Filed Pursuant to Rule 424(b)(3)

Registration File No.: 333-266318

BLACKROCK FLOATING RATE INCOME TRUST

Supplement dated February 20, 2024 to the

Prospectus and Statement of Additional Information (“SAI”),

each dated December 28, 2022, as supplemented on January 3, 2023 and May 10, 2023

This supplement amends certain information in the Prospectus and SAI, each dated December 28, 2022, as supplemented on January 3, 2023 and

May 10, 2023, of BlackRock Floating Rate Income Trust (the “Trust”). Unless otherwise indicated, all other information included in the Prospectus and SAI that is not inconsistent with the information set forth in this supplement

remains unchanged. Capitalized terms not otherwise defined in this supplement have the same meanings as in the Prospectus and SAI, as applicable.

Effective immediately, the following changes are made to the Trust’s Prospectus and SAI:

The section of the Prospectus entitled “Management of the Trust — Portfolio Managers” is deleted in its entirety and replaced with the

following:

Portfolio Managers

The members of

the portfolio management team who are primarily responsible for the day-to-day management of the Trust’s portfolio are as follows:

David Delbos, Managing Director of BlackRock is the Co-Head of U.S. High Yield within BlackRock’s Global

Credit team. He is also responsible for managing Global High Yield strategies. Mr. Delbos joined BlackRock in 2002 as a credit research analyst in the Leveraged Finance Group. He transitioned to a portfolio management role in 2012. Prior to

joining the Leveraged Finance team at BlackRock in 2002, Mr. Delbos was an analyst at Deutsche Bank Securities Inc. Mr. Delbos earned a BA degree, Magna Cum Laude, in history from Tufts University in 2000.

Mitchell S. Garfin, CFA, Managing Director of BlackRock, is the Co-Head of Leveraged Finance within

BlackRock’s Global Credit team. He is also responsible for managing US High Yield and Global strategies. Mr. Garfin joined BlackRock in 1997 as an analyst in the Account Management Group working with taxable financial institutional

clients. He joined the Portfolio Management Group in 2000 as a credit research analyst and in 2005 moved to portfolio management. Mr. Garfin moved to his current role in 2007 and serves as Head of the Global Credit Human Capital Committee.

Mr. Garfin earned a BA degree, with distinction, in finance from the University of Michigan in 1997, and an MBA degree in finance and economics from New York University in 2005

Carly Wilson, Managing Director, is a member of BlackRock’s Global Credit Platform. She is a portfolio manager for the platform’s bank

loan strategies and global long/short credit strategies. Since joining BlackRock in 2009, Ms. Wilson’s investment experience has focused on both single name and sector selection within Credit, as well as fund-level risk management. Her

bank loan experience spans mandate types, including daily liquidity mutual funds, semi-liquid offshore funds, CLOs and separate accounts managed on behalf of a global client base with bespoke needs. On behalf of the platform’s Global Long/Short

Credit Fund, Ms. Wilson focuses on asset allocation and cross-market relative value, as well as single name alpha generation and risk budgeting. In this role, she invests long and short in many global markets — including credit, rates and

equities, in both cash and derivatives. Ms. Wilson is currently on the Board of Directors of the Loan Syndications & Trading Association (LSTA). Prior to her current role, Ms. Wilson worked at multi-strategy hedge fund R3 Capital

where she focused on credit research and portfolio management. Previously, she worked at Lehman Brothers in Global Principal Strategies as part of the capital structure arbitrage investment team. Ms. Wilson began her career in equity trading at

Lehman Brothers. Ms. Wilson earned a bachelor’s degree in Economics from the Wharton School of Business at the University of Pennsylvania in 2004.

The SAI provides additional information about other accounts managed by the portfolio management team, the

compensation of each portfolio manager and the ownership of the Trust’s securities by each portfolio manager.

The section of the SAI entitled

“Management of the Trust — Portfolio Management” is deleted in its entirety and replaced with the following:

Portfolio Management

Portfolio Manager Assets Under Management

The

following table sets forth information about funds and accounts other than the Trust for which the portfolio managers are primarily responsible for

the day-to-day portfolio management as of December 31, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(ii) Number of Other Accounts Managed

and Assets by Account Type |

|

(iii) Number of Other Accounts and Assets

for Which Advisory Fee

is

Performance-Based |

| (i) Name of Portfolio

Manager |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

| David Delbos |

|

31

$41.67 Billion |

|

25

$15.82 Billion |

|

61

$17.55 Billion |

|

0

$0 |

|

0

$0 |

|

5

$1.03 Billion |

| Mitchell S. Garfin |

|

27

$45.92 Billion |

|

27

$15.54 Billion |

|

61

$16.87 Billion |

|

0

$0 |

|

0

$0 |

|

5

$1.03 Billion |

| Carly Wilson |

|

15

$11.73 Billion |

|

13

$2.38 Billion |

|

8

$729.3 Million |

|

0

$0 |

|

0

$0 |

|

0

$0 |

Portfolio Manager Compensation Overview

The discussion below describes the portfolio managers’ compensation as of December 31, 2021.

The Advisor’s financial arrangements with its portfolio managers, its competitive compensation and its career path emphasis at all levels reflect the

value senior management places on key resources. Compensation may include a variety of components and may vary from year to year based on a number of factors. The principal components of compensation include a base salary, a performance-based

discretionary bonus, participation in various benefits programs and one or more of the incentive compensation programs established by the Advisor.

Base Compensation. Generally, portfolio managers receive base compensation based on their position with the firm.

Discretionary Incentive Compensation

Discretionary

incentive compensation is a function of several components: the performance of BlackRock, the performance of the portfolio manager’s group within the Advisor, the investment performance, including risk-adjusted returns, of the firm’s

assets under management or supervision by that portfolio manager relative to predetermined benchmarks, and the individual’s performance and contribution to the overall performance of these portfolios and the Advisor. In most cases, these

benchmarks are the same as the benchmark or benchmarks against which the performance of the funds or other accounts managed by the portfolio managers are measured. Among other things, BlackRock’s Chief Investment Officers make a subjective

determination with respect to each portfolio manager’s compensation based on the performance of the funds and other accounts

- 2 -

managed by each portfolio manager relative to the various benchmarks. Performance of fixed income funds is measured

on a pre-tax and/or after-tax basis over various time

periods including 1-, 3-and 5-year periods, as applicable. With respect to these portfolio managers,

such benchmarks for the Trust and other accounts are:

|

|

|

| Portfolio Managers |

|

Applicable Benchmarks |

| David Delbos

Mitchell S. Garfin |

|

A combination of market-based indices (e.g., The Bloomberg U.S. Corporate High Yield 2% Issuer Cap Index), certain customized indices and certain fund industry peer groups. |

| Carly Wilson |

|

A combination of market-based indices (e.g., ICE BofA 3-Month U.S. Treasury Bill Index). |

Distribution of Discretionary Incentive Compensation. Discretionary incentive compensation is distributed

to portfolio managers in a combination of cash, deferred BlackRock stock awards, and/or deferred cash awards that notionally track the return of certain Advisor investment products.

Portfolio managers receive their annual discretionary incentive compensation in the form of cash. Portfolio managers whose total compensation is above a

specified threshold also receive deferred BlackRock stock awards annually as part of their discretionary incentive compensation. Paying a portion of discretionary incentive compensation in the form of deferred BlackRock stock puts compensation

earned by a portfolio manager for a given year “at risk” based on the Advisor’s ability to sustain and improve its performance over future periods. In some cases, additional deferred BlackRock stock may be granted to certain key

employees as part of a long-term incentive award to aid in retention, align interests with long-term shareholders and motivate performance. Deferred BlackRock stock awards are generally granted in the form of BlackRock restricted stock units that

vest pursuant to the terms of the applicable plan and, once vested, settle in BlackRock common stock. The portfolio managers of this Trust have deferred BlackRock stock awards.

For certain portfolio managers, a portion of the discretionary incentive compensation is also distributed in the form of deferred cash awards that notionally

track the returns of select Advisor investment products they manage, which provides direct alignment of portfolio manager discretionary incentive compensation with investment product results. Deferred cash awards vest ratably over a number of years

and, once vested, settle in the form of cash. Only portfolio managers who manage specified products and whose total compensation is above a specified threshold are eligible to participate in the deferred cash award program.

Other Compensation Benefits. In addition to base salary and discretionary incentive compensation, portfolio managers may be eligible to receive or

participate in one or more of the following:

Incentive Savings Plans — BlackRock has created a variety of incentive savings plans in which

BlackRock employees are eligible to participate, including a 401(k) plan, the BlackRock Retirement Savings Plan (RSP), and the BlackRock Employee Stock Purchase Plan (ESPP). The employer contribution components of the RSP include a company match

equal to 50% of the first 8% of eligible pay contributed to the plan capped at $5,000 per year, and a company retirement contribution equal to 3-5% of eligible compensation up to the Internal Revenue Service

(“IRS”) limit ($290,000 for 2021). The RSP offers a range of investment options, including registered investment companies and collective investment funds managed by the firm. BlackRock contributions follow the investment direction set by

participants for their own contributions or, absent participant investment direction, are invested into a target date fund that corresponds to, or is closest to, the year in which the participant attains age 65. The ESPP allows for investment in

BlackRock common stock at a 5% discount on the fair market value of the stock on the purchase date. Annual participation in the ESPP is limited to the purchase of 1,000 shares of common stock or a dollar value of $25,000 based on its fair market

value on the purchase date. All of the eligible portfolio managers are eligible to participate in these plans.

- 3 -

Securities Ownership of Portfolio Managers

As of December 31, 2021, the end of the Trust’s most recently completed fiscal year end, the dollar range of securities beneficially owned by each

portfolio manager in the Trust is shown below:

|

|

|

|

|

|

| Portfolio Manager |

|

Dollar Range of Equity Securities of the Trust

Beneficially Owned |

| David Delbos |

|

|

|

None |

|

| Mitchell S. Garfin |

|

|

|

None |

|

| Carly Wilson |

|

|

|

None |

|

Potential Material Conflicts of Interest

The Advisor has built a professional working environment, firm-wide compliance culture and compliance procedures and systems designed to protect against

potential incentives that may favor one account over another. The Advisor has adopted policies and procedures that address the allocation of investment opportunities, execution of portfolio transactions, personal trading by employees and other

potential conflicts of interest that are designed to ensure that all client accounts are treated equitably over time. Nevertheless, the Advisor furnishes investment management and advisory services to numerous clients in addition to the Trust, and

the Advisor may, consistent with applicable law, make investment recommendations to other clients or accounts (including accounts which are hedge funds or have performance or higher fees paid to the Advisor, or in which portfolio managers have a

personal interest in the receipt of such fees), which may be the same as or different from those made to the Trust. In addition, BlackRock, its affiliates and significant shareholders and any officer, director, shareholder or employee may or may not

have an interest in the securities whose purchase and sale the Advisor recommends to the Trust. BlackRock, or any of its affiliates or significant shareholders, or any officer, director, shareholder, employee or any member of their families may take

different actions than those recommended to the Trust by the Advisor with respect to the same securities. Moreover, the Advisor may refrain from rendering any advice or services concerning securities of companies of which any of BlackRock’s (or

its affiliates’ or significant shareholders’) officers, directors or employees are directors or officers, or companies as to which BlackRock or any of its affiliates or significant shareholders or the officers, directors and employees of

any of them has any substantial economic interest or possesses material non-public information. Certain portfolio managers also may manage accounts whose investment strategies may at times be opposed to the

strategy utilized for a fund. It should also be noted that Messrs. Delbos and Garfin and Ms. Wilson may be managing hedge fund and/or long only accounts, or may be part of a team managing hedge fund and/or long only accounts, subject to

incentive fees. Messrs. Delbos and Garfin and Ms. Wilson may therefore be entitled to receive a portion of any incentive fees earned on such accounts.

As a fiduciary, the Advisor owes a duty of loyalty to its clients and must treat each client fairly. When the Advisor purchases or sells securities for more

than one account, the trades must be allocated in a manner consistent with its fiduciary duties. The Advisor attempts to allocate investments in a fair and equitable manner among client accounts, with no account receiving preferential

treatment. To this end, BlackRock has adopted policies that are intended to ensure reasonable efficiency in client transactions and provide the Advisor with sufficient flexibility to allocate investments in a manner that is consistent with the

particular investment discipline and client base, as appropriate.

Shareholders should retain this Supplement for future reference.

- 4 -

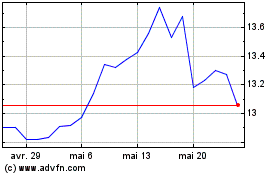

BlackRock Floating Rate ... (NYSE:BGT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

BlackRock Floating Rate ... (NYSE:BGT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024