GSTechnologies Ltd Acquisition of Semnet Pte Ltd (7891V)

06 Décembre 2023 - 8:00AM

UK Regulatory

TIDMGST

RNS Number : 7891V

GSTechnologies Ltd

06 December 2023

6 December 2023

GSTechnologies Limited

("GST" or the "Company" or the "Group")

Acquisition of Semnet Pte Ltd

GSTechnologies Limited (LSE: GST), the fintech company, is

pleased to announce that the Company has entered into an agreement

(the "Agreement") to acquire 66.67% of the issued share capital of

Semnet Pte Ltd ("Semnet"), a cybersecurity company based in

Singapore, for a total consideration of US$1.8 million, payable

through US$0.8 million in cash and US$1.0 million in new shares in

the Company, as detailed below (the "Acquisition").

S emnet is a profitable cybersecurity business that will provide

the Company with expertise and licences that the Directors believe

are a critical component to the advancement of the Company's GS

Money and B2B Neobanking operations. Cybersecurity is of particular

importance to the Company's developing global Neobank ecosystem

which has recently been enhanced by the acquisition of PAYPT

finance Ltd, now renamed Angra Global, as announced on 15 August

2023.

Angra Global started onboarding customers on 1 September 2023

and Semnet's cybersecurity expertise will enable the Company to

build a dedicated cybersecurity team to support client onboarding

and its operational activities, including the wider provision of

white-label software solutions to global money service businesses.

In addition, Semnet will continue to support and grow its client

base in other sectors, providing an additional profitable revenue

stream for the Group. Semnet is licensed by the Cyber Security

Regulatory Office (CRSO) in Singapore. Further information on

Semnet may be found at: https://www.semnet.co

Further details of the Acquisition

The Company has entered into the Agreement to acquire 66.67% of

the issued share capital of Semnet from two of Semnet's directors,

Choo Seet Ee and Zheng Kang Wen Mervyn (together the "Sellers"),

for a total consideration of US$1.8 million in cash and new shares

of no par value in the Company ("Ordinary Shares"). Completion of

the Acquisition ("Completion") is subject, inter alia, to the

agreement of a completion assets statement, which may require

adjustment of the consideration upwards or downwards, and no

material adverse change having occurred in the Semnet business.

Completion is expected to occur two months following the entering

into of the Agreement, or earlier as may be agreed between the

parties.

US$800,000 of the total consideration payable to the Sellers is

payable in cash ("Cash Consideration") and the remaining US$1.0

million through the issue of new Ordinary Shares ("Consideration

Shares"). US$80,000 of the Cash Consideration has been paid and the

remaining US$720,000 is payable as to US$500,000 on Completion and

the remaining US$220,000 is payable four months from Completion.

Should Completion of the Acquisition not occur the Company is

entitled to the return of the US$80,000 consideration already paid

if it has fulfilled its obligations under the Agreement.

The Company will issue the Consideration Shares on the nine

month anniversary of Completion, or on any earlier date designated

by the Company giving not less than seven days' notice in writing

to the vendors, at a price per Ordinary Share equal to the average

of the middle market quotations for a Consideration Share as shown

by the daily Official List of the London Stock Exchange for the

last five full trading days immediately preceding the payment date

.

The remaining 33.33% outstanding shares in Semnet are owned by

Ong Siew Phek (23.33%) and Lam Pek San (10%). Ong Siew Pek is the

spouse of the Company's Executive Director and CEO, Jack Bai. As

Ong Siew Pek is a related party of a director of the Company, the

Company considers the Acquisition to be a Material Related Party

Transaction as defined under DTR 7.3.6. The Company's Executive

Director and CEO, Jack Bai, has therefore not participated in the

GST Board resolution to approve the Acquisition and the Company's

independent directors consider that the terms of the Acquisition

are fair and reasonable from the perspective of the Company and its

independent shareholders.

In its most recently published unaudited accounts, to 30

September 2022, Semnet had a turnover of US$4.22 million and

reported profit before tax of approximately US$0.21 million.

Further announcements will be made as appropriate including if

the Acquisition is terminated for any reason or when Completion

occurs and the Consideration Shares are issued.

Tone Goh, Chairman of GST, Chairman of GST, commented: "This

strategic acquisition represents a further important step in the

Company's journey. Our commitment to innovation and excellence

remains unwavering, and having inhouse cybersecurity expertise and

capability is important as we continue to build a B2B Neobank

providing next-generation digital money solutions. We look forward

to providing updates in due course on the the progress of this

acquisition and the subsequent enhancements it brings to our

fintech offerings."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

Enquiries:

The Company

Tone Goh, Executive Chairman

+65 6444 2988

Financial Adviser

VSA Capital Limited

+44 (0)20 3005 5000

Simon Barton / Thomas Jackson

Broker

CMC Markets

+44 (0)20 3003 8632

Douglas Crippen

Financial PR & Investor Relations

IFC Advisory Limited

Tim Metcalfe / Graham Herring / Florence Chandler

+44 20 (0) 3934 6630

gst@investor-focus.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFZMGZLKZGFZM

(END) Dow Jones Newswires

December 06, 2023 02:00 ET (07:00 GMT)

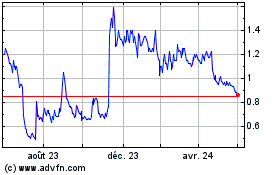

Gstechnologies (LSE:GST)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

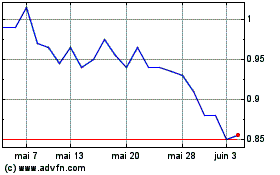

Gstechnologies (LSE:GST)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025