Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today

announced its financial results for the three and six months ended

March 31, 2024.

"Beazer delivered another successful quarter with strong sales,

solid margins and growth in both our community count and our lot

position," said Allan P. Merrill, the company’s Chairman and Chief

Executive Officer. "The combination of these factors and our

careful management of overheads enabled us to generate nearly $59

million in adjusted EBITDA."

Commenting on current market conditions, Mr. Merrill said,

"While affordability remains challenging, especially in light of

the recent increase in mortgage rates, the relatively strong

economy and lack of resale inventory leave us on track to achieve

our full year profitability and double-digit return on equity goals

for the fiscal year."

Looking further out, Mr. Merrill concluded, "We remain

optimistic for the years ahead given the persistent undersupply of

housing and our consistent advancement towards our multi-year

goals. Further growth in community count, combined with reductions

in leverage and the full implementation of our Zero Energy Ready

program should position us to generate durable value for our

shareholders."

Beazer Homes Fiscal Second Quarter 2024

Highlights and Comparison to Fiscal Second Quarter 2023

- Net income from continuing operations was $39.2 million, or

$1.26 per diluted share, compared to net income from continuing

operations of $34.7 million, or $1.13 per diluted share, in fiscal

second quarter 2023

- Adjusted EBITDA was $58.8 million, down 5.4%

- Homebuilding revenue was $538.6 million, down 0.6% on a 1.8%

decrease in home closings to 1,044, partially offset by a 1.2%

increase in average selling price (ASP) to $515.9 thousand

- Homebuilding gross margin was 18.7%, flat compared to a year

ago. Excluding impairments, abandonments and amortized interest,

homebuilding gross margin was 21.7%, down 30 basis points

- SG&A as a percentage of total revenue was 11.5%, up 30

basis points

- Net new orders were 1,299, up 10.0% on a 13.8% increase in

average community count to 140, partially offset by a 3.3% decrease

in orders per community per month to 3.1

- Backlog dollar value was $1.08 billion, up 8.9% on a 10.1%

increase in backlog units to 2,046, partially offset by a 1.1%

decrease in ASP of homes in backlog to $525.5 thousand

- Land acquisition and land development spending was $197.8

million, up 75.0% from $113.0 million

- Unrestricted cash at quarter end was $132.9 million; total

liquidity was $432.9 million

- Refinanced $197.9 million of its 6.750% Senior Unsecured Notes

due 2025 through the issuance of $250.0 million of 7.500% Senior

Unsecured Notes due 2031

- Extended the maturity of its $300.0 million Senior Unsecured

Revolving Credit Facility to March 2028

- Total debt to total capitalization ratio of 46.8% at quarter

end compared to 49.7% a year ago. Net debt to net capitalization

ratio of 43.4% at quarter end compared to 42.7% a year ago

The following provides additional details on the Company's

performance during the fiscal second quarter 2024:

Profitability. Net income from continuing operations was $39.2

million, generating diluted earnings per share of $1.26. This

included an $8.6 million, or $0.28 per diluted share, one-time gain

on sale of investment in a technology company specializing in

digital marketing for new home communities. Second quarter adjusted

EBITDA of $58.8 million, which excludes the one-time gain on sale

of investment, was down $3.3 million, or 5.4%, primarily due to

lower homebuilding gross profit.

Orders. Net new orders for the second quarter increased to

1,299, up 10.0% from 1,181 in the prior year quarter primarily

driven by a 13.8% increase in average community count to 140 from

123 a year ago, partially offset by a 3.3% decrease in sales pace

to 3.1 orders per community per month, down from 3.2 in the prior

year quarter. The cancellation rate for the quarter was 12.2%, down

from 18.6% in the prior year quarter.

Backlog. The dollar value of homes in backlog as of March 31,

2024 was $1.08 billion, representing 2,046 homes, compared to

$987.2 million, representing 1,858 homes, at the same time last

year. The ASP of homes in backlog was $525.5 thousand, down 1.1%

versus the prior year quarter.

Homebuilding Revenue. Second quarter homebuilding revenue was

$538.6 million, down 0.6% year-over-year. The decrease in

homebuilding revenue was driven by a 1.8% decrease in home closings

to 1,044 homes, partially offset by a 1.2% increase in the ASP to

$515.9 thousand. The decrease in closings was primarily due to a

lower volume of spec homes sold and delivered within the current

quarter compared to the prior year quarter.

Homebuilding Gross Margin. Homebuilding gross margin (excluding

impairments, abandonments and amortized interest) was 21.7% for the

second quarter, down from 22.0% in the prior year quarter as a

result of changes in product and community mix and an increase in

closing cost incentives, partially offset by a decrease in build

costs.

SG&A Expenses. Selling, general and administrative expenses

as a percentage of total revenue was 11.5% for the quarter, up 30

basis points year-over-year primarily due to higher sales and

marketing costs as the Company prepares for new community

activations and future growth, as well as a slight decrease in

homebuilding revenue.

Land Position. For the current fiscal quarter, land acquisition

and land development spending was $197.8 million, up 75.0%

year-over-year. Controlled lots increased 12.9% to 26,887, compared

to 23,820 from the prior year quarter. Excluding land held for

future development and land held for sale lots, active lots

controlled were 26,218, up 13.5% year-over-year. As of March 31,

2024, the Company controlled 51.6% of its total active lots through

option agreements compared to 54.0% as of March 31, 2023.

Liquidity. At the close of the second quarter, the Company had

$432.9 million of available liquidity, including $132.9 million of

unrestricted cash and $300.0 million of remaining capacity under

the unsecured revolving credit facility, compared to total

available liquidity of $505.8 million a year ago. In March, the

Company issued $250.0 million of 7.500% Senior Unsecured Notes due

2031. The proceeds were used to redeem the remaining $197.9 million

of the Company's 6.750% Senior Notes due 2025. In addition, the

Company extended the maturity under its existing $300.0 million

Senior Unsecured Revolving Credit Facility to March 2028.

Commitment to ESG Initiatives

During the quarter, the Company demonstrated its continued

leadership and commitment to advancing ESG.

Beazer Homes received the ENERGY STAR Partner of the Year Award

with Sustained Excellence for the ninth consecutive year. This

award highlights the Company’s dedication to continually enhancing

the energy efficiency of its homes in support of its industry-first

pledge that, by the end of 2025, every new home that we start will

be Zero Energy Ready, which means it will meet the requirements of

the U.S. Department of Energy’s Zero Energy Ready Home program. By

the end of the second quarter, the Company had Zero Energy Ready

homes under construction in every division, consisting of 77% of

new home starts. This represents a significant increase from the

54% achieved last quarter and the 28% from the prior year

quarter.

In addition, the Company earned the 2024 Top Workplaces USA

award for the second consecutive year, placing fifth among

companies headquartered in Georgia on the list published by USA

Today. Participating companies are measured on anonymous employee

feedback comparing the survey’s research-based statements,

including 15 Culture Drivers that are proven to predict high

performance against industry benchmarks.

Further, the Company was recognized on Newsweek’s list of

America’s Most Trustworthy Companies in America for the third year

in a row. This award identified companies based on an independent

survey of approximately 25,000 U.S. residents who rated companies

they knew from the perspective of customers, investors and

employees.

Finally, Beazer Homes announced the donation of $1.9 million to

Fisher House Foundation, representing extensive fundraising efforts

by Beazer Homes employees, generous contributions from its

partners, and a 150% match by the Beazer Charity Foundation for all

donations. For more than 25 years, the Fisher House has been

providing “a home away from home” for military and veterans’

families to stay free of charge, while a loved one is receiving

treatment at major military and VA medical centers.

Summary results for the three and six months ended March 31,

2024 are as follows:

Three Months Ended March

31,

2024

2023

Change*

New home orders, net of cancellations

1,299

1,181

10.0

%

Cancellation rates

12.2

%

18.6

%

(640) bps

Orders per community per month

3.1

3.2

(3.3

)%

Average active community count

140

123

13.8

%

Active community count at quarter-end

145

121

19.8

%

Land acquisition and land development

spending (in millions)

$

197.8

$

113.0

75.0

%

Total home closings

1,044

1,063

(1.8

)%

ASP from closings (in thousands)

$

515.9

$

509.9

1.2

%

Homebuilding revenue (in millions)

$

538.6

$

542.0

(0.6

)%

Homebuilding gross margin

18.7

%

18.7

%

0 bps

Homebuilding gross margin, excluding

impairments and abandonments (I&A)

18.7

%

18.8

%

(10) bps

Homebuilding gross margin, excluding

I&A and interest amortized to cost of sales

21.7

%

22.0

%

(30) bps

Income from continuing operations before

income taxes (in millions)

$

45.9

$

39.8

15.4

%

Expense from income taxes (in

millions)

$

6.7

$

5.1

32.3

%

Income from continuing operations, net of

tax (in millions)

$

39.2

$

34.7

12.9

%

Basic income per share from continuing

operations

$

1.27

$

1.14

11.4

%

Diluted income per share from continuing

operations

$

1.26

$

1.13

11.5

%

Net income (in millions)

$

39.2

$

34.7

12.9

%

Adjusted EBITDA (in millions)

$

58.8

$

62.1

(5.4

)%

LTM Adjusted EBITDA (in millions)

$

259.6

$

340.9

(23.9

)%

Total debt to total capitalization

ratio

46.8

%

49.7

%

(290) bps

Net debt to net capitalization ratio

43.4

%

42.7

%

70 bps

* Change and totals are calculated using

unrounded numbers.

"LTM" indicates amounts for the trailing

12 months.

Six Months Ended March

31,

2024

2022

Change*

New home orders, net of cancellations

2,122

1,663

27.6

%

Cancellation rates

15.0

%

25.0

%

(1,000) bps

LTM orders per community per month

2.7

2.2

22.7

%

Land acquisition and land development

spending (in millions)

$

396.5

$

227.7

74.1

%

Total home closings

1,787

1,896

(5.7

)%

ASP from closings (in thousands)

$

514.6

$

520.1

(1.1

)%

Homebuilding revenue (in millions)

$

919.6

$

986.1

(6.7

)%

Homebuilding gross margin

19.2

%

18.9

%

30 bps

Homebuilding gross margin, excluding

I&A

19.2

%

19.0

%

20 bps

Homebuilding gross margin, excluding

I&A and interest amortized to cost of sales

22.2

%

22.1

%

10 bps

Income from continuing operations before

income taxes (in millions)

$

68.8

$

68.4

0.7

%

Expense from income taxes (in

millions)

$

7.9

$

9.2

(14.4

)%

Income from continuing operations, net of

tax (in millions)

$

60.9

$

59.1

3.0

%

Basic income per share from continuing

operations

$

1.98

$

1.94

2.1

%

Diluted income per share from continuing

operations

$

1.96

$

1.93

1.6

%

Net income (in millions)

$

60.9

$

59.0

3.2

%

Adjusted EBITDA (in millions)

$

96.8

$

109.3

(11.4

)%

* Change and totals are calculated using

unrounded numbers.

"LTM" indicates amounts for the trailing 12 months.

As of March 31,

2024

2023

Change

Backlog units

2,046

1,858

10.1

%

Dollar value of backlog (in millions)

$

1,075.1

$

987.2

8.9

%

ASP in backlog (in thousands)

$

525.5

$

531.3

(1.1

)%

Land and lots controlled

26,887

23,820

12.9

%

Conference Call

The Company will hold a conference call on May 1, 2024 at 5:00

p.m. ET to discuss these results. Interested parties may listen to

the conference call and view the Company's slide presentation on

the "Investor Relations" page of the Company's website,

www.beazer.com. In addition, the conference call will be

available by telephone at 800-475-0542 (for international callers,

dial 630-395-0227). To be admitted to the call, enter the pass code

“8571348". A replay of the conference call will be available, until

11:59 PM ET on May 31, 2024 at 800-839-2204 (for international

callers, dial 203-369-3032) with pass code “3740”.

About Beazer Homes

Headquartered in Atlanta, Beazer Homes (NYSE: BZH) is one of

the country’s largest homebuilders. Every Beazer home is designed

and built to provide Surprising Performance, giving you more

quality and more comfort from the moment you move in – saving you

money every month. With Beazer's Choice Plans™, you can personalize

your primary living areas – giving you a choice of how you want to

live in the home, at no additional cost. And unlike most national

homebuilders, we empower our customers to shop and compare loan

options. Our Mortgage Choice program gives you the resources to

easily compare multiple loan offers and choose the best lender and

loan offer for you, saving you thousands over the life of your

loan.

We build our homes in Arizona, California, Delaware, Florida,

Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina,

Tennessee, Texas, and Virginia. For more information, visit

beazer.com, or check out Beazer on Facebook, Instagram

and Twitter.

This press release contains forward-looking statements. These

forward-looking statements represent our expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of our control, that could

cause actual results to differ materially from the results

discussed in the forward-looking statements, including, among other

things:

- the cyclical nature of the homebuilding industry and

deterioration in homebuilding industry conditions;

- other economic changes nationally and in local markets,

including declines in employment levels, increases in the number of

foreclosures and wage levels, each of which are outside our control

and may impact consumer confidence and affect the affordability of,

and demand for, the homes we sell;

- elevated mortgage interest rates for prolonged periods, as well

as further increases and reduced availability of mortgage financing

due to, among other factors, additional actions by the Federal

Reserve to address sharp increases in inflation;

- financial institution disruptions, such as the bank failures

that occurred in 2023;

- continued supply chain challenges negatively impacting our

homebuilding production, including shortages of raw materials and

other critical components such as windows, doors, and

appliances;

- continued shortages of or increased costs for labor used in

housing production, and the level of quality and craftsmanship

provided by such labor;

- inaccurate estimates related to homes to be delivered in the

future (backlog), as they are subject to various cancellation risks

that cannot be fully controlled;

- factors affecting margins, such as adjustments to home pricing,

increased sales incentives and mortgage rate buy down programs in

order to remain competitive;

- decreased revenues;

- decreased land values underlying land option agreements;

- increased land development costs in communities under

development or delays or difficulties in implementing initiatives

to reduce our cycle times and production and overhead cost

structures;

- not being able to pass on cost increases (including cost

increases due to increasing the energy efficiency of our homes)

through pricing increases;

- the availability and cost of land and the risks associated with

the future value of our inventory;

- our ability to raise debt and/or equity capital, due to factors

such as limitations in the capital markets (including market

volatility), adverse credit market conditions and financial

institution disruptions, and our ability to otherwise meet our

ongoing liquidity needs (which could cause us to fail to meet the

terms of our covenants and other requirements under our various

debt instruments and therefore trigger an acceleration of a

significant portion or all of our outstanding debt obligations),

including the impact of any downgrades of our credit ratings or

reduction in our liquidity levels;

- market perceptions regarding any capital raising initiatives we

may undertake (including future issuances of equity or debt

capital);

- changes in tax laws or otherwise regarding the deductibility of

mortgage interest expenses and real estate taxes, including those

resulting from regulatory guidance and interpretations issued with

respect thereto, such as the IRS's recent guidance regarding

heightened qualification requirements for federal credits for

building energy-efficient homes;

- increased competition or delays in reacting to changing

consumer preferences in home design;

- natural disasters or other related events that could result in

delays in land development or home construction, increase our costs

or decrease demand in the impacted areas;

- terrorist acts, protests and civil unrest, political

uncertainty, acts of war or other factors over which the Company

has no control, such as the conflict between Russia and Ukraine and

the conflict in the Gaza strip;

- potential negative impacts of public health emergencies such as

the COVID-19 pandemic;

- the potential recoverability of our deferred tax assets;

- increases in corporate tax rates;

- potential delays or increased costs in obtaining necessary

permits as a result of changes to, or complying with, laws,

regulations or governmental policies, and possible penalties for

failure to comply with such laws, regulations or governmental

policies, including those related to the environment;

- the results of litigation or government proceedings and

fulfillment of any related obligations;

- the impact of construction defect and home warranty

claims;

- the cost and availability of insurance and surety bonds, as

well as the sufficiency of these instruments to cover potential

losses incurred;

- the impact of information technology failures, cybersecurity

issues or data security breaches, including cybersecurity incidents

impacting third-party service providers that we depend on to

conduct our business;

- the impact of governmental regulations on homebuilding in key

markets, such as regulations limiting the availability of water and

electricity (including availability of electrical equipment such as

transformers and meters); and

- the success of our ESG initiatives, including our ability to

meet our goal that by the end of 2025 every home we start will be

Zero Energy Ready, as well as the success of any other related

partnerships or pilot programs we may enter into in order to

increase the energy efficiency of our homes and prepare for a Zero

Energy Ready future.

Any forward-looking statement, including any statement

expressing confidence regarding future outcomes, speaks only as of

the date on which such statement is made and, except as required by

law, we undertake no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events. New factors emerge from time to time, and it

is not possible to predict all such factors.

-Tables Follow-

BEAZER HOMES USA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

Six Months Ended

March 31,

March 31,

in thousands (except per share data)

2024

2023

2024

2023

Total revenue

$

541,540

$

543,908

$

928,358

$

988,836

Home construction and land sales

expenses

439,687

440,901

748,775

799,871

Inventory impairments and abandonments

—

111

—

301

Gross profit

101,853

102,896

179,583

188,664

Commissions

18,285

18,305

31,531

32,410

General and administrative expenses

44,004

42,779

85,990

83,427

Depreciation and amortization

3,573

3,020

5,806

5,533

Operating income

35,991

38,792

56,256

67,294

Loss on extinguishment of debt, net

(424

)

—

(437

)

(515

)

Other income, net

10,343

1,007

13,000

1,583

Income from continuing operations before

income taxes

45,910

39,799

68,819

68,362

Expense from income taxes

6,739

5,092

7,920

9,247

Income from continuing operations

39,171

34,707

60,899

59,115

Loss from discontinued operations, net of

tax

—

—

—

(77

)

Net income

$

39,171

$

34,707

$

60,899

$

59,038

Weighted-average number of shares:

Basic

30,769

30,394

30,681

30,464

Diluted

31,133

30,610

31,064

30,702

Basic income per share:

Continuing operations

$

1.27

$

1.14

$

1.98

$

1.94

Discontinued operations

—

—

—

—

Total

$

1.27

$

1.14

$

1.98

$

1.94

Diluted income per share:

Continuing operations

$

1.26

$

1.13

$

1.96

$

1.93

Discontinued operations

—

—

—

—

Total

$

1.26

$

1.13

$

1.96

$

1.93

Three Months Ended

Six Months Ended

March 31,

March 31,

Capitalized Interest in

Inventory

2024

2023

2024

2023

Capitalized interest in inventory,

beginning of period

$

119,596

$

113,143

$

112,580

$

109,088

Interest incurred

19,689

18,034

37,895

35,864

Capitalized interest amortized to home

construction and land sales expenses

(16,071

)

(17,291

)

27,261

(31,066

)

Capitalized interest in inventory, end of

period

$

123,214

$

113,886

$

123,214

$

113,886

BEAZER HOMES USA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

in thousands (except share and per share

data)

March 31, 2024

September 30, 2023

ASSETS

Cash and cash equivalents

$

132,867

$

345,590

Restricted cash

32,527

40,699

Accounts receivable (net of allowance of

$284 and $284, respectively)

54,226

45,598

Income tax receivable

246

—

Owned inventory

2,057,461

1,756,203

Deferred tax assets, net

132,521

133,949

Property and equipment, net

36,839

31,144

Operating lease right-of-use assets

15,867

17,398

Goodwill

11,376

11,376

Other assets

41,480

29,076

Total assets

$

2,515,410

$

2,411,033

LIABILITIES AND STOCKHOLDERS’

EQUITY

Trade accounts payable

$

168,669

$

154,256

Operating lease liabilities

17,543

18,969

Other liabilities

144,310

156,961

Total debt (net of debt issuance costs of

$9,314 and $5,759, respectively)

1,023,311

978,028

Total liabilities

1,353,833

1,308,214

Stockholders’ equity:

Preferred stock (par value $0.01 per

share, 5,000,000 shares authorized, no shares issued)

—

—

Common stock (par value $0.001 per share,

63,000,000 shares authorized, 31,547,284 issued and outstanding and

31,351,434 issued and outstanding, respectively)

32

31

Paid-in capital

862,636

864,778

Retained earnings

298,909

238,010

Total stockholders’ equity

1,161,577

1,102,819

Total liabilities and stockholders’

equity

$

2,515,410

$

2,411,033

Inventory Breakdown

Homes under construction

$

851,278

$

644,363

Land under development

951,221

870,740

Land held for future development

19,879

19,879

Land held for sale

18,264

18,579

Capitalized interest

123,214

112,580

Model homes

93,605

90,062

Total owned inventory

$

2,057,461

$

1,756,203

BEAZER HOMES USA, INC.

CONSOLIDATED OPERATING AND

FINANCIAL DATA – CONTINUING OPERATIONS

Three Months Ended March

31,

Six Months Ended March

31,

SELECTED OPERATING DATA

2024

2023

2024

2023

Closings:

West region

667

631

1,121

1,141

East region

215

236

351

391

Southeast region

162

196

315

364

Total closings

1,044

1,063

1,787

1,896

New orders, net of

cancellations:

West region

860

631

1,393

879

East region

263

296

435

416

Southeast region

176

254

294

368

Total new orders, net

1,299

1,181

2,122

1,663

As of March 31,

Backlog units:

2024

2023

West region

1,305

995

East region

407

435

Southeast region

334

428

Total backlog units

2,046

1,858

Aggregate dollar value of homes in backlog

(in millions)

$

1,075.1

$

987.2

ASP in backlog (in thousands)

$

525.5

$

531.3

in thousands

Three Months Ended March

31,

Six Months Ended March

31,

SUPPLEMENTAL FINANCIAL DATA

2024

2023

2024

2023

Homebuilding revenue:

West region

$

344,864

$

328,961

$

579,273

$

603,283

East region

111,631

119,869

183,384

205,900

Southeast region

82,141

93,177

156,898

176,908

Total homebuilding revenue

$

538,636

$

542,007

$

919,555

$

986,091

Revenue:

Homebuilding

$

538,636

$

542,007

$

919,555

$

986,091

Land sales and other

2,904

1,901

8,803

2,745

Total revenue

$

541,540

$

543,908

$

928,358

$

988,836

Gross profit:

Homebuilding

$

100,774

$

101,588

$

176,717

$

186,702

Land sales and other

1,079

1,308

2,866

1,962

Total gross profit

$

101,853

$

102,896

$

179,583

$

188,664

Reconciliation of homebuilding gross profit and the related

gross margin excluding impairments and abandonments and interest

amortized to cost of sales (each a non-GAAP financial measure) to

their most directly comparable GAAP measures is provided for each

period discussed below. Management believes that this information

assists investors in comparing the operating characteristics of

homebuilding activities by eliminating many of the differences in

companies' respective level of impairments and level of debt. These

non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies and should not be

considered in isolation or as a substitute for, or superior to,

financial measures prepared in accordance with GAAP.

Three Months Ended March

31,

Six Months Ended March

31,

in thousands

2024

2023

2024

2023

Homebuilding gross profit/margin

$

100,774

18.7

%

$

101,588

18.7

%

$

176,717

19.2

%

$

186,702

18.9

%

Inventory impairments and abandonments

(I&A)

—

111

—

301

Homebuilding gross profit/margin excluding

I&A

100,774

18.7

%

101,699

18.8

%

176,717

19.2

%

187,003

19.0

%

Interest amortized to cost of sales

16,071

17,291

27,261

31,066

Homebuilding gross profit/margin excluding

I&A and interest amortized to cost of sales

$

116,845

21.7

%

$

118,990

22.0

%

$

203,978

22.2

%

$

218,069

22.1

%

Reconciliation of Adjusted EBITDA (a non-GAAP financial measure)

to total company net income, the most directly comparable GAAP

measure, is provided for each period discussed below. Management

believes that Adjusted EBITDA assists investors in understanding

and comparing core operating results and underlying business trends

by eliminating many of the differences in companies' respective

capitalization, tax position, level of impairments, and other

non-recurring items. This non-GAAP financial measure may not be

comparable to other similarly titled measures of other companies

and should not be considered in isolation or as a substitute for,

or superior to, financial measures prepared in accordance with

GAAP.

Three Months Ended March

31,

Six Months Ended March

31,

LTM Ended March 31,(a)

in thousands

2024

2023

2024

2023

2024

2023

Net income

$

39,171

$

34,707

$

60,899

$

59,038

$

160,472

$

200,185

Expense from income taxes

6,739

5,092

7,920

9,225

22,631

45,961

Interest amortized to home construction

and land sales expenses and capitalized interest impaired

16,071

17,291

27,261

31,066

64,684

72,261

EBIT

61,981

57,090

96,080

99,329

247,787

318,407

Depreciation and amortization

3,573

3,020

5,806

5,533

12,471

12,981

EBITDA

65,554

60,110

101,886

104,862

260,258

331,388

Stock-based compensation expense

1,389

1,678

3,062

3,258

7,079

7,204

Loss on extinguishment of debt

424

—

437

515

468

42

Inventory impairments and

abandonments(b)

—

111

—

301

340

1,890

Gain on sale of investment(c)

(8,591

)

—

(8,591

)

—

(8,591

)

—

Severance expenses

—

224

—

335

—

335

Adjusted EBITDA

$

58,776

$

62,123

$

96,794

$

109,271

$

259,554

$

340,859

(a)

"LTM" indicates amounts for the trailing

12 months.

(b)

In periods during which we impaired

certain of our inventory assets, capitalized interest that is

impaired is included in the line above titled "Interest amortized

to home construction and land sales expenses and capitalized

interest impaired."

(c)

We previously held a minority interest in

a technology company specializing in digital marketing for new home

communities, which was sold during the quarter ended March 31,

2024. In exchange for the previously held investment, we received

cash in escrow along with a minority partnership interest in the

acquiring company, which was recorded within other assets in our

condensed consolidated balance sheets. The resulting gain of

$8.6 million from this transaction was recognized in other

income, net on our condensed consolidated statement of operations.

The Company believes excluding this one-time gain from Adjusted

EBITDA provides a better reflection of the Company's performance as

this item is not representative of our core operations.

Reconciliation of net debt to net capitalization ratio (a

non-GAAP financial measure) to total debt to total capitalization

ratio, the most directly comparable GAAP measure, is provided for

each period below. Management believes that net debt to net

capitalization ratio is useful in understanding the leverage

employed in our operations and as an indicator of our ability to

obtain financing. This non-GAAP financial measure may not be

comparable to other similarly titled measures of other companies

and should not be considered in isolation or as a substitute for,

or superior to, financial measures prepared in accordance with

GAAP.

in thousands

As of March 31, 2024

As of March 31, 2023

Total debt

$

1,023,311

$

985,220

Stockholders' equity

1,161,577

998,985

Total capitalization

$

2,184,888

$

1,984,205

Total debt to total capitalization

ratio

46.8

%

49.7

%

Total debt

$

1,023,311

$

985,220

Less: cash and cash equivalents

132,867

240,829

Net debt

890,444

744,391

Stockholders' equity

1,161,577

998,985

Net capitalization

$

2,052,021

$

1,743,376

Net debt to net capitalization ratio

43.4

%

42.7

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501588573/en/

Beazer Homes USA, Inc. David I. Goldberg Sr. Vice President

& Chief Financial Officer 770-829-3700

investor.relations@beazer.com

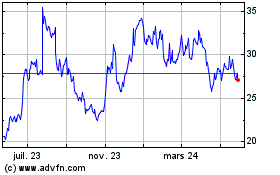

Beazer Homes USA (NYSE:BZH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

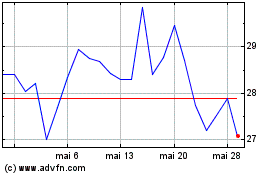

Beazer Homes USA (NYSE:BZH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025