Dukemount Capital PLC Further Funding and Funding Restructuring (4622C)

11 Octobre 2022 - 8:00AM

UK Regulatory

TIDMDKE

RNS Number : 4622C

Dukemount Capital PLC

11 October 2022

Dukemount Capital Plc

11th October 2022

Dukemount Capital Plc

("Dukemount" or the "Company")

Further Funding and Funding Restructuring

Dukemount announces that, further to the disposal of the peakers

as announced on 5 October 2022, the lenders (as detailed in the

announcement of 15 September 2021) (the "Investors") have agreed to

advance (the "Further Advance") the net proceeds of GBP50,000 in

aggregate in addition to restructuring their existing funding

arrangement. The maturity date for the existing debt plus the

Further Advance is to be 24 months from the date of the Advance

(being 10 October 2024).

The proceeds of the Further Advance have been used to settle

accrued liabilities of the Company.

The board has taken steps to ensure that the financial position

and prospects of the Company are maintained to facilitate a future

reverse transaction. To that end, the board confirm the following

has been undertaken:

- Geoffrey Dart and Paul Gazzard have released the Company from

all accrued but unpaid emoluments;

- Chesterfield Capital Limited have confirmed that the

outstanding balance of GBP500,000 due to Chesterfield Capital

Limited will be converted at the previously announced subscription

price of 0.65p. Such subscription to settle all balances due from

the Company and to be settled by the issuance of shares at the

earlier of (a) the approval of a prospectus, (b) the direction of

the board of the Company and (c) 11 April 2023.

Terms of the Restructuring and the Further Advance

The key terms of the restructuring and the Further Advance

being:

- 24 month term for the balances

- The debt is convertible at the nominal value of 0.1p of the ordinary shares of the Company

- The further advance is subject to the previously announced 5% implementation fee

- The Company has agreed to settle a 9.5% extension fee of

GBP74,575 to the Noteholders in the form of ordinary shares at

nominal value

Paul Gazzard CEO, comments "we are happy to work with the

Investors to ensure that the Company is financed for the next steps

as we work towards identifying a suitable reverse takeover target

which will be for the benefit of all the investors who have

committed to the work we have sought to do with the Company. We

hugely appreciate the further support and capital injection from

the Investors which, alongside our personal releases, we believe

the Company to be well positioned for the immediate steps of

securing a transaction. We expect to announce further updates on

this process in the coming weeks"

Market Abuse Regulation (MAR) disclosure

Certain statements in this announcement contain inside

information for the purpose of Article 7 of EU Regulation

596/2014.

For further information, please visit

www.dukemountcapitalplc.com or contact:

Dukemount Capital Plc

Geoffrey Dart / Paul Gazzard

Media Enquries

Miriad Media, Zak Mir Tel: +44 (0)7867 527

659

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

REPGPGCCUUPPUAG

(END) Dow Jones Newswires

October 11, 2022 02:00 ET (06:00 GMT)

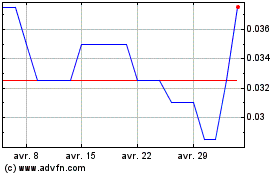

Dukemount Capital (LSE:DKE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

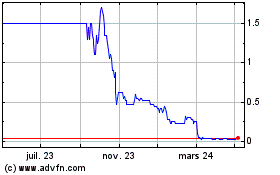

Dukemount Capital (LSE:DKE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025