Exposes How Poor Governance and a Private

Family Business Mentality Have Driven Massive Underperformance for

Shareholders

Outlines a Clear Path to ~$40 Per Share and

~100% Upside Through Governance Reforms, Board Refreshment and

Operational Excellence

Plans to Nominate Highly Qualified, Independent

Director Candidates for Election to the Company’s Board

Visit www.FixDaktronics.com to View the

Presentation

Alta Fox Capital Management, LLC (together with its affiliates,

“Alta Fox” or “we”), the largest shareholder of Daktronics, Inc.

(NASDAQ: DAKT) (“Daktronics” or the “Company”) based on its

beneficial ownership interest on a fully converted basis of 11.7%

of the outstanding shares, today released a presentation that

details a clear path to unlocking the full potential of the

Company. The presentation, a similar version of which was delivered

by Alta Fox Founder and Managing Partner Connor Haley at the

Bloomberg Activism Forum 2024, can be accessed at

www.FixDaktronics.com.

The ‘Governance Discount’ at Daktronics

In the presentation, Alta Fox highlights its belief that

Daktronics is a high-quality, secular growth business that remains

severely undervalued today due to ineffective corporate governance.

Despite the Company’s position as an undisputed market leader with

revenues fueled by the expanding sports and live events market,

Daktronics’ second-generation leadership under Chief Executive

Officer and Chairman Reece Kurtenbach has driven a culture of

complacency and nepotism that has resulted in significant long-term

underperformance.

During Mr. Kurtenbach’s tenure as Chairman of the Board of

Directors (the “Board”), shareholders have endured irresponsible

financial stewardship, a significant trading discount to the

Company’s peer set and 195% underperformance versus the S&P

500.1 The Board has failed to hold Mr. Kurtenbach and his family

members accountable for their disappointing long-term performance

and has enabled the Company’s broken culture to go unfixed.

Alta Fox, which currently holds ~5x the number of shares held by

the entire Daktronics Board combined, believes shareholders cannot

trust the current Board to act in their best interests, as

evidenced by the Board’s embrace of worst-in-class governance

practices such as staggered director classes, a combined Chairman

and Chief Executive Officer role, and a poison pill. The Board has

allowed key management roles to be filled by relatives, with three

of the Company’s five named executive officers coming from the

Kurtenbach family.2

A History of Constructive Collaboration Met with

Resistance

Alta Fox has consistently sought to collaborate with Daktronics

to help the Company reach its full potential, only to be met with

resistance at every turn. Long before Daktronics publicly disclosed

its going-concern warning in December 2022, Alta Fox traveled to

South Dakota to meet with management and proactively offer

financing and guidance to address the Company’s financial

challenges. Unfortunately, management chose not to engage, forcing

the Company into a crisis that ultimately resulted in a

going-concern notice from its auditors and the need for rescue

financing. While Alta Fox stepped in to provide that critical

financing, this situation could have been entirely avoided had

Daktronics’ leadership worked with us proactively – not

reactively.

Despite Alta Fox's efforts to be constructive, Daktronics has

continued to ignore our recommendations, including advice to engage

a top-tier third-party investor relations firm to improve its

narrative to the market – a story that remains confused and

underwhelming. Examples of communication missteps abound:

- Instead of providing specific guidance, Daktronics has a

history of using vague language around a generic plan to “increase

profit margins,” positioning the Board and management to avoid

accountability for failing to hit targets.

- Management cites margin and return on invested capital targets

during earnings calls that fall below the Company’s current

performance levels, indicating that leadership lacks an

understanding of its own metrics.

- In the Q2 FY25 earnings release, Daktronics failed to include a

working link to the earnings call, leaving some investors

scrambling for access. During the call itself, management

referenced page numbers in its prepared remarks, despite the

investor deck lacking any slide numbers.

These recurring issues reflect a deeper problem: a Board with

minimal equity ownership and little accountability, perpetuating a

culture of complacency and neglect. While such a culture might be

tolerable in a privately held family business, Daktronics is a

public company with fiduciary responsibilities to its shareholders

that demand higher standards. In our view, these are

responsibilities that the Kurtenbach family and its preferred Board

are failing to uphold. Alta Fox has consistently identified these

inefficiencies and proposed solutions to address them. Despite

these constructive efforts, Daktronics’ leadership continues to

resist meaningful change, prioritizing entrenchment over

shareholders’ long-term best interests.

Alta Fox’s Recommended Path to ~$40 Per Share

Shareholders deserve better – and Alta Fox is committed to

delivering positive change, even if it means nominating director

candidates for election to the Board in 2025 and thereafter. By

modernizing its governance and embracing public company governance

norms, the Company can reignite consistent growth and sustained

profitability and ultimately produce superior shareholder value.

Alta Fox has outlined a highly credible path for Daktronics to

achieve ~$1.88 in FY28 EPS, potentially resulting in a ~$40 per

share price target. Alta Fox’s proposed path includes:

- Collaborating with Shareholders on a Meaningful Board

Refresh – Daktronics would benefit from working with

shareholders to add new, highly qualified directors to the Board to

address deep-rooted issues related to its governance, investor

communication and engagement, and value creation efforts.

Individuals added to the Board in recent years have failed to fix

these issues. Alta Fox plans to nominate highly qualified,

independent director candidates for election at the 2025 annual

shareholder meeting, unless Daktronics embraces our recent

recommendations.

- Instituting Modern Governance Practices – The Company’s

Board should immediately de-stagger, split the roles of Chairman

and Chief Executive Officer, remove the poison pill and align

management’s compensation with share price outperformance.

- Recruiting a Highly Qualified Chief Financial Officer –

In light of the Company’s prior material weaknesses and going

concern notice, the Board should prioritize the hiring of a Chief

Financial Officer who possesses public company experience and a

track record of success.

- Restoring Accountability for Management and Setting a

Merit-Based Culture – The Board should establish a clear

capital allocation framework that is aimed toward maximizing

shareholder value and ensure management initiates short- and

long-term guidance. By taking these steps, the Board can hold

management accountable based on its ability to allocate capital and

hit targets. This will also position Daktronics to be operated like

a publicly traded company, rather than a private family business

brimming with complacency, nepotism and a lack of sustained focus

on creating shareholder value.

- Improving Investor Engagement – Daktronics should

consistently participate in well-attended investor conferences and

create a clear investor narrative aided by sufficient sell-side

coverage. Of course, this will require hiring a Chief Financial

Officer with credibility and public market experience.

About Alta Fox

Founded in 2018 by Connor Haley, Alta Fox is a Texas-based

alternative asset management firm that employs a long-term focused

investment strategy to pursue exceptional risk-adjusted returns for

a diverse group of institutions and qualified individual clients.

Alta Fox focuses on identifying often overlooked and

under-the-radar opportunities across asset classes, market

capitalization ranges and sectors. Learn more by visiting

www.AltaFoxCapital.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,”

“expects,” “intends,” “believes,” “anticipates,” “plans,”

“estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other

variations on such terms or comparable terminology. Similarly,

statements that describe our objectives, plans or goals are

forward-looking. Forward-looking statements relate to future events

or future performance and involve known and unknown risks,

uncertainties, and other factors that may cause actual results,

levels of activity, performance or achievements or those of the

industry to be materially different from those expressed or implied

by any forward-looking statements. Daktronics, Inc., a South Dakota

corporation, has also identified additional risks relating to its

business in its public filings with the Securities and Exchange

Commission (the “SEC”). Alta Fox Capital Management, LLC (together

with its affiliates, “Alta Fox”), has based these forward-looking

statements on current expectations, assumptions, estimates,

beliefs, and projections. While Alta Fox believes these

expectations, assumptions, estimates, and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which involve factors or circumstances that are beyond Alta Fox’s

control. There can be no assurance that any idea or assumption

herein is, or will be proven, correct. If one or more of the risks

or uncertainties materialize, or if the underlying assumptions of

Alta Fox described herein prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements.

Accordingly, forward-looking statements should not be regarded as a

representation by Alta Fox that the future plans, estimates or

expectations contemplated will ever be achieved. You should not

rely upon forward-looking statements as a prediction of actual

results and actual results may vary materially from what is

expressed in or indicated by the forward-looking statements. Except

to the extent required by applicable law, Alta Fox will not

undertake and specifically declines any obligation to disclose the

results of any revisions that may be made to any projected results

or forward-looking statements herein to reflect events or

circumstances after the date of such projected results or

statements or to reflect the occurrence of anticipated or

unanticipated events.

Certain statements and information included herein have been

sourced from third parties. Alta Fox does not make any

representations regarding the accuracy, completeness or timeliness

of such third party statements or information. Except as may be

expressly set forth herein, permission to cite such statements or

information has neither been sought nor obtained from such third

parties. Any such statements or information should not be viewed as

an indication of support from such third parties for the views

expressed herein.

_________________________ 1 Source: Bloomberg. Comparison is

inclusive of all dividends. Underperformance versus other indices,

such as Russell 2000 (IWM), is also significant. 2 Chief Executive

Officer and Chairman Reece Kurtenbach is the son of Daktronics’

founder, while his brother is Vice President of Manufacturing, and

his sister serves as the effective Head of Human Resources and

Corporate Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210414208/en/

For Shareholders:

Alta Fox Investor Relations ir@altafoxcapital.com

or

Okapi Partners Bruce Goldfarb / Chuck Garske, 212-297-0720

info@okapipartners.com

For Media:

Longacre Square Partners Kate Sylvester / Bela Kirpalani,

646-386-0091 altafox@longacresquare.com

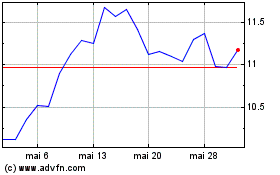

Daktronics (NASDAQ:DAKT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Daktronics (NASDAQ:DAKT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025