TIDMGAMA

RNS Number : 9824H

Gamma Communications PLC

02 August 2023

2 August 2023

Gamma Communications plc

("Gamma" or the "Group")

H1 trading update

Growth in all segments, continued high cash generation. Full

year guidance reiterated.

Gamma Communications plc, a leading provider of Unified

Communications as a Service ("UCaaS") to the business markets in

the UK, Germany, Spain and the Netherlands, is pleased to announce

a trading update for the six months ended 30 June 2023. This update

confirms the statements made at the time of the AGM on 17 May

2023.

Group overview

We are pleased to report that the Group performed well through

the first six months of the year with all business segments

contributing to healthy year-on-year adjusted EBITDA growth and

high group operating cash conversion.

In both the UK and Europe, our resilient recurring revenue

model, combined with selective price increases, helped mitigate the

impact of inflationary cost increases. The Group remains well

positioned to deliver growth in line with current market

expectations for the year ending 31 December 2023.

United Kingdom

Gamma Business (formerly Indirect - see Note 1 below) continues

to deliver a strong financial performance. Growth was primarily

driven by our UCaaS portfolio, which includes our Horizon Cloud PBX

solution as well as those SIP trunks supporting Microsoft Teams

implementations and other non-Gamma Cloud PBX solutions. UCaaS unit

growth continued with PhoneLine+ (Gamma's own software solution)

take up accelerating, whilst Horizon Cloud PBX and additional

module bolt ons net growth was lower than in prior periods

(partially due to some switching from Horizon to PhoneLine+).

Gamma Enterprise (formerly Direct - see Note 1 below) has seen a

number of significant contract wins, including an organisation-wide

mobility solution for the Home Office in the public sector, and an

SD-WAN for Lidl's UK store network. Additionally, there have been

several wins for our omnichannel contact centre management

solution, Smart Agent, within the NHS. Our Microsoft Teams voice

enablement services continued to grow in the first half with the

pipeline remaining strong.

Overheads across the UK remained within expectations during the

first half with continued careful management of spend.

Europe: Germany, Spain and the Netherlands

Europe delivered healthy adjusted EBITDA growth in the period.

Our results were further bolstered by foreign exchange movements,

with a Euro that strengthened against Sterling compared to the

prior year.

Product development

Gamma has continued to make progress in the development and

delivery of products and solutions. We are particularly pleased

with Microsoft Teams voice enablement which is now available in all

of the countries in which we operate, as well as the continued

capability improvement we are making to our UCaaS portfolio.

Cash

Gamma's balance sheet remains strong, with significant cash

generation from trading activities in line with our cash conversion

guidance of more than 90%. Closing net cash at the half year was

approximately GBP121.5m compared to GBP92.5m as at 31 December

2022.

Outlook

The Board remains positive about the prospects for Gamma. In

line with the statement made at the time of the AGM, management

expects adjusted EBITDA and adjusted EPS (fully diluted) for the

year ending 31 December 2023 to be within the range of market

forecasts .*

The Board will announce results for the half year ended 30 June

2023 on Tuesday 5 September 2023.

Andrew Belshaw, Chief Executive, commented on the results:

"I am pleased to report on a healthy first half performance

across all segments.

Our products are business critical and combine reliability and

innovation to support the ever-evolving communications challenges

for businesses of all sizes. These products continue to support a

financial model that has a high level of recurring revenue and

exceptional cash generation which enables us to invest in and grow

Gamma.

Our first half trading shows the value of sustained investment.

Our newer products, from Microsoft Teams voice integration to

PhoneLine+, are performing well and we are pleased with our

improved progress in Europe.

Although we are not immune from macro challenges, communications

services tend to be resilient through the cycle and we enter the

second half with confidence."

* Company compiled range is based on known sell side analyst

estimates. The ranges are adjusted EBITDA GBP 110. 4m - GBP 117. 2m

and adjusted EPS (fully diluted) 70.0 pence - 77.0 pence.

Enquiries:

Gamma Communications plc Tel: +44 ( 0)333 006 5972

Andrew Belshaw, Chief Executive Officer

Bill Castell, Chief Financial Officer

Rachael Matzopoulos, Company Secretary

Investec Bank plc (NOMAD & Broker) Tel: +44 (0)207 597 5970

Patrick Robb / Virginia Bull

Teneo (PR Adviser) Tel: +44 (0)207 353 4200

James Macey White / Matt Low / Rebecca

Hamer

Note 1 - Change in segmental reporting

In recent years, Gamma has widened its product and

solution/services set to address the communications needs of a

broader range of businesses. Post pandemic, customer requirements

have evolved in respect of their telecommunications and IT

infrastructure and methods of procurement for such products and

services have broadened. Because of this, t he Group's business

unit responsibilities have been realigned to allow the business

units to focus more directly on customer needs and preferences.

Our two UK business units are now aligned with customer groups

rather than routes to market. We have therefore updated our

segmental reporting structure to reflect the way in which the Group

now manages its operations.

Previously the reported segments were UK Indirect, UK Direct,

Europe and Central Functions. The new segments are Gamma Business,

Gamma Enterprise, Europe and Central Functions. Gamma Business

consists of the former UK Indirect business with the addition of

some customers and associated costs from the UK Direct business

(now Gamma Enterprise). This has resulted in a GBP13.5m revenue

movement between segments for FY 2022 (3% of group revenue) with no

change in Executive Committee leadership.

The Group's main operating segments are outlined:

-- Gamma Business - This division sells Gamma's products to

smaller businesses in the UK, typically with those with fewer than

250 employees. This division sells through different routes to

market, including the channel, direct, digital and as well as

through other carriers who sell to smaller businesses in the

UK.

-- Gamma Enterprise - This division sells Gamma's products to

larger businesses in the UK, typically with those with more than

250 employees. Larger organisations have more complex needs so this

division sells Gamma's and other suppliers' products to Enterprises

and Public Sector customers, together with an associated managed

service wrap and ordinarily sells directly.

-- Europe - This division consists of sales made in Europe

through Gamma's German, Spanish and Dutch businesses.

-- Central Functions - This comprises the central management team and wider Group costs.

This change in reporting structure has taken effect for

reporting in 2023. In advance of the announcement of our H1 results

for the six months ended 30 June 2023, we are providing the

following restated views of our HY22 and FY22 financial results

under this new segmentation to provide the correct comparability.

Going forward, the assets and liabilities of the segments along

with their depreciation and amortisation, which were previously

provided as supplementary information, will no longer be shown.

Gamma Gamma Europe Central Total

Business Enterprise Functions

Half Year to 30 June 2022 (restated) GBPm GBPm GBPm GBPm GBPm

------------------------------------------ ---------- ------------ ------- ----------- -------

Segment revenue 163.5 49.4 35.6 - 248.5

Inter-segment revenue (13.1) (0.7) - - (13.8)

---------- ------------ ------- ----------- -------

Revenue from external customers 150.4 48.7 35.6 - 234.7

---------- ------------ ------- ----------- -------

Timing of revenue recognition

At a point in time 7.9 2.9 15.2 - 26.0

Over time 142.5 45.8 20.4 - 208.7

---------- ------------ ------- ----------- -------

150.4 48.7 35.6 - 234.7

Total gross profit 80.2 24.0 16.2 - 120.4

Adjusted Earnings before depreciation,

amortisation and exceptional items 38.1 13.7 4.3 (4.2) 51.9

---------- ------------ ------- ----------- -------

Exceptional items - - - -

Earnings before depreciation and

amortisation 38.1 13.7 4.3 (4.2) 51.9

------------------------------------------ ---------- ------------ ------- ----------- -------

This change in segmentation resulted in the following movements

between the former Direct segment (now Gamma Enterprise) to the

former Indirect segment (now Gamma Business) for HY 2022: Revenue

of GBP6.7m, Gross Profit of GBP3.9m, Overheads of GBP3.1m,

resulting in a GBP0.8m EBITDA movement between segments for the

period ended 30 June 2022.

Gamma Gamma Europe Central Total

Business Enterprise Functions

Full Year to 31 December 2022 (restated) GBPm GBPm GBPm GBPm GBPm

-------------------------------------------- ---------- ------------ --------- ----------- ---------

Segment revenue 334.0 102.9 73.4 - 510.3

Inter-segment revenue (24.6) (0.9) (0.2) - (25.7)

---------- ------------ --------- ----------- ---------

Revenue from external customers 309.4 102.0 73.2 - 484.6

---------- ------------ --------- ----------- ---------

Timing of revenue recognition

At a point in time 17.5 6.7 28.7 - 52.9

Over time 291.9 95.3 44.5 - 431.7

---------- ------------ --------- ----------- ---------

309.4 102.0 73.2 - 484.6

Total gross profit 163.7 49.3 34.7 - 247.7

Adjusted Earnings before depreciation,

amortisation and exceptional items 78.6 27.9 9.0 (10.4) 105.1

---------- ------------ --------- ----------- ---------

Exceptional items - - (12.5) - (12.5)

Earnings before depreciation and

amortisation* 78.6 27.9 (3.5) (10.4) 92.6

-------------------------------------------- ---------- ------------ --------- ----------- ---------

* We add back the depreciation and amortisation charged in the

year to Profit from Operations (2022: GBP65.4m) to calculate a

figure for EBITDA (2022: GBP92.6m).

This change in segmentation resulted in the following movements

between the former Direct segment to the former Indirect segment

for FY 2022: Revenue of GBP13.5m, Gross Profit of GBP8.1m and

Overheads of GBP6.2m, resulting in a GBP1.9m EBITDA movement

between segments for the year ended 31 December 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZGGRGMMGFZZ

(END) Dow Jones Newswires

August 02, 2023 02:00 ET (06:00 GMT)

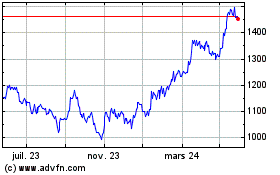

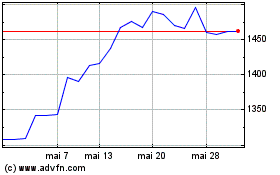

Gamma Communications (LSE:GAMA)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Gamma Communications (LSE:GAMA)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024