TIDMLTHM

RNS Number : 1626I

Latham(James) PLC

01 December 2022

James Latham plc

("James Latham" or the "Company")

HALF YEARLY RESULTS FOR THE PERIODED 30 SEPTEMBER 2022

Chairman's statement

Unaudited results for the six months trading to 30 September

2022

Revenue for the six months ended 30 September 2022 was

GBP212.8m, up 9.7% on GBP193.9m for the same period last year. Cost

prices on both timber and panels have risen at a much slower rate

than in the previous financial year but they are remaining stable

and there are currently little signs of price weakness. I am

pleased that volumes have remained at similar levels to the same

period last year, despite the economy being weaker.

Gross profit percentage, which includes warehouse costs, for the

six month period ended 30 September 2022 was 19.4% compared with

26.4% in the comparative six months. We anticipated that the gross

profit percentage would return to more normal levels, and the

percentage achieved is still higher than the ten year average.

Overheads have been well controlled during the six months,

although the increases in inflation especially around energy and

transport costs have inevitably led to an increase in

overheads.

Operating profit was GBP23.5m, down GBP10.6m compared with

GBP34.1m profit for the same period last year. This reduction is a

result of the margins returning to expected levels, but still

represents a significant improvement on historical levels of

operating profit as the exceptional trading conditions start to

normalise. Profit before tax was GBP23.7m compared with GBP34.0m

for the same period last year. The tax charge of GBP4.6m represents

an effective rate of 19.5%. Earnings per ordinary share were 95.6p

compared with 133.5 p for the same period last year.

As at 30 September 2022 net assets are GBP180.5m (2021:

GBP146.4m). Inventory levels of GBP74.6m have stabilised with

supply issues still requiring us to hold a higher volume of

inventory. Trade and other receivables are also similar to the

start of the financial year with bad debts remaining at a low

figure. Cash and cash equivalents of GBP36.9m (2021: GBP24.5m) have

been important to allow us to maintain our investment in working

capital especially the inventory levels. We continue to take

advantage of additional early settlement discount opportunities

with our suppliers.

The calculation of the pension deficit remains sensitive to

changes in assumptions, and the increase in corporate bond yields

has resulted in a surplus at 30 September 2022 of GBP7.3m compared

with a deficit of GBP12,000 in the same period last year. This is

allowing us to undertake a de-risking exercise to reduce the

volatility of this calculation.

Interim dividend

The Board has declared an increased interim dividend of 7.25p

per Ordinary Share (2021: 6.5p). The dividend is payable on 27

January 2023 to ordinary shareholders on the Company's Register at

close of business on 30 December 2022. The ex-dividend date will be

29 December 2022.

Current and future trading

The second half of 2022/23 has started with slightly weaker

volumes than the previous six months to 30 September 2022, with

margins also slightly lower than in the same period. The supply

chain has become easier over the past six months, with fewer

extended lead times on our products. Cost prices of the majority of

our products are stable at the moment, but there are still

uncertainties as to the effect of energy costs and other

inflationary pressures on the overheads for our key manufacturers.

Recent drops in container rates have affected the cost prices for

products that have been shipped via container, but these have been

artificially high since COVID-19 and we expected them to come down

to more normal rates.

There are a few market sectors, such as the merchant sector,

that are quieter at the moment, but many of our other customers

have steady order books and remain busy, but are clearly nervous

looking at the macro economic conditions next year.

I am pleased to report that the Yate extension is now completed,

and this extra capacity will allow us to grow our market share in

the South West of the UK. The board has recently approved a racking

investment at IJK in Northern Ireland, which will enable them to

extend their product range and develop sales. We are continuing to

increase the working hours at our depots with Purfleet becoming the

latest site to be working 24/5 from the beginning of October.

Nick Latham

Chairman

1 December 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended.

For further information please visit www.lathamtimber.co.uk or

contact:

James Latham plc Tel: 01442 849 100

Nick Latham, Chairman

David Dunmow, Finance Director

SP Angel Corporate Finance LLP

Matthew Johnson / Charlie Bouverat (Corporate Tel: 0203 470 0470

Finance)

Abigail Wayne (Corporate Broking)

JAMES LATHAM PLC

CONSOLIDATED INCOME STATEMENT

For the six months to 30 September 2022

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2022 unaudited 2021 unaudited 2022 audited

GBP000 GBP000 GBP000

Revenue 212,797 193,937 385,368

Cost of sales (including warehouse costs) (171,443) (142,822) (293,839)

Gross profit 41,354 51,115 91,529

Selling and distribution costs (12,147) (11,058) (22,151)

Administrative expenses (5,680) (5,924) (11,213)

Operating profit 23,527 34,133 58,165

Finance income 231 10 29

Finance costs (98) (112) (242)

Profit before tax 23,660 34,031 57,952

Tax expense (4,606) (7,463) (12,310)

Profit after tax attributable to owners

of the parent company 19,054 26,568 45,642

Earnings per ordinary share (basic) 95.6p 133.5p 229.3p

Earnings per ordinary share (diluted) 95.2p 133.0p 228.3p

============================================== ================ ================ ==============

All results relate to continuing operations.

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

For the six months to 30 September 2022

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2022 unaudited 2021 unaudited 2022 audited

GBP000 GBP000 GBP000

---------------------------------------------- ---------------- ---------------- --------------

Profit after tax 19,054 26,568 45,642

Other Comprehensive income

Actuarial gains on defined benefit pension

scheme 3,242 1,047 3,625

Deferred tax relating to components of other

comprehensive income (1,080) (199) (424)

Foreign translation credit/(charge) 492 8 (29)

---------------------------------------------- ---------------- ---------------- --------------

Other comprehensive income for the period,

net of tax 2,654 856 3,172

---------------------------------------------- ---------------- ---------------- --------------

Total comprehensive income, attributable

to owners of the parent company 21,708 27,424 48,814

============================================== ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED BALANCE SHEET

At 30 September 2022

As at As at 30 As at 31

30 Sept. Sept. 2021 March 2022

2022 unaudited unaudited audited

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Goodwill 1,363 872 1,372

Intangible assets 1,403 1,570 1,487

Property, plant and equipment 37,278 36,153 36,935

Right-of-use-asset 3,995 3,789 4,154

Retirement benefit surplus 7,318 - 1,119

Deferred tax asset 134 87 154

Total non-current assets 51,491 42,471 45,221

Current assets

Inventories 74,588 69,117 74,230

Trade and other receivables 69,380 68,414 68,332

Cash and cash equivalents 36,939 24,476 37,030

Total current assets 180,907 162,007 179,592

Total assets 232,398 204,478 224,813

------------------------------------------- ---------------- ------------ ------------

Current liabilities

Lease liabilities 1,429 1,243 1,275

Trade and other payables 40,471 45,972 50,876

Current tax payable 268 3,220 400

------------------------------------------- ---------------- ------------ ------------

Total current liabilities 42,168 50,435 52,551

Non-current liabilities

Interest bearing loans and borrowings 592 592 592

Lease liabilities 2,753 2,764 3,133

Retirement and other benefit obligation - 12 -

Deferred tax liabilities 6,369 4,273 4,566

------------------------------------------- ---------------- ------------ ------------

Total non-current liabilities 9,714 7,641 8,291

Total liabilities 51,882 58,076 60,842

Net assets 180,516 146,402 163,971

=========================================== ================ ============ ============

Capital and reserves

Issued capital 5,040 5,040 5,040

Share-based payment reserve 438 268 387

Own shares (708) (326) (873)

Capital reserve 398 398 398

Retained earnings 175,348 141,022 159,019

------------------------------------------- ---------------- ------------ ------------

Total equity attributable to shareholders

of the parent company 180,516 146,402 163,971

=========================================== ================ ============ ============

JAMES LATHAM PLC

CONSOLIDATED CASH FLOW STATEMENT

For the six months to 30 September 2022

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2022 unaudited 2021 unaudited 2022 audited

GBP000 GBP000 GBP000

-------------------------------------------------- ---------------- ---------------- --------------

Net cash flow from operating activities

Cash generated from operations 11,744 4,620 30,983

Interest paid (26) (27) (59)

Income tax paid (4,043) (2,850) (10,259)

Net cash inflow from operating activities 7,675 1,743 20,665

-------------------------------------------------- ---------------- ---------------- --------------

Cash flows from investing activities

Interest received and similar income 127 10 29

Acquisition of businesses net of cash and

cash equivalents acquired - - (2,238)

Purchase of property, plant and equipment (1,782) (2,231) (4,319)

Proceeds from sale of property, plant and

equipment 56 42 62

Net cash outflow from investing activities (1,599) (2,179) (6,466)

-------------------------------------------------- ---------------- ---------------- --------------

Cash flows before financing activities

Lease liability payments (787) (622) (1,408)

Equity dividends paid (5,380) (3,084) (4,379)

Cash outflow from financing activities (6,167) (3,706) (5,787)

-------------------------------------------------- ---------------- ---------------- --------------

(Decrease)/increase in cash and cash equivalents

for the period (91) (4,142) 8,412

==================================================

Cash and cash equivalents at beginning

of the period 37,030 28,618 28,618

Cash and cash equivalents at end of the

period 36,939 24,476 37,030

================================================== ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to owners of the

parent company

Share-based

Issued payment Own Capital Retained Total

capital reserve shares reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

As at 1 April 2021 (audited) 5,040 167 (471) 398 113,950 119,084

Profit for the period - - - - 26,568 26,568

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 1,047 1,047

Deferred tax relating to

components

of other comprehensive income - - - - (199) (199)

Foreign translation credit - - - - 8 8

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 27,424 27,424

Transaction with owners:

Dividends - - - - (3,084) (3,084)

Exercise of options - - (3) - - (3)

Deferred tax on share options - 25 - - - 25

Change in investment in ESOP

shares - - 148 - - 148

Share-based payment expense - 76 - - - 76

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 101 145 - (3,084) (2,838)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2021

(unaudited) 5,040 268 (326) 398 138,290 143,670

Profit for the period - - - - 19,074 19,074

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 2,578 2,578

Deferred tax relating to

components

of other comprehensive income - - - - (225) (225)

Foreign translation charge - - - - (37) (37)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 21,390 21,390

Transactions with owners:

Dividends - - - - (1,295) (1,295)

Exercise of options - (24) 231 - 4 211

Deferred tax on share options - 50 - - - 50

Change in investment in ESOP

shares - - (778) - 630 (148)

Share-based payment expense - 93 - - - 93

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 119 (547) - (661) (1,089)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 31 March 2022

(audited) 5,040 387 (873) 398 159,019 163,971

Profit for the period - - - - 19,054 19,054

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 3,242 3,242

Deferred tax relating to

components

of other comprehensive income - - - - (1,080) (1,080)

Foreign translation credit - - - - 492 492

Total comprehensive income for

the period - - - - 21,708 21,708

Transactions with owners:

Dividends - - - - (5,380) (5,380)

Deferred tax on share options - (37) - - - (37)

Change in investment in ESOP

shares - - 166 - - 166

Share-based payment expense - 88 - - - 88

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 51 166 - (5,380) (5,163)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2022

(unaudited) 5,040 438 (707) 398 175,347 180,516

================================= ============ ================ =========== =========== ============= ==========

JAMES LATHAM PLC

NOTES TO THE HALF YEARLY REPORT

1. The results presented in this report are unaudited and they have

been prepared in accordance with the recognition and measurement principles

of International Accounting Standards in conformity with the requirements

of the Companies Act 2006 and on the basis of the accounting policies

expected to be used in the financial statements for the year ending

31 March 2023. The half yearly report does not include all the disclosures

that would be required for full compliance with IFRS. The figures

for the year ended 31 March 2022 are extracted from the statutory

accounts of the group for that period.

2. The directors propose an interim dividend of 7.25p per ordinary

share which will absorb GBP1,445,000 (2021: 6.5p absorbing GBP1,293,000),

payable on 27 January 2023 to shareholders on the Company's Register

at the close of business on 30 December 2022. The ex-dividend date

is 29 December 2022.

3. This half yearly report does not constitute statutory financial

accounts within the meaning of section 434 of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2022 were filed

with the Registrar of Companies. The audit report on those financial

statements was not qualified and did not contain a reference to any

matters to which the auditor drew attention by way of emphasis without

qualifying the report and did not contain a statement under section

498 (2) or (3) of the Companies Act 2006. The half yearly report has

not been audited by the Company's auditor.

4. Earnings per ordinary share is calculated by dividing the net profit

for the period attributable to ordinary shareholders by the weighted

average number of ordinary shares outstanding during the period.

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2022 unaudited 2021 unaudited 2022 audited

GBP000 GBP000 GBP000

Net profit attributable to ordinary shareholders 19,054 26,568 45,642

Number '000 Number '000 Number

'000

Weighted average share capital 19,926 19,896 19,905

Add: diluted effect of share capital options

issued 95 79 85

Weighted average share capital for diluted

earnings per ordinary share calculation 20,021 19,975 19,990

---------------- ---------------- --------------

5. Net cash flow from operating activities

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2022 unaudited 2021 unaudited 2022 audited

GBP000 GBP000 GBP000

Profit before tax 23,660 34,031 57,952

Adjustment for finance income and expenditure (133) 102 213

Depreciation and amortisation 2,091 2,002 4,128

(Profit)/loss on disposal of property,

plant and equipment (51) 105 50

Increase in inventories (358) (20,855) (23,990)

Increase in receivables (1,048) (20,585) (18,034)

(Decrease)/increase in payables (9,652) 11,264 13,940

Retirement benefits non cash amounts (2,853) (1,520) (3,445)

Share-based payments non cash amounts 88 76 169

Cash generated from operations 11,744 4,620 30,983

---------------- ---------------- --------------

6. Copies of this statement will be posted on our website, www.lathamtimber.co.uk/investors

A copy can be emailed or posted upon application to the Company Secretary,

James Latham plc, Unit C2, Breakspear Park, Breakspear Way, Hempstead,

Herts, HP2 4TZ, or by email to plc@lathams.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FDUFWSEESEIF

(END) Dow Jones Newswires

December 01, 2022 02:00 ET (07:00 GMT)

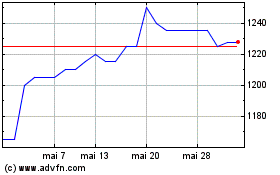

Latham (james) (LSE:LTHM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Latham (james) (LSE:LTHM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025