UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

January 2024

Date of Report (Date of Earliest Event Reported)

Embotelladora Andina S.A.

(Exact name of registrant as specified in its charter)

Andina Bottling Company, Inc.

(Translation of Registrant´s name into English)

Avda. Miraflores 9153

Renca

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Indicate by check mark whether the registrant by

furnishing the information contained in this Form 6-K is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934

Yes ¨ No x

EXECUTIVE SUMMARY

|

The quarter closed with a consolidated Sales Volume of 248.4 million unit cases*, a decrease of 1.0%

compared to the same quarter of the previous year. Transactions reached 1,361.3 million for the quarter, a decrease of 2.4% compared

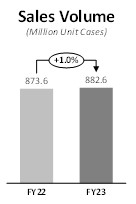

to the same quarter of the previous year. Accumulated consolidated sales volume reached 882.6 million unit cases, an increase of 1.0%

with respect to the previous year. Accumulated transactions reached 4,859.6 million, representing an increase of 0.7%. |

|

Company figures reported are the following: |

| · | Consolidated

Net Sales reached CLP 773,552 million in the quarter, decreasing by 2.1% over the same quarter

of the previous year. Accumulated consolidated Net Sales reached CLP 2,618,437 million, representing

a 1.4% decrease regarding the previous year. |

| · | Consolidated

Operating Income* reached CLP 130,138 million in the quarter, representing a 13.1% increase

over the same quarter of the previous year. Accumulated consolidated Operating Income reached

CLP 357,337 million, an increase of 3.5% regarding the previous year. |

| · | Consolidated

Adjusted EBITDA* increased by 7.3% over the same quarter of the previous year, reaching CLP

159,070 million in the quarter. Adjusted EBITDA Margin reached 20.6%, an expansion of 180

basis points compared to the same quarter of the previous year. Accumulated consolidated

Adjusted EBITDA reached CLP 470,108 million, which represents an increase of 1.2% compared

to the previous year. Adjusted EBITDA Margin for the period reached 18.0%, an expansion of

47 basis points compared to the previous year. |

| · | Net

Income attributable to the owners of the controller for the quarter reached CLP 80,740 million,

representing an increase of 78.7% regarding the same quarter of the previous year. Accumulated

Net Income attributable to the owners of the controller was CLP 171,441 million, which represents

a 36.6% increase regarding the previous year. |

|

Consolidated quarterly and accumulated results were strongly affected by the depreciation of local

currencies, especially the Argentine peso against the reporting currency. Isolating this effect, i.e. on a currency neutral* basis,

the company's figures are as follows: |

| · | Consolidated

Net Sales reached CLP 823,505 million in the quarter, an increase of 4.2% over the same quarter

of the previous year. Accumulated consolidated Net Sales reached CLP 2,837,973 million, an

increase of 6.8% over the previous year. |

| · | Consolidated

Operating Income* reached CLP 137,588 million in the quarter, an increase of 19.6% over the

same quarter of the previous year. Accumulated consolidated Operating Income was CLP 390,000

million, an increase of 13.0% over the previous year. |

| · | Consolidated

Adjusted EBITDA* reached CLP 168,816 million in the quarter, an increase of 13.9% over the

same quarter of the previous year. Accumulated consolidated Adjusted EBITDA was CLP 514,227

million, an increase of 10.7% over the previous year. |

SUMMARY OF RESULTS FOURTH QUARTER AND FULL YEAR

ENDED DECEMBER 31, 2023

| (Figures

in million CLP) | |

| 4Q22 | | |

4Q23 | | |

Var % | | |

FY22 | | |

FY23 | | |

Var % | |

Sales

Volume

(Million Unit Cases) | |

| 250.9 | | |

248.4 | | |

-1.0 | % | |

873.6 | | |

882.6 | | |

1.0 | % |

| Net Sales | |

| 789,934 | | |

773,552 | | |

-2.1 | % | |

2,656,878 | | |

2,618,437 | | |

-1.4 | % |

| Operating Income* | |

| 115,042 | | |

130,138 | | |

13.1 | % | |

345,144 | | |

357,337 | | |

3.5 | % |

| Adjusted EBITDA* | |

| 148,257 | | |

159,070 | | |

7.3 | % | |

464,510 | | |

470,108 | | |

1.2 | % |

| Net income attributable to the owners of the controller | |

| 45,194 | | |

80,740 | | |

78.7 | % | |

125,498 | | |

171,441 | | |

36.6 | % |

*The definitions used can be found in the Glossary on page 16 of this document.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -2- |

Comment of the Chief Executive Officer.

Mr. Miguel Ángel Peirano

"We closed the fourth quarter of 2023

with solid financial results, as we had done in previous quarters. In local currency terms, adjusted EBITDA increased 20.6% (in real

terms) in Argentina, 19.5% in Brazil, 5.5% in Chile, and 23.1% in Paraguay. Adjusted consolidated EBITDA for the quarter reached CLP

159,070 million, a 7.3% increase in Chilean pesos with a margin expansion of 180 basis points, while income for the quarter increased

by 78.7% compared to the same period last year, reaching CLP 80,740 million.

It is worth noting that the strong devaluation

of the Argentine currency in December 2023 had a negative impact on the company's consolidated results. Because Argentina is a hyperinflationary

economy, IAS 29 requires that the results of this operation for the full year (and fourth quarter) be translated into Chilean pesos

using the period's closing exchange rate. Isolating this effect, the Company's adjusted EBITDA on a currency neutral basis* increased

by 13.9% during the quarter. Excluding the Argentine operation, the Company's EBITDA increased 12.9% over the same period the previous

year.

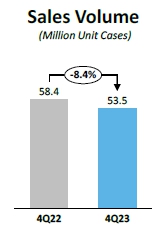

The Company's consolidated volume fell

1.0% in the quarter, owing to an 8.4% volume reduction in Argentina, a country experiencing a difficult macroeconomic situation that

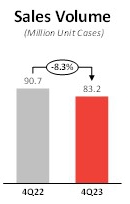

has resulted in a significant loss of purchasing power by consumers, and an 8.3% decline in Chile, where we had adverse weather conditions

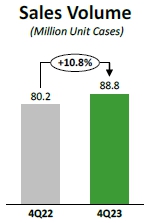

compared to the previous year. Both Brazil and Paraguay experienced volume growth of 10.8% and 5.5%, respectively, but it was insufficient

to offset the aforementioned volume reductions.

The

achievements we made in ESG issues in 2023 are equally important to the Company as the financial results. In December we were included

in the Dow Jones Chile Index for the eighth year in a row, as well as the Dow Jones Sustainability Index MILA Pacific Alliance for the

seventh year in a row. We are the top-ranked Chilean company in our industry and among the top four worldwide, also in our industry,

thanks to our commitment to these matters and our tenacity in addressing them. Our water consumption ratio at the end of the year

was 1.72 liters extracted for every liter of beverage produced. Notable accomplishments included the establishment of effluent water

treatment and recovery projects in Brazil and Chile, among other projects. In Argentina, Brazil, and Paraguay, we are already producing

bottles made from recycled PET resin. In Paraguay, we inaugurated Circular Pet, a plant in which we own 33.33%, allowing us to recycle

PET containers and transform them into recycled food-grade resin to produce new bottles, while in Chile, we are continuing to build the

Re-Ciclar plant, which will begin operations in 2024. In terms of soft drink returnability, we closed the year with 41.4% in Argentina,

40.0% in Paraguay, 41.1% in Chile, and 22.2% in Brazil, putting us among the top bottlers in the system globally. Our focus on energy

has led to the use of 100% renewable energy in Renca, Antofagasta, Ribeirão Preto and Duque de Caxias plants, as well as distribution

centers in Brazil. Finally, we were named Employer of the Year in Paraguay, and in Chile, we ranked first in the MERCO Talento beverage

category and second in the mass consumption category.

We estimate that the Capex for 2024 will

be around USD 250 million. A significant portion of this Capex will be allocated to investments in returnable bottles and cases, as well

as cold equipment to be installed at points of sale that require it, thereby supporting our on-premise and traditional channel customers.

In addition, we will continue with our project to expand and adapt our infrastructure in Brazil for the manufacture and storage of new

products, including the acquisition of a state-of-the-art mixed production line, capable of producing beer and alcoholic and non-alcoholic

beverages, which will be operational in early 2025. Finally, we will complete the projects for reopening the Mendoza plant in Argentina

and the PET resin recycling plant in Chile. It is important to note that this Capex estimate is constantly evaluated and monitored, and

it may change depending on the macroeconomic conditions of the countries in which we operate."

BASIS OF PRESENTATION

Figures in the following analysis are expressed

in accordance with IFRS, in nominal Chilean pesos, both for consolidated results and for the results of each of our operations. All variations

with respect to 2022 are nominal.

Since Argentina has been classified as a Hyperinflationary

economy, pursuant to IAS 29, translation of figures from local to reporting currency was performed using the closing exchange rate for

the translation to Chilean pesos. Local currency figures for both 2023 and 2022 referred to in the Argentina sections are expressed in

December 2023 currency.

Finally, a devaluation of local currencies regarding

the U.S. dollar has a negative impact on our dollarized costs and a devaluation of local currencies regarding the Chilean peso has a

negative impact upon consolidating figures.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -3- |

When we refer to "Argentina", we mean

our subsidiaries Embotelladora del Atlántico S.A. and Empaques Argentina S.A. When we refer to "Chile", we include all

companies domiciled in Chile, among which are Embotelladora Andina S.A., VJ S.A., Vital Aguas S.A., and Envases Central S.A.

CONSOLIDATED RESULTS: 4th Quarter 2023 vs. 4th Quarter 2022

| (Figures in million CLP) | |

4Q22 | | |

4Q23 | | |

Var % | |

| Net Sales | |

| 789,934 | | |

| 773,552 | | |

| -2.1 | % |

| Operating Income | |

| 115,042 | | |

| 130,138 | | |

| 13.1 | % |

| Adjusted EBITDA | |

| 148,257 | | |

| 159,070 | | |

| 7.3 | % |

| Net income attributable to the owners of the controller | |

| 45,194 | | |

| 80,740 | | |

| 78.7 | % |

During the quarter, consolidated Sales Volume

was 248.4 million unit cases, which represented a decrease of 1.0% compared to the same period of 2022, mainly explained by the volume

decrease of the operations in Argentina and Chile, partially offset by the volume increase of the operations in Brazil and Paraguay.

The Non-Alcoholic Beverages Segment represented 94.4% of consolidated Sales Volume and decreased 1.4%, mainly explained by the decrease

of the segment in Chile and Argentina, partially offset by the growth in Brazil and Paraguay. The Alcoholic Beverages Segment represented

5.6% of total volume and grew 6.6% explained by the volume growth in all countries where we operate. Transactions reached 1,361.3 million

during the quarter, representing a 2.4% decrease compared to the same quarter of the previous year.

Consolidated Net Sales decreased by 2.1% to CLP

773,552 million, explained by the reduction in revenues in Argentina, mainly due to lower volumes in that country and the impact of translating

figures to the reporting currency, which was partially offset by the revenue growth in Brazil and Paraguay.

Consolidated Cost of Sales decreased 4.4%, which

is mainly explained by (i) the effect of translating figures from the local currency of Argentina to the reporting currency, (ii) a

lower cost of Pet resin in the four countries where we operate, and (iii) lower volume sold in Argentina and Chile. This was partially

offset by (i) higher volume sold in Brazil and Paraguay, (ii) the shift in the mix towards higher unit cost products in Brazil,

Chile and Paraguay, and (iii) a higher cost of sugar, mainly in Argentina, Chile and Paraguay.

Consolidated Distribution Costs and Administrative

Expenses decreased 5.3%, which is mainly explained by (i) the effect of translating figures from the local currency of Argentina

to the reporting currency, and (ii) lower distribution costs in Argentina and Chile. This was partially offset by (i) higher

labor costs, and (ii) higher marketing expenses in Brazil and Chile.

The aforementioned effects led to a consolidated

Operating Income of CLP 130,138 million, an increase of 13.1%. Operating Margin was 16.8%.

Consolidated Adjusted EBITDA reached CLP 159,070

million, increasing by 7.3%. Adjusted EBITDA margin was 20.6%, an expansion of 180 basis points.

Net income attributable to the owners of the

controller for the quarter was CLP 80,740 million, an increase of 78.7%, and Net Margin reached 10.4%, an expansion of 472 basis points.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -4- |

ARGENTINA: 4th Quarter 2023 vs. 4th Quarter 2022

| | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | |

| | |

| (Figures in million CLP) | | |

| (Figures

in million ARS of December 2023) | |

| Net Sales | |

| 202,411 | | |

| 129,595 | | |

| -36.0 | % | |

| 129,848 | | |

| 119,449 | | |

| -8.0 | % |

| Operating Income | |

| 19,867 | | |

| 18,683 | | |

| -6.0 | % | |

| 12,745 | | |

| 17,221 | | |

| 35.1 | % |

| Adjusted EBITDA | |

| 28,789 | | |

| 24,169 | | |

| -16.0 | % | |

| 18,468 | | |

| 22,277 | | |

| 20.6 | % |

Sales volume in the quarter decreased 8.4%, reaching

53.5 million unit cases, explained by the decrease in the volume of the Soft Drinks, Waters and Juices and other non-alcoholic beverages

categories, partially offset by the increase in the Beer and other alcoholic beverages category. The reduction in sales volume is mainly

explained by the fact that the country is going through a difficult macroeconomic situation that has resulted in a significant loss of

purchasing power on the part of consumers. Transactions amounted to 252.4 million, representing a decrease of 8.8%.

Net sales amounted to CLP 129,595 million, down

36.0%. In local currency, they decreased by 8.0%, which was mainly explained by the aforementioned decrease in volume, slightly offset

by the increase in the average revenue per unit case sold, as a result of price increases in line with local inflation during the quarter.

Cost of Sales decreased 41.3%, while in local

currency it decreased 15.7%, which is mainly explained by (i) the lower sales volume, (ii) a lower cost of concentrate, and

(iii) a lower cost of Pet resin. This was partially offset by (i) higher labor costs, and (ii) higher sugar costs.

Distribution Costs and Administrative Expenses

decreased 36.3% in the reporting currency, while in local currency they decreased 8.4%, which is mainly explained by lower distribution

and transportation freight expenses and lower volume sold. This was partially offset by higher labor expenses.

The aforementioned effects led to an Operating

Income of CLP 18,683 million, a decrease of 6.0% compared to the same period of the previous year. Operating Margin was 14.4%. In local

currency, Operating Income increased 35.1%.

Adjusted EBITDA amounted to CLP 24,169 million,

a decrease of 16.0%. Adjusted EBITDA margin was 18.6%, an expansion of 443 basis points. Adjusted EBITDA in local currency increased

20.6%.

BRAZIL: 4th Quarter 2023 vs. 4th Quarter 2022

| | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | |

| | |

| (Figures

in million CLP) | | |

| (Figures

in million BRL) | |

| Net Sales | |

| 192,836 | | |

| 243,604 | | |

| 26.3 | % | |

| 1,112 | | |

| 1,349 | | |

| 21.3 | % |

| Operating Income | |

| 30,463 | | |

| 41,705 | | |

| 36.9 | % | |

| 177 | | |

| 231 | | |

| 30.7 | % |

| Adjusted EBITDA | |

| 39,558 | | |

| 49,284 | | |

| 24.6 | % | |

| 228 | | |

| 273 | | |

| 19.5 | % |

Sales volume for the quarter reached 88.8 million

unit cases, an increase of 10.8%, explained by the increase in all categories. The Non-Alcoholic Beverages Segment represented 98.0%

of total sales volume, and grew 10.2%, which was explained by the growth of all categories, especially Waters and Juices and other non-alcoholic

beverages. The Alcoholic Beverages segment represented 2.0% of total volume and grew 49.6%, explained by the increase in the Beer and

Other alcoholic beverages categories. Transactions amounted to 475.0 million, an increase of 8.5%.

Net Sales amounted to CLP 243,604 million, an

increase of 26.3%. In local currency, Net Sales increased 21.3%, which was mainly explained by the aforementioned increase in volume

and the increase in the average revenue per unit case sold. Net Sales of the Non-Alcoholic Beverages segment increased 20.0% in local

currency, representing 94.4% of total sales. Net Sales of the Alcoholic Beverages Segment increased 49.0% in local currency, representing

5.6% of total sales.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -5- |

Cost of Sales increased 23.9%, while in local

currency it increased 19.1%, which is mainly explained by (i) higher sales volume, (ii) a shift in the mix towards higher unit

cost products, and (iii) higher labor costs. This was partially offset by lower raw material costs, especially Pet resin.

Distribution Costs and Administrative Expenses

increased 25.7% in the reporting currency. In local currency, they increased 20.6%, which is mainly explained by (i) higher distribution

expenses, due to both higher volumes and higher tariffs, (ii) higher labor expenses, and (iii) higher marketing expenses.

The aforementioned effects led to an Operating

Income of CLP 41,705 million, an increase of 36.9%. Operating Margin was 17.1%. In local currency, Operating Income increased 30.7%.

Adjusted EBITDA reached CLP 49,284 million, an

increase of 24.6% over the previous year. Adjusted EBITDA margin was 20.2%, a contraction of 28 basis points. In local currency, Adjusted

EBITDA increased 19.5%.

CHILE: 4th Quarter 2023 vs. 4th Quarter 2022

| | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | |

| | |

| (Figures

in million CLP) | |

| Net Sales | |

| 332,666 | | |

| 332,474 | | |

| -0.1 | % |

| Operating Income | |

| 51,332 | | |

| 54,183 | | |

| 5.6 | % |

| Adjusted EBITDA | |

| 62,858 | | |

| 66,340 | | |

| 5.5 | % |

During the quarter, Sales Volume reached 83.2

million unit cases, a decrease of 8.3%, explained by the decrease in the Soft Drinks, Waters and Juices and other non-alcoholic beverages

categories, partially offset by the increase in the Beer and other alcoholic beverages category. Sales volume was mainly affected by

adverse weather factors compared to the previous year. Transactions totaled 494.5 million, representing a decrease of 10.0%. The volume

of the Non-Alcoholic Beverages Segment represented 85.7% of total Sales Volume, and decreased 9.6%, which was explained by the decrease

in all categories. The volume of the Alcoholic Beverages Segment represented 14.3% of total Sales Volume, and grew 0.8%, explained by

the increase in the Other alcoholic beverages category, partially offset by the decrease in the Beer category.

Net Sales reached CLP 332,474 million, a 0.1%

decrease, which is mainly explained by the aforementioned decrease in volume, partially offset by the increase in the average revenue

per unit case sold, as a result of price increases. Net Sales of the Non-Alcoholic Beverages segment decreased 2.9%, representing 74.3%

of total sales. Net Sales of the Alcoholic Beverages Segment increased 9.1%, representing 25.7% of total sales.

Cost of Sales decreased 3.7%, which is mainly

explained by (i) the lower volume sold, and (ii) a lower cost of raw materials, especially Pet resin. This was partially offset

by (i) a shift in the mix towards higher unit cost products, and (ii) a higher cost of sugar.

Distribution Costs and Administrative Expenses

increased 7.9%, which is mainly explained by (i) higher marketing expenses, and (ii) higher cost of labor and services provided

by third parties. This was partially offset by lower distribution and transportation expenses due to lower volumes.

The aforementioned effects led to an Operating

Income of CLP 54,183 million, 5.6% higher when compared to the previous year. Operating Margin was 16.3%.

Adjusted EBITDA reached CLP 66,340 million, an

increase of 5.5%. Adjusted EBITDA Margin was 20.0%, an expansion of 106 basis points.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -6- |

PARAGUAY: 4th Quarter 2023 vs. 4th Quarter 2022

| | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | | |

| 4Q22 | | |

| 4Q23 | | |

| Var

% | |

| | |

| (Figures

in million CLP) | | |

| (Figures

in million PGY) | |

| Net Sales | |

| 63,418 | | |

| 69,230 | | |

| 9.2 | % | |

| 503,558 | | |

| 572,666 | | |

| 13.7 | % |

| Operating Income | |

| 15,463 | | |

| 18,869 | | |

| 22.0 | % | |

| 123,670 | | |

| 156,560 | | |

| 26.6 | % |

| Adjusted EBITDA | |

| 19,136 | | |

| 22,662 | | |

| 18.4 | % | |

| 152,655 | | |

| 187,934 | | |

| 23.1 | % |

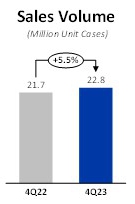

During the quarter, Sales Volume reached 22.8

million unit cases, an increase of 5.5%, explained by the volume increase in the Soft Drinks and Juices and other non-alcoholic beverages

categories, partially offset by the decrease in the Water category. Transactions totaled 139.3 million, an increase of 6.6%.

Net Sales amounted to CLP 69,230 million, an

increase of 9.2%. In local currency, Net Sales increased 13.7%, which was mainly explained by a higher average revenue per unit case

sold and the aforementioned increase in volume.

Cost of Sales in the reporting currency increased

7.1%. In local currency, it increased 11.6%, which is mainly explained by (i) the higher volume sold, (ii) a higher cost of

concentrate due to price increases, (iii) a higher cost of sugar and fructose, and (iv) the shift in the mix towards higher

unit cost products. This was partially offset by a lower cost of Pet resin.

Distribution Costs and Administrative Expenses

decreased 1.3%, and in local currency they increased 3.0%. This is mainly explained by (i) higher distribution expenses, due to

the higher volume sold, and (ii) higher cost of labor and services provided by third parties. This was partially offset by higher

other operating income, which is classified under this item.

The aforementioned effects led to an Operating

Income of CLP 18,869 million, 22.0% higher when compared to the previous year. Operating Margin reached 27.3%. In local currency, operating

income increased 26.6%.

Adjusted EBITDA reached CLP 22,662 million, an

increase of 18.4%, and Adjusted EBITDA Margin was 32.7%, an expansion of 256 basis points. In local currency Adjusted EBITDA increased

23.1%.

ACCUMULATED RESULTS: Full year ended December 31, 2023 vs.

Full year ended December 31, 2022

Consolidated Results

| (Figures in million CLP) | |

FY22 | | |

FY23 | | |

Var

% | |

| Net Sales | |

| 2,656,878 | | |

| 2,618,437 | | |

| -1.4 | % |

| Operating Income | |

| 345,144 | | |

| 357,337 | | |

| 3.5 | % |

| Adjusted EBITDA | |

| 464,510 | | |

| 470,108 | | |

| 1.2 | % |

| Net income attributable to the owners

of the controller | |

| 125,498 | | |

| 171,441 | | |

| 36.6 | % |

Consolidated Sales Volume was 882.6 million unit

cases, which represented an increase of 1.0% compared to the same period of 2022, mainly explained by the volume increase in the Brazilian

and Paraguayan operations, partially offset by the volume decrease in the Argentine and Chilean operations. The Non-Alcoholic Beverages

Segment represented 94.7% of consolidated Sales Volume and grew 1.1%, explained by the growth of the Segment in Brazil and Paraguay,

partially offset by the decrease in Argentina and Chile. The Alcoholic Beverages Segment represented 5.3% of total volume and grew 0.7%,

which was mainly explained by the growth of the Segment in the Brazilian and Argentine operations, and was partially offset by the reduction

of the Segment's volume in the Chilean operation. Transactions amounted to 4,859.6 million, an increase of 0.7%. Consolidated Net Sales

amounted to CLP 2,618,437 million, a decrease of 1.4%.

Consolidated Cost of Sales decreased by 1.6%,

which is mainly explained by (i) the effect of translating figures from the local currencies of Argentina and Paraguay to the reporting

currency, (ii) a lower cost of Pet resin in the four countries where we operate, and (iii) a lower cost of concentrate in Argentina.

This was partially offset by (i) the higher cost of concentrate due to price increases in Chile and Paraguay, (ii) the higher

volume sold in Brazil and Paraguay, (iii) the shift in the mix towards higher unit cost products in Brazil, Chile and Paraguay,

and (iv) a higher cost of sugar in all four operations.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -7- |

Consolidated Distribution Costs and Administrative

Expenses decreased by 3.5%, which is mainly explained by (i) the effect of translating figures from the local currencies of Argentina

and Paraguay to the reporting currency, and (ii) lower freight expense in Argentina. This was partially offset by (i) higher

distribution expenses in Brazil, Chile and Paraguay, (ii) higher labor costs, and (iii) higher marketing expenses in Argentina

and Chile.

The aforementioned effects led to a consolidated

Operating Income of CLP 357,337 million, an increase of 3.5%. Operating Margin was 13.6%.

Consolidated Adjusted EBITDA reached CLP 470,108

million, an increase of 1.2%. Adjusted EBITDA Margin was 18.0%, an expansion of 47 basis points.

Net income attributable to the owners of the

controller was CLP 171,441 million, an increase of 36.6%, and net margin reached 6.5%, an expansion of 182 basis points.

Argentina

| | |

FY22 | | |

FY23 | | |

Var

% | | |

FY22 | | |

FY23 | | |

Var

% | |

| | |

(Figures in million CLP) | | |

(Figures

in million ARS of December 2023) | |

| Net Sales | |

| 688,705 | | |

| 460,338 | | |

| -33.2 | % | |

| 441,807 | | |

| 424,298 | | |

| -4.0 | % |

| Operating Income | |

| 86,499 | | |

| 62,960 | | |

| -27.2 | % | |

| 55,490 | | |

| 58,031 | | |

| 4.6 | % |

| Adjusted EBITDA | |

| 119,942 | | |

| 86,016 | | |

| -28.3 | % | |

| 76,944 | | |

| 79,282 | | |

| 3.0 | % |

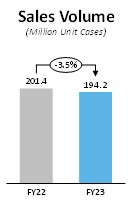

Sales volume decreased 3.5%, reaching 194.2 million

unit cases, explained by the decrease in the volume of the Soft Drinks and Juices and other non-alcoholic beverages category, partially

offset by the increase in the volume of the Water and Beer and other alcoholic beverages categories. Transactions amounted to 926.3 million,

representing a decrease of 2.2%.

Net Sales amounted to CLP 460,338 million, a

decrease of 33.2%, while in local currency, Net Sales decreased by 4.0%, which was mainly explained by the aforementioned decrease in

volume.

Cost of Sales decreased 36.2%. In local currency,

it decreased 8.3%, which is mainly explained by (i) the reduction in volume sold, (ii) a lower cost of concentrate, and (iii) a

lower cost of Pet resin. This was partially offset by higher labor costs.

Distribution Costs and Administrative Expenses

decreased 30.6% in the reporting currency. In local currency, these decreased 0.3%, which is mainly explained by a lower distribution

cost due to lower sales volume. This was partially offset by (i) higher labor expenses, and (ii) higher advertising expenses.

The aforementioned effects led to an Operating

Income of CLP 62,960 million, a decrease of 27.2%. Operating Margin was 13.7%. In local currency, Operating Income increased 4.6%.

Adjusted EBITDA reached CLP 86,016 million, a

decrease of 28.3%. Adjusted EBITDA margin was 18.7%, an expansion of 127 basis points. Adjusted EBITDA in local currency increased 3.0%.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -8- |

Brazil

| | |

FY22 | | |

FY23 | | |

Var % | | |

FY22 | | |

FY23 | | |

Var % | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Figures in million CLP) | | |

(Figures in million BRL) | |

| Net Sales | |

636,860 | | |

745,383 | | |

17.0 | % | |

3,753 | | |

4,404 | | |

17.3 | % |

| Operating Income | |

81,206 | | |

108,705 | | |

33.9 | % | |

479 | | |

638 | | |

33.3 | % |

| Adjusted EBITDA | |

113,094 | | |

140,090 | | |

23.9 | % | |

666 | | |

825 | | |

23.9 | % |

Sales volume increased 8.2%, reaching 300.9 million

unit cases, explained by the increase in volume of all categories. The Non-Alcoholic Beverages segment represented 98.1% of total sales

volume, and grew 8.0%, which was explained by the growth of all categories in the segment. The Alcoholic Beverages segment represented

1.9% of total volume and grew 23.6%, which was explained by the growth of all categories in the segment. Transactions reached 1,642.4

million, an increase of 7.5%.

Net Sales reached CLP 745,383 million, an increase

of 17.0%. In local currency, Net Sales increased 17.3%, due to a higher average price as a result of the price increases we have implemented

and the aforementioned increase in volume. Net Sales of the Non-Alcoholic Beverages segment increased 16.4% in local currency, representing

94.3% of total sales. Net Sales of the Alcoholic Beverages segment increased 35.2% in local currency, representing 5.7% of total sales.

Cost of Sales increased 14.1%, while in local

currency it increased 14.5%, which is mainly explained by (i) the higher sales volume, (ii) the shift in the mix towards higher

unit cost products, (iii) a higher sugar cost, and (iv) a higher labor cost. This was partially offset by a lower cost of raw

materials, especially Pet resin.

Distribution Costs and Administrative Expenses

increased 15.8% in the reporting currency, and in local currency they increased 16.3%, which is mainly explained by (i) higher labor

costs, (ii) higher distribution and transportation expenses, and (iii) higher depreciation charges.

The aforementioned effects led to an Operating

Income of CLP 108,705 million, an increase of 33.9%. Operating Margin was 14.6%. In local currency, Operating Income increased 33.3%.

Adjusted EBITDA reached CLP 140,090 million, an

increase of 23.9% over the previous year. Adjusted EBITDA Margin was 18.8%, an expansion of 104 basis points. In local currency, Adjusted

EBITDA increased 23.9%.

Chile

| | |

FY22 | | |

FY23 | | |

Var % | |

| | |

(Figures

in million CLP) | |

| Net Sales | |

| 1,123,665 | | |

| 1,191,974 | | |

| 6.1 | % |

| Operating Income | |

| 134,840 | | |

| 139,519 | | |

| 3.5 | % |

| Adjusted EBITDA | |

| 175,554 | | |

| 184,450 | | |

| 5.1 | % |

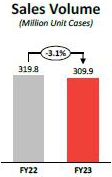

Sales volume reached 309.9 million unit cases,

a decrease of 3.1%, explained by the decrease in the volume of the Soft Drinks, Juices and other non-alcoholic beverages and Beer and

other alcoholic beverages categories, partially offset by the increase in the Water category. Transactions amounted to 1,813.2 million,

representing a decrease of 4.8%. The Non-Alcoholic Beverages Segment represented 86.9% of total Sales Volume, and decreased by 3.1%, which

was explained by the decrease in the volume of the Soft Drinks and Juices and other non-alcoholic beverages categories, partially offset

by the increase in the Waters category. The Alcoholic Beverages segment represented 13.1% of total sales volume and decreased 2.9%, explained

by the decrease in the Beer category, partially offset by the increase in the Other alcoholic beverages category.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -9- |

Net Sales amounted to CLP 1,191,974 million, an

increase of 6.1%, which is explained by a higher average price in the period, due to the price increases performed, partially offset by

the aforementioned decrease in volume. Net Sales of the Non-Alcoholic Beverages segment increased 5.6%, representing 75.6% of total sales.

Net Sales of the Alcoholic Beverages Segment increased 7.4%, representing 24.4% of total sales.

Cost of Sales increased 5.6%, which is mainly

explained by (i) a shift in the mix towards higher unit cost products, and (ii) a higher cost of concentrate due to the implementation

of price increases. This was partially offset by a lower cost of raw materials, especially Pet resin.

Distribution Costs and Administrative Expenses

increased 8.8%, which is mainly explained by (i) a higher cost of labor and services provided by third parties, (ii) higher

distribution and transportation expenses, as a consequence of higher tariffs, and (iii) higher marketing expenses.

The aforementioned effects led to an Operating

Income of CLP 139,519 million, 3.5% higher when compared to the previous year. Operating Margin was 11.7%.

Adjusted EBITDA reached CLP 184,450 million, an

increase of 5.1%. Adjusted EBITDA Margin was 15.5%, a contraction of 15 basis points.

Paraguay

| | |

FY22 | | |

FY23 | | |

Var % | | |

FY22 | | |

FY23 | | |

Var % | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Figures in million CLP) | | |

(Figures in million PGY) | |

| Net Sales | |

| 212,339 | | |

| 223,841 | | |

| 5.4 | % | |

| 1,706,394 | | |

| 1,937,751 | | |

| 13.6 | % |

| Operating Income | |

| 49,709 | | |

| 54,722 | | |

| 10.1 | % | |

| 402,745 | | |

| 473,188 | | |

| 17.5 | % |

| Adjusted EBITDA | |

| 63,029 | | |

| 68,452 | | |

| 8.6 | % | |

| 509,070 | | |

| 592,351 | | |

| 16.4 | % |

Sales volume reached 77.6 million unit cases,

an increase of 4.3%, explained by the increase in volume in all categories. Transactions reached 477.8 million, an increase of 6.4%.

Net sales amounted to CLP 223,841 million, an

increase of 5.4%. In local currency, Net Sales increased 13.6%, which is explained by a higher average price, and to a lesser extent by

the aforementioned increase in Sales Volume.

Cost of Sales increased 5.2% and in local currency

increased 13.5%, which is mainly explained by (i) the higher sales volume, (ii) a higher cost of concentrate due to price increases,

(iii) a change in the mix towards higher unit cost products, and (iv) a higher cost of sweeteners. This was partially offset

by the lower cost of Pet resin.

Distribution Costs and Administrative Expenses

increased 0.6% in reported currency. In local currency, it increased 9.1%, which is mainly explained by (i) higher distribution expenses,

mainly due to higher tariffs, and (ii) higher labor and services provided by third parties.

The aforementioned effects led to an Operating

Income of CLP 54,722 million, 10.1% higher when compared to the previous year. Operating Margin reached 24.4%. In local currency, Operating

Income increased 17.5%.

Adjusted EBITDA reached CLP 68,452 million, 8.6%

higher when compared to the previous year, and the Adjusted EBITDA Margin was 30.6%, an expansion of 90 basis points. In local currency,

Adjusted EBITDA increased 16.4%.

NON-OPERATING RESULTS

FOR THE QUARTER

Net Financial Income and Expenses account recorded

an expense of CLP 8,247 million, which compares to an expense of CLP 6,470 million in the same quarter of the previous year, mainly due

to higher debt and lower financial income in our subsidiary in Argentina.

Share of Profit or Loss from Investments Accounted

for by the Equity Method went from a gain of CLP 1,124 million to a gain of CLP 2,721 million, which is mainly explained by higher results

of subsidiaries in Chile.

Other Income and Expenses account recorded a loss

of CLP 1,282 million, compared to a loss of CLP 5,248 million in the same quarter of the previous year. The difference is mainly explained

by higher revenues from the sale of mineral water sources in Brazil to The Coca-Cola Company.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -10- |

Results by Adjustment Units and Exchange Rate

Differences account went from a loss of CLP 15,849 million to a loss of CLP 10,665 million. This lower loss is mainly explained by a decrease

in the loss from on indexation units, due to the positive effect of the price-level restatement of balance sheet and income statement

accounts in Argentina, as well as the effect of lower inflation in Chile on the UF debt. These effects were partially offset by exchange

losses in Argentina.

Income Tax went from -CLP 41,806 million to -CLP

30,255 million, a variation that is mainly explained by the positive tax effect of the exchange rate difference and by lower inflation.

These effects were partially offset by higher operating income.

CONSOLIDATED BALANCE

The following are the balances of Assets and Liabilities as of the

closing date of these financial statements:

| | |

12.31.2022 | | |

12.31.2023 | | |

Variation | |

| Assets | |

million CLP | | |

million CLP | | |

million CLP | |

| Current assets | |

| 1,161,729 | | |

| 981,771 | | |

| -179,958 | |

| Non-current assets | |

| 1,848,971 | | |

| 1,939,750 | | |

| 90,779 | |

| Total Assets | |

| 3,010,701 | | |

| 2,921,521 | | |

| -89,180 | |

| | |

| | | |

| | | |

| | |

| | |

12.31.2022 | | |

12.31.2023 | | |

Variation | |

| Liabilities | |

million CLP | | |

million CLP | | |

million CLP | |

| Current liabilities | |

| 949,245 | | |

| 692,871 | | |

| -256,374 | |

| Non-current liabilities | |

| 1,178,053 | | |

| 1,307,664 | | |

| 129,611 | |

| Total Liabilities | |

| 2,127,298 | | |

| 2,000,535 | | |

| -126,762 | |

| | |

| | | |

| | | |

| | |

| | |

12.31.2022 | | |

12.31.2023 | | |

Variation | |

| Equity | |

million CLP | | |

million CLP | | |

million CLP | |

| Non-controlling interests | |

| 28,143 | | |

| 34,695 | | |

| 6,552 | |

| Equity attributable to the owners of the controller | |

| 855,260 | | |

| 886,291 | | |

| 31,030 | |

| Total Equity | |

| 883,403 | | |

| 920,985 | | |

| 37,583 | |

At the closing of December 2023, with respect

to the closing of 2022, the Argentine peso depreciated 345.3% with respect to the Chilean peso, which generated a decrease in assets,

liabilities and equity accounts, due to the effect of translation of figures to the reporting currency. Additionally, the figures for

Argentina, in accordance with IAS 29, prior to the translation of figures, are adjusted for accumulated inflation as of the end of 2022,

until the closing currency of this report (December 2023), increasing the figures in local currency by 211.2%. On the other hand,

the Brazilian real and the Paraguayan guarani appreciated against the Chilean peso by 9.5% and 3.3%, respectively, which generated an

increase in assets, liabilities and equity accounts, due to the effect of translation of figures to the reporting currency.

In September, one of the 144A/RegS format bonds

issued in the United States matured. The maturity was for USD 365 million at a rate of 5.00% [USD], a bond that was redenominated through

derivatives into Brazilian reais for a total of BRL 840 million at a fixed rate of 13.51% [BRL]. This maturity was refinanced through

the issuance, in September, of a new bond in the Swiss market for a total of CHF 170 million at a fixed rate of 2.7175% [CHF] for a term

of 5 years, these conditions were redenominated through the use of derivatives, to Brazilian reais for a total of BRL 920 million at a

fixed rate of 11.27% [BRL].

Assets

Total assets decreased by CLP 89,180 million,

3.0% compared to December 2022.

Current assets decreased by CLP 179,958 million,

15.5% compared to December 2022, which is mainly explained by the decrease in Other current financial assets (- CLP 195,759 million),

mainly due to the liquidation of the cross currency swap associated with the 144A bond that matured in September 2023. This decrease

was partially offset by the increase in Trade and other current accounts receivable (CLP 19,122 million), mainly in the operations in

Chile, Brazil and Paraguay, and by the increase in Cash and cash equivalents (CLP 12,002 million).

Non-current assets increased by CLP 90,779 million,

4.9% compared to December 2022, mainly due to the increase in Property, plant and equipment (CLP 74,168 million) due to investments

made (CLP 222,620 million), which were partially offset by the negative effect of translation and readjustment due to IAS29, and by the

Depreciation account. In addition to this increase, there was an increase in Intangible assets other than goodwill (CLP 24,148 million),

mainly explained by the positive translation effect of the figures of our subsidiaries in Brazil and Paraguay.

Liabilities and Equity

Total liabilities decreased by CLP 126,762 million,

6.0% compared to December 2022.

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -11- |

Current liabilities decreased by CLP 256,374 million,

27.0% compared to December 2022, mainly due to the decrease in Other current financial liabilities (-CLP 314,305 million) mainly

explained by the payment on maturity of the 144A Bond. This decrease was partially offset by the increase in Trade and other current accounts

payable (CLP 44,110 million), mainly explained by the reclassification of the account payable maintained with the former shareholders

of Companhia de Bebidas Ipiranga related to a tax credit, from the caption "Other non-current non-financial liabilities", considering

that it is a debt that will be paid in the short term.

On the other hand, non-current liabilities increased

by CLP 129,611 million, 11.0% compared to December 2022, mainly due to the increase in Other non-current financial liabilities (CLP

139,524 million), which is mainly explained by the placement of the Swiss Bond, which is partially offset by the decrease in the mark

to market liability of the cross currency swap of the bond issued in the United States in 2020 (Senior Notes due 2050).

Equity increased by CLP 37,583 million, 4.3% compared

to December 2022, explained by the increase in Accumulated Earnings as a result of the profits obtained in the previously mentioned

period, the restatement of equity balances in our subsidiary in Argentina, in accordance with IAS 29 (CLP 48,864 million) and by the distribution

of dividends (-CLP 167,969 million). The increase in Accumulated Earnings was partially offset by the decrease in Other reserves (-CLP

21,306 million).

FINANCIAL ASSETS AND

LIABILITIES

| CONSOLIDATED NET FINANCIAL DEBT | |

(USD million) | |

| Total Financial Assets | |

| 452 | |

| Cash and Cash Equivalent (1) | |

| 346 | |

| Other current financial assets (1) | |

| 75 | |

| Net valuation of Hedge Derivatives (2) | |

| 30 | |

| | |

| | |

| Financial Debt | |

| 1,175 | |

| Bonds on the international market | |

| 505 | |

| Bonds on the local market (Chile) | |

| 614 | |

| Bank Debt and Others | |

| 57 | |

| | |

| | |

| Net Financial Debt | |

| 724 | |

(1) Financial

Assets corresponding to Cash and Cash Equivalents and Other current financial assets are held invested in low-risk instruments such as

time deposits, short-term fixed-income mutual funds and others.

(2)

Considers the net effect of valuations in favor of and against hedge derivatives.

CURRENCY EXPOSURE (%)

| | |

Financial

Assets (1) | | |

Financial

Debt (3) | |

| CLP (Chile) | |

43 | % | |

27 | % |

Unidad de Fomento (CLP indexed to inflation) | |

13 | % | |

54 | % |

| BRL (Brazil) | |

26 | % | |

19 | % |

| PGY (Paraguay) | |

11 | % | |

0 | % |

| ARS (Argentina) | |

5 | % | |

0 | % |

| USD (United States) | |

2 | % | |

0 | % |

| Total | |

100 | % | |

100 | % |

(3) Includes

valuation of hedge derivatives.

RISK RATING

| Local

rating agencies | |

Rating | |

| ICR | |

| AA+ | |

| Fitch Chile | |

| AA+ | |

| International

rating agencies | |

| Rating | |

| Standard & Poors | |

| BBB | |

| Fitch Ratings, Inc. | |

| BBB+ | |

DEBT AMORTIZATION PROFILE

CASH FLOW

| | |

12.31.2022 | | |

12.31.2023 | | |

Variation | |

| Cash flow | |

million CLP | | |

million CLP | | |

million CLP | | |

% | |

| Operating | |

397,452 | | |

366,830 | | |

-30,622 | | |

-7.7 | % |

| Investment | |

-85,168 | | |

-158,289 | | |

-73,120 | | |

85.9 | % |

| Financing | |

-286,963 | | |

-187,127 | | |

99,837 | | |

-34.8 | % |

| Net Cash Flow for the period | |

25,321 | | |

21,415 | | |

-3,906 | | |

-15.4 | % |

COCA-COLA ANDINA

4Q23 EARNINGS RELEASE

www.koandina.com | -12- |

During the period, the Company generated a positive

net cash flow of CLP 21,415 million, which is explained as follows:

Operating activities generated a positive net

cash flow of CLP 366,830 million, lower than the CLP 397,452 million recorded in the same period of 2022, mainly due to higher other

operating payments.

Investing activities generated a negative cash

flow of CLP 158,289 million, with a negative variation of CLP 73,120 million with respect to the previous period, which is mainly explained

by lower redemptions of financial instruments compared to 2022 for CLP 69,191 million, added to a higher investment in Capex for CLP

6,000 million.

Financing activities generated a negative cash

flow of CLP 187,127 million, with a positive variation of CLP 99,837 million with respect to the previous period, which is mainly explained

by lower dividend payments than in 2022.

MAIN INDICATORS

| INDICATOR |

Definition |

Unit |

Dec

23 |

Dec

22 |

Dec

23 vs Dec 22 |

| LIQUIDITY |

|

|

|

|

|

| |

Current

liquidity |

Current

Asset |

Times |

1.4 |

1.2 |

15.8% |

| |

|

Current

Liability |

|

|

|

|

| |

Acid

ratio |

Current

Asset – Inventory |

Times |

1.1 |

1.0 |

12.0% |

| |

|

Current

Liability |

|

|

|

|

| ACTIVITY |

|

|

|

|

|

| |

Investment |

|

Million

CLP |

222,620 |

173,675 |

28.2% |

| |

|

|

|

|

|

|

| |

Inventory

turnover |

Cost

of Sales |

Times |

6.7

|

7.4 |

-10.2% |

| |

|

Average

Inventory |

|

|

|

|

| INDEBTEDNESS |

|

|

|

|

|

| |

Indebtedness

ratio |

Net

Financial Debt* |

Times |

0.7 |

0.7 |

-2.7% |

| |

|

Total

Equity* |

|

|

|

|

| |

Financial

exp. coverage |

Adjusted

EBITDA (12M) |

Times |

13.6 |

19.9 |

-31.5% |

| |

|

Financial

Expenses* (12M) – Financial Income* (12M) |

|

|

|

|

| |

Net

financial debt / |

Net

Financial Debt |

Times |

1.4 |

1.3 |

0.2% |

| |

Adjusted

EBITDA |

Adjusted

EBITDA (12M) |

|

|

|

|

| PROFITABILITY

|

|

|

|

|

|

| |

On

Equity |

Net

Income Fiscal Year (12M) |

% |

19.7% |

13.0% |

6.7

pp |

| |

|

Average

Equity |

|

|

|

|

| |

On

Total Assets |

Net

Income Fiscal Year (12M) |

% |

5.8% |

4.2% |

1.6

pp |

| |

|

Average

Assets |

|

|

|

|

Liquidity

Current Liquidity showed a positive variation

of 15.8% with respect to December 2022, explained by the 27.0% decrease in current liabilities, which was greater than the decrease

in current assets (15.5%).

The Acid Ratio showed an increase of 12.0% with

respect to December 2022, for the reasons explained above, in addition to the decrease in inventories (5.2%) in the period. Current

assets excluding inventories showed a decrease of 18.2% compared to December 2022.

Activity

At the closing of December 2023, investments

reached CLP 222,620 million, which corresponds to an increase of 28.2% compared to the same period of 2022, mainly explained by higher

productive investments such as the returnable capacity expansion in our subsidiary in Argentina and the beer plant in our subsidiary

in Brazil.

Inventory turnover reached 6.7 times, showing

a decrease of 10.2% versus the same period of 2022, mainly explained by the increase in average inventory by 9.5% versus the same period

of 2022, added to the decrease in cost of sales (1.6%).

* Definitions

used are contained in the Glossary on page 16 of this document.

| COCA-COLA ANDINA | |

| 4Q23 EARNINGS RELEASE | |

| www.koandina.com | -13- |

Indebtedness

The indebtedness ratio reached 0.7 times at the

closing of December 2023, which corresponds to a decrease of 2.7% compared to the closing of December 2022. This is mainly

due to the 4.3% increase in equity.

The Financial Expense Coverage indicator shows

a decrease of 31.5% when compared to December 2022, reaching 13.6 times. This is explained by an increase in net financial expenses

(rolling 12 months) of 47.8% and the increase in Adjusted EBITDA (rolling 12 months) of 1.2% for the period.

Net financial debt/Adjusted EBITDA reached 1.4

times, which represents an increase of 0.2% compared to December 2022. This is due to the 1.5% increase in net financial debt, along

with the 1.2% increase in Adjusted EBITDA for the period.

Profitability

Return on equity reached 19.7%, 6.7 percentage

points higher than the indicator measured in December 2022. This result is due to the increase in Net Income for the rolling 12-month

period (36.6%), together with the decrease in Average Equity (9.8%).

Return on Total Assets was 5.8%, 1.6 percentage

points higher than the indicator measured in December 2022, explained by the increase in Net Income for the 12 rolling months, together

with the decrease in Average Assets (0.4%).

MACROECONOMIC INFORMATION

| INFLATION | |

|

| | |

Accumulated

FY23 | |

| Argentina* | |

| 211.20 | % |

| Brazil | |

| 4.62 | % |

| Chile | |

| 3.90 | % |

| Paraguay | |

| 3.67 | % |

*Official inflation reported

by the National Institute of Statistics and Censuses of Argentina (INDEC). It should be mentioned that the inflation used to restate

Argentina's figures in accordance with IAS 29 corresponds to inflation estimated by the Central Bank of the Argentine Republic (in its

Survey of Market Expectations report), which is also adjusted for the difference between the estimate (by the Central Bank) and the actual

inflation of the previous month (INDEC).

| | |

Local

currency/USD | | |

CLP/local

currency | |

| EXCHANGE | |

(Average

exchange rate*) | | |

(Average

exchange rate*) | |

| RATES USED | |

4Q22 | | |

4Q23 | | |

4Q22 | | |

4Q23 | |

| Argentina | |

| 177.2 | | |

| 808.5 | | |

| 4.8 | | |

| 1.1 | |

| Brazil | |

| 5.26 | | |

| 4.95 | | |

| 174.00 | | |

| 180.80 | |

| Chile | |

| 915 | | |

| 896 | | |

| N.A | | |

| N.A | |

| Paraguay | |

| 7,206 | | |

| 7,391 | | |

| 0.13 | | |

| 0.12 | |

*Except

Argentina, where the closing exchange rate is used, in accordance with IAS 29.

| | |

Local

currency/USD | | |

CLP/local

currency | |

| EXCHANGE | |

(Average

exchange rate*) | | |

(Average

exchange rate*) | |

| RATES

USED | |

FY22 | | |

FY23 | | |

FY22 | | |

FY23 | |

| Argentina | |

| 177.2 | | |

| 808.5 | | |

| 4.8 | | |

| 1.1 | |

| Brazil | |

| 5.16 | | |

| 4.99 | | |

| 169.08 | | |

| 168.15 | |

| Chile | |

| 873 | | |

| 840 | | |

| N.A | | |

| N.A | |

| Paraguay | |

| 6,988 | | |

| 7,294 | | |

| 0.12 | | |

| 0.12 | |

*Except

Argentina, where the closing exchange rate is used, in accordance with IAS 29.

MARKET RISK ANALYSIS

The Company’s risk management is the responsibility

of the office of the Chief Executive Officer, (through the areas of Corporate Management Control, Sustainability and Risks, which depends

on the office of the Chief Financial Officer), as well as each of the management areas of Coca-Cola Andina. The main risks that the Company

has identified and that could possibly affect the business are as follows:

Relationship with The Coca-Cola Company

A large part of the Company’s sales derives

from the sale of products whose trademarks are owned by The Coca-Cola Company, which has the ability to exert an important influence

on the business through its rights under the Licensing or Bottling Agreements. In addition, we depend on The Coca-Cola Company to renew

these Bottling Agreements.

| COCA-COLA ANDINA | |

| 4Q23 EARNINGS RELEASE | |

| www.koandina.com | -14- |

Non-alcoholic beverage business environment

Consumers, public health officials, and government

officials in our markets are increasingly concerned about the public health consequences associated with obesity, which can affect demand

for our products, especially those containing sugar.

The Company has developed a large portfolio of

sugar-free products and has also made reformulations to some of its sugary products, significantly reducing the sugar contents of its

products.

Raw material prices and exchange rate

Many raw materials are used in the production

of beverages and packaging, including sugar and PET resin, the prices of which may present great volatility. In the case of sugar, the

Company sets the price of a part of the volume that it consumes with some anticipation, in order to avoid having large fluctuations of

cost that cannot be anticipated.

In addition, these raw materials are traded in

dollars; the Company has a policy of hedging in the futures market a portion of the dollars it uses to buy raw materials.

Instability in the supply of utilities and

raw materials

In the countries in which we operate, our operations

depend on a stable supply of utilities, fuel and raw materials. Power outages or water shut offs as well as the lack of raw materials

may result in interruptions of our production. The Company has mitigation plans to reduce the effects of eventual interruptions in the

supply of utilities and raw materials.

Economic conditions of the countries where

we operate

The Company maintains operations in Argentina,

Brazil, Chile and Paraguay. The demand for our products largely depends on the economic situation of these countries. Moreover, economic

instability can cause depreciation of the currencies of these countries, as well as inflation, which may eventually affect the Company’s

financial situation.

New tax laws or modifications to tax incentives

We cannot ensure that any government authority

in any of the countries in which we operate will not impose new taxes or increase existing taxes on our raw materials, products or containers.

Likewise, we cannot assure that these authorities are going to uphold and/or renew tax incentives that currently benefit some of our

operations.

A devaluation of the currencies of the countries

where we have our operations, regarding the Chilean peso, can negatively affect the results reported by the Company in Chilean pesos

The Company reports its results in Chilean pesos,

while a large part of its revenues and Adjusted EBITDA comes from countries that use other currencies. Should currencies devaluate regarding

the Chilean peso, this would have a negative effect on the results of the Company, upon the translation of results into Chilean pesos.

The imposition of exchange controls could

restrict the entry and exit of funds to and from the countries in which we operate, which could significantly limit our financial capacity

The imposition of exchange controls in the countries

in which we operate could affect our ability to repatriate profits, which could significantly limit our ability to pay dividends to our

shareholders. Additionally, it may limit the ability of our foreign subsidiaries to finance payments of U.S. dollar denominated liabilities

required by foreign creditors.

Price control policies in Argentina may have

a material and adverse effect on the results of our Argentine operations

The Argentine government has from time to time

established price controls on consumer products. To the extent that the price of our products in Argentina are restricted by government

imposed price controls the results of our Argentine operations may be materially affected. We cannot assure that authorities will not

impose price controls on our products in Argentina.

Civil unrest in Chile could have a material

adverse effect on general economic conditions in Chile and our business and financial condition

Since October 18, 2019, there have been

protests and demonstrations in Chile, seeking to reduce inequality, including claims about better pensions, improvement in health plans

and reduced health care costs, reduction in the cost of public transportation, better wages, among others. Sometimes demonstrations have

been violent, causing damage to public and private property.

We cannot predict the extent to which the Chilean

economy will be affected by the civil unrest, nor can we predict if government policies enacted as a response to the civil unrest will

have a negative impact on the Chilean economy and our business. Neither can we assure that demonstrations and vandalism will not cause

damage to our logistics and production infrastructure. So far, the Company has not been affected in any material respect.

Our business is subject to risks arising from the COVID-19 pandemic

The COVID-19 pandemic has resulted in the countries

where we operate taking extraordinary measures to contain the spread of COVID-19, including travel restrictions, closing borders, restrictions

or bans on social gathering events, instructions to citizens to practice social distancing, non-essential business closure, quarantine

implementation, and other similar actions. The impact of this pandemic has substantially increased uncertainty regarding the development

of economies and is most likely to cause a global recession. We cannot predict how long this pandemic will last, or how long the restrictions

imposed by the countries where we operate will last.

| COCA-COLA ANDINA | |

| 4Q23 EARNINGS RELEASE | |

| www.koandina.com | -15- |

Since the impact of COVID-19 is very uncertain,

we cannot accurately predict the extent of impact this pandemic will have on our business and our operations. There is a risk that our

collaborators, contractors and suppliers may be restricted or prevented from carrying out their activities for an indefinite period of

time, due to shutdowns mandated by the authorities. Although our operations have not been materially disrupted to date, eventually the

pandemic and the measures taken by governments to contain the virus could affect the continuity of our operations. In addition, some

measures taken by governments have negatively affected some of our sales channels, especially the closing of restaurants and bars, as

well as the prohibition of social gathering events, which affects our sales volumes to these channels. We cannot predict the effect that

the pandemic and these measures will have on our sales to these channels, nor whether these channels will recover once the pandemic is

over. Nor can we predict how long our consumers will change their consumer spending pattern as a result of the pandemic.

Additionally,

a possible outbreak of other epidemics in the future, such as SARS, Zika or the Ebola virus, could also result in a similar impact

on our business than COVID-19.

A more detailed analysis of business risks is

available in the Company’s 20-F and Annual Report, available on our website.

RECENT EVENTS

Dow Jones Chile Index and Dow Jones Sustainability

Index MILA Pacific Alliance

We were included in the Dow Jones Chile Index

for the eighth year in a row in December, as well as the Dow Jones Sustainability Index MILA Pacific Alliance for the seventh time. Because

of our dedication and perseverance in addressing these issues, we have become the best-ranked Chilean company in our industry, as well

as one of the top four companies in the world, also in our industry.

Interim Dividend 229

On January 25, 2024, the Company paid Interim

Dividend 229: CLP 32.0 per Series A share; and CLP 35.2 per Series B share.

GLOSSARY

Adjusted

EBITDA: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial Statements

submitted to Chile’s Financial Market Commission and determined in accordance with IFRS, plus Depreciation.

Currency-neutral

of a quarter q for a Q year is calculated using the same ratio of local currencies to the Chilean peso as the q

quarter of the Q-1 year. In the case of Argentina, given that it is a hyperinflationary economy, the result of the

q quarter is also deflated by inflation of the last 12 months.

Financial

Expenses: correspond to interest generated by the Company’s financial debt.

Financial

Income: corresponds to the interest generated by the Company's cash.

Net

Financial Debt: considers the consolidated financial liability that accrues interest, i.e.: (i) other current financial

liabilities, plus (ii) other non-current financial liabilities, less (iii) the sum of cash and cash equivalent; plus other

current financial assets; plus other non-current financial assets (to the extent that they correspond to the balances of assets for derivative

financial instruments, taken to cover exchange rate risk and/or interest rate of financial liabilities).

Operating

Income: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial

Statements submitted to Chile Financial Market Commission and determined in accordance with IFRS.

Total

Equity: corresponds to the equity attributable to the owners of the controller plus non-controlling interests.

Transactions:

refers to the number of units sold, regardless of size.

Volume:

expressed in Unit Cases (UCs), which is the conventional measurement used to measure sales volume in the Coca-Cola System

worldwide.

| COCA-COLA ANDINA | |

| 4Q23 EARNINGS RELEASE | |

| www.koandina.com | -16- |

ADDITIONAL INFORMATION

| STOCK

EXCHANGES ON WHICH WE TRADE |

|

ANDINA-A

ANDINA-B

|

AKO/A

AKO/B

|

|

|

| |

|

|

|

| ESG

INDICES IN WHICH WE PARTICIPATE |

Dow

Jones Sustainability Index Chile

Dow Jones Sustainability MILA Pacific Alliance Index. |

|

|

|

| |

|

|

|

| NUMBER

OF SHARES |

|

|

|

| TOTAL:

946,570,604 |

SERIES

A: 473,289,301 |

SERIES

B: 473,281,303 |

SHARES

PER ADR: 6 |

| |

|

|

|

ABOUT COCA-COLA ANDINA

Coca-Cola Andina is among the three largest Coca-Cola

bottlers in Latin America, servicing franchised territories with almost 57.4 million people, delivering 882.6 million unit cases or 5,011

million liters of soft drinks, juices, bottled water, beer and other alcoholic beverages during 2023. Coca-Cola Andina has the franchise

to produce and commercialize Coca-Cola products in certain territories in Argentina (through Embotelladora del Atlántico), in

Brazil (through Rio de Janeiro Refrescos), in Chile, (through Embotelladora Andina) and in all of Paraguay (through Paraguay Refrescos).

The Chadwick Claro, Garcés Silva, Said Handal and Said Somavía families control Coca-Cola Andina in equal parts. The Company's

value generation proposal is to become a Total Beverage Company, using existing resources efficiently and sustainably, developing a relationship

of excellence with consumers of its products, as well as with its collaborators, customers, suppliers, the community in which it operates

and with its strategic partner The Coca-Cola Company, in order to increase ROIC for shareholders in the long term. For more company information

visit www.koandina.com.b

This document may contain

projections reflecting Coca-Cola Andina’s good faith expectations and are based on currently available information. However, the

results that are finally obtained are subject to diverse variables, many of which are beyond the Company's control, and which could materially

impact the current performance. Among the factors that could change the performance are the political and economic conditions on mass

consumption, pricing pressures resulting from competitive discounts of other bottlers, weather conditions in the Southern Cone and other

risk factors that would be applicable from time to time, and which are periodically informed in reports filed before the appropriate

regulatory authorities, and which are available on our website.

| COCA-COLA ANDINA | |

| 4Q23 EARNINGS RELEASE | |

| www.koandina.com | -17- |

Embotelladora

Andina S.A.

Fourth

Quarter Results for the period ended December 31, 2023. Reported figures, IFRS GAAP.

(In

nominal million Chilean pesos, except per share)

| | |

October-December 2023 | | |

October-December 2022 | | |

| |

| | |

Chilean

Operations | | |

Brazilian

Operations | | |

Argentine

Operations | | |

Paraguay

Operations | | |

Total

(1) | | |

Chilean

Operations | | |

Brazilian

Operations | | |

Argentine

Operations | | |

Paraguay

Operations | | |

Total

(1) | | |

%

Ch. | |

| Volume total

beverages (Million UC) | |

| 83.2 | | |

| 88.8 | | |

| 53.5 | | |

| 22.8 | | |

| 248.4 | | |

| 90.7 | | |

| 80.2 | | |

| 58.4 | | |

| 21.7 | | |

| 250.9 | | |

| -1.0 | % |

| Transactions (Million) | |

| 494.5 | | |

| 475.0 | | |

| 252.4 | | |

| 139.3 | | |

| 1,361.3 | | |

| 549.2 | | |

| 438.0 | | |

| 276.7 | | |

| 130.6 | | |

| 1,394.5 | | |

| -2.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

| 332,474 | | |

| 243,604 | | |

| 129,595 | | |

| 69,230 | | |

| 773,552 | | |

| 332,666 | | |

| 192,836 | | |

| 202,411 | | |

| 63,418 | | |

| 789,934 | | |

| -2.1 | % |

| Cost of sales | |

| (210,545 | ) | |

| (149,292 | ) | |

| (63,100 | ) | |

| (38,881 | ) | |

| (460,384 | ) | |

| (218,574 | ) | |

| (120,508 | ) | |

| (107,543 | ) | |

| (36,319 | ) | |

| (481,548 | ) | |

| -4.4 | % |

| Gross profit | |

| 121,929 | | |

| 94,312 | | |

| 66,495 | | |

| 30,350 | | |

| 313,169 | | |

| 114,092 | | |

| 72,328 | | |

| 94,868 | | |

| 27,099 | | |

| 308,386 | | |

| 1.6 | % |

| Gross margin | |

| 36.7 | % | |

| 38.7 | % | |

| 51.3 | % | |

| 43.8 | % | |

| 40.5 | % | |

| 34.3 | % | |

| 37.5 | % | |

| 46.9 | % | |

| 42.7 | % | |

| 39.0 | % | |

| | |

| Distribution and administrative

expenses | |

| (67,746 | ) | |

| (52,607 | ) | |

| (47,812 | ) | |

| (11,481 | ) | |

| (179,646 | ) | |

| (62,760 | ) | |

| (41,865 | ) | |

| (75,001 | ) | |

| (11,635 | ) | |

| (191,260 | ) | |

| -6.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Corporate expenses (2) | |

| | | |

| | | |

| | | |

| | | |

| (3,385 | ) | |

| | | |

| | | |

| | | |

| | | |

| (2,084 | ) | |

| 62.5 | % |

| Operating

income (3) | |

| 54,183 | | |

| 41,705 | | |

| 18,683 | | |

| 18,869 | | |

| 130,138 | | |

| 51,332 | | |

| 30,463 | | |

| 19,867 | | |

| 15,463 | | |

| 115,042 | | |

| 13.1 | % |

| Operating margin | |

| 16.3 | % | |

| 17.1 | % | |

| 14.4 | % | |

| 27.3 | % | |

| 16.8 | % | |

| 15.4 | % | |

| 15.8 | % | |

| 9.8 | % | |

| 24.4 | % | |

| 14.6 | % | |

| | |

| Adjusted EBITDA

(4) | |

| 66,340 | | |

| 49,284 | | |

| 24,169 | | |

| 22,662 | | |

| 159,070 | | |

| 62,858 | | |

| 39,558 | | |

| 28,789 | | |

| 19,136 | | |

| 148,257 | | |

| 7.3 | % |

| Adjusted EBITDA margin | |

| 20.0 | % | |

| 20.2 | % | |

| 18.6 | % | |

| 32.7 | % | |

| 20.6 | % | |

| 18.9 | % | |

| 20.5 | % | |

| 14.2 | % | |

| 30.2 | % | |

| 18.8 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial (expenses) income (net) | |

| | | |

| | | |

| | | |

| | | |

| (8,247 | ) | |

| | | |

| | | |

| | | |

| | | |

| (6,470 | ) | |

| 27.5 | % |

| Share of (loss) profit of investments

accounted for using the equity method | |

| | | |

| | | |

| | | |

| | | |

| 2,721 | | |

| | | |

| | | |

| | | |

| | | |

| 1,124 | | |

| 142.1 | % |

| Other income (expenses) (5) | |

| | | |

| | | |

| | | |

| | | |

| (1,282 | ) | |

| | | |

| | | |

| | | |

| | | |

| (5,248 | ) | |

| -75.6 | % |

| Results by readjustement unit

and exchange rate difference | |

| | | |

| | | |

| | | |

| | | |

| (10,665 | ) | |

| | | |

| | | |

| | | |

| | | |

| (15,849 | ) | |

| -32.7 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income before income

taxes | |

| | | |

| | | |

| | | |

| | | |

| 112,665 | | |

| | | |

| | | |

| | | |

| | | |

| 88,599 | | |

| 27.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| | | |

| | | |

| | | |

| | | |

| (30,255 | ) | |

| | | |

| | | |

| | | |

| | | |

| (41,806 | ) | |

| -27.6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

| 82,410 | | |

| | | |

| | | |

| | | |

| | | |

| 46,793 | | |

| 76.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income

attributable to non-controlling interests | |

| | | |

| | | |

| | | |

| | | |

| (1,670 | ) | |

| | | |

| | | |

| | | |

| | | |

| (1,599 | ) | |

| 4.5 | % |

| Net income attributable to

equity holders of the parent | |

| | | |

| | | |