Intrusion Inc. (NASDAQ: INTZ), a leader in cyberattack prevention

solutions, announced today financial results for the fourth quarter

and full year ended December 31, 2021.

Recent Financial & Business Highlights:

- Fourth quarter revenue of $1.6 million was flat year-over-year;

full year 2021 revenue of $7.3 million was up 10%

year-over-year.

- INTRUSION Shield revenue represented 12% of total revenue in

the fourth quarter, consistent with third quarter 2021.

- The Company transitioned to an executive and partner led sales

structure, strengthening its sales channels, and implementing

processes to facilitate sales growth through premier channel

partnerships.

- Intrusion realized operational efficiencies in the quarter,

reducing operating expenses to the lowest level in 2021.

- The Company improved its financial flexibility by issuing an

unsecured note on March 10, 2022.

"We are pleased to deliver double-digit top-line growth for the

year in the face of several headwinds, while also continuing to

position the Company for future success and responsibly invest for

our sustained growth," said Tony Scott, CEO of Intrusion. "During

the quarter, we took swift action to better align our sales and

marketing resources, while also making the necessary investments to

ensure we are well positioned to participate in the growing secular

demand for cybersecurity threat protection. We are currently

engaged in 18 proof of concept demos for our INTRUSION Shield

product, which continues to trend in a positive direction.

Additionally, we are encouraged by new opportunities in our ongoing

consulting business, which performed well in 2021 despite a federal

continuing resolution. With the conclusion on the continuing

resolution, we are optimistic about our consulting business in

2022.”

“The cybersecurity landscape is constantly changing and the

number of zero-day attacks continues to increase and now accounts

for 60% of all cybersecurity threats. While INTRUSION Shield offers

considerable advantages today, we continuously strive to improve

our products and drive innovation. To meet the growing demand, we

are broadening the INTRUSION Shield product offering to include

cloud and endpoint solutions, while providing high availability,

high throughput solutions to satisfy evolving customer needs. As I

highlighted earlier in the year, we plan to roll out additional

capabilities for INTRUSION Shield, including a hardware-less,

cloud-based product. While we do not plan to unveil those products

until the second half of this year, development is on

schedule.”

“Moving forward, we remain focused on improving our messaging

and marketing efforts to highlight how INTRUSION Shield products

increase the value and effectiveness of existing cybersecurity

technologies that an organization already may have in place. We

will continue to emphasize value-added channel partners and utilize

our executive-led sales model to drive INTRUSION Shield's growth,

while also continuing to take action to improve our financial

flexibility and strengthen our balance sheet to satisfy our

operational and strategic objectives and ultimately generate

shareholder value.”

Fourth Quarter and Full Year Financial

Results

Revenue for the fourth quarter of 2021 was $1.6 million, in-line

with the $1.6 million for the fourth quarter of 2020. Full year

revenue of $7.3 million increased 10% compared to 2020.

The gross profit margin was 65% for the fourth quarter of 2021,

compared to 58% for the fourth quarter of 2020. The gross profit

margin for the full year was 64%, compared to 59% in 2020. The

improvement in the gross profit margin was primarily driven by

increased INTRUSION Shield sales.

Operating expenses in the fourth quarter of 2021 were $4.9

million, up 1% compared to the fourth quarter of 2020. Operating

expenses for the year were $24.1 million, up 132% from 2020,

primarily driven by higher sales and marketing expenses incurred in

the first three quarters of 2021. Fourth quarter operating expenses

were at the lowest levels in all of 2021, and operating expenses

are expected to be consistent with current levels throughout

2022.

The fourth quarter 2021 net loss was $3.9 million, or ($0.20)

per share, compared to a loss of $3.9 million, or ($0.23) per

share, for the fourth quarter of 2020. The difference in the

per-share amount is due to an increase in shares outstanding. The

full year 2021 net loss was $18.8 million, compared to a net loss

of $6.5 million in 2020.

As of December 31, 2021, cash and cash equivalents were $4.1

million, and working capital was $2.1 million.

Financing

Intrusion closed a financing where it sold a 7% unsecured note

under a securities purchase agreement with Streeterville Capital.

The aggregate principal amount of this note was $5.4 million, and

the Company received $5 million less certain reimbursed expenses.

Intrusion also received an option to sell a second 7% unsecured

note on similar terms as the first note. The Company's option to

sell the second note is subject to certain conditions, including

that, within 180 days of issuance, Intrusion obtains stockholder

approval under Nasdaq rules for the issuance of more than 19.99% of

outstanding common stock in connection with potential redemptions

of the Notes. Each note has an 18 Month maturity, and 6 months

after a note has been issued, the noteholder can submit a

redemption notice for up to $500,000 per note, which the Company

can choose to satisfy, subject to certain exceptions and

limitations, in cash, Common stock, or a combination of both.

Additionally, the Company’s at-the-market ("ATM") offering

remains in place. Proceeds from sales under the ATM program are

expected to finance our operating activities, invest in INTRUSION

Shield, as well as potential note repayments.

Conference Call

Intrusion’s management will host a conference call today at 4:00

P.M., CST. Interested investors can access the live call by dialing

1-888-330-2041, or 1-646-960-0151 for international callers, and

providing the following access code: 6774917. For those unable to

participate in the live conference call, a replay will be

accessible beginning tonight at 7:00 P.M. CST until March 24, 2022,

by dialing 1-800-770-2030, or 1-647-362-9199 for international

callers, and entering the following access code: 6774917.

Additionally, a live and archived audio webcast of the conference

call will be available at www.intrusion.com.

About Intrusion Inc.

Intrusion, Inc. is a cybersecurity company based in Plano,

Texas. The Company offers its customers access to their exclusive

threat intelligence database containing the historical data, known

associations, and reputational behavior of over 8.5 billion IP

addresses. After years of gathering global internet intelligence

and working exclusively with government entities, the company

released its first commercial product in 2021. INTRUSION Shield is

designed to allow businesses to incorporate a Zero Trust,

reputation-based security solution into their existing

infrastructure. INTRUSION Shield observes traffic flow and

instantly blocks known malicious or unknown connections from both

entering or exiting a network to help protect against Zero-Day and

ransomware attacks. Incorporating INTRUSION Shield into a network

can elevate an organization's overall security posture by enhancing

the performance and decision-making of other solutions in its

cybersecurity architecture.

Cautionary Statement Regarding Forward-Looking

Information

This release may contain certain forward-looking statements,

including, without limitation, our expectations for positive

effects or our current sales and marketing efforts, our

restructured sales network, the expectation that our expanded

product offerings will have a positive impact on future sales and

revenues, and forecasts that our capital needs and cash flows for

the near future will be met by this recent financing, which

statements reflect management’s expectations regarding future

events and operating performance. These forward-looking statements

speak only as of the date hereof and involve a number of risks and

uncertainties. These statements are made under the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995

and involve risks and uncertainties which could cause actual

results to differ materially from those in the forward-looking

statements, including, the risk that this financing fails to

provide the needed capital for the Company to execute its current

business strategies, the Company does not achieve the anticipated

results from its current sales, marketing, operational, and product

development initiatives, as well as risks that we have detailed in

the Company’s most recent reports on Form 10-K and Form 10-Q,

particularly under the heading “Risk Factors.”

IR Contact

Alpha IR Group

Mike Cummings or David Freund

INTZ@alpha-ir.com

| |

|

INTRUSION INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2021 |

|

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Revenue |

$ |

1,645 |

|

|

$ |

1,580 |

|

|

$ |

7,277 |

|

|

$ |

6,619 |

|

| Cost

of revenue |

|

577 |

|

|

|

660 |

|

|

|

2,625 |

|

|

|

2,709 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

1,068 |

|

|

|

920 |

|

|

|

4,652 |

|

|

|

3,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

1,808 |

|

|

|

1,941 |

|

|

|

11,931 |

|

|

|

3,821 |

|

|

Research and development |

|

1,467 |

|

|

|

1,056 |

|

|

|

6,328 |

|

|

|

3,797 |

|

|

General and administrative |

|

1,634 |

|

|

|

1,852 |

|

|

|

5,896 |

|

|

|

2,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

(3,841 |

) |

|

|

(3,929 |

) |

|

|

(19,503 |

) |

|

|

(6,523 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

– |

|

|

|

3 |

|

|

|

87 |

|

|

|

11 |

|

|

Interest expense |

|

(11 |

) |

|

|

(2 |

) |

|

|

(21 |

) |

|

|

(6 |

) |

| Gain

on the extinguishment of debt |

|

– |

|

|

|

– |

|

|

|

635 |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

from operations before income taxes |

|

(3,852 |

) |

|

|

(3,928 |

) |

|

|

(18,802 |

) |

|

|

(6,518 |

) |

|

Income tax provision |

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(3,852 |

) |

|

$ |

(3,928 |

) |

|

$ |

(18,802 |

) |

|

$ |

(6,518 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividends accrued |

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(79 |

) |

| Net

loss attributable to common stockholders |

$ |

(3,852 |

) |

|

$ |

(3,928 |

) |

|

$ |

(18,802 |

) |

|

$ |

(6,597 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.20 |

) |

|

$ |

(0.23 |

) |

|

$ |

(1.05 |

) |

|

$ |

(0.45 |

) |

|

Diluted |

$ |

(0.20 |

) |

|

$ |

(0.23 |

) |

|

$ |

(1.05 |

) |

|

$ |

(0.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

18,885 |

|

|

|

17,029 |

|

|

|

17,992 |

|

|

|

14,678 |

|

|

Diluted |

|

18,885 |

|

|

|

17,029 |

|

|

|

17,992 |

|

|

|

14,678 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTRUSION INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except par value

amounts) |

|

|

|

|

|

|

|

|

|

|

| |

|

December 31 |

| |

|

2021 |

|

2020 |

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,100 |

|

|

$ |

16,704 |

|

|

Accounts receivable |

|

|

1,034 |

|

|

|

1,233 |

|

|

Prepaid expenses |

|

|

356 |

|

|

|

370 |

|

| Total current assets |

|

|

5,490 |

|

|

|

18,307 |

|

| Non-Current Assets: |

|

|

|

|

|

|

|

|

|

Property and Equipment: |

|

|

|

|

|

|

|

|

|

Equipment |

|

|

2,517 |

|

|

|

1,453 |

|

|

Furniture and fixtures |

|

|

43 |

|

|

|

43 |

|

|

Leasehold improvements |

|

|

67 |

|

|

|

67 |

|

|

Property and equipment, gross |

|

|

2,627 |

|

|

|

1,563 |

|

|

Accumulated depreciation and amortization |

|

|

(1,567 |

) |

|

|

(1,097 |

) |

|

Property and equipment, net |

|

|

1,060 |

|

|

|

466 |

|

|

Finance leases, right-of-use assets, net |

|

|

1,709 |

|

|

|

20 |

|

|

Operating leases, right-of-use assets, net |

|

|

808 |

|

|

|

1,010 |

|

|

Other assets |

|

|

166 |

|

|

|

79 |

|

| Total non-current assets |

|

|

3,743 |

|

|

|

1,575 |

|

| TOTAL

ASSETS |

|

$ |

9,233 |

|

|

$ |

19,882 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable, trade |

|

$ |

718 |

|

|

$ |

408 |

|

|

Accrued expenses |

|

|

534 |

|

|

|

628 |

|

|

Finance lease liabilities, current portion |

|

|

644 |

|

|

|

21 |

|

|

Operating lease liabilities, current portion |

|

|

935 |

|

|

|

487 |

|

|

PPP loan payable, current portion |

|

|

– |

|

|

|

421 |

|

|

Deferred revenue |

|

|

560 |

|

|

|

177 |

|

| Total current liabilities |

|

|

3,391 |

|

|

|

2,142 |

|

| |

|

|

|

|

|

|

|

|

| Non-Current Liabilities: |

|

|

|

|

|

|

|

|

|

PPP loan payable, noncurrent portion |

|

|

– |

|

|

|

212 |

|

|

Finance lease liabilities, noncurrent portion |

|

|

673 |

|

|

|

– |

|

|

Operating lease liabilities, noncurrent portion |

|

|

1,250 |

|

|

|

1,867 |

|

| Total non-current

liabilities |

|

|

1,923 |

|

|

|

2,079 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies

– (See Note 9) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred Stock $0.01 par value: Authorized shares – 5,000 Issued

shares – 0 in 2021 and2020 |

|

|

– |

|

|

|

– |

|

|

Common stock $0.01 par value: Authorized shares — 80,000 Issued

shares — 19,135 in2021 and 17,428 in 2020 Outstanding shares —

19,125 in 2021 and 17,418 in 2020 |

|

|

191 |

|

|

|

174 |

|

|

Common stock held in treasury, at cost – 10 shares |

|

|

(362 |

) |

|

|

(362 |

) |

|

Additional paid-in capital |

|

|

84,230 |

|

|

|

77,187 |

|

|

Accumulated deficit |

|

|

(80,097 |

) |

|

|

(61,295 |

) |

|

Accumulated other comprehensive loss |

|

|

(43 |

) |

|

|

(43 |

) |

| Total stockholders’

equity |

|

|

3,919 |

|

|

|

15,661 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

9,233 |

|

|

$ |

19,882 |

|

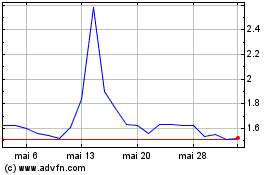

Intrusion (NASDAQ:INTZ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Intrusion (NASDAQ:INTZ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024