TIDMNUM

RNS Number : 8195P

Numis Corporation PLC

11 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION

FOR IMMEDIATE RELEASE

11 October 2023

RECOMMED CASH ACQUISITION

OF

Numis Corporation plc ("Numis")

BY

Deutsche Bank AG ("Deutsche Bank")

Court sanction of the Scheme

On 28 April 2023, the Board of Numis and the Management Board of

Deutsche Bank announced that they had reached agreement on the

terms of a recommended all cash offer pursuant to which Deutsche

Bank will acquire the entire issued and to be issued ordinary share

capital of Numis (the "Transaction"). The Transaction is being

implemented by means of a Court-sanctioned scheme of arrangement

under Part 26 of the Companies Act 2006 (the "Scheme"). Capitalised

terms used but not defined in this Announcement have the meanings

given to them in the scheme document published on 18 May 2023

containing the full terms and conditions of the Transaction (the

"Scheme Document").

On 21 June 2023, the Scheme was approved by the requisite

majority of Scheme Shareholders at the Court Meeting and the

resolution in connection with the implementation of the Scheme was

passed by the requisite majority of Numis Shareholders at the

General Meeting.

Further to the announcement made on 28 September 2023 in

relation to the satisfaction of key conditions, update on the

Scheme timetable and declaration of the Second Permitted Dividend,

the Board of Numis and the Management Board of Deutsche Bank are

pleased to announce that the Court has today issued the Court Order

sanctioning the Scheme under section 899 of the Companies Act

2006.

Admission of new Numis Shares

In order to satisfy the conditional exercises by the holders of

options and/or vesting of awards granted under the Numis Share

Schemes, Numis will issue 2,749,020 new Numis Shares (the "New

Shares") to Computershare Trustees (Jersey) Limited as a trustee of

the Numis Corporation Plc Employee Benefit Trust (No.2).

An application has been made to the London Stock Exchange for

the New Shares to be admitted to trading on AIM at 8.00 a.m. on 12

October 2023.

A further announcement regarding the Numis Share Schemes will be

made tomorrow, 12 October 2023.

Next steps and timetable

The Scheme remains conditional on the delivery of a copy of the

Court Order to the Registrar of Companies, which is expected to

occur on 13 October 2023.

Numis confirms that the Scheme Record Time will be 6.00 p.m. on

12 October 2023. Scheme Shareholders on the register of members of

Numis at the Scheme Record Time will, upon the Scheme becoming

Effective, be entitled to receive 339 pence in cash for each Scheme

Share held. Additionally, Numis Shareholders on the register of

members of Numis at the Scheme Record Time will, upon the Scheme

becoming Effective, be entitled to receive the Second Permitted

Dividend of 5 pence in cash per Numis Share held.

The last day and time for dealings in, and for registrations of

transfers of, and disablement in CREST of, Numis Shares is 12

October 2023 at 6.00 p.m., and trading in Numis Shares on AIM will

be suspended with effect from 7.30 a.m. on 13 October 2023. With

effect from, or as soon as practicable after the Effective Date,

share certificates in respect of Numis Shares will cease to be

valid and entitlements to Numis Shares held within the CREST system

will be cancelled.

It is expected that, subject to the Scheme becoming Effective,

the cancellation of admission to trading of Numis Shares on AIM

will take place at 7.00 a.m. on 16 October 2023.

Further announcements will be made when the Scheme becomes

Effective and when the admission to trading of Numis Shares on AIM

has been cancelled.

Enquiries:

Deutsche Bank +49 80 0910 8000

Ioana Patriniche - Head of Investor Relations

Silke-Nicole Szypa

Deutsche Bank, London Branch (Financial Adviser to Deutsche

Bank) +44 20 7545 8000

Daniel Ross

Derek Shakespeare

Oliver Ives

Nicholas Hunt

Lazard (Financial Adviser to Deutsche Bank) +44 20 7187 2000

Cyrus Kapadia

Nicholas Millar

Stephen Dibsdale

FGS Global (PR Adviser to Deutsche Bank) +44 20 7251 3801

James Murgatroyd

Charlie Chichester

Rory King

Numis (Communications) +44 7904 529 515

Noreen Biddle Shah

Fenchurch Advisory Partners (Financial Adviser to Numis) +44 20

7382 2222

Kunal Gandhi

Rob Williams

Richard Locke

Grant Thornton UK LLP (Nominated Adviser to Numis) +44 20 7383

5100

Philip Secrett

Harrison Clarke

FTI Consulting LLP (PR Adviser to Numis) +44 20 3727 1000

Edward Bridges

Daisy Hall

Cat Stirling

Ambrose Fullalove

Slaughter and May is acting as legal adviser, Cleary Gottlieb

Steen & Hamilton LLP is acting as US regulatory legal adviser

and Arthur Cox LLP is acting as Irish regulatory legal adviser to

Deutsche Bank.

Travers Smith LLP is acting as legal adviser, Latham &

Watkins LLP is acting as remuneration regulatory legal adviser and

Holland & Knight LLP is acting as US regulatory legal adviser

to Numis.

Important notices

This Announcement is for information purposes only and is not

intended to, and does not, constitute or form part of any offer or

inducement to sell or an invitation to purchase, otherwise acquire,

subscribe for, sell or otherwise dispose of, any securities or the

solicitation of an offer to buy any securities, any vote or

approval in any jurisdiction pursuant to the Transaction or

otherwise.

The Transaction will be made solely pursuant to the terms of the

Scheme Document, which contains the full terms and conditions of

the Transaction. Any decision in respect of, or other response to,

the Transaction should be made only on the basis of the information

in the Scheme Document.

This Announcement has been prepared in connection with proposals

in relation to a scheme of arrangement pursuant to and for the

purpose of complying with the laws of England and Wales and the

Code and information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws of jurisdictions outside England and

Wales. Nothing in this Announcement should be relied on for any

other purpose.

This Announcement does not constitute a prospectus or a

prospectus-equivalent document.

Disclaimers

Deutsche Bank is a joint stock corporation incorporated with

limited liability in the Federal Republic of Germany, with its head

office in Frankfurt am Main where it is registered in the

Commercial Register of the District Court under number HRB 30 000.

Deutsche Bank is authorised under German banking law. The London

branch of Deutsche Bank is registered in the register of companies

for England and Wales (registration number BR000005) with its

registered address and principal place of business at Winchester

House, 1 Great Winchester Street, London EC2N 2DB. Deutsche Bank is

authorised and regulated by the European Central Bank and the

German Federal Financial Supervisory Authority (BaFin). With

respect to activities undertaken in the United Kingdom, Deutsche

Bank is authorised by the Prudential Regulation Authority. It is

subject to regulation by the Financial Conduct Authority and

limited regulation by the Prudential Regulation Authority. Details

about the extent of Deutsche Bank's authorisation and regulation by

the Prudential Regulation Authority are available from Deutsche

Bank on request.

Deutsche Bank, London Branch is acting as financial adviser to

Deutsche Bank and no-one else in connection with the matters

described in this Announcement and will not be responsible to

anyone other than Deutsche Bank for providing the protections

afforded to clients of Deutsche Bank, London Branch nor for

providing advice in connection with the subject matter of this

Announcement or any other matter referred to in this

Announcement.

Lazard & Co., Limited ("Lazard"), which is authorised and

regulated in the UK by the Financial Conduct Authority, is acting

exclusively as financial adviser to Deutsche Bank and no one else

in connection with the matters set out in this Announcement and

will not be responsible to anyone other than Deutsche Bank for

providing the protections afforded to clients of Lazard nor for

providing advice in relation to the matters set out in this

Announcement. Neither Lazard nor any of its affiliates (nor their

respective directors, officers, employees or agents) owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Lazard in

connection with this Announcement, any statement contained herein

or otherwise.

Fenchurch Advisory Partners LLP, which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively for Numis and no-one else in connection with

the Transaction described in this Announcement and accordingly will

not be responsible to anyone other than Numis for providing the

protections afforded to its clients nor for providing advice in

relation to the matters described in this Announcement.

Grant Thornton UK LLP, which is authorised and regulated in the

United Kingdom by the Financial Conduct Authority, is acting

exclusively for Numis and no-one else in connection with the

Transaction described in this Announcement and accordingly will not

be responsible to anyone other than Numis for providing the

protections afforded to its clients nor for providing advice in

relation to the matters described in this Announcement.

Overseas jurisdictions

The release, publication or distribution of this Announcement in

jurisdictions other than the UK may be restricted by law and

therefore any persons who are subject to the laws of any

jurisdiction other than the UK should inform themselves about, and

observe any applicable requirements. This Announcement has been

prepared for the purpose of complying with English law, the AIM

Rules and the Code and the information disclosed may not be the

same as that which would have been disclosed if this Announcement

had been prepared in accordance with the laws of jurisdictions

outside the UK.

Copies of this Announcement and any formal documentation

relating to the Transaction are not being, and must not be,

directly or indirectly, mailed or otherwise forwarded, distributed

or sent in or into or from any Restricted Jurisdiction and persons

receiving such documents (including custodians, nominees and

trustees) must not mail or otherwise forward, distribute or send it

in or into or from any Restricted Jurisdiction. If the Transaction

is implemented by way of an Offer (unless otherwise permitted by

applicable law and regulation), the Offer may not be made directly

or indirectly, in or into, or by the use of mails or any means or

instrumentality (including, but not limited to, facsimile, e-mail

or other electronic transmission, telex or telephone) of interstate

or foreign commerce of, or of any facility of a national, state or

other securities exchange of any Restricted Jurisdiction and the

Offer may not be capable of acceptance by any such use, means,

instrumentality or facilities.

The Transaction shall be subject to the applicable requirements

of the Code, the Panel, the London Stock Exchange and the AIM

Rules.

Notice to US investors in Numis

The Transaction relates to the shares of an English company and

is being made by means of a scheme of arrangement provided for

under English company law. A transaction effected by means of a

scheme of arrangement is not subject to the tender offer rules or

the proxy solicitation rules under the US Exchange Act of 1934.

Accordingly, the Transaction and the Scheme will be subject to the

disclosure requirements and practices applicable in the UK to

schemes of arrangement which differ from the disclosure

requirements of United States tender offer and proxy solicitation

rules. If, in the future, Deutsche Bank exercises the right to

implement the Transaction by way of an Offer and determines to

extend the Offer into the United States, the Transaction will be

made in compliance with applicable United States laws and

regulations.

Financial information included in this Announcement has been or

will have been prepared in accordance with accounting standards

applicable in the UK that may not be comparable to financial

information of US companies or companies whose financial statements

are prepared in accordance with generally accepted accounting

principles in the United States.

The receipt of cash pursuant to the Transaction by a US holder

of Numis Shares as consideration for the transfer of its Scheme

Shares pursuant to the Scheme may be a taxable transaction for

United States federal income tax purposes and under applicable

United States state and local, as well as foreign and other, tax

laws. Each Numis Shareholder is urged to consult with independent

professional advisers immediately regarding the tax consequences of

the Transaction applicable to it.

It may be difficult for US holders of Numis Shares to enforce

their rights and any claim arising out of the US federal laws,

since Deutsche Bank and Numis are located in non-US jurisdictions,

and some or all of their officers and directors may be residents of

a non-US jurisdiction. US holders of Numis Shares may not be able

to sue a non-US company or its officers or directors in a non-US

court for violations of the US securities laws. Further, it may be

difficult to compel a non-US company and its affiliates to subject

themselves to a US court's judgement.

Neither the United States Securities and Exchange Commission nor

any US state securities commission has approved or disapproved the

Transaction, passed upon the merits or fairness of the Transaction

or passed any opinion upon the accuracy, adequacy or completeness

of this Announcement. Any representation to the contrary is a

criminal offence in the United States.

Cautionary note regarding forward-looking statements

This Announcement (including information incorporated by

reference into this Announcement) may contain certain

forward-looking statements with respect to the financial condition,

strategies, objectives, results of operations and businesses of the

Deutsche Bank Group and the Numis Group. All statements other than

statements of historical fact are, or may be deemed to be,

forward-looking statements. Forward-looking statements are

statements of future expectations that are based on management's

current expectations and assumptions and involve known and unknown

risks and uncertainties that could cause actual results,

performance or events to differ materially from those expressed or

implied in these statements. Forward-looking statements include,

among other things, statements concerning the potential exposure of

Deutsche Bank and the Deutsche Bank Group and Numis and the Numis

Group to market risks, statements as to accretion and statements

expressing management's expectations, beliefs, estimates,

forecasts, projections and assumptions, including as to future

potential cost savings, synergies, earnings, cash flow, return on

capital employed, production and prospects. These forward-looking

statements are identified by their use of terms and phrases such as

"aims", "anticipate", "believe", "could", "estimate", "expect",

"goals", "hopes", "intend", "may", "objectives", "outlook", "plan",

"probably", "project", "risks", "seek", "should", "target", "will",

"would" and similar terms and phrases.

By their very nature, forward-looking statements involve risks

and uncertainties. There are a number of factors that could affect

the future operations of Deutsche Bank and the Deutsche Bank Group

and Numis and the Numis Group and could cause those results to

differ materially from those expressed in the forward-looking

statements included in this Announcement.

Such factors include the conditions in the financial markets in

Germany, in Europe, in the United States and elsewhere from which

the Deutsche Bank Group and/or the Numis Group derives a

substantial portion of its revenues and in which the Deutsche Bank

Group and/or the Numis Group holds a substantial portion of its

assets, the development of asset prices and market volatility,

potential defaults of borrowers or trading counterparties, the

implementation of Deutsche Bank's and/or Numis' strategic

initiatives, the reliability of Deutsche Bank's and/or Numis' risk

management policies, procedures and methods, and other risks

referenced in Deutsche Bank's and/or Numis' filings with the U.S.

Securities and Exchange Commission. Such factors are described in

detail in Deutsche Bank's SEC Form 20-F of 17 March 2023 under the

heading "Risk Factors" (available at http://www.db.com/ir). These

factors also should be considered by the reader.

Neither Deutsche Bank, Numis, the Wider Deutsche Bank Group nor

the Wider Numis Group, nor any of their respective associates or

directors, officers or advisers, provide any representation,

assurance or guarantee that the occurrence of the events expressed

or implied in any forward-looking statements in this Announcement

will actually occur. Given these risks and uncertainties, potential

investors are cautioned not to place any reliance on these

forward-looking statements.

Other than in accordance with their legal or regulatory

obligations, neither Deutsche Bank, Numis, the Wider Deutsche Bank

Group nor the Wider Numis Group is under any obligation, and each

such person expressly disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

No profit forecasts, estimates or quantified benefits

statements

No statement in this Announcement, or incorporated by reference

into this Announcement, is intended as a profit forecast, profit

estimate or quantified benefits statement for any period and no

statement in this Announcement should be interpreted to mean that

earnings or earnings per share for Numis or Deutsche Bank, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Numis or Deutsche Bank, as appropriate.

Disclosure Requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 p.m. (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 p.m. (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 p.m. (London time) on the

business day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website and requesting hard copies

A copy of this Announcement will be available (subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions) on https://www.numis.com/investors by no later than

12 noon (London time) on the business day following the date of

this Announcement. The content of the website is not incorporated

into, and does not form part of, this Announcement.

In accordance with Rule 30.3 of the Code, Numis Shareholders,

persons with information rights and participants in the Numis Share

Schemes may request a hard copy of this Announcement by contacting

Computershare Investor Services PLC during business hours (8.30

a.m. to 5.30 p.m.) on +44 (0)370 707 1203 or by submitting a

request in writing to Computershare Investor Services PLC at The

Pavilions, Bridgwater Road, Bristol, BS99 6ZZ. In accordance with

Rule 30.3 of the Code, you may also request that all future

documents, announcements and information to be sent to you in

relation to the Transaction should be in hard copy form.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOALFLFFXBLBFBV

(END) Dow Jones Newswires

October 11, 2023 08:10 ET (12:10 GMT)

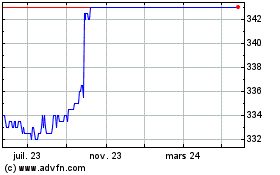

Numis (LSE:NUM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Numis (LSE:NUM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025