AM Best Affirms Credit Ratings of Members of Aegon Ltd.’s U.S. Subsidiaries

20 Décembre 2023 - 8:29PM

Business Wire

AM Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Ratings of “a+”

(Excellent) of the U.S. life/health (L/H) subsidiaries of Aegon

Ltd. (Bermuda) [NYSE: AEG]. Aegon Ltd.’s U.S. L/H companies are

Transamerica Life Insurance Company (Cedar Rapids, IA) and

Transamerica Financial Life Insurance Company (Harrison, NY) and

referred to collectively as Aegon USA Group (Aegon USA). The

outlook of these Credit Ratings (ratings) is stable.

The ratings reflect Aegon USA’s balance sheet strength, which AM

Best assesses as very strong, as well as its strong operating

performance, favorable business profile and appropriate enterprise

risk management.

Aegon Ltd., Aegon USA’s ultimate parent, announced on Oct. 27,

2022, that it has reached an agreement to sell its Dutch pension,

life and non-life insurance, banking, and mortgage origination

operations to ASR Nederland N.V. The transaction closed on July 4,

2023. On Sept. 30, 2023, Aegon Ltd.’s extraordinary general meeting

of shareholders approved its cross-border conversion into a Bermuda

Limited company. The company was renamed to Aegon Ltd. from Aegon

N.V. and on Oct. 1, 2023, the Bermuda Monetary Authority became

Aegon Ltd.’s group supervisor. AM Best expects this arrangement to

have a minimal impact to the group’s overall U.S. operations and to

maintain its very strong balance sheet strength assessment in the

near term, with at least a strong level of risk-adjusted

capitalization, as measured by Best’s Capital Adequacy Ratio

(BCAR). Realized losses in the fixed income portfolio in 2022 were

related to divestments made to maintain the group’s liquidity

position in line with its liquidity framework; however, the losses

negatively impacted the group’s risk-adjusted capitalization.

Aegon USA’s operating earnings have been positive over the

longer term with double-digit return on equity and diversified

earnings across different product lines. The company was impacted

by higher mortality in recent years due to COVID-19, but that has

reverted toward pre-pandemic levels broadly since mid-year 2022.

However, Aegon USA’s overall top-line premium growth has been

pressured in recent years, where direct premium declined in 2021

and 2022. Aegon USA’s overall business profile remains favorable

with continued progress toward building a less capital-intensive

book of business, driven by targeted growth and strategic exits and

buyouts in certain lines. The group’s diverse product line of

traditional life, indexed universal life, variable annuities (VA)

without interest sensitive living and death benefit riders, mutual

funds, retirement plans, and accident and health insurance

contribute to operating earnings. With the Transamerica brand

having a large operating footprint, Aegon USA’s business also is

viewed as geographically diversified. The group does have interest

rate sensitivity risk on its balance sheet. AM Best views the

group’s VA with living benefit riders as displaying some of the

highest risk characteristics, as well as being vulnerable to tail

risks, though Aegon USA has taken actions to manage and mitigate

these risks through increased hedging and closing this product line

for new business.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use

and limitations of Credit Rating opinions, please view Guide to

Best's Credit Ratings. For information on the proper use of

Best’s Credit Ratings, Best’s Performance Assessments, Best’s

Preliminary Credit Assessments and AM Best press releases,

please view Guide to Proper Use of Best’s Ratings &

Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2023 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231220577293/en/

Louis Silvers Senior Financial Analyst +1 908 882

2316 louis.silvers@ambest.com

Wayne Kaminski Associate Director +1 908 882

1916 wayne.kaminski@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

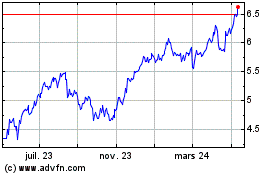

Aegon (NYSE:AEG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

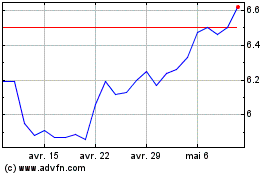

Aegon (NYSE:AEG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024