Commodity Currencies Rise Amid Risk Appetite

14 Janvier 2025 - 3:53AM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Tuesday amid risk appetite, as markets in the

region cheered news that President-elect Donald Trump's economic

team is discussing a cautious and slow approach in implementing

tariff hikes to avoid an inflation spike.

Crude oil prices rose as markets digested the impact of wider

U.S. sanctions on Russian oil. Market's expectation that the

existing consumers of Russian oil would be forced to source

supplies from the Middle East or other producers also boosted

prices. West Texas Intermediate Crude oil futures for February

closed up $2.25 or nearly 3 percent at $78.82 a barrel.

In economic news, data from Westpac showed that Australia's

consumer confidence weakened in January, but things are expected to

improve. The Westpac-Melbourne Institute Consumer Sentiment Index

declined 0.7 percent to 92.1 in January from 92.8 in December.

In the Asian trading today, the Australian dollar rose to a

1-week high of 1.6553 against the euro and a 4-day high of 97.70

against the yen, from yesterday's closing quotes of 1.6579 and

97.27, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 1.64 against the euro and 99.00

against the yen.

Against the U.S. and the Canadian dollars, the aussie advanced

to 4-day highs of 0.6193 and 0.8901 from Monday's closing quotes of

0.6177 and 0.8881, respectively. The aussie may test resistance

around 0.63 against the greenback and 0.90 against the loonie.

The NZ dollar rose to nearly a 1-month high of 1.8262 against

the euro, a 5-day high of 0.5612 against the U.S. dollar and a

4-day high of 88.53 against the yen, from yesterday's closing

quotes of 1.8345, 0.5583 and 87.92, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 1.80

against the euro and 0.58 against the greenback.

Against the Australian dollar, the kiwi edged up to 1.1031 from

Monday's closing value of 1.1062. On the upside, 91.00 against the

yen and 1.09 against the aussie are seen as the next resistance

level for the kiwi.

The Canadian dollar rose to a 6-day high of 1.4364 against the

U.S. dollar and a 4-day high of 109.87 against the yen, from

yesterday's closing quotes of 1.4378 and 109.51, respectively. If

the loonie extends its uptrend, it is likely to find resistance

around 1.41 against the greenback and 111.00 against the yen

Against the euro, the loonie edged up to 1.4727 from Monday's

closing value of 1.4729. The next possible upside target for the

loonie is seen around the 1.46 region.

Meanwhile, the safe-haven U.S. dollar weakened against other

major currencies in the Asian session amid risk appetite.

The U.S. dollar fell to 4-day lows of 1.0277 against the euro,

1.2232 against the pound and against the 0.9147 against the Swiss

franc, from yesterday's closing quotes of 1.0244, 1.2200 and

0.9165, respectively. If the greenback extends its downtrend, it is

likely to find support around 1.06 against the euro, 1.26 against

the pound and 0.89 against the franc.

Against the yen, the greenback edged down to 157.31 from an

early 4-day high of 158.02. On the downside, 155.00 is seen as the

next support level for the greenback.

Looking ahead, U.S. NFIB small business optimism for December,

Canada leading index for December, U.S. PPI for December and U.S.

Redbook report are slated for release in the New York session.

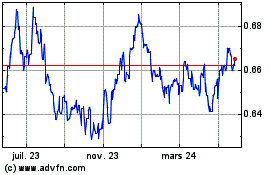

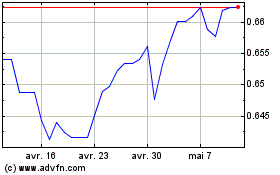

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025