Cencora Prices $500 Million 4.625% Senior Notes Due 2027, $600 Million 4.850% Senior Notes Due 2029 and $700 Million 5.150% Senior Notes Due 2035

03 Décembre 2024 - 4:49AM

Business Wire

Cencora, Inc. (NYSE: COR) today announced that it priced $500

million aggregate principal amount of its 4.625% Senior Notes due

December 15, 2027 (the “2027 Notes”), $600 million aggregate

principal amount of its 4.850% Senior Notes due December 15, 2029

(the “2029 Notes”) and $700 million aggregate principal amount of

its 5.150% Senior Notes due February 15, 2035 (the “2035 Notes”

and, together with the 2027 Notes and the 2029 Notes, the “Notes”),

in an underwritten registered public offering. The offering is

being made pursuant to an effective shelf registration statement

Cencora filed with the Securities and Exchange Commission (the

“SEC”) on November 26, 2024. The offering is expected to close on

December 9, 2024, subject to the satisfaction of customary closing

conditions. Cencora intends to use the net proceeds from the

offering to finance the acquisition of the majority of Retina

Consultants of America and related fees and expenses, and for

general corporate purposes.

The joint book-running managers for the offering are BofA

Securities, Inc., Citigroup Global Markets Inc., J.P. Morgan

Securities LLC and Wells Fargo Securities, LLC. Earlier today,

Cencora filed a preliminary prospectus supplement and an

accompanying prospectus with the SEC in connection with the

offering of the Notes. Copies of these materials can be made

available by contacting: BofA Securities, Inc., NC1-004-03-43, 200

North College Street, 3rd Floor, Charlotte, North Carolina 28255,

Attention: Prospectus Department, email:

dg.prospectus_requests@bofa.com; Citigroup Global Markets Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

New York 11717, email: prospectus@citi.com or telephone:

1-800-831-9146; J.P. Morgan Securities LLC, 383 Madison Avenue, New

York, New York 10179, Attention: Investment Grade Syndicate Desk,

3rd Floor, telephone collect at 1-212-834-4533; and Wells Fargo

Securities, LLC, 608 2nd Avenue South, Suite 1000, 608 2nd Avenue

South, Suite 1000, Minneapolis, Minnesota 55402, Attention: WFS

Customer Service, email: wfscustomerservice@wellsfargo.com or

telephone: 1-800-645-3751. Electronic copies of the preliminary

prospectus supplement and accompanying prospectus are also

available on the SEC’s web site at www.sec.gov.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Cencora

Cencora is a leading global pharmaceutical solutions

organization centered on improving the lives of people and animals

around the world. We partner with pharmaceutical innovators across

the value chain to facilitate and optimize market access to

therapies. Care providers depend on us for the secure, reliable

delivery of pharmaceuticals, healthcare products, and solutions.

Our 46,000+ worldwide team members contribute to positive health

outcomes through the power of our purpose: We are united in our

responsibility to create healthier futures. Cencora is ranked #10

on the Fortune 500 and #24 on the Global Fortune 500 with more than

$290 billion in annual revenue.

Cencora’s Cautionary Note Regarding

Forward-Looking Statements

Certain of the statements contained in this press release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Securities

Exchange Act”). Words such as “aim,” “anticipate,” “believe,”

“can,” “continue,” “could,”, “estimate,” “expect,” “intend,” “may,”

“might,” “on track,” “opportunity,” “plan,” “possible,”

“potential,” “predict,” “project,” “seek,” “should,” “strive,”

“sustain,” “synergy,” “target,” “will,” “would” and similar

expressions are intended to identify forward-looking statements,

but the absence of these words does not mean that a statement is

not forward-looking. These statements are based on management’s

current expectations and are subject to uncertainty and changes in

circumstances and speak only as of the date hereof. These

statements are not guarantees of future performance and are based

on assumptions and estimates that could prove incorrect or could

cause actual results to vary materially from those indicated. A

more detailed discussion of the risks and uncertainties that could

cause our actual results to differ materially from those indicated

is included in the “Risk Factors” and “Management’s Discussion and

Analysis” sections in the Company’s Annual Report on Form 10-K for

the fiscal year ended September 30, 2024 and elsewhere in that

report and other reports filed by the Company pursuant to the

Securities Exchange Act. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, except as

required by the federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202365743/en/

Bennett S. Murphy Senior Vice President, Head of Investor

Relations and Treasury 610-727-3693 bennett.murphy@cencora.com

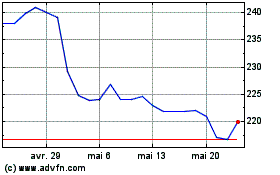

Cencora (NYSE:COR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Cencora (NYSE:COR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024