Starboard Value LP (together with its affiliates, “Starboard” or

“we”) is the largest shareholder of Algonquin Power & Utilities

Corp. (NYSE: AQN) (TSE: AQN) (“Algonquin” or the “Company”) with an

ownership stake of approximately 9.0%. Today, Starboard announced

that it has nominated three highly qualified candidates (the

“Starboard Nominees”) for election to the Company’s Board of

Directors (the “Board”) at the 2024 Annual General Meeting of

Shareholders (the “Annual Meeting”), which has been scheduled for

June 4, 2024. The Starboard Nominees are Brett Carter, Chris Lopez

and Rob Schriesheim.

In connection with its nominations, Starboard sent the below

letter to the members of the Board.

March 21, 2024

Board of Directors Algonquin Power & Utilities Corp. 354

Davis Road Oakville, Ontario Canada L6J 2X1

Dear Members of the Board,

As you know, Starboard Value LP (together with its affiliates,

“Starboard”) is the largest shareholder of Algonquin Power &

Utilities Corp. (“Algonquin” or the “Company”), with an ownership

stake of approximately 9.0%. We have spent a significant amount of

time with certain members of the Board of Directors (the “Board”)

and management over the past year. After substantial work on our

part, the Company has made several important changes, such as a

Chief Executive Officer change and initiating a strategic review

that has not yet yielded a positive result. However, this has not

been an easy engagement, with certain influential members of the

Board impeding progress and the majority of the Board either

passive or complicit.

Algonquin is at a critical juncture – it is currently in

the process of selecting its next CEO and is exploring a sale of

its Renewable Energy Group (the “Unregulated Renewables” business).

It is therefore essential that Algonquin have directors with the

expertise, fresh perspective and shareholder-focused mindset to

properly evaluate what may be a wide range of strategic

options.

Unfortunately, the current Board has a long history of making

value-destructive decisions. This is most clearly evidenced by the

Board’s poor succession planning around former CEO Ian Robertson’s

departure, the pursuit of the Kentucky Power acquisition (which,

thankfully, was terminated because it could not receive regulatory

approval), and careless management of the Company’s balance sheet,

which led to a material reduction in the dividend. As a result,

Algonquin’s stock has drastically underperformed its peers.1

Given the critical decisions and processes currently underway to

recruit the next CEO and explore a sale of the Unregulated

Renewables business, we have urged Board leadership for the better

part of a year to work with us to refresh the Board with highly

credentialed directors, including shareholder representatives and

directors with relevant expertise unburdened by the poor decisions

of the past. Unfortunately, these conversations with the Board have

only confirmed our strong view that substantial change is

necessary.

Therefore, we delivered a notice to the Company nominating

highly-qualified director candidates for election at the upcoming

Annual General Meeting of Shareholders, which the Company recently

scheduled for June 4, 2024. At the meeting, we will be seeking to

remove several long-serving directors with a history of presiding

over some of the Company’s most value-destructive decisions and

replace them with new highly-qualified directors who we believe

would add substantial experience in best-in-class utility

operations and complex financial and business transformations, and

who bring a shareholder-focused mindset. Importantly, our proposed

nominees would be acutely focused on smooth execution of the

Unregulated Renewables and Atlantica processes, and would not, in

any way, interfere with a value accretive transaction. To be clear,

we are NOT looking to remove interim-CEO Chris Huskilson from his

position as interim-CEO or from the Board.

We remain open to a constructive resolution, but our engagement

with the Company over the past year has proven to us that new Board

leadership is urgently required. We look forward to working with

the Board and management to renew and strengthen the Board to

oversee the Company’s exciting transformation.

Sincerely,

Jeffrey C. Smith Managing Member Starboard

Value LP

Biographies of Starboard Nominees

Brett C. Carter most recently served as the Executive

Vice President and Group President, Utilities and Chief Customer

Officer of Xcel Energy Inc. (NASDAQ: XEL) (“Xcel”), a major U.S.

electric and natural gas delivery company, from March 2022 to

October 2023. He served as Xcel’s Executive Vice President and

Chief Customer and Innovation Officer from May 2018 to March 2022.

Prior to that, Mr. Carter served as Senior Vice President and

Shared Services Executive, Global Technology and Operations, at

Bank of America Corporation (NYSE: BAC) (“BAC”), a global financial

services firm, from October 2015 to May 2018, and as Senior Vice

President and Chief Operating Officer, Global Technology and

Operations, at BAC from March 2015 to October 2015. Before joining

BAC, Mr. Carter held several leadership roles at Duke Energy

Corporation (NYSE: DUK) (“Duke”), a major U.S. energy company, from

2005 to 2015, including most recently as Senior Vice President and

Chief Distribution Officer, Duke Energy Operations, from 2013 to

March 2015. Prior to that, he served as President, Duke Energy

Carolinas, as Senior Vice President, Customer Origination and

Customer Service, and Vice President, Residential and Small

Business Customers at Duke. Mr. Carter currently serves as a

director of Graco Inc. (NYSE: GGG), a multi-national manufacturing

company, since February 2021. Mr. Carter holds a B.S. in accounting

from Clarion University of Pennsylvania and an MBA with a

concentration in marketing from the University of Pittsburgh. He

also completed the Harvard Business School Advanced Management

Program.

Christopher Lopez currently serves as Executive Vice

President, Chief Financial and Regulatory Officer at Hydro One

Limited (TSX: H) (“Hydro One”), an electricity transmission and

distribution company, since April 2023. Mr. Lopez joined Hydro One

in 2016 and served as its Chief Financial Officer from May 2019 to

April 2023, Acting Chief Financial Officer from September 2018 to

May 2019 and Senior Vice President, Finance, from 2016 to 2018.

Prior to that, Mr. Lopez served as Vice President, Corporate

Planning and Mergers & Acquisitions at TransAlta Corporation

(TSX: TA) (“TransAlta”), a clean energy solutions company, from

2011 to 2015, as Director of Operations Finance at TransAlta from

2007 to 2011, and in various senior financial roles with TransAlta

from 1999 to 2007. At the start of his career, he worked as a

financial accountant following the completion of the Graduate

Leadership Development Program, with Rio Tinto Group. Mr. Lopez

received a Bachelor of Business degree from Edith Cowan University

in Australia, and he holds a Chartered Accountant designation. He

is a Graduate member of the Australian Institute of Company

Directors and has completed the CFO Leadership Program at Harvard

Business School.

Robert A. Schriesheim is a multiple time public company

director, CFO and corporate strategist who is an expert in

restructuring and complex financial transactions. Mr. Schriesheim

is currently the Lead Independent Director and Chair of the Audit

Committee at Houlihan Lokey, Inc. (NYSE: HLI), a global investment

bank, and serves on the board of directors of Skyworks Solutions,

Inc. (NASDAQ: SWKS), a leading semiconductor products design and

manufacturing company. Mr. Schriesheim has served as chairman of

Truax Partners LLC, a consulting firm, since 2018, through which he

partners with, and advises, boards, CEOs and institutional

investors while serving as a director of public and private

companies undergoing complex transformations. From 2018 until 2021,

he served as a director of Frontier Communications Corporation

(formerly NASDAQ: FTR) (n/k/a Frontier Communications Parent, Inc.

(NASDAQ: FYBR)), a provider of communications services

(“Frontier”), where he served as a member of the Audit Committee

and as chairman of the Finance Committee, overseeing Frontier’s

financial restructuring and reorganization, including its emergence

from Chapter 11 in 2021. Mr. Schriesheim previously served as the

Executive Vice President and Chief Financial Officer of Sears

Holdings Corporation (formerly NASDAQ: SHLD), an American holding

company, from 2011 until 2016, and as the Chief Financial Officer

of Hewitt Associates, Inc. (formerly NYSE: HEW), a global human

resources consulting and outsourcing company, from 2010 until its

sale in 2010. From 2006 to 2009, he served as Executive Vice

President and Chief Financial Officer of Lawson Software, Inc.

(formerly NASDAQ: LWSN), an ERP software provider and as a board

member from 2006 until its sale in 2011. Prior to that, he was

affiliated with ARCH Development Partners, LLC, a seed stage

venture capital fund and earlier he held executive positions at

Global TeleSystems, SBC Equity Partners, Ameritech, AC Nielsen and

Brooke Group Ltd. From 2015 until its sale in 2019, he served as a

director of NII Holdings, Inc. (formerly NASDAQ: NIHD), a wireless

communications company. From 2018 to 2018, he also served as a

director of Forest City Realty Trust, Inc. (formerly NYSE: FCE.A),

a real estate investment trust, and served as the chair of its

audit committee until its sale to Brookfield Asset Management. From

2007 until its sale in 2009 he served as a director, including as

Co-Chairman, of MSC Software (NASDAQ: MSCS), a provider of

simulation software and from 2004 until its sale in 2007 he served

as a director of Dobson Communications (NASDAQ: DCEL), a rural

cellular provider. He also currently serves as an Adjunct Associate

Professor of Finance at The University of Chicago Booth School of

Business concentrating in the area of corporate governance. Mr.

Schriesheim earned an AB in Chemistry from Princeton University and

an M.B.A. from the University of Chicago Booth School of

Business.

About Starboard Value LP

Starboard Value LP is an investment adviser with a focused and

differentiated fundamental approach to investing in publicly traded

companies. Starboard invests in deeply undervalued companies and

actively engages with management teams and boards of directors to

identify and execute on opportunities to unlock value for the

benefit of all shareholders.

Information in Support of Public Broadcast

Solicitation

Starboard is relying on the exemption under section 9.2(4) of

National Instrument 51‐102 ‐ Continuous Disclosure Obligations (“NI

51-102”) to make this public broadcast solicitation. The following

information is provided in accordance with corporate and securities

laws applicable to public broadcast solicitations.

This solicitation is being made by Starboard, and not by or on

behalf of the management of Algonquin. The participants in the

solicitation are anticipated to be Starboard Value and Opportunity

Master Fund III LP, Starboard Value and Opportunity S LLC,

Starboard Value and Opportunity C LP, Starboard X Master Fund II

LP, Starboard Value R LP, Starboard Value and Opportunity Master

Fund L LP, Starboard Value L LP, Starboard Value R GP LLC,

Starboard G Fund, L.P., Starboard Value G GP, LLC, Starboard Value

A LP, Starboard Value A GP LLC, Starboard Value LP, Starboard Value

GP LLC, Starboard Principal Co LP, Starboard Principal Co GP LLC,

Peter A. Feld, Jeffrey C. Smith (which persons are collectively

referred to in this section as “Starboard”), and the Starboard

Nominees. The address of Algonquin is 354 Davis Road, Suite 100

Oakville, Ontario L6J 2X1.

Starboard has filed this news release containing the information

required by section 9.2(4)(c) of NI 51-102 and has filed a separate

document containing the information required by Form 51‐102F5 –

Information Circular in respect of the Starboard Nominees, as

required by section 9.2(6) of NI 51-102, on Algonquin’s company

profile on SEDAR+ at www.sedarplus.ca.

In connection with the Annual Meeting, Starboard may file a

dissident information circular in due course in compliance with

applicable securities laws and intends to solicit proxies primarily

by mail, but proxies may also be solicited personally by telephone,

e-mail or other electronic means, as well as by newspaper or other

media advertising or in person, by Starboard, certain of its

members, partners, directors, officers and employees, the Starboard

Nominees or Starboard’s agents, including a third party proxy

solicitation agent and tabulation agent to assist with Starboard’s

solicitation and to provide certain advisory and related services.

Such solicitation agent has not yet been retained by Starboard. It

is expected that, upon engagement of such agent, such agent’s

responsibilities will include advising Starboard on governance best

practices, liaising with proxy advisory firms, developing and

implementing shareholder communication and engagement strategies,

advising with respect to meeting and proxy protocol, developing and

implementing shareholder communication and engagement strategies,

mailing of the Annual Meeting materials and vote tabulation.

Starboard will pay such agent a fee to be determined, plus related

expenses. In addition, Starboard may solicit proxies in reliance

upon the public broadcast exemption to the solicitation

requirements under applicable Canadian corporate and securities

laws, conveyed by way of public broadcast, including press release,

speech or publication and any other manner permitted under

applicable Canadian laws. Any members, partners, directors,

officers or employees of Starboard and its affiliates or other

persons who solicit proxies on behalf of Starboard will do so for

no additional compensation.

The costs incurred in the solicitation will be borne by

Starboard. However, to the extent permitted under applicable law,

Starboard may seek reimbursement from Algonquin for Starboard’s

out-of-pocket expenses, including proxy solicitation expenses and

legal fees, incurred in connection with the Annual Meeting.

Although no forms of proxy have been provided at this time, a

registered holder of common shares of Algonquin that gives a proxy

may revoke it by: (a) completing and signing a valid proxy bearing

a later date and returning it in accordance with the instructions

contained in the form of proxy to be provided by Starboard, or as

otherwise provided in the applicable information circular; (b)

depositing an instrument in writing executed by the shareholder or

by the shareholder's attorney authorized in writing, as the case

may be (i) at the registered office of Algonquin at any time up to

and including the last business day preceding the day the Annual

Meeting or any adjournment or postponement thereof is to be held,

or (ii) with the chairman of the Annual Meeting prior to its

commencement on the day of the Annual Meeting or any adjournment or

postponement thereof; or (c) revoking their proxy in any other

manner permitted by law.

Although no forms of proxy have been provided at this time, a

non‐registered holder of common shares of Algonquin will be

entitled to revoke a form of proxy or voting instruction form given

to an intermediary at any time by written notice to the

intermediary in accordance with the instructions given to the

non-registered holder by its intermediary. It should be noted that

revocation of proxies or voting instructions by a non‐registered

holder can take several days or even longer to complete and,

accordingly, any such revocation should be completed well in

advance of the deadline prescribed in the form of proxy or voting

instruction form to ensure it is given effect in respect of the

Annual Meeting.

To the knowledge of Starboard, none of Starboard, or any of its

partners, managing members, directors or officers or any of its

associates or affiliates, nor any of the Starboard Nominees or

their respective associates or affiliates, has any material

interest, direct or indirect, (i) in any transaction since the

beginning of Algonquin's most recently completed financial year or

in any proposed transaction that has materially affected or would

materially affect Algonquin or any of its subsidiaries; or (ii) by

way of beneficial ownership of securities or otherwise and subject

to Algonquin disclosing the matters proposed to be acted on at the

Annual Meeting, in any matter proposed to be acted on at the Annual

Meeting, other than the election of directors to the Board or the

appointment of the auditors.

_____________________________________ 1Source: Capital IQ.

Market data as of March 20, 2024. Performance is measured as total

shareholder return adjusted for dividends across a 1Y, 3Y, and 5Y

period for AQN vs. the average of its Regulated utility peer group.

Regulated utility peer group includes AEE, AGR, AEP, CMS, CNP, CU,

D, DTE, DUK, ED, EMA, ES, FTS, H, LNT, NEE, PNW, SO, SR, SRE, WEC,

and XEL. Starboard has identified the aforementioned peers as the

relevant peer set. Starboard believes these peers provide

appropriate peer comparisons and align with the Company’s

self-selected peer set as of its January 12, 2023 Investor Update

presentation. This determination is subject to a certain degree of

subjectivity. As the full universe of potential peers is not listed

here, the comparisons made herein may differ materially if other

firms had been included.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240321229237/en/

Investor Contacts Peter Feld, (212) 201-4878 Gavin Molinelli,

(212) 201-4828 www.starboardvalue.com

Media Contacts Longacre Square Partners Greg Marose / Joe

Germani, (646) 386-0091 starboard@longacresquare.com

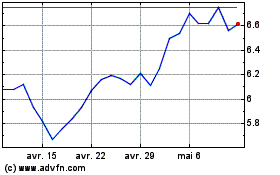

Algonquin Power (NYSE:AQN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Algonquin Power (NYSE:AQN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025