TIDMHBR

RNS Number : 0783A

Harbour Energy PLC

18 January 2024

Harbour Energy plc

("Harbour" or the "Company")

Trading and Operations Update

18 January 2024

Harbour Energy plc provides the following unaudited Trading and

Operations Update for the year ending 31 December 2023, ahead of

announcing its Full Year Results on 7 March 2024.

2023 Business Highlights

* Production averaged 186 kboepd (2022: 208 kboepd),

split approximately 50% liquids / 50% gas, and within

guidance

* Operating costs averaged c.$16/boe (2022: $14/boe),

in line with guidance

* Improved safety performance with total recordable

injury rate of 0.7 per million hours worked (2022:

0.8)

* Successful start-up of Tolmount East in Q4; other

material UK investments included the Talbot

development and the successful appraisal of the

Leverett discovery, supporting production from late

2024

* Significant gas discovery at Layaran-1 (Harbour 20%),

the first well drilled in the 2023-2024 multi-well

exploration campaign targeting a major gas play

across the Andaman Sea licences in Indonesia. This

follows the drilling of the Timpan gas discovery in

2022

* In Mexico, approval by the regulator in July of the

Zama Field Development Plan, and the Kan oil

discovery on Block 30 in April

* Significant momentum on Harbour's two UK CCS projects

which were awarded Track 2 status by the UK

government. For Harbour's operated Viking project,

FEED has been awarded and the project secured its

first potential CO(2) shipping customer

* Announced transformational acquisition of the

Wintershall Dea asset portfolio in December with

completion expected in Q4 2024

2023 Financial Highlights

* Revenue of c.$ 3.9 billion (2022: $5.4 billion) with

realised post-hedging oil and UK gas prices of $ 78

/bbl and 54 pence/therm (2022: $78/bbl, 86

pence/therm)

* Estimated total capex of c.$ 1.0 billion (2022: $0.9

billion), including c.$0.3 billion of decommissioning,

in line with guidance

* Estimated free cash flow of c.$1.0 billion (2022:

$2.1 billion), after total cash tax payments of

c.$0.4 billion and before shareholder distributions,

in line with expectations

* Shareholder distributions of $441 million (2022: $551

million), comprising c.$200 million of dividend

payments and $241 million of share buybacks

* Net debt reduced to $ 0.2 billion at year end 2023

(2022: $0.8 billion)

2024 Guidance and 2025 Outlook [1]

The 2024 guidance and 2025 outlook relates to Harbour's current

portfolio and excludes any effects or contribution from the

proposed acquisition of the Wintershall Dea asset portfolio.

* 2024 production of 150-165 kboepd, with an unusually

high level of planned shutdowns at our operated hubs

and the Beryl area, coinciding with planned pipeline

outages. Guidance also reflects the impact of

deferred partner-operated wells at Beryl and Elgin

Franklin in the UK and the anticipated sale of the

Vietnam business

* 2024 unit operating cost of c.$18/boe[2], higher than

2023 due to lower volumes with absolute operating

costs broadly flat year-on-year

* Increased total capital expenditure of c.$1.2 billion

(including lower decommissioning spend of $0.2

billion), driven by higher investment in the UK and

internationally:

* Increased UK drilling activity targeting high return,

quick payback opportunities in our operated J-Area,

Greater Britannia and AELE hubs, in addition to the

Talbot development, all of which will add to

production and support cash flow starting in late

2024

* Advancement of our UK CCS projects including FEED at

Viking

* Increased investment in our international growth

projects which have the potential to materially

increase our reserve life. This includes the

exploration campaign in Indonesia, where d rilling of

the Halwa and Gayo wells on the Andaman II license

(Harbour 40%, operator) is underway; and, in Mexico,

FEED for the Zama development and the drilling of the

Kan appraisal well

* At $85/bbl and 100p/therm, 2024 free cash flow of

$0.2 billion. This is after estimated tax of c.$1.2

billion, reflecting the expected full utilisation of

our UK corporation tax losses in H1 2024, and phasing

of UK EPL payments

* In line with our annual dividend policy, Harbour

expects to pay $200 million in dividends, comprising

a $100 million final dividend for 2023 and a $100

million 2024 interim dividend

* Harbour expects to be net debt free during H1 2024

but to close the year in a small net debt position,

reflecting the second half weighting of UK tax

payments. Harbour continues to expect to remain

undrawn on its RBL facility.

* Looking ahead to 2025, Harbour expects:

* Production to be similar to 2024, with less

maintenance downtime and volumes from new wells and

projects substantially offsetting natural decline

* Unit operating costs to be broadly flat with 2024

while capital expenditure is anticipated to be

materially lower

* Significantly higher free cash flow compared to 2024,

resulting in a sizeable net cash position by year end

Acquisition of Wintershall Dea Asset Portfolio

* On 21 December 2023, Harbour announced the

acquisition of substantially all of Wintershall Dea's

upstream assets for $11.2 billion. The acquisition is

subject to shareholder and regulatory approvals and

is anticipated to complete in Q4 2024

* In Q2 2024, Harbour plans to publish a prospectus and

shareholder circular which will include historical

financial information and an independent valuation of

2P reserves for the Wintershall Dea assets. They will

also set out the details of the shareholder meeting

to approve the Acquisition

* As at 17 January 2024, Harbour had received

irrevocable undertakings from shareholders currently

representing more than 25% of its issued share

capital to vote in favour of the acquisition

Linda Z Cook, Chief Executive Officer, commented:

"We made significant progress against our strategic goals in

2023. Our safety performance improved. We continued to maximise the

value of our UK production base while ensuring disciplined capital

allocation, resulting in significant free cash flow and shareholder

returns over and above our base dividend. We also advanced our UK

CCS projects and our international growth opportunities in

Indonesia and Mexico, delivering against key milestones. And, at

year end, we announced the transformational acquisition of the

Wintershall Dea portfolio.

"Looking ahead to 2024, our priorities are for the continued

safe and responsible operations of our existing portfolio and the

successful completion of the Wintershall Dea acquisition. We are

proud of our achievements over the past year and excited about the

future of the company."

Enquiries

Harbour Energy plc

Elizabeth Brooks, Head of Investor Relations

Tel: +44 203 833 2421

Brunswick

Patrick Handley, Will Medvei

Tel: +44 207 404 5959

Appendix 1: Group production

2023 2022

(net, kboepd) (net, kboepd)

Greater Britannia

Area 27 31

--------------- ---------------

J-Area 34 30

--------------- ---------------

AELE hub 22 27

--------------- ---------------

Catcher 16 19

--------------- ---------------

Tolmount 13 14

--------------- ---------------

East Irish Sea 4 8

--------------- ---------------

Elgin Franklin 19 24

--------------- ---------------

Buzzard 11 15

--------------- ---------------

Beryl 14 11

--------------- ---------------

West of Shetlands(1) 14 14

--------------- ---------------

Other North Sea(2) 1 2

--------------- ---------------

North Sea 175 195

--------------- ---------------

International 11 13

--------------- ---------------

Total Group 186 208

--------------- ---------------

(1) West of Shetlands comprises Clair, Schiehallion and Solan.

(2) Other North Sea includes Galleon, Ravenspurn North and

Johnston.

2023 2023

(net liquids, kboepd) (net gas, kboepd)

Greater Britannia

Area 9 18

----------------------- -------------------

J-Area 16 18

----------------------- -------------------

AELE hub 5 17

----------------------- -------------------

Catcher 15 1

----------------------- -------------------

Tolmount 1 12

----------------------- -------------------

East Irish Sea - 4

----------------------- -------------------

Elgin Franklin 7 12

----------------------- -------------------

Buzzard 11 -

----------------------- -------------------

Beryl 9 5

----------------------- -------------------

West of Shetlands(1) 13 1

----------------------- -------------------

Other North Sea(2) 1 1

----------------------- -------------------

North Sea 86 89

----------------------- -------------------

International 4 7

----------------------- -------------------

Total Group 90 96

----------------------- -------------------

(1) West of Shetlands comprises Clair, Schiehallion and Solan.

(2) Other North Sea includes Galleon, Ravenspurn North, and

Johnston.

Appendix 2: Hedging schedule(1)

2023 2024 2025 2026

Volume

(mmboe)

Volume Av. price Volume Av. price Av. price Volume Av. price

(mmboe) (p/th, $/bbl) (mmboe) (p/th, $/bbl) (p/th, $/bbl) (mmboe) (p/th, $/bbl)

UK

gas

Swaps 21.5 40 10.1 54 5.7 87 1.2 106

Collars 1.6 55-69 3.0 112-263 1.7 98-233 0.4 80-150

Oil

Swaps 11 74 7.3 84 4.4 77 0 0

--------- -------------- --------- -------------- ---------- -------------- --------- --------------

(1) As at 31 December 2023

Appendix 3: 2023 actual and 2023 and 2024 guidance

2023 Guidance 2023 Actual 2024 Guidance

(as at Nov (as at Jan 2024)

2023)

Production (kboepd) 185-195 186 150-165

------------- ----------- -----------------

Operating costs ($/boe) c.16 c.16 c.18

------------- ----------- -----------------

Total capex ($ billion) c.1.0 c.1.0 c.1.2

------------- ----------- -----------------

[1] 2024 guidance and 2025 outlook assumes that the sale of

Harbour's Vietnam business completes on 30 June 2024

[2] Assumes a US dollar to GBP sterling exchange rate of

$1.25/GBP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZGMMZNMGDZZ

(END) Dow Jones Newswires

January 18, 2024 02:09 ET (07:09 GMT)

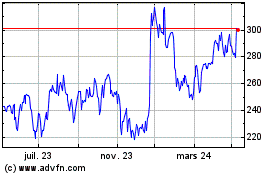

Harbour Energy (LSE:HBR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

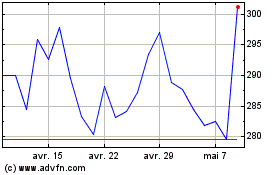

Harbour Energy (LSE:HBR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024