false000172248200017224822024-02-142024-02-140001722482us-gaap:CommonStockMember2024-02-142024-02-14

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2024

Avantor, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38912 | 82-2758923 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Radnor Corporate Center, Building One, Suite 200

100 Matsonford Road

Radnor, Pennsylvania 19087

(Address of principal executive offices, including zip code)

(610) 386-1700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | AVTR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 14, 2024, Avantor, Inc. (“Avantor”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

As previously disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on December 7, 2023, Avantor is realigning its business units, effective the first quarter of 2024, into two reportable business segments: Laboratory Solutions and Bioscience Production.

To assist investors who may want to consider the effects of these segment reporting changes on Avantor’s historical results, Avantor is furnishing herewith as Exhibit 99.2 unaudited supplemental recast financial information for each quarter of fiscal years 2022 and 2023 and for the fiscal years ended December 31, 2021, 2022, and 2023 that reflects the segment changes described above. The changes to Avantor’s segment reporting will be reflected in Avantor’s financial statements commencing with the first Quarterly Report of 2024 on Form 10-Q.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being “furnished” pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and thus shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section or incorporated by reference into any filings under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

| Avantor, Inc. |

| |

| Date: February 14, 2024 | By: | /s/ Steven Eck |

| | Name: | Steven Eck |

| | Title: | Senior Vice President and Chief Accounting Officer (Principal Accounting Officer) |

Exhibit 99.1

Avantor® Reports Fourth Quarter and Full-Year 2023 Results

Fourth Quarter 2023

•Net sales of $1.72 billion, decrease of 4.0%; core organic decline of 4.8%

•Net income of $98.5 million; Adjusted EBITDA of $302.1 million

•Diluted GAAP EPS of $0.15; adjusted EPS of $0.25

•Operating cash flow of $251.6 million; free cash flow of $201.0 million

Full Year 2023

•Net sales of $6.97 billion, decrease of 7.3%; core organic decline of 5.2%

•Net income of $321.1 million; Adjusted EBITDA of $1,309.1 million

•Diluted GAAP EPS of $0.47; adjusted EPS of $1.06

•Operating cash flow of $870.0 million; free cash flow of $723.6 million

•Adjusted net leverage of 3.9X; repaid approximately $850 million of debt in 2023

RADNOR, Pa. – Feb. 14, 2024 – Avantor, Inc. (NYSE: AVTR), a leading global provider of mission-critical products and services to customers in the life sciences and advanced technology industries, today reported financial results for the fourth quarter ended December 31, 2023.

“We had a solid finish to the year with fourth quarter revenue, margin and adjusted EPS coming in at the high end of our updated guidance. Our free cash flow for the year exceeded the top end of our guidance range, representing more than 120% conversion in the quarter. I am proud of our commercial team’s continued drive and intensity, which resulted in additional wins and expanded relationships among biotech, biopharma, and academic customers. Avantor’s results reflect our focus on operating with discipline through our Avantor Business System, our market position, and our relevance to customers’ workflows,” said Michael Stubblefield, President and Chief Executive Officer.

“Looking ahead to 2024, while we are seeing encouraging signs from our customers and end markets, we have not yet seen an inflection point. We are continuing to take actions that position Avantor for long-term growth, including advancing our new operating model which unlocks significant operating efficiencies, sharpens our focus on accelerating innovation, and builds on the strength of our platform."

Fourth Quarter 2023

For the three months ended December 31, 2023, net sales were $1.72 billion, a decrease of 4.0% compared to the fourth quarter of 2022. Foreign currency translation had a favorable impact of 1.9% resulting in an organic sales decline of 5.9% and core organic sales decline (excluding COVID-19 headwinds) of 4.8%. Adjusted EBITDA was $302.1 million and adjusted EBITDA margin was 17.5%. Net income decreased to $98.5 million from $141.7 million in the fourth quarter of 2022 and adjusted net income was $166.7 million as compared to $214.0 million in the comparable prior period.

Diluted earnings per share on a GAAP basis was $0.15, while adjusted EPS was $0.25.

Operating cash flow in the quarter was $251.6 million, while free cash flow was $201.0 million.

Full Year 2023

For the full year ended December 31, 2023, net sales were $6.97 billion, a decrease of 7.3% compared to 2022. Foreign currency translation had a favorable impact of 0.5% resulting in an organic sales decline of 7.8% and core organic sales decline (excluding COVID-19 headwinds) of 5.2%. Adjusted EBITDA was $1,309.1 million and adjusted EBITDA margin was 18.8%. Net income decreased to $321.1 million from $686.5 million in 2022 and adjusted net income was $720.1 million as compared to $955.5 million in 2022.

Diluted earnings per share on a GAAP basis was $0.47, while adjusted EPS was $1.06.

Operating cash flow was $870.0 million, while free cash flow was $723.6 million.

Adjusted net leverage was 3.9X as of December 31, 2023, and we have repaid approximately $850 million of total debt in 2023.

Fourth Quarter 2023 – Segment Results

Management uses Adjusted EBITDA to measure and evaluate the internal operating performance of our Company’s business segments. Adjusted EBITDA is also our segment reporting profitability measure under generally accepted accounting principles.

Americas

•Net sales were $994.8 million, a reported decrease of 5.1%, as compared to $1,048.0 million in the fourth quarter of 2022. Core organic sales decreased 3.8%.

•Adjusted EBITDA margin decreased approximately 180 basis points to 20.2%.

Europe

•Net sales were $603.5 million, a reported decrease of 2.2%, as compared to $617.2 million in the fourth quarter of 2022. Core organic sales decreased 6.8%.

•Adjusted EBITDA margin decreased approximately 240 basis points to 18.8%.

AMEA

•Net sales were $124.5 million, a reported decrease of 4.1%, as compared to $129.8 million in the fourth quarter of 2022. Core organic sales decreased 3.5%.

•Adjusted EBITDA margin decreased approximately 570 basis points to 25.4%.

Full Year 2023 – Segment Results

Americas

•Net sales were $4,071.6 million, a reported decrease of 8.9%, as compared to $4,471.2 million in 2022. Core organic sales decreased 6.1%.

•Adjusted EBITDA margin decreased approximately 170 basis points to 22.4%.

Europe

•Net sales were $2,420.4 million, a reported decrease of 3.8%, as compared to $2,516.5 million in 2022. Core organic sales decreased 3.9%.

•Adjusted EBITDA margin decreased approximately 220 basis points to 18.6%.

AMEA

•Net sales were $475.2 million, a reported decrease of 9.4%, as compared to $524.7 million in 2022. Core organic sales decreased 4.2%.

•Adjusted EBITDA margin decreased approximately 60 basis points to 26.4%.

Conference Call

We will host a conference call to discuss our results today, February 14, 2024, at 8:00 a.m. Eastern Time. The live webcast and presentation as well as a replay will be available on the investor section of Avantor's website.

About Avantor

Avantor®, a Fortune 500 company, is a leading global provider of mission-critical products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. Our portfolio is used in virtually every stage of the most important research, development and production activities in the industries we serve. Our global footprint enables us to serve more than 300,000 customer locations and gives us extensive access to research laboratories and scientists in more than 180 countries. We set science in motion to create a better world. For more information, please visit www.avantorsciences.com.

Use of Non-GAAP Financial Measures

To evaluate our performance, we monitor a number of key indicators. As appropriate, we supplement our results of operations determined in accordance with U.S. generally accepted accounting principles (“GAAP”) with certain non-GAAP financial measurements that we believe are useful to investors, creditors and others in assessing our performance. These measures should not be considered in isolation or as a substitute for reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly titled measures reported by other companies. Rather, these measures should be considered as an additional way of viewing aspects of our operations that provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements included in reports filed with the SEC in their entirety and not rely solely on any one, single financial measurement or communication.

The non-GAAP financial measures used in this press release are sales growth (decline) on an organic basis, sales growth (decline) on a core organic basis, Adjusted EBITDA, adjusted net income, adjusted EPS, adjusted net leverage and free cash flow.

•Sales growth (decline) on an organic basis eliminates from our reported net sales growth (decline) the impacts of earnings from any acquired or disposed businesses that have been owned for less than one year and changes in foreign currency exchange rates. Sales growth (decline) on a core organic basis eliminates from our organic growth (decline) the impacts of any COVID-19 related net sales. We believe that these measurements are useful as a way to measure and evaluate our underlying commercial operating performance consistently across our segments and the periods presented.

•Adjusted EBITDA is to measure and evaluate our operating performance exclusive of interest expense, income tax expense, depreciation, amortization and certain other adjustments. We believe that this measurement is useful as a way to analyze the underlying trends in our business consistently across the periods presented.

•Adjusted net income is our net income or loss first adjusted for the following items: (i) amortization of acquired intangible assets, (ii) net foreign currency remeasurement gains or losses relating to financing activities, (iii) losses on extinguishment of debt, (iv) charges associated with the impairment of certain assets, (v) other costs or credits that are either isolated or cannot be expected to recur with any regularity or predictability. From this amount, we then add or subtract an assumed incremental income tax impact on the above noted pre-tax adjustments, using estimated tax rates, to arrive at Adjusted Net Income. We believe that this measurement is useful as a way to analyze the business consistently across the periods presented.

•Adjusted EPS is our adjusted net income divided by our diluted GAAP weighted average share count adjusted for anti-dilutive instruments. We believe that this measurement is an additional way to analyze the underlying trends in our business consistently across the periods presented.

•Adjusted net leverage is equal to our gross debt, reduced by our cash and cash equivalents, divided by our trailing 12-month Adjusted EBITDA (excluding stock-based compensation expense and including the expected run-rate effect of cost synergies and the incremental results of completed acquisitions as if those acquisitions had occurred on the first day of the trailing 12-month period). We believe that this measurement is a useful way to evaluate and measure the Company’s capital allocation strategies and the underlying trends in the business.

•Free cash flow is equal to our cash flow from operating activities, excluding acquisition-related costs paid in the period, less capital expenditures. We believe that this measurement is useful as it provides a view on the Company’s ability to generate cash for use in financing or investment activities.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this release.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and are subject to the safe harbor created thereby under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” “assumption,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “goal,” “guidance,” “intend,” “likely,” “long-term,” “near-term,” “objective,” “opportunity,” “outlook,” “plan,” “potential,” “project,” “projection,” “prospects,” “seek,” “target,” “trend,” “can,” “could,” “may,” “should,” “would,” “will,” the negatives thereof and other words and terms of similar meaning.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions; they are not guarantees of performance. You should not place undue reliance on these statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, we cannot assure you that the assumptions and expectations will prove to be correct. Factors that could contribute to these risks, uncertainties and assumptions include, but are not limited to, the factors described in “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q, as such risk factors may be updated from time to time in our periodic filings with the SEC.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. In addition, all forward-looking statements speak only as of the date of this press release. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise other than as required under the federal securities laws.

Avantor, Inc. and subsidiaries

Consolidated statements of operations | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | Three months ended December 31, | | Year ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net sales | $ | 1,722.8 | | | $ | 1,795.0 | | | $ | 6,967.2 | | | $ | 7,512.4 | | | | | |

| Cost of sales | 1,152.4 | | | 1,180.5 | | | 4,603.4 | | | 4,909.6 | | | | | |

| Gross profit | 570.4 | | | 614.5 | | | 2,363.8 | | | 2,602.8 | | | | | |

| Selling, general and administrative expenses | 387.1 | | | 362.7 | | | 1,506.6 | | | 1,472.6 | | | | | |

| Impairment charges | — | | | — | | | 160.8 | | | — | | | | | |

Operating income | 183.3 | | | 251.8 | | | 696.4 | | | 1,130.2 | | | | | |

| Interest expense, net | (65.3) | |

| (69.8) | | | (284.8) | | | (265.8) | | | | | |

| Loss on extinguishment of debt | (1.0) | | | (1.7) | | | (6.9) | | | (12.5) | | | | | |

Other income (expense), net | 2.5 | |

| (5.6) | | | 5.8 | | | (0.8) | | | | | |

Income before income taxes | 119.5 | | | 174.7 | | | 410.5 | | | 851.1 | | | | | |

Income tax expense | (21.0) | |

| (33.0) | | | (89.4) | | | (164.6) | | | | | |

Net income | 98.5 | | | 141.7 | | | 321.1 | | | 686.5 | | | | | |

| Accumulation of yield on preferred stock | — | | | — | | | — | | | (24.2) | | | | | |

Net income available to common stockholders | $ | 98.5 | | | $ | 141.7 | | | $ | 321.1 | | | $ | 662.3 | | | | | |

| | | | | | | | | | | |

| Earnings per share: |

| | | | | | | | | | |

| Basic | $ | 0.15 | | | $ | 0.21 | | | $ | 0.48 | | | $ | 1.02 | | | | | |

| Diluted | $ | 0.15 | | | $ | 0.21 | | | $ | 0.47 | | | $ | 1.01 | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | | |

| Basic | 676.4 | | | 674.2 | | | 675.6 | | | 650.9 | | | | | |

| Diluted | 679.2 | | | 677.1 | | | 678.4 | | | 679.4 | | | | | |

Avantor, Inc. and subsidiaries

Consolidated balance sheets | | | | | | | | | | | |

| (in millions) | December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 262.9 | | | $ | 372.9 | |

| Accounts receivable, net | 1,150.2 | | | 1,218.4 | |

| Inventory | 828.1 | | | 913.5 | |

| Other current assets | 143.7 | | | 153.1 | |

| Total current assets | 2,384.9 | | | 2,657.9 | |

| Property, plant and equipment, net | 737.5 | | | 727.0 | |

| Other intangible assets, net | 3,775.3 | | | 4,133.3 | |

| Goodwill, net | 5,716.7 | | | 5,652.6 | |

| Other assets | 358.3 | | | 293.5 | |

| Total assets | $ | 12,972.7 | | | $ | 13,464.3 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Current portion of debt | $ | 259.9 | | | $ | 364.2 | |

| Accounts payable | 625.9 | | | 758.2 | |

| Employee-related liabilities | 133.1 | | | 122.4 | |

| Accrued interest | 50.2 | | | 49.9 | |

| Other current liabilities | 411.2 | | | 364.1 | |

| Total current liabilities | 1,480.3 | | | 1,658.8 | |

| Debt, net of current portion | 5,276.7 | | | 5,923.3 | |

| Deferred income tax liabilities | 612.8 | | | 731.4 | |

| Other liabilities | 350.3 | | | 295.4 | |

| Total liabilities | 7,720.1 | | | 8,608.9 | |

| Stockholders’ equity: | | | |

| | | |

| Common stock including paid-in capital | 3,830.1 | | | 3,785.3 | |

Accumulated earnings | 1,491.5 | | | 1,170.4 | |

Accumulated other comprehensive loss | (69.0) | | | (100.3) | |

| Total stockholders’ equity | 5,252.6 | | | 4,855.4 | |

| Total liabilities and stockholders' equity | $ | 12,972.7 | | | $ | 13,464.3 | |

Avantor, Inc. and subsidiaries

Consolidated statements of cash flows | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three months ended December 31, | | Year ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Cash flows from operating activities: | | | | | | | | | | | |

Net income | $ | 98.5 | | | $ | 141.7 | | | $ | 321.1 | | | $ | 686.5 | | | | | |

| Reconciling adjustments: | | | | | | | | | | | |

| Depreciation and amortization | 100.6 | | | 100.7 | | | 402.3 | |

| 405.5 | | | | | |

| Impairment charges | — | | | — | | | 160.8 | | | — | | | | | |

Stock-based compensation expense | 8.8 | | | 10.0 | | | 40.5 | |

| 45.8 | | | | | |

| Provision for accounts receivable and inventory | 22.0 | | | 21.1 | | | 84.5 | | | 65.0 | | | | | |

Deferred income tax benefit | (78.3) | | | (7.3) | | | (172.4) | | | (69.1) | | | | | |

| Amortization of deferred financing costs | 3.1 | | | 3.6 | | | 13.0 | | | 15.7 | | | | | |

| Loss on extinguishment of debt | 1.0 | | | 1.7 | | | 6.9 | | | 12.5 | | | | | |

Foreign currency remeasurement loss (gain) | 0.5 | | | 5.1 | | | (2.6) | | | 10.0 | | | | | |

| Changes in assets and liabilities: | | | | | | | | | | | |

| Accounts receivable | 21.9 | | | 53.8 | | | 77.0 | | | (45.2) | | | | | |

| Inventory | 21.2 | | | 1.6 | | | 30.3 | | | (112.5) | | | | | |

| Accounts payable | (43.8) | | | (49.5) | | | (139.6) | | | 15.6 | | | | | |

| Accrued interest | 10.6 | | | 11.3 | | | 0.3 | | | 0.1 | | | | | |

| Other assets and liabilities | 87.1 | | | (81.3) | | | 48.6 | | | (179.3) | | | | | |

| Other | (1.6) | | | (6.9) | | | (0.7) | | | (7.0) | | | | | |

Net cash provided by operating activities | 251.6 | | | 205.6 | | | 870.0 | | | 843.6 | | | | | |

| Cash flows from investing activities: | | | | | | | | | | | |

| Capital expenditures | (50.6) | | | (33.6) | | | (146.4) | | | (133.4) | | | | | |

| Cash paid for acquisitions, net of cash acquired | — | | | — | | | — | | | (20.2) | | | | | |

| Cash proceeds from settlement of cross currency swap | — | | | — | | | — | | | 42.5 | | | | | |

| Other | 0.6 | | | 0.5 | | | 2.7 | | | 1.5 | | | | | |

Net cash used in investing activities | (50.0) | | | (33.1) | | | (143.7) | | | (109.6) | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | |

| Debt borrowings | — | | | 82.2 | | | — | | | 327.2 | | | | | |

| Debt repayments | (188.1) | | | (164.0) | | | (846.0) | | | (947.0) | | | | | |

| Payments of debt refinancing fees and premiums | — | | | (0.6) | | | (2.3) | | | (0.6) | | | | | |

| Proceeds from issuance of stock, net of issuance costs | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | |

| Payments of dividends on preferred stock | — | | | — | | | — | | | (32.4) | | | | | |

| Proceeds received from exercise of stock options | 4.2 | | | 0.9 | | | 18.3 | | | 17.3 | | | | | |

| Shares repurchased to satisfy employee tax obligations for vested stock-based awards | (0.2) | | | (0.1) | | | (13.7) | | | (13.2) | | | | | |

Net cash (used in) provided by financing activities | (184.1) | | | (81.6) | | | (843.7) | | | (648.7) | | | | | |

| Effect of currency rate changes on cash and cash equivalents | 9.5 | | | 18.2 | | | 8.2 | | | (15.5) | | | | | |

| Net change in cash, cash equivalents and restricted cash | 27.0 | | | 109.1 | | | (109.2) | | | 69.8 | | | | | |

| Cash, cash equivalents and restricted cash, beginning of period | 260.7 | | | 287.8 | | | 396.9 | | | 327.1 | | | | | |

| Cash, cash equivalents and restricted cash, end of period | $ | 287.7 | | | $ | 396.9 | | | $ | 287.7 | | | $ | 396.9 | | | | | |

| | | | | | | | | | | |

Avantor, Inc. and subsidiaries

Reconciliations of non-GAAP measures | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three months ended December 31, | | Year ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

Net income | $ | 98.5 | | | $ | 141.7 | | | $ | 321.1 | | | $ | 686.5 | | | | | |

| Amortization | 75.0 | | | 78.5 | | | 307.7 | | | 318.3 | | | | | |

| Loss on extinguishment of debt | 1.0 | | | 1.7 | | | 6.9 | | | 12.5 | | | | | |

Net foreign currency (gain) loss from financing activities | (0.8) | | | 7.2 | | | (3.1) | | | 7.0 | | | | | |

Other stock-based compensation expense (benefit) | 0.2 | | | — | | | 0.3 | | | (3.3) | | | | | |

| | | | | | | | | | | |

Integration-related expenses1 | (0.7) | | | 5.6 | | | 7.6 | | | 19.2 | | | | | |

Purchase accounting adjustments2 | — | | | — | | | — | | | 9.4 | | | | | |

Restructuring and severance charges3 | 8.5 | | | (0.2) | | | 26.5 | | | 3.5 | | | | | |

| | | | | | | | | | | |

Reserve for certain legal matters4 | 3.1 | | | — | | | 7.1 | | | — | | | | | |

Impairment charges5 | — | | | — | | | 160.8 | | | — | | | | | |

Transformation expenses6 | 5.4 | | | — | | | 5.4 | | | — | | | | | |

Income tax benefit applicable to pretax adjustments | (23.5) | | | (20.5) | | | (120.2) | | | (97.6) | | | | | |

Adjusted net income | 166.7 | | | 214.0 | | | 720.1 | | | 955.5 | | | | | |

| Interest expense, net | 65.3 | | | 69.8 | | | 284.8 | | | 265.8 | | | | | |

| Depreciation | 25.6 | | | 22.2 | | | 94.6 | | | 87.2 | | | | | |

| Income tax provision applicable to Adjusted Net income | 44.5 | | | 53.5 | | | 209.6 | | | 262.2 | | | | | |

| Adjusted EBITDA | $ | 302.1 | | | $ | 359.5 | | | $ | 1,309.1 | | | $ | 1,570.7 | | | | | |

━━━━━━━━━

1.Represents non-recurring direct costs incurred with third-parties and the accrual of a long-term retention incentive to integrate acquired companies. These expenses represent incremental costs and are unrelated to normal operations of our business. Integration expenses are incurred over a pre-defined integration period specific to each acquisition.

2.Represents the non-cash reduction of contingent consideration related to the Ritter acquisition and the amortization of the purchase accounting adjustment to record Masterflex and Ritter inventory at fair value.

3.Reflects the incremental expenses incurred in the period related to initiatives to increase profitability and productivity. Typical costs included in this caption are employee severance, site-related exit costs, and contract termination costs.

4.Represents charges and legal costs in connection with certain litigation and other contingencies that are unrelated to our core operations and not reflective of on-going business and operating results.

5.Related to impairment of the Ritter asset group.

6.Represents non-recurring, incremental expenses directly associated with the Company’s publicly-announced program to transform our operating model.

Avantor, Inc. and subsidiaries

Reconciliations of non-GAAP measures (continued)

Earnings per share | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (shares in millions) | Three months ended December 31, | | Year ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Diluted Earnings per share (GAAP) | $ | 0.15 | | | $ | 0.21 | | | $ | 0.47 | | | $ | 1.01 | | | | | |

| Dilutive impact of convertible instruments | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | |

| Fully diluted Earnings per share (non-GAAP) | 0.15 | | | 0.21 | | | 0.47 | | | 1.01 | | | | | |

| Amortization | 0.11 | | | 0.12 | | | 0.45 | | | 0.47 | | | | | |

| Loss on extinguishment of debt | — | | | — | | | 0.01 | | | 0.01 | | | | | |

Net foreign currency loss from financing activities | — | | | 0.01 | | | — | | | 0.01 | | | | | |

Other stock-based compensation expense | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | |

| Integration-related expenses | — | | | 0.01 | | | 0.01 | | | 0.03 | | | | | |

| Purchase accounting adjustments | — | | | — | | | — | | | 0.01 | | | | | |

| Restructuring and severance charges | 0.01 | | | — | | | 0.04 | | | 0.01 | | | | | |

| | | | | | | | | | | |

| Reserve for certain legal matters | — | | | — | | | 0.01 | | | — | | | | | |

| Impairment charges | — | | | — | | | 0.24 | | | — | | | | | |

| | | | | | | | | | | |

| Transformation expenses | 0.01 | | | | | 0.01 | | | | | | | |

Income tax benefit applicable to pretax adjustments | (0.03) | | | (0.03) | | | (0.18) | | | (0.14) | | | | | |

| Adjusted EPS (non-GAAP) | $ | 0.25 | | | $ | 0.32 | | | $ | 1.06 | | | $ | 1.41 | | | | | |

| | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | | |

| Diluted (GAAP) | 679.2 | | | 677.1 | | | 678.4 | | | 679.4 | | | | | |

| Incremental shares excluded for GAAP | — | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | |

| Share count for Adjusted EPS (non-GAAP) | 679.2 | | | 677.1 | | | 678.4 | | | 679.4 | | | | | |

Avantor, Inc. and subsidiaries

Reconciliations of non-GAAP measures (continued)

Free cash flow | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three months ended December 31, | | Year ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

Net cash provided by operating activities | $ | 251.6 | | | $ | 205.6 | | | $ | 870.0 | | | $ | 843.6 | | | | | |

| | | | | | | | | | | |

| Capital expenditures | (50.6) | | | (33.6) | | | (146.4) | | | (133.4) | | | | | |

| Free cash flow (non-GAAP) | $ | 201.0 | | | $ | 172.0 | | | $ | 723.6 | | | $ | 710.2 | | | | | |

Adjusted net leverage | | | | | |

| (dollars in millions) | December 31, 2023 |

| Total debt, gross | $ | 5,580.0 | |

| Less cash and cash equivalents | (262.9) | |

| $ | 5,317.1 | |

| |

| Trailing twelve months Adjusted EBITDA | $ | 1,309.1 | |

| Trailing twelve months ongoing stock-based compensation expense | 40.2 | |

| |

| $ | 1,349.3 | |

| |

| Adjusted net leverage (non-GAAP) | 3.9 | x |

Avantor, Inc. and subsidiaries

Reconciliations of non-GAAP measures (continued)

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | December 31 | | Reconciliation of net sales growth (decline) to organic and core organic net sales growth (decline) |

Net sales

growth

(decline) | | Foreign currency impact | | | Organic net

sales growth

(decline) | | COVID -19 | | Core organic net sales growth (decline)1 |

| 2023 | | 2022 | | | |

| Three months ended: | | | | | | | | | | | | | | |

| Americas | $ | 994.8 | | | $ | 1,048.0 | | | $ | (53.2) | | | $ | 1.5 | | | | $ | (54.7) | | | $ | (14.7) | | | $ | (40.0) | |

| Europe | 603.5 | | | 617.2 | | | (13.7) | | | 31.1 | | | | (44.8) | | | (2.5) | | | (42.3) | |

| AMEA | 124.5 | | | 129.8 | | | (5.3) | | | 0.9 | | | | (6.2) | | | (1.7) | | | (4.5) | |

| Total | $ | 1,722.8 | | | $ | 1,795.0 | | | $ | (72.2) | | | $ | 33.5 | | | | $ | (105.7) | | | $ | (18.9) | | | $ | (86.8) | |

| Year ended: | | | | | | | | | | | | | | |

| Americas | $ | 4,071.6 | | | $ | 4,471.2 | | | $ | (399.6) | | | $ | (2.2) | | | | $ | (397.4) | | | $ | (125.1) | | | $ | (272.3) | |

| Europe | 2,420.4 | | | 2,516.5 | | | (96.1) | | | 50.5 | | | | (146.6) | | | (48.7) | | | (97.9) | |

| AMEA | 475.2 | | | 524.7 | | | (49.5) | | | (7.1) | | | | (42.4) | | | (20.5) | | | (21.9) | |

| Total | $ | 6,967.2 | | | $ | 7,512.4 | | | $ | (545.2) | | | $ | 41.2 | | | | $ | (586.4) | | | $ | (194.3) | | | $ | (392.1) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

1.Core organic net sales growth (decline) eliminates from our organic net growth (decline) the impact from the change in sales of COVID-19 related offerings from 2022 to 2023. Numbers in this column are calculated by removing the impact of COVID-19 sales from the numbers in the "Organic net sales growth (decline)" column.

Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Americas | $ | 201.2 | | | $ | 231.0 | | | $ | 912.6 | | | $ | 1,077.3 | |

| Europe | 113.7 | | | 131.1 | | | 449.5 | | | 524.1 | |

| AMEA | 31.6 | | | 40.4 | | | 125.3 | | | 141.5 | |

| Corporate | (44.4) | | | (43.0) | | | (178.3) | | | (172.2) | |

| Total | $ | 302.1 | | | $ | 359.5 | | | $ | 1,309.1 | | | $ | 1,570.7 | |

Investor Relations Contact

Christina Jones

Vice President, Investor Relations

Avantor

+1 805-617-5297

Christina.Jones@avantorsciences.com

Media Contact

Emily Collins

Vice President, External Communications

Avantor

+1 332-239-3910

Emily.collins@avantorsciences.com

Source: Avantor and Financial News

Exhibit 99.2

Avantor, Inc.

Summary Segment Information (unaudited)

(dollars in millions)

The unaudited reclassified segment financial information below is provided to reflect the change in the Company's reporting segments effective during the first quarter of 2024. The Company did not operate under the new structure for any of these prior periods and will begin to report comparative results under the new structure effective with the filing of its Quarterly Report on Form 10-Q for the quarter ending March 31, 2024.

Reportable segment data on an annual basis for the years ended December 31, 2023, 2022, and 2021 and a quarterly basis for the years ended December 31, 2023 and December 31, 2022 are presented in the tables below:

| | | | | | | | | | | | | | | | | |

| Year ended December 31, |

| 2023 | | 2022 | | 2021 |

| Net sales: | | | | | |

| Bioscience Production | $ | 2,228.9 | | | $ | 2,510.0 | | | $ | 2,173.7 | |

| Laboratory Solutions | 4,738.3 | | | 5,002.4 | | | 5,212.4 | |

| Total | $ | 6,967.2 | | | $ | 7,512.4 | | | $ | 7,386.1 | |

| | | | | |

| Adjusted operating income: | | | | | |

| Bioscience Production | $ | 601.9 | | | $ | 778.9 | | | $ | 632.6 | |

| Laboratory Solutions | 668.3 | | | 764.7 | | | 806.1 | |

| Corporate | (58.4) | | | (66.3) | | | (67.4) | |

| Total | $ | 1,211.8 | | | $ | 1,477.3 | | | $ | 1,371.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 | | |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | Total | | | | |

| Net sales: | | | | | | | | | | | | | |

| Bioscience Production | $ | 577.3 | | | $ | 550.1 | | | $ | 561.1 | | | $ | 540.4 | | | $ | 2,228.9 | | | | | |

| Laboratory Solutions | 1,203.0 | | | 1,193.8 | | | 1,159.1 | | | 1,182.4 | | | 4,738.3 | | | | | |

| Total | $ | 1,780.3 | | | $ | 1,743.9 | | | $ | 1,720.2 | | | $ | 1,722.8 | | | $ | 6,967.2 | | | | | |

| | | | | | | | | | | | | |

| Adjusted operating income: | | | | | | | | | | | | | |

| Bioscience Production | $ | 167.5 | | | $ | 154.2 | | | $ | 148.2 | | | $ | 132.0 | | | $ | 601.9 | | | | | |

| Laboratory Solutions | 172.2 | | | 179.7 | | | 159.1 | | | 157.3 | | | 668.3 | | | | | |

| Corporate | (16.6) | | | (15.0) | | | (12.3) | | | (14.5) | | | (58.4) | | | | | |

| Total | $ | 323.1 | | | $ | 318.9 | | | $ | 295.0 | | | $ | 274.8 | | | $ | 1,211.8 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2022 | | |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | Total | | | | |

| Net sales: | | | | | | | | | | | | | |

| Bioscience Production | $ | 625.2 | | | $ | 646.1 | | | $ | 636.3 | | | $ | 602.4 | | | $ | 2,510.0 | | | | | |

| Laboratory Solutions | 1,325.2 | | | 1,264.4 | | | 1,220.2 | | | 1,192.6 | | | 5,002.4 | | | | | |

| Total | $ | 1,950.4 | | | $ | 1,910.5 | | | $ | 1,856.5 | | | $ | 1,795.0 | | | $ | 7,512.4 | | | | | |

| | | | | | | | | | | | | |

| Adjusted operating income: | | | | | | | | | | | | | |

| Bioscience Production | $ | 186.4 | | | $ | 211.4 | | | $ | 200.3 | | | $ | 180.8 | | | $ | 778.9 | | | | | |

| Laboratory Solutions | 227.6 | | | 188.1 | | | 179.2 | | | 169.8 | | | 764.7 | | | | | |

| Corporate | (14.7) | | | (18.9) | | | (17.8) | | | (14.9) | | | (66.3) | | | | | |

| Total | $ | 399.3 | | | $ | 380.6 | | | $ | 361.7 | | | $ | 335.7 | | | $ | 1,477.3 | | | | | |

As part of the change in the Company’s reporting segments, the Company also changed the measures of operating performance used by the chief operating decision maker (CODM). The Company’s CODM analyzes net sales and adjusted operating income when measuring profitability by segment. Adjusted

operating income is a non-GAAP financial measurement used to evaluate our operating performance

exclusive of amortization of acquired intangibles, restructuring charges, impairment charges and certain

other items. The following table reconciles non-GAAP adjusted operating income to GAAP operating income for the years ended December 31, 2023, 2022, and 2021 and quarterly for the years ended December 31, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | |

| Year ended December 31, |

| Operating income reconciliation: | 2023 | | 2022 | | 2021 |

| Operating income | $ | 696.4 | | | $ | 1,130.2 | | | $ | 972.2 | |

| Amortization | 307.7 | | | 318.3 | | | 290.8 | |

Other stock-based compensation expense (benefit) | 0.3 | | | (3.3) | | | 3.0 | |

Acquisition-related expenses1 | — | | | — | | | 77.8 | |

Integration-related expenses2 | 7.6 | | | 19.2 | | | 15.9 | |

Purchase accounting adjustments3 | — | | | 9.4 | | | 6.3 | |

Restructuring and severance charges4 | 26.5 | | | 3.5 | | | 5.3 | |

Reserve for certain legal matters5 | 7.1 | | | — | | | — | |

Impairment charges6 | 160.8 | | | — | | | — | |

Transformation expenses7 | 5.4 | | | — | | | — | |

| Adjusted operating income | $ | 1,211.8 | | | $ | 1,477.3 | | | $ | 1,371.3 | |

1.Represents legal, accounting, investment banking and consulting fees incurred related to the acquisition of acquired companies.

2.Represents non-recurring direct costs incurred with third parties and the accrual of a long-term retention incentive to integrate acquired companies. These expenses represent incremental costs and are unrelated to

normal operations of our business. Integration expenses are incurred over a pre-defined integration period specific to each acquisition.

3.Represents the non-cash reduction of contingent consideration related to the Ritter acquisition and the amortization of the purchase accounting adjustment to record Masterflex and Ritter inventory at fair value.

4.Reflects the incremental expenses incurred in the period related to initiatives to increase profitability and productivity. Typical costs included in this caption are employee severance, site-related exit costs, and contract termination costs.

5.Represents charges and legal costs in connection with certain litigation and other contingencies that are unrelated to our core operations and not reflective of on-going business and operating results.

6.Related to impairment of the Ritter asset group.

7.Represents non-recurring, incremental expenses directly associated with the Company’s publicly-announced program to transform our operating model.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 |

| Operating income reconciliation: | First Quarter | | Second Quarter | | Third

Quarter | | Fourth Quarter | | Total |

| Operating income | $ | 231.2 | | | $ | 71.7 | | | $ | 210.2 | | | $ | 183.3 | | | $ | 696.4 | |

| Amortization | 78.4 | | | 78.9 | | | 75.4 | | | 75.0 | | | 307.7 | |

| Other stock-based compensation expense (benefit) | 0.1 | | | (0.1) | | | 0.1 | | | 0.2 | | | 0.3 | |

| | | | | | | | | |

Integration-related expenses1 | 8.7 | | | (0.6) | | | 0.2 | | | (0.7) | | | 7.6 | |

| | | | | | | | | |

Restructuring and severance charges2 | 4.7 | | | 7.2 | | | 6.1 | | | 8.5 | | | 26.5 | |

Reserve for certain legal matters3 | — | | | 1.0 | | | 3.0 | | | 3.1 | | | 7.1 | |

Impairment charges4 | — | | | 160.8 | | | — | | | — | | | 160.8 | |

Transformation expenses5 | — | | | — | | | — | | | 5.4 | | | 5.4 | |

| Adjusted operating income | $ | 323.1 | | | $ | 318.9 | | | $ | 295.0 | | | $ | 274.8 | | | $ | 1,211.8 | |

1.Represents non-recurring direct costs incurred with third parties and the accrual of a long-term retention incentive to integrate acquired companies. These expenses represent incremental costs and are unrelated to normal operations of our business. Integration expenses are incurred over a pre-defined integration period specific to each acquisition.

2.Reflects the incremental expenses incurred in the period related to initiatives to increase profitability and productivity. Typical costs included in this caption are employee severance, site-related exit costs, and contract termination costs.

3.Represents charges and legal costs in connection with certain litigation and other contingencies that are unrelated to our core operations and not reflective of on-going business and operating results.

4.Related to impairment of the Ritter asset group.

5.Represents non-recurring, incremental expenses directly associated with the Company’s publicly-announced program to transform our operating model.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2022 |

| Operating income reconciliation: | First Quarter | | Second Quarter | | Third

Quarter | | Fourth Quarter | | Total |

| Operating income | $ | 307.0 | | | $ | 295.6 | | | $ | 275.8 | | | $ | 251.8 | | | $ | 1,130.2 | |

| Amortization | 92.2 | | | 67.8 | | | 79.8 | | | 78.5 | | | 318.3 | |

| Other stock-based compensation (benefit) expense | (1.3) | | | (0.4) | | | (1.6) | | | — | | | (3.3) | |

| | | | | | | | | |

Integration-related expenses1 | 3.9 | | | 3.3 | | | 6.4 | | | 5.6 | | | 19.2 | |

Purchase accounting adjustments2 | (4.4) | | | 13.8 | | | — | | | — | | | 9.4 | |

Restructuring and severance charges3 | 1.9 | | | 0.5 | | | 1.3 | | | (0.2) | | | 3.5 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted operating income | $ | 399.3 | | | $ | 380.6 | | | $ | 361.7 | | | $ | 335.7 | | | $ | 1,477.3 | |

1.Represents non-recurring direct costs incurred with third parties and the accrual of a long-term retention incentive to integrate acquired companies. These expenses represent incremental costs and are unrelated to normal operations of our business. Integration expenses are incurred over a pre-defined integration period specific to each acquisition.

2.Represents the non-cash reduction of contingent consideration related to the Ritter acquisition and the amortization of the purchase accounting adjustment to record Masterflex and Ritter inventory at fair value.

3.Reflects the incremental expenses incurred in the period related to initiatives to increase profitability and productivity. Typical costs included in this caption are employee severance, site-related exit costs, and contract termination costs.

The Company will continue to provide consolidated adjusted EBITDA and there will be no change in the calculation or presentation of consolidated adjusted EPS from prior periods.

v3.24.0.1

Document and entity information

|

Feb. 14, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity Central Index Key |

0001722482

|

| Entity File Number |

001-38912

|

| Entity Registrant Name |

Avantor, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2758923

|

| Entity Address, Address Line One |

Radnor Corporate Center, Building One, Suite 200

|

| Entity Address, Address Line Two |

100 Matsonford Road

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

(610)

|

| Local Phone Number |

386-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

AVTR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

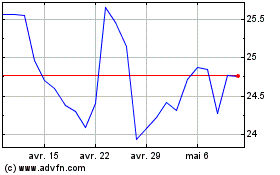

Avantor (NYSE:AVTR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Avantor (NYSE:AVTR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024