TIDMMTL

RNS Number : 7458N

Metals Exploration PLC

27 September 2023

METALS EXPLORATION PLC

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Metals Exploration plc (AIM: MTL) ("Metals Exploration", the

"Company" or, together with its subsidiaries the "Group"), a

Philippine gold producer, announces record interim results for the

six months ended 30 June 2023. The results will be made available

on the Company's website at www.metalsexploration.com .

Highlights

-- Record half-year operating profit of US$31.1 million achieved

(H1 2022: US$9.4 million) - up 231%;

-- Record half-year gold production of 45,533 ounces (H1 2022: 31,348 ounces) - up 45%;

-- Record half-year gold recoveries of 89.8% (H1 2022: 87.7%) - up 2.4%;

-- Record half-year positive cashflow from operations of US$39.8

million (H1 2022: US$17.0 million) - up 134%;

-- Net Debt as at 30 June 2023 US$48.8 million (H1 2022: US$92.9 million);

-- Debt repayments during H1 2023 of US$35.0 million (H1 2022: US$17.0 million);

-- Over 20 million man-hours since the last reported lost-time injury;

-- FY2023 full year production forecast of between 78,000 and

81,000 ounces of gold, with AISC forecast to be between US$1,120

and US$1,200 per ounce.

Production Summary

Runruno Project

---------- ---------- -------------

Production Summary Actual Actual Actual

---------- ---------- -------------

6 Months 6 Months 12 Months

to to to

30 June 30 June 31 December

Units 2023 2022 2022

------------------------- --------- ----------

Mining

--------- ---------- -------------

Ore Mined Tonnes 848,023 1,289,123 2,292,439

---------- ---------- -------------

Waste Mined Tonnes 5,385,929 5,676,856 11,422,847

---------- ---------- -------------

Total Mined Tonnes 6,233,952 6,965,979 13,715,286

---------- ---------- -------------

Au Grade Mined g/tonne 1.59 1.10 1.31

---------- ---------- -------------

Strip Ratio 6.08 4.28 4.89

---------- -------------

Processing

--------- ---------- -------------

Ore Milled Tonnes 1,068,391 1,017,258 2,068,031

---------- ---------- -------------

Gold (Au) Grade g/tonne 1.48 1.09 1.27

---------- ---------- -------------

Sulphur Grade % 1.41 0.98 1.36

---------- ---------- -------------

Au Milled (contained) ounces 50,701 35,742 84,677

---------- ---------- -------------

Recovery % 89.8 87.7 85.7

---------- ---------- -------------

Au Poured ounces 45,533 31,348 72,537

---------- ---------- -------------

Sales

--------- ---------- -------------

Au Sold ounces 46,186 30,676 69,249

---------- ---------- -------------

Au Price US$/oz 1,939 1,878 1,797

---------- ---------- -------------

Review of Operations

During H1 2023 the Group enjoyed a sustained stable mine and

process operations. Higher grade ore from Stage 3 of the mine plan

was accessed and processed, which combined with record recoveries

and consistently high prices led to a record operating profit of

US$31.1 million, up 231% on H1 2022.

Safety and health

The outstanding safety record of the operation continues with in

excess of 20 million man-hours with no lost time incidents

occurring since the last lost time incident in December 2016. This

is something we are incredibly proud of and all employees and

contractors are to be congratulated on this ongoing

achievement.

Finance

A higher head grade of 1.48g/t for H1 2023 (H1 2022: 1.09g/t)

contributed to the record gold production and sales revenue. Gold

sales were US$89.6 million (H1 2022 US$57.6 million). Operations

resulted in positive free cash flow of US$39.8 million (H1 2022:

US$17.0 million).

As at H1 2023 end, the Group's net debt was US$48.8 million (H1

2022: US$92.9 million). Total debt repayments made during H1 2023

were US$35.0 million (H1 2022: US$17.0 million). Details of these

debt facilities can be found in Note 6.

Mining

Mining production of ore and waste was slightly down at 6.2 Mt

for H1 2023 (H1 2022: 7.0Mt) due to diverting dump trucks to assist

with the Residual Storage Impoundment ("RSI") final spillway

earthworks which commenced in Q1 2023. Total ore mined was lower at

0.8Mt (H1 2022: 1.3Mt), however the grade mined was up at 1.59g/t

(H1 2022: 1.10g/t).

An exploration drill programme in Stages 4 and 5 commenced in Q1

2023, with the objective of identifying new gold resources both in

and near-to the current pit-shell design. To date, this drilling

has not produced any material gold discoveries. The final holes in

this drill programme should be completed in early Q4 2023.

Process plant

Stable operations were delivered during H1 2023, leading to

record gold production of 45,533 ounces (H1 2022: 30,676 ounces).

Throughput for H1 2023 of 1.07Mt (H1 2022: 1.02Mt) was on budget,

while unfettered access to mine plan Stage 3 and 4 provided an

increased head grade of 1.48g/t (H1 2022: 1.09g/t).

Efforts to bring BIOX performance up to design continue, however

ongoing issues with controlling the temperature in the BIOX tanks

continue. Notwithstanding this a higher record overall gold

recovery rate of 89.8% was achieved (H1 2022: 87.7%).

Unplanned process plant downtime during H1 2023 was caused in

the main by tails line failures and conveyor belt and return water

line repairs.

Residual Storage Impoundment

The RSI is operating to design with an excellent environmental

performance record. Construction of the final Stage 6 RSI lift was

completed in H1 2023 and the d am water freeboard remained well

within design limits.

Earthworks for the construction of the RSI final in-rock

spillway are well advanced and the day-to-day performance of the

RSI is continuously monitored by an independent international

consulting group.

Community & Government Relations

Productive relations with both the community and the Philippine

government continue. In conjunction with relevant government

agencies, the Company has largely completed the removal of illegal

miners, including their infrastructure and dwellings, from mine

plan Stages 4 and 5.

Corporate

In June 2023, the Company issued 7,147,850 new ordinary shares

at an issue price of GBP0.01679 (US$0.02032) to certain members of

senior management in lieu of a GBP120,012 (US$145,215) cash

bonus.

Darren Bowden, CEO of Metals Exploration, commented :

"We are delighted with the Group's performance in the first half

of 2023 which has seen significant operational improvements and

record performances at Runruno, also enabling us to continue to

reduce our debt substantially. We are also very proud of our

ongoing outstanding safety record as this is something that is at

the forefront of everything we do and is an incredible achievement

by all our employees and contractors.

The Company is well set for the remainder of the year as we look

to continue to deliver strong performances at Runruno across all

our key metrics and hit our target guidance for production and AISC

for FY2023."

For further information please visit or contact

www.metalsexploration.com

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial Adviser: STRAND HANSON LIMITED

-------------------------

James Spinney, James Dance,

Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & Broker: HANNAM & PARTNERS

-------------------------

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes +44 (0) 207 920 3150

-------------------------

CONDENSED CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

for the six months ended 30 June 2023

Notes 6 month period ended 6 month period ended Year ended

30 June 2023 30 June 2022 31 December 2022

(unaudited) (unaudited) (audited)

US$ US$ US$

Continuing Operations

Revenue 89,551,687 57,621,936 124,410,991

Cost of sales (53,677,981) (42,493,529) (91,667,471)

---------------------- ----------------------- -----------------------

Gross profit 35,873,706 15,128,407 32,743,520

Administrative expenses (4,758,815) (5,724,198) (8,924,926)

---------------------- ----------------------- -----------------------

Operating profit 31,114,891 9,404,209 23,818,594

---------------------- ----------------------- -----------------------

Impairment

reversal/(loss) 5 8,846,685 (670,677) (1,202,397)

Net finance and other

costs (2,930,501) (7,271,289) (13,765,824)

Loss on fair value

changes to derivatives (57,800) (526,495) (4,883)

Share based payment

expense (21,814) (75,698) (102,001)

Share of (loss)/ profit

of associates 3,021 (2,729) (76,854)

Profit before tax 36,954,482 857,321 8,666,635

Tax expense 4,141 (75,255) 87,321

---------------------- ----------------------- -----------------------

Profit for the period

attributable to equity

holders of the parent 36,958,623 782,066 8,753,956

====================== ======================= =======================

Other comprehensive

income :

Items that may be

re-classified

subsequently

to profit or loss:

Exchange differences on

translating foreign

operations (660,052) 40,020 (247,475)

Items that will not be

re-classified

subsequently

to profit or loss:

Re-measurement of pension

liabilities - - (634,652)

---------------------- ----------------------- -----------------------

Total comprehensive

profit for the period

attributable to equity

holders of the parent 36,298,571 822,086 7,871,829

====================== ======================= =======================

Earnings per share:

Basic cents per share 4 1.77 0.04 0.42

Diluted cents per share 4 1.75 0.04 0.42

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

as at 30 June 2023

Notes 30 June 2023 30 June 2022 (Unaudited) 31 December 2022

(Unaudited) (Audited)

US$ US$ US$

Non-current assets

Property, plant and

equipment 5 84,395,285 88,810,504 81,459,218

Other intangible assets 467,179 49,743 33,049

Investment in associate

companies 108,432 179,536 105,411

Trade and other

receivables 12,616,843 5,572,524 8,796,133

97,587,739 94,612,307 90,393,811

------------------------ ------------------------- ------------------------

Current assets

Inventories 19,471,994 22,136,388 21,215,487

Trade and other

receivables 7,640,051 6,890,283 8,135,100

Cash and cash

equivalents 490,207 288,439 861,069

27,602,252 29,315,110 30,211,656

------------------------ ------------------------- ------------------------

Non-current liabilities

Loans 6 - (74,146,474) (51,983,413)

Trade and other payables (1,247,303) - (1,314,556)

Retirement benefits

obligations (2,463,112) (1,871,640) (2,463,112)

Deferred tax liabilities (574,038) (880,935) (574,038)

Provision for mine

rehabilitation (3,781,339) (4,031,740) (3,764,708)

(8,065,792) (80,930,789) (60,099,827)

------------------------ ------------------------- ------------------------

Current liabilities

Trade and other payables (13,210,650) (12,791,908) (12,431,948)

Loans - current portion 6 (49,301,270) (18,711,883) (30,001,208)

Derivative liabilities (382,920) (805,124) (308,725)

(62,894,840) (32,308,915) (42,741,881)

------------------------ ------------------------- ------------------------

Net assets 54,229,359 10,687,713 17,763,759

======================== ========================= ========================

Equity

Share capital 7 282,503 27,952,353 281,638

Share premium account 7 144,350 196,118,890 -

Acquisition of

non-controlling

interest reserve (5,107,515) (5,107,515) (5,107,515)

Translation reserve 13,760,949 14,708,496 14,421,001

Re-measurement reserve (472,649) 162,003 (472,649)

Other reserves 1,661,734 1,613,617 1,639,920

Profit and loss account 43,959,987 (224,760,131) 7,001,364

------------------------ ------------------------- ------------------------

Equity attributable to

equity holders of the

parent 54,229,359 10,687,713 17,763,759

======================== ========================= ========================

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2023

Acquisition of

Share non-controlling Profit and

Share premium interest Translation Re-measurement Other loss Total

capital account reserve reserve reserve reserve account equity

US$ US$ US$ US$ US$ US$ US$ US$

------------ ------------ ---------------- ------------ --------------- ------------ ----------- ------------

Balance at 1 January

2023 281,638 - (5,107,515) 14,421,001 (472,649) 1,639,920 7,001,364 17,763,759

Exchange differences

on translating

foreign operations - - - (660,052) - - - (660,052)

Profit for the

period - - - - - - 36,958,623 36,958,623

Total comprehensive

(loss)/profit for

the period - - - (660,052) - - 36,958,623 36,298,571

Share based payment - - - - - 21,814 - 21,814

Equity issue 865 144,350 - - - - - 145,215

Balance at 30 June

2023 282,503 144,350 (5,107,515) 13,760,949 (472,649) 1,661,734 43,959,987 54,229,359

-------- -------- ------------ ----------- ---------- ---------- ----------- -----------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities and share-based

payments expense.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2022

Acquisition of

Share non-controlling Profit and

Share premium interest Translation Re-measurement Other loss Total

capital account reserve reserve reserve reserve account equity

US$ US$ US$ US$ US$ US$ US$ US$

------------ ------------ ---------------- ------------ --------------- ------------ ----------- ------------

Balance at 1

January 2022 27,950,217 195,855,125 (5,107,515) 14,668,476 162,003 1,537,919 (225,542,197) 9,524,028

Exchange

differences

on

translating

foreign

operations - - - 40,020 - - - 40,020

Profit for the

period - - - - - - 782,066 782,066

Total

comprehensive

(loss)/profit

for the

period - - - 40,020 - - 782,066 822,086

Share based

payment - - - - - 75,698 - 75,698

Equity issue 2,136 263,765 - - - - - 265,901

Balance at 30

June 2022 27,952,353 196,118,890 (5,107,515) 14,708,496 162,003 1,613,617 (224,760,131) 10,687,713

----------- ------------ ------------ ----------- -------- ---------- -------------- -----------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities and share-based

payments expense.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the year ended 31 December 2022

Acquisition of

non-controlling

Share Share premium interest Translation Re-measurement Other Profit and Total

capital account reserve reserve reserve reserve loss account equity

US$ US$ US$ US$ US$ US$ US$ US$

------------- -------------- ---------------- ------------ --------------- ---------- -------------- -----------

Balance at 1

January 2022 27,950,217 195,855,125 (5,107,515) 14,668,476 162,003 1,537,919 (225,542,197) 9,524,028

Exchange

differences

on

translating

foreign

operations - - - (247,475) - - - (247,475)

Change in

pension

liability - - - - (634,652) - - (634,652)

Profit for the

year - - - - - - 8,753,956 8,753,956

Total

comprehensive

profit/(loss)

for the

period - - - (247,475) (634,652) - 8,753,956 7,871,829

Share based

payments - - - - - 102,001 - 102,001

Share issue 2,136 263,765 - - - - - 265,901

Capital

reduction (27,670,715) (196,118,890) - - - - 223,789,605 -

Balance at 31

December 2022 281,638 - (5,107,515) 14,421,001 (472,649) 1,639,920 7,001,364 17,763,759

------------- -------------- ---------------- ------------ --------------- ---------- -------------- -----------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities and share-based

payments expense.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENT for the six

months ended 30 June 2023

6 month period ended 6 month period ended Year ended

30 June 2023 (unaudited) 30 June 2022 (unaudited) 31 December 2022

(audited)

US$ US$ US$

Net cash arising from

operating activities 39,838,746 17,037,683 38,189,947

-------------------------- -------------------------- --------------------------

Investing activities

Exploration expenses (449,477) -

incurred -

Purchase of property, plant

and equipment (4,687,652) (3,991,767) (8,227,773)

Net cash used in investing

activities (5,137,129) (3,991,767) (8,227,773)

-------------------------- -------------------------- --------------------------

Financing activities

Repayment of borrowings -

principal (32,855,626) (16,477,173)* (31,998,689)

Repayment of borrowings -

interest (2,194,374) (522,827)* (1,824,311)

Net cash used in financing

activities (35,050,000) (17,000,000) (33,823,000)

-------------------------- -------------------------- --------------------------

Net(decrease)/increase in

cash and cash equivalents (348,383) (3,954,084) (3,860,826)

Cash and cash equivalents

at beginning of period 861,069 4,736,970 4,736,970

Foreign exchange difference (22,479) (494,447) (15,075)

Cash and cash equivalents

at end of period 490,207 288,439 861,069

========================== ========================== ==========================

* Restated 30 June 2022 repayment of borrowings with a value of

US$17 million into its principal and interest elements to align

with disclosures in the 2022 full year financial statements.

Notes to the condensed consolidated interim financial

statements

1. General information

These condensed consolidated interim financial statements of

Metals Exploration and its subsidiaries (the "Group") were approved

by the Board of Directors on 26 September 2023. Metals Exploration

is the parent company of the Group. Its shares are quoted on AIM

market of the London Stock Exchange plc. The registered address of

Metals Exploration plc is 38 - 43 Lincoln's Inn Fields, London,

WC2A 3PE.

The condensed consolidated interim financial statements for the

period 1 January 2023 to 30 June 2023 are unaudited. The group has

chosen not to adopt IAS 34 "Interim Financial Statements" in

preparing the interim financial information. The condensed

consolidated interim financial statements incorporate unaudited

comparative figures for the interim period fro m 1 January 2022 to

30 June 2022 and the audited financial year ended 31 December

2022.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory accounts for the year

ended 31 December 2022, which were prepared under UK-adopted

international financial accounting standards, were filed with the

Registrar of Companies. The auditors reported on these accounts and

their report was unqualified and did not contain a statement under

either Section 498 (2) or Section 498 (3) of the Companies Act

2006.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with UK-adopted

international accounting standards. The financial information has

been prepared based on UK-adopted international accounting

standards that the Board of Directors expect to be applicable as at

31 December 2023.

These condensed consolidated interim financial statements have

been prepared under the historical cost convention, except for

derivative financial instruments, which are measured at fair value,

and in accordance with UK-adopted international accounting

standards . There have been no changes in accounting policies as

described in the 2022 annual financial statements.

3. Going concern

These condensed consolidated interim financial statements of the

Group have been prepared on a going concern basis, which

contemplates the continuity of business activities, the realisation

of assets and the settlement of liabilities in the normal course of

business.

Although as at 30 June 2023, the Group's current liabilities

continue to exceed its current assets, primarily due to the

estimated external borrowings the Group expects to repay within the

next 12 months, there is no obligation to adhere to a set loan

principal or interest repayment schedule.

The Group is not subject to any set principal or interest

repayment schedule. Excess free cashflow is required to be paid to

lenders on a minimum quarterly basis only when net working capital

is in excess of US$5million. In addition, the Group is not in

default if it is unable to make a quarterly payment to the lenders,

but would continue to be obliged to pay out the excess free cash

flow as soon as possible. As a result of these debt repayment

arrangements, including the ongoing existence of a US$5million

positive net working capital balance, together with the sustained

positive cash flows being produced by the Runruno Project, the

Directors believe there is no material uncertainty over the Group's

going concern.

The Group and its ability to operate as a going concern and to

meet its commitments as and when they fall due is dependent upon

the ability of the Group to operate the Runruno Project

successfully so as to generate sufficient cash flows to enable the

Group to settle its liabilities as they fall due.

T he Board of Directors believes that the Runruno Project will

continue to operate successfully and produce positive cash flows

for at least 12 months from the date of this interim report, being

26 September 2023. As a result, the Board of Directors considers it

appropriate that the half-year financial information should be

prepared on a going concern basis.

4. Earnings per share

The earnings per share was calculated on the basis of net

profit/(loss) attributable to equity shareholders divided by the

weighted average number of ordinary shares.

6 month period ended 30 June 6 month period ended 30 June Year ended

2023 2022 31 December 2022

(unaudited) (unaudited) (audited)

US$ US$ US$

Earnings

Net profit/(loss) attributable

to equity shareholders for the

purpose of basic and diluted

earnings per share 36,958,623 782,066 8,753,956

Number of shares

Weighted average number of

ordinary shares for the

purpose of basic earnings per

share 2,089,230,821 2,072,588,751 2,080,759,193

------------------------------- ------------------------------- ------------------

Number of dilutive shares under

warrant/option 22,000,000 19,958,011* 16,181,534

Weighted average number of

ordinary shares for the

purpose of diluted earnings

per share 2,111,230,821 2,092,546,762* 2,096,940,727

------------------------------- ------------------------------- ------------------

Basic earnings cents per share 1.77 0.04 0.42

Diluted earnings cents per

share 1.75 0.04 0.42

------------------------------- ------------------------------- ------------------

* Restated to remove 94,125,000 warrant instruments previously

incorrectly included as these were anti-dilutive in nature.

5. Impairment reversal

Property, plant and equipment ("PPE")

The Group considers that the entire Runruno project

(encompassing capitalised property, plant and equipment, mining

licence costs, deferred exploration expenditure and the provision

for mine rehabilitation and decommissioning) comprises a single

cash generating unit ("CGU") as all stages of the project are

interdependent in terms of generating cash flow and do not have the

capacity to generate separate and distinct cash flow streams.

The Group assesses the recoverable amount of the Runruno project

CGU based on the value in use of the Runruno operations using cash

flow projections over the remaining expected life of mine ("LOM")

and at appropriate discount rates. Based on assumptions current as

at 30 June 2023, in particular the ongoing relatively high gold

prices and the increased productivity of the Runruno mine, the

Group considered that a partial reversal of the 2018 impairment of

PPE be recognised. Accordingly, and in accordance with IAS 36 --

Impairment of Assets, an impairment credit has been raised in H1

2023 to increase the book value of the PPE by US$10 million.

6. Loans

Senior debt

The US$83,000,000 senior debt facility has effectively been

fully repaid with only US$1,253 outstanding as at 30 June 2023.

This small balance has remained in place to maintain the existing

security while the process of elevating the status of the mezzanine

debt from unsecured to secured debt (the "Elevation"). This

Elevation process provides for the interest rate on the mezzanine

debt to reduce from 15% to 7%.

The process of elevating the status of the mezzanine loans to

that of secured debt is continuing. The mechanics to achieve this

requires new securities to be created across several jurisdictions.

The documentation to achieve all aspects of the elevation is

largely agreed, and the process of executing these documents is

expected to commence in Q3 2023.

Mezzanine debt

Since 2015, the Company has entered into numerous facility

agreements with two major shareholders, MTL Luxembourg Sarl ("MTL

Luxembourg") and Runruno Holdings Limited (the "RHL Group") (the

"Mezzanine Lenders"). The purpose of these unsecured advances was

for general corporate and working capital requirements of the

Company and to enable completion of the Runruno Project.

In October 2020 the various original mezzanine facilities were

consolidated into two new facilities (the "New Mezzanine

Facilities") and a GBP100,000 revolving credit facility. There is

no obligation to make any repayment of any amounts due under the

New Mezzanine Facilities until the senior debt is fully repaid.

The majority mezzanine lender, MTL Luxembourg, Nick Candy's

investment vehicle (holding 70.7% of the mezzanine debt), has

confirmed in writing that, subject to completion of the elevation

documents within a reasonable period, the interest rate on its

portion of the mezzanine debt will reduce to 7% per annum from 15%

per annum as from 3 November 2022 (being the date that the Company

could have fully repaid the Senior Facility, but for the

requirements of the Elevation).

The minority 29.3% mezzanine lender, the RHL Group, has not

confirmed the same in writing; however, the Company is hopeful the

RHL Group will apply the 7% interest rate from 3 November 2022 and

that this will be formalised once the elevation documents are

completed within a reasonable period.

Total mezzanine debt payments of US$35.0 million were made

during H1 2023 (H1 2022: US$17.0 million).

The net debt position of the Group as at 30 June 2023 was

US$48.8 million (H1 2022: US$92.9 million).

The Group's outstanding debt is summarised as follows:

June 2023 June 2022 December 2022

US$ US$ US$

Total loans due within one year* 49,301,270 18,711,883 30,001,208

=========== =========== ==============

Total loans due after more than one year* - 74,146,474 51,983,413

=========== =========== ==============

* Given the Group is not subject to a fixed repayment schedule

then, in accordance with the restructured debt facilities, there is

no certainty as to what amount of debt will be repaid within one

year from period end. Thus, the determination of what debt is

deemed current and what is deemed non-current is subject to

estimation. In making this calculation the Group has taken account

of the Group's estimate of what principal repayments will be made

during the next 12 month period.

7. Share capital

The 17 June 2022 AGM approved a capital reorganisation which

consisted of both a capital sub-division and a capital reduction.

The capital sub-division effected a change in the nominal value of

ordinary shares. This was achieved by dividing the existing

ordinary shares of GBP0.01 nominal value into one New Ordinary

Share, with a nominal value of GBP0.0001 and one Deferred Share

with a nominal value of GBP0.0099 each. The Deferred Shares had

limited rights as set out in the new Articles of the Company

adopted at the AGM. This capital sub-division was effective as from

the day of the AGM. The capital reduction element was to cancel,

for no consideration, the deferred shares and share premium account

by way of creating a reserve to be offset against accumulated

losses. This capital reduction was completed in July 2022.

In June 2023 the Company issued 7,147,850 new ordinary shares at

an issue price of GBP0.01679 in lieu of paying a cash bonus.

June 2023 June 2022 December 2022 June 2023 June 2022 December 2022

Number of

shares Number of shares Number of shares US$ US$ US$

Ordinary shares

of GBP0.01 par

value

Opening balance - 2,071,334,586 2,071,334,586 - 27,950,217 27,950,217

Sub-division - ( 2,071,334,586) ( 2,071,334,586) - (27,950,217) (27,950,217)

Closing balance - - - - - -

-------------- ----------------- ----------------- ----------- ------------- --------------

Ordinary shares of

GBP0.0001 par value

Opening balance 2,088,796,421 - - 281,638 - -

Sub-division/capital

reduction - 2,071,334,586 2,071,334,586 - 279,502 279,502

Share issue in period 7,147,850 17,461,835 17,461,835 865 2,136 2,136

-------------- ----------------- ----------------- ----------- ------------- --------------

Closing balance 2,095,944,271 2,088,796,421 2,088,796,421 282,503 281,638 281,638

-------------- ----------------- ----------------- ----------- ------------- --------------

Deferred shares of

GBP0.0099 par value

Opening balance - - - - - -

Sub-division/capital

reduction - 2,071,334,586 - - 27,670,715 -

-------------- ----------------- ----------------- ----------- ------------- --------------

Closing balance - 2,071,334,586 - - 27,670,715 -

-------------- ----------------- -----------------

Share premium

Opening balance - - 195,855,125 195,855,125

Sub-division/capital

reduction - - (196,118,890)

Share issue in period 144,350 263,765 263,765

----------- ------------- --------------

Closing balance 144,350 196,118,890 -

----------- ------------- --------------

8. Contingent liabilities

The Group has no contingent liabilities identified as at 30 June

2023 (2022: US$nil) other than:

-- In accordance with the provisions of the Financial and

Technical Assistance Agreement ("FTAA") with the Philippine

government, which governs the operations of the Runruno mine, an

application to extend the exemption from numerous taxes including

corporate income tax, VAT, stamp duty and import duty has been

lodged. This application for the extension of the exemption from

these taxes has passed through several steps in the process of

being approved and has the garnered the support of some of the

relevant government departments.

Although uncertain, the Group remains confident that the

extension will ultimately be granted. As a result, the interim

financial statements are based on the assumption that the extension

will be granted (consistent with the December 2022 financial

statements).

However, should this exemption request not be granted, the Group

will have liability for various past taxes. The Group believes it

will be able to net this potential liability against past payments

VAT and import duties which it believes it is entitled to recover.

As some of these past VAT and Import duty payments are subject to

court proceedings the potential quantum of the tax liability can't

be predicted with certainty.

9. Subsequent events

There have been no subsequent disclosable events other than:

-- On 18 September 2023 the Company announced the resignation of

Mr David Cather as Independent Chairman and non-executive director.

Mr Steven Smith has been appointed interim Chairman until such time

as the Company appoints a new independent Chairman. Mr Cather will

continue as a director the of Metals Exploration Pte Ltd (the

group's Singapore incorporated holding company), while remaining a

mining engineering consultant to FCF Minerals, the Company's

Philippine operating subsidiary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFWMEDSEDU

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

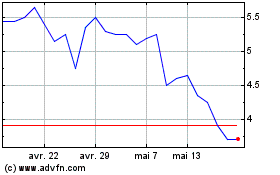

Metals Exploration (LSE:MTL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Metals Exploration (LSE:MTL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025