Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Novembre 2024 - 5:14PM

Edgar (US Regulatory)

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 1.5%

|

| Axon Enterprise, Inc.(1)

|

| 1,131

| $ 451,948

|

| Boeing Co.(1)(2)

|

| 9,288

| 1,412,147

|

| Northrop Grumman Corp.(2)

|

| 5,905

| 3,118,253

|

| RTX Corp.(2)

|

| 7,449

| 902,521

|

| Textron, Inc.(2)

|

| 11,648

| 1,031,780

|

|

|

|

| $ 6,916,649

|

| Air Freight & Logistics — 0.1%

|

| C.H. Robinson Worldwide, Inc.(2)

|

| 4,494

| $ 496,003

|

|

|

|

| $ 496,003

|

| Automobile Components — 0.0%(3)

|

| Lear Corp.(2)

|

| 1,734

| $ 189,266

|

|

|

|

| $ 189,266

|

| Automobiles — 1.4%

|

| Tesla, Inc.(1)(2)

|

| 23,797

| $ 6,226,009

|

|

|

|

| $ 6,226,009

|

| Banks — 3.8%

|

| Bank of America Corp.(2)

|

| 86,352

| $ 3,426,447

|

| Fifth Third Bancorp(2)

|

| 57,446

| 2,460,987

|

| JPMorgan Chase & Co.(2)

|

| 37,233

| 7,850,951

|

| KeyCorp(2)

|

| 50,596

| 847,483

|

| M&T Bank Corp.(2)

|

| 4,036

| 718,892

|

| PNC Financial Services Group, Inc.(2)

|

| 10,220

| 1,889,167

|

|

|

|

| $ 17,193,927

|

| Beverages — 1.7%

|

| Coca-Cola Co.(2)

|

| 50,990

| $ 3,664,141

|

| PepsiCo, Inc.(2)

|

| 24,019

| 4,084,431

|

|

|

|

| $ 7,748,572

|

| Biotechnology — 2.4%

|

| AbbVie, Inc.(2)

|

| 19,355

| $ 3,822,225

|

| Amgen, Inc.(2)

|

| 11,850

| 3,818,189

|

| Gilead Sciences, Inc.(2)

|

| 27,095

| 2,271,645

|

| Vertex Pharmaceuticals, Inc.(1)(2)

|

| 1,850

| 860,398

|

|

|

|

| $ 10,772,457

|

| Security

| Shares

| Value

|

| Broadline Retail — 4.1%

|

| Amazon.com, Inc.(1)(2)

|

| 98,987

| $ 18,444,248

|

|

|

|

| $ 18,444,248

|

| Building Products — 0.3%

|

| Johnson Controls International PLC(2)

|

| 11,083

| $ 860,152

|

| Trane Technologies PLC(2)

|

| 1,269

| 493,298

|

|

|

|

| $ 1,353,450

|

| Capital Markets — 1.5%

|

| Charles Schwab Corp.(2)

|

| 11,753

| $ 761,712

|

| S&P Global, Inc.(2)

|

| 7,711

| 3,983,657

|

| State Street Corp.(2)

|

| 23,543

| 2,082,849

|

|

|

|

| $ 6,828,218

|

| Chemicals — 1.8%

|

| AdvanSix, Inc.(2)

|

| 1,530

| $ 46,481

|

| Corteva, Inc.(2)

|

| 26,850

| 1,578,512

|

| Dow, Inc.(2)

|

| 14,210

| 776,292

|

| Eastman Chemical Co.(2)

|

| 4,673

| 523,142

|

| Linde PLC(2)

|

| 1,005

| 479,244

|

| LyondellBasell Industries NV, Class A(2)

|

| 13,836

| 1,326,873

|

| Sherwin-Williams Co.(2)

|

| 8,639

| 3,297,247

|

|

|

|

| $ 8,027,791

|

| Commercial Services & Supplies — 0.3%

|

| Waste Management, Inc.(2)

|

| 6,763

| $ 1,403,999

|

|

|

|

| $ 1,403,999

|

| Communications Equipment — 0.9%

|

| Cisco Systems, Inc.(2)

|

| 76,799

| $ 4,087,243

|

|

|

|

| $ 4,087,243

|

| Construction & Engineering — 0.3%

|

| Quanta Services, Inc.(2)

|

| 4,232

| $ 1,261,771

|

|

|

|

| $ 1,261,771

|

| Construction Materials — 0.3%

|

| Vulcan Materials Co.(2)

|

| 5,482

| $ 1,372,857

|

|

|

|

| $ 1,372,857

|

| Consumer Finance — 1.5%

|

| American Express Co.(2)

|

| 14,749

| $ 3,999,929

|

| Discover Financial Services(2)

|

| 20,166

| 2,829,088

|

|

|

|

| $ 6,829,017

|

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Consumer Staples Distribution & Retail — 1.4%

|

| Costco Wholesale Corp.(2)

|

| 2,935

| $ 2,601,936

|

| Target Corp.(2)

|

| 10,600

| 1,652,116

|

| Walmart, Inc.(2)

|

| 23,030

| 1,859,673

|

|

|

|

| $ 6,113,725

|

| Containers & Packaging — 0.5%

|

| Avery Dennison Corp.(2)

|

| 10,440

| $ 2,304,734

|

|

|

|

| $ 2,304,734

|

| Distributors — 0.3%

|

| Genuine Parts Co.(2)

|

| 8,899

| $ 1,243,012

|

|

|

|

| $ 1,243,012

|

| Diversified Telecommunication Services — 0.1%

|

| AT&T, Inc.

|

| 22,160

| $ 487,520

|

|

|

|

| $ 487,520

|

| Electric Utilities — 0.7%

|

| Edison International(2)

|

| 20,090

| $ 1,749,638

|

| Pinnacle West Capital Corp.(2)

|

| 7,168

| 635,013

|

| Xcel Energy, Inc.(2)

|

| 12,009

| 784,188

|

|

|

|

| $ 3,168,839

|

| Electrical Equipment — 0.8%

|

| Emerson Electric Co.(2)

|

| 25,293

| $ 2,766,295

|

| GE Vernova, Inc.(1)

|

| 1,014

| 258,550

|

| Generac Holdings, Inc.(1)

|

| 2,852

| 453,126

|

|

|

|

| $ 3,477,971

|

| Entertainment — 1.5%

|

| Netflix, Inc.(1)(2)

|

| 5,349

| $ 3,793,885

|

| Walt Disney Co.(2)

|

| 32,916

| 3,166,190

|

|

|

|

| $ 6,960,075

|

| Financial Services — 4.8%

|

| Berkshire Hathaway, Inc., Class B(1)(2)

|

| 20,974

| $ 9,653,493

|

| Fidelity National Information Services, Inc.(2)

|

| 25,140

| 2,105,475

|

| Mastercard, Inc., Class A(2)

|

| 12,219

| 6,033,742

|

| Visa, Inc., Class A(2)

|

| 13,804

| 3,795,410

|

|

|

|

| $ 21,588,120

|

| Food Products — 1.1%

|

| Mondelez International, Inc., Class A(2)

|

| 44,414

| $ 3,271,979

|

| Tyson Foods, Inc., Class A(2)

|

| 28,696

| 1,709,134

|

|

|

|

| $ 4,981,113

|

| Security

| Shares

| Value

|

| Ground Transportation — 1.0%

|

| Canadian Pacific Kansas City Ltd.(2)

|

| 11,700

| $ 1,000,818

|

| J.B. Hunt Transport Services, Inc.(2)

|

| 2,663

| 458,915

|

| Norfolk Southern Corp.(2)

|

| 11,072

| 2,751,392

|

| Uber Technologies, Inc.(1)

|

| 4,824

| 362,572

|

|

|

|

| $ 4,573,697

|

| Health Care Equipment & Supplies — 2.1%

|

| Abbott Laboratories(2)

|

| 36,650

| $ 4,178,466

|

| Baxter International, Inc.(2)

|

| 26,799

| 1,017,558

|

| Insulet Corp.(1)

|

| 659

| 153,382

|

| Solventum Corp.(1)

|

| 814

| 56,752

|

| Stryker Corp.(2)

|

| 9,802

| 3,541,071

|

| Zimmer Biomet Holdings, Inc.(2)

|

| 3,848

| 415,392

|

|

|

|

| $ 9,362,621

|

| Health Care Providers & Services — 2.2%

|

| CVS Health Corp.(2)

|

| 32,531

| $ 2,045,549

|

| DaVita, Inc.(1)

|

| 3,340

| 547,526

|

| UnitedHealth Group, Inc.(2)

|

| 12,816

| 7,493,259

|

|

|

|

| $ 10,086,334

|

| Hotels, Restaurants & Leisure — 2.5%

|

| Booking Holdings, Inc.(2)

|

| 870

| $ 3,664,544

|

| Carnival Corp.(1)

|

| 17,181

| 317,505

|

| Chipotle Mexican Grill, Inc.(1)(2)

|

| 18,700

| 1,077,494

|

| Marriott International, Inc., Class A(2)

|

| 5,996

| 1,490,606

|

| Marriott Vacations Worldwide Corp.(2)

|

| 2,064

| 151,663

|

| McDonald's Corp.(2)

|

| 13,981

| 4,257,354

|

| Travel & Leisure Co.(2)

|

| 9,305

| 428,774

|

|

|

|

| $ 11,387,940

|

| Household Durables — 0.6%

|

| Lennar Corp., Class A(2)

|

| 15,351

| $ 2,878,006

|

|

|

|

| $ 2,878,006

|

| Household Products — 1.1%

|

| Clorox Co.(2)

|

| 6,843

| $ 1,114,793

|

| Kimberly-Clark Corp.(2)

|

| 10,984

| 1,562,804

|

| Procter & Gamble Co.(2)

|

| 13,852

| 2,399,166

|

|

|

|

| $ 5,076,763

|

| Industrial Conglomerates — 0.9%

|

| 3M Co.(2)

|

| 3,258

| $ 445,368

|

| Honeywell International, Inc.(2)

|

| 17,701

| 3,658,974

|

|

|

|

| $ 4,104,342

|

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Industrial REITs — 0.6%

|

| ProLogis, Inc.(2)

|

| 21,887

| $ 2,763,890

|

|

|

|

| $ 2,763,890

|

| Insurance — 2.4%

|

| Allstate Corp.(2)

|

| 15,262

| $ 2,894,438

|

| Cincinnati Financial Corp.(2)

|

| 18,022

| 2,453,155

|

| Marsh & McLennan Cos., Inc.(2)

|

| 14,405

| 3,213,611

|

| Principal Financial Group, Inc.(2)

|

| 5,042

| 433,108

|

| Prudential Financial, Inc.(2)

|

| 5,899

| 714,369

|

| Travelers Cos., Inc.(2)

|

| 3,902

| 913,536

|

|

|

|

| $ 10,622,217

|

| Interactive Media & Services — 6.7%

|

| Alphabet, Inc., Class A(2)

|

| 62,618

| $ 10,385,195

|

| Alphabet, Inc., Class C(2)

|

| 51,234

| 8,565,813

|

| Meta Platforms, Inc., Class A(2)

|

| 19,763

| 11,313,132

|

|

|

|

| $ 30,264,140

|

| IT Services — 0.6%

|

| GoDaddy, Inc., Class A(1)

|

| 1,482

| $ 232,348

|

| VeriSign, Inc.(1)(2)

|

| 11,895

| 2,259,574

|

|

|

|

| $ 2,491,922

|

| Life Sciences Tools & Services — 1.0%

|

| Thermo Fisher Scientific, Inc.(2)

|

| 7,307

| $ 4,519,891

|

|

|

|

| $ 4,519,891

|

| Machinery — 1.5%

|

| Caterpillar, Inc.(2)

|

| 3,626

| $ 1,418,201

|

| Ingersoll Rand, Inc.(2)

|

| 9,136

| 896,790

|

| PACCAR, Inc.(2)

|

| 4,181

| 412,581

|

| Snap-on, Inc.(2)

|

| 6,380

| 1,848,350

|

| Stanley Black & Decker, Inc.(2)

|

| 12,924

| 1,423,320

|

| Westinghouse Air Brake Technologies Corp.(2)

|

| 4,982

| 905,578

|

|

|

|

| $ 6,904,820

|

| Media — 0.7%

|

| Comcast Corp., Class A(2)

|

| 74,449

| $ 3,109,735

|

| Paramount Global, Class B

|

| 7,273

| 77,239

|

|

|

|

| $ 3,186,974

|

| Multi-Utilities — 2.0%

|

| CenterPoint Energy, Inc.(2)

|

| 15,255

| $ 448,802

|

| CMS Energy Corp.(2)

|

| 37,021

| 2,614,793

|

| DTE Energy Co.(2)

|

| 10,342

|

1,328,016

|

| Security

| Shares

| Value

|

| Multi-Utilities (continued)

|

| NiSource, Inc.(2)

|

| 49,999

| $ 1,732,466

|

| Public Service Enterprise Group, Inc.(2)

|

| 30,431

| 2,714,750

|

|

|

|

| $ 8,838,827

|

| Oil, Gas & Consumable Fuels — 3.4%

|

| Chevron Corp.(2)

|

| 20,053

| $ 2,953,205

|

| Diamondback Energy, Inc.(2)

|

| 14,390

| 2,480,836

|

| DT Midstream, Inc.(2)

|

| 5,171

| 406,751

|

| EOG Resources, Inc.(2)

|

| 14,121

| 1,735,895

|

| Exxon Mobil Corp.(2)

|

| 23,411

| 2,744,237

|

| Marathon Petroleum Corp.(2)

|

| 17,046

| 2,776,964

|

| Phillips 66(2)

|

| 16,658

| 2,189,694

|

|

|

|

| $ 15,287,582

|

| Passenger Airlines — 0.2%

|

| Southwest Airlines Co.(2)

|

| 27,333

| $ 809,877

|

|

|

|

| $ 809,877

|

| Personal Care Products — 0.1%

|

| Estee Lauder Cos., Inc., Class A(2)

|

| 3,326

| $ 331,569

|

|

|

|

| $ 331,569

|

| Pharmaceuticals — 4.0%

|

| Bristol-Myers Squibb Co.(2)

|

| 32,959

| $ 1,705,299

|

| Eli Lilly & Co.(2)

|

| 5,238

| 4,640,554

|

| Johnson & Johnson(2)

|

| 32,699

| 5,299,200

|

| Merck & Co., Inc.(2)

|

| 38,958

| 4,424,070

|

| Pfizer, Inc.(2)

|

| 64,933

| 1,879,161

|

|

|

|

| $ 17,948,284

|

| Professional Services — 0.2%

|

| ManpowerGroup, Inc.(2)

|

| 1,193

| $ 87,710

|

| Robert Half, Inc.(2)

|

| 13,637

| 919,270

|

|

|

|

| $ 1,006,980

|

| Real Estate Management & Development — 0.2%

|

| CBRE Group, Inc., Class A(1)(2)

|

| 8,158

| $ 1,015,508

|

|

|

|

| $ 1,015,508

|

| Residential REITs — 0.5%

|

| AvalonBay Communities, Inc.(2)

|

| 9,432

| $ 2,124,558

|

|

|

|

| $ 2,124,558

|

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Retail REITs — 0.6%

|

| Simon Property Group, Inc.(2)

|

| 16,719

| $ 2,825,845

|

|

|

|

| $ 2,825,845

|

| Semiconductors & Semiconductor Equipment — 12.3%

|

| Advanced Micro Devices, Inc.(1)(2)

|

| 22,021

| $ 3,613,206

|

| Analog Devices, Inc.(2)

|

| 14,513

| 3,340,457

|

| Applied Materials, Inc.(2)

|

| 15,313

| 3,093,992

|

| Broadcom, Inc.(2)

|

| 55,482

| 9,570,645

|

| Enphase Energy, Inc.(1)

|

| 2,925

| 330,583

|

| NVIDIA Corp.(2)

|

| 254,492

| 30,905,508

|

| ON Semiconductor Corp.(1)(2)

|

| 11,033

| 801,106

|

| QUALCOMM, Inc.(2)

|

| 10,178

| 1,730,769

|

| Teradyne, Inc.(2)

|

| 16,574

| 2,219,756

|

|

|

|

| $ 55,606,022

|

| Software — 10.0%

|

| Adobe, Inc.(1)(2)

|

| 6,889

| $ 3,566,986

|

| Crowdstrike Holdings, Inc., Class A(1)

|

| 1,563

| 438,375

|

| Intuit, Inc.(2)

|

| 2,130

| 1,322,730

|

| Microsoft Corp.(2)

|

| 75,790

| 32,612,437

|

| Oracle Corp.(2)

|

| 29,049

| 4,949,949

|

| Palantir Technologies, Inc., Class A(1)

|

| 23,175

| 862,110

|

| Salesforce, Inc.(2)

|

| 5,963

| 1,632,133

|

|

|

|

| $ 45,384,720

|

| Specialized REITs — 0.3%

|

| Iron Mountain, Inc.(2)

|

| 10,704

| $ 1,271,956

|

|

|

|

| $ 1,271,956

|

| Specialty Retail — 1.4%

|

| Home Depot, Inc.(2)

|

| 15,226

| $ 6,169,575

|

|

|

|

| $ 6,169,575

|

| Technology Hardware, Storage & Peripherals — 7.6%

|

| Apple, Inc.(2)

|

| 148,052

| $ 34,496,116

|

|

|

|

| $ 34,496,116

|

| Textiles, Apparel & Luxury Goods — 0.5%

|

| NIKE, Inc., Class B(2)

|

| 27,115

| $ 2,396,966

|

|

|

|

| $ 2,396,966

|

| Security

| Shares

| Value

|

| Tobacco — 0.7%

|

| Philip Morris International, Inc.(2)

|

| 26,732

| $ 3,245,265

|

|

|

|

| $ 3,245,265

|

| Trading Companies & Distributors — 0.8%

|

| Fastenal Co.(2)

|

| 10,457

| $ 746,839

|

| United Rentals, Inc.(2)

|

| 3,497

| 2,831,626

|

|

|

|

| $ 3,578,465

|

Total Common Stocks

(identified cost $80,318,332)

|

|

| $460,038,258

|

| Short-Term Investments — 0.1%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 4.83%(4)

|

| 663,840

| $ 663,840

|

Total Short-Term Investments

(identified cost $663,840)

|

|

| $ 663,840

|

Total Investments — 101.9%

(identified cost $80,982,172)

|

|

| $460,702,098

|

Total Written Call Options — (1.8)%

(premiums received $3,861,899)

|

|

| $ (8,282,960)

|

| Other Assets, Less Liabilities — (0.1)%

|

|

| $ (358,279)

|

| Net Assets — 100.0%

|

|

| $452,060,859

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Non-income producing security.

|

| (2)

| Security (or a portion thereof) has been pledged as collateral for written options.

|

| (3)

| Amount is less than 0.05%.

|

| (4)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2024.

|

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Written Call Options (Exchange-Traded) — (1.8)%

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| S&P 500 Index

| 63

| $

| 36,303,624

| $

| 5,610

| 10/2/24

| $ (946,260)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,580

| 10/4/24

| (1,160,145)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,560

| 10/7/24

| (1,297,170)

|

| S&P 500 Index

| 64

|

| 36,879,872

|

| 5,550

| 10/9/24

| (1,407,040)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,700

| 10/11/24

| (636,615)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,710

| 10/14/24

| (591,255)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,725

| 10/16/24

| (557,550)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,780

| 10/18/24

| (382,410)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,790

| 10/21/24

| (361,620)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,810

| 10/23/24

| (322,560)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,825

| 10/25/24

| (308,700)

|

| S&P 500 Index

| 63

|

| 36,303,624

|

| 5,810

| 10/28/24

| (311,635)

|

| Total

|

|

|

|

|

|

| $(8,282,960)

|

| Abbreviations:

|

| REITs

| – Real Estate Investment Trusts

|

At September 30, 2024, the Fund had

sufficient cash and/or securities to cover commitments under open derivative contracts.

The Fund is subject to equity price

risk in the normal course of pursuing its investment objectives. The Fund writes index call options above the current value of the index to generate premium income. In writing index call options, the Fund in effect,

sells potential appreciation in the value of the applicable index above the exercise price in exchange for the option premium received. The Fund retains the risk of loss, minus the premium received, should the value

of the underlying index decline.

Affiliated Investments

At September 30, 2024, the value of

the Fund's investment in funds that may be deemed to be affiliated was $663,840, which represents 0.1% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date ended September

30, 2024 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $1,458,953

| $44,931,804

| $(45,726,917)

| $ —

| $ —

| $663,840

| $53,755

| 663,840

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value Measurements

Under generally accepted accounting

principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is

summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

Eaton Vance

Tax-Managed Buy-Write Income

Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

In cases where the inputs used to

measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At September 30, 2024, the hierarchy

of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at fair value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3

| Total

|

| Common Stocks

| $460,038,258*

| $ —

| $ —

| $460,038,258

|

| Short-Term Investments

| 663,840

| —

| —

| 663,840

|

| Total Investments

| $460,702,098

| $ —

| $ —

| $460,702,098

|

| Liability Description

|

|

|

|

|

| Written Call Options

| $ (8,282,960)

| $ —

| $ —

| $ (8,282,960)

|

| Total

| $ (8,282,960)

| $ —

| $ —

| $ (8,282,960)

|

| *

| The level classification by major category of investments is the same as the category presentation in the Portfolio of Investments.

|

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semi-annual or annual report to shareholders.

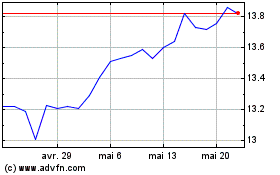

Eaton Vance Tax Managed ... (NYSE:ETB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Eaton Vance Tax Managed ... (NYSE:ETB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024