TIDMMAJE

RNS Number : 0640X

Majedie Investments PLC

18 December 2023

18 December 2023

Majedie Investments PLC

Annual Financial Report

Majedie Investments PLC ("Majedie" or "the Company") announces

its full year results for the 12 months ended 30 September

2023.

Highlights:

-- Successful transition to a new investment manager, Marylebone

Partners LLP, on 25 January 2023.

-- Adoption of a new benchmark, to achieve net annualised total

returns (in GBP) of at least 4% above the UK Consumer Prices Index

(CPI) over rolling five-year periods.

-- The new, long-term 'liquid endowment' strategy is designed to

deliver attractive real returns and comprises three primary

elements:

o Special Investments: eclectic opportunities with high return

potential, which include co-investments, thematic funds and special

purpose vehicles. Over time, these are expected to comprise at

least 20% of the portfolio;

o External Managers: specialist funds managed by some of the

world's leading fundamental investors, comprising 60% of the

portfolio at present;

o Direct Investments: a focused selection of publicly listed

equities selected by Marylebone Partners' in-house team, each

meeting stringent criteria regarding growth potential, business

profitability and quality.

-- Strong performance for the year, comprising a total

shareholder return (including dividends) of +26.2%.

-- The discount to Net Asset Value narrowed from -25.8% to -18.7% at the end of September.

-- New dividend policy adopted, which pays out c.0.75% of NAV

each quarter, making 3% of NAV per annum.

Christopher Getley, Chairman of Majedie Investments, said: "We

are pleased to have appointed Marylebone Partners as Majedie's

portfolio manager, and welcome the way in which they have

implemented the transition to the new liquid endowment model. The

new approach has been well received by existing shareholders and

brought new holders onto the register. This is an excellent

juncture at which to be deploying capital. Following a transition

from a multi-year regime that was characterised by low interest

rates, abundant liquidity and generally rising asset prices, the

Board expects the period ahead to be defined by structurally higher

rates, variable liquidity, more geopolitical and cyclical

volatility, and greater fundamental price dispersion within

markets. This is the sort of environment in which a highly

selective, fundamental approach that features distinctive bottom-up

investments should thrive."

Dan Higgins, CIO of Marylebone Partners and investment manager

at Majedie Investments, said: "We are excited about the prospect of

pursuing our distinctive approach for Majedie's shareholders,

especially when a recent transition of the market regime has

created so many opportunities for discriminating bottom-up

investors. Our ambition over the years ahead is to provide

Majedie's shareholders with a dynamic alternative, predominantly

invested in liquid underlying assets. Ultimately, a shareholder in

Majedie Investments PLC is buying into our people and our process.

We believe that more challenging conditions should only highlight

the merits of our approach as the fortunes of individual

enterprises, sectors, geographic regions, and asset classes

diverge.

For further information please contact:

Majedie Investments PLC

William Barlow +44 (0)7880 528774

--------------------

J.P. Morgan Cazenove

William Simmonds

Rupert Budge +44 (0)20 7742 4000

--------------------

TB Cardew (PR Adviser to Majedie Investments) +44 (0)20 7930 0777

Tania Wild +44 (0)7425 536903

Will Baldwin-Charles +44 (0)7834 524833

--------------------

About Majedie Investments :

Majedie Investments PLC is an investment trust whose objective

is to deliver long-term capital growth whilst preserving

shareholders' capital and paying a regular dividend. The

performance target is to achieve net annualised total returns (in

GBP) of at least 4 per cent. above the UK CPI, over rolling

five-year periods.

The Majedie Investments PLC portfolio features a combination of

hard-to-access special investments, allocations to funds managed by

boutique third-party managers, and direct investments in public

equities.

LEI: 2138007QEY9DYONC2723

About Marylebone Partners :

Marylebone Partners LLP is an independent investment manager,

owned by its principals. We help families, charities, endowments,

trusts and private investors to protect and grow their wealth in

real terms.

Our defining characteristic is an ability to access

differentiated fundamental investments, many of which never come

onto the radar screen of other allocators. We believe this

capability will be the key to delivering superior performance

outcomes over the years ahead.

Our partnership was founded in 2013 with the vision of bringing

a distinctive investment approach to clients who sought a

relationship based on trust and transparency. This remains our sole

purpose today. We invest our own capital alongside our clients.

Marylebone Partners LLP is authorised and regulated by the

Financial Conduct Authority.

ANNUAL FINANCIAL REPORT FOR THE YEARED 30 SEPTEMBER 2023

The Directors of Majedie Investments PLC are pleased to announce

the Annual Report and Accounts ("Annual Report") for the year ended

30 September 2023. The Annual Report can be obtained from the

Company's website at www.majedieinvestments.com or by contacting

the Company Secretary on telephone number 0131 378 0500.

Investment Objective

The Company's investment objective is to deliver long-term

capital growth whilst preserving shareholders' capital, and to pay

a regular dividend.

Performance Target

The performance target is to achieve net annualised total

returns (in GBP) of at least 4% above the UK Consumer Prices Index

over rolling five-year periods.

Financial Highlights

2023 2022

Total shareholder return (including dividends) * 26.2% -24.9%

Net asset value total return (debt at fair value including dividends) * 14.1% -18.2%

Net asset value total return (debt at par including dividends) * 14.2% -19.8%

Total dividends (per share): 5.4p 10.4p

*Alternative Performance Measures

Please refer to pages 88 and 89 of the Company's Annual

Report

YEAR'S SUMMARY

Note

Capital Structure (see below) 2023 2022 %

----------------------------------------------------- -------------- --------- --------- -------

As at 30 September

Total assets less current liabilities 1 GBP148.8m GBP137.6m 8.1

Which are attributable to:

Financial liabilities (debt at par value) 1 GBP20.7m GBP20.8m -

Equity Shareholders' Funds GBP128.1m GBP116.9m 9.6

------------------------------------------------------ ------------- --------- --------- -------

Gearing 1 9.2% 12.6% -

Potential Gearing 1 16.2% 17.8% -

------------------------------------------------------ ------------- --------- --------- -------

Total returns (capital growth plus dividends) ("TR")

Net asset value per share TR (debt at par value) 1 14.2% -19.8% -

Net asset value per share TR (debt at fair value) 1 14.1% -18.2% -

Share price TR 1 26.2% -24.9% -

------------------------------------------------------ ------------- --------- --------- -------

Capital returns

Net asset value per share (debt at par value) 241.7p 220.6p 9.6

Net asset value per share (debt at fair value) 241.6p 220.5p 9.6

Share price 196.5p 163.5p 20.2

------------------------------------------------------ ------------- --------- --------- -------

Discount of share price to net asset value per share

Debt at par value 1 18.7% 25.9% -

Debt at fair value 1 18.7% 25.8% -

------------------------------------------------------ ------------- --------- --------- -------

Revenue and dividends

Net revenue available to Equity Shareholders GBP0.9m GBP2.8m -67.9

Net revenue return per share 1.6p 5.2p -69.2

------------------------------------------------------ ------------- --------- --------- -------

Total dividends per share 2 5.4p 10.4p -48.1

------------------------------------------------------ ------------- --------- --------- -------

Total administrative expenses and management fees GBP3.4m GBP1.7m 100.0

Ongoing Charges Ratio 1,3 1.6% 1.3% -

Ongoing charges of underlying funds 0.4% - -

Ongoing Charges Ratio plus look through fund costs 2.0% 1.3% -

1. Alternative Performance Measures

Please refer to pages 88 and 89 of the Company's Annual Report

for definitions and a reconciliation of the Alternative Performance

Measures to the financial statements.

2. The 10.4p dividend in 2022 includes a 1.8p special dividend

paid on 27 January 2023. This dividend represented the first

quarterly payment to 31 December 2022 under the Company's new

dividend policy.

3. Excludes performance fee where payable.

Year's High/Low

2023 2022

--------------------------- ------ ------- -------

Share price high 223.0p 243.0p

low 158.0p 160.0p

Net asset value - debt at

par high 259.2p 297.1p

low 220.6p 220.7p

Discount - debt at par high 31.2% 28.7%

low 8.3% 14.9%

Discount - debt at fair

value high 30.8% 28.5%

low 8.0% 13.4%

Ten Year Record

to 30 September 2023

Total Share

Equity NAV Per Ongoing

share-holders' Share (Debt Potential Charges

Assets ++ Funds at par value) Price Discount Gearing Gearing Ratio(#)

Year Earnings Total Dividend**

End GBP000 GBP000 Pence Pence % Pence Pence % % %

------ ------------------- ------------------- ------------- ------- --------- ----------- ----------------------- -------- ------------ ---------

2014 167,934 134,061 256.7 229.0 10.79 9.36 7.50 23.39 25.27 1.66

2015 183,708 149,807 281.9 257.3 8.74 9.42 8.00 21.25 22.63 1.88

2016 203,917 169,986 318.1 257.1 19.18 9.25 8.75 18.46 19.96 1.58

2017 216,507 182,544 341.6 281.5 17.59 11.14 9.75 17.09 18.61 1.54

2018 199,151 178,626 334.3 277.5 16.99 12.47 11.00 10.01 11.49 1.33

2019 175,621 155,074 292.3 256.0 12.42 12.92 11.40 11.50 13.25 1.34

2020 152,153 131,333 247.7 176.5 28.74 9.11 11.40 10.97 15.85 1.34

2021 172,951 152,153 287.1 230.0 19.89 9.41 11.40 12.26 13.67 1.25

2022 137,647 116,887 220.6 163.5 25.80 5.20 10.40 12.65 17.80 1.34

2023 148,794 128,073 241.7 196.5 18.70 1.62 5.40 9.16 16.23 1.98

Notes:

++ Total Assets are defined as total assets less current

liabilities.

** Dividends disclosed represent dividends that relate to the

Company's financial year. Under UK adopted International Accounting

Standards dividends are not accrued until paid or approved. Total

dividends include special dividends paid, if any.

Calculated in accordance with AIC guidance.

# Excludes performance fee where payable and includes ongoing

charge ratio of underlying funds.

STRATEGIC REPORT

CHAIRMAN'S STATEMENT

During the year ended 30 September 2023 Majedie Investments has

successfully implemented the transition to a liquid endowment

investment policy* following its approval at the AGM in January

2023, principally through transferring responsibility for

management of the Company's assets to Marylebone Partners LLP

("Marylebone" or the "Investment Manager"). The Net Asset Value

(with debt at fair value) grew by 14.1% during the year and the

discount closed somewhat from 25.8% at the start of the financial

year to 18.7% at its close.

Investment conditions were challenging throughout the year as

global equity and bond markets were volatile as inflationary

expectations and political events created uncertainty for investors

and governments. A growing acceptance that interest rates are to

remain considerably higher for some time, together with a weaker

than expected economic recovery in China after its pandemic

restrictions were removed in January 2023, also put pressure on the

broader equity markets. Notably, the US equity market was one of

the best performers, once again driven by a very narrow selection

of technology stocks.

The background to market performance helps explain the decision

of your Board in late 2022 to appoint Marylebone as the Company's

portfolio manager. It also reinforces the central view that the

ending of a thirty year down trend of interest rates is likely to

lead to significant change in the sources of investment returns.

The Board focused on identifying an endowment style strategy that

would enable the Company to grow over time through strong

performance, developing the Company's culture and clear

differentiation that uses the benefits of the investment trust

structure. Whilst still in its very early days, the liquid

endowment portfolio has now been in place since February 2023, the

Board believes that the evidence to date vindicates its decision.

In addition to the distinctive and compelling investments that

feature in the portfolio, the Board notes that virtually all of its

underlying assets are priced frequently by an independent

source.

The investment approach includes three complementary strategies

comprising, at September 2023: External Managers (62%), Direct

Investments (20%) and Special Investments (9%). The remaining 9%

was in cash and UK gilts pending investment into additional Special

Investment opportunities. Whilst remaining equity-centric, the

drivers of the investments are fundamental, idiosyncratic and

generally not macro-predicated. The Board is confident that this

style of investing will stand the test of time and achieve the

clear targets set out by the Manager Review carried out in

2022.

Subsequent to the approval of the new investment policy by

shareholders, the Board has also transferred responsibilities under

the AIFMD to Marylebone. Further, the remaining administration

arrangements for Majedie that had been carried out internally have

now been outsourced to Juniper Partners Limited ("Juniper"). The

Board looks forward to developing both of these important new

relationships. These steps have however resulted in Majedie's

offices in Kings Arms Yard being vacated and I would like to take

this opportunity to record our thanks to the Majedie executive team

for their consistent and professional contribution throughout this

period despite the consequences to their own positions.

Of particular note through this year has been the development of

the shareholder base, which was one of the key aims of the Manager

Review. Approximately 25% of the shares in issue have changed hands

during the year and the Company remains fortunate in having a

supportive Barlow family shareholder group. The increased marketing

presence of the Company, well supported by the Marylebone team and

a refreshed website with explanatory short videos, has been helpful

in achieving this important step towards growth.

The Board has enjoyed a year of stability and I am grateful for

the commitment and wise counsel of my colleagues. Formal internal

Board reviews are carried out annually in October. The principal

areas for further focus in 2022 involved concluding and effectively

implementing the Manager Review conclusions and increasing the

demand for the Company's shares. In 2023 the Board has identified

targets relating to the development and monitoring of the

relationships with Marylebone and Juniper, planning for Board

member succession and building on the progress made on expanding

the shareholder base.

The Company's policy on dividends also changed following the

introduction of the new investment policy. Quarterly dividends of

approximately 0.75% of the NAV have been declared, albeit that in

this transition year the first quarterly payment to December 2022

was paid in January 2023 as a Special Dividend of 1.8p accrued in

the prior year. Going forward the Board hopes that the clarity of

quarterly dividend payments, equating to approximately 3% of NAV

over the year, is helpful to shareholders.

It is a core function of an investment trust Board to bear down

on costs where possible. The Board notes that investments through

External Managers as a significant part of the portfolio has

increased the cost measured by the Ongoing Charges Ratio ("OCR")

from 1.3% in 2022 to 2.0% in September 2023. The skills in

specialist areas that require substantial original research work

inevitably come with additional cost. However, in terms of true

active management of a liquid endowment style strategy the Board

understands this requirement whilst also noting that the costs

associated with the External Managers is expected to fall over time

as the exposure to Special Investments grows, as they typically

have low additional management fees. The remaining underlying costs

are made up of core management, administrative and transaction

costs; as all activities are now outsourced the Board expects that

these costs will also fall in 2024. Overall the OCR is expected to

fall in 2024.

In terms of investment outlook, Marylebone believes that this is

an excellent juncture at which to be deploying capital. Following a

transition from a multi-year regime that was characterised by low

interest rates, abundant liquidity and generally rising asset

prices, the Board expects the period ahead to be defined by

structurally higher rates, variable liquidity, more geopolitical

and cyclical volatility, and greater fundamental price dispersion

within markets. This is precisely the sort of environment in which

a highly selective, fundamental approach that features distinctive

bottom-up investments should thrive. Marylebone is confident that

current and future Special Investments are capable of achieving

their ambitious return targets for this component of the portfolio.

With respect to External Managers, those with an equity-centric

profile should be capable of annualised returns that are

substantially better than broad markets, whilst providing

shareholders with positions and style diversification away from the

indices. In addition, the External Manager allocation features a

significant exposure to leading practitioners in the specialist

credit strategies arena, an area of true differentiation for

Marylebone who see the best risk-adjusted return opportunity here

for many years. Finally, the Direct Investments component of the

new portfolio features an eclectic mix of positions that have been

researched and identified by Marylebone's inhouse team. These

provide not only return potential in the low-teens over a

multi-year period but also benefit the portfolio in terms of its

overall liquidity.

The Board was very pleased that the 2022 Annual General Meeting

could be held in person as it enabled a welcome opportunity to meet

again and learn directly from our shareholders. This year's AGM

will be held at Pewterers' Hall, Oat Lane, London EC2V 7DE at

12.00pm on Wednesday 17th January 2024. The Investment Manager will

present the details of the portfolio, its strategy and outlook. My

colleagues and I look forward to welcoming shareholders to that

meeting. Following the AGM the Investment Manager's presentation

will be available on the Company's website for those who cannot

attend.

In the meantime, I thank you for both trusting and supporting

Majedie Investments.

Christopher D Getley

Chairman

15 December 2023

* Please refer to page 6 of the Investment Manager's Report in

the Company's Annual Report

Please refer to note 20 on page 74 of the Company's Annual

Report for more information.

INVESTMENT MANAGER'S REPORT

Strategy

Marylebone Partners' appointment as the investment manager of

Majedie Investments PLC ("Majedie") marked a significant milestone.

We are excited about the prospect of pursuing our distinctive

approach for Majedie's shareholders, especially when the recent

transition of the market regime has created so many opportunities

for discriminating bottom-up investors. We welcome Majedie's

shareholders to our Partnership, by virtue of the membership stake

granted to the Company in a demonstration of our alignment. Given

the importance of this mandate to our business, it is only right

that Majedie's shareholders should participate in our future

success.

What exactly do we mean when we refer to the 'liquid endowment'

model we deploy for Majedie? The 'endowment' element evokes a truly

long-term investment mentality that is behind the success of the

elite university endowments (mostly based in the United States).

These institutions have harnessed differentiated - and sometimes

alternative - return sources, eschewing market timing or tactical

trading in favour of active fundamental strategies designed to

compound wealth at an attractive rate, after the potential effects

of inflation.

We aim to replicate this success for Majedie's shareholders by

identifying and assessing compelling, long-term investment

opportunities, few of which ever come onto the radars of our

industry peers. Unlike many university endowments, however, we

refrain from allocating to deeply illiquid and hard-to-price asset

classes such as private equity, venture capital, real estate, or

infrastructure. Our proficiency lies in more liquid markets, and we

do not believe it is necessary to lock up capital for extended

periods to generate attractive total returns.

Our ambition over the years ahead is to provide Majedie's

shareholders with an alternative to generic investment offerings or

strategies whose historic success depended on cheap leverage,

abundant liquidity, and rising asset prices. Ultimately, a

shareholder in Majedie is buying into our people and our process.

We believe that more challenging conditions should only highlight

the merits of our approach as the fortunes of individual

enterprises, sectors, geographic regions, and asset classes

diverge.

The Company delivered strong returns over the financial year,

investment performance between February 2023 (when we assumed

investment management responsibility) and the financial year-end

was effectively flat as contributions at the position level offset

one another. We implemented the transition towards the new

portfolio in a swift and cost-effective manner, with legacy

positions exited and holdings in place by the end of March. As part

of this exercise, we have substantially sold down the strategic

holding in Liontrust PLC and it is now below 0.5%.

The portfolio

The portfolio is eclectic and focused. It features

high-conviction investments of differing profiles and with varying

underlying return drivers. Although of course there can be no

guarantee of success, we believe that Majedie's most conservative

investments can achieve target returns over the next few years,

while some of its more ambitious positions have the potential to

deliver much stronger outcomes. It was simply not possible to

achieve portfolio balance, whilst striving for returns of this

magnitude, in the latter stages of the pre-COVID era.

The portfolio comprises three primary elements:

1. Special Investments. We identify co-investments, Special

Purpose Vehicles, and thematic opportunities, through a proprietary

ideas network built over nearly three decades. To earn a place in

the Majedie portfolio, a Special Investment must originate from a

trusted source, and have the potential to deliver annualised

returns of at least 20% over a time horizon of typically 2-3 years.

As an important aside, our investments are all marked-to-market at

least quarterly. So Majedie's shareholders should be confident that

the stated Net Asset Value is representative.

It will take time for us to build the portfolio's exposure to

Special Investments to its initial target of 20% (by definition,

these opportunities are situation specific and the bar for

inclusion is extremely high). Nevertheless, we had already made

five allocations by the Company's financial year-end, plus another

three on 1st October. These include targeted activist co --

investments in public equities, a thematic investment in the listed

Uranium sector, a unique factoring strategy and two

stressed/distressed credit co-investments. We have a strong

pipeline of new ideas.

2. External Managers. We have selected a total of 14 funds

managed by third-party managers, each of whom specialises in a

niche sector or geographic region that is structurally inefficient

and therefore offers potential for skill-based returns ('alpha').

These managers work within owner-operated boutiques that are

largely unknown to/inaccessible by most allocators. In keeping with

Majedie's longstanding philosophy, nine of the managers we have

selected pursue equity-centric strategies. Their role is to add

value through stock-picking in areas as diverse as midcap

biotechnology, value-style activism, Scandinavian equities,

software, Greater China, and Continental European value stocks. To

supplement nine managers with an equity-centric profile, we have

identified five leading managers who seek to deliver

less-correlated absolute returns, mostly though specialist credit

strategies. We believe the stressed/ distressed credit markets

offer extremely attractive risk-to-reward characteristics at the

present time.

At 62% of the total, the portfolio's initial allocation to

external managers is higher than one should expect over the medium

term. The weighting to this category should naturally decrease over

time, as we identify more Special Investments. In turn, this should

help to reduce look-through costs, although our primary concern is

always to maximise the net returns to shareholders whilst achieving

portfolio balance. In the meantime, we feel confident about the

performance potential of this group and believe they represent a

very attractive and differentiated combination of active

managers.

3. Direct Investments. Our in-house team has carefully selected

15 public equities, listed in the developed markets, each of which

meets our stringent criteria regarding growth potential, business

profitability and quality. Valuation also plays an important part

of our decision-making process; this sub-portfolio of eclectic,

factor-diverse and catalyst-rich stocks currently trades on quite

reasonable multiples of earnings and cash flow.

Its largest weightings are to the Industrials, Consumer,

Services and Healthcare sectors. By geography, the sub portfolio is

well spread across companies listed in the United States, Europe,

and our un-loved home market, the U.K. Reflecting much higher

valuation differentials, there is a mid-cap bias to our portfolio

and no exposure to the handful of mega-cap technology stocks that

are so heavily represented in the major indices.

Largest Five Holdings in each strategy at 30 September 2023

Largest Special Investment Holdings

Position Name Underlying Profile Asset Class % of

Total

Assets

---------------------- -------------------- ---------------- --------

Project Uranium Cameco Corporation Thematic Public Equity 1.8%

---------------------- -------------------- ---------------- --------

Project Bungalow Shake Shack Inc. Co-invest Public Equity 1.6%

---------------------- -------------------- ---------------- --------

Project Sherpa V.F. Corporation Co-invest Public Equity 1.6%

---------------------- -------------------- ---------------- --------

Metro Bank Snr Corporate

Project Challenger Non Pref Co-invest Debt 1.4%

---------------------- -------------------- ---------------- --------

Marblegate Overflow

Project Retain II Thematic Factoring 1.1%

---------------------- -------------------- ---------------- --------

Largest External Managers Holdings

Position Name Strategy Profile Region % of

Total

Assets

---------------------- -------------------- ---------------- --------

Silver Point

Capital Offshore Absolute (Specialist

Fund Credit) Distressed/Event DM Global 6.3%

---------------------- -------------------- ---------------- --------

Helikon Long

Short Equity

Fund Equity-centric Special Situations Europe 6.0%

---------------------- -------------------- ---------------- --------

Millstreet Credit Absolute (Specialist

Fund Credit) High Yield North America 6.0%

---------------------- -------------------- ---------------- --------

Contrarian Emerging Absolute (Specialist Emerging

Markets Credit) Distressed/Event Markets 5.3%

---------------------- -------------------- ---------------- --------

Eicos Fund S.A. Absolute (Specialist

SICAV-RAIF Credit) High Yield Europe 4.2%

---------------------- -------------------- ---------------- --------

Largest Direct Investments Holdings

Position Name Strategy GICS Sector Region % of

Total

Assets

---------------------- -------------------- ---------------- --------

KBR Inc Equity-centric IT Consulting United States 2.0%

---------------------- -------------------- ---------------- --------

Weir Group PLC Equity-centric Engineering United Kingdom 1.8%

---------------------- -------------------- ---------------- --------

UnitedHealth

Group Inc Equity-centric Healthcare United States 1.7%

---------------------- -------------------- ---------------- --------

Westinghouse

Air Brake Technologies Construction

Corp Equity-centric Machinery United States 1.7%

---------------------- -------------------- ---------------- --------

Sage Group plc Equity-centric Technology United Kingdom 1.5%

---------------------- -------------------- ---------------- --------

As we await entry points in certain investments, we have

maintained liquidity to take advantage of currently high short-term

interest rates by purchasing short-dated gilts.

To follow the progress of the portfolio and our approach, we

encourage you to visit the refreshed Majedie website where we post

video clips with examples along with a quarterly Portfolio Manager

commentary. We intend to be very transparent with shareholders.

Outlook

Markets have largely completed a transition to a new regime that

will be characterised by higher interest rates, variable liquidity,

and more geopolitical and cyclical volatility. Many of the

tailwinds upon which the fortunes of conventional investment

strategies rode have turned into headwinds. Against a backdrop that

is likely to be more challenging, an investor's ability to identify

- and capitalise upon - idiosyncratic, bottom-up situations will be

critical to success. The portfolio represents a distinctive mix of

fundamental bottom-up ideas with low cross-correlation to one

another. This results in a proposition that should not only be

capable of achieving inflation-beating returns over the medium-term

but also act as a complementary investment for shareholders.

The global economic outlook is uncertain and is likely to remain

so. When framing our decisions, we do not dismiss the possibility

of a recession over the next 12-24 months. We can identify numerous

possible threats to the equilibrium of markets, which include a

sharper-than-expected economic slowdown, geopolitical instability,

a possible resurgence of inflation (which would most likely be

caused by rising commodity prices), or some other extraneous

variable. The 'equity risk premium' is low by historic standards,

i.e. the projected earnings yield on equities is very close to the

yield on long-dated government bonds, which suggests that stocks

are expensive at an aggregate level.

Hence, at an asset class level, we are not especially bullish.

However, we also believe it is a mistake to generalise, especially

at a time of widening dispersion at an individual-security

level.

There is no shortage of attractive bottom-up situations that

meet our selection criteria, especially when one hunts for them in

areas that are off the beaten track. Selectivity, and an ability to

identify differentiated fundamental return sources, will be the key

to unlocking good investment outcomes over the years ahead.

Portfolio as at 30 September 2023

Market Value % of Total

(GBP000) Assets

less Current

Liabilities

Direct Investments

KBR Inc 3,016 2.0%

------------------------ --------------

Weir Group PLC 2,615 1.8%

------------------------ --------------

UnitedHealth Group Inc 2,588 1.7%

------------------------ --------------

Westinghouse Air Brake Technologies Corp 2,533 1.7%

------------------------ --------------

Sage Group plc 2,210 1.5%

------------------------ --------------

Heineken NV 2,153 1.5%

------------------------ --------------

Computacenter plc 2,112 1.4%

------------------------ --------------

Pernod Ricard SA 1,969 1.3%

------------------------ --------------

Alight Inc 1,917 1.3%

------------------------ --------------

Howmet Aerospace Inc 1,907 1.3%

------------------------ --------------

Thermo Fisher Scientific Inc 1,846 1.2%

------------------------ --------------

Breedon Group PLC 1,541 1.0%

------------------------ --------------

Other Direct Investments 3,549 2.4%

------------------------ --------------

29,956 20.1%

------------------------ --------------

External Managers

Silver Point Capital Offshore Fund, Ltd 9,447 6.3%

------------------------ --------------

Helikon Long Short Equity Fund ICAV 8,911 6.0%

------------------------ --------------

Millstreet Credit Offshore Fund, Ltd 8,896 6.0%

------------------------ --------------

Contrarian Emerging Markets Offshore Fund,

Ltd 7,971 5.3%

------------------------ --------------

Eicos Fund S.A. SICAV-RAIF 6,319 4.2%

------------------------ --------------

Praesidium Strategic Software Opportunities

Offshore Fund, LP 6,229 4.2%

------------------------ --------------

Keel Capital S.A., SICAV-SIF - Longhorn

Fund 6,204 4.2%

------------------------ --------------

Perseverance DXF Value Feeder Fund, Ltd. 6,140 4.1%

------------------------ --------------

KL Event Driven UCITS Fund 6,067 4.1%

------------------------ --------------

CastleKnight Offshore Fund Ltd 6,010 4.0%

------------------------ --------------

Paradigm BioCapital Partners Fund Ltd 5,909 4.0%

------------------------ --------------

Energy Dynamics Fund Ltd 5,447 3.7%

------------------------ --------------

Andurand Climate and Energy Transition Fund 4,112 2.8%

------------------------ --------------

Engaged Capital Flagship Fund, Ltd 2,797 1.9%

------------------------ --------------

Other External Managers 1,152 0.8%

------------------------ --------------

91,611 61.6%

------------------------ --------------

Special Investments

Project Uranium 2,647 1.8%

------------------------ --------------

Project Bungalow 2,424 1.6%

------------------------ --------------

Project Sherpa 2,297 1.6%

------------------------ --------------

Project Challenger 2,109 1.4%

------------------------ --------------

Project Retain 1,696 1.1%

------------------------ --------------

Project Diameter 1,651 1.1%

------------------------ --------------

Other Special Investments 263 0.2%

------------------------ --------------

13,087 8.8%

------------------------ --------------

Fixed Interest

United Kingdom Gilt 0.125 31/01/2024 4,325 2.9%

------------------------ --------------

Other Investments 700 0.5%

------------------------ --------------

Total Investments 139,679 93.9%

------------------------ --------------

Cash and Cash Equivalents 5,441 3.6%

------------------------ --------------

Net Current Assets 3,674 2.5%

------------------------ --------------

Total Assets less Current Liabilities 148,794 100.0%

------------------------ --------------

Dan Higgins

Marylebone Partners LLP

15 December 2023

ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on Wednesday

17 January 2024 at Pewterers' Hall, Oat Lane, London EC2V 7DE at 12

noon.

FURTHER INFORMATION

The Annual Report and Accounts for the year ended 30 September

2023 can be obtained from the Company's website at

www.majedieinvestments.com .

A copy of the Annual Report and Accounts will be submitted

shortly to the National Storage Mechanism ("NSM") and will be

available for inspection at the NSM, which is situated at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism , in

accordance with DTR 6.3.5(1A) of the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

END

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on this announcement (or

any other website) is incorporated into, or forms part of, this

announcement.

LEI: 2138007QEY9DYON C2723

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSEAFAXFDKDFFA

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

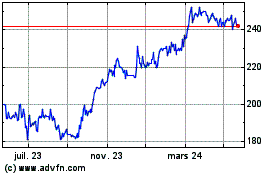

Majedie Investments (LSE:MAJE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

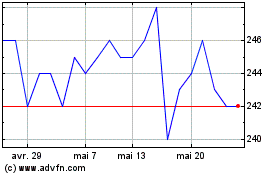

Majedie Investments (LSE:MAJE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025