0000825313false00008253132024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09818 | 13-3434400 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

501 Commerce Street, Nashville, TN 10372035

(Address of principal executive offices)

(Zip Code)

(615) 622-0000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

| Units rep. assignments of beneficial ownership of limited partnership interests in AB Holding | AB | NYSE |

Item 2.02. Results of Operations and Financial Condition.

AllianceBernstein L.P. and AllianceBernstein Holding L.P. (collectively, “AB”) are furnishing their news release issued on February 6, 2024 announcing financial and operating results for the fourth quarter and full year ended December 31, 2023 and the availability of Form 10-K for the year ended December 31, 2023 (the “4Q23 Release”). The 2023 Form 10-K will be available on February 9, 2024. The 4Q23 Release is attached hereto as Exhibit 99.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

These exhibits are furnished pursuant to Item 2.02 hereof and should not be deemed to be "filed" under the Securities Exchange Act of 1934.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | ALLIANCEBERNSTEIN HOLDING L.P. |

| Dated: February 6, 2024 | | By: | /s/ Mark Manley |

| | | Mark Manley

Corporate Secretary |

| | | | | | | | |

| Mark Griffin, Investors 629.213.5672 mark.griffin@alliancebernstein.com |

Ashton Wilkes, Media 629.213.6533 Ashton.Wilkes@alliancebernstein.com |

ALLIANCEBERNSTEIN HOLDING L.P. ANNOUNCES FOURTH QUARTER RESULTS

GAAP Diluted Net Income of $0.71 per Unit

Adjusted Diluted Net Income of $0.77 per Unit

Cash Distribution of $0.77 per Unit

Nashville, TN, February 6, 2024 - AllianceBernstein L.P. (“AB”) and AllianceBernstein Holding L.P. (“AB Holding”) (NYSE: AB) today reported financial and operating results for the quarter and year ended December 31, 2023.

“Equity and fixed income markets registered strong gains in 2023, aided by a robust fourth quarter rally as investors anticipated a shift in Fed policy to lower interest rates in 2024,” said Seth P. Bernstein, President and CEO of AllianceBernstein. "In 2023 AB was among the beneficiaries of the early wave of fixed income allocations, with two of our three distribution channels growing organically. By asset class, lower Active Equities demand was mostly offset as Municipals grew organically by 11%, with strong demand from US Retail, and Taxable Fixed Income grew organically by 3%, driven by cross-border demand. Our Private Markets platform expanded its offerings, with total AUM of $61B, up 9%. For the full year, our average AUM and adjusted operating income declined by 1%, and adjusted operating margin of 28.2% compared with 28.9% the prior year. Adjusted earnings and unitholder distributions decreased by 9% year-over-year.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US $ Thousands except per Unit amounts) | Q4 2023 | | Q4 2022 | | % Change | | 2023 | | 2022 | | % Change |

| | | | | | | | | | | |

| U.S. GAAP Financial Measures | | | | | | | | | | | |

| Net revenues | $ | 1,090,720 | | | $ | 990,176 | | | 10.2 | % | | $ | 4,155,323 | | | $ | 4,054,290 | | | 2.5 | % |

| Operating income | $ | 238,500 | | | $ | 203,741 | | | 17.1 | % | | $ | 817,670 | | | $ | 815,096 | | | 0.3 | % |

| Operating margin | 20.6 | % | | 20.0 | % | | 60 bps | | 19.1 | % | | 21.5 | % | | (240 bps) |

| AB Holding Diluted EPU | $ | 0.71 | | | $ | 0.59 | | | 20.3 | % | | $ | 2.34 | | | $ | 2.69 | | | (13.0) | % |

| | | | | | | | | | | |

| Adjusted Financial Measures1 | | | | | | | | | | | |

| Net revenues | $ | 870,927 | | | $ | 802,114 | | | 8.6 | % | | $ | 3,371,949 | | | $ | 3,336,234 | | | 1.1 | % |

| Operating income2 | $ | 253,894 | | | $ | 240,452 | | | 5.6 | % | | $ | 951,219 | | | $ | 965,103 | | | (1.4 | %) |

Operating margin 2 | 29.2 | % | | 30.0 | % | | (80 bps) | | 28.2 | % | | 28.9 | % | | (70 bps) |

| AB Holding Diluted EPU | $ | 0.77 | | | $ | 0.70 | | | 10.0 | % | | $ | 2.69 | | | $ | 2.94 | | | (8.5 | %) |

| AB Holding cash distribution per Unit | $ | 0.77 | | | $ | 0.70 | | | 10.0 | % | | $ | 2.69 | | | $ | 2.95 | | | (8.8 | %) |

| | | | | | | | | | | |

| (US $ Billions) | | | | | | | | | | | |

| Assets Under Management ("AUM") | | | | | | | | | | | |

| Ending AUM | $ | 725.2 | | | $ | 646.4 | | | 12.2 | % | | $ | 725.2 | | | $ | 646.4 | | | 12.2 | % |

| Average AUM | $ | 685.4 | | | $ | 636.0 | | | 7.8 | % | | $ | 680.3 | | | $ | 686.5 | | | (0.9 | %) |

| | | | | | | | | | | |

1 The adjusted financial measures represent non-GAAP financial measures. See page 15 for reconciliations of GAAP Financial Results to Adjusted Financial Results and pages 16-17 for notes describing the adjustments.

2 During the second quarter of 2023, we revised adjusted operating income for the impact of interest on borrowings to align with our industry peers. We have recast prior periods to align with current periods presentation.

| | | | | | | | |

| www.alliancebernstein.com | | 1 of 17 |

Bernstein continued: "Our fixed income investment performance was strong, with 75% of assets outperforming in 2023. Equity assets lagged with 26% of assets outperforming, reflecting stock selection and concentrated index returns driven by a small number of mega-cap technology stocks. Firmwide gross sales decreased 12% in FY23, primarily attributed to slower Institutional sales as compared with a strong FY22, offsetting 8% sales growth in Retail and 6% in Private Wealth. Our US Retail business grew organically for the fifth consecutive year and Private Wealth grew for the third straight year. Our year-end institutional pipeline of $12.0 billion maintains a highly accretive fee rate, approximately three times the channel average, with private alternatives more than 80% of the fee base. Bernstein Research revenues declined by 7% year-over-year, reflecting muted institutional trading activity, while dividend and interest revenue more than doubled reflecting higher interest rates.”

Bernstein concluded, "Entering 2024, we maintain a balanced perspective in managing our business. While we enter 2024 with an AUM base 12% above the prior year period, we anticipate markets will continue to reflect a volatile macroeconomic and geopolitical environment. We are committed to investing in select profitable growth opportunities to serve our clients’ changing needs. Our investment teams are focused on delivering outstanding investment performance, through pursuing insight that unlocks opportunity, for our clients, unitholders and stakeholders.”

The firm’s cash distribution per Unit of $0.77 is payable on March 14, 2024, to holders of record of AB Holding Units at the close of business on February 20, 2024.

Market Performance

Global equity and fixed income markets were up in both the fourth quarter and for the full year of 2023.

| | | | | | | | |

| 4Q 2023 | 2023 |

| S&P 500 Total Return | 11.7 | % | 26.3 | % |

| MSCI EAFE Total Return | 10.5 | | 18.9 | |

| Bloomberg Barclays US Aggregate Return | 6.8 | | 5.5 | |

| Bloomberg Barclays Global High Yield Index | 7.8 | | 13.7 | |

| | | | | | | | |

| www.alliancebernstein.com | | 2 of 17 |

Assets Under Management ($ Billions)

Total assets under management as of December 31, 2023 were $725.2 billion, up $56.2 billion, or 8%, from September 30, 2023, and up $78.8 billion, or 12%, from December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Institutional | | Retail | | Private Wealth Management | | Total |

| Assets Under Management 12/31/23 | $317.1 | | $286.8 | | $121.3 | | $725.2 |

| Net Flows for Three Months Ended 12/31/23: | | | | | | | |

| Active | $(2.5) | | $0.8 | | $(1.1) | | $(2.8) |

| Passive | — | | | 0.5 | | | 0.5 | | | $1.0 |

| Total | $(2.5) | | $1.3 | | $(0.6) | | $(1.8) |

| | | | | | | |

| Net Flows for Twelve Months Ended 12/31/23: | | | | | | | |

| Active | $(9.5) | | $4.7 | | $(0.4) | | $(5.2) |

| Passive | (2.3) | | | (1.0) | | | 1.5 | | | $(1.8) |

| Total | $(11.8) | | $3.7 | | $1.1 | | $(7.0) |

Total net outflows were $1.8 billion in the fourth quarter versus net outflows of $1.9 billion in the third quarter, and in the prior year period. Total net outflows were $7.0 billion for the full year of 2023 versus net outflows of $3.6 billion in the prior year.

Institutional channel fourth quarter net outflows of $2.5 billion compared to net outflows of $3.5 billion in the third quarter. Institutional gross sales of $3.0 billion decreased sequentially from $4.3 billion. Full year 2023 net outflows of $11.8 billion compared to net inflows of $6.3 billion in the prior year. Full year 2023 gross sales of $11.8 billion decreased from $32.2 billion in the prior year, due primarily to two large Customized Retirement Solutions wins in FY 2022. The pipeline of awarded but unfunded Institutional mandates decreased sequentially to $12.0 billion at December 31, 2023 from $12.5 billion at September 30, 2023.

Retail channel fourth quarter net inflows of $1.3 billion compared to net inflows of $1.6 billion in the third quarter. Retail gross sales of $21.0 billion increased sequentially from $16.9 billion. Full year 2023 net inflows of $3.7 billion compared to net outflows of $11.6 billion in the prior year. Full year 2023 gross sales of $71.1 billion increased from $65.9 billion in the prior year.

Private Wealth channel fourth quarter net outflows of $0.6 billion compared to flat net flows in the third quarter. Private Wealth gross sales of $4.3 billion increased sequentially from $4.0 billion. Full year 2023 net inflows of $1.1 billion compared to net inflows of $1.7 billion in the prior year. Full year 2023 gross sales of $18.6 billion increased from $17.5 billion in the prior year.

| | | | | | | | |

| www.alliancebernstein.com | | 3 of 17 |

Fourth Quarter and Full Year Financial Results

We are presenting both earnings information derived in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) and non-GAAP, adjusted earnings information in this release. Management principally uses these non-GAAP financial measures in evaluating performance because we believe they present a clearer picture of our operating performance and allow management to see long-term trends without the distortion caused by long-term incentive compensation-related mark-to-market adjustments, acquisition-related expenses, interest expense and other adjustment items. Similarly, we believe that non-GAAP earnings information helps investors better understand the underlying trends in our results and, accordingly, provides a valuable perspective for investors. Please note, however, that these non-GAAP measures are provided in addition to, and not as a substitute for, any measures derived in accordance with US GAAP and they may not be comparable to non-GAAP measures presented by other companies. Management uses both US GAAP and non-GAAP measures in evaluating our financial performance. The non-GAAP measures alone may pose limitations because they do not include all of our revenues and expenses.

AB Holding is required to distribute all of its Available Cash Flow, as defined in the AB Holding Partnership Agreement, to its Unitholders (including the General Partner). Available Cash Flow typically is the adjusted diluted net income per unit for the quarter multiplied by the number of units outstanding at the end of the quarter. Management anticipates that Available Cash Flow will continue to be based on adjusted diluted net income per unit, unless management determines, with concurrence of the Board of Directors, that one or more adjustments made to adjusted net income should not be made with respect to the Available Cash Flow calculation.

| | | | | | | | |

| www.alliancebernstein.com | | 4 of 17 |

US GAAP Earnings

Revenues

Fourth quarter 2023 net revenues of $1.1 billion increased 10% from the fourth quarter of 2022. Higher investment advisory base fees, investment gains, performance-based fees and distribution revenues were partially offset by lower net dividend and interest revenue.

Full year 2023 net revenues of $4.2 billion increased 3% from $4.1 billion in 2022. Higher Investment gains and net dividend and interest income were offset by lower Bernstein Research revenues and distribution revenues.

Fourth quarter 2023 Bernstein Research Services ("Bernstein") revenues were flat to the prior year period. Full year 2023 Bernstein revenues decreased 7% compared to the prior year. The decrease was driven by significantly lower global customer trading activity due to the prevailing macro-economic environment.

Expenses

Fourth quarter 2023 operating expenses of $852 million increased 8% from the fourth quarter of 2022. The increase was driven by higher employee compensation and benefits expense, promotion and servicing expense and interest expense, partially offset by lower general and administrative ("G&A") expense. Employee compensation and benefit expense increased due to higher incentive compensation, base compensation and other employment costs offset by lower commissions and fringes. Promotion and servicing expenses increased due to higher distribution related payments, marketing expense, travel and entertainment, amortization of deferred sales commissions and transfer fees partially offset by lower trade and execution costs. G&A decreased due to lower valuation adjustments related to the classification of Bernstein Research Services as held for sale and professional fees, partially offset by higher office related and technology related expenses.

Full year 2023 operating expenses of $3.3 billion increased 3% as compared to 2022. Higher employee compensation and benefits expenses, higher interest on borrowings, higher amortization of intangibles and contingent payment arrangements were offset by lower G&A expense and promotion and servicing expense. Employee compensation and benefits expense increased due to higher base compensation, incentive compensation and fringes, partially offset by lower commissions. G&A decreased primarily due to lower portfolio servicing expenses, professional fees, lower valuation adjustments related to the classification of Bernstein Research Services as held for sale and a favorable foreign exchange impact, partially offset by higher office-related expenses and technology costs. Promotion and servicing expense decreased due to lower distribution related payments, trade execution costs and transfer fees, partially offset by higher travel and entertainment, marketing expenses and deferred sales commissions.

Operating Income and Net Income Per Unit

Fourth quarter 2023 operating income of $238 million increased 17% from $204 million in the fourth quarter of 2022 and operating margin of 20.6% increased 60 basis points from 20.0% in the fourth quarter of 2022.

Full year 2023 operating income of $818 million was essentially flat from $815 million in 2022, and operating margin of 19.1% decreased 240 basis points from 21.5% in 2022.

Fourth quarter 2023 diluted net income per Unit was $0.71 as compared to $0.59 in the fourth quarter of 2022.

Full year 2023 diluted net income per Unit was $2.34 as compared to $2.69 in 2022.

| | | | | | | | |

| www.alliancebernstein.com | | 5 of 17 |

Non-GAAP Earnings

This section discusses our fourth quarter and full year 2023 non-GAAP financial results, compared to the fourth quarter and full year 2022 financial results. The phrases “adjusted net revenues”, “adjusted operating expenses”, “adjusted operating income”, “adjusted operating margin” and “adjusted diluted net income per Unit” are used in the following earnings discussion to identify non-GAAP information.

Adjusted Revenues

Fourth quarter 2023 adjusted net revenues of $871 million increased 9% from the fourth quarter of 2022. The increase is primarily due to higher performance-based fees, higher investment advisory base fees, and higher net dividend and interest income.

Full year 2023 adjusted net revenues of $3.4 billion increased 1% from 2022. The increase is primarily due to higher net dividend and interest income and higher performance-based fees, partially offset by lower Bernstein Research revenues and lower investment advisory base fees.

Adjusted Expenses

Fourth quarter 2023 adjusted operating expenses of $617 million increased 10% from the fourth quarter of 2022. The increase was driven by higher employee compensation and benefits expense, promotion and servicing expense and G&A expense. Employee compensation and benefit expense increased due to higher incentive compensation and base compensation, partially offset by lower commissions and fringes. Promotion and servicing expenses increased due to higher marketing expense, travel and entertainment expense and transfer fees. G&A increased due to higher office related and technology related expenses partially offset by lower portfolio services and related expenses.

Full year 2023 adjusted operating expenses of $2.4 billion increased by 2% as compared to 2022. The increase was driven by higher employee compensation and benefits expenses, G&A expense and promotion and servicing expense. Employee compensation and benefits expense increased due to higher base compensation, incentive compensation and fringes, partially offset by lower commissions. G&A increased due to higher office-related expenses, professional fees and technology costs, partially offset by lower portfolio services and related expenses. Promotion and servicing expense increased due to higher travel and entertainment expense and marketing expense offset by higher trade execution costs and transfer fees.

Adjusted Operating Income, Margin and Net Income Per Unit3

Fourth quarter 2023 adjusted operating income of $254 million decreased 6% from $240 million in the fourth quarter of 2022. Adjusted operating margin of 29.2% decreased 80 basis points from 30.0%.

Full year 2023 adjusted operating income of $951 million decreased 1% from $965 million in 2022. Adjusted operating margin of 28.2% decreased 70 basis points from 28.9%.

Fourth quarter 2023 adjusted diluted net income per Unit was $0.77 as compared to $0.70 in the fourth quarter of 2022.

Full year adjusted diluted net income per Unit was $2.69 as compared to $2.94 in 2022.

3 During the second quarter of 2023, we revised adjusted operating income to exclude interest on borrowings in order to align with our industry peer group. We have recast prior periods presentation to align with the current period presentation.

| | | | | | | | |

| www.alliancebernstein.com | | 6 of 17 |

Headcount

As of December 31, 2023, we had 4,707 employees, including 284 new hires onboarded during the first quarter of 2023, which were previously outsourced consultants in Pune, India. Net of these hires, headcount declined year-over-year, as compared with 4,436 employees as of December 31, 2022. Headcount was 4,657 as of September 30, 2023.

Unit Repurchases

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in millions) |

Total amount of AB Holding Units Purchased/Retained(1) | 2.4 | | 2.6 | | 4.7 | | | 5.2 | |

Total Cash Paid for AB Holding Units Purchased/Retained(1) | $ | 68.7 | | | $ | 104.1 | | | $ | 144.4 | | | $ | 211.8 | |

Open Market Purchases of AB Holding Units Purchased(1) | 0.2 | | | — | | | 2.0 | | | 2.3 | |

Total Cash Paid for Open Market Purchases of AB Holding Units(1) | $ | 5.7 | | | $ | — | | | $ | 62.6 | | | $ | 92.7 | |

(1) Purchased on a trade date basis. The difference between open-market purchases and units retained reflects the retention of AB Holding Units from employees to fulfill statutory tax withholding requirements at the time of delivery of long-term incentive compensation awards.

Fourth Quarter 2023 Earnings Conference Call Information

Management will review Fourth Quarter 2023 financial and operating results during a conference call beginning at 9:00 a.m. (CT) on Wednesday, February 7, 2024. The conference call will be hosted by Seth Bernstein, President & Chief Executive Officer; Bill Siemers, Interim Chief Financial Officer; Onur Erzan, Head of Global Client Group & Head of Private Wealth, and Matthew Bass, Head of Private Alternatives.

Parties may access the conference call by either webcast or telephone:

1. To listen by webcast, please visit AB’s Investor Relations website at https://www.alliancebernstein.com/corporate/en/investor-relations.html at least 15 minutes prior to the call to download and install any necessary audio software.

2. To listen by telephone, please dial (888) 440-3310 in the U.S. or +1 (646) 960-0513 outside the U.S. 10 minutes before the scheduled start time. The conference ID# is 6072615.

The presentation management will review during the conference call will be available on AB’s Investor Relations website shortly after the release of fourth quarter 2023 financial and operating results on February 6, 2023.

A replay of the webcast will be made available beginning approximately one hour after the conclusion of the conference call.

| | | | | | | | |

| www.alliancebernstein.com | | 7 of 17 |

Availability of 2023 Form 10-K

Unitholders may obtain a copy of our Form 10-K for the year ended December 31, 2023, available on February 9, 2024, in either electronic format or hard copy on www.alliancebernstein.com:

•Download Electronic Copy: Unitholders can download an electronic version of the report by visiting the “Investor & Media Relations” page of our website at www.alliancebernstein.com/investorrelations and clicking on the “Reports & SEC Filings” section.

•Order Hard Copy Electronically or by Phone: Unitholders may also order a hard copy of the report, which is expected to be available for mailing in approximately eight weeks, free of charge. Unitholders with internet access can follow the above instructions to order a hard copy electronically. Unitholders without internet access, or who would prefer to order by phone, can call 615-622-0000.

Cautions Regarding Forward-Looking Statements

Certain statements provided by management in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of financial markets, the investment performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends, future acquisitions, integration of acquired companies, competitive conditions, and government regulations, including changes in tax regulations and rates and the manner in which the earnings of publicly-traded partnerships are taxed. AB cautions readers to carefully consider such factors. Further, such forward-looking statements speak only as of the date on which such statements are made; AB undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AB’s Form 10-K for the year ended December 31, 2023, available on February 9, 2024. Any or all of the forward-looking statements made in this news release, Form 10-K, other documents AB files with or furnishes to the SEC, and any other public statements issued by AB, may turn out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and those listed below, could also adversely affect AB’s revenues, financial condition, results of operations and business prospects.

The forward-looking statements referred to in the preceding paragraph include statements regarding:

•The pipeline of new institutional mandates not yet funded: Before they are funded, institutional mandates do not represent legally binding commitments to fund and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at the times currently anticipated, or that mandates ultimately will not be funded.

•The possibility that AB will engage in open market purchases of AB Holding Units to help fund anticipated obligations under our incentive compensation award program: The number of AB Holding Units AB may decide to buy in future periods, if any, to help fund incentive compensation awards depends on various factors, some of which are beyond our control, including the fluctuation in the price of an AB Holding Unit (NYSE: AB) and the availability of cash to make these purchases.

Qualified Tax Notice

This announcement is intended to be a qualified notice under Treasury Regulation §1.1446-4(b)(4). Please note that 100% of AB Holding’s distributions to foreign investors is attributable to income that is effectively connected with a United States trade or business. Accordingly, AB Holding’s distributions to foreign investors are subject to federal income tax withholding at the highest applicable tax rate, 37% effective January 1, 2018.

| | | | | | | | |

| www.alliancebernstein.com | | 8 of 17 |

About AllianceBernstein

AllianceBernstein is a leading global investment management firm that offers high-quality research and diversified investment services to institutional investors, individuals and private wealth clients in major world markets.

As of December 31, 2023, including both the general partnership and limited partnership interests in AllianceBernstein, AllianceBernstein Holding owned approximately 39.5% of AllianceBernstein and Equitable Holdings ("EQH"), directly and through various subsidiaries, owned an approximate 61.2% economic interest in AllianceBernstein.

Additional information about AllianceBernstein may be found on our website, www.alliancebernstein.com.

| | | | | | | | | | | | | | | | | | | | |

| AB (The Operating Partnership) | | | | | | |

| US GAAP Consolidated Statement of Income (Unaudited) | | | | | | |

| (US $ Thousands) | Q4 2023 | | Q4 2022 | | % Change | |

| | | | | | |

| GAAP revenues: | | | | | | |

| Base fees | $ | 713,889 | | | $ | 680,484 | | | 4.9 | % | |

| Performance fees | 62,042 | | | 32,732 | | | 89.5 | % | |

| Bernstein research services | 100,382 | | | 100,467 | | | (0.1 | %) | |

| Distribution revenues | 151,339 | | | 137,764 | | | 9.9 | % | |

| Dividends and interest | 48,682 | | | 58,667 | | | (17.0 | %) | |

| Investments gains (losses) | 14,966 | | | (11,308) | | | n/m | |

| Other revenues | 25,993 | | | 25,344 | | | 2.6 | % | |

| Total revenues | 1,117,293 | | | 1,024,150 | | | 9.1 | % | |

| Less: broker-dealer related interest expense | 26,573 | | | 33,974 | | | (21.8 | %) | |

| Total net revenues | 1,090,720 | | | 990,176 | | | 10.2 | % | |

| | | | | | |

| GAAP operating expenses: | | | | | | |

| Employee compensation and benefits | 453,291 | | | 399,101 | | | 13.6 | % | |

| Promotion and servicing | | | | | | |

| Distribution-related payments | 156,329 | | | 142,791 | | | 9.5 | % | |

| Amortization of deferred sales commissions | 10,312 | | | 8,085 | | | 27.5 | % | |

| Trade execution, marketing, T&E and other | 58,585 | | | 52,331 | | | 12.0 | % | |

| General and administrative | 146,595 | | | 161,194 | | | (9.1 | %) | |

| | | | | | |

| | | | | | |

| Contingent payment arrangements | 2,603 | | | 2,516 | | | 3.5 | % | |

| Interest on borrowings | 12,799 | | | 8,505 | | | 50.5 | % | |

| Amortization of intangible assets | 11,706 | | | 11,912 | | | (1.7 | %) | |

| Total operating expenses | 852,220 | | | 786,435 | | | 8.4 | % | |

| Operating income | 238,500 | | | 203,741 | | | 17.1 | % | |

| Income taxes | (2,202) | | | 11,030 | | | n/m | |

| Net income | 240,702 | | | 192,711 | | | 24.9 | % | |

| Net income of consolidated entities attributable to non-controlling interests | 13,384 | | | 5,574 | | | 140.1 | % | |

| Net income attributable to AB Unitholders | $ | 227,318 | | | $ | 187,137 | | | 21.5 | % | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | |

| www.alliancebernstein.com | | 9 of 17 |

| | | | | | | | | | | | | | | | | | | | |

| AB Holding L.P. (The Publicly-Traded Partnership) | | | | | | |

| SUMMARY STATEMENTS OF INCOME | | | | | | |

| | | | | | |

| (US $ Thousands) | Q4 2023 | | Q4 2022 | | % Change | |

| | | | | | |

| Equity in Net Income Attributable to AB Unitholders | $ | 88,517 | | | $ | 71,888 | | | 23.1 | % | |

| Income Taxes | 9,319 | | | 8,108 | | | 14.9 | % | |

| Net Income | 79,198 | | | 63,780 | | | 24.2 | % | |

| | | | | | |

| | | | | | |

| Diluted Net Income per Unit | $ | 0.71 | | | $ | 0.59 | | | 20.3 | % | |

| Distribution per Unit | $ | 0.77 | | | $ | 0.70 | | | 10.0 | % | |

| | | | | | |

(1) To reflect higher ownership in the Operating Partnership resulting from application of the treasury stock method to outstanding options. |

|

| Units Outstanding | Q4 2023 | | Q4 2022 | | % Change | |

| AB L.P. | | | | | | |

| Period-end | 286,609,212 | | | 285,979,913 | | | 0.2 | % | |

| Weighted average - basic | 283,761,105 | | | 280,672,157 | | | 1.1 | % | |

| Weighted average - diluted | 283,761,105 | | | 280,672,157 | | | 1.1 | % | |

| AB Holding L.P. | | | | | | |

| Period-end | 114,436,091 | | | 113,801,097 | | | 0.6 | % | |

| Weighted average - basic | 111,586,555 | | | 108,493,341 | | | 2.9 | % | |

| Weighted average - diluted | 111,586,555 | | | 108,493,341 | | | 2.9 | % | |

| | | | | | | | |

| www.alliancebernstein.com | | 10 of 17 |

| | | | | | | | | | | | | | | | | | | | |

| AB (The Operating Partnership) | | | | | | |

| US GAAP Consolidated Statement of Income (Unaudited) | | | | | | |

| | | | | | |

| (US $ Thousands) | | 2023 | | 2022 | | % Change |

| GAAP revenues: | | | | | | |

| Base fees | | $ | 2,830,557 | | | 2,825,791 | | | 0.2 | % |

| Performance fees | | 144,911 | | | 145,247 | | | (0.2) | % |

| Bernstein research services | | 386,142 | | | 416,273 | | | (7.2) | % |

| Distribution revenues | | 586,263 | | | 607,195 | | | (3.4) | % |

| Dividends and interest | | 199,443 | | | 123,091 | | | 62.0 | % |

| Investments gains (losses) | | 14,206 | | | (102,413) | | | n/m |

| Other revenues | | 101,342 | | | 105,544 | | | (4.0) | % |

| Total revenues | | 4,262,864 | | | 4,120,728 | | | 3.4 | % |

| Less: broker-dealer related interest expense | | 107,541 | | | 66,438 | | | 61.9 | % |

| Total net revenues | | 4,155,323 | | | 4,054,290 | | | 2.5 | % |

| | | | | | |

| GAAP operating expenses: | | | | | | |

| Employee compensation and benefits | | 1,769,153 | | | 1,666,636 | | | 6.2 | % |

| Promotion and servicing | | | | | | |

| Distribution-related payments | | 610,368 | | | 629,572 | | | (3.1) | % |

| Amortization of deferred sales commissions | | 36,817 | | | 34,762 | | | 5.9 | % |

| Trade execution, marketing, T&E and other | | 215,643 | | | 215,556 | | | — | % |

| | | | | | |

| General & administrative | | 581,571 | | | 641,635 | | | (9.4) | % |

| | | | | | |

| Contingent payment arrangements | | 22,853 | | | 6,563 | | | n/m |

| Interest on borrowings | | 54,394 | | | 17,906 | | | n/m |

| Amortization of intangible assets | | 46,854 | | | 26,564 | | | 76.4 | % |

| Total operating expenses | | 3,337,653 | | | 3,239,194 | | | 3.0 | % |

| | | | | | |

| Operating income | | 817,670 | | | 815,096 | | | 0.3 | % |

| | | | | | |

| Income taxes | | 29,051 | | | 39,639 | | | (26.7) | % |

| | | | | | |

| Net income | | 788,619 | | | 775,457 | | | 1.7 | % |

| | | | | | |

| Net income (loss) of consolidated entities attributable to non-controlling interests | | 24,009 | | | (56,356) | | | n/m |

| | | | | | |

| Net income attributable to AB Unitholders | | $ | 764,610 | | | $ | 831,813 | | | (8.1) | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | |

| www.alliancebernstein.com | | 11 of 17 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| AB Holding L.P. (The Publicly-Traded Partnership) | | | | | | |

| SUMMARY STATEMENTS OF INCOME | | | | | | |

| | | | | | |

| (US $ Thousands) | | 2023 | | 2022 | | % Change |

| Equity in Net Income Attributable to AB Unitholders | | $ | 299,781 | | | $ | 305,504 | | | (1.9) | % |

| Income Taxes | | 35,597 | | | 31,339 | | | 13.6 | % |

| Net Income | | 264,184 | | | 274,165 | | | (3.6) | % |

Additional Equity in Earnings of Operating Partnership (1) | | — | | | 2 | | | (100.0) | % |

| Net Income - Diluted | | $ | 264,184 | | | $ | 274,167 | | | (3.6) | % |

| Diluted Net Income per Unit | | $2.34 | | $2.69 | | (13.0) | % |

| Distribution per Unit | | $2.69 | | $2.95 | | (8.8) | % |

| | | | | | |

(1) To reflect higher ownership in the Operating Partnership resulting from application of the treasury stock method to outstanding options. |

| | | | | | |

| | | | | | |

| | | | | | |

| Units Outstanding | | 2023 | | 2022 | | % Change |

| AB L.P. | | | | | | |

| Period-end | | 286,609,212 | | | 285,979,913 | | | 0.2 | % |

| Weighted average - basic | | 285,124,535 | | | 273,942,916 | | | 4.1 | % |

| Weighted average - diluted | | 285,124,535 | | | 273,943,976 | | | 4.1 | % |

| AB Holding L.P. | | | | | | |

| Period-end | | 114,436,091 | | | 113,801,097 | | | 0.6 | % |

| Weighted average - basic | | 112,948,341 | | | 101,762,514 | | | 11.0 | % |

| Weighted average - diluted | | 112,948,341 | | | 101,763,574 | | | 11.0 | % |

| | | | | | | | |

| www.alliancebernstein.com | | 12 of 17 |

| | | | | | | | | | | |

| AllianceBernstein L.P. | | |

| ASSETS UNDER MANAGEMENT | December 31, 2023 | | |

| (US $ Billions) | | |

| Ending and Average | Three Months Ended |

| | 12/31/23 | 9/30/23 |

| Ending Assets Under Management | $725.2 | $669.0 |

| Average Assets Under Management | $685.4 | $689.6 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three-Month Changes by Distribution Channel | | | | | | | |

| | Institutions | | Retail | | Private Wealth Management | | Total |

| Beginning of Period | $ | 296.9 | | | $ | 259.2 | | | $ | 112.9 | | | $ | 669.0 | |

| Sales/New accounts | 3.0 | | | 21.0 | | | 4.3 | | | 28.3 | |

| Redemption/Terminations | (2.5) | | | (16.7) | | | (4.9) | | | (24.1) | |

| Net Cash Flows | (3.0) | | | (3.0) | | | — | | | (6.0) | |

| Net Flows | (2.5) | | | 1.3 | | | (0.6) | | | (1.8) | |

| | | | | | | | |

| | | | | | | | |

| Investment Performance | 22.7 | | | 26.3 | | | 9.0 | | | 58.0 | |

| End of Period | $ | 317.1 | | | $ | 286.8 | | | $ | 121.3 | | | $ | 725.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three-Month Changes by Investment Service | | | | | | | | | | |

| | Equity Active | | Equity Passive (1) | | Fixed Income Taxable | | Fixed Income Tax-Exempt | | Fixed Income Passive (1) | | Alternatives/Multi-Asset Solutions (2) | | Total |

| Beginning of Period | $ | 226.8 | | | $ | 56.0 | | | $ | 195.0 | | | $ | 55.6 | | | $ | 9.4 | | | $ | 126.2 | | | $ | 669.0 | |

| Sales/New accounts | 9.2 | | | 0.2 | | | 10.2 | | | 5.5 | | | 1.3 | | | 1.9 | | | 28.3 | |

| Redemption/Terminations | (10.9) | | | (0.1) | | | (8.4) | | | (3.6) | | | (0.1) | | | (1.0) | | | (24.1) | |

| Net Cash Flows | (3.3) | | | (0.6) | | | (1.2) | | | — | | | — | | | (0.9) | | | (6.0) | |

| Net Flows | (5.0) | | | (0.5) | | | 0.6 | | | 1.9 | | | 1.2 | | | — | | | (1.8) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Investment Performance | 25.7 | | | 6.6 | | | 13.0 | | | 3.6 | | | 0.8 | | | 8.3 | | | 58.0 | |

| End of Period | $ | 247.5 | | | $ | 62.1 | | | $ | 208.6 | | | $ | 61.1 | | | $ | 11.4 | | | $ | 134.5 | | | $ | 725.2 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Three-Month Net Flows by Investment Service (Active versus Passive) |

| | Actively Managed | | Passively Managed (1) | | Total |

| Equity | $ | (5.0) | | | $ | (0.5) | | | $ | (5.5) | |

| Fixed Income | 2.5 | | | 1.2 | | | 3.7 | |

| Alternatives/Multi-Asset Solutions (2) | (0.3) | | | 0.3 | | | — | |

| Total | $ | (2.8) | | | $ | 1.0 | | | $ | (1.8) | |

(1) Includes index and enhanced index services.

(2) Includes certain multi-asset solutions and services not included in equity or fixed income services.

| | | | | | | | |

| www.alliancebernstein.com | | 13 of 17 |

| | | | | | | | | | | |

| AllianceBernstein L.P. | | |

| ASSETS UNDER MANAGEMENT | December 31, 2023 | | |

| (US $ Billions) | | |

| Ending and Average | Twelve Months Ended |

| | 12/31/23 | 12/31/22 |

| Ending Assets Under Management | $725.2 | $646.4 |

| Average Assets Under Management | $680.3 | $686.5 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve-Month Changes by Distribution Channel | | | | | | |

| | Institutions | | Retail | | Private Wealth Management | | Total |

| Beginning of Period | $ | 297.3 | | | $ | 242.9 | | | $ | 106.2 | | | $ | 646.4 | |

| Sales/New accounts | 11.8 | | | 71.1 | | | 18.6 | | | 101.5 | |

| Redemption/Terminations | (12.6) | | | (58.1) | | | (17.5) | | | (88.2) | |

| Net Cash Flows | (11.0) | | | (9.3) | | | — | | | (20.3) | |

| Net Flows | (11.8) | | | 3.7 | | | 1.1 | | | (7.0) | |

| | | | | | | | |

| | | | | | | | |

| Transfers | 0.1 | | | (0.1) | | | — | | | — | |

| Investment Performance | 31.5 | | | 40.3 | | | 14.0 | | | 85.8 | |

| End of Period | $ | 317.1 | | | $ | 286.8 | | | $ | 121.3 | | | $ | 725.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve-Month Changes by Investment Service | | | | | | | | |

| | Equity Active | | Equity Passive (1) | | Fixed Income Taxable | | Fixed Income Tax-Exempt | | Fixed Income Passive (1) | | Alternatives/Multi-Asset Solutions (2) | | Total |

| Beginning of Period | $ | 217.9 | | | $ | 53.8 | | | $ | 190.3 | | | $ | 52.5 | | | $ | 9.4 | | | $ | 122.5 | | | $ | 646.4 | |

| Sales/New accounts | 37.3 | | | 1.3 | | | 36.4 | | | 16.5 | | | 1.7 | | | 8.3 | | | 101.5 | |

| Redemption/Terminations | (43.8) | | | (0.3) | | | (27.3) | | | (11.1) | | | (0.3) | | | (5.4) | | | (88.2) | |

| Net Cash Flows | (9.0) | | | (5.0) | | | (2.5) | | | 0.3 | | | 0.1 | | | (4.2) | | | (20.3) | |

| Net Flows | (15.5) | | | (4.0) | | | 6.6 | | | 5.7 | | | 1.5 | | | (1.3) | | | (7.0) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Investment Performance | 45.1 | | | 12.3 | | | 11.7 | | | 2.9 | | | 0.5 | | | 13.3 | | | 85.8 | |

| End of Period | $ | 247.5 | | | $ | 62.1 | | | $ | 208.6 | | | $ | 61.1 | | | $ | 11.4 | | | $ | 134.5 | | | $ | 725.2 | |

| | | | | | | | | | | | | | | | | | | | |

| Twelve-Month Net Flows by Investment Service (Active versus Passive) |

| | Actively Managed | | Passively Managed (1) | | Total |

| Equity | $ | (15.5) | | | $ | (4.0) | | | $ | (19.5) | |

| Fixed Income | 12.3 | | | 1.5 | | | $ | 13.8 | |

| Alternatives/Multi-Asset Solutions (2) | (2.0) | | | 0.7 | | | $ | (1.3) | |

| Total | $ | (5.2) | | | $ | (1.8) | | | $ | (7.0) | |

(1) Includes index and enhanced index services.

(2) Includes certain multi-asset solutions and services not included in equity or fixed income services.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| By Client Domicile | | | | | | | |

| | Institutions | | Retail | | Private Wealth | | Total |

| U.S. Clients | $ | 235.8 | | | $ | 172.5 | | | $ | 118.7 | | | $ | 527.0 | |

| Non-U.S. Clients | 81.3 | | | 114.3 | | | 2.6 | | | 198.2 | |

| Total | $ | 317.1 | | | $ | 286.8 | | | $ | 121.3 | | | $ | 725.2 | |

| | | | | | | | |

| www.alliancebernstein.com | | 14 of 17 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AB L.P. | | | | | | | | | | | | | | |

| RECONCILIATION OF GAAP FINANCIAL RESULTS TO ADJUSTED FINANCIAL RESULTS | | | | | | | | | | | | | |

| | | | | Three Months Ended | Twelve Months Ended |

| (US $ Thousands, unaudited) | | 12/31/2023 | | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | | | |

| Net Revenues, GAAP basis | | $ | 1,090,720 | | $ | 1,032,056 | | $ | 1,008,456 | | $ | 1,024,091 | | $ | 990,176 | | $ | 4,155,323 | | | $ | 4,054,290 | |

| | Exclude: | | | | | | | | | | | | | | | |

| | Distribution-related adjustments: | | | | | | | | | | | | | |

| | Distribution revenues | (151,339) | | | (149,049) | | | (144,798) | | | (141,078) | | | (137,764) | | | (586,263) | | | (607,195) | |

| | Investment advisory services fees | (15,302) | | | (16,156) | | | (14,005) | | | (15,456) | | | (13,112) | | | (60,919) | | | (57,139) | |

| | Pass through adjustments: | | | | | | | | | | | | | |

| | Investment advisory services fees | (27,162) | | | (14,567) | | | (11,046) | | | (9,763) | | | (7,730) | | | (62,538) | | | (65,116) | |

| | Other revenues | (8,811) | | | (8,661) | | | (8,096) | | | (9,343) | | | (10,055) | | | (34,910) | | | (38,959) | |

| | Impact of consolidated company-sponsored investment funds | (13,670) | | | 1,931 | | | (2,975) | | | (10,409) | | | (2,512) | | | (25,123) | | | 57,436 | |

| | Incentive compensation-related items | (3,509) | | | 238 | | | (4,905) | | | (5,443) | | | (16,889) | | | (13,621) | | | (7,083) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted Net Revenues | | $ | 870,927 | | | $ | 845,792 | | | $ | 822,631 | | | $ | 832,599 | | | $ | 802,114 | | | $ | 3,371,949 | | | $ | 3,336,234 | |

| | | | | | | | | | | | | | | | | |

| Operating Income, GAAP basis | | $ | 238,500 | | | $ | 175,250 | | | $ | 188,661 | | | $ | 215,260 | | | $ | 203,741 | | | $ | 817,670 | | | $ | 815,096 | |

| | Exclude: | | | | | | | | | | | | | | | |

| | Real estate | (206) | | | (206) | | | (206) | | | (206) | | | (206) | | | (825) | | | (825) | |

| | Incentive compensation-related items | 1,126 | | | 1,354 | | | 1,103 | | | 1,608 | | | 378 | | | 5,192 | | | 3,461 | |

| | EQH award compensation | 179 | | | 142 | | | 215 | | | 191 | | | 134 | | | 727 | | | 606 | |

| | | | | | | | | | | | | | | |

| | Acquisition-related expenses | 14,879 | | | 44,941 | | | 20,525 | | | 17,725 | | | 33,474 | | | 98,070 | | | 72,503 | |

| | Interest on borrowings4 | 12,800 | | | 13,209 | | | 14,672 | | | 13,713 | | | 8,505 | | | 54,394 | | | 17,906 | |

| | | | | | | | | | | | | | | |

| | Sub-total of non-GAAP adjustments | 28,778 | | | 59,440 | | | 36,309 | | | 33,031 | | | 42,285 | | | 157,558 | | | 93,651 | |

| | Less: Net income (loss) of consolidated entities attributable to non-controlling interests | 13,384 | | | (2,164) | | | 3,023 | | | 9,767 | | | 5,574 | | | 24,009 | | | (56,356) | |

| Adjusted Operating Income 4 | | $ | 253,894 | | | $ | 236,854 | | | $ | 221,947 | | | $ | 238,524 | | | $ | 240,452 | | | $ | 951,219 | | | $ | 965,103 | |

| Operating Margin, GAAP basis excl. non-controlling interests | 20.6 | % | | 17.2 | % | | 18.4 | % | | 20.1 | % | | 20.0 | % | | 19.1 | % | | 21.5 | % |

| Adjusted Operating Margin4 | 29.2 | % | | 28.0 | % | | 27.0 | % | | 28.7 | % | | 30.0 | % | | 28.2 | % | | 28.9 | % |

| | | | | | | | | | | | | | | | | |

| AB Holding L.P. | | | | | | | | | | | | | |

| RECONCILIATION OF GAAP EPU TO ADJUSTED EPU | | | | | | | | | | | | | |

| | | | | Three Months Ended | Twelve Months Ended |

| ($ Thousands except per Unit amounts, unaudited) | 12/31/2023 | | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 2023 | | 2022 |

| Net Income - Diluted, GAAP basis | $ | 79,198 | | | $ | 56,991 | | | $ | 60,558 | | | $ | 67,437 | | | $ | 63,780 | | | $ | 264,184 | | | $ | 274,167 | |

| Impact on net income of AB non-GAAP adjustments | 6,228 | | | 17,077 | | | 8,124 | | | 7,401 | | | 12,394 | | | 39,355 | | | 25,468 | |

| Adjusted Net Income - Diluted | $ | 85,426 | | | $ | 74,068 | | | $ | 68,682 | | | $ | 74,838 | | | $ | 76,174 | | | $ | 303,539 | | | $ | 299,635 | |

| Diluted Net Income per Holding Unit, GAAP basis | $ | 0.71 | | | $ | 0.50 | | | $ | 0.53 | | | $ | 0.59 | | | $ | 0.59 | | | $ | 2.34 | | | $ | 2.69 | |

| Impact of AB non-GAAP adjustments | 0.06 | | | 0.15 | | | 0.08 | | | 0.07 | | | 0.11 | | | 0.35 | | | 0.25 | |

| Adjusted Diluted Net Income per Holding Unit | $ | 0.77 | | | $ | 0.65 | | | $ | 0.61 | | | $ | 0.66 | | | $ | 0.70 | | | $ | 2.69 | | | $ | 2.94 | |

4 During the second quarter of 2023, we adjusted operating income to exclude interest on borrowings in order to align with our industry peer group. We have recast prior periods presentation to align with the current period presentation.

| | | | | | | | |

| www.alliancebernstein.com | | 15 of 17 |

AB

Notes to Consolidated Statements of Income and Supplemental Information

(Unaudited)

Adjusted Net Revenues

Net Revenue, as adjusted, is reduced to exclude all of the company's distribution revenues, which are recorded as a separate line item on the consolidated statement of income, as well as a portion of investment advisory services fees received that is used to pay distribution and servicing costs. For certain products, based on the distinct arrangements, certain distribution fees are collected by us and passed through to third-party client intermediaries, while for certain other products, we collect investment advisory services fees and a portion is passed through to third-party client intermediaries. In both arrangements, the third-party client intermediary owns the relationship with the client and is responsible for performing services and distributing the product to the client on our behalf. We believe offsetting distribution revenues and certain investment advisory services fees is useful for our investors and other users of our financial statements because such presentation appropriately reflects the nature of these costs as pass-through payments to third parties that perform functions on behalf of our sponsored mutual funds and/or shareholders of these funds. Distribution-related adjustments fluctuate each period based on the type of investment products sold, as well as the average AUM over the period. Also, we adjust distribution revenues for the amortization of deferred sales commissions as these costs, over time, will offset such revenues.

We adjust investment advisory and services fees and other revenues for pass through costs, primarily related to our transfer agent and shareholder servicing fees. Also, we adjust for certain performance-based fees passed through to our investment advisors. These fees do not affect operating income, as such, we exclude these fees from adjusted net revenues.

We adjust for the revenue impact of consolidating company-sponsored investment funds by eliminating the consolidated company-sponsored investment funds' revenues and including AB's fees from such consolidated company-sponsored investment funds and AB's investment gains and losses on its investments in such consolidated company-sponsored investment funds that were eliminated in consolidation.

Adjusted net revenues exclude investment gains and losses and dividends and interest on employee long-term incentive compensation-related investments. Also, we adjust for certain acquisition related pass through performance-based fees and performance related compensation.

Adjusted Operating Income

Adjusted operating income represents operating income on a US GAAP basis excluding (1) real estate charges (credits), (2) the impact on net revenues and compensation expense of the investment gains and losses (as well as the dividends and interest) associated with employee long-term incentive compensation-related investments, (3) the equity compensation paid by EQH to certain AB executives, as discussed below, (4) acquisition-related expenses, (5) interest on borrowings and (6) the impact of consolidated company-sponsored investment funds.

Real estate charges (credits) incurred have been excluded because they are not considered part of our core operating results when comparing financial results from period to period and to industry peers. However, beginning in the fourth quarter of 2019, real estate charges (credits), while excluded in the period in which the charges (credits) are recorded, are included ratably over the remaining applicable lease term.

Prior to 2009, a significant portion of employee compensation was in the form of long-term incentive compensation awards that were notionally invested in AB investment services and generally vested over a period of four years. AB economically hedged the exposure to market movements by purchasing and holding these investments on its balance sheet. All such investments had vested as of year-end 2012 and the investments have been delivered to the participants, except for those investments with respect to which the participant elected a long-term deferral. Fluctuation in the value of these investments is recorded within investment gains and losses on the income statement. Management believes it is useful to reflect the offset achieved from economically hedging the market exposure of these investments in the calculation of adjusted operating income and adjusted operating margin. The non-GAAP measures exclude gains and losses and

| | | | | | | | |

| www.alliancebernstein.com | | 16 of 17 |

dividends and interest on employee long-term incentive compensation-related investments included in revenues and compensation expense.

The board of directors of EQH granted to Seth P. Bernstein, our CEO, equity awards in connection with EQH's IPO. Additionally, equity awards were granted to Mr. Bernstein and other AB executives for their membership on the EQH Management Committee. These individuals may receive additional equity or cash compensation from EQH in the future related to their service on the Management Committee. Any awards granted to these individuals by EQH are recorded as compensation expense in AB’s consolidated statement of income. The compensation expense associated with these awards has been excluded from our non-GAAP measures because they are non-cash and are based upon EQH's, and not AB's, financial performance.

Acquisition-related expenses have been excluded because they are not considered part of our core operating results when comparing financial results from period to period and to industry peers. Acquisition-related expenses include professional fees and the recording of changes in estimates to contingent payment arrangements associated with our acquisitions. Beginning in the first quarter of 2022, acquisition-related expenses also include certain compensation-related expenses, amortization of intangible assets for contracts

acquired and accretion expense with respect to contingent payment arrangements.

We adjust operating income to exclude interest on borrowings in order to align with our industry peer group.

We adjusted for the operating income impact of consolidating certain company-sponsored investment funds by eliminating the consolidated company-sponsored funds' revenues and expenses and including AB's revenues and expenses that were eliminated in consolidation. We also excluded the limited partner interests we do not own.

Adjusted Operating Margin

Adjusted operating margin allows us to monitor our financial performance and efficiency from period to period without the volatility noted above in our discussion of adjusted operating income and to compare our performance to industry peers on a basis that better reflects our performance in our core business. Adjusted operating margin is derived by dividing adjusted operating income by adjusted net revenues.

| | | | | | | | |

| www.alliancebernstein.com | | 17 of 17 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

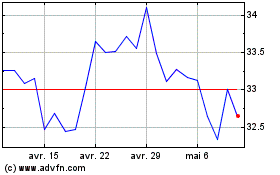

AllianceBernstein (NYSE:AB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

AllianceBernstein (NYSE:AB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024