Filed Pursuant to Rule 424(b)(2)

Registration No. 333-274078

PROSPECTUS

$150,000,000

American

Depository Shares representing Ordinary Shares,

Ordinary

Shares,

Warrants

to Purchase American Depositary Shares,

Subscription

Rights and/or Units

Offered

by the Company

BIONDVAX

PHARMACEUTICALS LTD.

We

may offer and sell to the public from time to time in one or more series or issuances up to $150,000,000 in the aggregate of American

Depositary Shares (“ADSs”), ordinary shares (“Ordinary Shares”), warrants, subscription rights and/or units consisting

of two or more of these classes or series of securities. Each ADS represents four hundred (400) ordinary shares.

We

refer to the ADSs, Ordinary Shares, warrants, subscription rights and units collectively as “securities” in this prospectus.

Each

time we sell securities pursuant to this prospectus, we will provide a supplement to this prospectus that contains specific information

about the offeror, the offering and the specific terms of the securities offered. This prospectus may not be used to consummate a sale

of securities by us unless accompanied by the applicable prospectus supplement. You should read this prospectus and the applicable prospectus

supplement carefully before you invest in our securities.

We

may, from time to time, offer to sell the securities, through public or private transactions, directly or through underwriters, agents

or dealers, on or off the Nasdaq Capital Market, as applicable, at prevailing market prices or at privately negotiated prices. If any

underwriters, agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth

the names of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

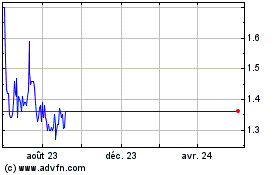

Our ADSs are traded on the

Nasdaq Capital Market under the symbol “BVXV.” The last reported sale price for our ADSs on August 25, 2023 as quoted on the

Nasdaq Capital Market was $1.32 per share.

Investing

in these securities involves a high degree of risk. Please carefully consider the risks discussed in this prospectus under “Risk

Factors” beginning on page 3 and the “Risk Factors” in “Item 1.A. Risk Factors” of our most recent Annual

Report on Form 10-K incorporated by reference in this prospectus and in any applicable prospectus supplement for a discussion of the

factors you should consider carefully before deciding to purchase these securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities being offered

by this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 25, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this process, we may offer and sell our securities under this prospectus.

Under

this shelf process, we may sell the securities described in this prospectus in one or more offerings up to a total dollar amount of $150,000,000.

The offer and sale of securities under this prospectus may be made from time to time, in one or more offerings, in any manner described

under the section in this prospectus entitled “Plan of Distribution.”

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities we will provide a prospectus

supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or

change information contained in this prospectus, and may also contain information about any material federal income tax considerations

relating to the securities covered by the prospectus supplement. You should read both this prospectus and any prospectus supplement together

with additional information under the headings “Where You Can Find More Information” and “Incorporation of Certain

Documents by Reference.”

This

summary may not contain all of the information that may be important to you. You should read this entire prospectus, including the financial

statements and related notes and other financial data incorporated by reference in this prospectus, before making an investment decision.

This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from

the results discussed in the forward-looking statements. Factors that might cause or contribute to such differences include those discussed

in “Risk Factors” and “Forward-Looking Statements.”

In

this prospectus, unless the context otherwise requires:

| |

● |

references

to “BiondVax,” the “Company,” “us,” “we” and “our” refer to BiondVax

Pharmaceuticals Ltd. (the “Registrant”), an Israeli company; |

| |

● |

references

to “ordinary shares,” “our shares” and similar expressions refer to the Registrant’s ordinary shares,

no par value; |

| |

● |

references

to “ADS” refer to the Registrant’s American Depositary Shares; |

| |

● |

references

to “dollars,” “U.S. dollars” and “$” are to United States Dollars; |

| |

● |

references

to the “Companies Law” are to Israel’s Companies Law, 5759-1999, as amended; and |

| |

● |

references

to the “SEC” are to the United States Securities and Exchange Commission. |

ABOUT

THE COMPANY

Overview

BiondVax

Pharmaceuticals Ltd. (Nasdaq: BVXV) is a biopharmaceutical company focused on developing, manufacturing and commercializing innovative

immunotherapeutic products primarily for the treatment of infectious and autoimmune diseases. Since its inception, the Company has

executed eight clinical trials including a seven country, 12,400 participant phase 3 trial of its prior lead drug candidate, a universal

influenza vaccine candidate (“M-001”), and has built a GMP biologics manufacturing facility for biopharmaceutical products.

After receiving the phase 3 trial results in Q3 2020, indicating that M-001 did not meet its clinical endpoints, the Company performed

a turnaround process that included raising fresh capital, hiring new talent (including a new CEO), signing a research collaboration agreement

with and in-licensing new intellectual property from world leading academic research institutes. . Since then, the Company is in the

process of developing a pipeline of diversified and commercially viable products built around the licensed innovative nanosized antibodies

(NanoAb). NanoAbs are nanosized antibodies derived from camelid animals and are also known as VHH-antibodies or Nanobodies. “Nanobody”

is a trademark registered by ABLYNX N.V., a wholly owned subsidiary of Sanofi. BiondVax has no affiliation with and is not endorsed by

Sanofi.

As

part of the abovementioned turnaround, on December 22, 2021, the Company signed a definitive exclusive, worldwide, License Agreement

(“LA”) with the Max Planck Society (“MPG”), the parent organization of the Max Planck Institute for Multidisciplinary

Sciences (“MPI”), and the University Medical Center Göttingen (“UMG”), both in Gottingen, Germany, for the

development and commercialization of innovative NanoAbs for the treatment of COVID-19. The agreement provides for an upfront payment,

development and sales milestones and royalties based on sales and sharing of sublicense revenues. In addition, the Company signed an

accompanying Research Collaboration Agreement (“aRCA”) with MPG and UMG in support of the abovementioned development of a

COVID-19 NanoAb by MPI and UMG. The aRCA provided for monthly payments to MPG and UMG and had a term until the earlier of two years or

the date the Company enters into first in-human clinical trials with the COVID-19 NanoAb.

On

March 23, 2022, we signed a five-year Research Collaboration Agreement (“RCA”; collectively, with the LA and aRCA, the “MPG/UMG

Agreements”) with MPG and UMG covering the discovery, selection and characterization of NanoAbs for up to nine molecular targets

that have the potential to be further developed into drug candidates for the treatment of disease indications such as psoriasis, psoriatic

arthritis, asthma and wet macular degeneration. These are all large and growing markets with underserved medical needs. In each case,

the molecular target has been validated as an appropriate target for therapeutic intervention through inhibition by an antibody, thereby

significantly reducing the discovery work that typically entails many years of research, high cost and high risk of failure. We believe

that we can leverage our NanoAbs’ unique and strong binding affinity, stability at high temperatures, and potential for more effective

and convenient routes of administration towards competitive commercial viability. We believe that since these are clinical validated

targets, we can develop NanoAb treatments with reduced risk and cost, and accelerate the time from NanoAb selection to initiation of

clinical development. Each NanoAb candidate is therefore positioned as a “biobetter” piggybacking on prior discoveries of

others to mitigate risk but with significant potential advantages over existing therapeutics. In addition, while each NanoAb constitutes

a novel molecule for which we file patent applications thereby creating a proprietary position, all of the developed NnoAbs when viewed

together constitute a pipeline that is built around the same drug discovery, development and manufacturing platform allowing us to reduce

risks and save costs. BiondVax has the exclusive option for an exclusive, pre-negotiated worldwide license agreement for the development

and commercialization of each of the NanoAbs covered by the RCA with MPG and UMG.

On

June 5, 2023, we announced that as part of our ongoing broad-based collaboration with the Max Planck Society and the University Medical

Center Gottingen (UMG), we signed an exclusive worldwide license agreement to develop and commercialize VHH antibodies (NanoAbs) targeting

Interleukin-17 (IL-17) as treatments for all potential indications, starting with psoriasis and psoriatic arthritis.

In

June 2023, the Companydisclosed that it was pursuing a strategic partnership for its COVID-19 self-administered inhaled NanoAb therapeutic/prophylactic

which demonstrated highly promising in vivo results in animals and that it will focus on developing the anti-IL-17 nanoAb.

Corporate

Information

Our

legal and commercial name is BiondVax Pharmaceuticals Ltd. We are a company limited by shares organized under the laws of Israel. We

were incorporated in Israel in 2003 as a privately held company and started operating in 2005. In February 2007, we completed an initial

public offering of our ordinary shares on the Tel Aviv Stock Exchange (TASE), and we voluntarily delisted from the TASE in January 2018.

In May 2015 we completed an initial public offering of ADSs and ADSs warrants (which have since expired) on the Nasdaq Capital Market.

Our

principal executive offices are located at Kiryat Hadassah, Building 1, Jerusalem BioPark (“JBP”), 2nd Floor, , Jerusalem,

Israel 9112001, and our telephone number is 972-8-930-2529. Our website address is http://www.biondvax.com. The information on our website

does not constitute a part of this prospectus. Our agent for service of process in the United States is Puglisi & Associates, located

at 850 Library Avenue, Suite 204, Newark, Delaware.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Our business, financial condition or results of operations could be adversely

affected by any of these risks. You should carefully consider the risk factors discussed under the caption “Item 1.A: Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2022, and in any other filing we make with the SEC subsequent to the

date of this prospectus, each of which are incorporated herein by reference, and in any supplement to this prospectus, before making

your investment decision. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our operations. Past financial performance may not be

a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

If any of these risks actually occurs, our business, business prospects, financial condition or results of operations could be seriously

harmed. This could cause the trading price of our ADSs to decline, resulting in a loss of all or part of your investment. Please also

read carefully the section below entitled “Forward-Looking Statements.”

OFFER

STATISTICS AND EXPECTED TIMETABLE

We

may sell from time to time pursuant to this prospectus (as may be detailed in a prospectus supplement) an indeterminate number of securities

as shall have a maximum aggregate offering price of $150,000,000. The actual price per share or per security of the securities that we

will offer pursuant hereto will depend on a number of factors that may be relevant as of the time of offer. See “Plan of Distribution.”

FORWARD-LOOKING

STATEMENTS

This

prospectus, including the information incorporated by reference into this prospectus, contains, and any prospectus supplement may include

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known

and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify

forward-looking statements by terms including “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking

statements, but these are not the only ways these statements are identified. Forward-looking statements reflect our current views with

respect to future events and are based on assumptions and subject to risks and uncertainties. You should not put undue reliance on any

forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend

to update or revise any forward-looking statements. Readers are encouraged to consult the Company’s filings made on Form 6-K, which

are periodically filed with or furnished to the SEC.

The

following is a summary of some of the principal risks we face. The list below is not exhaustive, and investors should read the “Risk

Factors” in “Item 1.A.: Risk Factors” of our most recent Annual Report on Form 10-K in full.

| ● | We

are a developmental stage biopharmaceutical company with a history of operating losses, with no product candidate that generates revenue

and as such we are not currently profitable, do not expect to become profitable in the near future, may never become profitable and as

a result may need to wind up our business and operation. |

| ● | We

will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could

force us to delay, limit, reduce or terminate our product development or commercialization efforts. |

| ● | Our

business strategy may not be successful. |

| ● | If

we breach certain provisions of our 24 million Euro finance agreement with the EIB it could result in the EIB accelerating the loans

thereunder and exercising secured creditor remedies over collateral securing those loans, and that collateral consists of substantially

all of our assets. The exercise of such remedies may have a material adverse effect on our company. We do not have control over certain

events that constitute a breach of this finance documentation. |

| ● | We

are highly dependent upon our ability to enter into agreements with partners to develop, commercialize, and market any current and future

product candidate(s) or enter into other strategic partnerships; |

| ● | Raising

additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our

technologies or product candidate(s); |

| ● | Our

novel nanosized antibodies, also known as VHH-antibodies, Nanobodies or NanoAbs, represent a relatively new approach to treating diseases,

and we must overcome significant challenges in order to successfully develop, commercialize and manufacture product candidates based

on this technology. |

| ● | Clinical

trials are very expensive, time-consuming and difficult to design and implement, and, as a result, we may suffer delays or suspensions

in future trials which would have a material adverse effect on our ability to generate revenues. |

| ● | Positive

results from any clinical trials we conduct may not be predictive of the results in later clinical trials of current and future product

candidates, and the results of any clinical trials we conduct may not be replicated in additional clinical trials that we may be required

to conduct, which could result in development delays or a failure to obtain marketing approval. |

| ● | We

may be unsuccessful in adapting our Covid-19 NanoAbs to protect against variants of COVID-19. Furthermore, our ability to commercialize

our Covid-19 NanoAbs may be adversely affected to the extent that the coronavirus disease evolves worldwide. |

We

may not be successful in finding a partner to further develop our pre-clinical stage COVID19 program. Such partners may be commercial,

pharmaceutical companies or governmental agencies. In such case, we may not have sufficient capital to take the COVID19 program to clinical

trials.

| ● | We

may not be successful in developing our anti-IL-17 NanoAbs for the treatment of autoimmune diseases, such as plaque psoriasis, psoriatic

arthritis and Hidradenitis suppurativa (HS). |

| ● | If

we are not successful in discovering, developing and commercializing current and future product candidates, our ability to expand our

business and achieve our strategic objectives may be impaired. |

| ● | Under

the collaboration agreement with MPG, we have the option to in-license up to 9 total NanoAbs. To date, we have licensed anti-COVID-19

NanoAbs and anti-IL-17 NanoAbs. We may be unsuccessful in in-licensing, developing, and/or commercializing additional NanoAbs from MPG. |

| ● | We

are a developmental stage biopharmaceutical company with no product candidate(s) in clinical development or approved, which makes it

difficult to assess our future viability. |

| ● | We

face significant competition. If we cannot successfully compete with new or existing product candidate(s), our marketing and sales will

suffer, and we may never be profitable. |

| ● | Our

NanoAbs program is based on an exclusive, worldwide license from the Max Planck Society, and we could lose our rights to this license

if a dispute with MPG arises or if we fail to comply with the financial and other terms of the license. |

| ● | We

recently announced our plans to utilize our manufacturing site and laboratories by launching a Contract Development and Manufacturing

Organization business unit. There is no guarantee that our strategy will succeed, that we will be able to ramp up operations, that we

will become profitable. |

| ● | We

are currently non-compliant with Nasdaq Listing Rule 5550(b) regarding minimum stockholders’ equity requirement for continued listing

on the Nasdaq Capital Market. If we do not regain compliance, and if we become non-compliant with other Nasdaq Listing Rules, we may

be delisted from the Nasdaq exchange. |

You

should review carefully the risks and uncertainties described under the heading “Risk Factors” in this prospectus for a discussion

of these and other risks that relate to our business and investing in our securities. The forward-looking statements contained in this

prospectus are expressly qualified in their entirety by this cautionary statement. Except as required by law, we undertake no obligation

to update publicly any forward-looking statements after the date of this prospectus to conform these statements to actual results or

to changes in our expectations.

CAPITALIZATION

The

table below sets forth our total capitalization as of June 30, 2023. The financial data in the following table should be read together

with our financial statements and notes thereto incorporated by reference herein.

| | |

As of June30,

2023 | |

| | |

Actual | |

| | |

(in thousands) | |

| | |

| |

| Ordinary shares, no par value | |

$ | - | |

| Additional paid-in capital | |

| 117,740 | |

| Accumulated deficit | |

| (123,112 | ) |

| Accumulated other comprehensive loss | |

| (1,740 | ) |

| Total shareholders’ deficit | |

| (7,112 | ) |

| Total capitalization | |

$ | 18,009 | |

OFFER

AND LISTING DETAILS

Our

ADSs have been trading on the Nasdaq Capital Market under the symbol “BVXV” since May 18, 2015.

USE

OF PROCEEDS

Except

as otherwise indicated in an accompanying prospectus supplement, we currently intend that the net proceeds from the sale of securities

will be used for general corporate purposes, which may include working capital, research and development activities, regulatory matters,

or other related purposes, and pre-commercialization and commercialization activities. Additional information relating thereto may

be set forth in any applicable prospectus supplement.

DESCRIPTION

OF ORDINARY SHARES

The

following description of our share capital is a summary of the material terms of our articles of association and Israeli corporate law

regarding our ordinary shares and the holders thereof. This description contains all material information concerning our ordinary shares

but does not purport to be complete.

For

a complete description, you should read our articles of association, a copy of which has been filed with the SEC as an exhibit to the

registration statement of which this prospectus forms a part. The following description is qualified in its entirety by reference to

our articles of association and applicable law.

General

As

of July 31, 2023 our authorized share capital consists of 20,000,000,000 ordinary shares, no par value. As of July 31, 2023 there were

3,651,927 ADSs (representing 1,460,770,784 Ordinary Shares) issued and outstanding. As of July 31, 2023, we had issued and outstanding,

outstanding warrants to purchase an aggregate of 2,279,700 ADSs with the latest expiration date of these warrants being between the years

2023 and 2025. We also have options to purchase an aggregate of 72,550 ADSs under the Employees Option Plan with the latest expiration

date of the year 2033. In addition, as of July 31, 2023, we had an aggregate of 204,897 RSUs ADSs.

All

of our outstanding ordinary shares are validly issued, fully paid and non-assessable. Our ordinary shares are not redeemable and do not

have any preemptive rights. Our ordinary shares are not listed on any national stock exchange. No preferred shares are issuable, issued

and outstanding.

Registration

Number and Purposes of the Company

Our

registration number with the Israeli Registrar of Companies is 51-343610-5. Our purpose as set forth in our articles of association is

to engage in any lawful activity, including every lawful purpose in the Biotechnology field.

Voting

Rights

Holders

of our ordinary shares have one vote for each ordinary share held on all matters submitted to a vote of shareholders at a shareholder

meeting. Shareholders may vote at shareholder meetings either in person, by proxy or by written ballot. Israeli law does not allow public

companies to adopt shareholder resolutions by means of written consent in lieu of a shareholder meeting. The board of directors shall

determine and provide a record date for each shareholders meeting and all shareholders at such record date may vote. Unless stipulated

differently in the Companies Law or in the articles of association, all shareholders’ resolutions shall be approved by a simple

majority vote. Except as otherwise disclosed herein, an amendment to our articles of association requires the prior approval of the holders

of at least 75% of our shares, represented and voting at a general meeting.

Transfer

of Shares

Our

ordinary shares that are fully paid for are issued in registered form and may be freely transferred under our articles of association,

unless the transfer is restricted or prohibited by applicable law or the rules of a stock exchange on which the shares are traded. The

ownership or voting of our ordinary shares by non-residents of Israel is not restricted in any way by our articles of association or

Israeli law, except for ownership by nationals of some countries that are, or have been, in a state of war with Israel.

The

Powers of the Directors

Our

board of directors shall direct the Company’s policy and shall supervise the performance of the Company’s Chief Executive

Officer. Pursuant to the Companies Law and our articles of association, our board of directors may exercise all powers and take all actions

that are not required under law or under our articles of association to be exercised or taken by our shareholders, including the power

to borrow money for company purposes.

Amendment

of share capital

Our

articles of association enable us to increase or reduce our share capital. Any such changes are subject to the provisions of the Companies

Law and must be approved by a resolution duly passed by our shareholders at a general or special meeting by voting on such change in

the capital. In addition, transactions that have the effect of reducing capital, such as the declaration and payment of dividends in

the absence of sufficient retained earnings and profits and an issuance of shares for less than their nominal value, require a resolution

of our board of directors and court approval.

Dividends

Under

Israeli law, we may declare and pay dividends only if, upon the determination of our board of directors, there is no reasonable concern

that the distribution will prevent us from being able to meet the terms of our existing and foreseeable obligations as they become due.

Under the Companies Law, the distribution amount is further limited to the greater of retained earnings or earnings generated over the

two most recent years legally available for distribution according to our then last reviewed or audited financial statements, provided

that the date of the financial statements is not more than six months prior to the date of distribution. In the event that we do not

have retained earnings or earnings generated over the two most recent years legally available for distribution, we may seek the approval

of the court in order to distribute a dividend. The court may approve our request if it is determines that there is no reasonable concern

that the payment of a dividend will prevent us from satisfying our existing and foreseeable obligations as they become due.

Election

of Directors

Our

ordinary shares do not have cumulative voting rights for the election of directors. As a result, the holders of a majority of the voting

power represented at a shareholders meeting have the power to elect all of our directors, subject to the special approval requirements

for external directors under the Israeli Companies Law.

Under

our articles of association, our board of directors must consist of at least three and not more than eleven directors, including any

external directors required by Israeli law. Our board of directors currently consists of ten members, including our non-executive Chairman

of the board of directors. Our directors, excluding the external directors, may be divided into three groups, as nearly equal in number

as practicable, with staggered three-year terms. group A, group B and group C shall each consist of one-third of the directors, constituting

our entire board of directors (other than the external directors). At each annual meeting, the three-year duration of service of one

group of directors shall expire and the directors of such group will stand for election. Each of the directors or the successors elected

to replace the directors of a group whose term shall have expired at such annual meeting shall be elected to hold office until the third

annual meeting held after the date of his or her election and until his or her respective successor is elected. If no directors are appointed

at the annual meeting, the directors appointed at the previous annual meeting will continue their service. Directors whose service period

has ended may be appointed again.

Shareholder

Meetings

Under

Israeli law, we are required to hold an annual general meeting of our shareholders once every calendar year and in any event no later

than 15 months after the date of the previous annual general meeting. All meetings other than the annual general meeting of shareholders

are referred to as special meetings. Our board of directors may call special meetings whenever it sees fit, at such time and place, within

or outside of Israel, as it may determine. In addition, the Companies Law and our articles of association provide that our board of directors

is required to convene a special meeting upon the written request of (i) any two of our directors or one quarter of the directors then

in office; or (ii) one or more shareholders holding, in the aggregate either (a) 5% of our issued share capital and 1% of our outstanding

voting power, or (b) 5% of our outstanding voting power.

Subject

to the provisions of the Companies Law and the regulations promulgated thereunder, shareholders entitled to participate and vote at general

meetings are the shareholders of record on a date to be decided by the board of directors. Furthermore, the Companies Law and our articles

of association require that resolutions regarding the following matters must be passed at a general meeting of our shareholders:

| |

● |

amendments

to our articles of association; |

| |

● |

appointment

or termination of our auditors; |

| |

● |

appointment

of directors and appointment and dismissal of external directors; |

| |

● |

approval

of acts and transactions requiring general meeting approval pursuant to the Companies Law; |

| |

● |

director

compensation, indemnification and change of the principal executive officer; |

| |

● |

increases

or reductions of our authorized share capital; |

| |

● |

the

exercise of our board of director’s powers by a general meeting, if our board of directors is unable to exercise its powers

and the exercise of any of its powers is required for our proper management. |

| |

● |

authorizing

the chairman of the board of directors or his relative to act as the company’s chief executive officer or act with such authority;

or authorize the company’s chief executive officer or his relative to act as the chairman of the board of directors or act

with such authority. |

The

Companies Law requires that a notice of any annual or special shareholders meeting be provided at least 21 days prior to the meeting

and if the agenda of the meeting includes the appointment or removal of directors, the approval of transactions with office holders or

interested or related parties, or an approval of a merger, notice must be provided at least 35 days prior to the meeting.

Quorum

The

quorum required for our general meetings of shareholders consists of one or more shareholders present in person, by proxy or by other

voting instrument in accordance with the Companies Law who hold or represent, in the aggregate, at least 10% of the total outstanding

voting rights, within half an hour from the appointed time.

A

meeting adjourned for lack of a quorum is adjourned to the same day in the following week at the same time and place or on a later date

if so specified in the summons or notice of the meeting. At the reconvened meeting, any number of our shareholders present in person

or by proxy shall constitute a lawful quorum.

Resolutions

Our

articles of association provide that all resolutions of our shareholders require a simple majority vote, unless otherwise required by

applicable law or by another provision of the articles of association.

Israeli

law provides that a shareholder of a public company may vote in a meeting and in a class meeting by means of a written ballot in which

the shareholder indicates how he or she votes on resolutions relating to the following matters:

| |

● |

an

appointment or removal of directors; |

| |

|

|

| |

● |

an

approval of transactions with office holders or interested or related parties, that require shareholder approval; |

| |

● |

an

approval of a merger; |

| |

● |

authorizing

the chairman of the board of directors or his relative to act as the company’s chief executive officer or act with such authority;

or authorize the company’s chief executive officer or his relative to act as the chairman of the board of directors or act

with such authority; |

| |

|

|

| |

● |

any

other matter that is determined in the articles of association to be voted on by way of a written ballot. Our articles of association

do not stipulate any additional matters; and |

| |

|

|

| |

● |

other

matters which may be prescribed by Israel’s Minister of Justice. |

| |

|

|

The

provision allowing the vote by written ballot does not apply where the voting power of the controlling shareholder is sufficient to determine

the vote.

The

Companies Law provides that a shareholder, in exercising his or her rights and performing his or her obligations toward the company and

its other shareholders, must act in good faith and in a customary manner, and avoid abusing his or her power. This is required when voting

at general meetings on matters such as changes to the articles of association, increasing the company’s registered capital, mergers

and approval of certain interested or related party transactions. A shareholder also has a general duty to refrain from depriving any

other shareholder of its rights as a shareholder. In addition, any controlling shareholder, any shareholder who knows that its vote can

determine the outcome of a shareholder vote and any shareholder who, under such company’s articles of association, can appoint

or prevent the appointment of an office holder or other power towards the company, is required to act with fairness towards the company.

The Companies Law does not describe the substance of this duty except that the remedies generally available upon a breach of contract

will also apply to a breach of the duty to act with fairness, and, to the best of our knowledge, there is no binding case law that addresses

this subject directly.

Under

the Companies Law, unless provided otherwise in a company’s articles of association, a resolution at a shareholders meeting requires

approval by a simple majority of the voting rights represented at the meeting, in person, by proxy or written ballot, and voting on the

resolution. Generally, a resolution for the voluntary winding up of the company requires the approval of holders of 75% of the voting

rights represented at the meeting, in person, by proxy or by written ballot and voting on the resolution.

In

the event of our liquidation, after satisfaction of liabilities to creditors, our assets will be distributed to the holders of our ordinary

shares in proportion to their shareholdings. This right, as well as the right to receive dividends, may be affected by the grant of preferential

dividend or distribution rights to the holders of a class of shares with preferential rights that may be authorized in the future.

Access

to Corporate Records

Under

the Companies Law, all shareholders of a company generally have the right to review minutes of the company’s general meetings,

its shareholders register and principal shareholders register, articles of association, financial statements and any document it is required

by law to file publicly with the Israeli Companies Registrar and the ISA. Any of our shareholders may request to review any document

in our possession that relates to any action or transaction with a related party, interested party or office holder that requires shareholder

approval under the Companies Law. We may deny a request to review a document if we determine that the request was not made in good faith,

that the document contains a commercial secret or a patent or that the document’s disclosure may otherwise prejudice our interests.

Acquisitions

under Israeli Law

Full

Tender Offer

A

person wishing to acquire shares of a public Israeli company and who would as a result hold over 90% of the target company’s issued

and outstanding share capital is required by the Companies Law to make a tender offer to all of the company’s shareholders for

the purchase of all of the issued and outstanding shares of the company. A person wishing to acquire shares of a public Israeli company

and who would as a result hold over 90% of the issued and outstanding share capital of a certain class of shares is required to make

a tender offer to all of the shareholders who hold shares of the same class for the purchase of all of the issued and outstanding shares

of the same class. If the shareholders who do not accept the offer hold less than 5% of the issued and outstanding share capital of the

company or of the applicable class, all of the shares that the acquirer offered to purchase will be transferred to the acquirer by operation

of law (provided that a majority of the offerees that do not have a personal interest in such tender offer shall have approved the tender

offer except that if the total votes to reject the tender offer represent less than 2% of the company’s issued and outstanding

share capital, in the aggregate, approval by a majority of the offerees that do not have a personal interest in such tender offer is

not required to complete the tender offer). However, a shareholder that had its shares so transferred may petition the court within six

months from the date of acceptance of the full tender offer, whether or not such shareholder agreed to the tender or not, to determine

whether the tender offer was for less than fair value and whether the fair value should be paid as determined by the court unless the

acquirer stipulated in the tender offer that a shareholder that accepts the offer may not seek appraisal rights, so long as prior to

the acceptance of the full tender offer, the acquirer and the company disclosed the information required by law in connection with the

full tender offer. If the shareholders who did not accept the tender offer hold 5% or more of the issued and outstanding share capital

of the company or of the applicable class, the acquirer may not acquire shares of the company that will increase its holdings to more

than 90% of the company’s issued and outstanding share capital or of the applicable class from shareholders who accepted the tender

offer.

Special

Tender Offer

The

Companies Law provides that an acquisition of shares of a public Israeli company must be made by means of a special tender offer if as

a result of the acquisition the purchaser would become a holder of 25% or more of the voting rights in the company, unless one of the

exemptions in the Companies Law is met. This rule does not apply if there is already another holder of at least 25% of the voting rights

in the company. Similarly, the Companies Law provides that an acquisition of shares in a public company must be made by means of a tender

offer if as a result of the acquisition the purchaser would become a holder of 45% or more of the voting rights in the company, if there

is no other shareholder of the company who holds 45% or more of the voting rights in the company, unless one of the exemptions in the

Companies Law is met.

A

special tender offer must be extended to all shareholders of a company, but the offeror is not required to purchase shares representing

more than 5% of the voting power attached to the company’s outstanding shares, regardless of how many shares are tendered by shareholders.

A special tender offer may be consummated only if (i) at least 5% of the voting power attached to the company’s outstanding shares

will be acquired by the offeror and (ii) the number of shares tendered in the offer exceeds the number of shares whose holders objected

to the offer.

If

a special tender offer is accepted, then the purchaser or any person or entity controlling it or under common control with the purchaser

or such controlling person or entity may not make a subsequent tender offer for the purchase of shares of the target company and may

not enter into a merger with the target company for a period of one year from the date of the offer, unless the purchaser or such person

or entity undertook to effect such an offer or merger in the initial special tender offer.

Under

regulations enacted pursuant to the Companies Law, the above special tender offer requirements may not apply to companies whose shares

are listed for trading on a foreign stock exchange if, among other things, the relevant foreign laws or the rules of the stock exchange,

include provisions limiting the percentage of control which may be acquired or that the purchaser is required to make a tender offer

to the public. However, the Israeli Securities Authority’s opinion is that such leniency does not apply with respect to companies

whose shares are listed for trading on stock exchanges in the United States, including the NASDAQ Capital Market, which do not provide

for sufficient legal restrictions on obtaining control or an obligation to make a tender offer to the public, therefore the special tender

offer requirements shall apply to such companies.

Merger

The

Companies Law permits merger transactions if approved by each party’s board of directors and, unless certain requirements described

under the Companies Law are met, a majority of each party’s shares voted on the proposed merger at a shareholders’ meeting

called with at least 35 days’ prior notice.

For

purposes of the shareholder vote, unless a court rules otherwise, the merger will not be deemed approved if a majority of the shares

represented at the shareholders meeting that are held by parties other than the other party to the merger, or by any person who holds

25% or more of the outstanding shares or the right to appoint 25% or more of the directors of the other party, vote against the merger.

If the transaction would have been approved but for the separate approval of each class or the exclusion of the votes of certain shareholders

as provided above, a court may still approve the merger upon the request of holders of at least 25% of the voting rights of a company,

if the court holds that the merger is fair and reasonable, taking into account the value of the parties to the merger and the consideration

offered to the shareholders.

Upon

the request of a creditor of either party to the proposed merger, the court may delay or prevent the merger if it concludes that there

exists a reasonable concern that, as a result of the merger, the surviving company will be unable to satisfy the obligations of any of

the parties to the merger, and may further give instructions to secure the rights of creditors.

In

addition, a merger may not be completed unless at least 50 days have passed from the date that a proposal for approval of the merger

was filed by each party with the Israeli Registrar of Companies and 30 days have passed from the date the merger was approved by the

shareholders of each party.

Anti-Takeover

Measures

The

Companies Law allows us to create and issue shares having rights different from those attached to our ordinary shares, including shares

providing certain preferred rights, distributions or other matters and shares having preemptive rights. As of the date of this annual

report, we do not have any authorized or issued shares other than our ordinary shares. In the future, if we do create and issue a class

of shares other than ordinary shares, such class of shares, depending on the specific rights that may be attached to them, may delay

or prevent a takeover or otherwise prevent our shareholders from realizing a potential premium over the market value of their ordinary

shares. The authorization of a new class of shares will require an amendment to our articles of association which requires the prior

approval of the holders of at least 75% of our shares at a general meeting. In addition, the rules and regulations of the TASE also limit

the terms permitted with respect to a new class of shares and prohibit any such new class of shares from having voting rights. Shareholders

voting in such meeting will be subject to the restrictions provided in the Companies Law as described above.

Transfer

Agent and Depositary

The

transfer agent and registrar for our ordinary shares is Vstock Transfer, LLC. Our ADRs were issued pursuant to a Depositary Agreement

entered into with The Bank of New York Mellon., which acts as depositary.

DESCRIPTION

OF AMERICAN DEPOSITARY SHARES

A

description of the ADSs, each of which represents four hundred (400) of our Ordinary Shares, can be found in Exhibit 4.1 to our Annual

Report on Form 10-K filed with the SEC on April 17, 2023.

DESCRIPTION

OF WARRANTS

We

may issue warrants to purchase ADS and/or Ordinary Shares. Warrants may be issued independently or together with any other securities

and may be attached to, or separate from, such securities. We will evidence each series of warrants by warrant certificates that we may

issue under a separate agreement. We may enter into a warrant agreement with a warrant agent. We may also choose to act as our own warrant

agent. We will indicate the name and address of any such warrant agent in the applicable prospectus supplement relating to a particular

series of warrants. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement

will be set forth in the applicable prospectus supplement.

The

applicable prospectus supplement will describe the following terms of any warrants in respect of which this prospectus is being delivered:

|

● |

the

title of such warrants; |

| |

|

|

| |

● |

the

aggregate number of such warrants; |

| |

|

|

| |

● |

the

price or prices at which such warrants will be issued and exercised; |

| |

|

|

| |

● |

the

currency or currencies in which the price of such warrants will be payable; |

| |

|

|

| |

● |

the

securities purchasable upon exercise of such warrants; |

| |

|

|

| |

● |

the

date on which the right to exercise such warrants shall commence and the date on which such right shall expire; |

| |

|

|

| |

● |

if

applicable, the minimum or maximum amount of such warrants which may be exercised at any one time; |

| |

|

|

| |

● |

if

applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued

with each such security; |

| |

|

|

| |

● |

if

applicable, the date on and after which such warrants and the related securities will be separately transferable; |

| |

|

|

| |

● |

information

with respect to book-entry procedures, if any; |

| |

|

|

| |

● |

any

material Israeli and United States federal income tax consequences; |

| |

|

|

| |

● |

the

anti-dilution provisions of the warrants, if any; and |

| |

|

|

| |

● |

any

other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants. |

Amendments

and Supplements to Warrant Agreement

We

and the warrant agent may amend or supplement the warrant agreement for a series of warrants without the consent of the holders of the

warrants issued thereunder to effect changes that are not inconsistent with the provisions of the warrants and that do not materially

and adversely affect the interests of the holders of the warrants.

DESCRIPTION

OF SUBSCRIPTION RIGHTS

We

may issue subscription rights to purchase our Ordinary Shares and/or ADSs. These subscription rights may be issued independently or together

with any other security offered hereby and may or may not be transferable by the shareholder receiving the subscription rights in such

offering. In connection with any offering of subscription rights, we may enter into a standby arrangement with one or more underwriters

or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed

for after such offering.

The

prospectus supplement relating to any subscription rights we offer, if any, will, to the extent applicable, include specific terms relating

to the offering, including some or all of the following:

|

● |

the

price, if any, for the subscription rights; |

| |

|

|

| |

● |

the

exercise price payable for each ordinary share and/or ADS upon the exercise of the subscription rights; |

| |

|

|

| |

● |

the

number of subscription rights to be issued to each shareholder; |

| |

|

|

| |

● |

the

number and terms of the Ordinary Shares and/or ADSs which may be purchased per each subscription right; |

| |

|

|

| |

● |

the

extent to which the subscription rights are transferable; |

| |

|

|

| |

● |

any

other terms of the subscription rights, including the terms, procedures and limitations relating to the exchange and exercise of

the subscription rights; |

| |

● |

the

date on which the right to exercise the subscription rights shall commence, and the date on which the subscription rights shall expire; |

| |

|

|

| |

● |

the

extent to which the subscription rights may include an over-subscription privilege with respect to unsubscribed securities; and |

| |

|

|

| |

● |

if

applicable, the material terms of any standby underwriting or purchase arrangement which may be entered into by us in connection

with the offering of subscription rights. |

The

description in the applicable prospectus supplement of any subscription rights we offer will not necessarily be complete and will be

qualified in its entirety by reference to the applicable subscription right agreement, which will be filed with the SEC if we offer subscription

rights. For more information on how you can obtain copies of the applicable subscription right agreement if we offer subscription rights,

see “Where You Can Find More Information; Incorporation of Information by Reference” beginning on page 20. We urge you to

read the applicable subscription right agreement and any applicable prospectus supplement in their entirety.

DESCRIPTION

OF UNITS

We

may issue units comprised of one or more of the other securities that may be offered under this prospectus, in any combination. Each

unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit

will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide

that the securities included in the unit may not be held or transferred separately at any time, or at any time before a specified date.

The

prospectus supplement relating to any units we offer, if any, will, to the extent applicable, include specific terms relating to the

offering, including some or all of the following:

|

● |

the

material terms of the units and of the securities comprising the units, including whether and under what circumstances those securities

may be held or transferred separately; |

| |

|

|

| |

● |

any

material provisions relating to the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising

the units; and |

| |

|

|

| |

● |

any

material provisions of the governing unit agreement that differ from those described above. |

The

description in the applicable prospectus supplement of any units we offer will not necessarily be complete and will be qualified in its

entirety by reference to the applicable unit agreement, which will be filed with the SEC if we offer units. For more information on how

you can obtain copies of the applicable unit agreement if we offer units, see “Where You Can Find More Information; Incorporation

of Information by Reference” beginning on page 20. We urge you to read the applicable unit agreement and any applicable prospectus

supplement in their entirety.

PLAN

OF DISTRIBUTION

The

securities being offered by this prospectus may be sold:

| |

● |

to

or through one or more underwriters on a firm commitment or agency basis; |

| |

● |

through

put or call option transactions relating to the securities; |

| |

|

|

| |

● |

in

“at the market offerings” into an existing trading market, on an exchange or otherwise; |

| |

● |

through

broker-dealers; |

| |

● |

directly

to purchasers, through a specific bidding or auction process, on a negotiated basis or otherwise; |

| |

● |

through

any other method permitted pursuant to applicable law; or |

| |

● |

through

a combination of any such methods of sale. |

At

any time a particular offer of the securities covered by this prospectus is made, a revised prospectus or prospectus supplement, if required,

will be distributed which will set forth the aggregate amount of securities covered by this prospectus being offered and the terms of

the offering, including the name or names of any underwriters, dealers, brokers or agents, any discounts, commissions, concessions and

other items constituting compensation from us and any discounts, commissions or concessions allowed or reallowed or paid to dealers.

Such prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a

part, will be filed with the SEC to reflect the disclosure of additional information with respect to the distribution of the securities

covered by this prospectus. In order to comply with the securities laws of certain states, if applicable, the securities sold under this

prospectus may only be sold through registered or licensed broker-dealers. In addition, in some states the securities may not be sold

unless they have been registered or qualified for sale in the applicable state or an exemption from registration or qualification requirements

is available and is complied with.

The

distribution of securities may be effected from time to time in one or more transactions, including block transactions and transactions

on the Nasdaq Capital Market or any other organized market where the securities may be traded. The securities may be sold at a fixed

price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices relating to the prevailing market

prices or at negotiated prices. The consideration may be cash or another form negotiated by the parties. Agents, underwriters or broker-dealers

may be paid compensation for offering and selling the securities. That compensation may be in the form of discounts, concessions or commissions

to be received from us or from the purchasers of the securities. Any dealers and agents participating in the distribution of the securities

may be deemed to be underwriters, and compensation received by them on resale of the securities may be deemed to be underwriting discounts.

If any such dealers or agents were deemed to be underwriters, they may be subject to statutory liabilities under the Securities Act.

Agents

may from time to time solicit offers to purchase the securities. If required, we will name in the applicable prospectus supplement any

agent involved in the offer or sale of the securities and set forth any compensation payable to the agent. Unless otherwise indicated

in the prospectus supplement, any agent will be acting on a best efforts basis for the period of its appointment. Any agent selling the

securities covered by this prospectus may be deemed to be an underwriter, as that term is defined in the Securities Act, of the securities.

If

underwriters are used in a sale, securities will be acquired by the underwriters for their own account and may be resold from time to

time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined

at the time of sale, or under delayed delivery contracts or other contractual commitments. Securities may be offered to the public either

through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters.

If an underwriter or underwriters are used in the sale of securities, an underwriting agreement will be executed with the underwriter

or underwriters, as well as any other underwriter or underwriters, with respect to a particular underwritten offering of securities,

and will set forth the terms of the transactions, including compensation of the underwriters and dealers and the public offering price,

if applicable. The prospectus and prospectus supplement will be used by the underwriters to resell the securities.

If

a dealer is used in the sale of the securities, we or an underwriter will sell the securities to the dealer, as principal. The dealer

may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale. To the extent required,

we will set forth in the prospectus supplement the name of the dealer and the terms of the transactions.

We

may directly solicit offers to purchase the securities and may make sales of securities directly to institutional investors or others.

These persons may be deemed to be underwriters within the meaning of the Securities Act with respect to any resale of the securities.

To the extent required, the prospectus supplement will describe the terms of any such sales, including the terms of any bidding or auction

process, if used.

Agents,

underwriters and dealers may be entitled under agreements which may be entered into with us to indemnification by us against specified

liabilities, including liabilities incurred under the Securities Act, or to contribution by us to payments they may be required to make

in respect of such liabilities. If required, the prospectus supplement will describe the terms and conditions of the indemnification

or contribution. Some of the agents, underwriters or dealers, or their affiliates may be customers of, engage in transactions with or

perform services for us or our subsidiaries.

Any

person participating in the distribution of securities registered under the registration statement that includes this prospectus will

be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the applicable SEC rules

and regulations, including, among others, Regulation M, which may limit the timing of purchases and sales of any of our securities by

that person. Furthermore, Regulation M may restrict the ability of any person engaged in the distribution of our securities to engage

in market-making activities with respect to our securities. These restrictions may affect the marketability of our securities and the

ability of any person or entity to engage in market-making activities with respect to our securities.

Certain

persons participating in an offering may engage in over-allotment, stabilizing transactions, short-covering transactions, penalty bids

and other transactions that stabilize, maintain or otherwise affect the price of the offered securities. These activities may maintain

the price of the offered securities at levels above those that might otherwise prevail in the open market, including by entering stabilizing

bids, effecting syndicate covering transactions or imposing penalty bids, each of which is described below.

| |

● |

A

stabilizing bid means the placing of any bid, or the effecting of any purchase, for the purpose of pegging, fixing or maintaining

the price of a security. |

| |

● |

A

syndicate covering transaction means the placing of any bid on behalf of the underwriting syndicate or the effecting of any purchase

to reduce a short position created in connection with the offering. |

| |

● |

A

penalty bid means an arrangement that permits the managing underwriter to reclaim a selling concession from a syndicate member in

connection with the offering when offered securities originally sold by the syndicate member are purchased in syndicate covering

transactions. |

These

transactions may be effected on an exchange or automated quotation system, if the securities are listed on that exchange or admitted

for trading on that automated quotation system, or in the over-the-counter market or otherwise.

If

so indicated in the applicable prospectus supplement, we will authorize agents, underwriters or dealers to solicit offers from certain

types of institutions to purchase offered securities from us at the public offering price set forth in such prospectus supplement pursuant

to delayed delivery contracts providing for payment and delivery on a specified date in the future. Such contracts will be subject only

to those conditions set forth in the prospectus supplement and the prospectus supplement will set forth the commission payable for solicitation

of such contracts.

In

addition, our ADSs may be issued upon conversion of or in exchange for debt securities or other securities.

Any

underwriters to whom offered securities are sold for public offering and sale may make a market in such offered securities, but such

underwriters will not be obligated to do so and may discontinue any market making at any time without notice. The offered securities

may or may not be listed on a national securities exchange. No assurance can be given that there will be a market for the offered securities.

Any

securities that qualify for sale pursuant to Rule 144 or Regulation S under the Securities Act, may be sold under Rule 144 or Regulation

S rather than pursuant to this prospectus.

To

the extent that we make sales to or through one or more underwriters or agents in at-the-market offerings, we will do so pursuant to

the terms of a distribution agreement between us and the underwriters or agents. If we engage in at-the-market sales pursuant to a distribution

agreement, we will sell securities to or through one or more underwriters or agents, which may act on an agency basis or on a principal

basis. During the term of any such agreement, we may sell securities on a daily basis in exchange transactions or otherwise as we agree

with the underwriters or agents. The distribution agreement will provide that any securities sold will be sold at prices related to the

then prevailing market prices for ADSs. Therefore, exact figures regarding proceeds that will be raised or commissions to be paid cannot

be determined at this time and will be described in a prospectus supplement. Pursuant to the terms of the distribution agreement, we

also may agree to sell, and the relevant underwriters or agents may agree to solicit offers to purchase, blocks of ADSs or other securities.

The terms of each such distribution agreement will be set forth in more detail in a prospectus supplement to this prospectus.

In

connection with offerings made through underwriters or agents, we may enter into agreements with such underwriters or agents pursuant

to which we receive our outstanding securities in consideration for the securities being offered to the public for cash. In connection

with these arrangements, the underwriters or agents may also sell securities covered by this prospectus to hedge their positions in these

outstanding securities, including in short sale transactions. If so, the underwriters or agents may use the securities received from

us under these arrangements to close out any related open borrowings of securities.

We

may enter into derivative transactions with third parties or sell securities not covered by this prospectus to third parties in privately

negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, such third parties

(or affiliates of such third parties) may sell securities covered by this prospectus and the applicable prospectus supplement, including

in short sale transactions. If so, such third parties (or affiliates of such third parties) may use securities pledged by us or borrowed

from us or others to settle those sales or to close out any related open borrowings of shares, and may use securities received from us

in settlement of those derivatives to close out any related open borrowings of shares. The third parties (or affiliates of such third

parties) in such sale transactions will be underwriters and, if not identified in this prospectus, will be identified in the applicable

prospectus supplement (or a post-effective amendment).

We

may loan or pledge securities to a financial institution or other third party that in turn may sell the securities using this prospectus.

Such financial institution or third party may transfer its short position to investors in our securities or in connection with a simultaneous

offering of other securities offered by this prospectus or in connection with a simultaneous offering of other securities offered by

this prospectus.

LEGAL

MATTERS

Certain

legal matters with respect to Israeli law and with respect to the validity of the offered securities under Israeli law will be

passed upon for us by Goldfarb Gross Seligman & Co. Certain legal matters with respect to U.S. federal securities law and

New York law will be passed upon for us by Lucosky Brookman LLP.

EXPERTS

The

financial statements incorporated in this prospectus by reference to the annual report on Form 10-K for the year ended December 31, 2022

have been so incorporated in reliance on the report of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, an independent

registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form F-3 under the Securities Act, with respect to the securities offered by this

prospectus. However, as is permitted by the rules and regulations of the SEC, this prospectus, which is part of our registration statement

on Form F-3, omits certain non-material information, exhibits, schedules and undertakings set forth in the registration statement. For

further information about us, and the securities offered by this prospectus, please refer to the registration statement.

We

are subject to the reporting requirements of the Exchange Act that are applicable to a foreign private issuer. In accordance with the

Exchange Act, we file reports, including annual reports on Form 20-F. We also furnish to the SEC under cover of Form 6-K material information

required to be made public in Israel, filed with and made public by any stock exchange or distributed by us to our shareholders.

The

SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, such

as us, that file electronically with the SEC (http://www.sec.gov).

As

a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements

to shareholders and our officers, directors and principal shareholders are exempt from the “short-swing profits” reporting

and liability provisions contained in Section 16 of the Exchange Act and related Exchange Act rules.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

We

file annual and special reports and other information with the SEC (File Number 001-37353). These filings contain important information

which does not appear in this prospectus. The SEC allows us to “incorporate by reference” information into this prospectus,

which means that we can disclose important information to you by referring you to other documents which we have filed or will file with

the SEC. We are incorporating by reference in this prospectus the documents listed below and all amendments or supplements we may file

to such documents, as well as any future filings we may make with the SEC on Form 20-F under the Exchange Act before the time that all

of the securities offered by this prospectus have been sold or de-registered:

| |

● |

our Annual Report on Form 10-K for the fiscal year ended on December 31, 2022, filed with the SEC on April 17, 2023. |

| |

● |

reports

on Form 6-K furnished to the Commission on July 3, 2023 (two reports), July 5, 2023 (relating to our Annual General Meeting of

Shareholders), July 12, 2023, August 1, 2023 and August 11, 2023 and reports on Form 6-K/A furnished to the Commission on August 14, 2023 and August 18, 2023. |

| |

● |

the description of our ordinary shares contained under the heading “Item 1. Description of Registrant’s Securities to be Registered” in our registration statement on Form 8-A, as filed with the SEC on April 20, 2015, including any subsequent amendment or any report filed for the purpose of updating such description. |

In

addition, any reports on Form 6-K submitted to the SEC by the registrant pursuant to the Exchange Act after the date of the initial registration

statement and prior to effectiveness of the registration statement that we specifically identify in such forms as being incorporated

by reference into the registration statement of which this prospectus forms a part and all subsequent annual reports on Form 20-F filed

after the effective date of this registration statement and prior to the termination of this offering and any reports on Form 6-K subsequently

submitted to the SEC or portions thereof that we specifically identify in such forms as being incorporated by reference into the registration

statement of which this prospectus forms a part, shall be considered to be incorporated into this prospectus by reference and shall be

considered a part of this prospectus from the date of filing or submission of such documents.

Certain

statements in and portions of this prospectus update and replace information in the above listed documents incorporated by reference.

Likewise, statements in or portions of a future document incorporated by reference in this prospectus may update and replace statements

in and portions of this prospectus or the above listed documents.

We

will provide you without charge, upon your written or oral request, a copy of any of the documents incorporated by reference in this

prospectus, other than exhibits to such documents which are not specifically incorporated by reference into such documents. Please direct

your written or telephone requests to BiondVax Pharmaceuticals Ltd., Jerusalem BioPark, 2nd Floor, Hadassah Ein Kerem Campus, Jerusalem,

Israel, Attn: Uri Ben Or, telephone number +972 8-930-2529. You may also obtain information about us by visiting our website at www.biondvax.com.

Information contained in our website is not part of this prospectus.

ENFORCEABILITY

OF CIVIL LIABILITIES

We

are incorporated under the laws of the State of Israel. Service of process upon us and upon our directors and officers and the Israeli

experts named in this prospectus, substantially all of whom reside outside the United States, may be difficult to obtain within the United

States. Furthermore, because substantially all of our assets and substantially all of our directors and officers are located outside

the United States, any judgment obtained in the United States against us or any of our directors and officers may not be collectible

within the United States.

We

have irrevocably appointed Puglisi & Associates as our agent to receive service of process in any action against us in any U.S. federal

or state court arising out of this offering or any purchase or sale of securities in connection with this offering. The address of our

agent is 850 Library Avenue, Suite 204, Newark, Delaware.

We have been informed by our legal counsel in Israel, Goldfarb Gross

Seligman & Co., that it may be difficult to initiate an action with respect to U.S. securities law in Israel. Israeli courts may refuse

to hear a claim based on an alleged violation of U.S. securities laws reasoning that Israel is not the most appropriate forum to hear

such a claim. In addition, even if an Israeli court agrees to hear a claim, it may determine that Israeli law and not U.S. law is applicable

to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proved as a fact by expert witnesses which

can be a time-consuming and costly process. Certain matters of procedure may also be governed by Israeli law.

Subject

to certain time limitations and legal procedures, Israeli courts may enforce a U.S. judgment in a civil matter which, subject to certain

exceptions, is non-appealable, including judgments based upon the civil liability provisions of the Securities Act and the Exchange Act

and including a monetary or compensatory judgment in a non-civil matter, provided that:

| |

● |

the

judgment was rendered by a court which was, according to the laws of the state of the court, competent to render the judgment; |

| |

● |

the

obligation imposed by the judgment is enforceable according to the rules relating to the enforceability of judgments in Israel and

the substance of the judgment is not contrary to public policy; and |

| |

● |

the

judgment is executory in the state in which it was given. |

Even