0000874501FALSE00008745012024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 27, 2024

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, Ambac Financial Group, Inc. issued a press release announcing financial results for its fourth quarter ended December 31, 2023. Exhibit 99.1 is a copy of such press release and is incorporated by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Ambac Financial Group, Inc. under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 99.1 | | Press Release dated February 27, 2024 |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 99.1 | | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | February 27, 2024 | | By: | | /s/ William J. White |

| | | | | First Vice President, Secretary and Assistant General Counsel |

Exhibit 99.1

Ambac Reports Fourth Quarter 2023 Results

NEW YORK, NY, February 27, 2024 (BUSINESS WIRE) -- Ambac Financial Group, Inc. (NYSE: AMBC) ("Ambac" or "AFG"), a financial services holding company, today reported its results for the fourth quarter and year ended December 31, 2023.

•Net loss of $(16) million or $(0.24) per diluted share and Adjusted net income of $10 million or $0.32 per diluted share in the fourth quarter of 2023

•Legacy Financial Guarantee segment generated net loss of $(12) million in fourth quarter of 2023

•Specialty P&C Insurance ("Everspan") produced its second consecutive quarterly pre-tax profit and wrote gross premium of $91 million, up 76% from the fourth quarter of 2022

•Insurance Distribution ("Cirrata") premiums placed of $50 million, up 31% from the fourth quarter of 2022

•Book Value per share of $30.13 was up 8% and Adjusted Book Value per share of $28.74 was up 3% from September 30, 2023

Claude LeBlanc, President and Chief Executive Officer, stated, "I am pleased to report that for 2023 our specialty P&C platform exceeded our targets and generated over a half billion dollars of premium production, a 79% increase over 2022. Moreover, Everspan produced its second consecutive quarterly profit and generated positive net income in 2023. Everspan's profitability was supported by improved underwriting results as it continued to gain scale, posting a combined ratio of 106.5% for the year, a 50 percentage point improvement over the prior year. Overall, we remain focused on building the premier destination for MGAs and program partners and see significant runway ahead."

LeBlanc continued, “Regarding our Legacy Financial Guarantee Business, working with AAC's regulator, we finalized the capital model and revised stipulation and order for AAC. In addition, the strategic review we announced and launched last quarter is proceeding on plan and we will update the market once we have something definitive to report. Overall Ambac made significant progress in 2023 advancing all strategic priorities across our businesses, and we look forward to building on that momentum in 2024."

| | | | | | | | | | | | | | | | | | | | |

| Ambac's Fourth Quarter 2023 Summary Results |

| | | | | | B (W)

Percent |

($ in millions, except per share data)1 | | 4Q2023 | | 4Q2022 | |

| Gross written premium | | $ | 93.1 | | | $ | 43.7 | | | 113 | % |

| Net premiums earned | | 30.5 | | | 17.0 | | | 79 | % |

| Commission income | | 12.2 | | | 8.8 | | | 38 | % |

| Program fees | | 2.5 | | | 1.4 | | | 77 | % |

| Net investment income | | 40.5 | | | 22.6 | | | 79 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Pretax income (loss) | | (15.3) | | | 172.9 | | | (109) | % |

| | | | | | |

| Net income (loss) attributable to common stockholders | | (15.7) | | | 175.2 | | | (109) | % |

Net income (loss) attributable to common stockholders per diluted share2,3 | | $ | (0.24) | | | $ | 3.86 | | | (106) | % |

EBITDA2,4 | | 9.3 | | | 217.1 | | | (96) | % |

Adjusted net income (loss) 2 | | 10.2 | | | 182.7 | | | (94) | % |

Adjusted net income (loss) per diluted share 2, 3 | | $ | 0.32 | | | $ | 4.03 | | | (92) | % |

| Weighted-average diluted shares outstanding (in millions) | | 45.6 | | | 46.1 | | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ambac's Fourth Quarter 2023 Summary Results |

| | December 31, 2023 | | September 30, 2023 | | B(W) |

($ in millions, except per share data)1 | | | | Amount | | Percent |

| Total Ambac Financial Group, Inc. stockholders' equity | | $ | 1,361.7 | | | $ | 1,265.2 | | | $ | 96.4 | | | 8 | % |

| Total Ambac Financial Group, Inc. stockholders' equity per share | | $ | 30.13 | | | $ | 28.00 | | | $ | 2.13 | | | 8 | % |

Adjusted book value1,2 | | $ | 1,298.9 | | | $ | 1,260.5 | | | $ | 38.3 | | | 3 | % |

Adjusted book value per share 1,2 | | $ | 28.74 | | | $ | 27.90 | | | $ | 0.84 | | | 3 | % |

(1)Some financial data in this press release may not add up due to rounding

(2)See Non-GAAP Financial Data section of this press release for further information

(3)Per diluted share includes the impact of adjusting redeemable noncontrolling interests to current redemption value

(4)EBITDA is prior to the impact of noncontrolling interests, relating to subsidiaries where Ambac does not own 100%, of $0.3 and $0.4 for the three months ended December 31, 2023 and 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Ambac's 2023 Full Year Summary Results |

| | | | | | Better (Worse) |

| ($ in millions, except per share data) | | 2023 | | 2022 | | Amount | | Percent |

| Gross written premium | | $ | 288.1 | | | $ | 126.9 | | | $ | 161.2 | | | 127 | % |

| Net premiums earned | | 78.0 | | | 56.3 | | | 21.7 | | | 39 | % |

| Net investment income | | 140.1 | | | 16.8 | | | 123.3 | | | 733 | % |

| | | | | | | | |

| Net investment gains (losses), including impairments | | (22.5) | | | 31.5 | | | (54.0) | | | (171) | % |

| | | | | | | | |

| | | | | | | | |

| Net gains (losses) on derivative contracts | | (1.0) | | | 128.6 | | | (129.5) | | | (101) | % |

| Commission income | | 51.3 | | | 30.7 | | | 20.6 | | | 67 | % |

| Other income | | 11.2 | | | 9.8 | | | 1.4 | | | 14 | % |

| Net realized gains on extinguishment of debt | | — | | | 81.3 | | | (81.3) | | | (100) | % |

| | | | | | | | |

| Litigation recoveries | | — | | | 125.9 | | | (125.9) | | | (100) | % |

| Losses and loss adjustment expenses | | (32.6) | | | (396.5) | | | (363.9) | | | (92) | % |

| General and administrative expenses | | 156.3 | | | 141.2 | | | (15.2) | | | (11) | % |

| Commission expense | | 29.5 | | | 17.6 | | | (11.8) | | | (67) | % |

| Interest expense | | 64.0 | | | 168.2 | | | 104.1 | | | 62 | % |

| | | | | | | | |

| Intangible amortization | | 28.9 | | | 46.8 | | | 18.0 | | | 38 | % |

| Pretax income (loss) | | 12.4 | | | 524.6 | | | (512.2) | | | (98) | % |

| Provision (benefit) for income taxes | | 7.4 | | | 2.5 | | | (5.0) | | | (202) | % |

| | | | | | | | |

| Net income (loss) attributable to common stockholders | | 3.6 | | | 522.4 | | | (518.7) | | | (99) | % |

| Net income (loss) per diluted share | | 0.18 | | | 11.31 | | | (11.13) | | | (98) | % |

| EBITDA | | 107.0 | | | 741.5 | | | (634.6) | | | (86) | % |

Adjusted net income (loss) 1,2 | | 93.4 | | | 495.0 | | | (401.6) | | | (81) | % |

Adjusted net income (loss) per diluted share 1,2 | | 2.11 | | | 10.72 | | | (8.61) | | | (80) | % |

| Weighted-average diluted shares outstanding (in millions) | | 46.5 | | | 46.4 | | | — | | | — | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)Per diluted share includes the impact of adjusting redeemable noncontrolling interests to current redemption value

(2)See Non-GAAP Financial Data section of this press release for further information.

(3)Some financial data in this press release may not add up due to rounding

Results of Operations by Segment

Specialty Property & Casualty Insurance Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Gross premiums written | | $ | 90.7 | | | $ | 51.7 | | | 76 | % | | $ | 273.3 | | | $ | 146.4 | | | 87 | % |

| Net premiums written | | $ | 36.7 | | | $ | 10.0 | | | 269 | % | | $ | 79.8 | | | $ | 28.6 | | | 180 | % |

| Net premiums earned | | $ | 24.9 | | | $ | 5.7 | | | 341 | % | | $ | 51.9 | | | $ | 13.9 | | | 274 | % |

| Program fees earned | | $ | 2.5 | | | $ | 1.4 | | | 77 | % | | $ | 8.4 | | | $ | 3.1 | | | 172 | % |

| Losses and loss expense | | $ | 16.8 | | | $ | 3.7 | | | 356 | % | | $ | 36.7 | | | $ | 9.1 | | | 83 | % |

| Pretax income (loss) | | $ | 1.1 | | | $ | (0.9) | | | 228 | % | | $ | 0.4 | | | $ | (6.3) | | | 97 | % |

| Combined Ratio | | 100.3 | % | | 124.3 | % | | 2400 | bps | | 106.5 | % | | 156.5 | % | | 5000 | bps |

| | | | | | | | | | | | |

•Everspan generated positive pre-tax income in both the fourth quarter of 2023 and for the full year 2023.

•Gross premium written ("GPW") of $90.7 million in the fourth quarter of 2023 increased 76% compared to the prior year period as Everspan continues to grow and diversify its program business partners.

•Net premium written ("NPW") of $36.7 million in the fourth quarter of 2023 increased 269% compared to the prior year period. NPW growth outpaced GPW due to the impact of an assumed reinsurance transaction closed in the fourth quarter of 2023.

•Net premiums earned of $24.9 million in the fourth quarter of 2023 were up 341% over the fourth quarter of 2022 reflecting NPW growth and the effects of assumed reinsurance transactions.

•The loss and loss expense ratio for the fourth quarter of 2023 was 67.4% compared to 65.1% for the fourth quarter of 2022. The loss and loss expense ratio for the 2023 was 70.7% compared to 65.4% for the 2022.

•Expense ratio(1) of 32.9% for the fourth quarter of 2023 was down from 59.2% in the prior year period. A sliding commission scale benefit reduced the expense ratio by 1.2% in the fourth quarter of 2023 compared to 0.2% in the prior year period. For the full year 2023 the Expense ratio(1) was 35.8%, down from 91.1% in the prior year period as the expense ratio continues to normalize from scale.

(1)Expense Ratio is defined as acquisition costs and general and administrative expenses, reduced by program fees divided by net premiums earned

Insurance Distribution Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Premiums placed | | $ | 50.2 | | | $ | 38.3 | | | 31 | % | | $ | 230.6 | | | $ | 135.5 | | | 70 | % |

| Gross commissions | | $ | 12.2 | | | $ | 8.8 | | | 38 | % | | $ | 51.3 | | | $ | 30.7 | | | 67 | % |

| Net commissions | | $ | 4.8 | | | $ | 3.8 | | | 26 | % | | $ | 21.8 | | | $ | 13.1 | | | 67 | % |

| General and administrative expenses | | $ | 3.2 | | | $ | 1.9 | | | 65 | % | | $ | 10.6 | | | $ | 6.3 | | | 69 | % |

| Pretax income | | $ | 0.6 | | | $ | 1.2 | | | (50) | % | | $ | 7.3 | | | $ | 4.5 | | | 61 | % |

EBITDA1 | | $ | 1.8 | | | $ | 2.1 | | | (16) | % | | $ | 11.5 | | | $ | 7.5 | | | 54 | % |

Pretax income margin2 | | 4.9 | % | | 13.4 | % | | -850 | bps | | 14.1 | % | | 14.4 | % | | -30 | bps |

EBITDA margin 3 | | 14.3 | % | | 23.2 | % | | -890 | bps | | 22.3 | % | | 23.8 | % | | -150 | bps |

(1)EBITDA is prior to the impact of noncontrolling interests, relating to subsidiaries where Ambac does not own 100%, of $0.3 and $0.4 for the three months ended December 31, 2023 and 2022, respectively, and $2.1 and $1.5 for the years ended December 31, 2023 and 2022, respectively.

(2)Represents Pretax income divided by total revenues

(3)See Non-GAAP Financial Data section of this press release for further information

•Premium placed grew $11.8 million over the fourth quarter of 2022 driven primarily by recent acquisitions and growth initiatives at existing business.

•Gross commission income, which is generated as a percentage of premium placed, grew by $3.3 million in the fourth quarter 2023 over the fourth quarter of 2022.

•Net commission income of $4.8 million, which is gross commission income less sub-producer commissions paid, grew by 26% over last year; largely in-line with the change in premiums placed, with some change for business mix.

•General and administrative expenses of $3.2 million in the fourth quarter of 2023 compared to $1.9 million in the prior year period, the increase was largely related to recent acquisitions and growth initiatives at existing business.

•EBITDA of $1.8 million for the quarter was down (16)% over fourth quarter of 2022; EBITDA Margin of 14.3% for the quarter compared to 23.2% last year was negatively impacted by business mix changes and growth initiatives.

Total Specialty P&C Insurance Production

Specialty P&C Insurance production, which includes gross premiums written by Ambac's Specialty P&C Insurance segment and premiums placed by the Insurance Distribution segment, totaled $141 million in the fourth quarter of 2023, an increase of 57% from the fourth quarter of 2022.

Specialty P&C Insurance revenues are dependent on gross premiums written as specialty program insurance companies earn premiums based on the portion of gross premiums written retained (i.e. net premiums written) and fees on gross premiums written that are ceded to reinsurers. Insurance Distribution revenues are dependent on premium volume as Managing General Agents/Underwriters and brokers receive commissions based on the amount of premiums placed (i.e. gross premiums written on behalf of insurance carriers) with insurance carriers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Specialty Property & Casualty Insurance Gross Premiums Written | | $ | 90.7 | | | $ | 51.7 | | | 76 | % | | $ | 273.2 | | | $ | 146.4 | | | 87 | % |

| Insurance Distribution Premiums Placed | | 50.2 | | | 38.3 | | | 31 | % | | 230.6 | | | 135.5 | | | 70 | % |

| Specialty P&C Insurance Production | | $ | 140.9 | | | $ | 90.0 | | | 57 | % | | $ | 503.8 | | | $ | 281.9 | | | 79 | % |

Legacy Financial Guarantee Insurance Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net premiums earned | | $ | 5.6 | | | $ | 11.4 | | | (51) | % | | $ | 26.0 | | | $ | 42.4 | | | (39) | % |

| Net investment income | | $ | 36.9 | | | $ | 20.8 | | | 77 | % | | $ | 127.0 | | | $ | 12.3 | | | 930 | % |

| Losses and loss adjustment expenses (benefit) | | $ | 1.9 | | | $ | (58.7) | | | 103 | % | | $ | (69.3) | | | $ | (405.5) | | | 83 | % |

| General and administrative expenses | | $ | 19.2 | | | $ | 38.7 | | | (50) | % | | $ | 106.3 | | | $ | 102.4 | | | 4 | % |

| Pretax income (loss) | | $ | (12.2) | | | $ | 178.0 | | | (107) | % | | $ | 17.2 | | | $ | 540.1 | | | (97) | % |

EBITDA1 | | $ | 11.1 | | | $ | 221.2 | | | (95) | % | | $ | 107.3 | | | $ | 754.0 | | | (86) | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)See Non-GAAP Financial Data section of this press release for further information

•Net premiums earned of $5.6 million in the fourth quarter of 2023 decreased from $11.4 million in the prior year period. This reduction is mainly the result of proactive de-risking transactions, lower accelerations and normal run-off of the insured portfolio.

•Net investment income of $36.9 million increased 77% over fourth quarter of 2022 on higher yields and stronger alternative investment performance.

•Losses and loss adjustment expenses for the fourth quarter of 2023 were $1.9 million, compared to a benefit of $58.7 million in the fourth quarter of 2022, which was favorably impacted by the litigation settlement with Nomura.

•General and administrative expenses for the fourth quarter of 2023 were down 50% compared to fourth quarter 2022 which included a $19 million defensive litigation expenses.

•4Q2023 pre-tax loss includes a net benefit of $13 million in relation to the commutation of certain student loans exposures, which included insured bonds held in AAC's investment portfolio while 4Q22 pre-tax income included a $126 million gain from the RMBS litigation settlement with Bank of America.

•Watch List and Adversely Classified Credits ("WLACC") decreased 2.2% (3.3%, excluding the impact of FX) to $5.7 billion in fourth quarter of 2023, from September 30, 2023.

•NPO was $19.5 billion at December 31, 2023 which was in-line with September 30, 2023, due to the impact of FX rates.

Consolidated Financial Information

Net Premiums Earned

During the fourth quarter of 2023, net premiums earned of $31 million, increased 79% compared to the fourth quarter of 2022. Significant growth in the Specialty P&C businesses more than off-set the reduction in the Legacy FG business.

Net Investment Income

Net investment income for the fourth quarter of 2023 was $40 million compared to net investment income of $23 million for the fourth quarter of 2022.

The increase in net investment income in the fourth quarter of 2023 compared to the fourth quarter of 2022 was driven by higher yields on the core fixed income portfolio and improved alternative investment returns.

Losses and Loss Expenses(Benefit)

Incurred Losses (Benefit) for the fourth quarter of 2023 were $19 million, compared to a $(55) million for the fourth quarter of 2022.

Incurred Losses for the fourth quarter of 2023 were driven by losses in the Specialty P&C business. The fourth quarter of 2022 loss benefit was driven by the Legacy Financial Guarantee business litigation settlement with Nomura.

General and Administrative Expenses

General and administrative expenses for the fourth quarter 2023 were $35 million compared to $51 million in the fourth quarter of 2022. The decrease was mostly attributable to higher defensive litigation related expenses at the Legacy Financial Guarantee business in the prior year quarter somewhat off-set by increased headcount associated with growth in the P&C businesses.

AFG (holding company only) Assets

AFG on a standalone basis, excluding its ownership interests in its Specialty P&C Insurance, Insurance Distribution, and Legacy Financial Guarantee subsidiaries, had net assets of $211 million as of December 31, 2023. Assets included cash and liquid securities of $156 million and other investments of $32 million.

Consolidated Ambac Financial Group, Inc. Stockholders' Equity

Stockholders’ equity at December 31, 2023, was $1.36 billion, or $30.13 per share compared to $1.27 billion or $28.00 per share as of September 30, 2023. The increase was primarily due to net unrealized investment gains of

$69 million and foreign exchange translation gains of $32 million, somewhat off-set by the net loss attributable to common shareholders of $16 million.

Non-GAAP Financial Data

In addition to reporting the Company’s quarterly financial results in accordance with GAAP, the Company is reporting non-GAAP financial measures: EBITDA, Adjusted Net Income, Adjusted Book Value and EBITDA Margin. These amounts are derived from our consolidated financial information, but are not presented in our consolidated financial statements prepared in accordance with GAAP.

We present non-GAAP supplemental financial information because we believe such information is of interest to the investment community, and that it provides greater transparency and enhanced visibility into the underlying drivers and performance of our businesses on a basis that may not be otherwise apparent on a GAAP basis. We view these non-GAAP financial measures as important indicators when assessing and evaluating our performance on a segmented and consolidated basis and they are presented to improve the comparability of our results between periods by eliminating the impact of the items that may not be representative of our core operating performance. These non-GAAP financial measures are not substitutes for the Company’s GAAP reporting, should not be viewed in isolation and may differ from similar reporting provided by other companies, which may define non-GAAP measures differently.

Adjusted Net Income (Loss) — We define Adjusted Net Income (Loss) as net income (loss) attributable to common stockholders adjusted to reflect the following items: (i) net investment (gains) losses, including impairments; (ii) amortization of intangible assets; (iii) litigation costs, including attorneys fees and other expenses to defend litigation against the Company, excluding loss adjustment expenses; (iv) foreign exchange (gains) losses; (v) workforce change costs, which primarily include severance and other costs related to employee terminations; and (vi) net (gain) loss on extinguishment of debt. Adjusted Net Income is also adjusted for the effect of the above items on both income taxes and noncontrolling interests. The income tax effects are determined by applying the statutory tax rate in each jurisdiction that generate these adjustments. The noncontrolling interest adjustments relate to subsidiaries where Ambac does not own 100%

Adjusted Net Income was $10.2 million, or $0.32 per diluted share, for the fourth quarter 2023 compared to an Adjusted Net Income of $182.7 million, or $4.03 per diluted share, for the fourth quarter of 2022.

The following table reconciles net income (loss) attributable to common stockholders to the non-GAAP measure, Adjusted Net Income (Loss), for the three-month periods ended December 31, 2023 and 2022, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | 2022 |

| ($ in millions, other than per share data) | | $ Amount | | Per Share | | $ Amount | | Per Share |

| Net income (loss) attributable to common shareholders | | $ | (15.7) | | | $ | (0.24) | | | $ | 175.2 | | | $ | 3.86 | |

| Adjustments: | | | | | | | | |

| | | | | | | | |

| Net investment (gains) losses, including impairments | | 15.5 | | | 0.34 | | | (0.3) | | | (0.01) | |

| Intangible amortization | | 8.3 | | | 0.18 | | | 13.2 | | | 0.29 | |

| | | | | | | | |

| Litigation costs | | 3.5 | | | 0.07 | | | 22.5 | | | 0.49 | |

| Foreign exchange (gains) losses | | (0.9) | | | (0.02) | | | (3.4) | | | (0.07) | |

| | | | | | | | |

| Workforce change costs | | 0.2 | | | — | | | 0.5 | | | 0.01 | |

| Net (gain) loss on extinguishment of debt | | — | | | — | | | (24.3) | | | (0.53) | |

| | | | | | | | |

| Pretax adjusted net income (loss) | | 10.8 | | | 0.33 | | | 183.5 | | | 4.04 | |

| Income tax effects | | (0.4) | | | (0.01) | | | (0.7) | | | (0.01) | |

| Net (gains) attributable to noncontrolling interests | | (0.2) | | | — | | | (0.2) | | | — | |

| Adjusted Net Income (Loss) | | $ | 10.2 | | | $ | 0.32 | | | $ | 182.7 | | | $ | 4.03 | |

| Weighted-average diluted shares outstanding (in millions) | | | | 46.5 | | | | | 46.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 |

| ($ in millions, other than per share data) | | $ Amount | | Per Share | | $ Amount | | Per Share |

| Net income (loss) attributable to common shareholders | | $ | 3.6 | | | $ | 0.18 | | | $ | 522.4 | | | $ | 11.31 | |

| Adjustments: | | | | | | | | |

| | | | | | | | |

| Net investment (gains) losses, including impairments | | 22.5 | | | 0.49 | | | (31.5) | | | (0.68) | |

| Intangible amortization | | 28.9 | | | 0.62 | | | 46.8 | | | 1.01 | |

| | | | | | | | |

| Litigation costs | | 40.6 | | | 0.87 | | | 33.1 | | | 0.71 | |

| Foreign exchange (gains) losses | | (0.8) | | | (0.02) | | | 2.7 | | | 0.06 | |

| | | | | | | | |

| Workforce change costs | | 1.1 | | | 0.02 | | | 1.3 | | | 0.03 | |

| Net (gain) loss on extinguishment of debt | | — | | | — | | | (81.3) | | | (1.75) | |

| | | | | | | | |

| Pretax adjusted net income (loss) | | 95.8 | | | 2.16 | | | 493.6 | | | 10.69 | |

| Income tax effects | | (1.6) | | | (0.03) | | | 2.0 | | | 0.04 | |

| Net (gains) attributable to noncontrolling interests | | (0.8) | | | (0.02) | | | (0.6) | | | (0.01) | |

| Adjusted Net Income (Loss) | | $ | 93.4 | | | $ | 2.11 | | | $ | 495.0 | | | $ | 10.72 | |

| Weighted average diluted shares outstanding | | | | 46.5 | | | | | 46.4 | |

(1)Per Diluted share includes the impact of adjusting the Insurance Distribution segment related noncontrolling interest to current redemption value

EBITDA — We define EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization of intangible assets.

The following table reconciles net income (loss) attributable to common shareholders to the non-GAAP measure, EBITDA on a consolidation and segment basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Legacy Financial Guarantee Insurance | | Specialty Property & Casualty Insurance | | Insurance Distribution | | Corporate & Other | | | | Consolidated |

| Three Months Ended December 31, 2023 | | | | | | | | | | | | |

| Net income (loss) | | $ | (12.2) | | | $ | 1.1 | | | $ | 0.6 | | | $ | (5.0) | | | | | $ | (15.6) | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | | 15.9 | | | — | | | — | | | — | | | | | 15.9 | |

| Income taxes | | — | | | — | | | — | | | 0.2 | | | | | 0.3 | |

| Depreciation | | 0.3 | | | — | | | — | | | 0.2 | | | | | 0.5 | |

| Amortization of intangible assets | | 7.1 | | | — | | | 1.1 | | | — | | | | | 8.3 | |

EBITDA (2) | | $ | 11.1 | | | $ | 1.1 | | | $ | 1.8 | | | $ | (4.7) | | | | | $ | 9.3 | |

| Three Months Ended December 31, 2022 | | | | | | | | | | | | |

| Net income (loss) | | $ | 178.9 | | | $ | (0.8) | | | $ | 1.2 | | | $ | (5.0) | | | | | $ | 174.3 | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | | 30.4 | | | — | | | — | | | — | | | | | 30.4 | |

| Income taxes | | (0.9) | | | (0.1) | | | — | | | (0.4) | | | | | (1.3) | |

| Depreciation | | 0.4 | | | — | | | — | | | — | | | | | 0.5 | |

| Amortization of intangible assets | | 12.4 | | | — | | | 0.9 | | | — | | | | | 13.2 | |

EBITDA (2) | | $ | 221.2 | | | $ | (0.9) | | | $ | 2.1 | | | $ | (5.4) | | | | | $ | 217.1 | |

(1)Net income (loss) is prior to the impact of noncontrolling interests.

(2)EBITDA is prior to the impact of noncontrolling interests, relating to subsidiaries where Ambac does not own 100%, of $0.3 and $0.4 for the three months ended December 31, 2023 and 2022, respectively. These noncontrolling interests are primarily in the Insurance Distribution segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Legacy Financial Guarantee Insurance | | Specialty Property & Casualty Insurance | | Insurance Distribution | | Corporate & Other | | | | Consolidated |

| Year Ended December 31, 2023 | | | | | | | | | | | | |

| Net income (loss) | | $ | 8.8 | | | $ | 0.3 | | | $ | 7.1 | | | $ | (11.3) | | | | | $ | 5.0 | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | | 64.0 | | | — | | | — | | | — | | | | | 64.0 | |

| Income taxes | | 8.4 | | | — | | | 0.2 | | | (1.2) | | | | | 7.4 | |

| Depreciation | | 1.3 | | | — | | | — | | | 0.3 | | | | | 1.7 | |

| Amortization of intangible assets | | 24.7 | | | — | | | 4.2 | | | — | | | | | 28.9 | |

| EBITDA | | $ | 107.3 | | | $ | 0.4 | | | $ | 11.5 | | | $ | (12.2) | | | | | $ | 107.0 | |

| Year Ended December 31, 2022 | | | | | | | | | | | | |

| Net income (loss) | | $ | 537.2 | | | $ | (6.3) | | | $ | 4.5 | | | $ | (13.2) | | | | | $ | 522.1 | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | | 168.2 | | | — | | | — | | | — | | | | | 168.2 | |

| Income taxes | | 2.9 | | | — | | | — | | | (0.5) | | | | | 2.5 | |

| Depreciation | | 1.8 | | | — | | | — | | | 0.1 | | | | | 2.0 | |

| Amortization of intangible assets | | 43.9 | | | — | | | 2.9 | | | — | | | | | 46.8 | |

| EBITDA | | $ | 754.0 | | | $ | (6.3) | | | $ | 7.5 | | | $ | (13.6) | | | | | $ | 741.5 | |

(1)Net income (loss) is prior to the impact of noncontrolling interests.

(2)EBITDA is prior to the impact of noncontrolling interests, relating to subsidiaries where Ambac does not own 100%, of $2.1 and $1.5 for the years ended December 31, 2023 and 2022, respectively. These noncontrolling interests are primarily in the Insurance Distribution segment.

EBITDA margin — We define EBITDA margin as EBITDA divided by total revenues. We report EBITDA margin for the Insurance Distribution segment only.

Adjusted Book Value. Adjusted book value is defined as Total Ambac Financial Group, Inc. stockholders’ equity as reported under GAAP, adjusted for after-tax impact of the following:

•Insurance intangible asset: Elimination of the financial guarantee insurance intangible asset that arose as a result of Ambac’s emergence from bankruptcy and the implementation of Fresh Start reporting. This adjustment ensures that all financial guarantee contracts are accounted for within adjusted book value consistent with the provisions of the Financial Services—Insurance Topic of the ASC.

•Net unearned premiums and fees in excess of expected losses: Addition of the value of the unearned premium revenue ("UPR") on financial guarantee contracts, in excess of expected losses, net of reinsurance. This non-GAAP adjustment presents the economics of UPR and expected losses for financial guarantee contracts on a consistent basis. In accordance with GAAP, stockholders’ equity reflects a reduction for expected losses only to the extent they exceed UPR. However, when expected losses are less than UPR for a financial guarantee contract, neither expected losses nor UPR have an impact on stockholders’ equity. This non-GAAP adjustment adds UPR in excess of expected losses, net of reinsurance, to stockholders’ equity for financial guarantee contracts where expected losses are less than UPR. This adjustment is only made for financial guarantee contracts since such premiums are non-refundable.

•Net unrealized investment (gains) losses in Accumulated Other Comprehensive Income: Elimination of the unrealized gains and losses on the Company’s investments that are recorded as a component of accumulated other comprehensive income (“AOCI”), net of income taxes.

Ambac has a significant U.S. tax net operating loss (“NOL”) that is offset by a full valuation allowance in the GAAP consolidated financial statements. As a result of this, tax planning strategies and other considerations, we utilized a 0% effective tax rate for non-GAAP operating adjustments to Adjusted Book.

Adjusted book value was $1.30 billion, or $28.74 per share, at December 31, 2023, as compared to $1.26 billion, or $27.90 per share, at September 30, 2023. The increase is primarily as a result of F(x) translation gains.

The following table reconciles Total Ambac Financial Group, Inc. stockholders’ equity to the non-GAAP measure adjusted book value as of each date presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| ($ in millions, other than per share data) | | $ Amount | | Per Share | | $ Amount | | Per Share |

| Total AFG Stockholders' Equity | | $ | 1,361.7 | | | $ | 30.13 | | | $ | 1,265.2 | | | $ | 28.00 | |

| Adjustments: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Insurance intangible asset | | (245.1) | | | (5.43) | | | (249.1) | | | (5.51) | |

| | | | | | | | |

| | | | | | | | |

| Net unearned premiums and fees in excess of expected losses | | 162.1 | | | 3.59 | | | 154.5 | | | 3.42 | |

| Net unrealized investment (gains) losses in Accumulated Other Comprehensive Income | | 20.2 | | | 0.45 | | | 89.9 | | | 1.99 | |

| | | | | | | | |

| Adjusted book value | | $ | 1,298.9 | | | $ | 28.74 | | | $ | 1,260.5 | | | $ | 27.90 | |

| Shares outstanding (in millions) | | | | 45.2 | | | | | 45.2 | |

Earnings Call and Webcast

On February 28, 2024, at 8:30am ET, Claude LeBlanc, President and Chief Executive Officer, and David Trick, Executive Vice President and Chief Financial Officer, will discuss Ambac's fourth quarter 2023 results during a conference call. A live audio webcast of the call will be available through the Investor Relations section of Ambac’s website, https://ambac.com/investor-relations/events-and-presentations/. Participants may also listen via telephone by dialing (877) 407-9716 (Domestic) or (201) 493-6779 (International).

The webcast will be archived on Ambac's website. A replay of the call will be available through March 13, 2024, and can be accessed by dialing (Domestic) (844) 512-2921 or (International) (412) 317-6671; and using ID#13744126

Additional information is included in an operating supplement and presentations at Ambac's website at www.ambac.com.

About Ambac

Ambac Financial Group, Inc. (“Ambac” or “AFG”) is a financial services holding company headquartered in New York City. Ambac’s core business is a growing specialty P&C distribution and underwriting platform. Ambac also has a legacy financial guaranty business in run off. Ambac’s common stock trades on the New York Stock Exchange under the symbol “AMBC”. Ambac is committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our website to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial, statistical and business-related information. For more information, please go to www.ambac.com.

The Amended and Restated Certificate of Incorporation of Ambac contains substantial restrictions on the ability to transfer Ambac’s common stock. Subject to limited exceptions, any attempted transfer of common stock shall be prohibited and void to the extent that, as a result of such transfer (or any series of transfers of which such transfer is a part), any person or group of persons shall become a holder of 5% or more of Ambac’s common stock or a holder of 5% or more of Ambac’s common stock increases its ownership interest.

Contact

Charles J. Sebaski

Managing Director, Investor Relations

(212) 208-3222

csebaski@ambac.com

Forward-Looking Statements

In this press release, statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results

that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” in our most recent SEC filed quarterly or annual report.

Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac Financial Group’s (“AFG”) and its subsidiaries’ (collectively, “Ambac” or the “Company”) actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) the high degree of volatility in the price of AFG’s common stock; (2) uncertainty concerning the Company’s ability to achieve value for holders of its securities, whether from Ambac Assurance Corporation (“AAC”) and its subsidiaries or from the specialty property and casualty insurance business, the insurance distribution business, or related businesses; (3) inadequacy of reserves established for losses and loss expenses and the possibility that changes in loss reserves may result in further volatility of earnings or financial results; (4) potential for rehabilitation proceedings or other regulatory intervention or restrictions against AAC; (5) credit risk throughout Ambac’s business, including but not limited to credit risk related to insured residential mortgage-backed securities, student loan and other asset securitizations, public finance obligations (including risks associated with Chapter 9 and other restructuring proceedings), issuers of securities in our investment portfolios, and exposures to reinsurers; (6) our inability to effectively reduce insured financial guarantee exposures or achieve recoveries or investment objectives; (7) AAC’s inability to generate the significant amount of cash needed to service its debt and financial obligations, and its inability to refinance its indebtedness; (8) AAC’s substantial indebtedness could adversely affect the Company’s financial condition and operating flexibility; (9) Ambac may not be able to obtain financing or raise capital on acceptable terms or at all due to its substantial indebtedness and financial condition; (10) greater than expected underwriting losses in the Company’s specialty property and casualty insurance business; (11) failure of specialty insurance program partners to properly market, underwrite or administer policies; (12) inability to obtain reinsurance coverage on expected terms; (13) loss of key relationships for production of business in specialty property and casualty and insurance distribution businesses or the inability to secure such additional relationships to produce expected results; (14) the impact of catastrophic public health, environmental or natural events, or global or regional conflicts; (15) credit risks related to large single risks, risk concentrations and correlated risks; (16) risks associated with adverse selection as Ambac’s financial guarantee insurance portfolio runs off; (17) the risk that Ambac’s risk management policies and practices do not anticipate certain risks and/or the magnitude of potential for loss; (18) restrictive covenants in agreements and instruments that impair Ambac’s ability to pursue or achieve its business strategies; (19) adverse effects on operating results or the Company’s financial position resulting from measures taken to reduce financial guarantee risks in its insured portfolio; (20) disagreements or disputes with Ambac's insurance regulators; (21) loss of control rights in transactions for which we provide financial guarantee insurance; (22) inability to realize expected recoveries of financial guarantee losses; (23) risks attendant to the change in composition of securities in Ambac’s investment portfolio; (24) adverse impacts from changes in prevailing interest rates; (25) events or circumstances that result in the impairment of our intangible assets and/or goodwill that was recorded in connection with Ambac’s acquisitions; (26) factors that may negatively influence the amount of installment premiums paid to Ambac; (27) the risk of litigation, regulatory inquiries, investigations, claims or proceedings, and the risk of adverse outcomes in connection therewith; (28) the Company’s ability to adapt to the rapid pace of regulatory change; (29) actions of stakeholders whose interests are not aligned with broader interests of Ambac's stockholders; (30) system security risks, data protection breaches and cyber attacks; (31) regulatory oversight of Ambac Assurance UK Limited (“Ambac UK”) and applicable regulatory restrictions may adversely affect our ability to realize value from Ambac UK or the amount of value we ultimately realize; (32) failures in services or products provided by third parties; (33) political developments that disrupt the economies where the Company has insured exposures; (34) our inability to attract and retain qualified executives, senior managers and other employees, or the loss of such personnel; (35) fluctuations in foreign currency exchange rates; (36) failure to realize our business expansion plans or failure of such plans to create value; (37) greater competition for our specialty property and casualty insurance business and/or our insurance distribution business; (38) loss or lowering of the AM Best rating for our property and casualty insurance company subsidiaries; (39) disintermediation within the insurance industry or greater competition from technology-based insurance solutions or non-traditional insurance markets; (40) changes in law or in the functioning of the healthcare market that impair the business model of our accident and health managing general underwriter; and (41) other risks and uncertainties that have not been identified at this time.

AMBAC FINANCIAL GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Income (Loss) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| | December 31, | | Year Ended |

| ($ in millions, except share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| Net premiums earned | | $ | 31 | | | $ | 17 | | | $ | 78 | | | $ | 56 | |

| Commission income | | 12 | | | 9 | | | 51 | | | 31 | |

| Program fees | | 2 | | | 1 | | | 8 | | | 3 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net investment income | | 40 | | | 23 | | | 140 | | | 17 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net investment gains (losses), including impairments | | (16) | | | — | | | (22) | | | 31 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net gains (losses) on derivative contracts | | (2) | | | 5 | | | (1) | | | 129 | |

| Net realized gains on extinguishment of debt | | — | | | 24 | | | — | | | 81 | |

| Income (loss) on variable interest entities | | 4 | | | 7 | | | 3 | | | 21 | |

| Other income | | 4 | | | 7 | | | 11 | | | 10 | |

| Litigation recoveries | | — | | | 126 | | | — | | | 126 | |

| Total revenues and other income | | 76 | | | 219 | | | 269 | | | 505 | |

| Expenses: | | | | | | | | |

| Losses and loss adjustment expenses | | 19 | | | (55) | | | (33) | | | (396) | |

| Amortization of deferred acquisition costs, net | | 6 | | | 1 | | | 11 | | | 3 | |

| Commission expense | | 7 | | | 5 | | | 29 | | | 18 | |

| General and administrative expenses | | 35 | | | 51 | | | 156 | | | 141 | |

| Intangible amortization | | 8 | | | 13 | | | 29 | | | 47 | |

| Interest expense | | 16 | | | 30 | | | 64 | | | 168 | |

| | | | | | | | |

| Total expenses | | 91 | | | 46 | | | 257 | | | (20) | |

| | | | | | | | |

| | | | | | | | |

| Pretax income (loss) | | (15) | | | 173 | | | 12 | | | 525 | |

| Provision (benefit) for income taxes | | — | | | (1) | | | 7 | | | 2 | |

| Net income (loss) | | (16) | | | 174 | | | 5 | | | 522 | |

| Less: net (gain) loss attributable to noncontrolling interest | | — | | | — | | | (1) | | | (1) | |

| Plus: gain on purchase of auction market preferred shares | | — | | | 1 | | | — | | | 1 | |

| Net income (loss) attributable to common stockholders | | $ | (16) | | | $ | 175 | | | $ | 4 | | | $ | 522 | |

| | | | | | | | |

| Net income (loss) per basic share | | $ | (0.24) | | | $ | 3.93 | | | $ | 0.18 | | | $ | 11.48 | |

| Net income (loss) per diluted share | | $ | (0.24) | | | $ | 3.86 | | | $ | 0.18 | | | $ | 11.31 | |

| | | | | | | | |

| Weighted-average number of common shares outstanding: | | | | | | | | |

| Basic | | 45,589,451 | | | 45,341,861 | | | 45,636,649 | | | 45,719,906 | |

| Diluted | | 45,589,451 | | | 46,078,826 | | | 46,540,706 | | | 46,414,830 | |

AMBAC FINANCIAL GROUP, INC. AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Year Ended December 31, |

| ($ in millions, except share data) | | 2023 | | 2022 |

| Assets: | | | | |

| Investments: | | | | |

| Fixed maturity securities, at fair value (amortized cost: $1,744 and $1,469) | | $ | 1,710 | | | $ | 1,395 | |

| | | | |

| Fixed maturity securities - trading | | 27 | | | 59 | |

| Short-term investments, at fair value (amortized cost: $426 and $507) | | 426 | | | 507 | |

| Short-term investments pledged as collateral, at fair value (amortized cost: $27 and $64) | | 27 | | | 64 | |

| Other investments (includes $463 and $556 at fair value) | | 475 | | | 568 | |

| Total investments (net of allowance for credit losses of $3 and $0) | | 2,664 | | | 2,593 | |

| | | | |

| | | | |

| Cash and cash equivalents (including $12 and $14 of restricted cash) | | 28 | | | 44 | |

| | | | |

| | | | |

| Premium receivables (net of allowance for credit losses of $4 and $5) | | 290 | | | 269 | |

| Reinsurance recoverable on paid and unpaid losses (net of allowance for credit losses of $0 and $0) | | 195 | | | 115 | |

| Deferred ceded premium | | 204 | | | 124 | |

| Deferred acquisition costs | | 11 | | | 3 | |

| Subrogation recoverable | | 137 | | | 271 | |

| | | | |

| | | | |

| | | | |

| Intangible assets, less accumulated amortization | | 307 | | | 326 | |

| Goodwill | | 70 | | | 61 | |

| Other assets | | 129 | | | 112 | |

| Variable interest entity assets: | | | | |

| Fixed maturity securities, at fair value | | 2,167 | | | 1,967 | |

| | | | |

| Restricted cash | | 246 | | | 17 | |

| | | | |

| Loans, at fair value | | 1,663 | | | 1,829 | |

| | | | |

| | | | |

| | | | |

| Derivative and other assets | | 318 | | | 241 | |

| Total assets | | $ | 8,428 | | | $ | 7,973 | |

| Liabilities and Stockholders’ Equity: | | | | |

| Liabilities: | | | | |

| | | | |

| Unearned premiums | | $ | 422 | | | $ | 372 | |

| Loss and loss adjustment expense reserves | | 893 | | | 805 | |

| Ceded premiums payable | | 90 | | | 39 | |

| | | | |

| Deferred program fees and reinsurance commissions | | 6 | | | 5 | |

| | | | |

| | | | |

| Long-term debt | | 508 | | | 639 | |

| Accrued interest payable | | 475 | | | 427 | |

| | | | |

| Other liabilities | | 199 | | | 201 | |

| | | | |

| Variable interest entity liabilities: | | | | |

| | | | |

| Long-term debt (includes $2,710 and $2,788 at fair value) | | 2,967 | | | 3,107 | |

| Derivative liabilities | | 1,197 | | | 1,048 | |

| | | | |

| Other liabilities | | 240 | | | 5 | |

| Total liabilities | | 6,997 | | | 6,647 | |

| | | | |

| Redeemable noncontrolling interest | | 17 | | | 20 | |

| Stockholders’ equity: | | | | |

| Preferred stock, par value $0.01 per share; 20,000,000 shares authorized shares; issued and outstanding shares—none | | — | | | — | |

| Common stock, par value $0.01 per share; 130,000,000 shares authorized; issued shares: 46,659,144 and 46,658,990 | | — | | | — | |

| Additional paid-in capital | | 292 | | | 274 | |

| Accumulated other comprehensive income (loss) | | (160) | | | (253) | |

| Retained earnings | | 1,246 | | | 1,245 | |

| Treasury stock, shares at cost: 1,463,774 and 1,685,233 | | (17) | | | (15) | |

| Total Ambac Financial Group, Inc. stockholders’ equity | | 1,362 | | | 1,252 | |

| Nonredeemable noncontrolling interest | | 53 | | | 53 | |

| Total stockholders’ equity | | 1,415 | | | 1,305 | |

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity | | $ | 8,428 | | | $ | 7,973 | |

The following table presents segment financial results and includes the non-GAAP measure, EBITDA on a segment and consolidated basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Legacy Financial Guarantee Insurance | | Specialty Property & Casualty Insurance | | Insurance Distribution | | Corporate & Other | | | | Consolidated |

| Three Months Ended December 31, 2023 | | | | | | | | | | | | |

| Gross premiums written | | $ | 2.3 | | | $ | 90.7 | | | | | | | | | $ | 93.1 | |

| Net premiums written | | 7.3 | | | 36.7 | | | | | | | | | 44.1 | |

| Revenues: | | | | | | | | | | | | |

| Net premiums earned | | 5.6 | | | 24.9 | | | | | | | | | 30.5 | |

| Commission income | | | | | | $ | 12.2 | | | | | | | 12.2 | |

| Program fees | | | | 2.5 | | | | | | | | | 2.5 | |

| Net investment income | | 36.9 | | | 1.2 | | | 0.1 | | | $ | 2.3 | | | | | 40.5 | |

| Net investment gains (losses), including impairments | | (15.5) | | | — | | | | | — | | | | | (15.5) | |

| Net gains (losses) on derivative contracts | | (2.3) | | | | | | | 0.1 | | | | | (2.2) | |

| Net realized gains on extinguishment of debt | | — | | | | | | | | | | | — | |

| Other income | | 7.5 | | | — | | | 0.1 | | | — | | | | | 7.6 | |

| | | | | | | | | | | | | |

| Total revenues and other income | | 32.2 | | | 28.6 | | | 12.3 | | | 2.4 | | | | | 75.5 | |

| Expenses: | | | | | | | | | | | | |

| Losses and loss adjustment expenses | | 1.9 | | | 16.8 | | | | | | | | | 18.7 | |

| Commission expense | | | | | | 7.4 | | | | | | | 7.4 | |

| Amortization of deferred acquisition costs, net | | — | | | 5.9 | | | | | | | | | 5.8 | |

| General and administrative expenses | | 19.2 | | | 4.8 | | | 3.2 | | | 7.0 | | | | | 34.3 | |

| | | | | | | | | | | | | |

| Total expenses included for EBITDA | | 21.1 | | | 27.5 | | | 10.6 | | | 7.0 | | | | | 66.2 | |

| | | | | | | | | | | | | |

| EBITDA | | 11.1 | | | 1.1 | | | 1.8 | | | (4.7) | | | | | 9.3 | |

| | | | | | | | | | | | | |

| Less: Interest expense | | 15.9 | | | | | | | | | | | 15.9 | |

| Less: Depreciation expense | | 0.3 | | | — | | | — | | | 0.2 | | | | | 0.5 | |

| Less: Intangible amortization | | 7.1 | | | | | 1.1 | | | | | | | 8.3 | |

| Pretax income (loss) | | (12.2) | | | 1.1 | | | 0.6 | | | (4.9) | | | | | (15.3) | |

| Income tax expense (benefit) | | — | | | — | | | — | | | 0.2 | | | | | 0.3 | |

| Net income (loss) | | $ | (12.2) | | | $ | 1.1 | | | $ | 0.6 | | | $ | (5.0) | | | | | $ | (15.6) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 | | | | | | | | | | | | |

| Gross premiums written | | $ | (8.0) | | | $ | 51.7 | | | | | | | | | $ | 43.7 | |

| Net premiums written | | (7.9) | | | 10.0 | | | | | | | | | 2.1 | |

| Revenues: | | | | | | | | | | | | |

| Net premiums earned | | 11.4 | | | 5.7 | | | | | | | | | 17.0 | |

| Commission income | | | | | | $ | 8.8 | | | | | | | 8.8 | |

| Program fees | | | | 1.4 | | | | | | | | | 1.4 | |

| Net investment income | | 20.8 | | | 0.5 | | | | | $ | 1.2 | | | | | 22.6 | |

| Net investment gains (losses), including impairments | | 0.3 | | | — | | | | | — | | | | | 0.3 | |

| Net gains (losses) on derivative contracts | | 5.0 | | | | | | | — | | | | | 5.0 | |

| Net realized gains on extinguishment of debt | | 24.3 | | | | | | | | | | | 24.3 | |

| Other income | | 13.7 | | | — | | | 0.2 | | | — | | | | | 13.9 | |

| Litigation recoveries | | 125.9 | | | | | | | | | | | 125.9 | |

| Total revenues and other income | | 201.3 | | | 7.5 | | | 9.1 | | | 1.2 | | | | | 219.1 | |

| Expenses: | | | | | | | | | | | | |

| Losses and loss adjustment expenses | | (58.7) | | | 3.7 | | | | | | | | | (55.1) | |

| Amortization of deferred acquisition costs, net | | — | | | 1.1 | | | | | | | | | 1.2 | |

| Commission expense | | | | | | 5.1 | | | | | | | 5.1 | |

| General and administrative expenses | | 38.7 | | | 3.6 | | | 1.9 | | | 6.6 | | | | | 50.9 | |

| | | | | | | | | | | | | |

| Total expenses included for EBITDA | | (20.0) | | | 8.4 | | | 7.0 | | | 6.6 | | | | | 2.1 | |

| | | | | | | | | | | | | |

| EBITDA | | 221.2 | | | (0.9) | | | 2.1 | | | (5.4) | | | | | 217.1 | |

| | | | | | | | | | | | | |

| Less: Interest expense | | 30.4 | | | | | | | | | | | 30.4 | |

| Less: Depreciation expense | | 0.4 | | | — | | | — | | | — | | | | | 0.5 | |

| Less: Intangible amortization | | 12.4 | | | | | 0.9 | | | | | | | 13.2 | |

| Pretax income (loss) | | 178.0 | | | (0.9) | | | 1.2 | | | (5.4) | | | | | 172.9 | |

| Income tax expense (benefit) | | (0.9) | | | (0.1) | | | — | | | (0.4) | | | | | (1.3) | |

| Net income (loss) | | $ | 178.9 | | | $ | (0.8) | | | $ | 1.2 | | | $ | (5.0) | | | | | $ | 174.3 | |

Results of Operations by Segment (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 | | Legacy Financial Guarantee Insurance | | Specialty Property & Casualty Insurance | | Insurance Distribution | | Corporate & Other | | | | Consolidated |

| ($ in millions) | | | | | | | | | | | | |

| Gross premiums written | | $ | 14.8 | | | $ | 273.3 | | | | | | | | | $ | 288.1 | |

| Net premiums written | | (35.5) | | | 79.8 | | | | | | | | | 44.4 | |

| Revenues: | | | | | | | | | | | | |

| Net premiums earned | | 26.0 | | | 51.9 | | | | | | | | | 78.0 | |

| Commission income | | | | | | $ | 51.3 | | | | | | | 51.3 | |

| Program fees | | | | 8.4 | | | | | | | | | 8.4 | |

| Net investment income | | 127.0 | | | 3.8 | | | 0.1 | | | $ | 9.3 | | | | | 140.1 | |

| Net investment gains (losses), including impairments | | (22.5) | | | — | | | | | 0.1 | | | | | (22.5) | |

| Net gains (losses) on derivative contracts | | (0.7) | | | | | | | (0.3) | | | | | (1.0) | |

| Net realized gains on extinguishment of debt | | — | | | | | | | | | | | — | |

| Other income | | 14.5 | | | — | | | 0.2 | | | — | | | | | 14.7 | |

| | | | | | | | | | | | | |

| Total revenues and other income | | 144.3 | | | 64.1 | | | 51.5 | | | 9.1 | | | | | 269.1 | |

| Expenses: | | | | | | | | | | | | |

| Losses and loss adjustment expenses | | (69.3) | | | 36.7 | | | | | | | | | (32.6) | |

| Amortization of deferred acquisition costs, net | | — | | | 10.6 | | | | | | | | | 10.6 | |

| Commission expense | | | | | | 29.5 | | | | | | | 29.5 | |

| General and administrative expenses | | 106.3 | | | 16.5 | | | 10.6 | | | 21.3 | | | | | 154.6 | |

| | | | | | | | | | | | | |

| Total expenses included for EBITDA | | 37.0 | | | 63.7 | | | 40.1 | | | 21.3 | | | | | 162.1 | |

| | | | | | | | | | | | | |

| EBITDA | | 107.3 | | | 0.4 | | | 11.5 | | | (12.2) | | | | | 107.0 | |

| | | | | | | | | | | | | |

| Less: Interest expense | | 64.0 | | | | | | | | | | | 64.0 | |

| Less: Depreciation expense | | 1.3 | | | — | | | — | | | 0.3 | | | | | 1.7 | |

| Less: Intangible amortization | | 24.7 | | | | | 4.2 | | | | | | | 28.9 | |

| Pretax income (loss) | | 17.2 | | | 0.4 | | | 7.3 | | | (12.5) | | | | | 12.4 | |

| Income tax expense (benefit) | | 8.4 | | | — | | | 0.2 | | | (1.2) | | | | | 7.4 | |

| Net income (loss) | | $ | 8.8 | | | $ | 0.3 | | | $ | 7.1 | | | $ | (11.3) | | | | | $ | 5.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 | | Legacy Financial Guarantee Insurance | | Specialty Property & Casualty Insurance | | Insurance Distribution | | Corporate & Other | | | | Consolidated |

| ($ in millions) | | | | | | | | | | | | |

| Gross premiums written | | $ | (19.5) | | | $ | 146.4 | | | | | | | | | $ | 126.9 | |

| Net premiums written | | (5.9) | | | 28.6 | | | | | | | | | 22.6 | |

| Revenues: | | | | | | | | | | | | |

| Net premiums earned | | 42.4 | | | 13.9 | | | | | | | | | 56.3 | |

| Commission income | | | | | | $ | 30.7 | | | | | | | 30.7 | |

| Program fees | | | | 3.1 | | | | | | | | | 3.1 | |

| Net investment income | | 12.3 | | | 1.6 | | | | | $ | 2.9 | | | | | 16.8 | |

| Net investment gains (losses), including impairments | | 31.5 | | | — | | | | | — | | | | | 31.5 | |

| Net gains (losses) on derivative contracts | | 127.6 | | | | | | | 0.9 | | | | | 128.6 | |

| Net realized gains on extinguishment of debt | | 81.3 | | | | | | | | | | | 81.3 | |

| Other income | | 30.3 | | | (0.1) | | | 0.7 | | | (0.1) | | | | | 30.8 | |

| Litigation recoveries | | 125.9 | | | | | | | | | | | 125.9 | |

| Total revenues | | 451.3 | | | 18.5 | | | 31.4 | | | 3.7 | | | | | 504.9 | |

| Expenses: | | | | | | | | | | | | |

| Losses and loss adjustment expenses | | (405.5) | | | 9.1 | | | | | | | | | (396.5) | |

| Amortization of deferred acquisition costs, net | | 0.4 | | | 2.5 | | | | | | | | | 3.0 | |

| Commission expense | | | | | | 17.6 | | | | | | | 17.6 | |

| General and administrative expenses | | 102.4 | | | 13.2 | | | 6.3 | | | 17.3 | | | | | 139.2 | |

| | | | | | | | | | | | | |

| Total expenses included for EBITDA | | (302.7) | | | 24.8 | | | 23.9 | | | 17.3 | | | | | (236.7) | |

| | | | | | | | | | | | | |

| EBITDA | | 754.0 | | | (6.3) | | | 7.5 | | | (13.6) | | | | | 741.5 | |

| | | | | | | | | | | | | |

| Less: Interest expense | | 168.2 | | | | | | | | | | | 168.2 | |

| Less: Depreciation expense | | 1.8 | | | — | | | — | | | 0.1 | | | | | 2.0 | |

| Less: Intangible amortization | | 43.9 | | | | | 2.9 | | | | | | | 46.8 | |

| Pretax income (loss) | | 540.1 | | | (6.3) | | | 4.5 | | | (13.7) | | | | | 524.6 | |

| Income tax expense (benefit) | | 2.9 | | | — | | | — | | | (0.5) | | | | | 2.5 | |

| Net income (loss) | | $ | 537.2 | | | $ | (6.3) | | | $ | 4.5 | | | $ | (13.2) | | | | | $ | 522.1 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

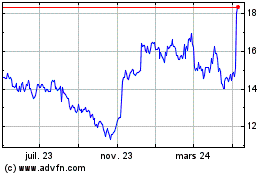

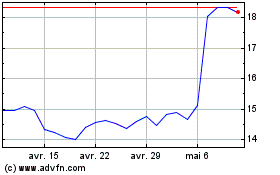

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024