XOMA Announces Stock Repurchase Program of up to $50 Million

02 Janvier 2024 - 1:30PM

XOMA Corporation (Nasdaq: XOMA), the biotech royalty aggregator,

today announced its Board of Directors has authorized XOMA’s first

stock repurchase program, which permits the Company to purchase up

to $50 million of XOMA’s common stock through January

2027.

“Upon arriving at XOMA, Brad Sitko, our Chief

Investment Officer and I made it very clear that we intended to be

active participants in our capital structure as we look to maximize

shareholder value through prudent capital allocation,” stated Owen

Hughes, Executive Chairman of XOMA. “Levering the future

cashflow streams of our growing royalty portfolio by reducing our

shares outstanding is one of several allocation strategies we plan

to utilize to generate superior risk-adjusted, non-correlated

returns for our investors.”

Under the program, management has discretion in

determining the conditions under which shares may be purchased from

time to time, including through transactions in the open market, in

privately negotiated transactions, or by other means in accordance

with applicable laws. The number, price, structure, and

timing of the repurchases, if any, will be at XOMA’s sole

discretion and repurchases will be evaluated by XOMA depending on

market conditions, royalty and milestone acquisition opportunities,

and other factors. The repurchase authorization does not

oblige XOMA to acquire any particular amount of its common

stock. The Board of Directors may suspend, modify, or

terminate the stock repurchase program at any time without prior

notice.

This press release does not constitute an offer to

sell or the solicitation of an offer to buy any securities, nor

shall it constitute an offer, solicitation, or sale in any

jurisdiction in which such offer, solicitation, or sale is

unlawful.

About XOMA CorporationXOMA is a

biotechnology royalty aggregator playing a distinctive role in

helping biotech companies achieve their goal of improving human

health. XOMA acquires the potential future economics

associated with pre-commercial and commercial therapeutic

candidates that have been licensed to pharmaceutical or

biotechnology companies. When XOMA acquires the future

economics, the seller receives non-dilutive, non-recourse funding

they can use to advance their internal drug candidate(s) or for

general corporate purposes. The Company has an extensive and

growing portfolio with more than 70 assets (asset defined as the

right to receive potential future economics associated with the

advancement of an underlying therapeutic candidate). For more

information about the Company and its portfolio, please visit

www.xoma.com.

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the economic

potential of XOMA’s royalty and milestone portfolio and intrinsic

value of its business model and the timing and nature of common

stock repurchases, if any, by XOMA. In some cases, you can

identify such forward-looking statements by terminology such as

“anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,”

“project,” “expect,” “may,” “will”, “would,” “could” or “should,”

the negative of these terms or similar expressions. These

forward-looking statements are not a guarantee of any future

events, and you should not place undue reliance on such

statements. These statements are based on assumptions that

may not prove accurate, and actual results could differ materially

from those anticipated due to certain risks, including those

described in more detail in XOMA's most recent filing on Form 10-Q

and in other filings with the Securities and Exchange

Commission. Consider such risks carefully when considering

XOMA's prospects. Any forward-looking statement in this press

release represents XOMA's beliefs and assumptions only as of the

date of this press release and should not be relied upon as

representing its views as of any subsequent date. XOMA

disclaims any obligation to update any forward-looking statement,

except as required by applicable law.

EXPLANATORY NOTE: Any references to “portfolio” in

this press release refer strictly to milestone and/or royalty

rights associated with a basket of drug products in

development. Any references to “assets” in this press release

refer strictly to milestone and/or royalty rights associated with

individual drug products in development.

As of the date of this press release, the assets in

XOMA’s milestone and royalty portfolio, except VABYSMO® (faricimab)

and IXINITY® [coagulation factor IX (recombinant)], are

investigational compounds. Efficacy and safety have not been

established. There is no guarantee that any of the

investigational compounds will become commercially

available.

|

Investor contact: |

Media contact: |

|

Juliane Snowden |

Kathy Vincent |

|

XOMA |

KV Consulting & Management |

|

+1-646-438-9754 |

+1-310-403-8951 |

|

juliane.snowden@xoma.com |

kathy@kathyvincent.com |

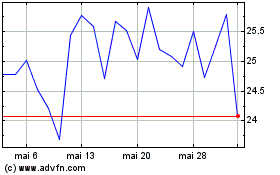

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024