis Terminal 55% stake, Rubis Terminal has been accounted for

under IFRS 5 – Noncurrent assets held for sale since 31 March 2024.

As a reminder, H1 2023 includes €5m related to Q2 2023.

On a comparable basis, Net income Group share

decreased by 4% over H1 2024.

The 18% increase in cash flow from operating

activities to €286m illustrates the strength of operations. Cash

flow generation before cost of net financial debt and tax stands at

€352m, 6% higher than in H1 2023.

Rubis corporate net financial debt (corporate

NFD) reached €1,079m at the end of H1 2024, leading to a corporate

NFD/EBITDA at 1.6x.

Capex reached €103m, of which €35m were

dedicated to Renewable Electricity Production. The remaining €68m

are split between maintenance (80%) and growth and energy

transition investments (20%) in the Energy Distribution business

line.

ENERGY DISTRIBUTION

Retail &

Marketing

The first half of 2024 saw volume increasing vs

an already high H1 2023. When excluding the refund by the State of

the 2022 revenue shortfall in Madagascar and the FX effect in

Nigeria from 2023, gross margin stayed stable at €416m. EBIT landed

at €200m, vs €247m in H1 2023 (-19% yoy, -3% on a comparable

basis). In H1 2024, Capex decreased to €59m (-15% yoy).

VOLUME SOLD AND GROSS MARGIN BY

PRODUCT IN H1

| |

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted Gross

margin(1) (in

€m) |

|

|

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

|

LPG |

660 |

654 |

1% |

158 |

158 |

0% |

158 |

158 |

0% |

|

Fuel |

2,101 |

1,988 |

6% |

214 |

231 |

-7% |

214 |

219 |

-2% |

|

Bitumen |

212 |

225 |

-6% |

44 |

59 |

-27% |

44 |

34 |

27% |

|

TOTAL |

2,973 |

2,867 |

4% |

416 |

448 |

-7% |

416 |

411 |

1% |

(1) Adjusted for

exceptional items and FX effects.

LPG demand was overall stable

over the first-half, autogas in Europe and bulk in Morocco,

compensating for the softer demand in South Africa. Gross margin

and unit margin remained stable, in line with volume.

As regards fuel:

-

The retail

business (service stations representing 49% of

fuel volume and 52% of H1 fuel gross margin) once again

showed its resilience. Volume was stable over H1. Gross

margin decreased by 23%, under separate effects:

- H1 2023 had seen

exceptional elements in Madagascar and in Kenya, leading to a

particularly high comparable base on retail gross margins;

- Retail activity in

Kenya was under pressure in H1 2024, challenges including protests,

floods and economic downturn weighed on performance. The Kenyan

Shilling further appreciation in Q2 also had a negative impact on

gross margin;

- On the other hand,

activity continued to be very dynamic in the Caribbean, with

Jamaica, Antigua, Grenada, Dominica (where operations resumed in

2023), and Guyana performing way above expectations.

- Following

the same strong momentum started in Q1, the

Commercial and Industrial

business (C&I, representing 28% of fuel volume

and 28% of H1 fuel gross margin) increased by 6% in volume, and 15%

in gross margin, led by Guyana and Barbados.

-

The aviation

segment (representing 20% of fuel volume and 17%

of fuel gross margin) was very dynamic with volume growth

reaching +32% over H1, and gross margin at +34%. This

excellent performance was driven by Kenya, where the

rationalisation of the aviation portfolio proved successful and

margins were managed very efficiently in Q2, and by the Eastern

Caribbean region, where airlines increased their frequencies.

Bitumen volume was down 6% yoy,

mainly driven by Nigeria, partially offset by the strong

performance of South Africa, Togo and Cameroon. When restated from

the passthrough of FX impact to customers in H1 2023, gross margin

showed a +27% increase yoy.

The table below provides volume and gross margin

split by region for H1.

VOLUME SOLD AND GROSS MARGIN BY

REGION IN H1

| |

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted Gross

margin(1) (in

€m) |

|

|

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

H1 2024 |

H1 2023 |

H1 2024 vs H1 2023 |

|

Europe |

464 |

451 |

3% |

114 |

111 |

3% |

114 |

111 |

3% |

|

Caribbean |

1,145 |

1,091 |

5% |

167 |

146 |

14% |

167 |

146 |

14% |

|

Africa |

1,364 |

1,326 |

3% |

134 |

191 |

-30% |

134 |

155 |

-13% |

|

TOTAL |

2,973 |

2,867 |

4% |

416 |

448 |

-7% |

416 |

411 |

1% |

(1) Adjusted for

exceptional items and FX effects.

Adjusted unit margin came in at

139€/m3, down 3% vs H1 2023.

EBIT BY REGION

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

Europe |

35 |

38 |

-8% |

|

Caribbean |

93 |

76 |

22% |

|

Africa |

72 |

133 |

-46% |

|

TOTAL RETAIL & MARKETING |

200 |

247 |

-19% |

By region, the dynamics of this first-half were

as follows:

-

Europe continues to benefit from its strong LPG

positioning (LPG accounts for >90% of regional gross profit)

This segment increased slightly (+4% in volume), driven by autogas

in France and Spain, and bottles in Portugal. The overall margin

was in line with volume growth at +3%. EBIT declined by 8%, but

increased by 3% on a comparable basis, in line with volume and

gross margin growth;

- the

Caribbean region remained buoyant, with volumes up

5%, despite the complicated situation in Haiti (volume: -24%). The

C&I business performed particularly well, with optimal

operating conditions, and +16% gains in unit margin. EBIT increased

by 22%, led by Jamaica and Guyana;

- lastly, in

Africa, gross margin was down 13%, adjusted for

the sequencing of payment in 2023 by the State of the 2022 revenue

shortfall in Madagascar (€11m) and the neutralisation of foreign

exchange losses in Nigeria (€25m). The half-year was marked by

difficult operating conditions in Nigeria and Kenya, combined with

high volatility in foreign exchange rate in Kenya.

Support &

Services

The Support & Services

business recorded EBIT of €85m (-10% yoy, -6% on a comparable

basis) in H1 2024.

Volume (+3%) and margins (-8%) have shown

resilience, after the record-high H1 2023. Q1 2023 had seen

significant crude deliveries, while 2024 deliveries have

experienced delays. The strong momentum observed in trading

activity in the Caribbean in Q1 continued in Q2 with +22% in volume

and +27% gross margin over the first-half, benefiting from the two

vessels acquired in 2023.

The SARA refinery and logistics operations

present specific business models with stable earnings profile.

Capex normalised at €9m (vs €39m in H1 2023,

-77% yoy), as H1 2023 included the acquisition of two new LPG

vessels in the Caribbean and one bitumen vessel.

RENEWABLE ELECTRICITY

PRODUCTION

The level of assets in operation grew by 17% yoy

at 460 MWp. The secured portfolio reached 1 GWp, up 55% yoy.

Revenue reached €24m over H1 2024, c. €4m of

which coming from direct sales to the market. When restated for

these direct sales to the market, revenue was stable vs H1 2023,

although Assets in operation grew by 17% yoy. EBITDA reached €11m

over H1 2024, hampered by:

- weather-related

effects (lower load factor, local hailstorms damaging panels);

- decrease in spot

prices, thereby downgrading the level of extra-revenue generated by

plants temporarily benefitting from spot price;

- acceleration of

development costs to support Photosol’s future growth.

|

Operational data |

H1 2024 |

H1 2023 |

Var % |

|

Assets in operation (MWp) |

460 |

394 |

17% |

|

Electricity production (GWh) |

221 |

234 |

-5% |

|

Sales (in €m) |

24 |

25 |

-3% |

|

EBITDA |

11 |

10 |

12% |

|

CAPEX |

35 |

24 |

48% |

|

Non-recourse project debt |

412 |

360 |

20% |

BULK LIQUID STORAGE

Further to the announcement of the divestment of

Rubis Terminal 55% stake, Rubis Terminal has been accounted for

under IFRS 5 - Noncurrent assets held for sale since 31 March

2024.

H1 2024 Net income Group share includes three

months of Rubis Terminal contribution while H1 2023 included six

months.

As of 30 June 2024, the completion of the sale

of Rubis Terminal 55% stake is subject to the satisfaction of

various closing conditions, including obtaining all the required

administrative approvals. The corresponding capital gain will be

included in Net income Group share at closing.

OUTLOOK

After a very solid performance in H1 2024, the

Caribbean region will continue to deliver strong growth. Europe

positive operating momentum will also continue. The economic

situation in Africa remains unstable, in Kenya in particular.

The acceleration of development costs in the

Renewable division will weigh on 2024 and 2025 EBITDA, paving the

way for future growth.

As a result, the guidance provided to the market

for 2024 is reiterated with a Group EBITDA expected to reach €725m

to €775m. Net income Group share should remain stable despite the

first-time application of the Global Minimum Tax representing an

impact estimated between €20m and €25m. Confidence in dividend

growth is also renewed.

NON-FINANCIAL RATING

- MSCI: AA

(reiterated in Dec-23)

- Sustainalytics:

30.7 (from 29.7 previously)

- ISS ESG: C (from C-

previously)

- CDP: B (reiterated

in Feb-24)

Conference for investors and

analysts

Date: 5 September 2024, 6:00pm

To access via the audio webcast:

https://channel.royalcast.com/landingpage/rubisen/20240905_1/

To access via the conference

call:

- France: +33 (0 1 70 37 71

66

- UK-International: +44 (0) 33

0551 0200

- US: +1 786 697 3501

- Then verbally tell the operator

the code « Rubis »

Participants from Rubis:

- Clarisse Gobin-Swiecznik,

Managing Partner

- Marc Jacquot, CFO

Upcoming events

Photosol Day: 17 September 2024 -

Paris

Q3 & 9M 2024 trading update: 5 November

2024 (after market close)

FY 2024 results: 13 March 2025 (after market

close)

|

Press Contact |

Analyst Contact |

|

RUBIS - Communication department |

RUBIS - Clémence Mignot-Dupeyrot, Head of IR |

Tel: +33 (0)1 44 17 95 95

presse@rubis.fr |

Tel: +33 (0)1 45 01 87 44

investors@rubis.fr |

appendix

1. Q2 FIGURES

REVENUE BREAKDOWN

|

Revenue (in €m) |

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

|

Energy distribution |

1,663 |

1,569 |

+6% |

|

Retail & Marketing |

1,436 |

1,343 |

+7% |

|

Europe |

195 |

192 |

+2% |

|

Caribbean |

624 |

562 |

+11% |

|

Africa |

617 |

589 |

+5% |

|

Support & Services |

227 |

226 |

+0% |

|

Renewable Electricity production |

16 |

16 |

-1% |

|

TOTAL |

1,679 |

1,585 |

+6% |

RETAIL & MARKETING: VOLUME SOLD AND GROSS

MARGIN BY PRODUCT IN Q2

| |

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted1

Gross margin (in €m) |

|

|

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

|

LPG |

317 |

318 |

0% |

74 |

75 |

-1% |

74 |

75 |

-1% |

|

Fuel |

1,052 |

1,010 |

4% |

107 |

114 |

-6% |

107 |

114 |

-6% |

|

Bitumen |

112 |

108 |

4% |

21 |

23 |

-9% |

21 |

16 |

28% |

|

TOTAL |

1,481 |

1,435 |

3% |

202 |

212 |

-5% |

202 |

206 |

-2% |

(1) Adjusted for

exceptional items and FX effects.

RETAIL & MARKETING: VOLUME SOLD AND GROSS

MARGIN BY REGION IN Q2

| |

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted1

Gross margin (in €m) |

|

|

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

Q2 2024 |

Q2 2023 |

Q2 2024 vs Q2 2023 |

|

Europe |

219 |

207 |

6% |

52 |

52 |

1% |

52 |

52 |

1% |

|

Caribbean |

572 |

553 |

3% |

83 |

73 |

13% |

83 |

73 |

13% |

|

Africa |

690 |

676 |

2% |

67 |

88 |

-23% |

67 |

81 |

-17% |

|

TOTAL |

1,481 |

1,435 |

3% |

202 |

212 |

-5% |

202 |

206 |

-2% |

(1) Adjusted for

exceptional items and FX effects.

2. ADJUSTMENTS AND

RECONCILIATIONS:

COMPOSITION OF NET DEBT/EBITDA EXCLUDING IFRS

16

|

(in million euros) |

Jun-2024 |

Dec-2023 |

Var % |

|

Corporate net financial debt(1) (corporate NFD) |

1,079 |

992 |

9% |

|

LTM EBITDA (a) |

747 |

798 |

-6% |

|

LTM Rental expenses IFRS 16 (b) |

51 |

46 |

11% |

|

LTM EBITDA Photosol prod (c) |

32 |

34 |

-8% |

|

LTM EBITDA pre IFRS 16 & excl. Photosol prod (a)-(b)-(c) |

664 |

717 |

-7% |

|

Corporate NFD / LTM EBITDA pre IFRS 16 & excl. Photosol

prod |

1.6x |

1.4x |

0.2x |

|

Non-recourse project debt |

412 |

367 |

12% |

|

Total Net financial debt (NFD) |

1,491 |

1,360 |

10% |

|

NFD/LTM EBITDA pre IFRS 16 |

2.1x |

1.8x |

0.2x |

(1) Corporate net financial

debt – excluding non-recourse debt.

KPIS ON A COMPARABLE BASIS

1. AT

GROUP LEVEL

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBITDA (reported) |

358 |

409 |

-12% |

|

Naira passthrough |

|

- 25 |

|

|

Madagascar shortfall refund |

|

- 11 |

|

|

Compensation-related impacts (including IFRS 2) |

15 |

6 |

|

|

Other |

3 |

|

|

|

EBITDA (on a comparable basis) |

376 |

379 |

-1% |

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBIT (reported) |

257 |

323 |

-20% |

|

Naira passthrough |

|

- 25 |

|

|

Madagascar shortfall refund |

|

- 11 |

|

|

Compensation-related impacts (including IFRS 2) |

15 |

6 |

|

|

Excess depreciation vessels |

4 |

|

|

|

Other |

3 |

|

|

|

EBIT (on a comparable basis) |

279 |

293 |

-5% |

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

Net income Group share (reported) |

130 |

171 |

-24% |

|

Naira passthrough |

|

|

|

|

Madagascar shortfall refund |

|

- 9 |

|

|

Compensation-related impacts (including IFRS 2) |

13 |

11 |

|

|

Excess depreciation vessels |

4 |

|

|

|

Other |

2 |

- 1 |

|

|

Rubis Terminal Q2 2023 contribution |

|

-5 |

|

|

First-time application of OECD Global Minimum Tax |

12 |

|

|

|

Net income Group share (on a comparable

basis) |

160 |

167 |

-4% |

2. BY

BUSINESS LINE

1. RETAIL

& MARKETING

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBITDA (reported) |

258 |

300 |

-14% |

|

Naira passthrough |

|

- 25 |

|

|

Madagascar shortfall refund |

|

- 11 |

|

|

Compensation-related impacts (including IFRS 2) |

4 |

|

|

|

EBITDA (on a comparable basis) |

262 |

264 |

-1% |

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBIT (reported) |

200 |

247 |

-19% |

|

Naira passthrough |

|

- 25 |

|

|

Madagascar shortfall refund |

|

- 11 |

|

|

Compensation-related impacts (including IFRS 2) |

4 |

|

|

|

EBIT (on a comparable basis) |

204 |

211 |

-3% |

SPLIT BY REGION

A) EUROPE

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBIT (reported) |

35 |

38 |

-8% |

|

Compensation-related impacts (including IFRS 2) |

4 |

- |

|

|

EBIT (on a comparable basis) |

39 |

38 |

3% |

B) AFRICA

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBIT (reported) |

72 |

133 |

-46% |

|

Naira passthrough |

|

- 25 |

|

|

Madagascar shortfall refund |

|

- 11 |

|

|

EBIT (on a comparable basis) |

72 |

293 |

-25% |

2. SUPPORT

& SERVICES

|

(in million euros) |

H1 2024 |

H1 2023 |

Var % |

|

EBIT (reported) |

85 |

94 |

-10% |

|

Excess depreciation vessels |

4 |

|

|

|

EBIT (on a comparable basis) |

88 |

94 |

-6% |

3. FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

ASSET (in thousands of euros) |

30/06/2024 |

31/12/2023 |

|

Non-current assets |

|

|

|

Intangible assets |

100,207 |

90,665 |

|

Goodwill |

1,734,497 |

1,659,544 |

|

Property, plant and equipment |

1,798,763 |

1,746,515 |

|

Property, plant and equipment – right-of-use assets |

240,624 |

230,764 |

|

Interests in joint ventures |

25,496 |

310,671 |

|

Other financial assets |

153,302 |

168,793 |

|

Deferred taxes |

21,783 |

28,770 |

|

Other non-current assets |

13,351 |

11,469 |

|

TOTAL NON-CURRENT ASSETS (I) |

4,088,023 |

4,247,191 |

|

Current assets |

|

|

|

Inventory and work in progress |

711,087 |

651,853 |

|

Trade and other receivables |

812,105 |

781,410 |

|

Tax receivables |

29,718 |

34,384 |

|

Other current assets |

63,262 |

42,214 |

|

Cash and cash equivalents |

457,712 |

589,685 |

|

TOTAL CURRENT ASSETS (II) |

2,073,884 |

2,099,546 |

|

ASSETS HELD FOR SALE |

293,132 |

0 |

|

TOTAL ASSETS (I + II) |

6,455,039 |

6,346,737 |

|

EQUITY AND LIABILITIES (in thousands of

euros) |

30/06/2024 |

31/12/2023 |

|

Shareholders’ equity – Group share |

|

|

|

Share capital |

130,198 |

128,994 |

|

Share premium |

1,561,561 |

1,553,914 |

|

Retained earnings |

1,008,226 |

948,449 |

|

TOTAL |

2,699,985 |

2,631,357 |

|

Non-controlling interests |

125,854 |

131,588 |

|

EQUITY (I) |

2,825,839 |

2,762,945 |

|

Non-current liabilities |

|

|

|

Borrowings and financial debt |

1,222,918 |

1,166,074 |

|

Lease liabilities |

213,620 |

200,688 |

|

Deposit/consignment |

151,781 |

151,785 |

|

Provisions for pensions and other employee benefit obligations |

45,664 |

40,929 |

|

Other provisions |

157,010 |

137,820 |

|

Deferred taxes |

80,336 |

83,659 |

|

Other non-current liabilities |

145,445 |

148,259 |

|

TOTAL NON-CURRENT LIABILITIES (II) |

2,016,774 |

1,929,214 |

|

Current liabilities |

|

|

|

Borrowings and short-term bank borrowings (portion due in less than

one year) |

726,086 |

783,519 |

|

Lease liabilities (portion due in less than one year) |

33,109 |

38,070 |

|

Trade and other payables |

808,750 |

792,512 |

|

Current tax liabilities |

27,428 |

25,245 |

|

Other current liabilities |

17,053 |

15,232 |

|

TOTAL CURRENT LIABILITIES (III) |

1,612,426 |

1,654,578 |

|

TOTAL EQUITY AND LIABILITIES (I + II + III) |

6,455,039 |

6,346,737 |

CONSOLIDATED INCOME STATEMENT

|

(in thousands of euros) |

%

2024/

2023 |

30/06/2024 |

30/06/2023 |

|

NET REVENUE |

0% |

3,338,885 |

3,324,412 |

|

Consumed purchases |

|

(2,491,037) |

(2,473,182) |

|

External expenses |

|

(269,370) |

(247,080) |

|

Employee benefits expense |

|

(149,898) |

(125,593) |

|

Taxes |

|

(70,128) |

(69,327) |

|

EBITDA |

-12% |

358,452 |

409,230 |

|

Other operating income |

|

906 |

805 |

|

Net depreciation and provisions |

|

(98,684) |

(87,522) |

|

Other operating income and expenses |

|

(3,262) |

624 |

|

CURRENT OPERATING INCOME |

-20% |

257,412 |

323,137 |

|

Other operating income and expenses |

|

(882) |

(5,260) |

|

OPERATING INCOME BEFORE SHARE OF NET INCOME FROM JOINT

VENTURES |

-19% |

256,530 |

317,877 |

|

Share of net income from joint ventures |

|

5,344 |

6,308 |

|

OPERATING INCOME AFTER SHARE OF NET INCOME FROM JOINT

VENTURES |

-19% |

261,874 |

324,185 |

|

Income from cash and cash equivalents |

|

5,502 |

8,114 |

|

Gross interest expense and cost of debt |

|

(49,352) |

(38,471) |

|

COST OF NET FINANCIAL DEBT |

44% |

(43,850) |

(30,357) |

|

Interest expense on lease liabilities |

|

(6,488) |

(5,522) |

|

Other finance income and expenses |

|

(32,700) |

(78,462) |

|

PROFIT (LOSS) BEFORE TAX |

-15% |

178,836 |

209,844 |

|

Income tax |

|

(44,655) |

(32,438) |

|

NET INCOME |

-24% |

134,181 |

177,406 |

|

NET INCOME, GROUP SHARE |

-24% |

129,503 |

170,624 |

|

NET INCOME, NON-CONTROLLING INTERESTS |

-31% |

4,678 |

6,782 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in thousands of euros) |

30/06/2024 |

31/12/2023 |

30/06/2023 |

|

TOTAL CONSOLIDATED NET INCOME |

134,181 |

367,013 |

177,406 |

|

Adjustments: |

|

|

|

|

Elimination of income of joint ventures |

(5,344) |

(14,930) |

(6,308) |

|

Elimination of depreciation and provisions |

119,613 |

222,146 |

99,133 |

|

Elimination of profit and loss from disposals |

527 |

1,344 |

(643) |

|

Elimination of dividend earnings |

(741) |

(363) |

(361) |

|

Other income and expenditure with no impact on cash

(1) |

8,433 |

7,623 |

(6,127) |

|

CASH FLOW AFTER COST OF NET FINANCIAL DEBT AND

TAX |

256,669 |

582,833 |

263,100 |

|

Elimination of income tax expenses |

44,655 |

57,860 |

32,438 |

|

Elimination of the cost of net financial debt and interest expense

on lease liabilities |

50,337 |

84,359 |

35,880 |

|

CASH FLOW BEFORE COST OF NET FINANCIAL DEBT AND

TAX |

351,661 |

725,052 |

331,418 |

|

Impact of change in working capital* |

(25,888) |

(91,682) |

(48,002) |

|

Tax paid |

(40,151) |

(70,752) |

(42,200) |

|

CASH FLOWS RELATED TO OPERATING ACTIVITIES |

285,622 |

562,618 |

241,216 |

|

Impact of changes to consolidation scope (cash acquired - cash

disposed) |

460 |

387 |

308 |

|

Acquisition of financial assets: Energy Distribution division |

(5,775) |

(3,396) |

|

|

Acquisition of financial assets: Renewable Energies division

(2) |

(7,360) |

(8,543) |

|

|

Acquisition of property, plant and equipment and intangible

assets |

(103,166) |

(283,340) |

(131,970) |

|

Change in loans and advances granted |

71 |

(30,252) |

(29,660) |

|

Disposal of property, plant and equipment and intangible

assets |

2,335 |

6,175 |

5,135 |

|

(Acquisition)/disposal of other financial assets |

(127) |

(193) |

(5,332) |

|

Dividends received |

2,520 |

6,111 |

5,898 |

|

Other cash flows from investing activities |

|

|

|

|

CASH FLOWS RELATED TO INVESTING ACTIVITIES |

(111,042) |

(313,051) |

(155,621) |

CONSOLIDATED STATEMENT OF CASH FLOWS

(CONTINUED)

|

(in thousands of euros) |

30/06/2024 |

31/12/2023 |

30/06/2023 |

|

Capital increase |

8,851 |

4,096 |

4,115 |

|

Share buyback (capital decrease) |

|

|

|

|

(Acquisition)/disposal of treasury shares |

(1,087) |

633 |

(384) |

|

Borrowings issued |

655,177 |

1,028,541 |

675,291 |

|

Borrowings repaid |

(690,962) |

(1,092,443) |

(650,536) |

|

Repayment of lease liabilities |

(19,790) |

(36,516) |

(17,942) |

|

Net interest paid (2) |

(52,199) |

(81,285) |

(34,770) |

|

Dividends payable |

(204,979) |

(197,524) |

(197,524) |

|

Dividends payable to non-controlling interests |

(5,523) |

(13,993) |

(10,176) |

|

Acquisition of financial assets: Renewable Energies division |

(318) |

(14,627) |

(6,333) |

|

Other cash flows from financing operations |

2,345 |

8,502 |

|

|

CASH FLOWS RELATED TO FINANCING ACTIVITIES |

(308,485) |

(394,616) |

(238,259) |

|

Impact of exchange rate changes |

1,932 |

(70,173) |

(37,955) |

|

Impact of change in accounting policies |

|

|

|

|

CHANGE IN CASH AND CASH EQUIVALENTS |

(131,973) |

(215,222) |

(190,619) |

|

Cash flows from continuing operations |

|

|

|

|

Opening cash and cash equivalents (3) |

589,685 |

804,907 |

804,907 |

|

Change in cash and cash equivalents |

(131,973) |

(215,222) |

(190,619) |

|

Closing cash and cash equivalents (3) |

457,712 |

589,685 |

614,288 |

|

Financial debt excluding lease liabilities |

(1,949,004) |

(1,949,593) |

(2,060,200) |

|

Cash and cash equivalents net of financial debt |

(1,491,292) |

(1,359,908) |

(1,445,912) |

(1) Including change in fair value of

financial instruments, IFRS 2 expense, goodwill (impairment),

etc.

(2) Net financial interest paid includes the impacts related to

restatements of leases (IFRS 16).

(3) Cash and cash equivalents net of bank overdrafts.

|

(*) Breakdown of the impact of change in working

capital: |

|

|

Impact of change in inventories and work in progress |

(46,061) |

|

Impact of change in trade and other receivables |

(5,243) |

|

Impact of change in trade and other payables |

25,416 |

|

Impact of change in working capital |

(25,888) |

1

Operating cash flow before

net financial costs and tax.

2 On a comparable basis:

taking into account non-recurring or exceptional elements – See

appendix for further detail.

3 Debt excluding

Photosol SPV project non-recourse

debt; LTM EBITDA excluding IFRS

16 – lease obligations.

4 The Management Board,

which met on 4 September

2024, approved the accounts for the

first half-year 2024; these accounts were

examined by the Supervisory Board on 5

September 2024. The

Statutory Auditors have carried out a limited review of these

financial statements, and their report on the interim financial

information was issued on the same date.

5 LFL:

Like-for-like i.e., excluding exceptional items and FX

effects.

- Rubis H1 2024 results Press Release

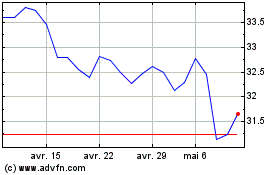

Rubis (EU:RUI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Rubis (EU:RUI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025