TIDMCML

RNS Number : 7308P

CML Microsystems PLC

22 November 2016

22 November 2016

CML Microsystems Plc

Half Yearly Report

CML Microsystems Plc, ("CML" or "the Group"), which designs,

manufactures and markets mixed-signal and Radio Frequency (RF)

semiconductors, primarily for global communication and solid state

storage markets, is pleased to announce results for the six months

ended 30 September 2016.

Financial Highlights

-- First half results materially exceeded initial expectations for the period

-- Group revenues up 19% to GBP13.04m (H1 2015: GBP11.00m)

o Sicomm contribution of GBP0.40m (H1 2015: GBPNil)

-- Gross profit up 17% to GBP9.31m (H1 2015: GBP7.98m)

-- Profit before tax up 28% to GBP1.94m (H1 2015: GBP1.51m)

-- Adjusted EBITDA up 27% to GBP4.23m (H1 2015: GBP3.33m)

-- Basic EPS up 33% to 10.25p (H1 2015: 7.69p)

-- No borrowings and net cash of GBP11.56m (31 March 2016:

GBP13.60m), following payment of net GBP3.58m cash consideration

for the acquisition of Sicomm and GBP1.13m dividend payment

Operational Highlights

-- Successful acquisition of Wuxi Sicomm Technologies Ltd

("Sicomm"), expanding the Group's technological expertise and Far

East presence

-- Launch of three new products across Storage and

Communications market sectors, expanding our addressable market

-- Successfully implemented new sales and marketing structure in the Americas

-- Continued investment in Research and Development to provide for long-term growth

-- Several design wins from prior periods now entering the early

ramping phase, expected to contribute to revenue growth in H2 FY17

and subsequent years

-- Significant number of the Group's top 40 customers increased their spend in the period

Chris Gurry, Group Managing Director of CML, commented: "We are

pleased with the operational progress we have made during the first

half. We have continued to expand our product range, increased

sales revenue from the existing customer base, made good progress

with the integration of the Sicomm acquisition and successfully

implemented a new operational structure within our American

business."

"Our strong financial position, with a healthy cash balance,

tangible assets and no borrowings provides us with the confidence

to continue to invest in the expansion of our business. Trading in

the second half of the year has begun well and we are confident of

a full-year advance in both revenues and profitability."

All figures above represent Group total including the two month

contribution from Sicomm, unless otherwise stated.

The information contained within this announcement is deemed by

the Group to constitute inside information under the Market Abuse

Regulations (EU) No. 596/2014.

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: +44 (0)1621 875

Director 500

Neil Pritchard, Group

Financial Director

Cenkos Securities plc Tel: +44 (0)20 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate

Finance)

SP Angel Corporate Finance Tel: +44 (0)203 463 2260

LLP

Jeff Keating

Alma PR

Josh Royston Tel: +44 (0)7780 901979

Caroline Forde Tel: +44 (0)7779 664584

Robyn McConnachie Tel: +44 (0)7540 706191

About CML Microsystems PLC

CML designs and develops semiconductors for the industrial

storage and communications markets. The Group utilises a

combination of in-house and outsourced manufacturing and has

trading operations in Europe, the Far East and the USA. CML targets

niche markets with strong growth profiles and high barriers to

entry. It has secured a diverse, blue chip customer base, including

some of the world's leading telecoms equipment providers and

industrial product manufacturers.

The spread of its customers and products largely protects the

business from the cyclicality usually associated with the

semiconductor industry. Growth in its end-markets is being driven

by factors such as the ever-increasing trend towards solid state

storage devices in the commercial and industrial sectors, the

upgrading of telecoms infrastructure around the world and the

growing prevalence of private commercial communications networks

for voice and/or data communications linked to the industrial

internet of things (IIoT).

The Group is cash-generative, has no borrowings and is dividend

paying.

Chairman's statement

Strong revenue growth coupled with stable gross margins has

meant that our first half unaudited results have materially

exceeded initial expectations. This revenue uplift, assisted by

weak Sterling and a two month contribution from Wuxi Sicomm

Technologies Ltd ("Sicomm"), was underpinned by good growth in the

underlying businesses, which is extremely pleasing. Our objective

is to achieve long-term, sustainable revenue growth which, due to

the natural gearing within our business, provides the ability to

generate accelerated profit growth.

It is evident that we are now beginning to see the results of

the strategic investments that we have made into the business over

the last few years. With our focus on R&D and customer support,

we have a more diverse customer base, an excellent customer

reputation, and are delivering leading products within our market

niches through our global distribution network.

One of the important strategic and operational highlights during

the first half of the year was the completion of the acquisition of

Sicomm, a Chinese fabless semiconductor and solutions provider for

the global wireless communications markets. Sicomm's product range,

trading relationships and technical support abilities complement

and enhance the Group's existing skills and strategy. These are

expected to enable compelling technical and commercial benefits for

our customers. We have been pleased with the success of the

integration thus far and look forward to further growth from the

business.

The Group delivered a good trading performance, with growth from

both Storage and Communications market sectors (Communications

formerly reported separately as Wireless and Wireline Telecom).

Revenues grew 19% in the half year to GBP13.04m (H1 2015:

GBP11.00m). Organic growth, excluding the Sicomm contribution, was

15%. The operational gearing within the business contributed to a

28% growth in profit before tax to GBP1.94m (H1 2015: GBP1.51m),

while maintaining high levels of investment into R&D. Cash

levels, which are always a key management focus, stood at GBP11.56m

(31 March 2016: GBP13.60m) representing a very positive outcome

following payment of an increased dividend and the cash element of

the purchase of Sicomm during the first half. We have no

borrowings.

Considering this strong performance, I must thank our employees

for their dedication and hard work. They and our growing customer

base remain fundamental to the future growth of the business.

Market conditions appear to have improved and importantly there

are solid underlying growth drivers within each of our target

markets. This coupled with our strong financial position, positive

trading momentum, expanded business and strengthened management

team provide us with the opportunity to continue our pursuit of

growth both organically and through targeted acquisitions. I am

confident we are progressively putting in place the building blocks

for the long-term success of CML.

Nigel Clark

Group Non-Executive Chairman

21 November 2016

Operational and Financial Review

Introduction

This has been a good first half of operational progress. We have

continued to expand our product range through the launch of three

new products across our Storage and Communications market sectors.

We have increased sales revenue from the existing customer base,

secured new customers, made good progress with the integration of

the Sicomm acquisition and successfully implemented a new

operational structure within our American business.

Financial Review

Total Group revenues for the six-month period amounted to

GBP13.04m (H1 2015: GBP11.00m) which included a two month

contribution of GBP0.40m from newly acquired Sicomm. Gross margins

remained relatively stable leading to a 17% increase in gross

profit to GBP9.31m (H1 2015: GBP7.98m). The Group has a somewhat

natural hedge in respect of US dollar and euro exchange rate

exposure.

Revenue growth was driven predominantly by increased shipments

with existing long-term customers, with a significant number of our

top 40 customers increasing their spend. In particular, our USB

storage products started to generate meaningful revenues whilst our

digital voice and data modem IC's contributed strongly.

Distribution and administration costs increased to GBP7.81m (H1

2015: GBP6.62m) due to a combination of a general increase in

direct staff costs, higher amortisation levels for the R&D

investment, and the addition of Sicomm.

Profit from operations climbed 29% to GBP1.99m (H1 2015:

GBP1.54m). This increase consisted of 11% from the improved trading

performance, with the balance derived from government grants

received outside of the UK and rental income from the letting of

commercial properties that the Group no longer trades from.

Profit before taxation amounted to GBP1.94m (H1 2015: GBP1.51m)

with GBP1.81m generated from non-acquired operations and the

remainder attributable to Sicomm.

Following payment of a GBP1.13m dividend in respect of the

previous year (H1 2015: GBP1.12m) and a net cash outflow, including

all costs relating to the Sicomm acquisition of GBP3.47m, cash

balances fell from GBP13.60m at the 31 March 2016 to GBP11.56m at

30 September 2016. Inventory levels were GBP1.81m against GBP1.57m

at 31 March 2016.

The basic earnings per share recorded from overall operations

was 10.25p including a 0.75p contribution from Sicomm (H1 2015:

7.69p).

Strategy Overview

Our business is focused on two important niche markets, the

industrial storage market and the industrial communications market,

where our proprietary IP along with the quality and reliability of

our technology sets us apart from our peers and makes us an

integral part of our customers' products. We have developed a

strong reputation in both of these markets and have a world-class

customer base and an established sales network.

Growth in both markets is ultimately being driven by the

on-going demand for increasing amounts of data to be delivered

faster and stored more reliably and securely. We are committed to

generating a diverse revenue stream across a broad range of

customers and products. We are a single-source supplier to our

customers, meaning that once designed in, the displacement of our

chips would require end-product redesign.

R&D is a key tenet of our growth strategy. Our focus is on

developing products which will lead to design wins with new and

existing customers that we believe have the potential to develop

into long-term, significant revenue generators. We intend to

complement our organic growth with appropriate acquisitions.

Storage

The main element of our strategy within Storage is to ensure

that the Group continues to increase business with our existing

customers whilst simultaneously adding new customers through

R&D investment. Our focus has been on expanding our product

portfolio to include all major interface standards used within our

target industrial end-markets and interoperation with all relevant

third-party Flash Memory devices from the global tier 1 flash

memory suppliers.

We have transitioned from a narrow "Controller" product

portfolio with only CompactFlash as the available interface, to an

enlarged product range that now also includes USB, SD, SATA &

MMC interface technologies.

Through the period, Storage revenue increased by 17% to GBP6.56m

(H1 2015: GBP5.60m). In line with our strategy, in the first half

of the year we added our proprietary hyMap technology to the USB

product range which greatly improves the reliability of

non-industrial class flash memory technology. The flash memory

itself is typically the most expensive component of the solid-state

storage device and, as the capacity of the storage devices

increase, hyMap enables our industrial customers to use memory that

has a lower "cost per bit".

Communications

Our strategy within Communications (previously referred to as

our Wireless and Wireline markets) has been to grow customer share

and expand the customer base through R&D investments that

increase the addressable chip content within the customers' end

product. This includes expanding our product portfolio to include

separate IC's with additional functionality and operation over a

larger Radio Frequency (RF) range capable of addressing wider

bandwidth applications. This significantly expands the size of the

market that can be addressed.

We have progressed well with this strategy in the first half of

the year evidenced by a 22% increase in revenue to GBP6.38m (H1

2015: GBP5.21m) with 15% coming from organic growth. We released

two new products; one which is ideally suited to voice-over IP

(VoIP) applications and digital voice interconnect systems and one

enhanced Analogue Front End (AFE) IC for software defined radio

(SDR) that bridges the gap between digital radio's RF section and

the customers signal progressing circuitry.

In the second half of the year, we are planning to release a new

Flash Memory controller, further hyMap enhancements and three new

Communications products - all in keeping with our strategy for

sustainable growth.

In total, the Group has released nine new products in the last

three years, however it is important to note that first half

revenues are predominantly from products that were released

pre-2013. The more recent products provide us with a pipeline of

additional future revenue, with numerous design wins already having

been secured.

Market Developments

As previously stated, the Group is focused on two industrial

markets which each show solid long-term underlying growth trends.

The overriding factor in both is the incessant demand for

ever-greater amounts of data, to be transmitted and stored more

quickly and securely.

Within the industrial data storage market there are several

specific areas which are going through exciting transitions, and

for which we have secured design wins or are in the process of

developing new products. These areas include the telecoms/network

infrastructure market, industrial automation and the in-vehicle

infotainment market.

A number of the major original equipment manufacturers (OEMs) or

tier 1 suppliers to those OEMs in each of these markets are our

customers meaning we are well positioned to benefit from the

growing demand.

Within the Communications market, the exciting growth areas

include: the transition to higher-capacity digital networks within

voice-centric markets and, in data-centric markets, the increasing

data throughput requirements within terrestrial and satellite

communications applications. The latter is required to meet the

needs of the growing Machine to Machine (M2M) and the Industrial

Internet of Things sectors (IIoT).

Again, we are already suppliers to or working with many of the

leading OEMs in these areas and believe we are well placed for

future growth.

Key customer developments

During the period we were pleased that a substantial amount of

our top 40 current customers increased their business with CML,

predominantly through delivery of our more established

semiconductor products but also through entering the shipping phase

of relatively recent new products. By maintaining a high level of

R&D spend we are constantly ensuring that we stay ahead of

customer demand across our two market sectors. We believe we are in

a strong position and have an increasing number of opportunities at

all stages of our new business pipeline.

Products entering the early ramping phase include our latest USB

controller; with one of the global leaders in flash memory

technology adopting the solution and expected to complete full

qualification in the second half.

For the Communications sector, prior design-wins achieved with

customers for both wireless voice and wireless data products have

commenced volume production and are in the early stages of

growth.

Operational Development

Sicomm acquisition and integration

The need to improve market coverage in the Far East and more

specifically in China to drive growth in that market, coupled with

the opportunity to acquire a company with complementary solutions,

led to the acquisition of Sicomm. This is an important strategic

move targeted to give a long-term benefit. This acquisition builds

on our existing resources in the region and provides an established

Chinese trading operation with an instant impact. Coupling these

benefits with those of the complimentary product line, with

excellent cross-selling potential, demonstrates the compelling

nature of this acquisition.

Throughout this year we will continue integrating Sicomm but

this will not detract from pursuing suitable acquisition

opportunities.

New Sales and Marketing structure

Operationally, important investments and enhancements were made

in sales, marketing and engineering support resources to ensure the

Group is positioned appropriately to handle the increasing customer

engagement levels that an expanding product range demands. Our

Americas business is already benefitting from efficiencies that

arise from having dedicated resources allocated to specific sectors

and products. Additionally, our structure is now inherently

scalable to facilitate future growth objectives. In the second half

of the year, we intend to continue enhancing our global operating

structure through the investment in people and practices that will

maximise our opportunities for success.

Outlook

Our strong financial position, with a healthy cash balance,

tangible assets and no borrowings, provides us with the confidence

to continue to invest in the expansion of our business. Trading in

the second half of the year has begun well and we are confident of

a full-year advance in both revenues and profitability.

Chris Gurry

Group Managing Director

21 November 2016

Condensed consolidated income statement

for the six months ended 30 September 2016

Unaudited Unaudited

Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------------------- ------------ ------------ ---------

Continuing operations

Revenue 13,044 11,003 22,833

----------------------------------------------------------------------------- ------------ ------------ ---------

Consisting of:

Revenue - excluding acquisition 12,642 11,003 22,833

Revenue - acquisition 402 - -

----------------------------------------------------------------------------- ------------ ------------ ---------

Cost of sales (3,733) (3,027) (6,580)

----------------------------------------------------------------------------- ------------ ------------ ---------

Gross profit 9,311 7,976 16,253

Distribution and administration costs (7,805) (6,623) (13,272)

----------------------------------------------------------------------------- ------------ ------------ ---------

1,506 1,353 2,981

Other operating income 487 190 405

----------------------------------------------------------------------------- ------------ ------------ ---------

Profit from operations 1,993 1,543 3,386

Share-based payments (72) (49) (117)

----------------------------------------------------------------------------- ------------ ------------ ---------

Profit after share-based payments 1,921 1,494 3,269

Finance income 17 20 55

----------------------------------------------------------------------------- ------------ ------------ ---------

Profit before taxation 1,938 1,514 3,324

----------------------------------------------------------------------------- ------------ ------------ ---------

Consisting of:

Profit before taxation - excluding acquisition 1,811 1,514 3,324

Profit before taxation - acquisition 127 - -

----------------------------------------------------------------------------- ------------ ------------ ---------

Income tax expense (217) (266) (399)

----------------------------------------------------------------------------- ------------ ------------ ---------

Profit after taxation 1,721 1,248 2,925

----------------------------------------------------------------------------- ------------ ------------ ---------

Profit after taxation for period attributable to equity owners of the parent 1,721 1,248 2,925

----------------------------------------------------------------------------- ------------ ------------ ---------

Basic earnings per share

From operations excluding acquisition 9.50p 7.69p 18.03p

----------------------------------------------------------------------------- ------------ ------------ ---------

From profit for the period 10.25p 7.69p 18.03p

----------------------------------------------------------------------------- ------------ ------------ ---------

Diluted earnings per share

From operations excluding acquisition 9.34p 7.65p 17.94p

----------------------------------------------------------------------------- ------------ ------------ ---------

From profit for the period 10.08p 7.65p 17.94p

----------------------------------------------------------------------------- ------------ ------------ ---------

Adjusted EBITDA* 4,226 3,325 6,970

---------------------------------------- ----- ----- -----

Consisting of:

Adjusted EBITDA - excluding acquisition 3,858 3,325 6,970

Adjusted EBITDA - acquisition 368 - -

---------------------------------------- ----- ----- -----

* See Note 11 for definition and reconciliation

Condensed consolidated statement of total comprehensive

income

for the six months ended 30 September 2016

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------ ------------ --------

Profit for the period 1,721 1,248 2,925

Other comprehensive income, net of tax:

Items that will not be reclassified subsequently to profit or loss:

Actuarial gain on retirement benefit obligations - - 1,570

Deferred tax movement on actuarial gain - - (283)

-------------------------------------------------------------------------------- ------------ ------------ --------

Items reclassified subsequently to profit or loss upon derecognition:

Foreign exchange differences 946 65 584

-------------------------------------------------------------------------------- ------------ ------------ --------

Other comprehensive income for the period net of taxation attributable to equity

holders of

the parent 946 65 1,871

-------------------------------------------------------------------------------- ------------ ------------ --------

Total comprehensive income for the period attributable to the equity holders of

the parent 2,667 1,313 4,796

-------------------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of financial position

as at 30 September 2016

Unaudited Unaudited Audited

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------ --------- --------- --------

Assets

Non-current assets

Goodwill 9,181 3,512 3,512

Other intangible assets arising on acquisition 1,382 - -

Property, plant and equipment 5,250 5,146 5,171

Investment properties 3,550 3,550 3,550

Equity investment 84 - -

Development costs 10,846 8,289 9,292

Deferred tax asset 1,158 1,301 893

------------------------------------------------------------------ --------- --------- --------

31,451 21,798 22,418

------------------------------------------------------------------ --------- --------- --------

Current assets

Inventories 1,812 1,779 1,571

Trade receivables and prepayments 3,451 2,525 3,458

Current tax assets 598 767 830

Cash and cash equivalents 11,557 12,263 13,596

------------------------------------------------------------------ --------- --------- --------

17,418 17,334 19,455

------------------------------------------------------------------ --------- --------- --------

Total assets 48,869 39,132 41,873

------------------------------------------------------------------ --------- --------- --------

Liabilities

Current liabilities

Trade and other payables 6,427 3,583 4,190

Current tax liabilities 46 246 39

------------------------------------------------------------------ --------- --------- --------

6,473 3,829 4,229

------------------------------------------------------------------ --------- --------- --------

Non-current liabilities

Deferred tax liabilities 3,516 2,654 3,001

Retirement benefit obligation 2,067 3,624 2,067

------------------------------------------------------------------ --------- --------- --------

5,583 6,278 5,068

------------------------------------------------------------------ --------- --------- --------

Total liabilities 12,056 10,107 9,297

------------------------------------------------------------------ --------- --------- --------

Net assets 36,813 29,025 32,576

------------------------------------------------------------------ --------- --------- --------

Capital and reserves attributable to equity owners of the parent

Share capital 851 813 813

Share premium 8,294 5,700 5,700

Treasury shares - own share reserve (190) (190) (190)

Share-based payments reserve 456 336 388

Foreign exchange reserve 1,264 (201) 318

Accumulated profits 26,138 22,567 25,547

------------------------------------------------------------------ --------- --------- --------

Total shareholders' equity 36,813 29,025 32,576

------------------------------------------------------------------ --------- --------- --------

Condensed consolidated cash flow statement

for the six months ended 30 September 2016

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------------ ------------ --------

Operating activities

Net profit for the period before taxation 1,938 1,514 3,324

Adjustments for:

Depreciation 358 121 254

Amortisation of development costs 1,849 1,661 3,330

Amortisation of intangibles recognised on acquisition 26 - -

Movement in pension net costs - - 13

Share-based payments 72 49 117

Finance income (17) (20) (55)

Movement in working capital 2,002 435 317

------------------------------------------------------ ------------ ------------ --------

Cash flows from operating activities 6,228 3,760 7,300

Income tax received/(paid) 367 (174) 279

------------------------------------------------------ ------------ ------------ --------

Net cash flows from operating activities 6,595 3,586 7,579

------------------------------------------------------ ------------ ------------ --------

Investing activities

Purchase of acquisition, net of cash acquired (3,576) - -

Purchase of property, plant and equipment (413) (290) (443)

Investment in development costs (2,900) (2,905) (5,356)

Receipt /(payment) of escrow cash deposit 385 - (331)

Finance income 17 20 55

------------------------------------------------------ ------------ ------------ --------

Net cash flows from investing activities (6,487) (3,175) (6,075)

------------------------------------------------------ ------------ ------------ --------

Financing activities

Purchase of treasury shares - (190) (190)

Dividend paid to Group shareholders (1,134) (1,118) (1,118)

------------------------------------------------------ ------------ ------------ --------

Net cash flows from financing activities (1,134) (1,308) (1,308)

------------------------------------------------------ ------------ ------------ --------

(Decrease)/increase in cash and cash equivalents (1,026) (897) 196

------------------------------------------------------ ------------ ------------ --------

Movement in cash and cash equivalents:

At start of period/year 13,596 13,188 13,188

(Decrease)/increase in cash and cash equivalents (1,026) (897) 196

Effects of exchange rate changes (1,013) (28) 212

At end of period 11,557 12,263 13,596

------------------------------------------------------ ------------ ------------ --------

During the six month period ending 30 September 2016, 774,181

shares in CML Microsystems Plc were issued in part consideration

for the acquisition of Sicomm equity to the value of GBP2,632,000

(see note 8). As a significant non-cash transaction this is not

reflected in the above consolidated cash flow statement.

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2016

Foreign

Share Share Treasury Share-based exchange Accumulated

capital premium shares payments reserve profits Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

At 31 March 2015 813 5,700 - 287 (266) 22,437 28,971

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Profit for period 1,248 1,248

Other comprehensive income net of taxes:

Foreign exchange differences 65 65

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Total comprehensive income for the

period - - - - 65 1,248 1,313

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Transactions with owners in their

capacity as owners

Dividend paid (1,118) (1,118)

Purchase of treasury shares (190) (190)

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Total of transactions with owners in

their capacity as owners - - (190) - - (1,118) (1,308)

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Share-based payments 49 49

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

At 30 September 2015 813 5,700 (190) 336 (201) 22,567 29,025

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Profit for period 1,677 1,677

Other comprehensive income net of taxes:

Foreign exchange differences 519 519

Actuarial gain on retirement benefit

obligation 1,570 1,570

Deferred tax movement on actuarial gain (283) (283)

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Total comprehensive income for the

period - - - - 519 2,964 3,483

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Transactions with owners in their

capacity as owners

Issue of ordinary shares - - -

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Total of transactions with owners in

their capacity as owners - - - - - - -

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Share-based payments 68 68

Cancellation/transfer of share-based

payments (16) 16 -

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

At 31 March 2016 813 5,700 (190) 388 318 25,547 32,576

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Profit for period 1,721 1,721

Other comprehensive income net of taxes:

Foreign exchange differences 946 946

Total comprehensive income for the

period - - - - 946 1,721 2,667

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Transactions with owners in their

capacity as owners

Dividend paid (1,134) (1,134)

Issue of ordinary shares 38 2,594 2,632

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Total of transactions with owners in

their capacity as owners 38 2,594 - - - (1,134) 1,498

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Share-based payments 72 72

Cancellation/transfer of share-based

payments (4) 4 -

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

At 30 September 2016 851 8,294 (190) 456 1,264 26,138 36,813

---------------------------------------- ------- ------- -------- ----------- ---------- -------------- -------

Notes to the condensed consolidated financial statements

for the six months ended 30 September 2016

1 Segmental analysis

Information about revenue, profit/loss, assets and

liabilities

Unaudited Unaudited Audited

6 months end 6 months end year end

30/09/16 30/09/15 31/03/16

------------------- ------------------- --------------------

Semi- Semi- Semi-

conductor conductor conductor

components Group components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Revenue

By origin 20,537 20,537 17,423 17,423 35,924 35,924

Inter-segmental revenue (7,493) (7,493) (6,420) (6,420) (13,091) (13,091)

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Total segmental revenue 13,044 13,044 11,003 11,003 22,833 22,833

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Consisting of:

Segmental revenue - excluding acquisition 12,642 12,642 11,033 11,033 22,833 22,833

Segment revenue - acquisition 402 402 - - - -

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Profit/(loss)

Segmental result 1,921 1,921 1,494 1,494 3,269 3,269

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Consisting of:

Segmental result - excluding acquisiiton 1,794 1,794 1,494 1,494 3,269 3,269

Segment result - acquisition 127 127 - - - -

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Finance income 17 20 55

Income tax expense (217) (266) (399)

------- ------- --------

Profit after taxation 1,721 1,248 2,925

------- ------- --------

Assets and liabilities

Segmental assets 43,563 43,563 33,514 33,514 36,600 36,600

------------------------------------------ ---------- ---------- ----------

Unallocated corporate assets

Investment properties 3,550 3,550 3,550

Deferred tax assets 1,158 1,301 893

Current tax assets 598 767 830

------- ------- --------

Consolidated total assets 48,869 39,132 41,873

------- ------- --------

Segmental liabilities 6,427 6,427 3,583 3,583 4,190 4,190

------------------------------------------ ---------- ---------- ----------

Unallocated corporate liabilities

Deferred tax liabilities 3,516 2,654 3,001

Current tax liabilities 46 246 39

Retirement benefit obligation 2,067 3,624 2,067

------- ------- --------

Consolidated total liabilities 12,056 10,107 9,297

------- ------- --------

Other segmental information

Property, plant and equipment additions 413 413 290 290 443 443

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Development cost additions 2,900 2,900 2,905 2,905 5,356 5,356

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Depreciation 358 358 121 121 254 254

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Amortisation of development costs 1,849 1,849 1,661 1,661 3,330 3,330

------------------------------------------ ---------- ------- ---------- ------- ---------- --------

Geographical segments

The acquired Sicomm Group of Companies are included within the

'Far East' classification below.

UK Rest of Europe Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------- ------- -------------- -------- -------- --------

Unaudited

Six months ended 30 September 2016

Revenue by origin 6,223 6,481 2,878 4,955 20,537

Inter-segmental revenue (3,443) (4,050) - - (7,493)

----------------------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 2,780 2,431 2,878 4,955 13,044

----------------------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 5,043 189 12 6 5,250

----------------------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,550 - - - 3,550

----------------------------------------------- ------- -------------- -------- -------- --------

Development costs 3,487 7,359 - - 10,846

----------------------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - 5,669 9,181

----------------------------------------------- ------- -------------- -------- -------- --------

Other intangible assets arising on acquisition - - - 1,382 1,382

----------------------------------------------- ------- -------------- -------- -------- --------

Total assets 32,741 12,300 1,602 2,226 48,869

----------------------------------------------- ------- -------------- -------- -------- --------

Unaudited

Six months ended 30 September 2015

Revenue by origin 5,101 5,577 2,562 4,183 17,423

----------------------------------------------- ------- -------------- -------- -------- --------

Inter-segmental revenue (2,518) (3,902) - - (6,420)

----------------------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 2,583 1,675 2,562 4,183 11,003

----------------------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 5,022 97 11 16 5,146

----------------------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,550 - - - 3,550

----------------------------------------------- ------- -------------- -------- -------- --------

Development costs 2,906 5,383 - - 8,289

----------------------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------------------- ------- -------------- -------- -------- --------

Other intangible assets arising on acquisition - - - - -

----------------------------------------------- ------- -------------- -------- -------- --------

Total assets 25,538 10,162 1,325 2,107 39,132

----------------------------------------------- ------- -------------- -------- -------- --------

Audited

Year ended 31 March 2016

Revenue by origin 10,563 11,647 4,858 8,856 35,924

Inter-segmental revenue (5,526) (7,565) - - (13,091)

----------------------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 5,037 4,082 4,858 8,856 22,833

----------------------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 4,997 143 12 19 5,171

----------------------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,550 - - - 3,550

----------------------------------------------- ------- -------------- -------- -------- --------

Development costs 3,121 6,171 - - 9,292

----------------------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------------------- ------- -------------- -------- -------- --------

Other intangible assets arising on acquisition - - - - -

----------------------------------------------- ------- -------------- -------- -------- --------

Total assets 28,281 10,100 1,412 2,080 41,873

----------------------------------------------- ------- -------------- -------- -------- --------

Segmental reporting is, in accordance with IFRS 8, based on

internal management reporting information that is regularly

reviewed by the chief operating decision maker. The measurement

policies the Group uses for segmental reporting under IFRS 8 are

the same as those used in its full year financial statements.

Revenue

The geographical classification of business turnover (by

destination) is as follows:

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

--------------- ------------ ------------ --------

United Kingdom 366 495 950

Rest of Europe 3,350 2,379 5,621

Far East 6,110 5,205 10,704

Americas 2,930 2,745 5,122

Other 288 179 436

--------------- ------------ ------------ --------

13,044 11,003 22,833

--------------- ------------ ------------ --------

2 Dividend paid and proposed

A dividend of 7.0p per 5p ordinary share in respect of the year

ended 31 March 2016 was paid on 29 July 2016 (2015: 6.9p per 5p

ordinary share in respect of the year ended 31 March 2015). No

dividend is proposed in respect of the six months period ended 30

September 2016 (2015: GBPNil per 5p ordinary share in respect of

the period ended 30 September 2015).

3 Income tax expense

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

---------------------------------- ------------ ------------ --------

UK income tax credit (167) (167) (501)

Overseas income tax charge 268 283 431

---------------------------------- ------------ ------------ --------

Total current tax charge/(credit) 101 116 (70)

Deferred tax charge 116 150 469

---------------------------------- ------------ ------------ --------

Reported income tax expense 217 266 399

---------------------------------- ------------ ------------ --------

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

4 Earnings per share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year, as

explained below:

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2016 16,787,173 17,066,490

----------------------------------- ---------- ----------

Six months ended 30 September 2015 16,219,037 16,295,008

----------------------------------- ---------- ----------

Year ended 31 March 2016 16,219,037 16,305,914

----------------------------------- ---------- ----------

On 10 June 2015, the Company purchased 50,000 ordinary shares of

5p each in the Company at a price of 376.5p per ordinary share.

These shares are held in treasury and are excluded from the

denominators listed above for the purposes of earnings per share

calculations.

5 Investment properties

Investment properties are revalued at each discrete period end

by the Directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At 31 March 2015 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants, on an open market basis.

6 Analysis of changes in net cash

6 months 6 months

Net cash at end Net cash at end Net cash at 6 months end 6 months end

01/04/15 30/09/15 30/09/15 31/03/2016 31/03/16 30/09/16 30/09/16 Net cash at

Cash flow Cash flow Cash flow Acquisition 30/09/16

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ----------- ----------- ----------- ----------- ----------- ------------ ------------ -----------

Cash and

cash

equivalents 13,188 (925) 12,263 1,333 13,596 1,537 (3,576) 11,557

13,188 (925) 12,263 1,333 13,596 1,537 (3,576) 11,557

------------ ----------- ----------- ----------- ----------- ----------- ------------ ------------ -----------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

7 Retirement benefit obligations

The Directors have not obtained an actuarial IAS19 Employee

Benefits report in respect of the defined benefit pension scheme

for the purpose of this Half Yearly Report.

8 Acquisition of Sicomm

Following the definitive agreement to acquire all its shares

announced on 27 May 2016, and having satisfied the principal

regulatory conditions and other transaction closing conditions, the

Group took control of the China--based Wuxi Sicomm Technologies Ltd

("Sicomm") and affiliated companies on 3 August 2016. The total

consideration was $11.05m (GBP8.01m), payable in cash and in shares

(see below). The 774,181 new shares were also admitted for trading

by the London Stock Exchange in August 2016. The majority of the

shares are subject to specific lock--in restrictions over a three

year period and were provided under existing AGM resolution

approval.

Founded in 2003, Sicomm is a fabless semiconductor company and

solutions provider specialising in the development of integrated

baseband processors and RF semiconductors for global wireless

communication markets. Sicomm has approximately 30 employees and is

headquartered in Wuxi, China, with offices in Shanghai and

Quanzhou. The company's product range, which partially competes

with existing CML solutions, is targeted for use within consumer,

industrial and professional radio products and focuses on the

customer need to achieve the right balance between cost,

functionality and technical performance.

This acquisition expands the Group's product portfolio,

strengthens its Far Eastern regional support resources and

reinforces CML's position as a leader in the professional and

industrial wireless communication semiconductor market.

For the above reasons, combined with the anticipated

profitability of Sicomm products in other Group markets, synergies

to arise from integrating the Sicomm business into existing Group

businesses, plus the ability to hire the workforce of the Sicomm

group of companies (including the founder and management team), the

Group paid a premium over the acquisition net assets, giving rise

to goodwill. All intangible assets in accordance with IFRS3

Business Combinations were recognised at their provisional fair

values on the date of acquisition, with the residual excess over

net assets being recognised as goodwill. Intangibles arising from

the acquisition consist of brand values, customer relationships and

intellectual property and have been independently valued by

professional advisors.

The following table summarises the consideration and provisional

fair values of assets acquired and liabilities assumed at the date

of acquisition:

GBP'000

---------------------------------- -------

Property, plant and equipment 20

Long term equity investment 84

Intangible fixed assets:

Brands 96

Customer relationships 934

Intellectual property 402

Deferred tax assets 191

Inventories 212

Trade receivables and prepayments 128

Cash and cash equivalents 1,456

Trade and other payables (1,028)

Deferred tax liabilities (154)

----------------------------------- -------

Net assets acquired 2,341

----------------------------------- -------

Goodwill 5,669

----------------------------------- -------

Acquisition cost 8,010

----------------------------------- -------

There are no non-controlling interests in relation to the Sicomm

acquisition. Fair values in the above table have only been

determined provisionally and may be subject to change in the light

of any subsequent new information becoming available in time. The

review of the fair value of assets and liabilities acquired will be

completed within 12 months of the acquisition date.

The acquisition cost satisfied by:

GBP'000

---------------------- ----------------

Cash 5,378

Share consideration 2,632

---------------------- ---------------

Total consideration 8,010

---------------------- ---------------

Net cash outflow arising on acquisition:

GBP'000

------------------------------ --- ----------

Cash consideration paid

(less cash retention) 5,032

Cash returned under escrow

due diligence deposit (385)

Acquisition related costs 277

Cash and cash equivalents

within the Sicomm business

on acquisition (1,456)

------------------------------ --------

Total net cash outflow

on acquisition 3,468

------------------------------ --------

The cash consideration excludes a GBP346,000 (RMB3m) retention

which is included in Other Payables. Other costs relating to the

acquisition have not been included in the consideration cost.

Directly attributable acquisition costs include external legal and

accounting costs incurred in compiling the acquisition legal

contracts and the performance of due diligence activity and amount

to GBP277,000. These costs have been charged in distribution and

administrative expenses in the consolidated income statement.

Sicomm, in common with other Chinese companies, has a 31

December calendar year end. In the two months to 30 September 2016

Sicomm contributed revenue of GBP402,000 and net profit before

taxation of GBP127,000. Had the acquisition taken place from the

start of the Group's financial year (from 1 April 2016), management

estimate that Sicomm would have contributed revenue of GBP959,000

and net profit before taxation of GBP211,000 at the half year to

the Group results.

9 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency would have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key Group customers can represent a significant amount of

revenue, though their end-customers may be a diversified portfolio.

Key customer relationships are closely monitored; however changes

in buying patterns of a key customer could have an adverse effect

on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly-competitive

global market, which is undergoing continual geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

10 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

a) the condensed financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position and profit of the Group and

the undertakings included in the consolidation taken as a whole;

and

b) the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting; and

c) the Chairman's statement and Group Managing Director's

statement and operational and financial review include a fair

review of the development and performance of the business and the

position of the Company and the undertakings included in the

consolidation taken as a whole together with a description of the

principal risks and uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

11 Basis of preparation

The basis of preparation and accounting policies used in

preparation of the Half Yearly Financial Report are the same

accounting policies set out in the year ended 31 March 2016

financial statements, with the exception of the additional

accounting policy item and presentation:

Externally acquired intangibles

Externally acquired intangible assets have been recognised in

accordance with the provisions of IFRS3 Business Combinations in

relation to the acquisition of Sicomm (note 8). These acquired

intangibles have been amortised in accordance with the

following:

o Brand 10 years from date of acquisition

o Customer relationships 9 years from date of acquisition

o Intellectual property 10 years from date of acquisition

Amortisation of the above acquired intangibles assets is

recognised on consolidation and reported in distribution and

administration costs in the consolidated income statement.

Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ('Adjusted EBITDA') is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the three periods

presented:

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/16 30/09/15 31/03/16

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------------ ------------ --------

Profit after taxation (Earnings) 1,721 1,248 2,925

Adjustments for:

Finance income (17) (20) (55)

Income tax expense 217 266 399

Depreciation 358 121 254

Amortisation of development costs 1,849 1,661 3,330

Amortisation of intangibles recognised on acquisition 26 - -

Share-based payments 72 49 117

Adjusted EBITDA 4,226 3,325 6,970

------------------------------------------------------ ------------ ------------ --------

12 General

Other than already stated within the Chairman's statement and

Group Managing Director's statement and operational and financial

review there have been no important events during the first six

months of the financial year that have impacted this Half Yearly

Financial Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 9 above.

In the segmental analysis (note 1) inter-segmental transfers or

transactions are entered into under commercial terms and conditions

appropriate to the location of the entity whilst considering that

the parties are related.

This Half Yearly Financial Report includes a fair review of the

information required by DTR 4.2.7/8 (indication of important events

and their impact, and description of principal risks and

uncertainties for the remaining six months of the financial

year).

This Half Yearly Financial Report does not include all the

information and disclosures required in the Annual Report, and

should be read in conjunction with the consolidated Annual Report

for the year ended 31 March 2016.

The financial information contained in this Half Yearly

Financial Report has been prepared using International Financial

Reporting Standards as adopted by the European Union. This Half

Yearly Financial Report does not constitute statutory accounts as

defined by Section 434 of the Companies Act 2006. The financial

information for the year ended 31 March 2016 is based on the

statutory accounts for the financial year ended 31 March 2016 that

have been filed with the Registrar of Companies and on which the

Auditor gave an unqualified audit opinion.

The Auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Financial Report has not been audited or reviewed

by the Group Auditor.

A copy of this Half Yearly Financial Report can be viewed on the

Company website www.cmlmicroplc.com.

13 Approvals

The Directors approved this Half Yearly Report on 21 November

2016.

Glossary

ATA an advanced technology attachment

DTR Disclosure and Transparency Rules

EU European Union

IAS International Accounting Standard

IC integrated circuit

IIoT Industrial Internet of Things

IFRS International Financial Reporting Standards

IP intellectual property

M2M machine--to--machine

MMC multimedia card

OEM original equipment manufacturer

R&D research and development

RF radio frequency

SATA serial ATA interface

SD secure digital

SDR software defined radio

USB universal serial bus

VoIP Voice-over Internet Protocol

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BSBDBBDDBGLB

(END) Dow Jones Newswires

November 22, 2016 02:00 ET (07:00 GMT)

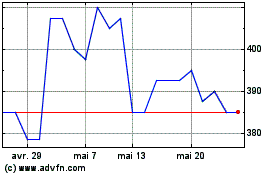

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024