TIDMMAB1

RNS Number : 1340N

Mortgage Advice Bureau(Holdings)PLC

28 September 2021

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("MAB" or "the Group")

28 September 2021

Interim Results for the six months ended 30 June 2021

Mortgage Advice Bureau (Holdings) Plc (AIM: MAB1.L) is pleased

to announce its interim results for the six months ended 30 June

2021.

Financial highlights

H1 2021 H1 2020 H1 2019 Change Change

vs 2020 vs 2019

Revenue GBP92.4m GBP63.5m GBP60.9m +46% +52%

--------- --------- --------- ---------- ---------

Gross profit GBP24.6m GBP17.2m GBP14.2m +43% +74%

--------- --------- --------- ---------- ---------

Gross profit margin 26.7% 27.2% 23.3% -0.5pp(1) +3.4pp

--------- --------- --------- ---------- ---------

Adjusted overheads

ratio(2) 14.8% 14.9% 11.2% -0.1pp +3.6pp

--------- --------- --------- ---------- ---------

Adjusted profit before

tax(3) GBP11.6m GBP7.9m GBP7.4m +47% +56%

--------- --------- --------- ---------- ---------

Statutory profit before

tax GBP10.8m GBP6.1m GBP7.2m +77% +50%

--------- --------- --------- ---------- ---------

Adjusted profit before

tax margin(3) 12.5% 12.4% 12.2% +0.1pp +0.3pp

--------- --------- --------- ---------- ---------

Adjusted profit before

tax as a percentage

of net revenue(4) 41% 39% 49% +2pp -8pp

--------- --------- --------- ---------- ---------

Reported profit before

tax margin 11.7% 9.6% 11.8% +2.1pp -0.1pp

--------- --------- --------- ---------- ---------

Adjusted(3) EPS 17.9p 13.2p 12.3p +36% +46%

--------- --------- --------- ---------- ---------

Basic EPS 16.5p 10.1p 11.9p +63% +38%

--------- --------- --------- ---------- ---------

Operating profit to

adjusted cash conversion(5) 120% 97% 99% +23pp +21pp

--------- --------- --------- ---------- ---------

Interim dividend(6) 13.4p Nil 11.1p - +21%

--------- --------- --------- ---------- ---------

Operational highlights

-- Adviser numbers up 7% to 1,694(7) at 30 June 2021 (31

December 2020: 1,580)

-- Average number of mainstream advisers(8) up 13% to 1,584

(H1 2020: 1,396)

-- Revenue per mainstream adviser up 28%(9)

-- Gross mortgage completions (including product transfers)

up 48% to GBP11.0bn (H1 2020: GBP7.5bn)

-- Gross new mortgage completions (excluding product transfers)

up 50% to GBP9.6bn (H1 2020: GBP6.4bn)

-- Market share of new mortgage lending at 6.0%(10) (H1

2020: 5.9%)

-- Proportion of revenue from refinancing at 24% (H1 2020:

38%)

-- Acquisition of a 25% stake in M & R FM Ltd by First Mortgage

Direct Ltd

-- Investment in, and strategic relationship with, Boomin,

the next generation property portal

-- Commercial agreements with Boomin, The Nottingham Building

Society and Moneybox represent significant progress in

lead generation and early customer capture strategy

Post period end

-- Adviser numbers increased to 1,800(7) at 24 September

2021

-- Acquisition of a 49% stake in Evolve FS Ltd ("Evolve"),

a leading specialist new build mortgage broker

-- Moneysupermarket.com secured as major new lead source

in our fast-growing lead generation capability

Peter Brodnicki, Chief Executive, commented:

"I am delighted to report a strong set of results where we

achieved revenue growth of 46% to GBP92.4m, and adjusted EPS growth

of 36% to 17.9p. Our mortgage completions increased by 48% in a

favourable market fuelled by strong customer demand as well as the

stamp duty holiday. Accordingly, the Board is pleased to declare an

interim dividend of 13.4p per share.

"Our strategic progress has been excellent during the period, in

particular with regards to our lead generation initiatives. We have

secured significant new lead sources, including a long-term

agreement with Moneysupermarket. We also achieved a 7% growth in

adviser numbers to 1,694 despite the delay in recruitment pipeline

conversion due to the UK lockdown and restrictions for much of H1.

We expect to see a significant increase in adviser numbers in H2

and moving into 2022.

"I am confident the recent developments in lead generation and

continued enhancements to our technology platform put MAB in an

ever-stronger position to accelerate the pace of its growth."

Current Trading and Outlook

Whilst the start of the second half of the year saw the expected

softening in activity compared to H1 2021 following the tapering

down of the stamp duty holiday, the underlying fundamentals driving

levels of consumer demand for housing and mortgage products remain

strong. Current trading is in line with the Board's expectations

for the 2021 financial year.

With the current pace of growth and momentum in the business,

derived from maturing and new growth drivers, the Group is

well-positioned to meet the Board's recently revised expectations

for 2022 and beyond.

For further information please contact:

Mortgage Advice Bureau (Holdings) Plc Tel: +44 (0) 1332 525007

Peter Brodnicki - Chief Executive Officer

Ben Thompson - Deputy Chief Executive Officer

Lucy Tilley - Chief Financial Officer

Numis Securities Limited Tel: +44 (0)20 7260 1000

Stephen Westgate / Hugo Rubinstein / Laura White

Media Enquiries: investor.relations@mab.org.uk

Analyst presentation

There will be an analyst presentation to discuss the results at

9:30am today.

Those analysts wishing to attend are asked to contact

investor.relations@mab.org.uk

Copies of this interim results announcement are available at

www.mortgageadvicebureau.com/investor-relations

(1) Percentage points.

(2) MAB uses adjusted results as key performance indicators as

the Directors believe that these provide a more consistent measure

of operating performance by adjusting for acquisition related

charges and significant one-off or non-cash items. Adjusted

overheads ratio is stated before GBP0.2m amortisation of acquired

intangibles in H1 2020 and H1 2021 and GBP0.6m of additional

non-cash operating expenses relating to the put and call option

agreement to acquire the remaining 20% of First Mortgage in H1 2021

(H1 2020: GBP0.4m). In H1 2019, adjusted overheads ratio is stated

before GBP0.2m of costs associated with the acquisition of First

Mortgage.

(3) Adjusted profit before tax is stated before the items in (2)

above and the loan write off and loan provision totalling GBP1.7m

and GBP0.5m of Government grant income (net GBP1.2m) in H1 2020.

Adjusted earnings per share is stated before the items in (2) above

and the loan write off and loan provision totalling GBP1.7m and

GBP0.5m of Government grant income (net GBP1.2m) in H1 2020, net of

any associated tax effects.

(4) Net revenue is revenue less commissions paid. MAB acquired

First Mortgage in H2 2019. As the Group retains 100% of revenue for

First Mortgage, this calculation is rebased thereafter.

(5) Adjusted cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(0.9)m in H1 2021 (H1

2020: GBP0.3m; H1 2019: GBP1.6m), GBP(0.2)m of Government grant

income received in H1 2020, and increases in restricted cash

balances of GBP 1.2m in H1 2021 (H1 2020: GBP0.3m; H1 2019:

GBP1.0m), as a percentage of adjusted operating profit.

(6) Payout ratio of 75% of adjusted profit after tax post

minority interests in H1 2021 (H1 2019: 90%).

(7) Includes a total of 52 advisers at 30 June 2021 and 53

advisers at 24 September 2021 who are either directly authorised or

later life advisers. The directly authorised advisers are employees

of a firm previously authorised under an Appointed Representative

agreement with MAB until 7 December 2020. MAB continues to provide

services to this firm, which is now directly authorised by the FCA.

For both later life and directly authorised advisers the fees

received by MAB represent the net income received by MAB as there

are no commission payouts made by MAB. The 24 September 2021 number

also includes 46 advisers from associates, who are in the process

of being onboarded under MAB's AR arrangements. These advisers will

shortly become mainstream advisers. Until these 46 advisers become

onboarded fully as mainstream advisers, MAB currently only

recognises its share of profit after tax from these associates.

(8) Excludes directly authorised advisers, later life advisers,

and advisers from associates in the process of being onboarded

under MAB's AR arrangements. In H1 2020 advisers on furlough were

not included.

(9) Based on average number of mainstream advisers.

(10) Market share for the seven months ended 31 July 2021 due to

the distortion effect around 30 June 2021 with the tapering of the

stamp duty holiday thereafter.

Chief Executive's Review

I am very pleased with MAB's performance in the first half of

this financial year. The Group achieved revenue of GBP92.4m for the

period, a 46% increase on H1 2020 (GBP63.5m), which was heavily

affected by the Covid-19 pandemic, and a 52% increase compared to

H1 2019. The Group's adjusted PBT rose 47% to GBP11.6m compared to

H1 2020 (GBP7.9m) and 56% compared to H1 2019 (GBP7.4m).

Our growth in mortgage completions is set out below:

H1 2021 H1 2020 H1 2019 Increase Increase

GBPbn GBPbn GBPbn vs 2020 vs 2019

-------- -------- -------- --------- ---------

New mortgage

lending 9.6 6.4 6.3 +50% +52%

-------- -------- -------- --------- ---------

Product Transfers 1.4 1.1 0.6 +27% +133%

-------- -------- -------- --------- ---------

Gross mortgage

lending 11.0 7.5 6.9 +48% +59%

-------- -------- -------- --------- ---------

Despite the Government-imposed restrictions and national

lockdown that lasted for much of the first half, housing market

activity was fuelled by strong consumer demand following the

re-opening of the housing market last year as well as the stamp

duty holiday. The Group achieved record levels of mortgage

applications and completions per adviser during the period.

UK gross new mortgage lending activity (excluding product

transfers) in H1 2021 rose by 58% to GBP169.9bn compared to H1

2020, which was heavily affected by the closure of the housing

market in Q2 2020, and by 34% compared to H1 2019. The increase in

home-mover activity was particularly pronounced, largely driven by

changing working and living patterns. The 30 June 2021 stamp duty

holiday deadline in England, Wales and Northern Ireland generated

record completion activity levels in June 2021.

Our gross mortgage completions (including product transfers)

rose to GBP11.0bn, a 48% increase compared to H1 2020, and a 59%

increase compared to H1 2019. Our market share of UK new mortgage

lending was broadly flat for the period, rising slightly to 6.0%

for the first seven months of the year (H1 2020: 5.9%, H1 2019:

5.0%).

Adviser numbers grew by 7% to 1,694 during the period. With

restrictions starting to slowly lift from mid-April 2021, most of

the recruitment discussions that were paused because of the

lockdown and social restrictions have now completed. We expect to

see a significant increase in adviser numbers in H2 2021 that will

extend into 2022.

During the period, we achieved excellent progress on our

strategic initiatives. Our lead generation capability continues to

build strongly, and significant new lead sources, including most

recently a long-term agreement with Moneysupermarket.com Ltd, were

secured during the period. These developments, together with the

continued enhancements to our technology platform, will further

strengthen our leading position in the mortgage intermediary

market.

Since the end of the half year, the Group has acquired a 49%

stake in Evolve FS Limited, a leading 32 adviser new build

telephone advice firm based in Ipswich. This is another

strategically important addition to the MAB New Homes proposition

as the Group looks to achieve an even stronger market presence in

this specialist sector.

Delivering our growth strategy

Recruitment of advisers

The recruitment of new advisers progressed well despite being

hampered by the UK lockdown and restrictions for much of H1. By 30

June 2021, the Group's adviser numbers had risen to 1,694(1) , a 7%

increase compared to 31 December 2020 (1,580).

With restrictions having been gradually lifted from mid-April

2021, face-to-face meetings that had temporarily been put on hold

quickly resumed through the remainder of Q2. The current pipeline

of ARs and advisers is very strong, and we expect to see a

significant increase in adviser numbers throughout the remainder of

2021 and into 2022. On 24 September 2021, adviser numbers had grown

to 1,800, a 14% increase compared to 31 December 2020.

Lead generation

Lead generation is a key area of focus for MAB, which combined

with technology developments will become an ever more significant

driver of adviser growth and productivity, as well as AR

recruitment and adviser retention.

During the period MAB secured a range of high calibre new lead

sources. Under the new long-term relationship with The Nottingham

Building Society, MAB is servicing a fast-growing customer base of

over 50,000 Lifetime ISA online savers through the Beehive Money

app. Helping these future first-time buyers to secure their first

homes will increase MAB's market share in this core sector. This

follows the recently launched commercial relationship with

Moneybox, another example of MAB's early customer capture strategy

and proven ability to integrate with an increasing number of

digital platforms.

During the period, we entered into a strategic relationship

with, and invested in, Boomin, the next generation property portal.

Boomin differentiates itself with many unique features that appeal

to aspiring first time buyers and home movers, but also to the much

larger audience of currently passive customers who are at an

earlier stage of their home buying journey. MAB will provide

mortgage services across various parts of the Boomin portal, with

the opportunity to engage and nurture passive consumers in a

meaningful way as they move to becoming active buyers.

This week, MAB will also launch its new relationship with

Moneysupermarket.com Ltd, the leading UK price comparison site.

Under this new long-term agreement, the Group will help its ARs to

provide mortgages to the many first-time buyers and home-movers

that Moneysupermarket attracts. This is another significant

development in our lead generation strategy.

As customers adapt their ways of researching and buying mortgage

products and services, MAB intends to be at the forefront of this

change and increasingly drive a meaningful flow of quality leads

through AR firms, thereby ensuring both their and the Group's

future growth and success. We are pleased with the progress

achieved to date and expect this area to continue to gain

significant momentum.

Technology

The development of our technology platform continues at pace.

MAB has built new foundations and functionality for lead generation

into its platform that assists customer engagement, including

helping a large number of potential future customers who are

currently in the early research phase of buying a home and

therefore not yet ready to receive advice. Early customer capture

and nurture is a central pillar of our lead generation strategy,

allowing MAB to significantly widen the number and variety of lead

sources to help ensure increasingly more secure and consistent lead

flow to MAB advisers regardless of market conditions. The

technology encompasses everything required from initial engagement

with a customer, through to helping them to become purchase and

advice ready, and lead distribution and management across the MAB

network.

The significant and increased investment in the development of

our platform will continue over the remainder of this year and

throughout next year, enabling MAB to further its competitive

advantage.

Broadening our addressable market

Using our technology developments to proactively engage and help

an increasing number of aspiring first time buyers, especially

those in an early research phase, enables MAB to broaden its

addressable market and therefore its market share of this

sector.

This strategy has helped form new lead generation relationships

with Lifetime ISA savings platforms such as Beehive and Moneybox,

that provide MAB with access to large numbers of future first time

buyers who are using these apps to help save for their deposit.

Further foundations for success in this area will come from

strategic relationships such as Boomin, whose strategy includes

proactively engaging with and adding value to the broad audience of

visitors that are at various stages of their research process

including first time buyers.

Investment strategy

We continue to make strategic investments in new distribution

partners or to enhance our specialism in key markets. In H1 2021,

we entered into a strategic relationship with, and invested GBP2.5m

in, Boomin, the next generation property portal. This is a

significant development in our lead generation capability which

will enable us to reach a very broad audience of consumers across

the spectrum from early stage customers to active buyers.

In July 2021, the Group acquired a 49% stake in Evolve FS Ltd, a

32 adviser, leading new build telephone advice firm based in

Ipswich. This is another important addition to the MAB New Homes

proposition, and follows last year's investment in new build

specialist firm Meridian Holdings Group Ltd, which went on to

acquire shared-ownership broker Metro Finance Brokers Ltd. During

the period, our subsidiary First Mortgage Direct Ltd also acquired

a 25% stake in M & R FM Ltd, a fast-growing broker based in

Gateshead that had previously been operating under the First

Mortgage franchise.

We are pleased with the overall performance of our portfolio of

investments. Their share of profit, net of tax, amounted to over

GBP0.7m during the first half of the year (H1 2020: GBP0.1m). This

is a very good result and the start of what we believe will be a

positive trend. We are confident in our strategy of investing in

high quality distribution, as well as in other key strategic areas,

and expect the contribution from our investments to continue to

increase.

Summary

MAB has performed strongly in a period that saw high demand for

property and mortgages. The lockdown impacted new AR recruitment

for the first four months of the year, but activity resumed

immediately when restrictions were lifted, and as a result we

expect to finish the year strongly, with that accelerated growth

expected to continue into next year.

Adviser growth and productivity will be boosted moving forward

by securing major and strategically important lead sources.

Significant progress has already been made this year thanks to

MAB's unique distribution model, our technology developments in

customer capture, nurture, and distribution, and the strength of

our consumer brand.

Great progress has also been seen in terms of our investments,

with those now maturing starting to contribute to our profit

growth. More recent investments will be making an immediate

contribution, and will form a key part of our growth plans.

Although the current housing market activity has understandably

softened in H2, underlying demand remains strong and market

conditions are forecast to remain healthy and stable, which enables

our AR firms to plan their growth with more certainty.

(1) Includes a total of 52 advisers who are either directly

authorised or later life advisers. The directly authorised advisers

are employees of a firm previously authorised under an Appointed

Representative agreement with MAB until 7 December 2020. MAB

continues to provide services to this firm, which is now directly

authorised by the FCA. For both later life and directly authorised

advisers the fees received by MAB represent the net income received

by MAB as there are no commission payouts made by MAB.

Market review

Strong consumer demand coupled with the stamp duty holiday

generated a surge in the housing market and stimulated the demand

for mortgages during the period. The increase in home-mover

activity was particularly pronounced, largely driven by changing

working and living patterns.

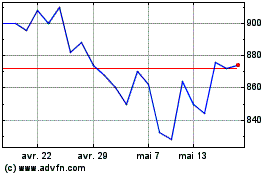

Overall, gross new mortgage lending activity (excluding product

transfers) in H1 2021 rose by 58% to GBP169.9bn compared to H1

2020, which was heavily affected by the closure of the housing

market in Q2 2020, and 34% compared to H1 2019. UK housing

transactions increased by 103% and 52% versus the comparative

periods in 2020 and 2019 respectively, as illustrated in the graph

below. The 30 June 2021 stamp duty holiday deadline generated

record activity levels in June 2021.

http://www.rns-pdf.londonstockexchange.com/rns/1340N_1-2021-9-27.pdf

Source: HM Revenue and Customs

At the same time as the surge in home-mover activity, buy-to-let

purchase lending values also saw significant growth of 140% and

106% compared to H1 2020 and H1 2019 respectively, with the stamp

duty holiday providing a compelling stimulus in that segment. The

demand from first time buyers was also strong, with mortgage

lending increasing by 95% and 52% compared to H1 2020 and H1 2019

respectively in that segment.

Re-financing activity remained steady, driven by product

transfers. Product transfer lending values increased by 8% and 13%

compared to H1 2020 and H1 2019 respectively. External

re-mortgaging lending values decreased by 15% and 21% compared to

H1 2020 and H1 2019, as lenders and intermediaries applied maximum

focus towards the exceptionally busy housing market. The increase

in average house prices in H1 2021 was 10% compared to H1 2020 and

12% compared to H1 2019, although house price increases did not

fully feed through to higher average new mortgage values due to the

lack of availability of high loan to value mortgages through much

of this period.

The trends in gross new mortgage lending are illustrated in the

graph below.

http://www.rns-pdf.londonstockexchange.com/rns/1340N_2-2021-9-27.pdf

Source: UK Finance

Approximately 79% of UK residential mortgage transactions

(excluding buy to let, where intermediaries have a higher market

share, and product transfers where intermediaries have a lower

market share) were via intermediaries in H1 2021 (H1 2020: 79%).

MAB expects this position to remain broadly stable in the near

term.

We are confident that the underlying fundamentals of consumer

demand for housing and mortgages remain strong and will continue to

drive sustained transaction activity in the mortgage market.

(1) Land Registry House Price Index

Financial review

We measure the development, performance, and position of our

business against several key indicators.

http://www.rns-pdf.londonstockexchange.com/rns/1340N_3-2021-9-27.pdf

Revenue

The Group achieved revenue of GBP92.4m for the six months ended

30 June 2021. This represents a 46% increase on H1 2020 (GBP63.5m),

and a 52% increase compared to H1 2019. The increase in revenue

since H1 2019 is driven by the combination of a 28% increase in the

average number of mainstream advisers(1) to 1,584 over the two-year

period (H1 2019: 1,242) and a 19% increase in revenue per

mainstream adviser.

The Group continued to generate revenue from three core areas,

summarised as follows:

Group

Income source H1 H1 2020 H1 Change Change

2021 2019 vs 2020 vs 2019

------ -------- ------ --------- ---------

GBPm GBPm GBPm % %

------ -------- ------ --------- ---------

Mortgage Procuration Fees 42.7 27.6 26.7 +55 +60

------ -------- ------ --------- ---------

Protection and General Insurance

Commission 35.8 26.3 23.6 +36 +52

------ -------- ------ --------- ---------

Client Fees 11.6 8.1 9.7 +43 +20

------ -------- ------ --------- ---------

Other Income 2.3 1.5 0.9 +56 +155

------ -------- ------ --------- ---------

Total 92.4 63.5 60.9 +46 +52

------ -------- ------ --------- ---------

All key income sources continued to grow strongly, with the

average number of mainstream active advisers in the period

increasing by 13% on last year.

During the period, MAB's banked mortgage mix saw a higher

proportion of purchase business compared to the prior year, and

versus H1 2019. Strong underlying demand, heightened by the

impending stamp duty changes on 1 July 2021, were in marked

contrast to the prior year, when the first national lockdown

severely restricted the completion of purchase transactions in that

period. Mortgage procuration fees increased by 55% with gross

mortgage completions increasing by 48%. MAB's average mortgage size

increased by 8% compared to prior year, driven by the increase in

house prices in the period. However, the average mortgage in the

period did not rise at an equivalent level to house price growth

due to the lack of availability of high loan to value mortgages

through much of this period.

The comparatively lower increase of 36% in protection and

general insurance commission for the Group mainly reflects the

faster banking profile of protection income that we saw in the

unusual prior period. As expected, we are seeing this normalise

through 2021.

Client fees increased by 43% in the period with gross mortgage

completions increasing by 48%; client fees typically bank in a

shorter timeframe compared to other income sources.

MAB's overall revenue from refinancing (including both

re-mortgages and product transfers) represented circa 24% (H1 2020:

38%, H1 2019: 32%) of total revenue for the period with a

particularly high level of purchase transactions completing in H1

2021.

MAB's revenue, in terms of proportion, is split as follows:

Income source H1 2021 H1 2020 H1 2019

Mortgage Procuration Fees 46% 44% 44%

-------- -------- --------

Protection and General Insurance

Commission 39% 41% 39%

-------- -------- --------

Client Fees 13% 13% 16%

-------- -------- --------

Other Income 2% 2% 1%

-------- -------- --------

Total 100% 100% 100%

-------- -------- --------

The slight comparative increase in the proportion of mortgage

procuration fees reflects the run up to the stamp duty deadline. We

expect client fees to become increasingly dependent upon the type

and complexity of the mortgage transaction, as well as the delivery

channel. This will lead to a broader spread of client fees on

mortgage transactions, which, by their nature, are our lowest

margin revenue stream.

Government grant income

No government grant income was received during H1 2021. During

H1 2020, Government grant income of GBP0.5m was received due to

some employees being placed on furlough during the months of April,

May, and June 2020. These amounts were repaid in full in December

2020.

Gross profit margin

Gross profit margin for the period was 26.7% (H1 2020: 27.2%), a

slight reduction on the prior year due to the skew towards higher

margin protection income in the comparative period as a direct

result of actions the Group took during the first national

lockdown. The Group typically receives a slightly reduced margin

(revenue share) as its existing ARs grow their revenue organically

through increasing their adviser numbers. In addition, larger new

ARs typically join the Group on lower-than-average margins due to

their existing scale, hence we expect to see a degree of erosion of

our underlying gross profit margin due to the continued growth of

our existing ARs and the addition of new larger ARs.

Overheads

Overheads in the period increased by GBP4.4m to GBP14.4m

compared to prior year, mainly because of the salary cuts

implemented in Q2 2020 as the pandemic escalated, but also

increased IT costs and bonuses accrued in H1 2021 (in H1 2020 only

adviser bonuses were accrued). MAB has been investing in its

technology platform and its marketing team to drive lead generation

opportunities as it continues to extend its business model. All

development work on our technology platform is expensed.

Overheads as a percentage of revenue, before GBP0.2m (H1 2020:

GBP0.2m) of amortisation of acquired intangibles and GBP0.6m (H1

2020: GBP0.4m) of additional non-cash operating expenses relating

to the put and call option agreement to acquire the remaining 20%

of First Mortgage, were 14.8% (H1 2020: 14.9%).

Our FCA and FSCS regulatory fees and charges are usually closely

correlated to growth in revenue. MAB expects its FSCS levy cost for

the period from 1 April 2021 to 31 March 2022 to now be c.GBP1m

higher than in the prior year.

MAB continues to benefit from the scalable nature of most of its

cost base, where those costs typically rise at a slower rate than

revenue, which will, in part, counter the expected erosion of MAB's

underlying gross margin as the business continues to grow.

Associates and investments

MAB's share of profits from associates was GBP0.7m (H1 2020:

GBP0.1m) with the majority of the Group's associates performing

strongly during the period. In addition, we realised our minority

investment in the sales progression platform Yourkeys Technology

Ltd and further impaired the value of the investment in The

Mortgage Broker Group Limited by GBP0.4m.

MAB considers the value of a number of these investments exceeds

their balance sheet value as accounted for using the equity

accounting method under IAS 28.

Profit before tax and margin thereon

Adjusted(2) profit before tax rose by 47% to GBP11.6m (H1 2020:

GBP7.9m), with the margin thereon broadly stable at 12.5% (H1 2020:

12.4%). Statutory profit before tax rose by 77% to GBP10.8m (H1

2020: GBP6.1m) with the margin thereon being 11.7% (H1 2020:

9.6%).

Adjusted(2) profit before tax as a percentage of net revenue(3)

was 41% (H1 2020: 39%).

Finance revenue

Finance income of GBP0.03m (H1 2020: GBP0.08m) reflects

continued low interest rates and interest income accrued or

received on loans to associates. Finance expense of GBP0.07m (H1

2020: GBP0.12m) reflects the non-utilisation fee payable on MAB's

Revolving Credit Facility of GBP12m, which was repaid in December

2020, and interest expense on lease liabilities.

Taxation

The effective rate of tax increased to 16.8% (H1 2020: 12.4%),

as the prior year saw a lower effective rate principally due to the

higher tax deduction arising from the exercise of employee and

Appointed Representative share options than in the current period.

We expect our effective tax rate to continue to be marginally below

the prevailing UK corporation tax rate, subject to tax credits for

MAB's research and development expenditure on the continued

development of MIDAS Platform, MAB's proprietary software, still

being available and further tax deductions arising from the

exercise of employee share options.

Earnings per share and dividend

Adjusted(2) earnings per share rose by 36% to 17.9 pence (H1

2020: 13.2 pence). Basic earnings per share increased by 63% to

16.5 pence (H1 2020: 10.1 pence).

The Board is pleased to confirm an interim dividend for the year

ending 31 December 2021 of 13.4 pence per share (H1 2020: nil pence

per share), amounting to a cash outlay of GBP7.1m. Due to the

uncertainty arising from the pandemic, the Board did not pay an

interim dividend relating to H1 2020 in the year ending 31 December

2020. Following payment of the dividend, the Group will continue to

maintain significant surplus regulatory reserves. This interim

dividend represents circa 75% of the Group's post-tax adjusted

profits for H1 2021. MAB requires circa 10% of its profit after tax

to fund increased regulatory capital and other regular capital

expenditure.

The record date for the interim dividend is 1 October 2021 and

the payment date is 29 October 2021. The ex-dividend date will be

30 September 2021.

Cash flow and cash conversion

The Group's operations produce positive cash flow. This is

reflected in the net cash generated from operating activities of

GBP14.7m (H1 2020: GBP5.9m).

Headline cash conversion(4) was:

H1 2021 130%

H1 2020 101%

------------

Adjusted cash conversion(5) was:

H1 2021 120%

------------

H1 2020 97%

------------

The Group's operations are capital-light with the most

significant ongoing capital investment being in computer equipment.

Only GBP0.1m of capital expenditure on office and computer

equipment was required during the period (H1 2020: GBP0.2m). Group

policy is not to provide company cars, and no other significant

capital expenditure is foreseen in the coming year.

The Group had no bank borrowings at 30 June 2021 (31 December

2020: GBPnil). The Group had unrestricted bank balances of GBP18.3m

at 30 June 2021 (31 December 2020: GBP18.6m).

The Group has a regulatory capital requirement amounting to 2.5%

of regulated revenue. At 30 June 2021 this regulatory capital

requirement was GBP4.2m (31 December 2020: GBP3.4m), with the Group

having a surplus of GBP15.9m.

The following table demonstrates how cash generated by the Group

was applied:

GBPm

Unrestricted bank balances at the beginning of the year 18.6

Cash generated from operating activities excluding movements in restricted balances and dividends

received from associates 14.3

Dividends received from associates 0.1

Dividends paid (10.5)

Tax paid (0.9)

Investment in associates (0.8)

Disposal of unlisted investment 0.3

Acquisition of unlisted investment (2.5)

Net interest paid and principal element of lease payments (0.2)

Capital expenditure (0.1)

Unrestricted bank balances at the end of the period 18.3

-------------------------------------------------------------------------------------------------- ------

(1) Excludes directly authorised advisers, later life advisers,

and advisers from associates in the process of being onboarded

under MAB's AR arrangements.

(2) In H1 2021 and H1 2020 adjusted for GBP0.2m amortisation of

acquired intangibles. In H1 2021, adjusted for GBP0.6m of

additional non-cash operating expenses relating to the put and call

option agreement to acquire the remaining 20% of First Mortgage (H1

2020: GBP0.4m). In H1 2020 also adjusted for the loan write off and

loan provision totalling GBP1.7m, and GBP0.5m of Government grant

income (resulting in a GBP1.2m net adjustment in H1 2020).

(3) Net revenue is revenue less commissions paid.

(4) Headline cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(0.9)m in H1 2021 (H1

2020: GBP0.3m), and GBP(0.2)m of government grant income received

in H1 2020 resulting in a GBP(0.2)m net adjustment, as a percentage

of adjusted operating profit.

(5) Adjusted cash conversion is headline cash conversion

adjusted for increases in restricted cash balances of GBP1.2m in H1

2021 (H1 2020: GBP0.3m) as a percentage of adjusted operating

profit.

INDEPENT REVIEW REPORT TO MORTGAGE ADVICE BUREAU (HOLDINGS)

PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2021 which comprises the interim condensed

consolidated statement of financial position, interim condensed

consolidated statement of comprehensive income, interim condensed

consolidated statement of changes in equity and interim condensed

consolidated statement of cash flows.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with the rules of the London Stock Exchange for companies trading

securities on AIM.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

BDO LLP

Chartered Accountants

London

United Kingdom

27 September 2021

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Interim condensed consolidated statement of comprehensive income

for the six months ended 30 June 2021

Six months ended

30 June

Note 2021 2020

Unaudited Unaudited

GBP'000 GBP'000

-------------------------------------- ----- ----------- -----------

Revenue 2 92,432 63,464

Cost of sales 2 (67,783) (46,220)

-------------------------------------- ----- ----------- -----------

Gross profit 24,649 17,244

Government grant income - 513

Administrative expenses (14,392) (10,033)

Impairment of loans to related

parties 11 (14) (1,656)

Share of profit from associates,

net of tax 9 723 88

Impairment of associate 9 (400) -

-------------------------------------- ----- ----------- -----------

Operating profit 10,566 6,156

-------------------------------------- ----- ----------- -----------

Analysed as:

Operating profit before: 11,313 7,898

Government grant income - 513

Amortisation of acquired intangibles 3 (183) (183)

Costs relating to the First Mortgage

option 3 (550) (416)

Impairment of loans to related

parties 11 (14) (1,656)

Operating profit 10,566 6,156

-------------------------------------- ----- ----------- -----------

Finance income 4 27 75

Finance expense 4 (67) (117)

Profit on sale of investment 10 309 -

-------------------------------------- ----- ----------- -----------

Profit before tax 10,835 6,114

Tax expense 5 (1,820) (759)

-------------------------------------- ----- ----------- -----------

Profit for the period 9,015 5,355

-------------------------------------- ----- ----------- -----------

Total comprehensive income 9,015 5,355

-------------------------------------- ----- ----------- -----------

Profit is attributable to:

Equity owners of Parent Company 8,763 5,244

Non-controlling interests 252 111

-------------------------------------- ----- ----------- -----------

9,015 5,355

-------------------------------------- ----- ----------- -----------

Earnings per share attributable

to the owners of the Parent Company

Basic 6 16.5p 10.1p

Diluted 6 16.4p 10.0p

Interim condensed consolidated statement of financial

position

as at 30 June 2021 and 31 December 2020

30 June 2021 31 Dec

Note Unaudited 2020

GBP'000 Audited

GBP'000

---------------------------------- ------ ------------- ---------

Assets

Non-current assets

Property, plant and equipment 2,771 2,847

Right of use assets 2,414 2,590

Goodwill 8 15,155 15,155

Other intangible assets 2,983 3,262

Investments in associates and

joint venture 9 5,940 4,883

Investments in non-listed equity

shares 10 2,500 75

Other receivables 11 1,349 806

Deferred tax asset 5 1,739 822

---------------------------------- ------ ------------- ---------

Total non-current assets 34,851 30,440

---------------------------------- ------ ------------- ---------

Current assets

Trade and other receivables 11 11,332 5,603

Cash and cash equivalents 14 33,949 32,981

---------------------------------- ------ ------------- ---------

Total current assets 45,281 38,584

---------------------------------- ------ ------------- ---------

Total assets 80,132 69,024

---------------------------------- ------ ------------- ---------

Interim condensed consolidated statement of financial

position

as at 30 June 2021 and 31 December 2020 (continued)

Note 30 June 2021 31 Dec

Unaudited 2020

GBP'000 Audited

GBP'000

------------------------------- ----- ------------- ---------

Equity and liabilities

Share capital 15 53 53

Share premium 9,778 9,778

Capital redemption reserve 20 20

Share option reserve 3,074 1,807

Retained earnings 22,578 23,882

------------------------------- ----- ------------- ---------

Equity attributable to owners

of Parent Company 35,503 35,540

Non-controlling interests 1,907 1,908

------------------------------- ----- ------------- ---------

Total equity 37,410 37,448

------------------------------- ----- ------------- ---------

Liabilities

Non-current liabilities

Provisions 5,269 4,576

Lease liabilities 2,192 2,352

Deferred tax liability 726 643

------------------------------- ----- ------------- ---------

Total non-current liabilities 8,187 7,571

------------------------------- ----- ------------- ---------

Current liabilities

Trade and other payables 12 33,648 23,662

Lease liabilities 341 343

Corporation tax liability 546 -

------------------------------- ----- ------------- ---------

Total current liabilities 34,535 24,005

------------------------------- ----- ------------- ---------

Total liabilities 42,722 31,576

------------------------------- ----- ------------- ---------

Total equity and liabilities 80,132 69,024

------------------------------- ----- ------------- ---------

Interim condensed consolidated statement of changes in equity

for the six months ended 30 June 2021

Attributable to the holders of the

Parent Company

----------------------------------------------------------------------

Share

Capital option Non-controlling

Share Share redemption reserve Retained Interest Total

capital premium reserve GBP'000 earnings Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at

1 January

2020 52 5,451 20 2,799 17,272 25,594 1,595 27,189

Profit for the

period - - - - 5,244 5,244 111 5,355

Total

comprehensive

income - - - - 5,244 5,244 111 5,355

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Transactions

with owners

Issue of

shares - 601 - - - 601 - 601

Share based

payment

transactions - - - 430 - 430 - 430

Deferred tax

assets

recognised

in equity - - - (423) - (423) - (423)

Reserve

transfer - - - (438) 438 - - -

Dividends paid - - - - (3,311) (3,311) (86) (3,397)

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

transactions

with owners - 601 - (431) (2,873) (2,703) (86)) (2,789)

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at 30

June 2020

(unaudited) 52 6,052 20 2,368 19,643 28,135 1,620 29,755

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at 1

January 2021 53 9,778 20 1,807 23,882 35,540 1,908 37,448

Profit for the

period - - - - 8,763 8,763 252 9,015

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

comprehensive

income - - - - 8,763 8,763 252 9,015

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Transactions

with owners

Issue of - - - - - - - -

shares

Share based

payment

transactions - - - 693 - 693 - 693

Deferred tax

asset

recognised

in equity - - - 717 - 717 - 717

Reserve

transfer - - - (143) 143 - - -

Dividends paid - - - - (10,210) (10,210) (253) (10,463)

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

transactions

with owners - - - 1,267 (10,067) (8,800) (253) (9,053)

Balance at 30

June 2021

(unaudited) 53 9,778 20 3,074 22,578 35,503 1,907 37,410

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Interim condensed consolidated statement of cash flows for the

six months ended 30 June 2021

Six months ended

30 June

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------- ------------ -----------

Cash flows from operating activities

Profit for the period before tax 10,835 6,114

Adjustments for

Depreciation of property, plant

and equipment 185 189

Depreciation of rights of use assets 191 185

Amortisation of intangibles 279 302

Profit on disposal of unlisted investment (309) -

Share based payments 693 430

Share of profit from associates (723) (88)

Impairment of associate 400 -

Dividends received from associates 88 58

Finance income (27) (75)

Finance expense 67 117

11,679 7,232

Changes in working capital

(Increase)/Decrease in trade and

other receivables (6,730) 1,148

Increase/(Decrease) in trade and

other payables 9,986 (703)

Increase in provisions 693 242

Cash generated from operating activities 15,628 7,919

Income taxes paid (892) (1,993)

-------------------------------------------- ------------ -----------

Net cash generated from operating

activities 14,736 5,926

-------------------------------------------- ------------ -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (109) (188)

Purchase of Intangibles - (1)

Acquisition of associates (822) -

Disposal of unlisted investment 329 -

Acquisition of unlisted investment (2,500) -

------------------------------------------- ------------ -----------

Net cash used in investing activities (3,102) (189)

-------------------------------------------- ------------ -----------

Cash flows from financing activities

Proceeds from borrowings - 12,000

Interest received 41 46

Interest paid (67) (34)

Principal element of lease payments (177) (185)

Issue of shares - 601

Dividends paid (10,210) (3,311)

Dividends paid to minority interest (253) (86)

-------------------------------------------- ------------ -----------

Net cash (used)/generated in financing

activities (10,666) 9,031

-------------------------------------------- ------------ -----------

Net Increase in cash and cash equivalents 968 14,768

Cash and cash equivalents at the

beginning of the period 32,981 20,867

-------------------------------------------- ------------ -----------

Cash and cash equivalents at the

end of the period 33,949 35,635

-------------------------------------------- ------------ -----------

Notes to the interim condensed consolidated financial statements

for the six months ended 30 June 2021

1 Accounting policies

Corporate information

The interim condensed consolidated financial statements of

Mortgage Advice Bureau (Holdings) Plc and its subsidiaries

(collectively, "the Group") for the six months ended 30 June 2021

were authorised for issue in accordance with a resolution of the

directors on 27 September 2021.

Mortgage Advice Bureau (Holdings) Plc ("the Company") is a

limited company incorporated and domiciled in England whose shares

are publicly traded on the Alternative Investment Market ("AIM").

The registered office is located at Capital House, Pride Place,

Pride Park, Derby, DE24 8QR. The Group's principal activity is the

provision of financial services.

Basis of preparation

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into UK law and became UK-adopted

international accounting standards, with future changes being

subject to endorsement by the UK Endorsement Board. The Group

transitioned to UK-adopted international accounting standards in

its consolidated financial statements on 1 January 2021. There was

no impact or changes in accounting policies from the

transition.

These condensed consolidated interim financial statements for

the six months ended 30 June 2021 have been prepared in accordance

with IAS 34 'Interim financial reporting' and also in accordance

with the measurement and recognition principles of UK adopted

international accounting standards. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the 2020 Annual Report and

Accounts, which were prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 and in accordance with international financial

reporting standards adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union.

The comparative figures for the six months ended 30 June 2020

are not the Group's statutory accounts for that financial period.

The accounts for the year ended 31 December 2020 have been reported

on by the Group's auditors and delivered to the registrar of

companies. The report of the auditor was (i) unqualified, (ii) did

not include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

Going Concern

The Directors have assessed the Group's prospects until 31

December 2022, taking into consideration the current operating

environment, including the impact of the coronavirus pandemic on

property and lending markets. The Directors' financial modelling

considers the Group's profit, cash flows, regulatory capital

requirements, borrowing covenants and other key financial metrics

over the period.

These metrics are subject to sensitivity analysis, which

involves flexing a number of key assumptions underlying the

projections, including the effect of pandemic-related social

restrictions and their impact on the UK property market and the

Group's revenue mix, which the Directors consider to be severe but

plausible stress tests on the Group's cash position, banking

covenants and regulatory capital adequacy. The Group's financial

modelling shows that the Group should continue to be cash

generative, maintain a surplus on its regulatory capital

requirements and be able to operate within its current financing

arrangements.

Based on the results of the financial modelling, the Directors

expect that the Group will be able to continue in operation and

meet its liabilities as they fall due over this period.

Accordingly, the Directors continue to adopt the going concern

basis for the preparation of the financial statements.

Significant estimates and judgements

Other than as set out below, the judgements, estimates and

assumptions applied in the interim financial statements, including

the key sources of estimation uncertainty, were the same as those

applied in the Group's last annual financial statements for the

year ended 31 December 2020. There have been no material revisions

to the nature and amount of estimates of amounts reported in prior

periods.

The Group has been able to enhance its revenue recognition

procedures in relation to estimates made on accrued income.

Significant accounting policies

The accounting policies applied are consistent with those

described in the Annual Report and Group financial statements for

the year ended 31 December 2020. New or amended standards effective

in the period have not had a material impact on the condensed

consolidated interim financial statements.

The Group has not early adopted any standards, interpretations

or amendments that have been issued but are not yet effective.

New standards with no impact on the Group

-- Amendments to IFRS 7, IFRS 9 and IAS 39 Interest Rate

Benchmark Reform - Phase 2. Under the detailed rules of IFRS 9

Financial Instruments, modifying a financial contract can require

recognition of a significant gain or loss in the income statement.

However, the amendments introduce a practical expedient if a change

results directly from IBOR reform and occurs on an 'economically

equivalent' basis. In these cases, changes will be accounted for by

updating the effective interest rate. The Group does not have any

interest rate hedge relationships.

-- Amendments to IFR16 - Covid 19 related rent concessions

beyond 30 June 2021. In March 2021, the IASB amended IFRS 16

Leases, extending the practical expedient to permit lessees to

apply it to rent concessions for which reductions in lease payments

affect payments originally due on or before 30 June 2022. This

amendment is applicable for annual reporting periods beginning on

or after 1 April 2021, with early application permitted. The Group

did not receive any rent concessions beyond 30 June 2021.

Future new standards and interpretations

A number of new standards and amendments to standards and

interpretations will be effective for future annual and interim

periods, and therefore have not been applied in preparing these

condensed consolidated interim financial statements. At the date of

authorisation of these financial statements, the following

standards and interpretations which have not been applied in these

financial statements were in issue but not yet effective:

Standard or Interpretation Periods commencing

on or after

Amendments to IFRS 3, IAS 16, IAS 37 and annual 1 January 2022

improvements on IFRS 1, IFRS 9, IAS 41 and IFRS

1

-------------------

Amendments to IAS 1 and IAS 8 on classification 1 January 2023

of liabilities, disclosure of accounting policies

and definition of accounting estimates.

-------------------

Amendments to IFRS 17, IFRS 4 and IAS 12 1 January 2023

-------------------

Current versus non-current classification

The Group presents assets and liabilities in the statement of

financial position based on current/non-current classification. An

asset is current when it is:

-- expected to be realised or intended to be sold or consumed in

the normal operating cycle; and

-- held primarily for the purpose of trading; and

-- expected to be realised within twelve months after the reporting date.

All other assets are classified as non-current.

Assets included in current assets which are expected to be

realised within twelve months after the reporting date are measured

at amortised cost which may equate to fair value. Fair value for

investments in unquoted equity shares is the net proceeds that

would be received for the sale of the asset where this can be

reasonably determined.

Basis of consolidation

Where the Company has control over an investee, it is classified

as a subsidiary. The Company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

Company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Entities that are not subsidiaries but where the Group has

significant influence (i.e. the power to participate in the

financial and operating policy decisions) are accounted for as

associates. The results and assets and liabilities of the

associates are included in the consolidated accounts using the

equity method of accounting.

Segment Reporting

An operating segment is a distinguishable segment of an entity

that engages in business activities from which it may earn revenues

and incur expenses and whose operating results are reviewed

regularly by the entity's chief operating decision maker ("CODM").

The Board reviews the Group's operations and financial position as

a whole and therefore considers that it has only one operating

segment, being the provision of financial services operating solely

within the UK. The information presented to the CODM directly

reflects that presented in the financial statements and they review

the performance of the Group by reference to the results of the

operating segment against budget.

Operating profit is the profit measure, as disclosed on the face

of the consolidated statement of comprehensive income that is

reviewed by the CODM.

During the six month period to 30 June 2021, there have been no

changes from the prior periods in the measurement methods used to

determine operating segments and reported segment profit or

loss.

2 Revenue

The Group operates in one segment being that of the provision of

financial services in the UK.

Revenue is derived as follows:

Six months ended 30

June

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

Mortgage procuration fees 42,721 27,606

Client fees 11,624 8,122

Insurance and other protection products 35,803 26,271

Other income 2,284 1,465

------------------------------------------ ------------ ------------

92,432 63,464

------------------------------------------ ------------ ------------

Costs of sales are as follows:

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

Commissions paid 63,924 43,355

Impairment of trade receivables (5) 4

Wages and salary costs 3,864 2,861

----------------------------------------- ------------ ------------

67,783 46,220

----------------------------------------- ------------ ------------

There is no significant seasonality to income which arises

fairly evenly throughout the year and therefore profits also arise

fairly evenly throughout the financial year.

3 Acquisition costs

On 2 July 2019 Mortgage Advice Bureau (Holdings) Plc acquired 80

per cent of the entire issued share capital of First Mortgage

Direct Limited ("First Mortgage" or the "Business").

Costs relating to the amortisation of acquired intangibles

amounted to GBP183,000 in the six months ended 30 June 2021 and

2020. The option (comprising the put and the call option) over the

remaining 20% of the issued share capital of First Mortgage has

been accounted for under IAS 19 Employee Benefits and IFRS 2 Share

Based Payments due to its link to the service of First Mortgage's

Managing Director. In accordance with IAS 19, GBP212,303 (2020:

GBP188,000) has been included within administrative expenses under

staff costs, and in accordance with IFRS 2, a further GBP338,118

(2020 - GBP227,968) has been included within administrative expense

under share based payments (see note 17).

4 Finance income and expense

Six months ended 30

June

2021 2020

Unaudited Unaudited

Finance income GBP'000 GBP'000

------------------------------------------------ ------------ -----------

Interest income 18 46

Interest income accrued on loans to associates 9 29

------------------------------------------------ ------------ -----------

27 75

------------------------------------------------ ------------ -----------

Finance expenses

---------------------------------------- --- ----

Interest expense 37 84

Interest expenses on lease liabilities 30 33

---------------------------------------- --- ----

67 117

---------------------------------------- --- ----

5 Income tax

The Group calculates the period income tax expense using the tax

rate that would be applicable to the expected total annual

earnings. The major components of income tax expense in the interim

condensed statements of comprehensive income are:

Six months ended 30

June

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------------ ------------ -----------

Current tax expense

UK corporation tax charge on profit for

the period 1,937 826

Total current tax 1,937 826

------------------------------------------------ ------------ -----------

Deferred tax expense

Origination and reversal of timing differences (30) (62)

Temporary difference on share based payments (170) (44)

Adjustment due to rate change 83 39

Total deferred tax (117) (67)

------------------------------------------------ ------------ -----------

Total tax expenses 1,820 759

------------------------------------------------ ------------ -----------

For the period ended 30 June 2021, the deferred tax recognised

in equity was GBP717,160 (2020: GBP423,000). A change to the

corporation tax rate was substantively enacted on 24 May 2021 to

increase it to 25% from 1 April 2023 rather than the previously

enacted 19%. The impact of this in the year has been to increase

the tax charge by GBP82,925.

The deferred tax asset is recognised after being assessed as

recoverable on the basis of available evidence including projected

profits, capital and liquidity position. The deferred tax asset is

only recognised to the extent that it is probable that future

taxable profits will be available against which the asset can be

utilised. The deferred tax asset is reviewed at each reporting date

and reduced to the extent that it is no longer probable that the

related tax benefit will be realised.

6 Earnings per share

Both the basic and diluted earnings per share have been

calculated using the profit attributable to shareholders of the

Parent Company, Mortgage Advice Bureau (Holdings) Plc, as the

numerator.

The weighted average number of shares for the purposes of the

calculation of diluted earnings per share can be reconciled to the

weighted average number of ordinary shares used in the calculation

of basic earnings per share as follows:

Six months ended 30 June

2021 2020

Unaudited Unaudited

---------------------------------------- ------------- ------------

Weighted average number of shares used

in basic earnings per share 53,165,081 51,896,090

Potential ordinary shares arising from

options 349,327 701,335

---------------------------------------- ------------- ------------

Weighted average number of shares used

in diluted earnings per share 53,514,408 52,597,425

---------------------------------------- ------------- ------------

The Group uses adjusted results as key performance indicators,

as the Directors believe that these provide a more consistent

measure of operating performance. Adjusted profit is therefore

stated before Government grant income, one-off acquisition costs,

ongoing non-cash items relating to the acquisition of First

Mortgage Direct Limited and impairment of loans to related parties,

net of tax.

The reconciliation between the basic and adjusted figures is as

follows:

Six months ended 30 Six months ended 30 June

June

2021 2020 2021 2020 2021 2020

Unaudited Unaudited Basic Basic Diluted Diluted

GBP'000 GBP'000 earnings earnings earnings earnings

per share per share per share per share

pence pence pence pence

Profit for the period 8,763 5,244 16.5 10.1 16.4 10.0

Adjustments:

Government grant

income - (447) - (0.9) - (0.9)

Amortisation of acquired

intangibles 183 183 0.4 0.4 0.4 0.3

Costs relating to

the First Mortgage

option 550 416 1.0 0.8 1.0 0.8

Impairment of loans

to related parties 14 1,656 0.0 3.2 0.0 3.1

Tax effect of adjustments (3) (230) 0.0 (0.4) 0.0 (0.4)

---------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Adjusted earnings 9,507 6,822 17.9 13.2 17.8 12.9

---------------------------- ----------- ----------- ----------- ----------- ----------- -----------

In the period ended 30 June 2020, the Government grant income of

GBP447,414 represented amounts attributable to the equity owner of

the parent company and excludes GBP65,735 attributable to

non-controlling interests included in the amounts shown in the

consolidated statement of comprehensive income.

7 Dividends

Six months Six months Year ended

ended 30 ended 30 31 December

June June 2020

2021 2020 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Dividends paid and declared during

the period:

On ordinary shares at 19.2p per share

(2020: 6.4p) 10,210 3,311 3,311

Interim dividend for 2020: 6.4p per

share - - 3,401

10,210 3,311 6,712

--------------------------------------- ----------- ----------- -------------

Equity dividends on ordinary shares:

Declared:

Interim dividend for 2021: 13.4p per 7,129 - -

share (2020: nil)

Proposed for approval:

Final dividend for 2020: 19.2p per

share - - 10,205

--------------------------------------- ------ -------

7,129 - 10.205

-------------------------------------- ------ -------

8 Goodwill

The goodwill relates to the acquisition of Talk Limited in 2012,

and in particular its main operating subsidiary Mortgage Talk

Limited, and the acquisition of First Mortgage Direct Limited

("FMD") in 2019. The goodwill is deemed to have an indefinite

useful life. It is currently carried at cost and is reviewed

annually for impairment.

Under IAS 36, "Impairment of assets", the Group is required to

review and test its goodwill annually each year or in the event of

a significant change in circumstances. The impairment reviews

conducted at the end of 2020 concluded that there had been no

impairment of goodwill.

The key basis for determining that there was no impairment to

the carrying value of goodwill was disclosed in the annual

consolidated financial statements for the year ended 31 December

2020. There are no matters which have arisen in the period to 30

June 2021 which indicated that an impairment was required at that

date.

9 Investments in associates and joint ventures

The investment in associates and joint ventures at the reporting

date is as follows:

30 June 2021 31 December

Unaudited 2020

GBP'000 Audited

GBP'000

-------------------------------------- ------------- ------------

At start of the period 4,883 3,133

Additions 822 2,345

Credit to statement of comprehensive

income

Share of profit 723 36

Impairment (400) (473)

-------------------------------------- ------------- ------------

323 (437)

Dividends received (88) (158)

-------------------------------------- ------------- ------------

At period end 5,940 4,883

-------------------------------------- ------------- ------------

Acquisitions and disposals

2021: On 12 January 2021, First Mortgage Direct Limited, an 80%

owned subsidiary of the Group acquired a 25% stake in M&R FM

Ltd, for an initial cash consideration of GBP663,400. On 13 January

2021, the Group ceased to have an investment in Freedom 365

Mortgage Solutions Limited, having entered into a deed of

termination. The Group acquired a further 29% interest in Vita

Financial on 28 May 2021 for an initial cash consideration of

GBP159,081. In accordance with IAS28 the Group impaired the value

of the investment in The Mortgage Broker Group Limited by

GBP400,000 (2020: GBP472,850).

2020: The Group acquired a 40% interest in Meridian Holdings

Group Limited on 12 October 2020 at a cost of GBP1,340,000. The

Group acquired a further 24% interest in Clear Mortgage Solutions

Limited on 17 December 2020 at an initial consideration of

GBP461,593. In connection with Australian Finance Group Ltd

becoming the Group's new joint venture partner for MAB Broker

Services PTY Ltd, the Group increased its investment in MAB Broker

Services PTY Limited by 3.05% on 30 October 2020 at a cost of

GBP543,095 (AUD1,000,000). In accordance with IAS28 the Group

impaired the value of the investment in The Mortgage Broker Group

Limited by GBP472,850.

10 Investments in non-listed equity shares

30 June 31 December

2021 2020

Unaudited Audited

GBP'000 GBP'000

------------------------ ----------- ------------

At start of the period 75 75

Disposals (75) -

Additions 2,500 -

At period end 2,500 75

------------------------ ----------- ------------

The investment at the start of the year represented a 2.23%

interest in Yourkeys. This was sold on 23 April 2021 for initial

consideration of GBP329,000 with estimated total proceeds

(including deferred consideration) of GBP384,000.

On 9 April 2021, the Group acquired a 3.17% stake in the

property portal Boomin for a cash consideration of GBP2,500,000.

The price of this recent transaction was verified based on the

current facts and circumstances, including changes in the market.

Based on this, the price of the recent transaction is deemed fair

value as at 30 June 2021. This investment is classified as Level 3

for the purpose of disclosure in the fair value hierarchy.

11 Trade and other receivables

30 June 31 December

2021 2020

Unaudited Audited

GBP'000 GBP'000

----------------------------------------------- ----------- ------------

Trade receivables 1,421 1,460

Less provision for impairment of trade

receivables (373) (379)

----------------------------------------------- ----------- ------------

Trade receivables - net 1,048 1,081

Receivables from related parties - 12

Corporation tax - 499

Other receivables 457 468

Loans to related parties 1,519 1,919

Less provision for impairment of loans

to related parties (628) (614)

Less amounts written off loans to related

parties - (1,069)

----------------------------------------------- ----------- ------------

Total financial assets other than cash

and cash equivalents classified at amortised

costs 2,396 2,296

Prepayments and accrued income 10,285 4,113

----------------------------------------------- ----------- ------------

Total trade and other receivables 12,681 6,409

----------------------------------------------- ----------- ------------

Less: non-current portion - Loans to

related parties (658) (220)

Less: non-current - Trade receivables (691) (586)

----------------------------------------------- ----------- ------------

Current portion 11,332 5,603

----------------------------------------------- ----------- ------------

30 June 30 June

2021 2020

Reconciliation of movement in trade Unaudited Unaudited