Filed Pursuant to Rule 424(b)(3)

Registration No. 333-277702

This preliminary prospectus supplement relates to an effective registration statement filed with the U.S. Securities and Exchange Commission, but is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell the securities described herein, and are not soliciting an offer to buy such securities, in any state or jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION DATED MARCH 6, 2024

PRELIMINARY PROSPECTUS SUPPLEMENT (to Prospectus dated March 6, 2024)

12,000,000 Shares

Crescent Energy Company

Class A Common Stock

This prospectus supplement relates to the offer and sale by the selling stockholder of up to 12,000,000 shares of Class A common stock, par value $0.0001 per share (“Class A Common Stock”), of Crescent Energy Company (the “Company,” “we,” “our” or “us”). We will not receive any of the proceeds from the sale of the shares by the selling stockholder.

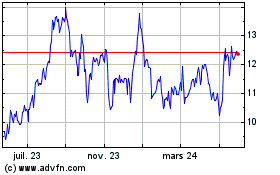

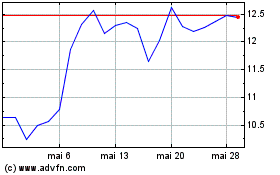

Our Class A Common Stock is traded on The New York Stock Exchange (“NYSE”) under the symbol “CRGY”. The closing price for our Class A Common Stock on March 5, 2024, was $11.93 per share, as reported on the NYSE.

Investing in our Class A Common Stock involves risks. See “Risk Factors” beginning on page S-17 of this prospectus supplement. | | | | | | | | | | | |

| Per Share | | Total |

Price to Public | $ | | $ |

Underwriting Discounts and Commissions(1) | $ | | $ |

Proceeds to the Selling Stockholder, Before Expenses | $ | | $ |

__________________

(1)See “Underwriting” for additional information regarding underwriting compensation.

The selling stockholder has granted the underwriters the option to purchase up to an additional 1,800,000 shares of Class A Common Stock on the same terms and conditions set forth above within 30 days from the date of this prospectus.

Delivery of the shares of Class A Common Stock will be made on or about , 2024.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission or other regulatory body has approved or disapproved of the Class A Common Stock to be sold hereby or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| | | | | | | | | | | |

Wells Fargo Securities | Evercore ISI | | Raymond James |

The date of this prospectus supplement is , 2024.

| | | | | | | | |

Crescent Energy Company (1) | | |

Proved Reserves at SEC Pricing | | 548.2 MMBoe |

Proved Reserves % Liquids / % Developed at SEC Pricing | | 64% / 80% |

Proved PV-10 at SEC Pricing | | $5.6 BN |

Proved PV-10 at 1/31 NYMEX Pricing (2) | | $4.6 BN |

First Year PDP Decline (%) | | 19% |

Current Operated Rigs | | 2 |

__________________

Note: As of December 31, 2023. See “Summary—Summary reserve data based on NYMEX pricing” and “Summary—Summary reserve data based on SEC pricing.”

(1)Our SEC reserves include volumes based on the report prepared by our independent reserve engineer and estimates by the Company.

(2)GAAP does not prescribe any corresponding measure for PV-10 of reserves based on pricing other than SEC Pricing. As a result, it is not practicable for us to reconcile our PV-10 using NYMEX Pricing to standardized measure as determined in accordance with GAAP.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part contains an accompanying prospectus relating to sales of shares of Class A Common Stock and other securities by Crescent Energy Company and gives more general information, some of which may not apply to this offering. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined. Unless otherwise indicated, capitalized terms used but not defined herein have the meaning assigned to them in the registration statement of which this prospectus forms a part. You should read the entire prospectus supplement, as well as the accompanying prospectus and the documents incorporated by reference that are described under “Incorporation of Certain Information by Reference” in this prospectus supplement. To the extent that any statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference herein, you should rely on the information contained in this prospectus supplement, which will be deemed to modify or supersede those made in the accompanying prospectus or documents incorporated by reference herein or therein.

You should rely only on the information included or incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus. Neither we, the underwriters, the selling stockholder nor any of our or their representatives have authorized anyone to provide you with information different from that included or incorporated by reference in this prospectus supplement and accompanying prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholder and the underwriters are offering to sell shares of Class A Common Stock and seeking offers to buy shares of Class A Common Stock only in jurisdictions where offers and sales are permitted. The information in this prospectus supplement is accurate only as of the date of this prospectus supplement, and the information in the accompanying prospectus or contained in any document incorporated by reference is accurate as of the date of such prospectus or document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any sale of the Class A Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Presentation of the Western Eagle Ford Acquisitions

On July 3, 2023, we consummated the previously announced acquisition contemplated by the Purchase and Sale Agreement (the “July Western Eagle Ford Acquisition Agreement”), dated as of May 2, 2023, with Mesquite Comanche Holdings, LLC (“Comanche Holdings”) and SN EF Maverick, LLC (“SN EF Maverick,” and together with Comanche Holdings, the “Seller”), pursuant to which we acquired from the Seller certain interests in oil and gas properties, rights and related assets in the Western Eagle Ford basin (the “July Western Eagle Ford Assets”) for aggregate cash consideration of $592.7 million, including capitalized transaction costs and certain final settlement statement adjustments (the “July Western Eagle Ford Acquisition”). The purchase price was funded by borrowings under the Revolving Credit Facility (as defined herein) in the amount of $532.7 million (the “Acquisition Borrowings”), which represented the purchase price after purchase price adjustments less a $60.0 million deposit funded by borrowings under the Revolving Credit Facility made at signing on May 2, 2023 (the “Acquisition Deposit”).

On October 2, 2023, we consummated an unrelated acquisition contemplated by the Purchase and Sale Agreement, dated as of August 22, 2023, between our subsidiary and an unaffiliated third party, pursuant to which we agreed to acquire certain incremental working interests in oil and natural gas properties (the "October Western Eagle Ford Acquisition," and together with the July Western Eagle Ford Acquisition, the "Western Eagle Ford Acquisitions") in certain of our existing Western Eagle Ford assets from the seller for aggregate cash consideration of approximately $235.1 million, including certain customary purchase price adjustments.

The Western Eagle Ford Acquisitions are reflected in our historical financial statements from July 3 and October 2, 2023, the date of each respective acquisition.

The summary unaudited pro forma financial information presented herein and the unaudited pro forma statement of operations incorporated by reference herein for the year ended December 31, 2023 give effect to the July Western Eagle Ford Acquisition as if it had been consummated on January 1, 2023. The pro forma data is presented for illustrative purposes only and should not be relied upon as an indication of the operating results that would have been achieved if the July Western Eagle Ford Acquisition had taken place on the specified date. In addition, future results may vary significantly from the results reflected in such pro forma financial and operating data and should not be relied on as an indication of future results. For additional information regarding the pro forma data included or incorporated by reference herein, see our pro forma statement of operations, together with the related notes thereto, as filed in our Current Report on Form 8-K on March 6, 2024, as incorporated by reference herein.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the “Exchange Act”). All statements, other than statements of historical facts, included or incorporated by reference herein concerning, among other things, planned capital expenditures, increases in oil, natural gas and NGL production, the number of anticipated wells to be drilled or completed after the date hereof, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other plans and objectives for future operations, are forward-looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties. Our results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, among others:

•commodity price volatility;

•our business strategy;

•our ability to identify and select possible additional acquisition and disposition opportunities;

•capital requirements and uncertainty of obtaining additional funding on terms acceptable to us;

•the impact of sales hereunder to the trading price of our Class A Common Stock;

•risks and restrictions related to our debt agreements and the level of our indebtedness;

•our reliance on KKR Energy Assets Manager LLC (the “Manager”) as our external manager;

•our hedging strategy and results;

•realized oil, natural gas and NGL prices;

•political and economic conditions and events in foreign oil, natural gas and NGL producing countries, including embargoes, continued hostilities in the Middle East, including the Israel-Hamas conflict and other sustained military campaigns, the armed conflict in Ukraine and associated economic sanctions on Russia, conditions in South America, Central America and China and acts of terrorism or sabotage;

•general economic conditions, including the impact of inflation and associated changes in monetary policy;

•the impact of central bank policy actions and disruptions in the banking industry and capital markets;

•the severity and duration of public health crises and any resultant impact on governmental actions, commodity prices, supply and demand considerations, and storage capacity;

•timing and amount of our future production of oil, natural gas and NGLs;

•a decline in oil, natural gas and NGL production, and the impact of general economic conditions on the demand for oil, natural gas and NGLs and the availability of capital;

•unsuccessful D&C activities and the possibility of resulting write downs;

•our ability to meet our proposed drilling schedule and to successfully drill wells that produce oil, natural gas and NGLs in commercially viable quantities;

•shortages of equipment, supplies, services and qualified personnel and increased costs for such equipment, supplies, services and personnel, including any delays and/or supply chain disruptions due to increased hostilities in the Middle East;

•adverse variations from estimates of reserves, production, prices and expenditure requirements, and our inability to replace our reserves through exploration and development activities;

•incorrect estimates associated with properties we acquire relating to estimated proved reserves, the presence or recoverability of estimated oil, natural gas and NGL reserves and the actual future production rates and associated costs of such acquired properties;

•hazardous, risky drilling operations, including those associated with the employment of horizontal drilling techniques, and adverse weather and environmental conditions;

•limited control over non-operated properties;

•title defects to our properties and inability to retain our leases;

•our ability to successfully develop our large inventory of undeveloped acreage;

•our ability to retain key members of our senior management and key technical employees;

•risks relating to managing our growth, particularly in connection with the integration of significant acquisitions, including the Western Eagle Ford Assets;

•risks related to the Western Eagle Ford Acquisitions, including the risk that we may fail to realize the expected benefits of the Western Eagle Ford Acquisitions;

•our ability to successfully execute our growth strategies;

•impact of environmental, occupational health and safety, and other governmental regulations, and of current or pending legislation that may negatively impact the future production of oil and natural gas or drive the substitution of renewable forms of energy for oil and natural gas;

•federal and state regulations and laws, including the Inflation Reduction Act of 2022;

•our ability to predict and manage the effects of actions of the Organization of the Petroleum Exporting Countries (“OPEC”) and agreements to set and maintain production levels, including as a result of recent production cuts by OPEC, which may be exacerbated by the increased hostilities in the Middle East;

•information technology failures or cyberattacks;

•changes in tax laws;

•effects of competition; and

•seasonal weather conditions.

We caution you that these forward-looking statements are subject to all of the risks and uncertainties incident to the development, production, gathering and sale of oil, natural gas and NGLs, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability and cost of drilling and production equipment and services, project construction delays, environmental risks, drilling and other operating risks, lack of availability or capacity of midstream gathering and transportation infrastructure, regulatory changes, the uncertainty inherent in estimating reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures and the other risks described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, incorporated herein by reference.

Reserve engineering is a process of estimating underground accumulations of hydrocarbons that cannot be measured in an exact way. The accuracy of any reserve estimates depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development program. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered.

Should one or more of the risks or uncertainties described in this prospectus supplement occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this prospectus supplement are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus supplement.

SUMMARY

This summary highlights information included elsewhere in, or incorporated by reference into, this prospectus supplement. This summary does not contain all of the information that you should consider before investing in our Class A Common Stock. You should carefully read the entire prospectus, together with the additional information described under “Information Incorporated by Reference,” before investing in our Class A Common Stock. The information presented in this prospectus supplement assumes, unless otherwise indicated, that the underwriters’ option to purchase additional shares of Class A Common Stock is not exercised. References in this prospectus supplement to the “selling stockholder” refer to the selling stockholder that is offering shares of Class A Common Stock as set forth in the section entitled “Selling Stockholder” in this prospectus supplement. Unless otherwise indicated, the estimates of our proved, probable and possible reserves as of December 31, 2023 are based primarily on a report prepared by Ryder Scott, our independent reserve engineer, a summary of which is incorporated by reference into this prospectus, which we refer to herein as our “reserve report.”

Our Company

Overview

We are a differentiated U.S. energy company committed to delivering value for shareholders through a disciplined growth through acquisition strategy and consistent return of capital. Our portfolio of low-decline, cash-flow oriented assets comprises both mid-cycle unconventional and conventional assets with a long reserve life and deep inventory of high-return development locations in the Eagle Ford and Uinta basins. Our leadership is an experienced team of investment, financial and industry professionals that combines proven investment and operating expertise. For more than a decade, we and our predecessors have executed on a consistent strategy focused on cash flow, risk management and returns. Our Class A Common Stock trades on the NYSE under the symbol “CRGY.”

Our free cash flow-focused portfolio includes a balanced set of oil and natural gas assets in proven onshore U.S. basins with substantial existing production, a low decline rate and an acreage position that is 96% held by production as of December 31, 2023. Based on forecasts used in our reserve report and the reserve reports for the Western Eagle Ford Assets, our proved developed producing (“PDP”) reserves as of December 31, 2023 have estimated average five-year and ten-year annual decline rates of approximately 13% and approximately 12%, respectively, and an estimated 2024 PDP decline rate of approximately 19%. As a result of this overall low decline profile, we require relatively minimal capital expenditures to maintain our production and cash flows while supporting our dividend policy. We have a robust inventory of attractive operated undeveloped locations, providing for optimal flexibility to maintain or grow our production base. While many operators in our industry have historically focused on the capital intensive pursuit of high production growth rates, our management team has a track record of selectively acquiring cash flow oriented assets, operating them more profitably and making disciplined, returns focused reinvestment decisions to drive free cash flow generation. Our portfolio is enhanced and complemented by our additional interests in mineral acreage and midstream infrastructure, which provide operational benefits and enhance our cash flow margins. Through the combination of our asset profile, our disciplined risk management and premier operational capabilities, we intend to generate attractive risk adjusted returns and substantial free cash flow while maintaining a commitment to low leverage and prudent risk management.

We have built a substantial portfolio of reserves, production, cash flows and reinvestment opportunities.

Our portfolio of assets:

•at December 31, 2023, consisted of 548.2 net MMBoe of proved reserves, of which approximately 64% were liquids, reflecting $5.3 billion in standardized measure and $5.6 billion and $4.4 billion in net proved and net proved developed (“PD”) present value discounted at a 10% discount rate;

•during the year ended December 31, 2023, produced 149 net MBoe/d; and

•during the year ended December 31, 2023, generated $322.0 million of net income, $935.8 million of net cash provided by operating activities, $1,022.7 million of Adjusted EBITDAX and $310.2 million of Levered Free Cash Flow.

For definitions of Adjusted EBITDAX and Levered Free Cash Flow, including reconciliations to the nearest U.S. generally accepted accounting principles (“GAAP”) measures, see “—Summary Historical and Pro Forma Financial Data—Non-GAAP Financial Measures.”

Free cash flow-focused portfolio promotes return of capital to investors

We have constructed a liquids-weighted portfolio of long-lived reserves and low decline production that generates substantial cash flow with a robust inventory of attractive undeveloped locations. We believe that the stable nature of our producing assets combined with our risk management approach, hedging strategy and low leverage profile provides us the ability to generate strong free cash flow in a variety of commodity price environments, which positions us to maintain financial strength and maximize returns while limiting downside risk and consistently return capital to our stockholders. Our asset base, which includes oil and natural gas assets in proven onshore basins such as the Eagle Ford and Rockies, is composed of producing properties with substantial production and hedged cash flow that are complemented by an extensive inventory of reinvestment opportunities on our undeveloped acreage. We believe that our producing assets will provide us with significant flexibility to maintain and grow our asset base and free cash flow through disciplined reinvestment in our portfolio of identified development opportunities. Our estimated 2024 PDP decline rate of approximately 19%, based on forecasts used in our reserve report, is substantially lower than the industry average. The low decline nature of our asset base requires minimal reinvestment to maintain our production, and provides us with significant flexibility to pursue both reinvestment opportunities within our current portfolio and strategic acquisitions. While many of our peers have historically outspent their cash flows, we have averaged a reinvestment rate, which we define as our historical capital expenditures (excluding acquisitions) over a specified period as a percentage of our historical Adjusted EBITDAX for such period, of approximately 45% of Adjusted EBITDAX since 2019. This highlights management’s capital discipline and commitment to returning capital to stockholders. Adjusted EBITDAX is a non-GAAP financial measure, as discussed further under “—Summary Historical and Pro Forma Financial Data—Non-GAAP financial measures.”

On March 4, 2024, we announced an updated return of capital framework that includes a fixed $0.12 per share quarterly dividend and a share repurchase program, which provides for the repurchase of up to $150 million of our outstanding shares of Class A Common Stock and/or OpCo Units (with the cancellation of a corresponding number of shares of Class B Common Stock). The share repurchase program will initially be focused on the repurchase of OpCo Units. Our return of capital framework is designed to deliver a reliable return of capital to our stockholders, and we believe our dividend is more stable than that of our peers as it is not impacted by capital expenditures with our dividends taking priority to reinvestment decisions and is supported by an active hedging program. Our management team has a long history of paying dividends to stockholders and Independence, our predecessor, paid dividends for nine consecutive years as a private company, through volatile commodity and market conditions and while maintaining a low leverage profile. See “Dividend Policy” and “—Recent Developments—Share Repurchase Program.”

Low-decline production base underpins free cash flow generation

Our reserves are generally long-lived and characterized by relatively low production decline rates, affording us significant capital flexibility and an ability to efficiently hedge material quantities of future expected production. Based on forecasts used in our reserve report, our PDP reserves as of December 31, 2023 have estimated average five-year and ten-year annual decline rates of approximately 13% and approximately 12%, respectively, and an estimated 2024 PDP decline rate of approximately 19%. As a result of this overall low decline profile, we require relatively minimal capital expenditures to maintain our production and cash flows, while supporting our dividend policy. Our properties located in the Eagle Ford and Rockies represent approximately 76% of our proved reserves as of December 31, 2023, and provide us with diversification from both a regional location and commodity price perspective, which provides us certain downside protection as it relates to commodity-specific pressures, isolated infrastructure constraints or severe weather events. Our net proved standardized measure totaled $5.3 billion as of

December 31, 2023. The table below illustrates the aggregate reserve volumes associated with our proved assets as of December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Area | | Net Proved Reserves(1) | | % Oil & Liquids(1) | | Net PD Reserves(1) | | 2023

Total Net

Production | | SEC(1) Net PD PV-10(1)(2) | | NYMEX(3) Net PD PV-10(1)(2) |

| | (MMBoe) | | | | (MMBoe) | | (MBoe) | | (MM) | | (MM) |

| Eagle Ford | | 231 | | 73 | % | | 187 | | | 16,191 | | | $ | 2,175 | | | $ | 2,263 | |

| Rockies | | 434 | | 62 | % | | 121 | | | 23,051 | | | 1,313 | | | $ | 1,525 | |

Other(4) | | 661 | | 49 | % | | 128 | | | 15,291 | | | 887 | | | $ | 790 | |

Total | | 1,326 | | 64 | % | | 436 | | | 54,533 | | | $ | 4,375 | | | $ | 4,578 | |

__________________

(1)Our reserves and PV-10 were determined using average first-day-of-the-month prices for the prior 12 months in accordance with guidance from the SEC. For oil and NGL volumes, the average WTI posted price of $78.22 per barrel as of December 31, 2023, was adjusted for items such as gravity, quality, local conditions, gathering, transportation fees and distance from market. For natural gas volumes, the average Henry Hub Index spot price of $2.64 per MMBtu as of December 31, 2023, was similarly adjusted for items such as quality, local conditions, gathering, transportation fees and distance from market. All prices are held constant throughout the lives of the properties. The average adjusted product prices over the remaining lives of the properties are $74.71 per barrel of oil, $2.36 per Mcf of natural gas and $27.33 per barrel of NGLs.

(2)Reflects the net proved and net PD present values reflected in our proved reserve estimates as of December 31, 2023. PV-10 is not a financial measure prepared in accordance with GAAP because it does not include the effects of income taxes on future revenues.

(3)Our NYMEX reserves and PV-10 were determined using index prices for oil and natural gas, respectively, without giving effect to derivative transactions and were calculated based on settlement prices to better reflect the market expectations as of that date, as adjusted for our estimates of quality, transportation fees, and market differentials. The NYMEX reserves calculations are based on NYMEX futures pricing at closing on January 31, 2024 for oil and natural gas. The average adjusted product prices over the remaining lives of the properties are $62.88 per barrel of oil, $3.30 per Mcf of natural gas and $22.83 per barrel of NGLs as of January 31, 2024 for Crescent Energy Company. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not a substitute, for the data presented based on SEC pricing. See “—Summary Reserve and Operating Data—Summary reserve data based on NYMEX pricing.”

(4)Includes working interest properties located in Mid-Con, Barnett, California and Permian as well as diversified minerals.

Attractive development opportunities

Our asset portfolio includes a robust inventory of attractive reinvestment opportunities that complement our producing assets. As a result, we have the ability to strategically allocate capital to a diverse set of drilling opportunities with the potential to maintain or grow our production and free cash flow, while being able to generate attractive risk-adjusted returns. Our development inventory is low-risk and located in proven basins with substantial well control. Our reinvestment opportunities are all located in well understood basins where we have deep operational experience, and provide us with relatively de-risked opportunities to reinvest a portion of our cash flow from our producing assets. Additionally, we strategically evaluate accretive acquisitions of oil and natural gas assets as well as certain midstream assets and minerals in targeted areas that are complementary to our underlying asset base and are supported by strong cash flow. For example, our current mineral acreage provides operational benefits and enhances our cash flow margins, generating $61.9 million of revenues less direct operating expenses for the year ended December 31, 2023.

Total identified drilling locations

As of December 31, 2023, we have identified 255 net locations as PUD drilling locations. The majority of these locations are on acreage that is held by production and, accordingly, we have limited near term lease obligations, providing us significant flexibility and valuable optionality to reinvest through development over time when asset level returns are strong. This allows us to react quickly to commodity price fluctuations.

Recent developments

Concurrent OpCo Unit Purchase

In connection with this offering, we have agreed to purchase from the selling stockholder 2,000,000 OpCo Units, at a price per OpCo Unit equal to the price per share at which the underwriters purchase shares of our Class A

Common Stock from the selling stockholder in this offering (the “Concurrent OpCo Unit Purchase”) and to cancel a corresponding number of shares of Class B Common Stock held by such selling stockholder. The total amount paid by us to the selling stockholder will be approximately $ . If the underwriters exercise their option to purchase additional shares from the selling stockholder in this offering, we intend to purchase a number of additional OpCo Units from the selling stockholder, and to cancel a corresponding number of shares of Class B Common Stock held thereby, in equal proportion to the number of additional shares of Class A Common Stock sold hereby pursuant to the underwriters’ option. This offering is not conditioned upon the completion of the Concurrent OpCo Unit Purchase, but the Concurrent OpCo Unit Purchase is conditioned upon the completion of this offering.

We intend to fund the Concurrent OpCo Unit Purchase with cash on hand.

Share Repurchase Program

Our Board of Directors authorized a stock repurchase program on March 4, 2024 with an approved limit of $150.0 million and a two-year term. All repurchased shares of Class A Common Stock are held in treasury. Repurchases may be made from time to time in the open market, in privately negotiated transactions, or by such other means as will comply with applicable state and federal securities laws. The timing of any repurchases under the share repurchase program will depend on market conditions, contractual limitations and other considerations. The program may be extended, modified, suspended or discontinued at any time, and does not obligate us to repurchase any dollar amount or number of shares.

Commodity Hedging Program

A key tenet of our focused risk management effort is an active economic hedging strategy to mitigate near-term price volatility while maintaining long-term exposure to underlying commodity prices. Our hedging program limits our near-term exposure to product price volatility and allows us to protect the balance sheet and corporate returns through commodity cycles and return capital to investors. Future transactions may include price swaps whereby we will receive a fixed price for our production and pay a variable market price to the contract counterparty. Additionally, we may enter into collars, whereby we receive the excess, if any, of the fixed floor over the floating rate or pay the excess, if any of the floating rate over the fixed ceiling. As of January 31, 2024, our derivative portfolio had an aggregate notional value of approximately $1.6 billion. We determine the fair value of our oil and natural gas commodity derivatives using valuation techniques that utilize market quotes and pricing analysis. Inputs include publicly available prices and forward price curves generated from a compilation of data gathered from third parties.

The following table details our net volume positions by commodity as of January 31, 2024.

| | | | | | | | | | | | | | | | | | | | |

| Production Period | | Volumes | | Weighted Average Fixed Price |

| | (in thousands) | | | | |

| Crude oil swaps (Bbls): | | | | | | |

| WTI | | | | | | |

| 2024 | | 10,669 | | | $67.75 |

| Brent | | | | | | |

| 2024 | | 244 | | | $69.24 |

| Crude oil collars – WTI (Bbls): | | | | | | |

| 2024 | | 3,588 | | | $ | 64.62 | | — | | $ | 79.54 | |

2025(1) | | 1,460 | | | $ | 60.00 | | — | | $ | 85.00 | |

| Crude oil collars – Brent (Bbls): | | | | | | |

| 2024 | | 110 | | | $ | 65.00 | | — | | $ | 100.00 | |

| 2025 | | 365 | | | $ | 65.00 | | — | | $ | 91.61 | |

| Natural gas swaps (MMBtu): | | | | | | |

| 2024 | | 37,599 | | | $3.69 |

| Natural gas collars (MMBtu): | | | | | | |

| 2024 | | 16,750 | | | $ | 3.38 | | — | | $ | 4.56 | |

| 2025 | | 58,765 | | | $ | 3.00 | | — | | $ | 6.03 | |

| Crude oil basis swaps (Bbls): | | | | | | |

| 2024 | | 6,243 | | | $1.49 |

| Natural gas basis swaps (MMBtu): | | | | | | |

| 2024 | | 31,214 | | | $(0.12) |

| 2025 | | 5,037 | | | $0.32 |

| Calendar Month Average ("CMA") roll swaps (Bbls): | | | | | | |

| 2024 | | 6,248 | | | $0.36 |

| Total | | | | | | |

_______________

(1) Represents outstanding crude oil collar options exercisable by the counterparty until December 16, 2024.

2024 Guidance Outlook

Crescent’s 2024 outlook is in-line with the Company’s historical focus on generating significant free cash flow, exercising prudent risk management and delivering attractive returns on investment. As a result of our ongoing evaluation of year-to-date performance , we announced that our average net daily production for the year ended December 31, 2024 is estimated to range from approximately 155 to 160 MBoe/d, which represents a 6% increase relative to 2023. Our total capital expenditures (excluding acquisitions) for the year ending December 31, 2024 is estimated to range from approximately $550 million to $625 million, which is consistent with our 2023 program and supported by a 2-3 rig development program. Maintaining capital expenditures at 2023 levels while projecting year-over-year production growth is supported by increased efficiencies from the Company’s operations. This forward-looking guidance represents our management’s estimates as of the date of this prospectus supplement, is based upon a number of assumptions that are inherently uncertain and is subject to numerous business, economic, competitive, financial and regulatory risks, including the risks described under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus supplement and in the documents incorporated herein by reference.

Our Relationship with the KKR Group

On December 7, 2021, in connection with the closing of the Merger Transactions, we entered into the management agreement (the “Management Agreement”), dated as of December 7, 2021, by and between us and the Manager, that engages the Manager to provide certain management and investment advisory services to Crescent

Energy Company and its subsidiaries, including us. Our management team provides services to us pursuant to the Management Agreement.

The Manager is an indirect subsidiary of KKR and a part of the KKR Group. The KKR Group is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions.

Pursuant to the Management Agreement, the Manager has agreed to provide us with management services, including senior members of our full executive and corporate management teams, and other assistance, including with respect to strategic planning, risk management, identifying and screening potential acquisitions, identifying and analyzing sustainability issues and providing such other assistance as we may require. Furthermore, entities affiliated with the KKR Group invested in the predecessor of Crescent Energy Company, helped found the strategy we have employed since 2011 and continue to hold a significant investment in our company.

Through our integration with the KKR Group’s global platform, we believe that we benefit from: the power of the “KKR” brand; KKR Global Macro and Asset Allocation, which assists with assessing the impact of macroeconomic factors on potential investments and helps identify market opportunities; KKR Capital Markets, which assists with optimizing the capital structure of investments and underwrites and arranges debt, equity and other forms of financing for both KKR portfolio companies and independent clients; KKR Public Affairs, which, together with the KKR Global Institute, provides insight into public policy, government and regulatory affairs, including experience working with key stakeholders, such as labor unions, industry and trade associations and non-governmental organizations, and sustainability issues and opportunities; and KKR Capstone, which creates value by assisting with due diligence and identifying and delivering sustainable operational performance improvements within the KKR Group’s portfolio companies.

For additional information regarding our Management Agreement and our relationship with the KKR Group, see “Item 1A, Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated herein by reference.

The following diagram displays our simplified ownership structure, as of December 31, 2023 and after giving effect to this offering and the Concurrent OpCo Unit Purchase, assuming that the underwriters do not exercise their option to purchase additional shares:

__________________

(1)The shares of Class A Common Stock to be sold by the selling stockholder, a Former Independence Owner, represent the shares of Class A Common Stock to be issued upon redemption of an equivalent number of OpCo Units and cancellation of a corresponding number of shares of Class B Common Stock immediately prior to the closing of this offering. See “Selling Stockholder.”

(2)Guarantors under the Revolving Credit Facility and Senior Notes.

The Offering

| | | | | | | | |

Class A Common Stock offered by the selling stockholder | | 12,000,000 shares (or 13,800,000 shares if the underwriters exercise their option to purchase additional shares in full). All of such shares represent shares of Class A Common Stock to be issued to the selling stockholder upon redemption of an equivalent number of OpCo Units and the cancellation of a corresponding number of shares of Class B Common Stock immediately prior to the closing of this offering. See “Selling Stockholder.” |

| | |

Class A Common Stock outstanding immediately after this offering | | 103,608,800 shares (or 105,408,800 shares if the underwriters exercise their option to purchase additional shares in full). |

| | |

Class B Common Stock outstanding immediately after this offering and the Concurrent OpCo Unit Purchase | | 74,048,124 shares (or 71,948,124 shares if the underwriters exercise their option to purchase additional shares in full). Shares of our Class B Common Stock are non-economic. In connection with any redemption of OpCo Units pursuant to the Redemption Right (as defined below) or acquisition pursuant to our call right, the corresponding number of shares of Class B Common Stock will be cancelled. |

| | |

Shares held by the selling stockholder immediately after this offering and the Concurrent OpCo Unit Purchase | | 37,234,496 shares of Class B Common Stock (or 35,134,496 shares of Class B Common Stock if the underwriters exercise their option to purchase additional shares in full). See “Selling Stockholder.” |

| | |

Voting power of Class A Common Stock after giving effect to this offering and the Concurrent OpCo Unit Purchase | | 58.3% (or 59.4% if the underwriters exercise their option to purchase additional shares in full). |

| | |

Voting power of Class B Common Stock after giving effect to this offering and the Concurrent OpCo Unit Purchase | | 41.7% (or 40.6% if the underwriters exercise their option to purchase additional shares in full). |

| | |

Voting rights | | Prior to the Trigger Date (as defined in the section titled “Description of Capital Stock” in the accompanying prospectus), holders of our Common Stock will not be entitled to elect directors to our Board of Directors. On and after the Trigger Date, the holders of our Common Stock will be entitled to elect directors but will not have cumulative voting rights in the election of directors. Holders of our Common Stock will otherwise be entitled to one vote per share held of record on all matters to be voted upon by the stockholders. Holders of our Class A Common Stock and Class B Common Stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. See the section titled “Description of Capital Stock” in the accompanying prospectus. |

| | |

Use of proceeds | | We will not receive any of the proceeds from the sale of shares of our Class A Common Stock by the selling stockholder in this offering (including any sales pursuant to the underwriters’ option to purchase additional shares from the selling stockholder). |

| | |

Listing and trading symbol | | Shares of our Class A Common Stock trade on the NYSE under the symbol “CRGY.” |

| | | | | | | | |

| | |

Risk factors | | You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our Class A Common Stock. |

| | |

Dividend Policy | | On March 4, 2024, our Board of Directors approved a quarterly cash dividend of $0.12 per share of Class A Common Stock, or $0.48 per share of Class A Common Stock on an annualized basis, to be paid to holders of our Class A Common Stock. The quarterly dividend will be paid on March 28, 2024 to shareholders of record as of the close of business on March 15, 2024. Our return of capital framework includes a fixed $0.12 per share quarterly dividend. Dividend payments are subject to approval by our Board of Directors, in its discretion, and will depend on our level of earnings, financial requirements, applicable law, the terms of our existing debt documents, including the credit agreement governing the Revolving Credit Facility and the indentures governing the 2026 Senior Notes and 2028 Senior Notes, respectively, and other factors deemed relevant by our Board of Directors. Please see the section titled “Dividend Policy” |

The number of shares of our Class A Common Stock and Class B Common Stock to be outstanding after this offering and the Concurrent OpCo Unit Purchase is based on the number of shares of our Class A Common Stock and Class B Common Stock, respectively, outstanding as of December 31, 2023 and excludes 3,338,550 shares of Class A Common Stock reserved for issuance under our 2021 Equity Incentive Plan as of December 31, 2021, any shares of Class A Common Stock issuable under the 2021 Manager Incentive Plan, and any shares of Class A Common Stock issuable pursuant to the Management Agreement. See “Item 12. Security Ownership of Certain Beneficial Owner and Management and Related Stockholder Matters—Equity Compensation Plan Information” and “Items 1 and 2. Business and Properties—Management Agreement” in our Annual Report on Form 10-K for the year ended December 31, 2023 incorporated herein by reference for more information.

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL DATA

The following table shows our summary historical financial data for each of the periods indicated. The summary historical financial data as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021 were derived from the audited combined and consolidated financial statements of Crescent Energy Company incorporated by reference herein. The Western Eagle Ford Acquisitions are reflected in our historical financial statements from July 3 and October 2, 2023, the date of each respective acquisition.

The summary pro forma financial data for the year ended December 31, 2023 were derived from the unaudited pro forma condensed combined and consolidated statement of operations incorporated by reference herein, which has been prepared from the respective historical consolidated statement of operations of Crescent Energy Company for the year ended December 31, 2023 and the statement of revenues and direct operating expenses of the July Western Eagle Ford Assets for the period from January 1, 2023 through July 2, 2023. The unaudited pro forma statement of operations for the year ended December 31, 2023 gives effect to the July Western Eagle Ford Acquisition as if it had occurred on January 1, 2023. See our Current Report on Form 8-K filed on March 6, 2024, incorporated by reference herein.

Neither the historical nor pro forma results of Crescent Energy Company are necessarily indicative of future operating results. The summary financial data presented below are qualified in their entirety by reference to, and should be read in conjunction with, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference in this prospectus supplement and the historical financial statements and pro forma statement of operations and related notes incorporated by reference in this prospectus supplement.

| | | | | | | | | | | | | | | | | | | | | | | |

| Historical | | Pro Forma |

| Year Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2021 | | 2023 |

| (in thousands) |

Statement of operations data: | | | | | | | |

Revenues and other operating income | | | | | | | |

Oil | $ | 1,750,961 | | | $ | 1,969,070 | | | $ | 883,087 | | | $ | 1,860,549 | |

Natural gas | 371,066 | | | 766,962 | | | 354,298 | | | 388,291 | |

Natural gas liquids | 192,870 | | | 268,192 | | | 185,530 | | | 216,014 | |

Midstream and other | 67,705 | | | 52,841 | | | 54,062 | | | 60,988 | |

Total revenues | 2,382,602 | | | 3,057,065 | | | 1,476,977 | | | 2,525,842 | |

Expenses | | | | | | | |

Lease operating expense | 495,380 | | | 438,753 | | | 243,501 | | | 524,034 | |

Workover expense | 58,441 | | | 66,864 | | | 10,842 | | | 58,441 | |

Asset operating expense | 86,593 | | | 78,709 | | | 45,940 | | | 86,593 | |

Gathering, transportation and marketing | 235,153 | | | 177,078 | | | 187,059 | | | 280,976 | |

Production and other taxes | 162,963 | | | 238,381 | | | 108,992 | | | 171,353 | |

Depreciation, depletion, and amortization | 675,782 | | | 532,926 | | | 312,787 | | | 699,890 | |

Impairment expense | 153,495 | | | 142,902 | | | — | | | 153,495 | |

Exploration expense | 9,328 | | | 3,425 | | | 1,180 | | | 9,328 | |

Midstream and other operating expense | 39,809 | | | 13,513 | | | 13,389 | | | 39,809 | |

General and administrative expense | 140,918 | | | 84,990 | | | 78,342 | | | 140,918 | |

Gain on sale of assets | — | | | (4,641) | | | (8,794) | | | — | |

Total expenses | 2,057,862 | | | 1,772,900 | | | 993,238 | | | 2,164,837 | |

Income from operations | 324,740 | | | 1,284,165 | | | 483,739 | | | 361,005 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Historical | | Pro Forma |

| Year Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2021 | | 2023 |

| (in thousands) |

Other income (expense) | | | | | | | |

Interest expense | (145,807) | | | (95,937) | | | (50,740) | | | (166,900) | |

Gain (loss) on derivatives(1) | 166,980 | | | (676,902) | | | (866,020) | | | 166,980 | |

Income from equity affiliates | (413) | | | 4,616 | | | 368 | | | (413) | |

Other income (expense) | (282) | | | 949 | | | 120 | | | (282) | |

Total other income (expense) | 20,478 | | | (767,274) | | | (916,272) | | | (615) | |

Income (loss) before income taxes | 345,218 | | | 516,891 | | | (432,533) | | | 360,390 | |

Income tax benefit (expense) | (23,227) | | | (36,291) | | | 306 | | | (24,217) | |

Net income (loss) | 321,991 | | | 480,600 | | | (432,227) | | | 336,173 | |

Less: net loss attributable to Predecessor | — | | | — | | | 339,168 | | | — | |

Less: net (income) loss attributable to noncontrolling interests | (472) | | | (2,669) | | | 14,922 | | | (472) | |

Less: net (income) loss attributable to redeemable noncontrolling interests | (253,909) | | | (381,257) | | | 58,761 | | | (263,168) | |

Net income (loss) attributable to Crescent Energy | $ | 67,610 | | | $ | 96,674 | | | $ | (19,376) | | | $ | 72,533 | |

Balance sheet data (at period end): | | | | | | | |

Cash and cash equivalents | $ | 2,974 | | | $ | — | | | | | |

Property, plant and equipment, net | 6,115,826 | | | 5,437,770 | | | | | |

Total assets | 6,803,335 | | | 6,019,849 | | | | | |

Total debt | 1,694,375 | | | 1,247,558 | | | | | |

Total liabilities | 3,167,617 | | | 2,720,855 | | | | | |

Redeemable noncontrolling interests | 1,901,208 | | | 2,436,703 | | | | | |

Total equity | 1,734,510 | | | 862,291 | | | | | |

Net cash provided by (used in): | | | | | | | |

Operating activities | $ | 935,769 | | | $ | 1,012,372 | | | $ | 233,147 | | | |

Investing activities | (1,398,800) | | | (1,124,344) | | | (244,595) | | | |

Financing activities | 456,456 | | | (7,841) | | | 105,145 | | | |

Non-GAAP financial measures(2): | | | | | | | |

Adjusted EBITDAX | $ | 1,022,748 | | | $ | 1,167,248 | | | $ | 520,051 | | | $ | 1,083,121 | |

Levered Free Cash Flow | 310,204 | | | 434,052 | | | 276,670 | | | 348,494 | |

__________________

(1)Realized loss on commodity derivatives for the year ended December 31, 2021 includes non-recurring early settlement of derivative contracts.

(2)See “—Non-GAAP financial measures” for definitions of Adjusted EBITDAX and Levered Free Cash Flow and reconciliations to the nearest comparable GAAP metric.

Non-GAAP financial measures

Adjusted EBITDAX

We define Adjusted EBITDAX as net income (loss) before interest expense, realized loss on interest rate derivatives, income tax expense (benefit), depreciation, depletion and amortization, exploration expense, non-cash gain (loss) on derivatives, impairment expense, non-cash equity-based compensation expense, (gain) loss on sale of assets, other (income) expense, transaction and nonrecurring expenses and early settlement of derivative contracts. Additionally, we further subtract certain redeemable noncontrolling interest distributions made by OpCo related to

Manager Compensation and settlement of acquired derivative contracts. As consideration for the services rendered pursuant to the Management Agreement and the Manager’s overhead, including compensation of the executive management team (as further discussed under “—Our Relationship with the KKR Group”), the Manager is entitled to receive compensation (“Manager Compensation”) equal to an amount per annum representing our pro rata portion (based on our relative ownership of OpCo) of $55.5 million.

Adjusted EBITDAX is not a measure of performance as determined by GAAP. We believe Adjusted EBITDAX is a useful performance measure because it allows for an effective evaluation of our operating performance when compared against our peers, without regard to our financing methods, corporate form or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDAX because these amounts can vary substantially within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income (loss) as determined in accordance with GAAP, of which such measure is the most comparable GAAP measure. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax burden, as well as the historic costs of depreciable assets, none of which are reflected in Adjusted EBITDAX. Our presentation of Adjusted EBITDAX should not be construed as an inference that our results will be unaffected by unusual or nonrecurring items. Our computations of Adjusted EBITDAX may not be identical to other similarly titled measures of other companies. In addition, the Revolving Credit Facility and Senior Notes include a calculation of Adjusted EBITDAX for purposes of covenant compliance.

Levered Free Cash Flow

We define Levered Free Cash Flow as Adjusted EBITDAX less interest expense, excluding non-cash deferred financing cost amortization, realized loss on interest rate derivatives, current income tax expense, tax-related redeemable noncontrolling interest distributions made by OpCo and development of oil and natural gas properties. Levered Free Cash Flow does not take into account amounts incurred on acquisitions.

Levered Free Cash Flow is not a measure of liquidity as determined by GAAP. Levered Free Cash Flow is a supplemental non-GAAP liquidity measure that is used by our management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. We believe Levered Free Cash Flow is a useful liquidity measure because it allows for an effective evaluation of our operating and financial performance and the ability of our operations to generate cash flow that is available to reduce leverage or distribute to our equity holders. Levered Free Cash Flow should not be considered as an alternative to, or more meaningful than, Net cash flow provided by operating activities as determined in accordance with GAAP, of which such measure is the most comparable GAAP measure, or as an indicator of actual liquidity, operating performance or investing activities. Our computations of Levered Free Cash Flow may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDAX and Levered Free Cash Flow should be read in conjunction with the information contained in Crescent Energy Company’s combined and consolidated financial statements prepared in accordance with GAAP. The following table presents a reconciliation of Adjusted EBITDAX and Levered Free Cash Flow to net income (loss), the most directly comparable financial measure calculated in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Historical | | Pro Forma |

| Year Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2021 | | 2023 |

| (in thousands) |

Net income (loss) | $ | 321,991 | | | $ | 480,600 | | | $ | (432,227) | | | $ | 336,173 | |

Adjustments to reconcile to Adjusted EBITDAX: | | | | | | | |

Interest expense | 145,807 | | | 95,937 | | | 50,740 | | | 166,900 | |

Realized loss on interest rate derivatives | — | | | — | | | 7,373 | | | — | |

Income tax expense (benefit) | 23,227 | | | 36,291 | | | (306) | | | 24,217 | |

Depreciation, depletion and amortization | 675,782 | | | 532,926 | | | 312,787 | | | 699,890 | |

Exploration expense | 9,328 | | | 3,425 | | | 1,180 | | | 9,328 | |

Non-cash (gain) loss on derivatives | (320,714) | | | (102,358) | | | 330,368 | | | (320,714) | |

Impairment expense | 153,495 | | | 142,902 | | | — | | | 153,495 | |

Non-cash equity-based compensation expense | 82,936 | | | 38,063 | | | 39,919 | | | 82,936 | |

(Gain) loss on sale of assets | — | | | (4,641) | | | (8,794) | | | — | |

Other (income) expense | 282 | | | (949) | | | (120) | | | 282 | |

Certain redeemable noncontrolling interest distributions made by OpCo related to Manager Compensation | (30,563) | | | (39,070) | | | (2,706) | | | (30,563) | |

Transaction and nonrecurring expenses(1) | 22,632 | | | 34,051 | | | 23,149 | | | 22,632 | |

Early settlement of derivative contracts(2) | — | | | — | | | 198,688 | | | — | |

Settlement of acquired derivative contracts(3) | (61,455) | | | (49,929) | | | — | | | (61,455) | |

Adjusted EBITDAX (non- GAAP) | $ | 1,022,748 | | | $ | 1,167,248 | | | $ | 520,051 | | | $ | 1,083,121 | |

Adjustments to reconcile to Levered Free Cash Flow: | | | | | | | |

Interest expense, excluding non-cash deferred financing cost amortization | (132,981) | | | (87,043) | | | (40,551) | | | (154,074) | |

Realized loss on interest rate derivatives | — | | | — | | | (7,373) | | | — | |

Current income tax (expense) | (494) | | | (3,113) | | | (629) | | | (1,484) | |

Tax-related redeemable noncontrolling interest (distributions) made by OpCo | (753) | | | (18,160) | | | — | | | (753) | |

Development of oil and natural gas properties | (578,316) | | | (624,880) | | | (194,828) | | | (578,316) | |

Levered Free Cash Flow (non-GAAP) | $ | 310,204 | | | $ | 434,052 | | | $ | 276,670 | | | $ | 348,494 | |

__________________

(1)Transaction and nonrecurring expenses of $22.6 million during the year ended December 31, 2023 were primarily related to the Western Eagle Ford Acquisitions and the Merger Transactions. Transaction and nonrecurring expenses of $34.1 million during the year ended December 31, 2022 were primarily related to (i) legal, consulting, transition service agreement costs, related restructuring of acquired derivative contracts and other fees incurred for the Uinta Acquisition and Merger Transactions, (ii) severance costs subsequent to the Merger Transactions, (iii) merger integration costs and (iv) acquisition and debt transaction related costs. Transaction and nonrecurring expenses of $23.1 million during the year ended December 31, 2021 were primarily related to legal, consulting and other fees incurred for the Carve-out, the April 2021 Exchange and the Merger Transactions.

(2)Represents the settlement in June 2021 of certain outstanding derivative oil commodity contracts for open positions associated with calendar years 2022 and 2023. Subsequent to the settlement, we entered into new commodity derivative contracts at prevailing market prices.

(3)Represents the settlement of certain oil commodity derivative contracts acquired in connection with the Uinta Acquisition.

Summary reserve and operating data

Summary reserve data

The following tables summarize our estimated net proved reserves as of December 31, 2023. For more information regarding our reserve volume and values, see “Items 1 and 2. Business and Properties—Oil, Natural Gas and NGL Reserve Data” in our Annual Report on Form 10-K for the year ended December 31, 2023, incorporated by reference herein.

Summary reserve data based on SEC Pricing

The following table provides our historical reserves, PV-0 and PV-10 as of December 31, 2023 for Crescent Energy Company prepared in accordance with SEC guidelines. The reserve estimates presented with respect to Crescent Energy Company in the tables below are based primarily on a reserve report prepared by Ryder Scott. In preparing its report, Ryder Scott evaluated properties representing approximately 98% of our total proved reserves as of December 31, 2023. Our internal technical staff evaluated the remaining properties.

| | | | | |

| As of December 31, 2023 (1) |

Net Proved Reserves: | |

Oil (MBbls) | 250,465 | |

Natural gas (MMcf) | 1,176,416 | |

NGLs (MBbls) | 101,632 | |

Total Proved Reserves (MBoe) | 548,166 | |

Standardized Measure (millions) (2) | $ | 5,289 | |

PV-0 (millions) (2) | $ | 9,656 | |

PV-10 (millions) (2) | $ | 5,566 | |

Net Proved Developed Reserves: | |

Oil (MBbls) | 176,546 | |

Natural gas (MMcf) | 1,032,578 | |

NGLs (MBbls) | 87,316 | |

Total Proved Developed Reserves (MBoe) | 435,958 | |

PV-0 (millions) (2) | $ | 7,010 | |

PV-10 (millions) (2) | $ | 4,375 | |

Net Proved Undeveloped Reserves: | |

Oil (MBbls) | 73,919 | |

Natural gas (MMcf) | 143,838 | |

NGLs (MBbls) | 14,316 | |

Total Proved Undeveloped Reserves (MBoe) | 112,208 | |

PV-0 (millions) (2) | $ | 2,646 | |

PV-10 (millions) (2) | $ | 1,191 | |

__________________

(1)Our reserves, PV-0 and PV-10 were determined using SEC pricing. For oil and NGL volumes, the average WTI posted price of $78.22 per barrel as of December 31, 2023, was adjusted for items such as gravity, quality, local conditions, gathering, transportation fees and distance from market. For natural gas volumes, the average Henry Hub Index spot price of $2.64 per MMBtu as of December 31, 2023, was similarly adjusted for items such as quality, local conditions, gathering, transportation fees and distance from market. All prices are held constant throughout the lives of the properties. The average adjusted product prices over the remaining lives of the properties are $74.71 per barrel of oil, $2.36 per Mcf of natural gas and $27.33 per barrel of NGLs as of December 31, 2023.

(2)Present value (discounted at PV-0 and PV-10) is not a financial measure calculated in accordance with GAAP because it does not include the effects of income taxes on future net revenues. None of PV-0, PV-10 and standardized measure represent an estimate of the fair market value of our oil and natural gas properties or our proved reserves. Our PV-0 measurement does not provide a discount rate to estimated future cash flows. PV-0 therefore does not reflect the risk associated with future cash flow projections like PV-10 does. PV-0 should therefore only be evaluated in connection with an evaluation of our PV-10 and standardized measure. We believe that the presentation of

PV-0 and PV-10 is relevant and useful to investors as supplemental disclosure to standardized measure because they present future net cash flows attributable to our reserves, prior to taking into account future income taxes and our current tax structure. For Crescent Energy Company, the PV-0 and PV-10 income tax amounts included in standardized measure but not included in PV-0 and PV-10 were $410.7 million and $276.8 million, respectively. We and others in our industry use PV-0 and PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities.

Summary reserve data based on NYMEX pricing

The following table provides our historical reserves, PV-0 and PV-10 as of December 31, 2023 for Crescent Energy Company using NYMEX pricing. We have included this reserve sensitivity in order to provide an additional method of presentation of the fair value of our assets and the cash flows that we expect to generate from those assets based on the market’s forward-looking pricing expectations as of January 31, 2024. The historical 12-month pricing average in our 2023 disclosures under the heading “—Summary reserve data based on SEC pricing” does not reflect the oil and natural gas futures. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not a substitute, for the data presented based on SEC pricing. In addition, we believe strip pricing provides relevant and useful information because it is widely used by investors in our industry as a basis for comparing the relative size and value of our proved reserves to our peers and in particular addresses the impact of differentials compared with our peers. Our estimated historical reserves, PV-0 and PV-10 based on NYMEX pricing, were otherwise prepared on the same basis as our estimations based on SEC pricing reserves for the comparable period. Reserve estimates using NYMEX pricing are calculated using the internal systems of our management and have not been prepared or audited by an independent, third-party reserve engineer, but otherwise contain the same parameters, except for price and minor system differences.

| | | | | |

| As of December 31, 2023(1) |

Net Proved Reserves: | |

Oil (MBbls) | 235,776 | |

Natural gas (MMcf) | 1,381,025 | |

NGLs (MBbls) | 102,908 | |

Total Proved Reserves (MBoe) | 568,856 | |

PV-0 (millions) (2) | $ | 7,630 | |

PV-10 (millions) (2) | $ | 4,578 | |

Net Proved Developed Reserves: | |

Oil (MBbls) | 162,947 | |

Natural gas (MMcf) | 1,238,762 | |

NGLs (MBbls) | 88,779 | |

Total Proved Developed Reserves (MBoe) | 458,187 | |

PV-0 (millions) (2) | $ | 5,766 | |

PV-10 (millions) (2) | $ | 3,804 | |

Net Proved Undeveloped Reserves: | |

| Oil (MBbls) | 72,829 | |

Natural gas (MMcf) | 142,263 | |

NGLs (MBbls) | 14,129 | |

Total Proved Undeveloped Reserves (MBoe) | 110,669 | |

PV-0 (millions) (2) | $ | 1,864 | |

PV-10 (millions) (2) | $ | 774 | |

__________________

(1)Our NYMEX reserves, PV-0 and PV-10 were determined using NYMEX pricing, without giving effect to derivative transactions and were calculated based on settlement prices to better reflect the market expectations as of that date, as adjusted for our estimates of quality, transportation fees, and market differentials. The NYMEX reserves calculations are based on NYMEX pricing at closing on January 31,

2024 for oil and natural gas. The average adjusted product prices over the remaining lives of the properties are $62.88 per barrel of oil, $3.30 per Mcf of natural gas and $22.83 per barrel of NGLs as of January 31, 2024 for Crescent Energy Company. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date, although we caution investors that this information should be viewed as a helpful alternative, not as a substitute, for the data presented based on SEC pricing. See “Risk factors.”

(2)Present value (discounted at PV-0 and PV-10) is not a financial measure calculated in accordance with GAAP because it does not include the effects of income taxes on future net revenues. Neither PV-0 nor PV-10 represent an estimate of the fair market value of our oil and natural gas properties. Our PV-0 measurement does not provide a discount rate to estimated future cash flows. PV-0 therefore does not reflect the risk associated with future cash flow projections like PV-10 does. PV-0 should therefore only be evaluated in connection with an evaluation of our PV-10 of discounted future net cash flows. We believe that the presentation of PV-0 and PV-10 is relevant and useful to our investors about the future net cash flows of our reserves in the absence of a comparable measure such as standardized measure. We and others in our industry use PV-0 and PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities. Investors should be cautioned that neither of PV-0 and PV-10 represent an estimate of the fair market value of our proved reserves. GAAP does not prescribe any corresponding measure for PV-10 of reserves based on pricing other than SEC pricing. As a result, it is not practicable for us to reconcile our PV-10 using NYMEX pricing to standardized measure as determined in accordance with GAAP.

Summary operating data

The following table summarizes production, price and cost data for the years ended December 31, 2023, 2022 and 2021, in each case without giving effect to any pre-acquisition results of the Western Eagle Ford Acquisitions.

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | 2021 |

Net Production: | | | | | |

Oil (MBbls) | 24,287 | | | 21,865 | | | 13,237 | |

Natural gas (MMcf) | 130,629 | | | 128,470 | | | 89,455 | |

NGLs (MBbls) | 8,475 | | | 7,110 | | | 6,099 | |

Total (MBoe) | 54,533 | | | 50,387 | | | 34,245 | |

Average daily production (MBoe/d) | 149 | | | 138 | | | 94 | |

Average Realized Prices (before effects of derivatives): | | | | | |

Oil (per Bbl) | $ | 72.09 | | | $ | 90.06 | | | $ | 66.71 | |

Natural gas (per Mcf) | 2.84 | | | 5.97 | | | 3.96 | |

NGLs (per Bbl) | 22.76 | | | 37.72 | | | 30.42 | |

Average Realized Prices (after effects of derivatives): | | | | | |

Oil (per Bbl) | $ | 65.04 | | | $ | 71.98 | | | $ | 53.07 | |

Natural gas (per Mcf) | 2.83 | | | 3.42 | | | 3.06 | |

NGLs (per Bbl) | 24.95 | | | 29.70 | | | 19.15 | |

Average Operating Costs per Boe: | | | | | |

Operating expense excluding production and other tax | $ | 16.79 | | | $ | 15.38 | | | $ | 14.62 | |

Production and other tax | 2.99 | | | 4.73 | | | 3.18 | |

Depreciation, depletion, and amortization | 12.39 | | | 10.58 | | | 9.13 | |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider those risk factors described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (other than, in each case, information furnished rather than filed), which are incorporated by reference herein, together with all of the other information included in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference, in evaluating an investment in our securities. Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our Class A Common Stock could decline due to any of these risks, and, as a result, you may lose all or part of your investment. Before deciding whether to invest in our securities, you should also refer to the other information contained in or incorporated by reference into this prospectus supplement, including the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to This Offering and our Common Stock

The prevailing market price of shares of Class A Common Stock may be volatile.

The prevailing market price of shares of Class A Common Stock may fluctuate due to a variety of factors, including:

•general market conditions, including fluctuations in commodity prices and continuing or worsening inflation and related changes in monetary policy;

•our operating and financial performance;

•the number of identified drilling locations and our reserves estimates;

•quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income and revenues, capital expenditures, production, and unit costs;

•the public reaction to our press releases (including press releases relating to this offering), our other public announcements and our filings with the SEC;

•strategic actions by our competitors;

•changes in revenue or earnings estimates, or changes in recommendations or withdrawal of research coverage, by equity research analysts;

•speculation in the press or investment community;

•the failure of research analysts to cover our Class A Common Stock;

•sales of our Class A Common Stock by us or other stockholders, or the perception that such sales may occur;

•changes in accounting principles, policies, guidance, interpretations or standards;

•additions or departures of key management personnel;

•actions by our stockholders;

•domestic and international economic, geopolitical, legal and regulatory factors unrelated to our performance;

•general economic and political conditions, such as the effects of the COVID-19 pandemic, recessions, interest rates, local and national elections, fuel prices, international currency fluctuations, corruption, political instability and acts of war or terrorism, including the armed conflict in Ukraine; and

•the realization of any risks described in this “Risk Factors” section or in the “Risk Factors” section in our most recent Annual Report on Form 10-K or subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

These market and industry factors may materially reduce the prevailing market price of shares of Class A Common Stock regardless of our operating performance.

Future sales of our Class A Common Stock in the public market, or the perception that such sales may occur, could reduce the price of our Class A Common Stock, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us.

We, the selling stockholder or other holders of our Common Stock may sell additional shares of our Class A Common Stock in subsequent offerings. In addition, subject to certain limitations and exceptions, OpCo Unitholders may redeem their OpCo Units (together with a corresponding number of shares of our Class B Common Stock) for shares of our Class A Common Stock (on a one-for-one basis, subject to conversion rate adjustments for stock splits, stock dividends and reclassification and other similar transactions) and then sell those shares of our Class A Common Stock. As of December 31, 2023, we had 91,608,800 outstanding shares of Class A Common Stock and 88,048,124 outstanding shares of Class B Common Stock. Former Independence Owners, including the selling stockholder, own all of the outstanding shares of our Class B Common Stock, representing approximately 49% of our total outstanding common stock. The registration rights agreement we entered into at closing of the Merger Transactions requires us to effect the registration of their shares in certain circumstances, and this offering on behalf of the selling stockholder named herein is being conducted pursuant to such registration rights agreement.

In connection with this offering, we, our executive officers, directors and certain holders of our outstanding Common Stock (including the selling stockholder) will sign lock-up agreements with the underwriters that will, subject to certain customary exceptions, restrict the sale of the shares of our Class A Common Stock and certain other securities held by them for 60 days following the date of this prospectus. Wells Fargo Securities, LLC may, in its sole discretion and at any time without notice, release all or any portion of the shares or securities subject to the lock-up agreements. See “Underwriting” for a description of these lock-up agreements.