UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date:

November 25, 2024

Exhibit 99.1

KE

Holdings Inc. Announces Third Quarter 2024 Unaudited Financial Results

BEIJING,

China, November 21, 2024 - KE Holdings Inc. (“Beike” or the “Company”) (NYSE: BEKE and HKEX:

2423), a leading integrated online and offline platform for housing transactions and services, today announced its unaudited financial

results for the third quarter ended September 30, 2024.

Business

and Financial Highlights for the Third Quarter 2024

| · | Gross

transaction value (GTV)1 was RMB736.8 billion (US$105.0 billion), an increase of 12.5% year-over-year. GTV

of existing home transactions was RMB477.8 billion (US$68.1 billion), an increase of 8.8% year-over-year. GTV

of new home transactions was RMB227.6 billion (US$32.4 billion), an increase of 18.4% year-over-year. GTV

of home renovation and furnishing was RMB4.1 billion (US$0.6 billion), an increase of 24.6% year-over-year. GTV

of emerging and other services was RMB27.3 billion (US$3.9 billion), an increase of 31.9% year-over-year. |

| · | Net

revenues were RMB22.6 billion (US$3.2 billion), an increase of 26.8% year-over-year. |

| · | Net

income was RMB1,168 million (US$167 million). Adjusted net income2

was RMB1,782 million (US$254 million). |

| · | Number

of stores was 48,230 as of September 30, 2024, a 12.1% increase from one year ago.

Number of active stores3 was 46,857 as of September 30, 2024, a

14.6% increase from one year ago. |

1

GTV for a given period is calculated as the total value of all transactions which the Company facilitated on the Company’s platform

and evidenced by signed contracts as of the end of the period, including the value of the existing home transactions, new home transactions,

home renovation and furnishing and emerging and other services (excluding home rental services), and including transactions that are

contracted but pending closing at the end of the relevant period. For the avoidance of doubt, for transactions that failed to close afterwards,

the corresponding GTV represented by these transactions will be deducted accordingly.

2

Adjusted net income (loss) is a non-GAAP financial measure, which is defined as net income (loss), excluding (i) share-based compensation

expenses, (ii) amortization of intangible assets resulting from acquisitions and business cooperation agreement, (iii) changes in fair

value from long-term investments, loan receivables measured at fair value and contingent consideration, (iv) impairment of goodwill, intangible

assets and other long-lived assets, (v) impairment of investments, and (vi) tax effects of the above non-GAAP adjustments. Please refer

to the section titled “Unaudited reconciliation of GAAP and non-GAAP results” for details.

3

Based on our accumulated operational experience, we have introduced the operating metrics of number of active stores and number of active

agents on our platform, which can better reflect the operational activeness of stores and agents on our platform.

“Active stores” as of a given date is defined as stores

on our platform excluding the stores which (i) have not facilitated any housing transaction during the preceding 60 days, (ii) do not

have any agent who has engaged in any critical steps in housing transactions (including but not limited to introducing new properties,

attracting new customers and conducting property showings) during the preceding seven days, or (iii) have not been visited by any agent

during the preceding 14 days. The number of active stores was 40,903 as of September 30, 2023.

| · | Number

of agents was 476,420 as of September 30, 2024, a 11.0% increase from one year ago.

Number of active agents4 was 423,400 as of September 30, 2024, a

6.1% increase from one year ago. |

| · | Mobile

monthly active users (MAU)5 averaged 46.2 million in the third quarter of

2024, compared to 49.2 million in the same period of 2023. |

Mr. Stanley

Yongdong Peng, Chairman of the Board and Chief Executive Officer of Beike, commented, “In the third quarter of 2024, we continued

to demonstrate proactive and sustainable growth momentum. Against the backdrop of market adjustments, each of our business lines achieved

solid results. In our housing transaction services, we are actively pursuing growth while also committed to fostering a more harmonious

ecosystem. Through initiatives such as the ‘store point-based system’, we’re helping store owners achieve better returns

and benefit from the platform’s value, ultimately enhancing their level of satisfaction with the platform. In our home renovation

and furnishing and home rental services, we are also continuously strengthening our foundational capabilities across product development,

process restructuring, and supply chain improvements. Meanwhile, we have officially upgraded our management governance framework, adopting

a mechanism of clear responsibilities and collective leadership to deliberate and plan key strategies and matters, ensuring steady and

sustainable growth for the Company.”

“All

above initiatives are centered around our steadfast commitment to a long-term vision. By focusing on 'doing the right thing even if

it’s difficult' and continuously exploring innovations, we aim to build our business with a long-term perspective, ensuring

sustainable growth and vitality. We are also pleased to see that the supportive policy packages introduced by the government at the

end of September have already shown promising initial results. In October, transaction volumes on our platform rebounded

significantly, signaling the start of the market recovery. With an improving external environment, we will stay true to our

long-term vision, remaining optimistic, persistent, and united as we move toward a brighter future,” concluded Mr. Peng.

Mr. Tao Xu, Executive Director and Chief Financial Officer of Beike, added, “The market in the third quarter of this year

gradually retreated following the pulse-like rebound fueled by the intensive supportive policies released in May. The existing home

market was relatively stable, while the new home market was still in a bottoming stage with weak supply and demand.

4

“Active agents” as of a given date is defined as agents on our platform excluding the agents who (i) delivered notice to

leave but have not yet completed the exit procedures, (ii) have not engaged in any critical steps in housing transactions (including

but not limited to introducing new properties, attracting new customers and conducting property showings) during the preceding 30 days,

or (iii) have not participated in facilitating any housing transaction during the preceding three months. The number of active agents

was 399,048 as of September 30, 2023.

5 “Mobile monthly active users” or “mobile

MAU” are to the sum of (i) the number of accounts that have accessed our platform through our Beike or Lianjia mobile

app (with duplication eliminated) at least once during a month, and (ii) the number of Weixin users that have accessed our platform through

our Weixin Mini Programs at least once during a month. Average mobile MAU for any period is calculated by dividing (i) the sum of the

Company’s mobile MAUs for each month of such period, by (ii) the number of months in such period.

For

performance in the third quarter, our net revenues reached RMB22.6 billion, gross margin stood at 22.7%; net income reached RMB1,168

million, and adjusted net income was RMB1,782 million. Home transaction services demonstrated a stable revenue performance. The monetization

capability of our new home transaction services has been further strengthened. We are actively advancing our ‘one body, three wings’

strategy, with revenues of home renovation and furnishing, home rental services, and emerging and other services growing by 54.3% year-over-year

in the third quarter. They accounted for an increasing portion of our total net revenues at 38.3%, increasing by 6.8 percentage points

from the same period of 2023. Among these, revenue from home renovation and furnishing reached RMB4.21 billion, rising by 32.6% year-over-year,

while revenue from home rental services reached RMB3.94 billion, up 118.4% year-over-year.

With

robust cash reserves, we continued to reward our shareholders who have grown with us, sharing the value created by the Company. In the

third quarter, we allocated approximately US$200 million to share repurchases.

As

our businesses become more diverse, we have elevated our standards for resource allocation and prudent management. Moving forward, we

will continue to focus on the fundamentals of our business, ensuring strict adherence to risk controls and maintaining healthy cash flow,

while fully supporting the growth of our ‘one body, three wings’ businesses.”

Third

Quarter 2024 Financial Results

Net

Revenues

Net

revenues increased by 26.8% to RMB22.6 billion (US$3.2 billion) in the third quarter of 2024 from RMB17.8 billion in the same period

of 2023, primarily attributable to the increase of net revenues from new home transaction services and the expansion of home renovation

and furnishing and home rental business. Total GTV increased by 12.5% to RMB736.8 billion (US$105.0 billion) in the third quarter of

2024 from RMB655.2 billion in the same period of 2023, primarily attributable to the recovery of existing home transaction market and

the Company’s proactive growth strategy and improved market coverage capabilities.

| · | Net

revenues from existing home transaction services were RMB6.2 billion (US$0.9 billion)

in the third quarter of 2024, relatively flat compared with RMB6.3 billion in the same period

of 2023. GTV of existing home transactions increased by 8.8% to RMB477.8 billion (US$68.1

billion) in the third quarter of 2024 from RMB439.0 billion in the same period of 2023. The

different trend between net revenues and GTV of existing home transaction services was primarily

attributable to a higher contribution from GTV of existing home transaction services served

by connected agents on the Company’s platform, for which revenue is recorded on a net

basis from platform service, franchise service and other value-added services, while for

GTV served by Lianjia brand, the revenue is recorded on a gross commission revenue

basis. |

Among

that, (i) commission revenue was RMB5.1 billion (US$0.7 billion) in the third quarter of 2024, relatively flat compared with

RMB5.1 billion in the same period of 2023, while the GTV of existing home transactions served by Lianjia stores increased by 1.7%

to RMB194.5 billion (US$27.7 billion) in the third quarter of 2024 from RMB191.2 billion in the same period of 2023; and

(ii) revenues

derived from platform service, franchise service and other value-added services, which are mostly charged to connected stores and

agents on the Company’s platform were RMB1.2 billion (US$0.2 billion) in the third quarter of 2024, relatively flat compared with

RMB1.2 billion in the same period of 2023, mainly due to an increase of GTV of existing home transactions served by connected agents

on the Company’s platform of 14.3% to RMB283.3 billion (US$40.4 billion) in the third quarter of 2024 from RMB247.8 billion in

the same period of 2023, offset by the decrease in revenues from certain value-added services which were not directly driven by GTV of

existing home transactions served by connected agents.

| · | Net

revenues from new home transaction services increased by 30.9% to RMB7.7 billion (US$1.1

billion) in the third quarter of 2024 from RMB5.9 billion in the same period of 2023, primarily

due to the increase of GTV of new home transactions of 18.4% to RMB227.6 billion (US$32.4

billion) in the third quarter of 2024 from RMB192.1 billion in the same period of 2023, and

the improved monetization capability. Among that, the GTV of new home transactions facilitated

on Beike platform through connected agents, dedicated sales team with the expertise

on new home transaction services and other sales channels increased by 20.5% to RMB183.0

billion (US$26.1 billion) in the third quarter of 2024 from RMB151.9 billion in the same

period of 2023, and the GTV of new home transactions served by Lianjia brand increased

by 10.5% to RMB44.5 billion (US$6.3 billion) in the third quarter of 2024 from RMB40.3 billion

in the same period of 2023. |

| · | Net

revenues from home renovation and furnishing increased by 32.6% to RMB4.2 billion (US$0.6

billion) in the third quarter of 2024 from RMB3.2 billion in the same period of 2023, primarily

attributable to a) the increase of orders driven by the synergetic effects from customer

acquisition and conversion between home transaction services and home renovation and furnishing

business, b) a larger contribution from furniture and home furnishing sales (in categories

such as customized furniture, soft furnishings, and electrical appliances), and c) the shortened

lead time driven by enhanced delivery capabilities. |

| · | Net

revenues from home rental services increased by 118.4% to RMB3.9 billion (US$0.6 billion)

in the third quarter of 2024 from RMB1.8 billion in the same period of 2023, primarily attributable

to the increase of the number of rental units under the Carefree Rent model. |

| · | Net

revenues from emerging and other services were RMB0.5 billion (US$0.1 billion) in the

third quarter of 2024, compared to RMB0.6 billion in the same period of 2023. |

Cost

of Revenues

Total

cost of revenues increased by 35.0% to RMB17.4 billion (US$2.5 billion) in the third quarter of 2024 from RMB12.9 billion in the

same period of 2023.

| · | Commission

– split. The Company’s cost of revenues for commissions to connected agents

and other sales channels was RMB5.2 billion (US$0.7 billion) in the third quarter of 2024,

compared to RMB4.0 billion in the same period of 2023, primarily due to the increase in net

revenues from new home transaction services derived from transactions facilitated through

connected agents and other sales channels. |

| · | Commission

and compensation – internal. The Company’s cost of revenues for internal

commission and compensation increased by 17.2% to RMB4.4 billion (US$0.6 billion) in the

third quarter of 2024 from RMB3.7 billion in the same period of 2023, primarily due to an

increase in the net revenues from new home transactions derived from transactions facilitated

through Lianjia agents and the increase in fixed compensation costs mainly driven

by the increased number of Lianjia agents and improved welfare for them. |

| · | Cost

of home renovation and furnishing. The Company’s cost of revenues for home renovation

and furnishing increased by 28.6% to RMB2.9 billion (US$0.4 billion) in the third quarter

of 2024 from RMB2.3 billion in the same period of 2023, which was in line with the growth

of net revenues from home renovation and furnishing. |

| · | Cost

of home rental services. The Company’s cost of revenues for home rental services

increased by 115.5% to RMB3.8 billion (US$0.5 billion) in the third quarter of 2024 from

RMB1.7 billion in the same period of 2023, primarily attributable to the growth of net revenues

from home rental services. |

| · | Cost

related to stores. The Company’s cost related to stores was RMB0.7 billion (US$0.1

billion) in the third quarter of 2024, relatively flat compared with RMB0.7 billion in the

same period of 2023. |

| · | Other

costs. The Company’s other costs increased to RMB502 million (US$72 million) in

the third quarter of 2024 from RMB480 million in the same period of 2023, mainly due to the

increased tax and surcharges in line with the increased net revenues. |

Gross

Profit

Gross

profit increased by 5.2% to RMB5.1 billion (US$0.7 billion) in the third quarter of 2024 from RMB4.9 billion in the same period of

2023. Gross margin was 22.7% in the third quarter of 2024, compared to 27.4% in the same period of 2023, primarily due to a) a lower

contribution from net revenues from existing home transaction services with a relatively higher margin than other revenue streams; b)

a lower contribution margin of existing home transaction services led by the increased fix compensation costs as percentage of net revenues

from existing home transaction services.

Income

from Operations

Total

operating expenses increased by 11.0% to RMB4.4 billion (US$0.6 billion) in the third quarter of 2024 from RMB4.0 billion in the

same period of 2023.

| · | General

and administrative expenses were RMB1.9 billion (US$0.3 billion) in the third quarter

of 2024, relatively flat compared with RMB1.9 billion in the same period of 2023. |

| · | Sales

and marketing expenses increased by 18.6% to RMB1.9 billion (US$0.3 billion) in the third

quarter of 2024 from RMB1.6 billion in the same period of 2023, mainly due to the increase

in sales and marketing expenses for home renovation and furnishing business which was in

line with the growth of net revenues from home renovation and furnishing and increased expenses

on marketing and promotion activities for business development of new connected brands and

stores. |

| · | Research

and development expenses increased by 21.5% to RMB573 million (US$82 million) in the

third quarter of 2024 from RMB472 million in the same period of 2023, primarily due to the

increased headcount of research and development personnel and the increased technical service

costs. |

Income

from operations was RMB727 million (US$104 million) in the third quarter of 2024, compared to income from operations of RMB911 million

in the same period of 2023. Operating margin decreased to 3.2% in the third quarter of 2024 from 5.1% in the same period of 2023,

primarily due to a lower gross margin partially offset by the improved operating leverage in the third quarter of 2024, compared to the

same period of 2023.

Adjusted

income from operations6 was RMB1,363 million (US$194 million) in the third quarter of 2024, compared to RMB1,886 million

in the same period of 2023. Adjusted operating margin7 was 6.0% in the third quarter of 2024, compared to 10.6% in

the same period of 2023. Adjusted EBITDA8 was RMB2,154 million (US$307 million) in the third quarter of 2024, compared

to RMB2,515 million in the same period of 2023.

6

Adjusted income (loss) from operations is a non-GAAP financial measure, which is defined as income (loss) from operations, excluding (i)

share-based compensation expenses, (ii) amortization of intangible assets resulting from acquisitions and business cooperation agreement,

and (iii) impairment of goodwill, intangible assets and other long-lived assets. Please refer to the section titled “Unaudited reconciliation

of GAAP and non-GAAP results” for details.

7

Adjusted operating margin is adjusted income (loss) from operations as a percentage of net revenues.

8

Adjusted EBITDA is a non-GAAP financial measure, which is defined as net income (loss), excluding (i) income tax expense, (ii) share-based

compensation expenses, (iii) amortization of intangible assets, (iv) depreciation of property, plant and equipment, (v) interest income,

net, (vi) changes in fair value from long-term investments, loan receivables measured at fair value and contingent consideration, (vii)

impairment of goodwill, intangible assets and other long-lived assets,and (viii) impairment of investments. Please refer to the section

titled “Unaudited reconciliation of GAAP and non-GAAP results” for details.

Net

Income

Net

income was RMB1,168 million (US$167 million) in the third quarter of 2024, compared to RMB1,170 million in the same period of 2023.

Adjusted

net income was RMB1,782 million (US$254 million) in the third quarter of 2024, compared to RMB2,159 million in the same period of

2023.

Net

Income attributable to KE Holdings Inc.’s Ordinary Shareholders

Net

income attributable to KE Holdings Inc.’s ordinary shareholders was RMB1,171 million (US$167 million) in the third quarter

of 2024, compared to RMB1,158 million in the same period of 2023.

Adjusted

net income attributable to KE Holdings Inc.’s ordinary shareholders9 was RMB1,785 million (US$254 million) in

the third quarter of 2024, compared to RMB2,147 million in the same period of 2023.

Net

Income per ADS

Basic

and diluted net income per ADS attributable to KE Holdings Inc.’s ordinary shareholders10 were RMB1.04 (US$0.15)

and RMB1.00 (US$0.14) in the third quarter of 2024, respectively, compared to RMB0.99 and RMB0.97 in the same period of 2023, respectively.

9

Adjusted net income (loss) attributable to KE Holdings Inc.’s ordinary shareholders is a non-GAAP financial measure and defined

as net income (loss) attributable to KE Holdings Inc.’s ordinary shareholders, excluding (i) share-based compensation expenses,

(ii) amortization of intangible assets resulting from acquisitions and business cooperation agreement, (iii) changes in fair value from

long-term investments, loan receivables measured at fair value and contingent consideration, (iv) impairment of goodwill, intangible assets

and other long-lived assets, (v) impairment of investments, (vi) tax effects of the above non-GAAP adjustments, and (vii) effects of non-GAAP

adjustments on net income (loss) attributable to non-controlling interests shareholders. Please refer to the section titled “Unaudited

reconciliation of GAAP and non-GAAP results” for details.

10

ADS refers to American Depositary Share. Each ADS represents three Class A ordinary shares of the Company. Net income (loss)

per ADS attributable to KE Holdings Inc.’s ordinary shareholders is net income (loss) attributable to ordinary shareholders divided

by weighted average number of ADS outstanding during the periods used in calculating net income (loss) per ADS, basic and diluted.

Adjusted

basic and diluted net income per ADS attributable to KE Holdings Inc.’s ordinary shareholders11 were RMB1.58 (US$0.23)

and RMB1.53 (US$0.22) in the third quarter of 2024, respectively, compared to RMB1.84 and RMB1.80 in the same period of 2023, respectively.

Cash,

Cash Equivalents, Restricted Cash and Short-Term Investments

As

of September 30, 2024, the combined balance of the Company’s cash, cash equivalents, restricted cash and short-term investments

amounted to RMB59.5 billion (US$8.5 billion).

Share

Repurchase Program

As

previously disclosed, the Company established a share repurchase program in August 2022 and upsized and extended it in August 2023

and August 2024, under which the Company may purchase up to US$3 billion of its Class A ordinary shares and/or ADSs until August 31,

2025, subject to obtaining another general unconditional mandate for the repurchase from the shareholders of the Company at the next

annual general meeting to continue its share repurchase after the expiry of the existing share repurchase mandate granted by the annual

general meeting held on June 14, 2024. As of September 30, 2024, the Company in aggregate has purchased approximately 102.2

million ADSs (representing approximately 306.5 million Class A ordinary shares) on the New York Stock Exchange with a total consideration

of approximately US$1,493.4 million under this share repurchase program since its launch.

Conference

Call Information

The

Company will hold an earnings conference call at 7:00 A.M. U.S. Eastern Time on Thursday, November 21, 2024 (8:00 P.M. Beijing/Hong

Kong Time on Thursday, November 21, 2024) to discuss the financial results.

For

participants who wish to join the conference call using dial-in numbers, please complete online registration using the link provided

below at least 20 minutes prior to the scheduled call start time. Dial-in numbers, passcode and unique access PIN would be provided upon

registering.

11

Adjusted net income (loss) per ADS attributable to KE Holdings Inc.’s ordinary shareholders is a non-GAAP financial measure, which

is defined as adjusted net income (loss) attributable to KE Holdings Inc.’s ordinary shareholders divided by weighted average number

of ADS outstanding during the periods used in calculating adjusted net income (loss) per ADS, basic and diluted. Please refer to the section

titled “Unaudited reconciliation of GAAP and non-GAAP results” for details.

Participant

Online Registration:

English

Line: https://s1.c-conf.com/diamondpass/10042784-y6whdt.html

Chinese

Simultaneous Interpretation Line (listen-only mode): https://s1.c-conf.com/diamondpass/10042787-mwq6c3.html

A

replay of the conference call will be accessible through November 28, 2024, by dialing the following numbers:

| United

States: |

+1-855-883-1031 |

| Mainland,

China: |

400-1209-216 |

| Hong

Kong, China: |

800-930-639 |

| International: |

+61-7-3107-6325 |

| Replay

PIN (English line): |

10042784 |

| Replay

PIN (Chinese simultaneous interpretation line): |

10042787 |

A

live and archived webcast of the conference call will also be available at the Company’s investor relations website at https://investors.ke.com.

Exchange

Rate

This

press release contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for

the convenience of the reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.0176 to US$1.00,

the noon buying rate in effect on September 30, 2024, in the H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular

rate or at all. For analytical presentation, all percentages are calculated using the numbers presented in the financial information

contained in this earnings release.

Non-GAAP

Financial Measures

The

Company uses adjusted income (loss) from operations, adjusted net income (loss), adjusted net income (loss) attributable to KE Holdings

Inc.’s ordinary shareholders, adjusted operating margin, adjusted EBITDA and adjusted net income (loss) per ADS attributable to

KE Holdings Inc.’s ordinary shareholders, each a non-GAAP financial measure, in evaluating its operating results and formulating

its business plan. Beike believes that these non-GAAP financial measures help identify underlying trends in the Company’s business

that could otherwise be distorted by the effect of certain expenses that the Company includes in its net income (loss). Beike also believes

that these non-GAAP financial measures provide useful information about its results of operations, enhance the overall understanding

of its past performance and future prospects and allow for greater visibility with respect to key metrics used by its management in formulating

its business plan. A limitation of using these non-GAAP financial measures is that these non-GAAP financial measures exclude share-based

compensation expenses that have been, and will continue to be for the foreseeable future, a significant recurring expense in the Company’s

business.

The

presentation of these non-GAAP financial measures should not be considered in isolation or construed as an alternative to gross profit,

net income (loss) or any other measure of performance or as an indicator of its operating performance. Investors are encouraged to review

these non-GAAP financial measures and the reconciliation to the most directly comparable GAAP measures. The non-GAAP financial measures

presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly

titled measures differently, limiting their usefulness as comparative measures to the Company’s data. Beike encourages investors

and others to review its financial information in its entirety and not rely on a single financial measure. Adjusted income (loss)

from operations is defined as income (loss) from operations, excluding (i) share-based compensation expenses, (ii) amortization

of intangible assets resulting from acquisitions and business cooperation agreement, and (iii) impairment of goodwill, intangible

assets and other long-lived assets. Adjusted operating margin is defined as adjusted income (loss) from operations as a percentage

of net revenues. Adjusted net income (loss) is defined as net income (loss), excluding (i) share-based compensation expenses,

(ii) amortization of intangible assets resulting from acquisitions and business cooperation agreement, (iii) changes in fair

value from long-term investments, loan receivables measured at fair value and contingent consideration, (iv) impairment of goodwill,

intangible assets and other long-lived assets, (v) impairment of investments, and (vi) tax effects of the above non-GAAP adjustments.

Adjusted net income (loss) attributable to KE Holdings Inc.’s ordinary shareholders is defined as net income (loss) attributable

to KE Holdings Inc.’s ordinary shareholders, excluding (i) share-based compensation expenses, (ii) amortization of intangible

assets resulting from acquisitions and business cooperation agreement, (iii) changes in fair value from long-term investments, loan

receivables measured at fair value and contingent consideration, (iv) impairment of goodwill, intangible assets and other long-lived

assets, (v) impairment of investments, (vi) tax effects of the above non-GAAP adjustments, and (vii) effects of non-GAAP

adjustments on net income (loss) attributable to non-controlling interests shareholders. Adjusted EBITDA is defined as net income

(loss), excluding (i) income tax expense, (ii) share-based compensation expenses, (iii) amortization of intangible assets,

(iv) depreciation of property, plant and equipment, (v) interest income, net, (vi) changes in fair value from long-term

investments, loan receivables measured at fair value and contingent consideration, (vii) impairment of goodwill, intangible assets

and other long-lived assets, and (viii) impairment of investments. Adjusted net income (loss) per ADS attributable to KE Holdings

Inc.’s ordinary shareholders is defined as adjusted net income (loss) attributable to KE Holdings Inc.’s ordinary shareholders

divided by weighted average number of ADS outstanding during the periods used in calculating adjusted net income (loss) per ADS, basic

and diluted.

Please

see the “Unaudited reconciliation of GAAP and non-GAAP results” included in this press release for a full reconciliation

of each non-GAAP measure to its respective comparable GAAP measure.

About

KE Holdings Inc.

KE

Holdings Inc. is a leading integrated online and offline platform for housing transactions and services. The Company is a pioneer in

building infrastructure and standards to reinvent how service providers and customers efficiently navigate and complete housing transactions

and services in China, ranging from existing and new home sales, home rentals, to home renovation and furnishing, and other services.

The Company owns and operates Lianjia, China’s leading real estate brokerage brand and an integral part of its Beike

platform. With more than 23 years of operating experience through Lianjia since its inception in 2001, the Company believes

the success and proven track record of Lianjia pave the way for it to build its infrastructure and standards and drive the rapid

and sustainable growth of Beike.

Safe

Harbor Statement

This

press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “likely to,” and similar statements. Among other things,

the quotations from management in this press release, as well as Beike’s strategic and operational plans, contain forward-looking

statements. Beike may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange

Commission (the “SEC”) and The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”),

in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including statements about KE Holdings Inc.’s beliefs,

plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number

of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited

to the following: Beike’s goals and strategies; Beike’s future business development, financial condition and results of operations;

expected changes in the Company’s revenues, costs or expenditures; Beike’s ability to empower services and facilitate transactions

on Beike platform; competition in the industry in which Beike operates; relevant government policies and regulations relating

to the industry; Beike’s ability to protect the Company’s systems and infrastructures from cyber-attacks; Beike’s dependence

on the integrity of brokerage brands, stores and agents on the Company’s platform; general economic and business conditions in

China and globally; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks

is included in KE Holdings Inc.’s filings with the SEC and the Hong Kong Stock Exchange. All information provided in this press

release is as of the date of this press release, and KE Holdings Inc. does not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

For

investor and media inquiries, please contact:

In

China:

KE

Holdings Inc.

Investor

Relations

Siting

Li

E-mail:

ir@ke.com

Piacente

Financial Communications

Jenny

Cai

Tel:

+86-10-6508-0677

E-mail:

ke@tpg-ir.com

In

the United States:

Piacente

Financial Communications

Brandi

Piacente

Tel:

+1-212-481-2050

E-mail:

ke@tpg-ir.com

Source:

KE Holdings Inc.

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(All

amounts in thousands, except for share, per share data)

| | |

As of

December 31, | | |

As of

September 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 19,634,716 | | |

| 9,576,948 | | |

| 1,364,704 | |

| Restricted cash | |

| 6,222,745 | | |

| 6,243,476 | | |

| 889,688 | |

| Short-term investments | |

| 34,257,958 | | |

| 43,654,035 | | |

| 6,220,650 | |

| Short-term financing receivables, net of allowance for credit losses of RMB122,482 and RMB118,504 as of December 31, 2023 and September 30, 2024, respectively | |

| 1,347,759 | | |

| 773,567 | | |

| 110,232 | |

| Accounts receivable and contract assets, net of allowance for credit losses of RMB1,681,127 and RMB1,640,694 as of December 31, 2023 and September 30, 2024, respectively | |

| 3,176,169 | | |

| 3,277,775 | | |

| 467,079 | |

| Amounts due from and prepayments to related parties | |

| 419,270 | | |

| 407,966 | | |

| 58,135 | |

| Loan receivables from related parties | |

| 28,030 | | |

| 18,030 | | |

| 2,569 | |

| Prepayments, receivables and other assets | |

| 4,666,976 | | |

| 5,726,438 | | |

| 816,012 | |

| Total current assets | |

| 69,753,623 | | |

| 69,678,235 | | |

| 9,929,069 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment, net | |

| 1,965,098 | | |

| 2,248,709 | | |

| 320,438 | |

| Right-of-use assets | |

| 17,617,915 | | |

| 22,259,923 | | |

| 3,172,014 | |

| Long-term investments, net | |

| 23,570,988 | | |

| 21,457,347 | | |

| 3,057,647 | |

| Intangible assets, net | |

| 1,067,459 | | |

| 948,723 | | |

| 135,192 | |

| Goodwill | |

| 4,856,807 | | |

| 4,839,219 | | |

| 689,583 | |

| Long-term loan receivables from related parties | |

| 27,000 | | |

| 25,360 | | |

| 3,614 | |

| Other non-current assets | |

| 1,473,041 | | |

| 1,338,196 | | |

| 190,693 | |

| Total non-current assets | |

| 50,578,308 | | |

| 53,117,477 | | |

| 7,569,181 | |

| TOTAL ASSETS | |

| 120,331,931 | | |

| 122,795,712 | | |

| 17,498,250 | |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (Continued)

(All

amounts in thousands, except for share, per share data)

| | |

As of

December 31, | | |

As of

September 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

| 6,328,516 | | |

| 6,389,882 | | |

| 910,551 | |

| Amounts due to related parties | |

| 430,350 | | |

| 382,816 | | |

| 54,551 | |

| Employee compensation and welfare payable | |

| 8,145,779 | | |

| 6,136,481 | | |

| 874,442 | |

| Customer deposits payable | |

| 3,900,564 | | |

| 3,999,101 | | |

| 569,867 | |

| Income taxes payable | |

| 698,568 | | |

| 616,621 | | |

| 87,868 | |

| Short-term borrowings | |

| 290,450 | | |

| 306,610 | | |

| 43,692 | |

| Lease liabilities current portion | |

| 9,368,607 | | |

| 12,900,946 | | |

| 1,838,370 | |

| Contract liability and deferred revenue | |

| 4,665,201 | | |

| 5,223,016 | | |

| 744,274 | |

| Accrued expenses and other current liabilities | |

| 5,695,948 | | |

| 7,191,733 | | |

| 1,024,813 | |

| Total current liabilities | |

| 39,523,983 | | |

| 43,147,206 | | |

| 6,148,428 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 279,341 | | |

| 279,341 | | |

| 39,806 | |

| Lease liabilities non-current portion | |

| 8,327,113 | | |

| 8,472,711 | | |

| 1,207,352 | |

| Other non-current liabilities | |

| 389 | | |

| 2,791 | | |

| 398 | |

| Total non-current liabilities | |

| 8,606,843 | | |

| 8,754,843 | | |

| 1,247,556 | |

| TOTAL LIABILITIES | |

| 48,130,826 | | |

| 51,902,049 | | |

| 7,395,984 | |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (Continued)

(All

amounts in thousands, except for share, per share data)

| | |

As of December 31, | | |

As of September 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| KE Holdings Inc. shareholders’ equity | |

| | | |

| | | |

| | |

| Ordinary

shares (US$0.00002 par value; 25,000,000,000 ordinary shares authorized, comprising of 24,114,698,720 Class A ordinary shares

and 885,301,280 Class B ordinary shares. 3,571,960,220 Class A ordinary shares issued and 3,443,860,844 Class A

ordinary shares outstanding(1) as of December 31, 2023; 3,491,188,042 Class A ordinary shares issued and

3,357,035,782 Class A ordinary shares outstanding(1) as of September 30, 2024; and 151,354,549 and

145,897,002 Class B ordinary shares issued and outstanding as of December 31, 2023 and September 30, 2024,

respectively) | |

| 475 | | |

| 463 | | |

| 66 | |

| Treasury shares | |

| (866,198 | ) | |

| (408,535 | ) | |

| (58,216 | ) |

| Additional paid-in capital | |

| 77,583,054 | | |

| 72,274,027 | | |

| 10,298,966 | |

| Statutory reserves | |

| 811,107 | | |

| 811,107 | | |

| 115,582 | |

| Accumulated other comprehensive income | |

| 244,302 | | |

| 275,516 | | |

| 39,261 | |

| Accumulated deficit | |

| (5,672,916 | ) | |

| (2,178,008 | ) | |

| (310,364 | ) |

| Total KE Holdings Inc. shareholders' equity | |

| 72,099,824 | | |

| 70,774,570 | | |

| 10,085,295 | |

| Non-controlling interests | |

| 101,281 | | |

| 119,093 | | |

| 16,971 | |

| TOTAL SHAREHOLDERS' EQUITY | |

| 72,201,105 | | |

| 70,893,663 | | |

| 10,102,266 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| 120,331,931 | | |

| 122,795,712 | | |

| 17,498,250 | |

| (1) | Excluding

the Class A ordinary shares registered in the name of the depositary bank for future

issuance of ADSs upon the exercise or vesting of awards granted under our share incentive

plans and the Class A ordinary shares repurchased but not cancelled in the form of ADSs. |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(All

amounts in thousands, except for share, per share data, ADS and per ADS data)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net revenues | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Existing home transaction services | |

| 6,307,085 | | |

| 6,217,054 | | |

| 885,923 | | |

| 21,904,172 | | |

| 19,278,973 | | |

| 2,747,232 | |

| New home transaction services | |

| 5,901,966 | | |

| 7,726,316 | | |

| 1,100,991 | | |

| 23,001,680 | | |

| 20,576,636 | | |

| 2,932,147 | |

| Home renovation and furnishing | |

| 3,176,739 | | |

| 4,213,041 | | |

| 600,354 | | |

| 7,209,569 | | |

| 10,662,113 | | |

| 1,519,339 | |

| Home rental services | |

| 1,804,374 | | |

| 3,941,234 | | |

| 561,621 | | |

| 3,905,262 | | |

| 9,753,977 | | |

| 1,389,931 | |

| Emerging and other services | |

| 620,541 | | |

| 487,002 | | |

| 69,397 | | |

| 1,552,023 | | |

| 2,060,692 | | |

| 293,646 | |

| Total net revenues | |

| 17,810,705 | | |

| 22,584,647 | | |

| 3,218,286 | | |

| 57,572,706 | | |

| 62,332,391 | | |

| 8,882,295 | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commission-split | |

| (3,982,415 | ) | |

| (5,199,321 | ) | |

| (740,897 | ) | |

| (15,345,975 | ) | |

| (14,057,167 | ) | |

| (2,003,130 | ) |

| Commission and compensation-internal | |

| (3,737,715 | ) | |

| (4,381,616 | ) | |

| (624,375 | ) | |

| (13,098,490 | ) | |

| (12,446,905 | ) | |

| (1,773,670 | ) |

| Cost of home renovation and furnishing | |

| (2,252,251 | ) | |

| (2,897,013 | ) | |

| (412,821 | ) | |

| (5,077,310 | ) | |

| (7,345,082 | ) | |

| (1,046,666 | ) |

| Cost of home rental services | |

| (1,748,021 | ) | |

| (3,766,972 | ) | |

| (536,789 | ) | |

| (3,996,906 | ) | |

| (9,248,794 | ) | |

| (1,317,943 | ) |

| Cost related to stores | |

| (729,388 | ) | |

| (703,045 | ) | |

| (100,183 | ) | |

| (2,145,039 | ) | |

| (2,069,022 | ) | |

| (294,833 | ) |

| Others | |

| (479,935 | ) | |

| (501,947 | ) | |

| (71,526 | ) | |

| (1,335,018 | ) | |

| (1,391,552 | ) | |

| (198,295 | ) |

| Total cost of revenues(1) | |

| (12,929,725 | ) | |

| (17,449,914 | ) | |

| (2,486,591 | ) | |

| (40,998,738 | ) | |

| (46,558,522 | ) | |

| (6,634,537 | ) |

| Gross profit | |

| 4,880,980 | | |

| 5,134,733 | | |

| 731,695 | | |

| 16,573,968 | | |

| 15,773,869 | | |

| 2,247,758 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing expenses(1) | |

| (1,630,543 | ) | |

| (1,933,878 | ) | |

| (275,575 | ) | |

| (4,573,815 | ) | |

| (5,439,341 | ) | |

| (775,100 | ) |

| General and administrative expenses(1) | |

| (1,862,347 | ) | |

| (1,900,959 | ) | |

| (270,884 | ) | |

| (5,588,830 | ) | |

| (5,999,453 | ) | |

| (854,915 | ) |

| Research and development expenses(1) | |

| (471,631 | ) | |

| (572,932 | ) | |

| (81,642 | ) | |

| (1,403,160 | ) | |

| (1,544,741 | ) | |

| (220,124 | ) |

| Impairment of goodwill, intangible assets and other long-lived assets | |

| (5,201 | ) | |

| - | | |

| - | | |

| (37,976 | ) | |

| (36,397 | ) | |

| (5,187 | ) |

| Total operating expenses | |

| (3,969,722 | ) | |

| (4,407,769 | ) | |

| (628,101 | ) | |

| (11,603,781 | ) | |

| (13,019,932 | ) | |

| (1,855,326 | ) |

| Income from operations | |

| 911,258 | | |

| 726,964 | | |

| 103,594 | | |

| 4,970,187 | | |

| 2,753,937 | | |

| 392,432 | |

| Interest income, net | |

| 349,143 | | |

| 310,493 | | |

| 44,245 | | |

| 951,369 | | |

| 976,746 | | |

| 139,185 | |

| Share of results of equity investees | |

| 12,753 | | |

| 7,783 | | |

| 1,109 | | |

| 27,228 | | |

| 4,048 | | |

| 577 | |

| Impairment loss for equity investments accounted for equity method | |

| (6,182 | ) | |

| - | | |

| - | | |

| (6,182 | ) | |

| - | | |

| - | |

| Fair value changes in investments, net | |

| 1,187 | | |

| 109,170 | | |

| 15,557 | | |

| 74,193 | | |

| 187,458 | | |

| 26,713 | |

| Impairment loss for equity investments accounted for using Measurement Alternative | |

| (2,882 | ) | |

| (388 | ) | |

| (55 | ) | |

| (12,195 | ) | |

| (8,437 | ) | |

| (1,202 | ) |

| Foreign currency exchange gain (loss) | |

| 96,336 | | |

| 45,156 | | |

| 6,435 | | |

| 80,503 | | |

| (27,869 | ) | |

| (3,971 | ) |

| Other income, net | |

| 309,914 | | |

| 472,359 | | |

| 67,311 | | |

| 1,037,197 | | |

| 1,373,969 | | |

| 195,789 | |

| Income before income tax expense | |

| 1,671,527 | | |

| 1,671,537 | | |

| 238,196 | | |

| 7,122,300 | | |

| 5,259,852 | | |

| 749,523 | |

| Income tax expense | |

| (501,237 | ) | |

| (503,131 | ) | |

| (71,696 | ) | |

| (1,902,759 | ) | |

| (1,758,920 | ) | |

| (250,644 | ) |

| Net income | |

| 1,170,290 | | |

| 1,168,406 | | |

| 166,500 | | |

| 5,219,541 | | |

| 3,500,932 | | |

| 498,879 | |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Continued)

(All

amounts in thousands, except for share, per share data, ADS and per ADS data)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net loss (income) attributable to non-controlling interests shareholders | |

| (12,248 | ) | |

| 2,667 | | |

| 380 | | |

| (5,922 | ) | |

| (6,024 | ) | |

| (858 | ) |

| Net income attributable to KE Holdings Inc. | |

| 1,158,042 | | |

| 1,171,073 | | |

| 166,880 | | |

| 5,213,619 | | |

| 3,494,908 | | |

| 498,021 | |

| Net income attributable to KE Holdings Inc.’s ordinary shareholders | |

| 1,158,042 | | |

| 1,171,073 | | |

| 166,880 | | |

| 5,213,619 | | |

| 3,494,908 | | |

| 498,021 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 1,170,290 | | |

| 1,168,406 | | |

| 166,500 | | |

| 5,219,541 | | |

| 3,500,932 | | |

| 498,879 | |

| Currency translation adjustments | |

| (180,974 | ) | |

| (252,110 | ) | |

| (35,925 | ) | |

| 712,745 | | |

| (131,660 | ) | |

| (18,761 | ) |

| Unrealized gains (losses) on available-for-sale investments, net of reclassification | |

| (49,243 | ) | |

| 130,261 | | |

| 18,562 | | |

| (50,267 | ) | |

| 162,874 | | |

| 23,209 | |

| Total comprehensive income | |

| 940,073 | | |

| 1,046,557 | | |

| 149,137 | | |

| 5,882,019 | | |

| 3,532,146 | | |

| 503,327 | |

| Comprehensive loss (income) attributable to non-controlling interests shareholders | |

| (12,248 | ) | |

| 2,667 | | |

| 380 | | |

| (5,922 | ) | |

| (6,024 | ) | |

| (858 | ) |

| Comprehensive income attributable to KE Holdings Inc. | |

| 927,825 | | |

| 1,049,224 | | |

| 149,517 | | |

| 5,876,097 | | |

| 3,526,122 | | |

| 502,469 | |

| Comprehensive income attributable to KE Holdings Inc.’s ordinary shareholders | |

| 927,825 | | |

| 1,049,224 | | |

| 149,517 | | |

| 5,876,097 | | |

| 3,526,122 | | |

| 502,469 | |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Continued)

(All

amounts in thousands, except for share, per share data, ADS and per ADS data)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Weighted average number of ordinary shares used in computing net income per share, basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 3,491,785,849 | | |

| 3,380,011,519 | | |

| 3,380,011,519 | | |

| 3,527,781,652 | | |

| 3,408,518,304 | | |

| 3,408,518,304 | |

| —Diluted | |

| 3,569,150,049 | | |

| 3,501,151,763 | | |

| 3,501,151,763 | | |

| 3,612,305,297 | | |

| 3,522,652,156 | | |

| 3,522,652,156 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADS used in computing net income per ADS, basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 1,163,928,616 | | |

| 1,126,670,506 | | |

| 1,126,670,506 | | |

| 1,175,927,217 | | |

| 1,136,172,768 | | |

| 1,136,172,768 | |

| —Diluted | |

| 1,189,716,683 | | |

| 1,167,050,588 | | |

| 1,167,050,588 | | |

| 1,204,101,766 | | |

| 1,174,217,385 | | |

| 1,174,217,385 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share attributable to KE Holdings Inc.'s ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 0.33 | | |

| 0.35 | | |

| 0.05 | | |

| 1.48 | | |

| 1.03 | | |

| 0.15 | |

| —Diluted | |

| 0.32 | | |

| 0.33 | | |

| 0.05 | | |

| 1.44 | | |

| 0.99 | | |

| 0.14 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS attributable to KE Holdings Inc.'s ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 0.99 | | |

| 1.04 | | |

| 0.15 | | |

| 4.43 | | |

| 3.08 | | |

| 0.44 | |

| —Diluted | |

| 0.97 | | |

| 1.00 | | |

| 0.14 | | |

| 4.33 | | |

| 2.98 | | |

| 0.42 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) Includes share-based compensation expenses as follows: | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 136,990 | | |

| 136,101 | | |

| 19,394 | | |

| 363,556 | | |

| 385,935 | | |

| 54,995 | |

| Sales and marketing expenses | |

| 51,637 | | |

| 53,149 | | |

| 7,574 | | |

| 129,118 | | |

| 143,910 | | |

| 20,507 | |

| General and administrative expenses | |

| 576,635 | | |

| 370,106 | | |

| 52,740 | | |

| 1,765,532 | | |

| 1,461,016 | | |

| 208,193 | |

| Research and development expenses | |

| 48,867 | | |

| 47,220 | | |

| 6,729 | | |

| 138,905 | | |

| 140,146 | | |

| 19,971 | |

KE

Holdings Inc.

UNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS

(All

amounts in thousands, except for share, per share data, ADS and per ADS data)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Income from operations | |

| 911,258 | | |

| 726,964 | | |

| 103,594 | | |

| 4,970,187 | | |

| 2,753,937 | | |

| 392,432 | |

| Share-based compensation expenses | |

| 814,129 | | |

| 606,576 | | |

| 86,437 | | |

| 2,397,111 | | |

| 2,131,007 | | |

| 303,666 | |

| Amortization of intangible assets resulting from acquisitions and business cooperation agreement | |

| 155,495 | | |

| 29,883 | | |

| 4,258 | | |

| 458,268 | | |

| 214,167 | | |

| 30,519 | |

| Impairment of goodwill, intangible assets and other long-lived assets | |

| 5,201 | | |

| - | | |

| - | | |

| 37,976 | | |

| 36,397 | | |

| 5,187 | |

| Adjusted income from operations | |

| 1,886,083 | | |

| 1,363,423 | | |

| 194,289 | | |

| 7,863,542 | | |

| 5,135,508 | | |

| 731,804 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 1,170,290 | | |

| 1,168,406 | | |

| 166,500 | | |

| 5,219,541 | | |

| 3,500,932 | | |

| 498,879 | |

| Share-based compensation expenses | |

| 814,129 | | |

| 606,576 | | |

| 86,437 | | |

| 2,397,111 | | |

| 2,131,007 | | |

| 303,666 | |

| Amortization of intangible assets resulting from acquisitions and business cooperation agreement | |

| 155,495 | | |

| 29,883 | | |

| 4,258 | | |

| 458,268 | | |

| 214,167 | | |

| 30,519 | |

| Changes in fair value from long-term investments, loan receivables measured at fair value and contingent consideration | |

| 11,720 | | |

| (16,867 | ) | |

| (2,404 | ) | |

| (26,861 | ) | |

| (3,589 | ) | |

| (511 | ) |

| Impairment of goodwill, intangible assets and other long-lived assets | |

| 5,201 | | |

| - | | |

| - | | |

| 37,976 | | |

| 36,397 | | |

| 5,187 | |

| Impairment of investments | |

| 9,064 | | |

| 388 | | |

| 55 | | |

| 18,377 | | |

| 8,437 | | |

| 1,202 | |

| Tax effects on non-GAAP adjustments | |

| (6,560 | ) | |

| (6,494 | ) | |

| (925 | ) | |

| (19,682 | ) | |

| (19,904 | ) | |

| (2,836 | ) |

| Adjusted net income | |

| 2,159,339 | | |

| 1,781,892 | | |

| 253,921 | | |

| 8,084,730 | | |

| 5,867,447 | | |

| 836,106 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 1,170,290 | | |

| 1,168,406 | | |

| 166,500 | | |

| 5,219,541 | | |

| 3,500,932 | | |

| 498,879 | |

| Income tax expense | |

| 501,237 | | |

| 503,131 | | |

| 71,696 | | |

| 1,902,759 | | |

| 1,758,920 | | |

| 250,644 | |

| Share-based compensation expenses | |

| 814,129 | | |

| 606,576 | | |

| 86,437 | | |

| 2,397,111 | | |

| 2,131,007 | | |

| 303,666 | |

| Amortization of intangible assets | |

| 158,893 | | |

| 36,125 | | |

| 5,148 | | |

| 468,807 | | |

| 230,643 | | |

| 32,866 | |

| Depreciation of property, plant and equipment | |

| 193,791 | | |

| 166,373 | | |

| 23,708 | | |

| 578,606 | | |

| 505,232 | | |

| 71,995 | |

| Interest income, net | |

| (349,143 | ) | |

| (310,493 | ) | |

| (44,245 | ) | |

| (951,369 | ) | |

| (976,746 | ) | |

| (139,185 | ) |

| Changes in fair value from long-term investments, loan receivables measured at fair value and contingent consideration | |

| 11,720 | | |

| (16,867 | ) | |

| (2,404 | ) | |

| (26,861 | ) | |

| (3,589 | ) | |

| (511 | ) |

| Impairment of goodwill, intangible assets and other long-lived assets | |

| 5,201 | | |

| - | | |

| - | | |

| 37,976 | | |

| 36,397 | | |

| 5,187 | |

| Impairment of investments | |

| 9,064 | | |

| 388 | | |

| 55 | | |

| 18,377 | | |

| 8,437 | | |

| 1,202 | |

| Adjusted EBITDA | |

| 2,515,182 | | |

| 2,153,639 | | |

| 306,895 | | |

| 9,644,947 | | |

| 7,191,233 | | |

| 1,024,743 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to KE Holdings Inc.’s ordinary shareholders | |

| 1,158,042 | | |

| 1,171,073 | | |

| 166,880 | | |

| 5,213,619 | | |

| 3,494,908 | | |

| 498,021 | |

| Share-based compensation expenses | |

| 814,129 | | |

| 606,576 | | |

| 86,437 | | |

| 2,397,111 | | |

| 2,131,007 | | |

| 303,666 | |

| Amortization of intangible assets resulting from acquisitions and business cooperation agreement | |

| 155,495 | | |

| 29,883 | | |

| 4,258 | | |

| 458,268 | | |

| 214,167 | | |

| 30,519 | |

| Changes in fair value from long-term investments, loan receivables measured at fair value and contingent consideration | |

| 11,720 | | |

| (16,867 | ) | |

| (2,404 | ) | |

| (26,861 | ) | |

| (3,589 | ) | |

| (511 | ) |

| Impairment of goodwill, intangible assets and other long-lived assets | |

| 5,201 | | |

| - | | |

| - | | |

| 37,976 | | |

| 36,397 | | |

| 5,187 | |

| Impairment of investments | |

| 9,064 | | |

| 388 | | |

| 55 | | |

| 18,377 | | |

| 8,437 | | |

| 1,202 | |

| Tax effects on non-GAAP adjustments | |

| (6,560 | ) | |

| (6,494 | ) | |

| (925 | ) | |

| (19,682 | ) | |

| (19,904 | ) | |

| (2,836 | ) |

| Effects of non-GAAP adjustments on net income attributable to non-controlling interests shareholders | |

| (7 | ) | |

| (7 | ) | |

| (1 | ) | |

| (21 | ) | |

| (21 | ) | |

| (3 | ) |

| Adjusted net income attributable to KE Holdings Inc.’s ordinary shareholders | |

| 2,147,084 | | |

| 1,784,552 | | |

| 254,300 | | |

| 8,078,787 | | |

| 5,861,402 | | |

| 835,245 | |

KE

Holdings Inc.

UNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS (Continued)

(All

amounts in thousands, except for share, per share data, ADS and per ADS data)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Weighted average number of ADS used in computing net income per ADS, basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 1,163,928,616 | | |

| 1,126,670,506 | | |

| 1,126,670,506 | | |

| 1,175,927,217 | | |

| 1,136,172,768 | | |

| 1,136,172,768 | |

| —Diluted | |

| 1,189,716,683 | | |

| 1,167,050,588 | | |

| 1,167,050,588 | | |

| 1,204,101,766 | | |

| 1,174,217,385 | | |

| 1,174,217,385 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADS used in calculating adjusted net income per ADS, basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 1,163,928,616 | | |

| 1,126,670,506 | | |

| 1,126,670,506 | | |

| 1,175,927,217 | | |

| 1,136,172,768 | | |

| 1,136,172,768 | |

| —Diluted | |

| 1,189,716,683 | | |

| 1,167,050,588 | | |

| 1,167,050,588 | | |

| 1,204,101,766 | | |

| 1,174,217,385 | | |

| 1,174,217,385 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS attributable to KE Holdings Inc.'s ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 0.99 | | |

| 1.04 | | |

| 0.15 | | |

| 4.43 | | |

| 3.08 | | |

| 0.44 | |

| —Diluted | |

| 0.97 | | |

| 1.00 | | |

| 0.14 | | |

| 4.33 | | |

| 2.98 | | |

| 0.42 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjustments to net income per ADS attributable to KE Holdings Inc.'s ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 0.85 | | |

| 0.54 | | |

| 0.08 | | |

| 2.44 | | |

| 2.08 | | |

| 0.30 | |

| —Diluted | |

| 0.83 | | |

| 0.53 | | |

| 0.08 | | |

| 2.38 | | |

| 2.01 | | |

| 0.29 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income per ADS attributable to KE Holdings Inc.'s ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 1.84 | | |

| 1.58 | | |

| 0.23 | | |

| 6.87 | | |

| 5.16 | | |

| 0.74 | |

| —Diluted | |

| 1.80 | | |

| 1.53 | | |

| 0.22 | | |

| 6.71 | | |

| 4.99 | | |

| 0.71 | |

KE

Holdings Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(All

amounts in thousands)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net cash provided by operating activities | |

| 1,956,650 | | |

| 448,890 | | |

| 63,971 | | |

| 9,388,339 | | |

| 4,306,568 | | |

| 613,680 | |

| Net cash used in investing activities | |

| (15,323,257 | ) | |

| (518,848 | ) | |

| (73,936 | ) | |

| (7,689,643 | ) | |

| (7,362,441 | ) | |

| (1,049,140 | ) |

| Net cash used in financing activities | |

| (2,614,917 | ) | |

| (1,589,390 | ) | |

| (226,486 | ) | |

| (5,484,524 | ) | |

| (6,966,444 | ) | |

| (992,710 | ) |

| Effect of exchange rate change on cash, cash equivalents and restricted cash | |

| 164,808 | | |

| (46,881 | ) | |

| (6,685 | ) | |

| 186,945 | | |

| (14,720 | ) | |

| (2,097 | ) |

| Net decrease in cash and cash equivalents and restricted cash | |

| (15,816,716 | ) | |

| (1,706,229 | ) | |

| (243,136 | ) | |

| (3,598,883 | ) | |

| (10,037,037 | ) | |

| (1,430,267 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 37,812,092 | | |

| 17,526,653 | | |

| 2,497,528 | | |

| 25,594,259 | | |

| 25,857,461 | | |

| 3,684,659 | |

| Cash, cash equivalents and restricted cash at the end of the period | |

| 21,995,376 | | |

| 15,820,424 | | |

| 2,254,392 | | |

| 21,995,376 | | |

| 15,820,424 | | |

| 2,254,392 | |

KE

Holdings Inc.

UNAUDITED

SEGMENT CONTRIBUTION MEASURE

(All

amounts in thousands)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Existing home transaction services | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net revenues | |

| 6,307,085 | | |

| 6,217,054 | | |

| 885,923 | | |

| 21,904,172 | | |

| 19,278,973 | | |

| 2,747,232 | |

| Less: Commission and compensation | |

| (3,237,237 | ) | |

| (3,667,827 | ) | |

| (522,661 | ) | |

| (11,407,196 | ) | |

| (10,700,539 | ) | |

| (1,524,815 | ) |

| Contribution | |

| 3,069,848 | | |

| 2,549,227 | | |

| 363,262 | | |

| 10,496,976 | | |

| 8,578,434 | | |

| 1,222,417 | |

| New home transaction services | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net revenues | |

| 5,901,966 | | |

| 7,726,316 | | |

| 1,100,991 | | |

| 23,001,680 | | |

| 20,576,636 | | |

| 2,932,147 | |

| Less: Commission and compensation | |

| (4,418,771 | ) | |

| (5,812,384 | ) | |

| (828,258 | ) | |

| (16,880,830 | ) | |

| (15,581,327 | ) | |

| (2,220,321 | ) |

| Contribution | |

| 1,483,195 | | |

| 1,913,932 | | |

| 272,733 | | |

| 6,120,850 | | |

| 4,995,309 | | |

| 711,826 | |

| Home renovation and furnishing | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net revenues | |

| 3,176,739 | | |

| 4,213,041 | | |

| 600,354 | | |

| 7,209,569 | | |

| 10,662,113 | | |

| 1,519,339 | |

| Less: Material costs, commission and compensation | |

| (2,252,251 | ) | |

| (2,897,013 | ) | |

| (412,821 | ) | |

| (5,077,310 | ) | |

| (7,345,082 | ) | |

| (1,046,666 | ) |

| Contribution | |

| 924,488 | | |

| 1,316,028 | | |

| 187,533 | | |

| 2,132,259 | | |

| 3,317,031 | | |

| 472,673 | |

| Home rental services | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net revenues | |

| 1,804,374 | | |

| 3,941,234 | | |

| 561,621 | | |

| 3,905,262 | | |

| 9,753,977 | | |

| 1,389,931 | |

| Less: Property leasing costs, commission and compensation | |

| (1,748,021 | ) | |

| (3,766,972 | ) | |

| (536,789 | ) | |

| (3,996,906 | ) | |

| (9,248,794 | ) | |

| (1,317,943 | ) |

| (Deficit)/Contribution | |

| 56,353 | | |

| 174,262 | | |

| 24,832 | | |

| (91,644 | ) | |

| 505,183 | | |

| 71,988 | |

| Emerging and other services | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net revenues | |

| 620,541 | | |

| 487,002 | | |

| 69,397 | | |

| 1,552,023 | | |

| 2,060,692 | | |

| 293,646 | |

| Less: Commission and compensation | |

| (64,122 | ) | |

| (100,726 | ) | |

| (14,353 | ) | |

| (156,439 | ) | |

| (222,206 | ) | |

| (31,664 | ) |

| Contribution | |

| 556,419 | | |

| 386,276 | | |

| 55,044 | | |

| 1,395,584 | | |

| 1,838,486 | | |

| 261,982 | |

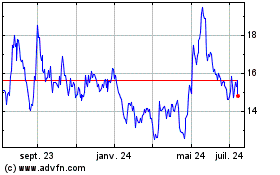

KE (NYSE:BEKE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

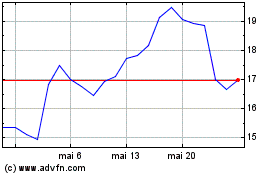

KE (NYSE:BEKE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025