0001866175FALSE600 Travis Street,Suite 7200HoustonTexas7700200018661752024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 6, 2024

Crescent Energy Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-41132 | 87-1133610 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

|

600 Travis Street, Suite 7200 |

Houston, Texas 77002 |

| (address of principal executive offices) (zip code) |

(713) 337-4600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $0.0001 per share | | CRGY | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

As reported in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) by Crescent Energy Company (the “Company”) on July 10, 2023, as amended on a Form 8-K/A filed with the SEC on September 6, 2023, on July 3, 2023, the Company consummated the acquisition contemplated by the Purchase and Sale Agreement (the “Purchase Agreement”) dated as of May 2, 2023, by and among Javelin EF L.P. (the “Purchaser”), a subsidiary of the Company, Mesquite Comanche Holdings, LLC (“Comanche Holdings”) and SN EF Maverick, LLC (“SN EF Maverick,” and collectively with Comanche Holdings, the “Seller”), pursuant to which the Purchaser agreed to acquire from the Seller certain interests in oil and gas properties, rights and related assets (such assets, the “Western Eagle Ford Assets,” and such transactions contemplated by the Purchase Agreement, collectively, the “Western Eagle Ford Acquisition”).

This Current Report on Form 8-K provides a pro forma statement of operations of the Company, as described in Item 9.01 below and which is incorporated into this Item 2.02 by reference, giving effect to the Western Eagle Ford Acquisition as if it has been consummated on January 1, 2023. This Current Report on Form 8-K should be read in connection with the Company’s July 10 and September 6 filings referenced above, which together provide a more complete description of the Western Eagle Ford Acquisition.

In addition, to the extent required, the information contained in Item 8.01 of this Current Report on Form 8-K is incorporated into this Item 2.02 by reference.

The information contained in this Item 2.02 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item 7.01. Regulation FD Disclosure.

The information contained in Item 8.01 of this Current Report on Form 8-K is incorporated into this Item 7.01 by reference.

The information contained in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act or the Exchange Act.

Item 8.01. Other Events.

On March 6, 2024, the Company provided certain updates to potential investors, the relevant excerpts of which are set forth below.

*****

Our reserves are generally long-lived and characterized by relatively low production decline rates, affording us significant capital flexibility and an ability to efficiently hedge material quantities of future expected production. Based on forecasts used in our reserve report, our PDP reserves as of December 31, 2023 have estimated average five-year and ten-year annual decline rates of approximately 13% and approximately 12%, respectively, and an estimated 2024 PDP decline rate of approximately 19%. As a result of this overall low decline profile, we require relatively minimal capital expenditures to maintain our production and cash flows, while supporting our dividend policy. Our properties located in the Eagle Ford and Rockies represent approximately 76% of our proved reserves as of December 31, 2023, and provide us with diversification from both a regional location and commodity price perspective, which provides us certain downside protection as it relates to commodity-specific pressures, isolated infrastructure constraints or severe weather events. Our net proved standardized measure totaled $5.3 billion as of December 31, 2023. The table below illustrates the aggregate reserve volumes associated with our proved assets as of December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Area | | Net Proved Reserves(1) | | % Oil & Liquids(1) | | Net PD Reserves(1) | | 2023 Total Net Production | | SEC(1) Net PD PV-10(1)(2) | | NYMEX(3) Net PD PV-10(1)(2) |

| | (MMBoe) | | | | (MMBoe) | | (MBoe) | | (MM) | | (MM) |

| Eagle Ford | | 231 | | 73 | % | | 187 | | | 16,191 | | | $ | 2,175 | | | $ | 2,263 | |

| Rockies | | 434 | | 62 | % | | 121 | | | 23,051 | | | 1,313 | | | $ | 1,525 | |

Other(4) | | 661 | | 49 | % | | 128 | | | 15,291 | | | 887 | | | $ | 790 | |

| Total | | 1,326 | | 64 | % | | 436 | | | 54,533 | | | $ | 4,375 | | | $ | 4,578 | |

__________________

(1)Our reserves and PV-10 were determined using average first-day-of-the-month prices for the prior 12 months in accordance with guidance from the SEC. For oil and NGL volumes, the average WTI posted price of $78.22 per barrel as of December 31, 2023, was adjusted for items such as gravity, quality, local conditions, gathering, transportation fees and distance from market. For natural gas volumes, the average Henry Hub Index spot price of $2.64 per MMBtu as of December 31, 2023, was similarly adjusted for items such as quality, local conditions, gathering, transportation fees and distance from market. All prices are held constant throughout the lives of the properties. The average adjusted product prices over the remaining lives of the properties are $74.71 per barrel of oil, $2.36 per Mcf of natural gas and $27.33 per barrel of NGLs.

(2)Reflects the net proved and net PD present values reflected in our proved reserve estimates as of December 31, 2023. PV-10 is not a financial measure prepared in accordance with GAAP because it does not include the effects of income taxes on future revenues.

(3)Our NYMEX reserves and PV-10 were determined using index prices for oil and natural gas, respectively, without giving effect to derivative transactions and were calculated based on settlement prices to better reflect the market expectations as of that date, as adjusted for our estimates of quality, transportation fees, and market differentials. The NYMEX reserves calculations are based on NYMEX futures pricing at closing on January 31, 2024 for oil and natural gas. The average adjusted product prices over the remaining lives of the properties are $62.88 per barrel of oil, $3.30 per Mcf of natural gas and $22.83 per barrel of NGLs as of January 31, 2024 for Crescent Energy Company. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not a substitute, for the data presented based on SEC pricing.

(4)Includes working interest properties located in Mid-Con, Barnett, California and Permian as well as diversified minerals.

*****

As of December 31, 2023, we have identified 255 net locations as PUD drilling locations. The majority of these locations are on acreage that is held by production and, accordingly, we have limited near term lease obligations, providing us significant flexibility and valuable optionality to reinvest through development over time when asset level returns are strong. This allows us to react quickly to commodity price fluctuations.

*****

Commodity Hedging Program

A key tenet of our focused risk management effort is an active economic hedging strategy to mitigate near-term price volatility while maintaining long-term exposure to underlying commodity prices. Our hedging program limits our near-term exposure to product price volatility and allows us to protect the balance sheet and corporate returns through commodity cycles and return capital to investors. Future transactions may include price swaps whereby we will receive a fixed price for our production and pay a variable market price to the contract counterparty. Additionally, we may enter into collars, whereby we receive the excess, if any, of the fixed floor over the floating rate or pay the excess, if any of the floating rate over the fixed ceiling. As of January 31, 2024, our derivative portfolio had an aggregate notional value of approximately $1.6 billion. We determine the fair value of our oil and natural gas commodity derivatives using valuation techniques that utilize market quotes and pricing analysis. Inputs include publicly available prices and forward price curves generated from a compilation of data gathered from third parties.

The following table details our net volume positions by commodity as of January 31, 2024.

| | | | | | | | | | | | | | | | | | | | |

| Production Period | | Volumes | | Weighted Average Fixed Price |

| | (in thousands) | | | | |

| Crude oil swaps (Bbls): | | | | | | |

| WTI | | | | | | |

| 2024 | | 10,669 | | | $67.75 |

| Brent | | | | | | |

| 2024 | | 244 | | | $69.24 |

| Crude oil collars – WTI (Bbls): | | | | | | |

| 2024 | | 3,588 | | | $ | 64.62 | | — | $79.54 |

2025(1) | | 1,460 | | | $ | 60.00 | | — | $85.00 |

| Crude oil collars – Brent (Bbls): | | | | | | |

| 2024 | | 110 | | | $ | 65.00 | | — | $100.00 |

| 2025 | | 365 | | | $ | 65.00 | | — | $91.61 |

| Natural gas swaps (MMBtu): | | | | | | |

| 2024 | | 37,599 | | | $3.69 |

| Natural gas collars (MMBtu): | | | | | | |

| 2024 | | 16,750 | | | $ | 3.38 | | — | $4.56 |

| 2025 | | 58,765 | | | $ | 3.00 | | — | $6.03 |

| Crude oil basis swaps (Bbls): | | | | | | |

| 2024 | | 6,243 | | | $1.49 |

| Natural gas basis swaps (MMBtu): | | | | | | |

| 2024 | | 31,214 | | | $(0.12) |

| 2025 | | 5,037 | | | $0.32 |

| Calendar Month Average ("CMA") roll swaps (Bbls): | | | | | | |

| 2024 | | 6,248 | | | $0.36 |

| Total | | | | | | |

_________________

(1)Represents outstanding crude oil collar options exercisable by the counterparty until December 16, 2024.

*****

2024 Guidance Outlook

Crescent’s 2024 outlook is in-line with the Company’s historical focus on generating significant free cash flow, exercising prudent risk management and delivering attractive returns on investment. As a result of our ongoing evaluation of year-to-date performance, we announced that our average net daily production for the year ended December 31, 2024 is estimated to range from approximately 155 to 160 MBoe/d, which represents a 6% increase relative to 2023. Our total capital expenditures (excluding acquisitions) for the year ending December 31, 2024 is estimated to range from approximately $550 million to $625 million, which is consistent with our 2023 program and supported by a 2-3 rig development program. Maintaining capital expenditures at 2023 levels while projecting year-over-year production growth is supported by increased efficiencies from the Company’s operations. This forward-looking guidance represents our management’s estimates as of the date hereof, is based upon a number of assumptions that are inherently uncertain and is subject to numerous business, economic, competitive, financial and regulatory risks, including the risks described under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2023.

Summary reserve data based on NYMEX pricing

The following table provides our historical reserves, PV-0 and PV-10 as of December 31, 2023 for Crescent Energy Company using NYMEX pricing. We have included this reserve sensitivity in order to provide an additional method of presentation of the fair value of our assets and the cash flows that we expect to generate from those assets based on the market’s forward-looking pricing expectations as of January 31, 2024. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not a substitute, for the data presented based on SEC pricing. In addition, we believe strip pricing provides relevant and useful information because it is widely used by investors in our industry as a basis for comparing the relative size and value of our proved reserves to our peers and in particular addresses the impact of differentials compared with our peers. Our estimated historical reserves, PV-0 and PV-10 based on NYMEX pricing, were otherwise prepared on the same basis as our estimations based on SEC pricing reserves for the comparable period. Reserve estimates using NYMEX pricing are calculated using the internal systems of our management and have not been prepared or audited by an independent, third-party reserve engineer, but otherwise contain the same parameters, except for price and minor system differences.

| | | | | | | | |

| | Crescent Energy Company |

| | As of December 31, 2023(1) |

| Net Proved Reserves: | | |

| Oil (MBbls) | | 235,776 | |

| Natural gas (MMcf) | | 1,381,025 | |

| NGLs (MBbls) | | 102,908 | |

| Total Proved Reserves (MBoe) | | 568,856 | |

PV-0 (millions) (2) | | $ | 7,630 | |

PV-10 (millions) (2) | | $ | 4,578 | |

| Net Proved Developed Reserves: | | |

| Oil (MBbls) | | 162,947 | |

| Natural gas (MMcf) | | 1,238,762 | |

| NGLs (MBbls) | | 88,779 | |

| Total Proved Developed Reserves (MBoe) | | 458,187 | |

PV-0 (millions) (2) | | $ | 5,766 | |

PV-10 (millions) (2) | | $ | 3,804 | |

| Net Proved Undeveloped Reserves: | | |

| Oil (MBbls) | | 72,829 | |

| Natural gas (MMcf) | | 142,263 | |

| NGLs (MBbls) | | 14,129 | |

| Total Proved Undeveloped Reserves (MBoe) | | 110,669 | |

PV-0 (millions) (2) | | $ | 1,864 | |

PV-10 (millions) (2) | | $ | 774 | |

__________________

(1)Our NYMEX reserves, PV-0 and PV-10 were determined using NYMEX pricing, without giving effect to derivative transactions and were calculated based on settlement prices to better reflect the market expectations as of that date, as adjusted for our estimates of quality, transportation fees, and market differentials. The NYMEX reserves calculations are based on NYMEX pricing at closing on January 31, 2024 for oil and natural gas. The average adjusted product prices over the remaining lives of the properties are $62.88 per barrel of oil, $3.30 per Mcf of natural gas and $22.83 per barrel of NGLs as of January 31, 2024 for Crescent Energy Company. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not as a substitute, for the data presented based on SEC pricing.

(2)Present value (discounted at PV-0 and PV-10) is not a financial measure calculated in accordance with GAAP because it does not include the effects of income taxes on future net revenues. Neither PV-0 nor PV-10 represent an estimate of the fair market value of our oil and natural gas properties. Our PV-0 measurement does not provide a discount rate to estimated future cash flows. PV-0 therefore does not reflect the risk associated with future cash flow projections like PV-10 does. PV-0 should therefore only be evaluated in connection with an evaluation of our PV-10 of discounted future net cash flows. We believe that the presentation of PV-0 and PV-10 is relevant and useful to our investors about the future net cash flows of our reserves in the absence of a comparable measure such as standardized measure. We and others in our industry use PV-0 and PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities. Investors should be cautioned that neither of PV-0 and PV-10 represent an estimate of the fair market value of our proved reserves. GAAP does not prescribe any corresponding measure for PV-10 of reserves based on pricing other than SEC pricing. As a result, it is not practicable for us to reconcile our PV-10 using NYMEX pricing to standardized measure as determined in accordance with GAAP.

*****

Pro Forma Financial Statements

This Current Report on Form 8-K provides a pro forma statement of operations, as described in Item 9.01 below, which is incorporated into this Item 8.01 by reference.

Item 9.01. Financial Statements and Exhibits.

(b)Pro Forma Financial Information

The following unaudited pro forma condensed combined financial information of the Company, giving effect to the Western Eagle Ford Acquisition, attached as Exhibit 99.1 hereto:

•Unaudited Pro Forma Condensed Combined Statement of Operations for the year ended December 31, 2023; and

•Notes to the Unaudited Pro Forma Condensed Combined Financial Statements.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CRESCENT ENERGY COMPANY |

| Date: March 6, 2024 | | |

| By: | /s/ Bo Shi |

| Name: | Bo Shi |

| Title: | General Counsel |

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

On July 3, 2023, Javelin EF L.P. (the “Purchaser”), a subsidiary of Crescent Energy Company ("Crescent" or the "Company"), consummated the acquisition contemplated by the Purchase and Sale Agreement (the “Western Eagle Ford Acquisition Agreement”), dated as of May 2, 2023, with Mesquite Comanche Holdings, LLC (“Comanche Holdings”) and SN EF Maverick, LLC (“SN EF Maverick,” and together with Comanche Holdings, the “Seller”), pursuant to which the Purchaser acquired from the Seller certain interests in oil and gas properties, rights and related assets in the Western Eagle Ford basin (the “July Western Eagle Ford Assets”) for aggregate cash consideration of $592.7 million, including capitalized transaction costs and certain final settlement statement adjustments (the “July Western Eagle Ford Acquisition”). The cash purchase price was funded by borrowings under the Revolving Credit Facility (the “Acquisition Borrowings”), which represented the purchase price, after purchase price adjustments less a $60.0 million deposit funded by borrowings under the Revolving Credit Facility made at signing on May 2, 2023 (the “Acquisition Deposit”).

The unaudited pro forma condensed combined statement of operations (the “pro forma statement of operations”) has been prepared from the historical consolidated financial statements of Crescent for the year ended December 31, 2023 and the statement of revenues and direct operating expenses of the July Western Eagle Ford Assets for the period from January 1, 2023 through July 2, 2023, adjusted to give effect to the July Western Eagle Ford Acquisition as if it had been consummated on January 1, 2023.

The following pro forma statement of operations is based on, and should be read in conjunction with:

•the historical audited combined and consolidated financial statements of Crescent for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K, and

•the statement of revenues and direct operating expenses of the July Western Eagle Ford Assets for the six months ended June 30, 2023 included as Exhibit 99.1 in the Company's Current Report on Form 8-K/A dated September 6, 2023.

The pro forma statement of operations was derived by making certain transaction accounting adjustments to the historical financial statements noted above. The adjustments are based on currently available information and certain estimates and assumptions. Therefore, the actual impact of the July Western Eagle Ford Acquisition may differ from the adjustments made to the pro forma statement of operations. However, management believes that the assumptions provide a reasonable basis for presenting the significant effects for the period presented as if the July Western Eagle Ford Acquisition had been consummated earlier, and that all adjustments necessary to present fairly the pro forma statement of operations have been made. The pro forma adjustments have been made solely for the purpose of providing the unaudited pro forma statement of operations presented below.

The pro forma statement of operations and related notes are presented for illustrative purposes only and should not be relied upon as an indication of the operating results that the Company would have achieved if the Western Eagle Ford Acquisition Agreement had been entered into and the July Western Eagle Ford Acquisition had taken place on the assumed date. The pro forma statement of operations does not reflect future events that may occur after the consummation of the July Western Eagle Ford Acquisition, including, but not limited to, the anticipated realization of ongoing savings from potential operating efficiencies, asset dispositions, cost savings, or economies of scale that the Company may achieve with respect to the combined operations. As a result, future results may vary significantly from the results reflected in the pro forma statement of operations and should not be relied on as an indication of the future results of the Company.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2023

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined | |

| Revenues: | | | | | | | | |

| Oil | $ | 1,750,961 | | | $ | 109,588 | | | $ | — | | | $ | 1,860,549 | | |

| Natural gas | 371,066 | | | 17,225 | | | — | | | 388,291 | | |

| Natural gas liquids | 192,870 | | | 23,144 | | | — | | | 216,014 | | |

| Midstream and other | 67,705 | | | — | | | (6,717) | | (a) | 60,988 | | |

| Total revenues | 2,382,602 | | | 149,957 | | | (6,717) | | | 2,525,842 | | |

| Expenses: | | | | | | | | |

| Lease operating expense | 495,380 | | | 28,654 | | | — | | | 524,034 | | |

| Workover expense | 58,441 | | | — | | | — | | | 58,441 | | |

| Asset operating expense | 86,593 | | | — | | | — | | | 86,593 | | |

| Gathering, transportation and marketing | 235,153 | | | 52,540 | | | (6,717) | | (a) | 280,976 | | |

| Production and other taxes | 162,963 | | | 8,390 | | | — | | | 171,353 | | |

| Depreciation, depletion and amortization | 675,782 | | | — | | | 24,108 | | (b) | 699,890 | | |

| Impairment expense | 153,495 | | | — | | | — | | | 153,495 | | |

| Exploration expense | 9,328 | | | — | | | — | | | 9,328 | | |

| Midstream operating expense | 39,809 | | | — | | | — | | | 39,809 | | |

| General and administrative expense | 140,918 | | | — | | | — | | | 140,918 | | |

| Gain on sale of assets | — | | | — | | | — | | | — | | |

| Total expenses | 2,057,862 | | | 89,584 | | | 17,391 | | | 2,164,837 | | |

| Income (loss) from operations | 324,740 | | | 60,373 | | | (24,108) | | | 361,005 | | |

| Other income (expense): | | | | | | | | |

| Gain (loss) on derivatives | 166,980 | | | — | | | — | | | 166,980 | | |

| Interest expense | (145,807) | | | — | | | (21,093) | | (c) | (166,900) | | |

| Other income (expense) | (282) | | | — | | | — | | | (282) | | |

| Income from equity affiliates | (413) | | | — | | | — | | | (413) | | |

| Total other income (expense) | 20,478 | | | — | | | (21,093) | | | (615) | | |

| Income before taxes | 345,218 | | | 60,373 | | | (45,201) | | | 360,390 | | |

| Income tax expense | (23,227) | | | — | | | (990) | | (d) | (24,217) | | |

| Net income | 321,991 | | | 60,373 | | | (46,191) | | | 336,173 | | |

| Less: net income attributable to noncontrolling interests | (472) | | | — | | | — | | | (472) | | |

| Less: net income attributable to redeemable noncontrolling interests | (253,909) | | | — | | | (9,259) | | (e) | (263,168) | | |

| Net income attributable to Crescent Energy | $ | 67,610 | | | $ | 60,373 | | | $ | (55,450) | | | $ | 72,533 | | |

| Net income per share: | | | | | | | | |

| Class A common stock – basic | $ | 1.02 | | | | | | | $ | 1.09 | | (f) |

| Class A common stock – diluted | $ | 1.02 | | | | | | | $ | 1.09 | | (f) |

| Class B common stock – basic and diluted | $ | — | | | | | | | $ | — | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Class A common stock – basic | 66,598 | | | | | | 66,598 | |

| Class A common stock – diluted | 67,402 | | | | | | 67,402 | |

| Class B common stock – basic and diluted | 104,271 | | | | | | 104,271 | |

Notes to unaudited pro forma condensed combined statement of operations

NOTE 1 – Basis of pro forma presentation

The pro forma statement of operations has been derived from the historical financial statements of Crescent and the statement of revenues and direct operating expenses for the July Western Eagle Ford Assets. The pro forma statement of operations for the year ended December 31, 2023 gives effect to the July Western Eagle Ford Acquisition as if it occurred on January 1, 2023.

The statement of revenues and direct operating expenses for the July Western Eagle Ford Assets, which is being presented in accordance with Article 3-05 of Regulation S-X, represents an abbreviated financial statement that includes less information about the historical business associated with the July Western Eagle Ford Assets or about our current and future results as the owner of the July Western Eagle Ford Assets than full financial statements. For example, the statement of revenues and direct operating expenses does not include information about capital structure, interest expense, entity-level taxes, or depreciation, depletion and amortization and certain overhead recoveries allowed for under our joint operating agreements.

The pro forma statement of operations reflects pro forma adjustments that are based on available information and certain assumptions that management believes are reasonable. However, actual results may differ from those reflected in this statement. In management’s opinion, all adjustments known to date that are necessary to fairly present the pro forma information have been made. The pro forma statement of operations does not purport to represent what the combined entity’s results of operations would have been if the July Western Eagle Ford Acquisition had actually occurred on January 1, 2023, nor are they indicative of Crescent’s future results of operations.

This pro forma statement of operations should be read in conjunction with Crescent’s historical financial statements for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K.

NOTE 2 – Pro forma acquisition accounting

In July 2023, we consummated the acquisition contemplated by the Western Eagle Ford Acquisition Agreement, pursuant to which we acquired the July Western Eagle Ford Assets for aggregate consideration of $592.7 million, including capitalized transaction costs and certain final settlement statement adjustments. The purchase consideration was funded using Crescent's Revolving Credit Facility. The July Western Eagle Ford Acquisition was accounted for as an asset acquisition. The pro forma purchase price allocation is as follows:

| | | | | |

| (in thousands) | July Western Eagle Ford Acquisition |

| Cash consideration paid | $ | 587,346 | |

| Transaction costs incurred | 5,389 | |

| Purchase consideration | $ | 592,735 | |

| |

| Assets acquired and liabilities assumed: | |

| Oil and natural gas properties - proved | $ | 595,025 | |

| Oil and natural gas properties - unproved | 22,310 | |

| Prepaid and other current assets | 355 | |

| Accounts payable and accrued liabilities | (12,668) | |

| Asset retirement obligations | (10,541) | |

| Other liabilities | (1,746) | |

| Net assets acquired | $ | 592,735 | |

NOTE 3 – Adjustments to the pro forma statement of operations

The pro forma statement of operations has been prepared to illustrate the effect of the July Western Eagle Ford Acquisition and has been prepared for informational purposes only.

The preceding pro forma statement of operations has been prepared in accordance with Article 11 of Regulation S-X as amended by the final rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed

Businesses.” Release No. 33-10786 replaced the previous pro forma adjustment criteria with simplified requirements to depict the accounting for the transaction (“Transaction Accounting Adjustments”) and allows for supplemental disclosure of the reasonably estimable synergies and other transaction effects that have occurred or are reasonably expected to occur (“Management Adjustments”). Management has elected not to disclose Management Adjustments.

The adjustments included in the pro forma statement of operations for the year ended December 31, 2023 are as follows:

| | | | | |

(a) | Reflects the elimination of intercompany transactions for gathering, transportation and marketing between Crescent and the July Western Eagle Ford Assets. |

(b) | Reflects the pro forma depletion expense calculated in accordance with the successful efforts method of accounting for oil and gas properties totaling $24.1 million. |

(c) | Reflects the pro forma interest expense related to borrowings to fund the transaction purchase consideration of $21.1 million. |

(d) | Reflects the income tax effect of the pro forma adjustments presented. The tax rate applied to the pro forma adjustments was the estimated combined federal and state statutory rate, after the effect of noncontrolling interests, of 6.5%. The effective rate of the Company could be significantly different (either higher or lower) depending on a variety of factors. |

(e) | Reflects the impact of the allocation of net income attributable to redeemable noncontrolling interests for the portion of Crescent Energy OpCo LLC not owned by Crescent. |

(f) | Reflects the impact of the allocation of net income attributable to Crescent on the computation of basic and diluted net income (loss) per share. |

| Note that the above adjustments do not include amounts for certain overhead recoveries associated with the joint operating agreements that we expect to collect as operator of the July Western Eagle Ford Acquisition assets. |

NOTE 4 – Supplemental pro forma oil and natural gas reserves information

Oil and natural gas reserves

The following tables present the estimated pro forma combined net proved developed and undeveloped oil, natural gas, and NGLs reserves information as of December 31, 2023 for our consolidated operations, along with a summary of changes in quantities of net remaining proved reserves for the year ended December 31, 2023 for our consolidated operations. Our equity affiliates had no proved oil, natural gas, and NGL reserves as of December 31, 2022 and 2023. The estimates below are in certain instances presented on a “barrels of oil equivalent or “Boe” basis. To determine Boe in the following tables, natural gas is converted to a crude oil equivalent at the ratio of six Mcf of natural gas to one barrel of crude oil equivalent.

The pro forma oil and natural gas reserves information is not necessarily indicative of the results that might have occurred had the July Western Eagle Ford Acquisition been completed on January 1, 2023 and is not intended to be a projection of future results. Future results may vary significantly from the results reflected because of various factors, including those discussed in “Risk Factors” included in the Company’s Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Oil and Condensate (MBbls) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Proved Developed and Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 243,082 | | | 32,471 | | | — | | | 275,553 | |

| Revisions of previous estimates | | (15,501) | | | (5,691) | | | — | | | (21,192) | |

| Extensions, discoveries, and other additions | | 2,808 | | | 808 | | | — | | | 3,616 | |

| Sales of reserves in place | | (1,655) | | | (26,456) | | | 26,456 | | | (1,655) | |

| Purchases of reserves in place | | 46,018 | | | — | | | (26,456) | | | 19,562 | |

| Production | | (24,287) | | | (1,132) | | | — | | | (25,419) | |

| December 31, 2023 | | 250,465 | | | — | | | — | | | 250,465 | |

| | | | | | | | |

| Proved Developed Reserves as of: | | | | | | | | |

| December 31, 2022 | | 160,113 | | | 23,237 | | | — | | | 183,350 | |

| December 31, 2023 | | 176,546 | | | — | | | — | | | 176,546 | |

| | | | | | | | |

| Proved Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 82,969 | | | 9,234 | | | — | | | 92,203 | |

| December 31, 2023 | | 73,919 | | | — | | | — | | | 73,919 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Natural Gas (MMcf) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Proved Developed and Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 1,506,535 | | | 180,625 | | | — | | | 1,687,160 | |

| Revisions of previous estimates | | (472,337) | | | (22,660) | | | — | | | (494,997) | |

| Extensions, discoveries, and other additions | | 16,240 | | | 4,359 | | | — | | | 20,599 | |

| Sales of reserves in place | | (15,075) | | | (156,194) | | | 156,194 | | | (15,075) | |

| Purchases of reserves in place | | 271,682 | | | — | | | (156,194) | | | 115,488 | |

| Production | | (130,629) | | | (6,130) | | | — | | | (136,759) | |

| December 31, 2023 | | 1,176,416 | | | — | | | — | | | 1,176,416 | |

| | | | | | | | |

| Proved Developed Reserves as of: | | | | | | | | |

| December 31, 2022 | | 1,398,770 | | | 146,228 | | | — | | | 1,544,998 | |

| December 31, 2023 | | 1,032,578 | | | — | | | — | | | 1,032,578 | |

| | | | | | | | |

| Proved Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 107,765 | | | 34,397 | | | — | | | 142,162 | |

| December 31, 2023 | | 143,838 | | | — | | | — | | | 143,838 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | NGLs (MBbls) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Proved Developed and Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 78,621 | | | 28,177 | | | — | | | 106,798 | |

| Revisions of previous estimates | | (11,676) | | | (2,977) | | | — | | | (14,653) | |

| Extensions, discoveries, and other additions | | 1,635 | | | 695 | | | — | | | 2,330 | |

| Sales of reserves in place | | (1,774) | | | (24,894) | | | 24,894 | | | (1,774) | |

| Purchases of reserves in place | | 43,301 | | | — | | | (24,894) | | | 18,407 | |

| Production | | (8,475) | | | (1,001) | | | — | | | (9,476) | |

| December 31, 2023 | | 101,632 | | | — | | | — | | | 101,632 | |

| | | | | | | | |

| Proved Developed Reserves as of: | | | | | | | | |

| December 31, 2022 | | 66,803 | | | 22,811 | | | — | | | 89,614 | |

| December 31, 2023 | | 87,316 | | | — | | | — | | | 87,316 | |

| | | | | | | | |

| Proved Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 11,818 | | | 5,366 | | | — | | | 17,184 | |

| December 31, 2023 | | 14,316 | | | — | | | — | | | 14,316 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total (MBoe) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Proved Developed and Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 572,793 | | | 90,752 | | | — | | | 663,545 | |

| Revisions of previous estimates | | (105,901) | | | (12,445) | | | — | | | (118,346) | |

| Extensions, discoveries, and other additions | | 7,150 | | | 2,230 | | | — | | | 9,380 | |

| Sales of reserves in place | | (5,942) | | | (77,382) | | | 77,382 | | | (5,942) | |

| Purchases of reserves in place | | 134,599 | | | — | | | (77,382) | | | 57,217 | |

| Production | | (54,533) | | | (3,155) | | | — | | | (57,688) | |

| December 31, 2023 | | 548,166 | | | — | | | — | | | 548,166 | |

| | | | | | | | |

| Proved Developed Reserves as of: | | | | | | | | |

| December 31, 2022 | | 460,046 | | | 70,419 | | | — | | | 530,465 | |

| December 31, 2023 | | 435,958 | | | — | | | — | | | 435,958 | |

| | | | | | | | |

| Proved Undeveloped Reserves as of: | | | | | | | | |

| December 31, 2022 | | 112,747 | | | 20,333 | | | — | | | 133,080 | |

| December 31, 2023 | | 112,208 | | | — | | | — | | | 112,208 | |

Standardized measure of discounted future net cash flows

The following tables present the estimated pro forma standardized measure of discounted future net cash flows (the “pro forma standardized measure”) at December 31, 2023. The pro forma standardized measure information set forth below gives effect to the July Western Eagle Ford Acquisition as if it had been completed on January 1, 2023. Transaction Adjustments reflect adjustments related to the tax effects resulting from the July Western Eagle Ford Acquisition. An explanation of the underlying methodology applied, as required by SEC regulations, can be found within the historical financial statements included in the Company’s Annual Report on Form 10-K. The calculations assume the continuation of existing economic, operating and contractual conditions at December 31, 2023.

The pro forma standardized measure is not necessarily indicative of the results that might have occurred had the July Western Eagle Ford Acquisition been completed on January 1, 2023 and is not intended to be a projection of future results. Future results may vary significantly from the results reflected because of various factors, including those discussed in “Risk Factors” included in the Company’s Annual Report on Form 10-K.

The pro forma standardized measure of discounted future net cash flows relating to proved oil and natural gas reserves of our consolidated operations as of December 31, 2023 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (in thousands) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Future cash inflows | | $ | 24,267,134 | | | $ | — | | | $ | — | | | $ | 24,267,134 | |

| Future production costs | | (11,897,791) | | | — | | | — | | | (11,897,791) | |

| Future development costs (1) | | (2,713,247) | | | — | | | — | | | (2,713,247) | |

| Future income taxes | | (410,721) | | | — | | | — | | | (410,721) | |

| Future net cash flows | | 9,245,375 | | | — | | | — | | | 9,245,375 | |

| Annual discount of 10% for estimated timing | | (3,956,193) | | | — | | | — | | | (3,956,193) | |

| Standardized measure of discounted future net cash flows as of December 31, 2023 | | $ | 5,289,182 | | | $ | — | | | $ | — | | | $ | 5,289,182 | |

__________

(1) Future development costs include future abandonment and salvage costs.

Changes in standardized measure

The changes in the pro forma standardized measure of discounted future net cash flows relating to proved oil and natural gas reserves of our consolidated operations for the year ended December 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (in thousands) |

| | Crescent

(Historical) | | July Western Eagle Ford Assets

(Historical) | | Transaction Adjustments | | Crescent Pro Forma Combined |

| Balance at December 31, 2022 | | $ | 9,134,666 | | | $ | 1,160,312 | | | $ | (54,734) | | | $ | 10,240,244 | |

| Net change in prices and production costs | | (2,859,297) | | | (363,196) | | | — | | | (3,222,493) | |

| Net change in future development costs | | (141,382) | | | — | | | — | | | (141,382) | |

| Sales and transfers of oil and natural gas produced, net of production expenses | | (1,354,856) | | | (60,373) | | | — | | | (1,415,229) | |

| Extensions, discoveries, additions and improved recovery, net of related costs | | 119,025 | | | 37,122 | | | — | | | 156,147 | |

| Purchases of reserves in place | | 1,338,224 | | | — | | | (769,355) | | | 568,869 | |

| Sales of reserves in place | | (90,157) | | | (812,911) | | | 812,911 | | | (90,157) | |

| Revisions of previous quantity estimates | | (2,244,012) | | | (234,565) | | | — | | | (2,478,577) | |

| Previously estimated development costs incurred | | 301,839 | | | 29,286 | | | — | | | 331,125 | |

| Net change in taxes | | 190,444 | | | — | | | 16,651 | | | 207,095 | |

| Accretion of discount | | 960,208 | | | 116,031 | | | (5,473) | | | 1,070,766 | |

| Changes in timing and other | | (65,520) | | | 128,294 | | | — | | | 62,774 | |

| Balance at December 31, 2023 | | $ | 5,289,182 | | | $ | — | | | $ | — | | | $ | 5,289,182 | |

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity Registrant Name |

Crescent Energy Company

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41132

|

| Entity Tax Identification Number |

87-1133610

|

| Entity Address, Address Line One |

600 Travis Street,

|

| Entity Address, Address Line Two |

Suite 7200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

337-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CRGY

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001866175

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

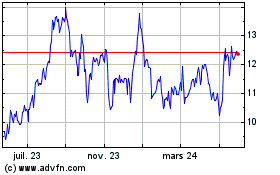

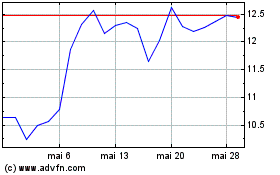

Crescent Energy (NYSE:CRGY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Crescent Energy (NYSE:CRGY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024