Company Highlights

- Fourth quarter 2023 net loss available to common

stockholders of $(475.9) million, or $(6.04) per diluted common

share compared to net income of $21.7 million, or $0.25 per diluted

common share for fourth quarter 2022 restated for the adoption of

Accounting Standards Update 2018-12 — more commonly known as Long

Duration Targeted Improvements (LDTI)

- Full year 2023 net income available to common stockholders

of $166.9 million, or $2.06 per diluted common share compared to

net income of $1.9 billion, or $20.50 per diluted common for full

year 2022 restated for the adoption of LDTI

- Non-GAAP operating income available to common stockholders1

for the fourth quarter and full year 2023 of $159.6 million and

$607.1 million, respectively, or $1.99 and $7.50 per diluted common

share, respectively; Notable items2 negatively impacted per share

results in the quarter and full year 2023 by $0.17 and $0.13,

respectively

- For full year 2023, GAAP return on equity and non-GAAP

operating return on equity1 of 8.4% and 18.7%,

respectively

- Total fourth quarter sales4 of $2.0 billion, substantially

all of which were in fixed index annuity (FIA) sales. Total FIA

sales for 2023 were over $7.0 billion - an all-time record for

American Equity - compared to 2020 FIA sales of $2.3 billion before

the execution of the AEL 2.0 strategy

- Fourth quarter investment yield of 4.65%, up 35 basis points

year-over-year, while the sequential change from the third quarter

reflects lower-than-expected returns on market-to-market private

assets

- Increase in private assets to 25.8% of the investment

portfolio as of December 31, 2023, with an additional $7 billion of

liquidity - or 15% of the investment portfolio - at year-end;

Expect to have $10 billion of liquidity available to be redeployed

opportunistically after the close of the planned merger with

Brookfield Reinsurance (NYSE, TSX: BNRE) in the first half of

2024

American Equity Investment Life Holding Company (NYSE: AEL), a

leading issuer of fixed index annuities, today reported strong

fourth quarter 2023 results. Sales of fixed index annuities

remained strong supported by the company's continued emphasis on

its guaranteed retirement income product offerings.

American Equity's President and CEO, Anant Bhalla stated:

"Supported by our strategy flywheel, American Equity had an

outstanding 2023 capped off by our strong results in the fourth

quarter. FIA sales for the year were a record $7.0 billion as our

shareholder value of new business-focused guaranteed income

products – IncomeShield and Eagle Select Income Focus – accounted

for roughly 62% of premium deposits. Our in-house expertise in

tactical asset allocation and asset manager selection positioned us

to achieve a 26% allocation to private assets. We delivered a

23-basis point increase in yield compared to full year 2022 and 92

basis points of yield improvement compared to full year 2021,

excluding non-trendable items3, despite lower than modeled returns

on mark-to-market private assets this past year. In our view, our

agreement to merge with Brookfield Reinsurance was an important

marker in our transformation of the American Equity business model,

delivering both shareholder value creation from the AEL 2.0

strategy and validation of our capabilities in insurance liability

origination asset management. In the latter, we have proven out the

ability to both source robust returns on private assets and then

restructure these investments to deliver a superior return on

equity for the insurance balance sheet. This strategy has created a

more than three-fold increase in value for American Equity

shareholders based on the average volume-weighted stock price of

$17.86 in March 2020 while also returning approximately $1.1

billion to shareholders over that period over the ten quarters from

the fourth quarter of 2020 to the first quarter of 2023."

Non-GAAP operating income available to common stockholders1 for

the fourth quarter of 2023 was $159.6 million, or $1.99 per diluted

common share, compared to non-GAAP operating income available to

common stockholders1 of $195.5 million, or $2.45 per diluted common

share, for the third quarter of 2023 and $141.7 million, or $1.64

per diluted common share, for the fourth quarter of 2022, restated

for the adoption of LDTI. For the fourth quarter of 2023, non-GAAP

operating income available to common stockholders1 was negatively

affected by $13.3 million, or $0.17 per share, after taxes, from

notable items2. Results in the third quarter of 2023 included

positive notable items2 of $21.0 million, or $0.26 per share after

taxes.

The year-over-year change in quarterly non-GAAP operating income

available to common stockholders1, excluding the impact of notable

items2, reflects higher net investment income and surrender

charges, increased recurring fee revenue related to reinsurance,

and a decrease in the quarterly change in the Market Risk Benefit

liability.

Compared to the third quarter of 2023, quarterly non-GAAP

operating income available to common stockholders1. excluding the

impact of notable items2, decreased reflecting lower investment

spread and increased other operating expenses. Notable items2 in

the fourth and third quarters of 2023 reflect the special incentive

compensation plan put in place in November 2022. Notable items2 in

the third quarter also include the effect of actuarial assumption

revisions.

For the fourth quarter of 2023, net investment income fell to

$581 million, when adjusted to reflect non-GAAP operating income

available to common stockholders1, from $585 million for the third

quarter of 2023. Notable items2 totaled $3 million and $2 million

in the fourth and third quarters of 2023, respectively, reflecting

the allocation of quarterly expense associated with the strategic

incentive compensation award made in November 2022. The $3 million

decline in net investment income relative to the third quarter of

2023, adjusted to reflect non-GAAP operating income available to

common stockholders1 and notable items2, reflects a 4-basis point

decrease in effective yield on the investment portfolio.

Compared to the third quarter of 2023, fourth quarter surrender

charge income increased $12 million to $58 million, reflecting both

increased lapse activity associated with higher interest rates as

well as cohort changes in policies being surrendered.

Outflows in the fourth quarter of 2023, including surrenders,

income utilization, death benefits and partial withdrawals,

increased $712 million from the third quarter of 2023 to $2.1

billion. The increase in outflows primarily reflects a $497 million

increase in surrenders of multi-year guaranteed annuities (MYGA)

driven by lapsation of such policies having three-year surrender

charge periods that were sold in the fourth quarter of 2020.

American Equity currently expects $1.5 billion to $2 billion of

MYGA in-force to lapse in the first half of 2024, reflecting the

corresponding scale of MYGA business with three-year surrender

charge periods written by both American Equity Life and Eagle Life

in late 2020 and early 2021.

As of December 31, 2023, account value of business ceded subject

to fee income was $11.5 billion, down slightly from $11.6 billion

three months earlier. This reflects a modification of the AEL 2.0

reinsurance strategy given the impending merger, as American Equity

is now retaining all FIA new business on its balance sheet

effective October 1, 2023, until the close of the merger. Flow

reinsurance ceded subject to fee income in the fourth quarter of

2023 was just $44 million of account value reflecting the

relatively low level of MYGA sales. Revenue associated with

recurring fees under reinsurance agreements for the fourth quarter

of 2023 totaled $28 million compared to $27 million for the third

quarter of 2023, each as adjusted to reflect non-GAAP operating

income available to common stockholders1.

Interest sensitive and index product benefits, as adjusted to

reflect non-GAAP operating income available to common

stockholders1, for the fourth quarter of 2023 reflected an $8

million increase in the cost of money for deferred annuities

compared to the third quarter. Cost of money for deferred annuities

in the fourth quarter benefited from $9 million of hedging gains

compared to $6 million in the third quarter. In addition, interest

sensitive and index product benefits adjusted to reflect non-GAAP

operating income available to common stockholders1 for the third

quarter of 2023 includes a benefit from notable items2 of $2

million reflecting the annual actuarial assumption revision

process.

Compared to the third quarter of 2023, the change in the MRB

liability increased by $31 million to $26 million when adjusted to

reflect non-GAAP operating income available to common

stockholders1. Third quarter change in MRB liability when adjusted

to reflect non-GAAP operating income available to common

stockholders1 included a benefit from notable items2 of $33 million

reflecting the annual actuarial assumption revision process. For

the fourth quarter, the change in the MRB liability adjusted to

reflect non-GAAP operating income available to common stockholders1

was $6 million less than expected, consisting of a $12 million

benefit from reserves released due to higher-than-expected

surrenders and other policyholder behavior experience, offset by a

$6 million less-than-expected benefit from amortization of net

deferred capital market impact due to unfavorable fourth quarter

capital market changes – primarily a lower discount rate as

interest rates fell during the quarter. The change in the modeled

expectation for the MRB liability, adjusted to reflect non-GAAP

operating income available to common stockholders1, for the first

quarter of 2024 is $42 million, based on current in-force. First

quarter 2024 expected change in the MRB liability includes an

expected benefit from the amortization of capital market impacts on

the fair value of market risk benefits of $22 million.

Amortization of deferred policy acquisition and sales inducement

cost was $123 million for the fourth quarter of 2023, in-line with

modeled expectations. For the first quarter of 2024, the modeled

expectation for deferred acquisition cost and deferred sales

inducement amortization is $127 million before the effect of new

sales and experience variances and excluding the potential

application of purchase GAAP accounting.

Other operating costs and expenses adjusted to reflect non-GAAP

operating income available to common stockholders1 for the fourth

quarter of 2023 increased to $72 million, up $5 million from the

third quarter. Notable items2 in the fourth and third of 2023 were

$4 million and $7 million, pre-tax, respectively, both reflecting

quarterly expense associated with the strategic incentive

compensation award made in November 2022.

The effective tax rate on pre-tax operating income available for

common stockholders1 for the fourth quarter of 2023 was 26.6%

compared to the third quarter of 2023 tax rate of 21.9%. The income

tax rate in the fourth quarter reflected approximately $12 million

of additional expense primarily resulting from increased

non-deductible compensation of which $8 million is considered a

notable item as it was related to the strategic incentive

compensation award made in November 2022.

INVESTMENT SPREAD DECREASES FROM PRIOR SEQUENTIAL QUARTER ON

LOWER MARK-TO-MARKET PRIVATE ASSET RETURNS

American Equity’s investment spread was 2.64% for the fourth

quarter of 2023 compared to 2.73% for the third quarter of 2023 and

2.54% for the fourth quarter of 2022. Excluding non-trendable

items3, adjusted investment spread decreased to 2.56% in the fourth

quarter of 2023 from 2.68% in the third quarter of 2023.

Average yield on invested assets was 4.65% in the fourth quarter

of 2023 compared to 4.69% in the third quarter of 2023. The average

adjusted yield on invested assets excluding non-trendable items3

was 4.64% in the fourth quarter of 2023 compared to 4.69% in the

third quarter of 2023.

The return on mark-to-market private assets declined from the

third quarter of 2023, and was $24 million, or 20 basis points of

yield, less than assumed rates of return used in our investment

process due to fair value changes on real estate and lower

partnership income. This compares to a contribution that was $10

million, or 8 basis points of yield, less than assumed rates of

return on such assets recognized in the third quarter. Fixed income

investment yield increased 4 basis points from the third quarter to

4.65%.

During the fourth quarter of 2023, long-term investment asset

purchases totaled $696 million and were made at an average expected

rate of 8.61%.

The point-in-time yield on the portfolio at December 31, 2023,

was 4.86%.

The aggregate cost of money for annuity liabilities of 2.01% in

the fourth quarter of 2023 was up 5 basis points compared to the

third quarter of 2023. The cost of money in the fourth quarter of

2023 reflects a seven-basis point benefit from the over-hedging of

index-linked credits compared to a 5-basis point benefit in the

third quarter of 2023. The 7-basis point increase in the adjusted

cost of money compared to the third quarter is in line with

increased market costs.

Cost of options in the fourth quarter of 2023 averaged 1.70%

compared to 2.02% in the third quarter of 2023, reflecting both

market effects on the cost of options for renewals as well as lower

option costs on new sales resulting from mix shift towards lower

option cost guaranteed retirement income products following the

October 1, 2023, pause of the flow reinsurance agreement with

Brookfield Reinsurance.

Net account balance growth in the fourth quarter was a positive

$139 million, or 0.3% of account values. Index credits in the

fourth quarter increased to $137 million from $121 million in the

third quarter of 2023.

FIA SALES REMAIN STRONG BOLSTERED BY INCREASE IN GUARANTEED

RETIREMENT INCOME PRODUCT SALES

Fourth quarter 2023 sales were $2.0 billion, substantially all

of which were in fixed index annuities. Total enterprise FIA sales

decreased 11% from the third quarter of 2023 but were up 153%

compared to the fourth quarter of 2022. Despite the sequential

quarterly decrease, the level of quarterly FIA sales was still the

third highest in the company's history.

Compared to the third quarter of 2023, FIA sales at American

Equity Life in the Independent Marketing Organization (IMO) channel

fell 10%, while Eagle Life FIA sales through banks and

broker-dealers fell 14%. The decrease in FIA sales relative to the

third quarter was driven by lower sales in the accumulation product

space.

Bhalla noted, "We continued to record strong FIA sales in the

fourth quarter of 2023, despite lowering S&P 500 caps on our

accumulation products late in the third quarter, in line with our

product profitability targets in light of lower interest rates. We

were particularly pleased that sales of income products, which we

believe is the most attractive sector in the FIA marketplace, were

up 4% from the third quarter on a total enterprise basis to nearly

$1.5 billion. Income product sales are not as subject to churn as

are accumulation products in a higher interest rate environment and

have weighted average life duration characteristics that best match

our at scale capabilities in originating and structuring private

asset strategies."

Bhalla continued, "I could not be more proud of the efforts of

my teammates in making 2023 a record sales year for FIAs with total

deposits of just over $7 billion compared with FIA sales of $2.3

billion in 2020 – my first year as Chief Executive Officer. This

was particularly gratifying as we celebrated our 28 years of

existence and 20th anniversary as a public company."

CREDIT AND CAPITAL METRICS REMAIN STABLE

With regard to credit markets, Jim Hamalainen, Chief Investment

Officer, added, "Credit metrics in the investment portfolio

continued to be stable in the fourth quarter, and our core fixed

income portfolio remains 'A' rated. Net realized losses for the

quarter totaled just $2 million. We saw very little deterioration

in the commercial mortgage loan portfolio and all loans are

current. Average loan-to-value of the commercial mortgage loan

portfolio remained steady at 51%, and 82% of the portfolio

maintains a debt service coverage ratio of 1.2x or higher. Looking

specifically at our direct office mortgage loan exposure, we are

considerably underweight relative to our peers at just 7% of the

commercial mortgage loan portfolio. The average debt service

coverage ratio on the office mortgage loan portfolio is 1.86x with

an average loan-to-value ratio of 62%. We have only $2 million in

principal amount of office mortgage loans maturing through the end

of 2024 with just $30 million set to mature in 2025."

Hamalainen continued, "At year-end, the cash position in the

investment portfolio totaled $7.4 billion and was over $9 billion

at the end of January funded primarily through sales of the core

fixed income portfolio and new annuity sales. Our considerable cash

holdings will provide the company with substantial dry powder to

take advantage of opportunities that may emerge in the private

asset sector while helping to protect the company if macro-economic

trends were to deteriorate or surrenders increase to greater than

expected levels."

Effective October 1, 2023, the company completed its second

Vermont-domiciled redundant reserve financing facility. Backed by a

new relationship with a leading international reinsurer, the new

facility reinsured approximately $550 million of in-force statutory

reserves for lifetime income benefit guarantees resulting from

sales of both American Equity Life's IncomeShield product and

Eagles Life's Eagle Select Income Focus product freeing up

approximately $450 million, pre-tax, of capital at close. In

addition, the financing facility allows future new business to

automatically benefit from the financing of redundant reserves,

thereby enabling the capital-efficient growth of our guaranteed

retirement income products going forward.

As of December 31, 2023, total adjusted capital at American

Equity Life totaled $4.3 billion with estimated excess capital of

approximately $800 million above rating agency requirements and an

estimated risk-based capital ratio of 370% to 390%. Cash and

equivalents at the holding company level was $560 million at

year-end and $875 million at January 31, 2024 after a $320 million

ordinary dividend paid by the life company to the holding company

on January 16th.

PENDING MERGER WITH BROOKFIELD REINSURANCE

On July 5, 2023, Brookfield Reinsurance and American Equity

announced that they had entered into a definitive agreement whereby

Brookfield Reinsurance will acquire all outstanding shares of

common stock of American Equity it does not already own in a cash

and stock transaction that values AEL at approximately $4.3

billion.

Following approval of the transaction by shareholders at the

special meeting held November 10, 2023, American Equity continues

to expect the merger to close in the first half of 2024. Closing

remains subject to the satisfaction of certain closing conditions

customary for a transaction of this type, including receipt of

insurance regulatory approvals in relevant jurisdictions.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

The forward-looking statements in this release such as believe,

build, confident, continue, could, estimate, expect, exposure,

future, grow, likely, maintain, may, might, model, opportunity,

outlook, plan, potential, proposed, risk, scenario, should, trend,

will, would, and their derivative forms and similar words, as well

as any projections of future results, are based on assumptions and

expectations that involve risks and uncertainties, including the

"Risk Factors" the company describes in its U.S. Securities and

Exchange Commission filings and as described in the "Cautionary

Notice Regarding Forward-Looking Statements" in AEL's July 5, 2023

news release. The Company's future results and events could differ,

and it has no obligation to correct or update any of these

statements.

ABOUT AMERICAN EQUITY

At American Equity Investment Life Holding Company, our

policyholders work with over 40,000 independent agents and advisors

affiliated with independent market organizations (IMOs), banks and

broker-dealers through our wholly-owned operating subsidiaries.

Advisors and agents choose one of our leading annuity products best

suited for their clients' personal needs to create financial

dignity in retirement. To deliver on its promises to policyholders,

American Equity has re-framed its investment focus — building a

stronger emphasis on insurance liability driven asset allocation

and specializing in alternate, private asset management while

partnering with world renowned, public fixed income asset managers.

American Equity is headquartered in West Des Moines, Iowa with

additional offices in Charlotte, NC, New York, NY and Miami, FL.

For more information, please visit www.american-equity.com.

1

Use of non-GAAP financial measures is

discussed in this release in the tables that follow the text of the

release.

2

Notable items reflect the increase

(decrease) to non-GAAP operating income (loss) available to common

stockholders for certain matters where more detail may help

investors better understand, evaluate, and forecast results.

Notable items are further discussed in the tables that follow the

text of the release.

3

Non-trendable items are the impact of

investment yield – additional prepayment income and cost of money

effect of over (under) hedging as shown in our December 31, 2023

financial supplement on page 10, “Spread Results”.

4

For the purposes of this document, all

references to sales are on a gross basis. Gross sales is defined as

sales before the use of reinsurance.

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands, except per share data)

Consolidated Statements of

Operations

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Revenues:

Premiums and other considerations

$

2,657

$

2,991

$

11,967

$

19,739

Annuity product charges

96,947

61,666

315,496

230,354

Net investment income

582,176

537,995

2,272,798

2,307,463

Change in fair value of derivatives

353,443

22,243

259,046

(1,138,128

)

Net realized gains (losses) on

investments

(2,065

)

14,411

(99,203

)

(47,848

)

Other revenue

21,973

13,032

75,866

42,245

Total revenues

1,055,131

652,338

2,835,970

1,413,825

Benefits and expenses:

Insurance policy benefits and change in

future policy benefits

3,161

5,948

17,687

33,220

Interest sensitive and index product

benefits

193,439

57,626

567,423

554,871

Market risk benefits (gains) losses

241,998

33,490

(14,546

)

3,684

Amortization of deferred sales

inducements

50,346

45,966

192,252

181,970

Change in fair value of embedded

derivatives

977,178

342,409

1,143,576

(2,352,598

)

Interest expense on notes and loan

payable

11,642

10,228

45,890

32,098

Interest expense on subordinated

debentures

1,341

1,335

5,355

5,331

Amortization of deferred policy

acquisition costs

72,428

66,831

279,700

284,011

Other operating costs and expenses

75,250

62,389

301,581

239,526

Total benefits and expenses

1,626,783

626,222

2,538,918

(1,017,887

)

Income (loss) before income taxes

(571,652

)

26,116

297,052

2,431,712

Income tax expense (benefit)

(108,202

)

(6,817

)

85,133

511,135

Net income (loss)

(463,450

)

32,933

211,919

1,920,577

Less: Net income available to

noncontrolling interests

1,545

361

1,389

358

Net income (loss) available to American

Equity Investment Life Holding Company stockholders

(464,995

)

32,572

210,530

1,920,219

Less: Preferred stock dividends

10,919

10,919

43,675

43,675

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(475,914

)

$

21,653

$

166,855

$

1,876,544

Earnings (loss) per common share

$

(6.04

)

$

0.25

$

2.10

$

20.72

Earnings (loss) per common share -

assuming dilution

$

(6.04

)

$

0.25

$

2.06

$

20.50

Weighted average common shares outstanding

(in thousands):

Earnings (loss) per common share

78,754

85,274

79,476

90,558

Earnings (loss) per common share -

assuming dilution

78,754

86,402

80,952

91,538

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands, except per share data)

NON-GAAP FINANCIAL MEASURES

In addition to net income (loss) available to common

stockholders, we have consistently utilized non-GAAP operating

income available to common stockholders and non-GAAP operating

income available to common stockholders per common share - assuming

dilution, non-GAAP financial measures commonly used in the life

insurance industry, as economic measures to evaluate our financial

performance. Non-GAAP operating income available to common

stockholders equals net income (loss) available to common

stockholders adjusted to eliminate the impact of items that

fluctuate from quarter to quarter in a manner unrelated to core

operations, and we believe measures excluding their impact are

useful in analyzing operating trends. The most significant

adjustments to arrive at non-GAAP operating income available to

common stockholders eliminate the impact of fair value accounting

for our fixed index annuity business. These adjustments are not

economic in nature but rather impact the timing of reported

results. We believe the combined presentation and evaluation of

non-GAAP operating income available to common stockholders together

with net income (loss) available to common stockholders provides

information that may enhance an investor’s understanding of our

underlying results and profitability.

Reconciliation from Net Income (Loss)

Available to Common Stockholders to Non-GAAP Operating Income

Available to Common Stockholders

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(475,914

)

$

21,653

$

166,855

$

1,876,544

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized gains (losses) on financial

assets, including credit losses

(2,277

)

(19,460

)

91,615

48,264

Change in fair value of derivatives and

embedded derivatives

583,961

169,767

549,600

(1,549,205

)

Capital markets impact on the change in

fair value of market risk benefits

216,214

2,309

(122,094

)

(393,617

)

Net investment income

(1,509

)

1,476

(1,137

)

1,476

Other revenue

5,969

5,969

23,876

5,969

Expenses incurred related to

acquisition

3,750

—

13,464

—

Income taxes

(170,603

)

(39,998

)

(115,116

)

401,838

Non-GAAP operating income available to

common stockholders

$

159,591

$

141,716

$

607,063

$

391,269

Impact of excluding notable items (a)

$

13,255

$

—

$

10,755

$

181,890

Per common share - assuming dilution:

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(6.04

)

$

0.25

$

2.06

$

20.50

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Anti-dilutive impact for losses (b)

0.11

—

—

—

Net realized gains (losses) on financial

assets, including credit losses

(0.03

)

(0.23

)

1.13

0.53

Change in fair value of derivatives and

embedded derivatives

7.28

1.96

6.79

(16.92

)

Capital markets impact on the change in

fair value of market risk benefits

2.70

0.03

(1.51

)

(4.30

)

Net investment income

(0.02

)

0.02

(0.01

)

—

Other revenue

0.07

0.07

0.29

0.01

Expenses incurred related to

acquisition

0.05

—

0.17

0.06

Income taxes

(2.13

)

(0.46

)

(1.42

)

4.39

Non-GAAP operating income available to

common stockholders

$

1.99

$

1.64

$

7.50

$

4.27

Impact of excluding notable items (a)

$

0.17

$

—

$

0.13

$

1.99

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands, except per share data)

Notable Items

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

$

13,255

$

—

$

38,323

$

—

Impact of actuarial assumption updates

—

—

(27,568

)

181,890

Total notable items (a)

$

13,255

$

—

$

10,755

$

181,890

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income available to

common stockholders for certain matters where more detail may help

investors better understand, evaluate, and forecast results.

For the three months ended December 31,

2023 and 2022, non-GAAP operating income (loss) available to common

stockholders would increase $13.3 million and $0.0 million,

respectively, if we were to exclude the impact of notable

items.

For the year ended December 31, 2023 and 2022, non-GAAP

operating income (loss) available to common stockholders would

increase $10.8 million and $181.9 million, respectively, if we were

to exclude the impact of notable items. (b) For periods with

a loss, dilutive shares were not included in the calculation as

inclusion of such shares would have an anti-dilutive effect.

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands, except share and per share

data)

Book Value per Common

Share

Q4 2023

Total stockholders’ equity attributable

to American Equity Investment Life Holding Company

$

3,023,260

Equity available to preferred stockholders

(a)

(700,000

)

Total common stockholders' equity (b)

2,323,260

Accumulated other comprehensive (income)

loss (AOCI)

2,979,657

Total common stockholders’ equity

excluding AOCI (b)

5,302,917

Net impact of fair value accounting for

derivatives and embedded derivatives

(1,240,397

)

Net capital markets impact on the fair

value of market risk benefits

(698,808

)

Total common stockholders’ equity

excluding AOCI and the net impact of fair value accounting for

fixed index annuities (b)

$

3,363,712

Common shares outstanding

79,337,818

Book Value per Common Share:

(c)

Book value per common share

$

29.28

Book value per common share excluding AOCI

(b)

$

66.84

Book value per common share excluding AOCI

and the net impact of fair value accounting for fixed index

annuities (b)

$

42.40

(a)

Equity available to preferred stockholders

is equal to the redemption value of outstanding preferred stock

plus share dividends declared but not yet issued.

(b)

Total common stockholders' equity, total

common stockholders' equity excluding AOCI and total common

stockholders' equity excluding AOCI and the net impact of fair

value accounting for fixed index annuities, non-GAAP financial

measures, exclude equity available to preferred stockholders. Total

common stockholders’ equity and book value per common share

excluding AOCI, non-GAAP financial measures, are based on common

stockholders’ equity excluding the effect of AOCI. Since AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale securities, we believe these

non-GAAP financial measures provide useful supplemental

information. Total common stockholders' equity and book value per

common share excluding AOCI and the net impact of fair value

accounting for fixed index annuities, non-GAAP financial measures,

are based on common stockholders' equity excluding AOCI and the net

impact of fair value accounting for fixed index annuities. Since

the net impact of fair value accounting for our fixed index annuity

business is not economic in nature but rather impact the timing of

reported results, we believe these non-GAAP financial measures

provide useful supplemental information.

(c)

Book value per common share including and

excluding AOCI and book value per common share excluding AOCI and

the net impact of fair value accounting for fixed index annuities

are calculated as total common stockholders’ equity, total common

stockholders’ equity excluding AOCI and total common stockholders'

equity excluding AOCI and the net impact of fair value accounting

for fixed index annuities divided by the total number of shares of

common stock outstanding.

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands)

NON-GAAP FINANCIAL MEASURES

Average Common Stockholders' Equity and

Return on Average Common Stockholders' Equity

Return on average common stockholders' equity measures how

efficiently we generate profits from the resources provided by our

net assets. Return on average common stockholders' equity is

calculated by dividing net income available to common stockholders,

for the trailing twelve months, by average equity available to

common stockholders. Non-GAAP operating return on average common

stockholders' equity excluding average accumulated other

comprehensive income (AOCI) and average net impact of fair value

accounting for fixed index annuities is calculated by dividing

non-GAAP operating income available to common stockholders, for the

trailing twelve months, by average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities. We exclude AOCI because AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale investments. We exclude the net

impact of fair value accounting for fixed index annuities as the

amounts are not economic in nature but rather impact the timing of

reported results.

Twelve Months Ended

December 31, 2023

Average Common Stockholders' Equity

Attributable to American Equity Investment Life Holding Company,

Excluding Average AOCI and Average Net Impact of Fair Value

Accounting for Fixed Index Annuities

Average total stockholders’ equity

$

2,686,389

Average equity available to preferred

stockholders

(700,000

)

Average equity available to common

stockholders

1,986,389

Average AOCI

3,362,944

Average common stockholders' equity

excluding average AOCI

5,349,333

Average net impact of fair value

accounting for derivatives and embedded derivatives

(1,446,283

)

Average net capital markets impact on the

fair value of market risk benefits

(649,833

)

Average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities

$

3,253,217

Net income available to American Equity

Investment Life Holding Company common stockholders

$

166,855

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

91,615

Change in fair value of derivatives and

embedded derivatives

549,600

Capital markets impact on the change in

fair value of market risk benefits

(122,094

)

Net investment income

(1,137

)

Other revenue

23,876

Expenses incurred related to

acquisition

13,464

Income taxes

(115,116

)

Non-GAAP operating income available to

common stockholders

$

607,063

Impact of excluding notable items (a)

$

10,755

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company

Net income available to common

stockholders

8.4

%

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company, Excluding Average AOCI and Average Net Impact of Fair

Value Accounting for Fixed Index Annuities

Non-GAAP operating income available to

common stockholders

18.7

%

Notable

Items

Twelve Months Ended

December 31, 2023

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

$

38,323

Impact of actuarial assumption updates

(27,568

)

Total notable items (a)

$

10,755

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income available to

common stockholders for certain matters where more detail may help

investors better understand, evaluate, and forecast results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214542354/en/

Steven D. Schwartz, Head of Investor Relations (515)

273-3763, sschwartz@american-equity.com

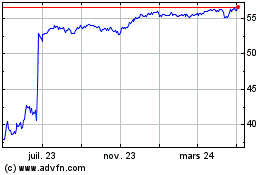

American Equity Investme... (NYSE:AEL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

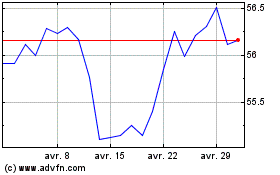

American Equity Investme... (NYSE:AEL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025