false0000922864APARTMENT INVESTMENT & MANAGEMENT CO00009228642023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 13, 2023 |

Apartment Investment and Management Company

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-13232 |

84-1259577 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4582 South Ulster Street Suite 1450 |

|

Denver, Colorado |

|

80237 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 303 224-7900 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock (Apartment Investment and Management Company) |

|

AIV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

From November 14-15, 2023, representatives of Apartment Investment and Management Company ("Aimco"), including Wes Powell, President and Chief Executive Officer, Lynn Stanfield, Executive Vice President and Chief Financial Officer, and Matt Foster, Sr. Director of Capital Markets and Investor Relations, will be meeting with investors at Nareit's REITworld 2023 Investor Conference. During those meetings, Aimco representatives will discuss the attached presentation. The presentation is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are filed with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY |

|

|

|

|

Date: |

November 13, 2023 |

By: |

/s/ H. Lynn C. Stanfield |

|

|

|

H. Lynn C. Stanfield

Executive Vice President and Chief Financial Officer |

CONTENTS AIV NYSE LISTED 29 YEARS PUBICLY TRADED +2,600bps COMPARED TO RUSSELL 2000 SINCE 2020 SPIN-OFF1 PRESENTATION TOPICS: About Aimco – Apartment specialists with a deep history and differentiated strategy Aimco Portfolio & Results – Strong stabilized operating performance with net operating income (NOI) up 10% year-to-date, active developments on track to reach $55M of annual stabilized NOI, supported by a solid balance sheet Capital Allocation – Prudent allocation of capital, currently favoring the return of capital to shareholders, sourced from cash on hand and planned asset sales Value Proposition – Continued value creation with opportunities to narrow the gap between share price and net asset value [1] As of November 10, 2023 16% TOTAL SHAREHOLDER RETURN SINCE 2020 SPIN-OFF1

AIMCO HISTORY 1994 1994-2008 2008 - 2015 2016-2020 IPO Apartment Investment and Management Company becomes publicly traded on the New York Stock Exchange. GROWTH Through portfolio and corporation M&A, Aimco grows to become one of the largest owners and operators of apartments in the nation. Portfolio Distillation Aimco narrows its geographic focus, trimming its target markets from 20+ to 12, and ramps up its redevelopment program. 2020 NEW AIMCO Aimco spins off AIR Communities into separate public REIT, appoints new executive management team and reconstitutes Board of Directors. Transition Aimco expands its development and opportunistic investing, exits the affordable apartment business and enhances its property management function.

2020 SPIN-OFF The 2020 spin-off of AIR Communities was completed in December 2020, with 88% of the market capitalization being separated into the new entity and 12% remaining in Aimco. Following the spin-off, Aimco has a refreshed Board of Directors, new executive leadership team, a new mission, and a new business plan. PRE and POST SPIN-OFF ASSET ALLOCATION

AIMCO INVESTMENTS Aimco couples outsized growth prospects from opportunistic investments with the safety of a stable apartment portfolio resulting in a nimble platform that can move the needle quickly. 6 Current Allocation Investment in Value Add and Opportunistic Real Estate Provides outsized growth opportunities compared to a primarily�stabilized apartment portfolio Aimco invests where it has the local knowledge and expertise that provides a comparative advantage over other developers and mitigates execution risk Maintain a portfolio of Core and Core Plus Real Estate Provides stability and safety compared to a pure development portfolio Aimco’s diversified portfolio of apartments in major U.S. markets provides additional certainty of performance through local economic cycles Select Alternative Investments Aimco plans to continue its reduction of capital allocated to these investments

AIMCO TEAM Executive team has an average Aimco tenure of 20 YEARS Development team has collectively built or renovated approximately $15Bn IN PROJECTS, including 50K APARTMENT HOMES, and has an average of 22 YEARS of industry experience Capital Markets and Transactions teams have participated in more than $16Bn OF TRANSACTIONS AND FINANCINGS and have an average of 17 YEARS of industry experience Aimco team had RECORD ENGAGEMENT SCORE OF 4.74 in 2023 Aimco maintained a team of highly engaged and deeply experienced real estate professionals

SUCCESSFUL TRACK RECORD SELECT HIGHLIGHTS Since the spin-off of AIR Communities, Aimco has had a strong performance track record. Aimco Stabilized Portfolio Delivered Strong Growth Net Operating Income (NOI) Growth of more than 35% with NOI margins expanding by 460 basis points Exited Seattle and reduced California exposure through the sale of assets for $249M – NOI Cap Rate of 4.0% Developments and Redevelopments Completed On-Time and On-Budget Completed construction activities on six projects or more than $750M of development and redevelopment projects Monetized four of the completed projects for $669M – Levered Multiple on Invested Capital (MOIC) 5.9x Tripled Aimco’s pipeline providing optionality to maximize value through vertical development or monetization prior to construction Significantly Fortified the Balance Sheet Retired or refinanced more than $1Bn of near-term liabilities Sourced $775M of fixed-rate non-recourse property debt at rates significantly below today’s potential refinancing levels – Rate 4.25% Hedged floating-rate debt so that 100% of Aimco’s total debt is either fixed-rate or hedged with interest rate cap protection Accretive Capital Allocation Unlocked almost $1Bn of asset value through development monetizations, stabilized asset dispositions, and selling partial interests in certain alternative investments with proceeds used to repay debt, acquire pipeline assets, and repurchase Aimco stock Repurchased 8.8M shares of Aimco common stock at an average price of $7.33 per share Committed to “Best in Class” Governance Complete Board refreshment Opted out of the provisions of the Maryland Unsolicited Takeover Act (MUTA) Enhanced financial and environmental disclosure including reporting to Task Force on Climate-Related Financial Disclosures (TCFD)

STABILIZED PORTFOLIO REAL ESTATE INVESTMENTS Royal Crest Estates (Nashua) 902 Units – Nashua, NH Plantation Gardens 372 Units – Plantation, FL Evanston Place 190 Units – Evanston, IL The Milan 42 Units – New York, NY Hyde Park Tower 155 Units – Chicago, IL URBAN vs SUBURBAN BY MARKET Aimco owns a portfolio of 21 stabilized apartment communities with 5,600 apartment homes diversified by geography and price point. PORTFOLIO STATS 64% 26% 10%�Class B Class C+ Class A 19.5% �3Q Rent-to-Income Ratio $2,358 3Q Avg Monthly Revenue per Home PERCENT OF STABILIZED OPERATING NOI SELECT STABILIZED OPERATING COMMUNITIES Source: Company Records Class A refers to apartment communities with rents >120% of local market average Class B refers to apartment communities with rents between 90% and 120% of local market average Class C refers to apartment communities with rents less than 90% of local market average

2023 3Q YTD RESULTS 2023 OUTLOOK 96.5% �Average Daily Occupancy 8.25% - 8.75% Stabilized Revenue Growth 9.0%�Revenue Growth 5.75% - 6.75% Stabilized Expense Growth 10.0%�NOI Growth 9.00% - 9.75% Stabilized NOI Growth STABILIZED PORTFOLIO PERFORMANCE METRICS Preliminary October YTD ADO, revenue growth, and blended lease-to-lease were 96.5%, 8.8%, and 7.8%, respectively. In November, with our third quarter earnings report, we increased our projection for year-over-year NOI growth by more than 100 basis points at the midpoint. Source: Company Records

STABILIZED PORTFOLIO REAL ESTATE INVESTMENTS More than 80% of Aimco’s 3Q 2023 Stabilized Operating NOI was earned by apartment communities located in markets with: LOWER EXPECTED SUPPLY GROWTH and HIGHER EXPECTED REVENUE GROWTH. Higher expected revenue growth results in higher valuation multiples (lower cap rates). Source: Green Street, Company Records Supply Growth ('23E-'27E) Market RevPAF ('23E-'27E) Aimco Stabilized Portfolio Market - sized to represent weighting by % of 3Q 2023 NOI

ACTIVE DEVELOPMENTS The Benson Hotel & Fac. Club Aurora, CO 106-Key Placemaking Development includes 18,000 sf of Event Space Construction Complete Critical placemaking addition to the build-out of the Anschutz Medical Campus Oak Shore Corte Madera, CA 24-Home Single Family Rental Development Initial Units Complete – Ready for Occupancy November 2023 Three units pre-leased ~$1,000/mo ahead of underwriting High Barrier Marin County submarket The Hamilton Miami, FL 276-Unit Major Redevelopment Construction Complete – 96% Occupied Rents >$800/mo ahead of underwriting Condo conversion potential Avg unit size of >1,400 sf Upton Place Washington D.C. 689-Unit Mixed Use Development Initial 81 units delivered in October 2023 Initial rents >$300/mo ahead of underwriting 105K sf of Commercial Space 80% pre-leased High Barrier to entry Upper-Northwest submarket Strathmore Square Bethesda, MD 220-Unit Phase I Development Initial Delivery on track for 3Q 2024 Infill site two miles from the main campus of the National Institutes of Health ON TRACK TO ADD VALUE Total direct investment of $814M and expected to produce $55M of NOI when stabilized. Aimco equity fully deployed. 600 new units to be delivered in 2023, and another 700 projected in 2024. Sources: Green Street, Company Records, Estimates as of 3Q 2023.

Aimco’s current alternative investments include a mezzanine loan secured by a stabilized apartment property with an option to participate in future apartment development, as well as three passive equity investments. Over time, we plan to continue our REDUCTION OF CAPITAL ALLOCATED to these investments. Mezzanine Loan Parkmerced Aimco is under agreement to sell its remaining 80% stake in a mezzanine loan made to the partnership that owns Parkmerced apartments for $134 million plus accrued interest. The borrower continues to be current on their senior debt obligations and operations at Parkmerced are continuing to show modest improvement with occupancy reaching into the low 80% range as they balance increasing occupancy at the expense of rental rate achievement. Passive Equity Investments IQHQ In July 2022, Aimco redeemed 22% of its passive equity investment in IQHQ Inc., a life sciences developer. Aimco received proceeds of $16.5 million from the sale resulting in a greater than 50% internal rate of return over the hold period for this portion of its investment. Aimco retains 2.4 million shares worth $59.7 million and the opportunity to collaborate with IQHQ on future development opportunities that include a residential component. ALTERNATIVE INVESTMENTS Real Estate Tech Funds Aimco also has two smaller passive equity investments in real estate technology ventures.

BALANCE SHEET SOLID WITH LIMITED EXPOSURE Aimco primarily utilizes assumable, non-recourse, property-level debt and construction loans. As of September 30, 2023, Aimco had: [1] Maturities presented at Aimco’s September 30, 2023 share of outstanding balances and inclusive of all contractual extensions. Limited interest rate exposure, with Aimco total debt either fixed-rate or with rate caps currently mitigating all floating rate exposure A favorable mark-to-market on its fixed rate leverage, including the fair value of interest hedges, of ~$110M Ample liquidity with access to $320 million of cash on hand, short-term treasuries, and capacity on its revolving credit facility A weighted average cost of debt, including interest rate caps, of 5.45%

NEAR-TERM SOURCES OF CAPITAL Aimco is preparing to market for sale its BRICKELL ASSEMBLAGE located in Miami, as well as certain recently COMPLETED DEVELOPMENT PROJECTS and SELECT LAND HOLDINGS. In addition, Aimco remains under agreement to sell its 80% stake in the PARKMERCED MEZZANINE LOAN for $134M plus accrued interest. The sales are expected to take place in 2024, provided pricing and terms are favorable. 17 BRICKELL ASSEMBLAGE Includes the 357-unit Yacht Club apartment building and the neighboring 300k rsf 1001 Brickell Bay Drive office tower. The two assets sit on 4.25 acres of prime waterfront land in Miami’s Brickell district. The site and existing improvements provide considerable optionality given the steady current income and potential for more than 3 million square feet of development.

NEAR-TERM CAPITAL ALLOCATION 18 RETURN OF CAPITAL TO SHAREHOLDERS through common stock repurchases, partnership unit redemptions, and special cash dividends. At current market pricing, Aimco views the repurchase of common stock as an attractive opportunity. Over the past 22 months Aimco has repurchased 8.8 million shares at an average price of $7.33 per share Aimco redeemed ~140K operating partnership units for cash Aimco’s Board of Directors increased the repurchase authorization to 30 million shares LEVERAGE REDUCTION through the retirement of asset-level debt upon completion of planned transactions. Earlier in 2023, Aimco retired $60 million of high-cost floating-rate debt SELECT NEW INVESTMENTS which offer the prospect of strong risk adjusted returns. Aimco anticipates maintaining an active development business but reducing the amount of Aimco capital allocated to development activity over the year ahead. Aimco currently favors the RETURN OF CAPITAL TO SHAREHOLDERS while continuing to ADVANCE THE BUSINESS and maintain BALANCE SHEET STABILITY.

NEAR-TERM CAPITAL ALLOCATION Fitzsimons 4 Bioscience Strathmore Phase 2 Hamilton House�3333 Biscayne 300 Broward�One Edgewater Flagler Village Phase 1 Aimco Pipeline Investments INVEST CAPITAL PRUDENTLY Aimco expects to fund advancing the remaining pipeline development projects with 50% - 60% loan-to-cost construction loans, Aimco equity of 10% to 15% of the total development cost, with the remaining costs funded with Co-GP and/or LP equity. Aimco expects to advance plans for a SELECT NUMBER OF NEW PROJECTS, which offer the prospect of strong risk adjusted returns. The projects are likely to be selected from the pipeline opportunities listed below.

NET ASSET VALUE VALUATION BUILDING BLOCKS Aimco provides a summary of the items needed to support your calculation of an estimate of Net Asset Value (NAV) in Supplement Schedule 8 in our quarterly earnings release. The building blocks of Aimco’s valuation as of September 30, 2023, are: Source: Company Records, Green Street Market Reports Net Assets Annualized NOI for Stabilized Apartment Properties [1] $107.9 Annualized NOI for Other Real Estate [1] 8.1 Annualized NOI for unconsolidated real estate at AIV share [1] 1.6 Projected Annual NOI for Active Development Projects upon Stabilization [1][2] 55.3 Land, Planning and Entitlement Investment at Cost 163.5 Parkmerced Mezzanine Investment 123.8 IQHQ and Real Estate Tech Funds [3] 64.5 Cash and Equivalents 95.7 Restricted Cash 20.2 Short-term Treasury Investments 54.3 Notes receivable 39.8 Fair Value Adjustment on Fixed Rate Debt & Preferred Equity [2] 100.0 Net Liabilities Non-recourse property debt $877.1 Construction Loans and Preferred Equity Interests 258.4 Preferred Equity Interests 170.2 Investment Remaining to Complete Active Development Projects 119.1 Other Liabilities, net [4] 162.3 Total shares, units and dilutive share equivalents 154.7 Noncontrolling Interests in Real Estate[5] Annualized 3Q 2023 NOI before 3% management fees. Aimco estimated values that are not guarantees of future performance or results, actual performance could differ significantly. IQHQ based on 2022 recapitalization value and Real Estate Tech Funds based on 3Q 2023 GAAP fair value. Other Liabilities, net generally consists of Aimco’s land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities. Amounts presented at 100% ownership exclusive of noncontrolling interests. Aimco estimates this value to be $40M - $50M. Multifamily “B” Cap Rates for Aimco’s Markets per Green Street range from 4.8% to 6.0% Primarily Aimco’s 1001 Brickell Bay Drive Office Asset located in Miami, FL Private market unlevered discount rates for assets in active construction and lease-up are estimated to range from 8%-9%, a 100-200 bps spread to stabilized returns, depending on the level of development risks outstanding Excludes the 4.25-acre Brickell Assemblage where recent land sales support a valuation $125 - $175M greater than that of the capitalized income value, and pipeline planning and entitlement investment with an estimated value of at least $40M[2] Represents the remaining mezzanine investment asset, net after the partial sale of the Parkmerced mezzanine loan

VALUE PROPOSITION COMMITTED TO MAXIMIZING AND UNLOCKING SHAREHOLDER VALUE There can be no assurance that the ongoing review will result in any particular transaction or transactions or other strategic changes or outcomes and the timing of any such event is similarly uncertain. The Company does not intend to disclose or comment on developments related to the foregoing unless or until it determines that further disclosure is appropriate or required. The Aimco Board of Directors, in coordination with management, remains intently focused on maximizing and unlocking value for Aimco stockholders. During the ongoing review, the Board continues to engage regularly with several leading advisory firms, including Morgan Stanley & Co. LLC, to review current market conditions. Aimco believes it is well positioned for long term growth given its high-quality development pipeline and investment platform, diversified portfolio of core and opportunistic multifamily assets, and long-duration, low-cost balance sheet. As such, the timing of any broad strategic action to unlock stockholder value will take into consideration a host of factors, including the health and stability of both the financial and capital markets.

AIMCO LEADERSHIP Jennifer Johnson EVP, CHIEF ADMINISTRATIVE OFFICER, GENERAL COUNSEL Wes Powell PRESIDENT & CHIEF EXECUTIVE OFFICER Lynn Stanfield EVP & CHIEF FINANCIAL OFFICER Lee Hodges SENIOR VICE PRESIDENT�SOUTHEAST REGION 8 Years with Aimco Previously with: Peebles Development�The Related Group Matt Konrad SENIOR VICE PRESIDENT NATIONAL TRANSACTIONS 6 Years with Aimco Previously with:�Brandywine Realty�Akridge Tom Marchant SENIOR VICE PRESIDENT�ACCOUNTING, TAX, & FP&A 9 Years with Aimco Previously with:�Extra Space Storage�Deloitte Derek Ullian SENIOR VICE PRESIDENT�DEVELOPMENT 7 Years with Aimco Previously with:�Benchmark RE Group John Nicholson SENIOR VICE PRESIDENT DEBT & CAPITAL MARKETS 19 Years with Aimco Previously with: Tuchenhagen N.A,. Elizabeth (Tizzie) Likovich SENIOR VICE PRESIDENT�CENTRAL REGION 3 Years with Aimco Previously with:�UDR�Wells Fargo Kellie Dreyer SENIOR VICE PRESIDENT�CHIEF ACCOUNTING OFFICER 1 Year with Aimco Previously with: Ernst & Young Matt Hopkins SENIOR VICE PRESIDENT�MID-ATLANTIC REGION 7 Years with Aimco Previously with: Streetsense DNC Architects COHESIVE AND EXPERIENCED SENIOR LEADERSHIP TEAM 19 years with Aimco 22 years with Aimco 19 years with Aimco

ASSET LIST Operating Apartment Communities Operating Office Building Property Name Location Apartment Homes Property Name Location Square Feet 118-122 West 23rd Street New York, NY 42 1001 Brickell Bay Drive Miami, FL 300k 173 E. 90th Street New York, NY 72 237-239 Ninth Avenue New York, NY 36 Active Projects 1045 on the Park Apartments Homes Atlanta, GA 30 Property Name Location Approved Units 2200 Grace Lombard, IL 72 The Benson Hotel & faculty Club Aurora, CO 106 Bank Lofts Denver, CO 125 The Hamilton Miami, FL 276 Bluffs at Pacifica, The Pacifica, CA 64 Oak Shore Corte Madera, CA 24 Eldridge Townhomes Elmhurst, IL 58 Upton Place Washington, DC 689 Elm Creek Elmhurst, IL 400 Strathmore Square Phase 1 Bethesda, MD 220 Evanston Place Evanston, IL 190 Hillmeade Nashville, TN 288 Development Land Hyde Park Tower Chicago, IL 155 Property Name Location Acres Plantation Gardens Plantation ,FL 372 Brickell Assemblage Miami, FL 4.25 Royal Crest Estates Warwick, RI 492 200 Broward Fort Lauderdale, FL 1.1 Royal Crest Estates Nashua, NH 902 300 Broward Fort Lauderdale, FL 2.3 Royal Crest Estates Marlborough, MA 473 Hamilton House Miami, FL 1.1 Waterford Village Bridgewater, MA 588 One Edgewater Miami, FL 0.5 Wexford Village Worcester, MA 264 3333 Biscayne Miami, FL 2.8 Willow Bend Rolling Meadows, IL 328 Fitzsimons Aurora, CO 5.2 Yacht Club at Brickell Miami, FL 357 Flagler Village Parcel 1 Fort Lauderdale, FL 5.7 Yorktown Apartments Lombard, IL 292 Flagler Village Parcels 2 & 3 Fort Lauderdale, FL 3.1 Flying Horse Colorado Springs, CO 7.5 Partnership Owned Strathmore Square Phase 2 Bethesda, MD 1.4 Casa del Hermosa La Jolla, CA 41 Bioscience Aurora, CO 4.8 Casa del Mar La Jolla, CA 30 Casa del Norte La Jolla, CA 34 Alternative Investments Casa del Sur La Jolla, CA 37 Investment Name Investment Type St. George Villas St. George, SC 40 IQHQ Passive Equity Parkmerced Mezzanine Loan RE Tech Funds Passive Equity

PIPELINE INVESTMENTS Pipeline Project Summaries As of September 30, 2023 (unaudited) Project Location Project Name / Description Estimated / Currently Planned [1] Acreage Gross Sq Ft Multifamily Units Leasable Commercial Sq Ft Earliest Vertical Construction Start Southeast Florida 556-640 NE 34th Street (Miami) Hamilton House 1.10 830,000 241 5,000 1Q 2024 3333 Biscayne Boulevard (Miami) 3333 Biscayne 2.80 1,760,000 650 176,000 1Q 2024 510-532 NE 34th Street (Miami) One Edgewater 0.50 533,000 204 — 3Q 2024 200 Broward Boulevard (Fort Lauderdale) 200 Broward 1.08 725,000 380 20,000 3Q 2024 300 Broward Boulevard (Fort Lauderdale) 300 Broward 2.31 1,700,000 935 40,000 4Q 2024 901 N Federal Highway (Fort Lauderdale) Flagler Village Phase I 4.60 1,315,000 455 200,000 4Q 2024 902 N Federal Highway (Fort Lauderdale) Flagler Village Phase II 1.10 315,000 300 — 4Q 2026 1001-1111 Brickell Bay Drive (Miami) Brickell Assemblage 4.25 3,200,000 1,500 500,000 2Q 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase III 1.70 400,000 300 — 4Q 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase IV 1.40 400,000 300 — 4Q 2028 Washington D.C. Metro Area 5300 Block of Tuckerman Lane (Bethesda) Strathmore Square Phase II 1.35 525,000 399 11,000 2Q 2024 Colorado's Front Range 1765 Silversmith Road (Colorado Springs) Flying Horse 7.45 300,000 95 — 1Q 2024 E 23rd Avenue & N Scranton Street (Aurora) Fitzsimons 4 1.77 415,000 285 — 2Q 2024 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 4 1.53 232,000 — 225,000 2Q 2024 E 22nd Avenue & N Scranton Street (Aurora) Fitzsimons 2 2.29 390,000 275 — 1Q 2025 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 5 1.22 230,000 — 190,000 2Q 2026 E 23rd Avenue & Uvalda (Aurora) Fitzsimons 3 1.11 400,000 225 — 1Q 2027 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 6 2.04 385,000 — 315,000 2Q 2028 Total Future Pipeline 39.60 14,055,000 6,544 1,682,000 Aimco estimates are not guarantees of future plans which could differ significantly

POTENTIAL PIPELINE PROJECT SELECT PIPELINE HIGHLIGHTS Edgewater Miami, Florida Acres: 8.3 | GSF of Development: ~2,300,000 | Green Street Submarket Grade: A- Aimco’s Financial Interest: Aimco is sole owner of The Hamilton and the adjacent land which can accommodate ~1.3M sf. Aimco has a 20% interest in the remaining assemblage. Two and three-bedroom rents in Edgewater have increased >40% since Aimco’s acquisition of the land in July 2021. Source: Company Records Representative only of the sites available density and potential massing.

POTENTIAL PIPELINE PROJECT SELECT PIPELINE HIGHLIGHTS Source: U.S. Census Bureau 2021 MSA Data, University of Colorado, Company Records Fitzsimons Anschutz Medical Campus – Aurora, Colorado Acres: 10.0 | GSF of Development: ~2,100,000 | Green Street Submarket Grade: B+ Aimco’s Financial Interest: Aimco is the sole owner of options to purchase the only multifamily parcels on the campus. Aimco recently entered an option agreement for the long-term lease of land for commercial life science development. Anschutz Medical Campus has an economic impact of ~$8.5Bn annually and supports the employment of ~31,000 and the education of ~4,500 annually. The next phase of residential development is in planning and is being funded in partnership with Alaska Permanent Fund. Representative of the potential campus when fully built out.

POTENTIAL PIPELINE PROJECT SELECT PIPELINE HIGHLIGHTS Source: U.S. Census Bureau 2021 MSA Data, Company Records Flagler Village Fort Lauderdale, Florida Acres: 8.8 | GSF of Development: ~2,400,000 | Green Street Submarket Grade: A- Aimco’s Financial Interest: Aimco is the sole owner. Amendments to the previous owner’s plans have been submitted with the City. To meet downtown Fort Lauderdale housing demand another 13,000 residential units, 600,000 sf of shopping and dining, 1.1M sf of office, and 1,000 new hotel rooms are needed by 2030. Rendering of amended plans submitted with the City.

NON-GAAP RECONCILIATION PROPERTY NET OPERATING INCOME (NOI): NOI is defined by Aimco as total property rental and other property revenues less direct property operating expenses, including real estate taxes. NOI does not include: property management revenues, primarily from affiliates; casualties; property management expenses; depreciation; or interest expense. NOI is helpful because it helps both investors and management to understand the operating performance of real estate excluding costs associated with decisions about acquisition pricing, overhead allocations, and financing arrangements. NOI is also considered by many in the real estate industry to be a useful measure for determining the value of real estate. Reconciliations of NOI as presented in this report to Aimco’s consolidated GAAP amounts are provided below. Due to the diversity of its economic ownership interests in its apartment communities in the periods presented, Aimco evaluates the performance of the apartment communities in its segments using Property NOI, which represents the NOI for the apartment communities that Aimco consolidates and excludes apartment communities that it does not consolidate. Property NOI is defined as rental and other property revenue less property operating expenses. In its evaluation of community results, Aimco excludes utility cost reimbursement from rental and other property revenues and reflects such amount as a reduction of the related utility expense within property operating expenses. The following table presents the reconciliation of GAAP rental and other property revenue to the revenues before utility reimbursements and GAAP property operating expenses to expenses, net of utility reimbursements as presented on Supplemental Schedule 6 of Aimco’s quarterly earnings release and supplemental schedules. OTHER LIABILITIES, NET: Other liabilities, net, as presented herein and on in Aimco’s Earnings Release on Supplemental Schedule 8, Net Asset Value Components, generally consists of the Aimco's development land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities, net of interest rate options and other assets, excluding the fair value of Aimco's investments in IQHQ and real estate technology funds. Other liabilities, net as of September 30, 2023, as presented in Supplemental Schedule 8, Net Asset Value Components, is calculated as follows (in millions): Segment NOI Reconciliation Nine Months Ended (in thousands) September 30, 2023 September 30, 2022 Total Real Estate Operations Revenues,�Before Utility�Reimbursements Expenses,�Net of Utility�Reimbursements Revenues,�Before Utility�Reimbursements Expenses,�Net of Utility�Reimbursements Total (per consolidated statements of operations) $ 137,643 $ 54,648 $ 148,375 $ 56,384 Adjustment: Utilities reimbursement (4,544 ) (4,544 ) (4,323 ) (4,323 ) Adjustment: Other Real Estate (10,664 ) (4,237 ) (11,466 ) (3,656 ) Adjustment: Non-stabilized and other amounts not allocated (11,031 ) (12,441 ) (30,380 ) (17,060 ) Total Stabilized Operating (per Schedule 6) $ 111,404 $ 33,426 $ 102,206 $ 31,345 Accrued Liabilities and Other (per Consolidated Balance Sheet) $ 111.0 Lease liabilities - finance leases (per Consolidated Balance Sheet) 117.7 Other assets, net (per Consolidated Balance Sheet) (176.0 ) Interest Rate Options (per Consolidated Balance Sheet) (9.2 ) Total (per Consolidated Balance Sheet) 43.5 Reduction in assets (reported elsewhere on Schedule 8): Short term treasury investment 54.3 IQHQ and Real Estate Tech Funds 64.5 Other liabilities, net (per Schedule 8) $ 162.3

Forward Looking Statement This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to, the statements in this document regarding our future plans and goals, including our pipeline investments and projects, our plans to eliminate certain near term debt maturities, our estimated value creation and potential, our timing, scheduling and budgeting, projections regarding lease growth, our plans to form joint ventures, our plans for new acquisitions or dispositions, our strategic partnerships and value added therefrom, and changes to our corporate governance. We caution investors not to place undue reliance on any such forward-looking statements. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Aimco that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statement. Important factors, among others, that may affect actual results or outcomes include, but are not limited to: (i) the risk that the 2023 plans and goals may not be completed, as expected, in a timely manner or at all, (ii) the inability to recognize the anticipated benefits of the pipeline investments and projects, and (iii) changes in general economic conditions, including, increases in interest rates and other force-majeure events. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These forward-looking statements reflect management’s judgment and expectations as of this date, and Aimco assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances. Certain financial and operating measures found herein are used by management and are not defined under accounting principles generally accepted in the United States, or GAAP. These measures are reconciled to the most comparable GAAP measures at the end of this presentation. Definitions can be found in Aimco’s Earnings Release and Supplemental Schedules for the quarter ended June 30, 2023.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

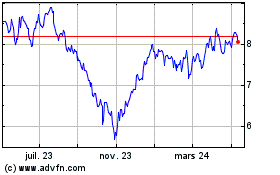

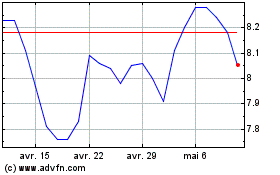

Apartment Investment and... (NYSE:AIV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Apartment Investment and... (NYSE:AIV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024