CML Microsystems PLC - Final Results

10 Juin 1998 - 9:32AM

UK Regulatory

RNS No 6833u

CML MICROSYSTEMS PLC

10th June 1998

Preliminary Results for the year ended 31st March 1998

Further improvement

10th June 1998

* Turnover #20.6m (1997: #18.2m) - up 13.2%

* Operating profit #2.13m (1997: #1.54m) - up 38.3%

* Profit before tax #2.52m (1997: #1.93m) - up 30.6%

* Earnings per share 10.99p (1997: 8.40p) - up 30.8%

* Recommended dividend per ordinary share for the year of

7.0p, an increase of 14.8% (1997: 6.1p)

* Net cash reserves remain virtually unchanged at the year

end at #8m

* "Performance remained under pressure throughout the

latter half, but the progress made in newer semiconductor

product markets proved a positive factor in the final

results."

* "As usual, this is an early point to offer assurances for

the present year. The most material factor in the

outcome will likely be the growth in benefit achieved

from the semiconductor businesses.. ...subject to

unforeseen circumstances, I feel optimistic that the

results for the present year will show a further

improvement".

G.W. Gurry

Chairman

For further information:

Nigel Clark Lulu Bridges/Peter Willetts

CML Microsystems Plc Tavistock Communications

Tel: 01376 513833 Tel: 0171 600 2288

Email: nclark@cmlmicro.com

World wide web page: www.cmlmicro.com

Chairman's Statement

I am pleased to report that the outcome for the year shows the

further improvement that I had looked forward to when

reviewing the results at the half-way stage. Performance

remained under pressure throughout the latter half, but the

progress made in newer semiconductor product markets proved a

positive factor in the final results.

Group sales for the 12 Month period ending the 31st March,

1998, were up 13% to #20.6M (1997 #18.23M), and operating

profits rose by 38% to #2.126M (1997 #1.535M).

Pre-tax profit came out 30% higher at #2.524M (1997 #1.934M),

with the contribution from net interest earnings virtually

unchanged at #398,000. Earnings per share grew by 30.8% to

10.99p (1997 8.4p).

The Group's net cash reserves stood at #7.972M at the year end

(1997 #8.032M), which reflects delays to the programme for

planned capital spending during the year. The capital

projects involved have now reached the active phase and

material capital expenditure will occur within the current

period.

The balance sheet shows Shareholder funds slightly up at

#18.12M (1997 #17.66M).

Your directors have taken account of these results, and the

forward requirements for capital and other investments, and

they believe that they should recommend an increase in the

dividend for the year just completed. They are therefore

recommending the payment of a dividend of 7p per ordinary

share, an increase of 14.75% on the dividend paid last year

(1997 6.1p). Subject to Shareholder approval, this dividend

will be payable to all Shareholders registered as on the 10th

July, 1998.

For the Group's semiconductor businesses, their successes in

developing a growing reward from the newer products and

improved marketing arrangements formed a welcome counter to

the reducing opportunities seen in mature business areas.

The Singapore-based business, CML Microcircuits (Singapore),

recorded a year of strong growth in both sales and

profitability. CMLM(S) now services the markets for the

Group's products in China and countries in the South East Asia

region, where many important telecom and radiocom equipment

producers are found. CMLM(S) made good progress in developing

the Group's business throughout their region.

The results from other market territories were rather more

varied, although Consumer Microcircuits (the UK based

semiconductor producer) and MX-COM (the US based equivalent

business) each achieved higher overall sales and posted

increased profits.

Telecommunications formed the highest growth market sector for

sales of the Group's semiconductor products, with a material

volume of parts shipped to customers in the Far East, Europe

and South America. These products form part of the new and

growing range of Caller-ID, Billing and Modem devices for

subscriber and network applications.

Wireless Data products also showed a healthy growth in sales,

although forecast shipments to the terminal producers for

certain US and Far East data networks were delayed beyond the

year.

Sales of analogue PMR products were down for the period. The

markets for analogue PMR devices continued to shrink, and

market prospects are centred on the emerging new digital

standards for these services. The Group has introduced

leading solutions to this sector, but the benefits may not

prevent a short term further fall in PMR sales.

Sales of products to the analogue Cellular markets declined to

a negligible level.

Integrated Micro Systems, the Group's advanced semiconductor-

products design centre, gave ongoing support to the Group's

plans in new market areas. IMS has an important role in the

product path for the Group's semiconductor business, and its

results formed an expected cost within the reported figures.

Microsense Systems, the Group's Traffic business, did not make

its expected progress in the closing months. A forecast

positive contribution to Group profit was not achieved,

although a rise in annual sales was posted.

The Field Services division showed growing importance to the

Traffic business. This division encountered some costly hand-

over problems with a major maintenance contract it won for an

area of London, but had completed planned coverage for all

contracts won by the year-end. It formed an important sales

resource for the company's products, as well as contributing

directly and indirectly towards the company's position in its

markets.

The Traffic Products division fell short of reaching

completion of a major system software contract in the period.

The benefits from completion, which includes associated

equipment sales, should fall within the current year.

Radio Data Technology is the Group business producing end-user

equipment for the wireless communication of data and video

information. RDT posted a good increase in total sales, some

35% of which went to export. New video products, introduced

near to the year-end, allow the long distance full colour

transmission of video over new "license free" wireless

frequencies. The Group supported the expansion of RDT's

business last year.

The current year will see the construction and occupation of a

new facility for the Group's UK semiconductor operations, for

a cost in the region of #3m. This aims to ensure that the

Group is well placed to serve the design and part-volume

demands of the future market.

Support will be provided, as necessary, to particular business

activities directed at the overall future benefit to the

Group.

As usual, this is an early point to offer assurances for the

present year. The most material factor in the outcome will

likely be the growth in benefit achieved from the

semiconductor businesses, with Traffic and Wireless-equipment

having an important but lesser influence.

I have some concern that volume part-pricing for semiconductor

parts might come under increased pressure in the Far East. I

am hopeful that a balance, across the markets, will be

achieved.

Subject to my comment, and to any unforeseen circumstances, I

feel optimistic that the results for the present year will

show a further improvement.

In closing, I wish to record the thanks of myself and the

directors to the Company's employees for a successful year,

and to say that we hope to enjoy their future support.

G. W. Gurry

Chairman

CML Microsystems Plc

Preliminary Results for the

year ended 31st March 1998

Group Profit and Loss Account

Unaudited Audited

1998 1997

#'000 #'000

Turnover 20,611 18,233

======= =======

Operating Profit 2,126 1,535

Interest Receivable 457 421

Interest Payable (59) (22)

------- -------

Profit on Ordinary Activities before

Taxation 2,524 1,934

Taxation (870) (679)

------- -------

Profit on Ordinary Activities after

Taxation 1,654 1,255

Minority Interest 95 81

------- -------

1,749 1,336

Proposed Dividend (1,114) (971)

------- -------

Profit Attributable to Shareholders 635 365

======= =======

Earnings Per Share 10.99p 8.40p

======= =======

CML Microsystems Plc

Preliminary Results

Summary Group Balance Sheet

as at 31st March 1998

Unaudited Audited

1998 1997

#'000 #'000

Fixed Assets

Tangible assets 7,177 6,967

======= =======

Current Assets

Stocks 2,414 2,346

Debtors 5,651 4,711

Investments 5,302 5,963

Cash at Bank & in hand 2,671 2,069

------- -------

16,038 15,089

Creditors: Amounts falling due

within one year 5,091 4,381

------- -------

Net Current Assets 10,947 10,708

------- -------

Deferred Taxation 3 13

------- -------

18,121 17,662

======= =======

Capital & Reserves

Called up share Capital 796 796

Share Premium Account 2,349 2,347

Capital Redemption Reserve 155 155

Profit & Loss Account 14,811 14,259

------- -------

18,111 17,557

Minority Interests 10 105

------- -------

18,121 17,662

======= =======

CML Microsystems Plc

Preliminary Results for the

year ended 31st March 1998

Summary Group Cash Flow Statement

Unaudited Audited

1998 1997

#'000 #'000

Net cash inflow from operating activities 2,469 1,494

Returns on investments and servicing

of finance 430 400

Taxation (952) 169

Capital expenditure and financial investment (970) (752)

Equity dividends paid (971) (971)

------- -------

Net cash inflow before financing 6 340

Financing 2 0

------- -------

Increase in cash 8 340

======= =======

Notes:

1. The profit and loss account, balance sheet and cash flow

statement are an abridged version of the Company's full

accounts which have not yet been filed with the Registrar

of Companies and which have not yet been reported on by

the Company's auditors.

2. A dividend of 7p per Ordinary Share (1997: 6.1p per

Ordinary Share) is recommended in respect of the year

ended 31st March 1998 and will be paid on 7th August 1998

to shareholders on the register as at 10th July 1998.

3. The calculation of earnings per share is on the net basis

on earnings of #1,748,679 (1997: #1,336,371) and on a

weighted average number of 15,918,325 shares (1997:

15,917,338 shares).

END

FR SSLFWUUAUFDM

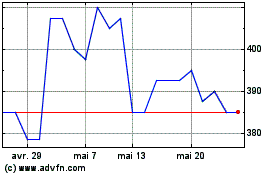

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024