FICO and Affirm Unveil Industry-Leading Analysis of ‘Buy Now, Pay Later’ Loans

04 Février 2025 - 2:00PM

Business Wire

First-of-its-kind analysis finds Affirm

customers with multiple BNPL loans would be most likely to

experience score increases with FICO’s innovative treatment of that

data

FICO (NYSE: FICO), global analytics software leader,

today released key guidance and takeaways from a study that

analyzed the impact of including ‘Buy Now, Pay Later’ (BNPL) loans

in a consumer’s FICO® Score.

FICO conducted the 12-month study in partnership with Affirm

(NASDAQ: AFRM), the payment network that empowers consumers

and helps merchants drive growth. The research compared the FICO®

Scores of more than 500,000 consumers who opened at least one new

Affirm BNPL loan against a benchmark population of consumers

without an Affirm BNPL loan. FICO simulated the inclusion of these

Affirm loans into consumers’ credit reports, and then examined the

potential impact to resulting credit scores of those consumers.

The goal of the research was focused on outlining the potential

benefits or impacts that BNPL lending products could have on FICO®

Scores. It was also intended to help inform both responsible

furnishing of BNPL loans to the credit bureaus, as well as an

appropriate and empirically supported treatment of this data within

the FICO Score. Through this first-of-its-kind study with Affirm,

FICO developed a proprietary treatment to harness the benefits

offered by incorporation of BNPL data into consumers’ FICO Score

calculation. The research showed that this treatment can improve

model performance and lead to increased FICO Scores for some BNPL

borrowers.

“Given the growing popularity of BNPL loans, understanding how

to effectively capture the benefit that BNPL data can have on FICO

Scores is crucial to all stakeholders in the credit ecosystem,”

said Ethan Dornhelm, vice president of Scores and Predictive

Analytics at FICO. “Our findings show that the inclusion of

BNPL data via our innovative treatment can drive score increases

for some consumers, while improving model risk performance for

lenders. We appreciate Affirm’s leadership and collaboration on

this study.”

A unique consumer behavior associated with BNPL loans is the

potential for a large number of these loans to be opened within a

short period of time. To address this, FICO developed an innovative

approach that includes aggregating separate BNPL loans together

when calculating certain in-model variables. This novel treatment

has proven effective at capturing predictive signal from the

inclusion of BNPL data while increasing FICO® Scores for some BNPL

consumers.

Key findings

- Utilizing FICO’s novel treatment, the simulated inclusion of

BNPL data into consumers’ credit files yielded:

- FICO Score impacts that were generally consistent with the

opening of a new account – within less than +/- 10 points for over

85% of the consumers in the study.

- Higher scores or no score changes for the majority of the

population of consumers in the study who had recently obtained five

or more Affirm BNPL loans.

- Impacts on FICO Score predictiveness ranging from modest

improvement to no adverse impact, across a range of different use

cases.

- Given the unique aspects of BNPL loans, FICO’s empirically

supported treatment of this data is necessary to mitigate impacts

to borrowers, and maintain credit risk assessment

effectiveness.

“We appreciate the collaboration and partnership with FICO as we

sought to conduct a thorough analysis examining the impact of

furnishing BNPL loans on credit scores,” said Don Lemire, vice

president of Credit Analytics at Affirm. “Through studies like

this, we aim to drive greater transparency and promote industry

best practices for responsible reporting of BNPL data to credit

bureaus. We invite other providers of pay-over-time products to

join us in conducting studies with FICO and committing to furnish

data on all BNPL loans in a manner that is beneficial for consumers

and the broader financial system.”

Based on learnings from this industry-leading analysis, FICO is

developing a solution to introduce its proprietary treatment of

BNPL data to the credit-scoring marketplace. FICO will be releasing

more information on this exciting product development soon.

“As the provider of the credit score relied on by 90% of top

U.S. lenders, we understand the need to continuously produce

innovative insights and solutions that guide the industry’s

responsible use of credit data,” said Julie May, vice president

and general manager of Scores at FICO. “We are eager to arm

lenders with a tool that allows them to incorporate BNPL data into

their credit evaluation process, demonstrating FICO’s commitment to

innovation, transparency and inclusivity in lending.”

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com.

Join the conversation at https://x.com/FICO_corp &

https://www.fico.com/en/blogs/.

For FICO news and media resources, visit

https://www.fico.com/en/newsroom.

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

About Affirm

Affirm’s mission is to deliver honest financial products that

improve lives. By building a new kind of payment network – one

based on trust, transparency and putting people first – we empower

millions of consumers to spend and save responsibly, and give

thousands of businesses the tools to fuel growth. Unlike most

credit cards and other pay-over-time options, we never charge any

late or hidden fees. Follow Affirm on social media: LinkedIn |

Instagram | Facebook | X.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204481887/en/

FICO Julie Huang press@fico.com

Affirm Brian Levin press@affirm.com

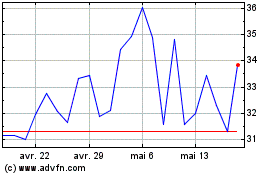

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025