Deutsche Bank and First Citizens Bank Close $315.7 Million Financing for Four Texas Battery Energy Storage Projects

04 Septembre 2024 - 3:00PM

Business Wire

Deutsche Bank and First Citizens Bank announced today they

served as co-lead arrangers on a $315.7 million financing for four

battery energy storage systems in Texas. Deutsche Bank Trust

Company Americas served as Administrative Agent on the transaction.

SocGen and Siemens joined as Joint Lead Arrangers and BankUnited,

Mitsubishi HC Capital, and Bayern LB rounded out the syndicate.

All four projects are expected to be operational later this year

and collectively represent 730 MW / 1,049 MWh of capacity owned by

a battery energy storage-focused fund at UBS Asset Management.

Battery energy storage systems are increasingly seen as a key

component for supporting grid stability and reliability, as well as

for maximizing the value of renewable power generation.

“We see expanding opportunities for battery storage systems,

such as these four projects in Texas, to support the reliability

and cost-effectiveness of clean energy sources,” said Ken-Ichi

Hino, Co-head of the Energy Storage investment strategy at UBS

Asset Management. "We greatly appreciated the industry knowledge

and expertise of the First Citizens Energy Finance and Deutsche

Bank teams in helping arrange this financing."

“We are pleased to support UBS Asset Management’s storage

investment strategy within its infrastructure portfolio,” said

Jeremy Eisman, Managing Director and Head of Infrastructure &

Energy Financing at Deutsche Bank. “This financing builds upon

Deutsche Bank’s leading track record of supporting renewable

project developers at both the asset and platform level.”

“These four battery projects represent a significant addition to

the battery energy storage capacity of the Texas electrical

system,” said Mike Lorusso, who heads First Citizens Energy

Finance. “We were pleased to serve as co-lead arranger for these

important projects and to work closely with UBS Asset Management to

deliver a successful financing.”

Deutsche Bank's Infrastructure & Energy Financing group

provides structured financing solutions for clients across the

renewable, power and energy sectors.

First Citizens Energy Finance leverages its deep industry

knowledge and expertise to offer comprehensive financing solutions

for renewable and conventional power generation. The unit manages a

large, diverse portfolio that includes investments in all asset

classes across the energy sector.

About UBS Asset Management UBS Asset Management is a

large-scale asset manager with a presence in 23 markets. It offers

investment capabilities and investment styles across all major

traditional and alternative asset classes to institutions,

wholesale intermediaries and wealth management clients around the

world. It is a leading fund house in Europe, the largest mutual

fund manager in Switzerland, the second largest fund of hedge funds

manager and one of the largest real estate investment managers in

the world.

About Deutsche Bank Deutsche Bank provides retail and

private banking, corporate and transaction banking, lending, asset

and wealth management products and services as well as focused

investment banking to private individuals, small and medium-sized

companies, corporations, governments and institutional investors.

Deutsche Bank is the leading bank in Germany with strong European

roots and a global network. Discover more at db.com.

About First Citizens Bank First Citizens Bank helps

personal, business, commercial and wealth clients build financial

strength that lasts. Headquartered in Raleigh, N.C., First Citizens

has built a unique legacy of strength, stability and long-term

thinking that has spanned generations. First Citizens offers an

array of general banking services including a network of more than

500 branches and offices in 30 states; commercial banking expertise

delivering best-in-class lending, leasing and other financial

services coast to coast; innovation banking serving businesses at

every stage; and a nationwide direct bank. Parent company First

Citizens BancShares, Inc. (NASDAQ: FCNCA) is a top 20 U.S.

financial institution with more than $200 billion in assets and a

member of the Fortune 500™. Discover more at firstcitizens.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904314164/en/

MEDIA RELATIONS: Meredith Zaritheny Deutsche Bank

929.742.4613 meredith.zaritheny@db.com

John M. Moran First Citizens Bank 212-461-5507

john.moran2@firstcitizens.com

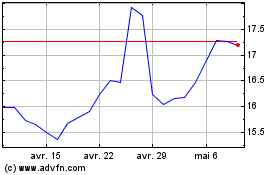

Deutsche Bank Aktiengese... (NYSE:DB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Deutsche Bank Aktiengese... (NYSE:DB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024