IP Group PLC Top 20 portfolio company funding round (7581X)

22 Décembre 2023 - 8:10AM

UK Regulatory

TIDMIPO

RNS Number : 7581X

IP Group PLC

22 December 2023

FOR RELEASE ON 22 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE UK VERSION OF THE MARKET ABUSE REGULATION (EU NO. 596/2014)

WHICH FORMS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018.

IP Group plc - Top 20 portfolio company funding round

IP Group plc (LSE: IPO) ("IP Group" or "the Group"), which

invests in breakthrough science and innovation companies with the

potential to create a better future for all, notes its

participation today in a follow-on portfolio company funding round

, for which it anticipates recording a net unrealised fair value

gain of approximately GBP40m* or 4p per share.

IP Group has committed a total of US$15m (GBP11.8m*) to the

funding round . Completion of the transaction is subject to certain

conditions and is due to occur in mid-January 2024. Further

information on the funding round, which has been supported by both

existing and new investors, will be provided in due course.

The Group's directors are currently reviewing the carrying

values of all assets in the portfolio as part of the usual year-end

process. While it is too early to provide guidance as to the

carrying values of the Group's portfolio companies, they currently

anticipate that the gain relating to this investment will be offset

by other fair value reductions in the portfolio.

*GBP equivalent using 1.26 USD/GBP

For more information, please contact:

IP Group plc www.ipgroupplc.com

+44 (0) 20 7444 0062/+44 (0)

Liz Vaughan-Adams, Communications 7967 312125

Portland

Vic Wallin +44 (0) 7973 823119

Alex Donaldson +44 (0) 7516 729702

Notes for editors

About IP Group

IP Group accelerates the impact of science for a better future.

As the most active UK based, early stage science investor , we

develop and support some of th e world's most exciting businesses

in deeptech, life sciences and cleantech (led by Kiko Ventures).

Through Parkwalk, the UK's largest growth EIS fund manager, we also

back world-changing innovation emerging in leading universities and

research institutions. Our specialist investment team combines

sector expertise with an international approach. Together we have a

strong track record of success, having backed high-profile

companies including Oxford Nanopore Technologies plc, First Light

Fusion, Hysata, and Oxa. IP Group is listed on the Main Market of

the London Stock Exchange under the code IPO. For more information,

please visit our website at www.ipgroupplc.com .

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDTTBRTMTMTMFJ

(END) Dow Jones Newswires

December 22, 2023 02:10 ET (07:10 GMT)

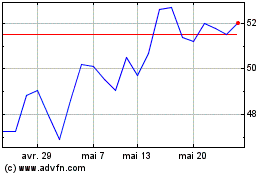

Ip (LSE:IPO)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

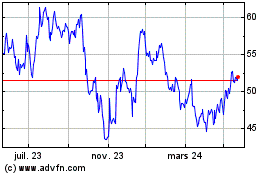

Ip (LSE:IPO)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024