Sinclair Enters Into Agreement with Creditors on Liquidity Enhancing Transaction

14 Janvier 2025 - 1:30PM

Business Wire

Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair,"

today announced that Sinclair Television Group, Inc. (“STG”) and

certain affiliated entities have entered into a Transaction Support

Agreement (including the attached term sheet and other attachments

thereto, the “TSA”) with certain of STG's secured creditors (the

“Consenting Creditors”), including lenders holding term loans (the

“Existing Term Loan Facility”) under STG’s existing credit

facilities (the “Existing Credit Facilities”) governed by STG’s

existing bank credit agreement (the “Existing Credit Agreement”)

and various holders of STG’s outstanding 4.125% Senior Secured

Notes due 2030 (the “Existing Secured Notes”), on the principal

terms of new money financings and a debt recapitalization (the

“Transactions”) to strengthen the Company’s balance sheet and

better position it for long-term growth.

“The transactions, as contemplated in the TSA, demonstrate the

strong support of our creditors in positioning the Company for

long-term success by enhancing its financial liquidity and

flexibility,” said Chris Ripley, Sinclair’s President and Chief

Executive Officer. “The refinancings are expected to push our

closest meaningful maturity to December 2029 and extend all of our

maturities to a weighted average of 6.6 years, while materially

reducing our first lien net leverage and improving our financial

optionality, allowing us to continue to be opportunistic in the

marketplace to deleverage over time while driving enhanced returns

for all of the company’s stakeholders.”

The lenders of the Existing Term Loan Facility party to the TSA

represent approximately 80% of the aggregate principal amount of

STG’s outstanding loans under its Existing Credit Facilities, and

the holders of Existing Secured Notes party to the TSA represent

approximately 75% of the aggregate principal amount of the Existing

Secured Notes, which, in each case, is in excess of the consent

thresholds necessary to permit the Transactions. By executing the

TSA, the lenders and noteholders party thereto agreed to, among

other things, (i) with respect to certain backstop lenders, provide

a backstopped First-Out Term Loan Facility (as defined below); (ii)

use commercially reasonable efforts to support and take all

commercially reasonable actions necessary or reasonably requested

by the Company to facilitate the consummation of the Transactions,

and (iii) negotiate in good faith the applicable definitive

documents consistent with the terms of the TSA.

The Transactions, once finalized, will provide for the

following, including the amendment of certain existing debt

documents to permit the following:

- First-Out First Lien Credit Facilities. STG will use

commercially reasonable efforts to enter into an up to $650.0

million aggregate principal amount first-out first lien revolving

credit facility, including a letter of credit sub-facility and a

swing-line sub-facility (the “First-Out Revolving Credit

Facility”). STG will use commercially reasonable efforts to ensure

that the First-Out Revolving Credit Facility will be offered to all

eligible holders of revolving loans and commitments outstanding

under the Existing Credit Agreement (the “Existing Revolving Credit

Facility”). Obligations under the Existing Revolving Credit

Facility held by non-consenting holders that do not participate in

or consent to the exchange into obligations under the First-Out

Revolving Credit Facility will be ranked as third lien obligations

under an amended credit agreement (the “Amended Credit Agreement”),

which will amend the Existing Credit Agreement to eliminate

substantially all covenants, events of default and related

definitions contained therein. In the event that the net cash

proceeds of any Other First-Out First Lien Debt (as defined below)

STG anticipates borrowing (if any) on or prior to the closing date

of the Transactions are not sufficient to repay in full all of the

outstanding $1,175 million of aggregate principal amount of

outstanding term loans B-2 under the Existing Credit Agreement,

certain parties to the Transaction Support Agreement have made

available, and STG may elect to borrow, in lieu of such Other

First-Out First Lien Debt, $1,175 million aggregate principal

amount of backstop first-out first lien term loans, which amount

shall, at STG’s option, be increased (solely by including such

increase as additional principal) to fund any backstop fees and

original issue discount (together with any new term loans B-5 (as

described below), the “First-Out Term Loan Facility”), the proceeds

of which shall be used to repay the outstanding term loans B-2

under the Existing Credit Agreement. The First-Out Revolving Credit

Facility and First-Out Term Loan Facility will be documented under

a new credit agreement (the “New Credit Agreement”).

In addition, on or after the closing date of

the Transactions, STG may incur other debt on a pari passu basis

(as to payment and lien priority, including as to the application

of proceeds with respect to, and distributions made on account of,

collateral) with the First-Out Term Loan Facility and the First-Out

Revolving Credit Facility, whether in the form of bonds, notes,

loans or other debt instruments, and that has substantially the

same collateral securing such debt as the First-Out Term Loan

Facility and the First-Out Revolving Credit Facility (in each case

after giving effect to any applicable transactions to merge any

finance or “escrow” subsidiary which initially may issue such debt

into STG or any guarantor(s)) (the “Other First-Out First Lien

Debt”).

- Term Loan Exchanges. Holders of the approximately $714 million

and $731 million aggregate principal amount of outstanding term

loans B-3 and B-4, respectively, under the Existing Credit

Agreement will be afforded the opportunity to refinance and/or

exchange such term loans into second-out first lien term loans

under the New Credit Agreement (the “Second-Out Term Loan

Facility”), consisting of (x) approximately $714 million aggregate

principal amount term loans B-6 maturing December 31, 2029 offered

to holders of the outstanding term loans B-3 and (y) approximately

$731 million aggregate principal amount term loans B-7 maturing

December 31, 2030 offered to holders of the outstanding term loans

B-4. Term loans B-3 and B-4 held by non-consenting holders that do

not participate in or consent to the exchange into Second-Out Term

Loan Facility will be ranked as third lien obligations under the

Amended Credit Agreement, which will amend the Existing Credit

Agreement to eliminate substantially all covenants, events of

default and related definitions contained therein. In the event

that the net cash proceeds from the incurrence of any Other

First-Out First Lien Debt or borrowings under the First-Out Term

Loan Facility STG elects to borrow (if any) are not sufficient to

repay in full all of the outstanding $1,175 million of aggregate

principal amount of outstanding term loans B-2 under the Existing

Credit Agreement, holders thereof will be afforded the opportunity

to exchange such term loans into first-out first lien term loans

B-5 on a dollar-for-dollar basis on the same terms and conditions

as the First-Out First Lien Term Loan Facility, other than in

respect of pricing and maturity, which pricing and maturity of the

new term loans B-5 will remain the same as under the existing term

loans B-2.

- Exchange Offer. STG will undertake an offering to all eligible

holders of the Existing Secured Notes to exchange up to

approximately $246 million aggregate principal amount of Existing

Secured Notes for up to approximately $246 million aggregate

principal amount of STG’s 4.375% Senior Second-Out Secured Notes

due 2032 (the “Exchange Second-Out Notes”) (the “Exchange Offer”).

Certain holders of Existing Secured Notes party to the Transaction

Support Agreement will not participate in the Exchange Offer and

instead will participate in the transactions described under

“Private Exchange Offers” or “Private Debt Repurchase” below, as

applicable. Non-tendering holders of Existing Secured Notes will

continue to hold Existing Secured Notes under the indenture related

thereto, subject to amendments to release all collateral securing

such Existing Secured Notes and eliminate substantially all

covenants, events of default and related definitions. As amended,

such Existing Secured Notes will become unsecured obligations of

STG. Prior to the commencement of the Exchange Offer or in

connection therewith, it is expected that the holders of Existing

Secured Notes party to the Transaction Support Agreement, who

represent an aggregate principal amount of the Existing Secured

Notes necessary to consent to the indenture amendments described

above, shall have delivered such consents. The Exchange Offer may

be commenced subsequent to the closing of the other Transactions,

in which event, as a condition to the consummation of the other

Transactions, the holders of Existing Secured Notes party to the

Transaction Support Agreement, who represent an aggregate principal

amount of the Existing Secured Notes necessary to consent to the

indenture amendments described above, shall have delivered such

consents and such Existing Secured Notes shall have become

unsecured obligations of STG.

- Private Debt Repurchase. Unless STG elects to effect the AHG

Notes Exchange (as defined below), STG will purchase or redeem for

cash up to $59.3 million aggregate principal amount of Existing

Secured Notes at 84% of the principal amount thereof (the “AHG

Existing Secured Notes Purchase”) and up to $104.2 million

aggregate principal amount of 5.125% Senior Unsecured Notes at 97%

of the principal amount thereof (the “AHG 5.125% Senior Unsecured

Notes Purchase,” and together with the AHG Existing Secured Notes

Purchase, the “AHG Notes Repurchase”), each together with any

accrued and unpaid interest, held by certain parties to the

Transaction Support Agreement.

- Private Exchange Offers. STG will issue to certain holders of

the Existing Secured Notes party to the Transaction Support

Agreement approximately $432 million aggregate principal amount of

STG’s 9.75% Senior Secured Second Lien Notes due 2033 (the “New

Second Lien Notes”) in exchange for approximately $432 million

aggregate principal amount of Existing Secured Notes, with accrued

and unpaid interest on the exchanged amount of Existing Secured

Notes being paid in cash on the date of exchange. In addition, at

STG’s election, in lieu of consummating the AHG Notes Repurchase,

STG may issue to certain parties to the Transaction Support

Agreement (the selection of the following clauses (a) and (b) at

the election of each such party) (a) additional term loans B-5 in

exchange for such holder’s Existing Secured Notes at an exchange

price of 84% of the aggregate principal amount thereof and/or for

such holder’s STG’s 5.125% Senior Unsecured Notes due 2027 (the

“5.125% Senior Unsecured Notes”) at an exchange price of 97% of the

aggregate principal amount thereof or (b) 4.125% First-Out First

Lien Notes due 2030 (the “AHG 4.125% First-Out Notes”) in exchange

for such holder’s Existing Secured Notes and/or 5.125% First-Out

First Lien Notes due 2027 (the “AHG 5.125% First-Out Notes,” and

together with the AHG 4.125% First-Out Notes, the “AHG First-Out

Notes”) in exchange for such holder’s 5.125% Senior Unsecured

Notes, each on a dollar for dollar basis, on terms substantially

consistent with the terms of the Exchange Second-Out Notes, other

than in respect of pricing and maturity, which pricing and maturity

of the AHG 4.125% First-Out Notes and AHG 5.125% First-Out Notes

will remain the same as the respective pricing and maturity of the

Existing Secured Notes and 5.125% Senior Unsecured Notes,

respectively, so exchanged except that the AHG First-Out Notes will

include a special call feature permitting STG to repurchase the AHG

4.125% First-Out Notes at a price of 84% of the principal amount

thereof and the AHG 5.125% First-Out Notes at a price of 97% of the

principal amount thereof. The note exchanges in clause (b) above

are referred to as the “AHG Existing Secured Notes Exchange” and

the “AHG 5.125% Senior Unsecured Notes Exchange,” and together, the

“AHG Notes Exchange”.

- Private Offering of New Second Lien Notes. At its election, STG

may issue up to $50 million aggregate principal amount of New

Second Lien Notes to one or more purchasers for cash.

The net proceeds from the incurrence of Other First-Out First

Lien Debt or borrowings under the First-Out Term Loan Facility STG

elects to borrow (if any), the net proceeds of any issuance of New

Second Lien Notes for cash, and cash and/or draws under the

Existing Revolving Credit Facility or the First-Out Revolving

Credit Facility will be used to repay all of the outstanding $1,175

million of aggregate principal amount outstanding under our term

loans B-2, to consummate the AHG Notes Repurchase (unless STG

elects to effect the AHG Notes Exchange), and to pay related fees

and expenses related to the Transactions.

The closing of the Transactions is conditioned on the

satisfaction or waiver of certain conditions precedent, including

finalizing definitive documents consistent with the TSA, receipt of

the requisite consents from lenders under the Existing Credit

Agreement and holders of Existing Secured Notes, and satisfaction

or waiver of the conditions described in the TSA.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor a solicitation

of consents from any holders of securities, nor shall there be any

sale of securities or solicitation of consents in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such jurisdiction. Any solicitation or offer will only be made

pursuant to a separate disclosure statement distributed to the

relevant holders of securities.

Pillsbury Winthrop Shaw Pittman LLP and Fried Frank Harris

Shriver & Jacobson LLP are serving as legal advisors to the

Company and STG, and J.P. Morgan acted as exclusive advisor to

Sinclair in connection with structuring and negotiating the

transactions, with Simpson Thacher & Bartlett LLP acting as its

counsel. Milbank LLP is serving as legal advisor to the Consenting

Creditors, including the new money lenders providing the First-Out

Term Loan Facility, and Perella Weinberg Partners LP is serving as

financial advisor to the Consenting Creditors.

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, future operating results.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the occurrence of any event, change or other circumstance that

could give rise to the termination of the TSA, the ability to

negotiate and reach agreement on definitive documentation relating

to the Transactions, the ability to satisfy closing conditions to

the completion of the Transactions; the Company’s ability to

achieve the anticipated benefits from the Transactions; other risks

related to the completion of the Transactions and actions related

thereto, the Company’s ability the rate of decline in the number of

subscribers to services provided by traditional and virtual

multi-channel video programming distributors (“Distributors”); the

Company’s ability to generate cash to service its substantial

indebtedness; the successful execution of outsourcing agreements;

the successful execution of retransmission consent agreements; the

successful execution of network and Distributor affiliation

agreements; the Company’s ability to identify and consummate

acquisitions and investments, to manage increased financial

leverage resulting from acquisitions and investments, and to

achieve anticipated returns on those investments once consummated;

the Company’s ability to compete for viewers and advertisers;

pricing and demand fluctuations in local and national advertising;

the appeal of the Company’s programming and volatility in

programming costs; material legal, financial and reputational risks

and operational disruptions resulting from a breach of the

Company’s information systems; the impact of FCC and other

regulatory proceedings against the Company; compliance with laws

and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company’s recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114853154/en/

Investor Contacts: Christopher C. King, VP, Investor Relations

Billie-Jo McIntire, VP, Corporate Finance (410) 568-1500 Media

Contact: Sinclair@5wpr.com

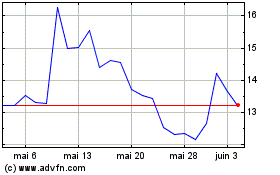

Sinclair (NASDAQ:SBGI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sinclair (NASDAQ:SBGI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025