Significant Reduction in Leverage and over

80% increase in AFFO per Share Year over Year

Farmland Partners Inc. (NYSE: FPI) (“FPI” or the “Company”)

today reported financial results for the year ended December 31,

2024.

Selected Highlights

During the year ended December 31, 2024, the Company:

- recorded net income of $61.5 million, or $1.19 per share

available to common stockholders, compared to $31.7 million, or

$0.55 per share available to common stockholders for the same

period in 2023;

- recorded AFFO of $14.1 million, or $0.29 per share, compared to

$8.1 million, or $0.16 per share, for the same period in 2023;

- completed 54 farm dispositions for $312.0 million in aggregate

consideration and total gain on sale of $54.1 million, including

$2.1 million in connection with properties sold in 2023 for which

the gain was deferred;

- completed acquisitions of four properties for total

consideration of $17.9 million;

- repurchased 2,240,295 shares of its common stock at a weighted

average price of $12.25 per share;

- decreased total indebtedness by $158.5 million (repaid $189.4

million of debt with a weighted average interest rate of 5.77% in

the fourth quarter of 2024), eliminating the Company’s exposure to

floating rate debt and positioning the Company for approximately

$10.9 million of projected annual interest savings going

forward;

- decreased debt as a percentage of gross book value from 36.3%

as of December 31, 2023 to 27.2% as of December 31, 2024 and

decreased the ratio of total debt to EBITDAre from 11.5 to 6.3 year

over year;

- increased total operating revenues by $0.1 million, or 1.3%,

despite a decrease in average gross book value of real estate from

$1.05 billion to $0.87 billion from 2023 to 2024, a decrease of

17.3% as a result of dispositions that occurred during 2023 and

2024, reflecting the Company’s strategic balancing of maximizing

farm revenue while realizing for stockholders the benefit of

selling appreciated farmland;

- reduced total operating expenses by approximately $5.9 million,

a 15.0% decrease compared to the same period in 2023; and

- declared a one-time special dividend of $1.15 per share of

common stock and Class A Common OP Unit in December 2024 which was

paid in January 2025.

Subsequent to December 31, 2024, the Company:

- completed one farm disposition in the West Coast region for

$4.1 million in aggregate consideration, including $2.1 million in

seller financing;

- made principal repayments on MetLife Term Loan #9 of $2.0

million;

- issued two additional loans under the FPI Loan Program with an

aggregate principal amount of $3.1 million to third-party farmers

(both tenant and non-tenant) and landowners. Total principal

repayments on the FPI Loan Program subsequent to December 31, 2024

were $2.0 million; and

- repurchased 63,023 shares of its common stock at a weighted

average price of $11.74 per share.

CEO Comments

Luca Fabbri, President and Chief Executive Officer, commented:

“2024 was a very strong year for FPI, as we successfully executed

on our strategies to reduce overhead, enhance operational

efficiencies, and selectively dispose of assets. Proceeds from the

properties we sold in 2024 allowed us to reduce leverage in a

period of elevated interest rates and repurchase stock at what we

believe to be a significant discount to fair value. The gains from

these dispositions highlight the appreciation of our high-quality

assets and our ability to create stockholder value. As a result, we

were pleased to return a portion of these gains through a special

dividend, reinforcing our ongoing commitment to delivering

value.”

Financial and Operating Results

- The table below shows financial and operating results for the

years ended December 31, 2024 and 2023.

(in thousands)

For the years ended December

31,

Financial Results:

2024

2023

Change

Net Income

$

61,450

$

31,681

94.0

%

Net income available to common

stockholders ⁽¹⁾

$

1.19

$

0.55

116.4

%

AFFO (2)

$

14,074

$

8,140

72.9

%

AFFO per weighted average common share

$

0.29

$

0.16

81.3

%

Adjusted EBITDAre (2)

$

35,882

$

33,403

7.4

%

Operating Results:

Total Operating Revenues

$

58,226

$

57,466

1.3

%

Net Operating Income (NOI)

$

46,921

$

44,052

6.5

%

_____________

NM = Not Meaningful

(1)

Basic net income per share available to

common stockholders. See “Note 9—Stockholders’ Equity and

Non-controlling Interests” in the Annual Report on Form 10-K for

the year ended December 31, 2024, when filed, for more

information.

(2)

The year ended December 31, 2024

includes approximately $1.2 million of income from forfeited

deposits due to the termination of a repurchase agreement and

excludes approximately $1.4 million of severance expense.

- See “Non-GAAP Financial Measures” below for complete

definitions of AFFO, Adjusted EBITDAre, and NOI and the financial

tables accompanying this press release for reconciliations of net

income to AFFO, Adjusted EBITDAre and NOI.

Acquisition and Disposition Activity

- During the year ended December 31, 2024, the Company acquired

four properties for total consideration of $17.9 million.

- During the year ended December 31, 2024, the Company completed

54 property dispositions for approximately $312.0 million in

aggregate consideration and total gain on sale of $54.1 million.

This gain includes $2.1 million in connection with dispositions of

certain properties with seller financing sold in 2023, whereby the

gain was deferred until the Company collected the seller financing

in 2024.

Balance Sheet

- The Company had total debt outstanding of approximately $204.6

million at December 31, 2024 compared to total debt outstanding of

approximately $363.1 million at December 31, 2023.

- At December 31, 2024, the Company had access to liquidity of

$245.8 million, consisting of $78.4 million in cash and $167.4

million in undrawn availability under its credit facilities,

compared to liquidity of $206.6 million, consisting of cash of $5.5

million and $201.1 million in undrawn availability under its credit

facilities at December 31, 2023.

- As of February 14, 2025, the Company had 47,097,743 shares of

common stock outstanding on a fully diluted basis.

Dividend Declarations

On February 18, 2025, the Company’s Board of Directors declared

a quarterly cash dividend of $0.06 per share of common stock and

Class A Common OP unit. The dividends are payable on April 15, 2025

to stockholders and common unit holders of record as of April 1,

2025.

2025 Earnings Guidance and Supplemental Package

For 2025 earnings guidance, please see page 15 of the

supplemental package, which can be accessed through the Investor

Relations section of the Company's website.

Conference Call Information

The Company has scheduled a conference call on February 20,

2025, at 11:00 a.m. (U.S. Eastern Time) to discuss the financial

results and provide a company update.

The call can be accessed live over the phone by dialing

1-800-715-9871 and using the conference ID 4868033. The conference

call will also be available via a live listen-only webcast that can

be accessed through the Investor Relations section of the Company's

website, www.farmlandpartners.com.

A replay of the conference call will be available beginning

shortly after the end of the event until March 2, 2025, which can

be accessed by dialing 1-800-770-2030 and using the playback ID

4868033. A replay of the webcast will also be accessible on the

Investor Relations section of the Company's website for a limited

time following the event.

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers (both tenant and non-tenant)

and landowners secured by farm real estate and/or other

agricultural related assets. As of December 31, 2024, the Company

owned and/or managed approximately 141,800 acres of farmland in 16

states, including Arkansas, California, Colorado, Illinois,

Indiana, Iowa, Kansas, Louisiana, Mississippi, Missouri, Nebraska,

North Carolina, Ohio, South Carolina, Texas and West Virginia. In

addition, the Company owns land and buildings for four agriculture

equipment dealerships in Ohio leased to Ag Pro under the John Deere

brand. The Company elected to be taxed as a real estate investment

trust, or REIT, for U.S. federal income tax purposes, commencing

with the taxable year ended December 31, 2014. Additional

information: www.farmlandpartners.com or (720) 452-3100.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws, including, without

limitation, statements with respect to our outlook and the outlook

for the farm economy generally, proposed and pending acquisitions

and dispositions, financing activities, crop yields and prices and

anticipated rental rates. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” or similar expressions or their negatives,

as well as statements in future tense. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, beliefs and

expectations, such forward-looking statements are not predictions

of future events or guarantees of future performance, and our

actual results could differ materially from those set forth in the

forward-looking statements. Some factors that might cause such a

difference include the following: market factors and other

considerations that could result in the Company deciding not to

declare and pay a special dividend or to declare and pay a special

dividend that is less than stockholders anticipate; the ongoing war

in Ukraine and the ongoing conflicts in the Middle East and their

impacts on the world agriculture market, world food supply, the

farm economy generally, and our tenants’ businesses; changes in

trade policies in the United States and other countries that import

agricultural products from the United States; high inflation and

elevated interest rates; the onset of an economic recession in the

United States and other countries that impact the farm economy;

extreme weather events, such as droughts, tornadoes, hurricanes,

wildfires or floods; the impact of future public health crises on

our business and on the economy and capital markets generally;

general volatility of the capital markets and the market price of

the Company’s common stock; changes in the Company’s business

strategy, availability, terms and deployment of capital; the

Company’s ability to refinance existing indebtedness at or prior to

maturity on favorable terms, or at all; availability of qualified

personnel; changes in the Company’s industry, interest rates or the

general economy; adverse developments related to crop yields or

crop prices; the degree and nature of the Company’s competition;

the outcomes of ongoing litigation; the timing, price or amount of

repurchases, if any, under the Company's share repurchase program;

the ability to consummate acquisitions or dispositions under

contract; and the other factors described in the section entitled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, and the Company’s other filings with

the Securities and Exchange Commission. Any forward-looking

information presented herein is made only as of the date of this

press release, and the Company does not undertake any obligation to

update or revise any forward-looking information to reflect changes

in assumptions, the occurrence of unanticipated events, or

otherwise.

Farmland Partners Inc.

Consolidated Balance Sheets As of December 31, 2024 and 2023 (in

thousands)

December 31,

December 31,

2024

2023

ASSETS

Land, at cost

$

645,592

$

869,848

Grain facilities

7,714

12,222

Groundwater

11,033

11,472

Irrigation improvements

28,890

41,988

Drainage improvements

8,243

10,315

Permanent plantings

42,461

39,620

Other

3,983

4,696

Construction in progress

1,484

4,453

Real estate, at cost

749,400

994,614

Less accumulated depreciation

(31,557

)

(33,083

)

Total real estate, net

717,843

961,531

Deposits

—

426

Cash and cash equivalents

78,441

5,489

Assets held for sale

61

28

Loans and financing receivables, net

55,305

31,020

Right of use asset

194

399

Accounts receivable, net

3,199

7,743

Derivative asset

498

1,707

Inventory

2,659

2,335

Equity method investments

4,101

4,136

Intangible assets, net

1,374

2,035

Goodwill

2,706

2,706

Prepaid and other assets

2,179

2,447

TOTAL ASSETS

$

868,560

$

1,022,002

LIABILITIES AND EQUITY

LIABILITIES

Mortgage notes and bonds payable, net

$

203,683

$

360,859

Lease liability

194

399

Dividends payable

57,253

13,286

Accrued interest

3,062

4,747

Accrued property taxes

1,650

1,898

Deferred revenue

65

2,149

Accrued expenses

6,096

7,854

Total liabilities

272,003

391,192

Commitments and contingencies

Redeemable non-controlling interest in

operating partnership, Series A preferred units

101,970

101,970

EQUITY

Common stock, $0.01 par value, 500,000,000

shares authorized; 45,931,827 shares issued and outstanding at

December 31, 2024, and 48,002,716 shares issued and outstanding at

December 31, 2023

459

482

Additional paid in capital

551,994

577,237

Retained earnings

88,352

31,411

Cumulative dividends

(160,406

)

(95,939

)

Other comprehensive income

1,512

2,691

Non-controlling interests in operating

partnership

12,676

12,958

Total equity

494,587

528,840

TOTAL LIABILITIES, REDEEMABLE

NON-CONTROLLING INTERESTS IN OPERATING PARTNERSHIP AND EQUITY

$

868,560

$

1,022,002

Farmland Partners Inc.

Consolidated Statements of Operations Years Ended December 31, 2024

and 2023 (in thousands except per share amounts)

For the Years Ended

December 31,

2024

2023

OPERATING REVENUES:

Rental income

$

47,119

$

49,185

Crop sales

5,027

2,257

Other revenue

6,080

6,024

Total operating revenues

58,226

57,466

OPERATING EXPENSES

Depreciation, depletion and

amortization

5,588

7,499

Property operating expenses

7,368

8,660

Cost of goods sold

3,937

4,754

Acquisition and due diligence costs

28

17

General and administrative expenses

14,071

11,274

Legal and accounting

1,654

1,279

Impairment of assets

790

5,840

Other operating expenses

103

144

Total operating expenses

33,539

39,467

OTHER (INCOME) EXPENSE:

Other (income)

(123

)

(39

)

(Income) from equity method investment

(125

)

(1

)

(Gain) on disposition of assets, net

(54,148

)

(36,133

)

(Income) from forfeited deposits

(1,205

)

—

Interest expense

18,854

22,657

Total other (income)

(36,747

)

(13,516

)

Net income before income tax benefit

61,434

31,515

Income tax benefit

(16

)

(166

)

NET INCOME

61,450

31,681

Net (income) attributable to

non-controlling interests in operating partnership

(1,539

)

(768

)

Net income attributable to the Company

59,911

30,913

Dividend equivalent rights allocated to

performance-based unvested restricted shares

(53

)

—

Nonforfeitable distributions allocated to

time-based unvested restricted shares

(460

)

(157

)

Distributions on Series A Preferred

Units

(2,970

)

(2,970

)

Net income available to common

stockholders of Farmland Partners Inc.

$

56,428

$

27,786

Basic and diluted per common share

data:

Basic net income available to common

stockholders

$

1.19

$

0.55

Diluted net income available to common

stockholders

$

1.06

$

0.53

Basic weighted average common shares

outstanding

47,546

50,243

Diluted weighted average common shares

outstanding

55,987

58,292

Dividends declared per common share -

regular and special

$

1.39

$

0.45

Farmland Partners Inc.

Reconciliation of Non-GAAP Measures Years Ended December 31, 2024

and 2023

For the years ended December

31,

(in thousands except per share

amounts)

2024

2023

Net income

$

61,450

$

31,681

(Gain) on disposition of assets, net

(54,148

)

(36,133

)

Depreciation, depletion and

amortization

5,588

7,499

Impairment of assets

790

5,840

FFO (1)

$

13,680

$

8,887

Stock-based compensation and incentive

1,963

2,008

Deferred impact of interest rate swap

terminations

—

198

Real estate related acquisition and due

diligence costs

28

17

Distributions on Preferred units and

stock

(2,970

)

(2,970

)

Severance expense

1,373

—

AFFO (1)

$

14,074

$

8,140

AFFO per diluted weighted average share

data:

AFFO weighted average common shares

49,127

51,810

Net income available to common

stockholders of Farmland Partners Inc.

$

1.19

$

0.55

Income available to redeemable

non-controlling interest and non-controlling interest in operating

partnership

0.07

0.08

Depreciation, depletion and

amortization

0.11

0.14

Impairment of assets

0.02

0.11

Stock-based compensation and incentive

0.04

0.04

(Gain) on disposition of assets, net

(1.10

)

(0.70

)

Distributions on Preferred units and

stock

(0.07

)

(0.06

)

Severance expense

0.03

0.00

AFFO per diluted weighted average share

(1)

$

0.29

$

0.16

For the years ended December

31,

(in thousands)

2024

2023

Net income

$

61,450

$

31,681

Interest expense

18,854

22,657

Income tax benefit

(16

)

(166

)

Depreciation, depletion and

amortization

5,588

7,499

Impairment of assets

790

5,840

(Gain) on disposition of assets, net

(54,148

)

(36,133

)

EBITDAre (1)

$

32,518

$

31,378

Stock-based compensation and incentive

1,963

2,008

Real estate related acquisition and due

diligence costs

28

17

Severance expense

1,373

—

Adjusted EBITDAre (1)

$

35,882

$

33,403

(1)

The year ended December 31, 2024

includes approximately $1.2 million of income from forfeited

deposits due to the termination of a repurchase agreement and

excludes approximately $1.4 million of severance expense.

Farmland Partners Inc.

Reconciliation of Non-GAAP Measures Years Ended December 31, 2024

and 2023

For the years ended December

31,

($ in thousands)

2024

2023

OPERATING REVENUES:

Rental income

$

47,119

$

49,185

Crop sales

5,027

2,257

Other revenue

6,080

6,024

Total operating revenues

58,226

57,466

Property operating expenses

7,368

8,660

Cost of goods sold

3,937

4,754

NOI

46,921

44,052

Depreciation, depletion and

amortization

5,588

7,499

Acquisition and due diligence costs

28

17

General and administrative expenses

14,071

11,274

Legal and accounting

1,654

1,279

Impairment of assets

790

5,840

Other operating expenses

103

144

Other (income)

(123

)

(39

)

(Income) from equity method investment

(125

)

(1

)

(Gain) on disposition of assets, net

(54,148

)

(36,133

)

(Income) from forfeited deposits

(1,205

)

—

Interest expense

18,854

22,657

Income tax benefit

(16

)

(166

)

NET INCOME

$

61,450

$

31,681

Non-GAAP Financial Measures

The Company considers the following non-GAAP measures to be

useful to investors as key supplemental measures of its

performance: FFO, NOI, AFFO, EBITDAre and Adjusted EBITDAre. These

non-GAAP financial measures should be considered along with, but

not as alternatives to, net income or loss as a measure of the

Company’s operating performance. FFO, NOI, AFFO, EBITDAre and

Adjusted EBITDAre, as calculated by the Company, may not be

comparable to other companies that do not define such terms in

exactly the same way as the Company.

FFO

The Company calculates FFO in accordance with the standards

established by the National Association of Real Estate Investment

Trusts, or Nareit. Nareit defines FFO as net income (loss)

(calculated in accordance with GAAP), excluding gains (or losses)

from sales of depreciable operating property, real estate related

depreciation, depletion and amortization (excluding amortization of

deferred financing costs), impairment write-downs of depreciated

property, and adjustments associated with impairment write-downs

for unconsolidated partnerships and joint ventures. Management

presents FFO as a supplemental performance measure because it

believes that FFO is beneficial to investors as a starting point in

measuring the Company’s operational performance. Specifically, in

excluding real estate related depreciation and amortization and

gains and losses from sales of depreciable operating properties,

which do not relate to or are not indicative of operating

performance, FFO provides a performance measure that, when compared

year over year, captures trends in occupancy rates, rental rates

and operating costs. The Company also believes that, as a widely

recognized measure of the performance of REITs, FFO will be used by

investors as a basis to compare the Company’s operating performance

with that of other REITs. However, other equity REITs may not

calculate FFO in accordance with the Nareit definition as the

Company does, and, accordingly, the Company’s FFO may not be

comparable to such other REITs’ FFO.

AFFO

The Company calculates AFFO by adjusting FFO to exclude the

income and expenses that the Company believes are not reflective of

the sustainability of the Company’s ongoing operating performance,

including, but not limited to, real estate related acquisition and

due diligence costs, stock-based compensation and incentive,

deferred impact of interest rate swap terminations, distributions

on the Company’s preferred units and severance expense.

Changes in GAAP accounting and reporting rules that were put in

effect after the establishment of Nareit’s definition of FFO in

1999 result in the inclusion of a number of items in FFO that do

not correlate with the sustainability of the Company’s operating

performance. Therefore, in addition to FFO, the Company presents

AFFO and AFFO per share, fully diluted, both of which are non-GAAP

measures. Management considers AFFO a useful supplemental

performance metric for investors as it is more indicative of the

Company’s operational performance than FFO. AFFO is not intended to

represent cash flow or liquidity for the period and is only

intended to provide an additional measure of the Company’s

operating performance. Even AFFO, however, does not properly

capture the timing of cash receipts, especially in connection with

full-year rent payments under lease agreements entered into in

connection with newly acquired farms. Management considers AFFO per

share, fully diluted to be a supplemental metric to GAAP earnings

per share. AFFO per share, fully diluted provides additional

insight into how the Company’s operating performance could be

allocated to potential shares outstanding at a specific point in

time. Management believes that AFFO is a widely recognized measure

of the operations of REITs and presenting AFFO will enable

investors to assess the Company’s performance in comparison to

other REITs. However, other REITs may use different methodologies

for calculating AFFO and AFFO per share, fully diluted and,

accordingly, the Company’s AFFO and AFFO per share, fully diluted

may not always be comparable to AFFO and AFFO per share amounts

calculated by other REITs. AFFO and AFFO per share, fully diluted

should not be considered as an alternative to net income (loss) or

earnings per share (determined in accordance with GAAP) as an

indication of financial performance, or as an alternative to net

income (loss) earnings per share (determined in accordance with

GAAP) as a measure of the Company’s liquidity, nor are they

indicative of funds available to fund the Company’s cash needs,

including its ability to make distributions.

EBITDAre and Adjusted EBITDAre

The Company calculates Earnings Before Interest Taxes

Depreciation and Amortization for real estate (“EBITDAre”) in

accordance with the standards established by Nareit in its

September 2017 White Paper. Nareit defines EBITDAre as net income

(calculated in accordance with GAAP) excluding interest expense,

income tax, depreciation and amortization, gains or losses on

disposition of depreciated property (including gains or losses on

change of control), impairment write-downs of depreciated property

and of investments in unconsolidated affiliates caused by a

decrease in value of depreciated property in the affiliate, and

adjustments to reflect the entity’s pro rata share of EBITDAre of

unconsolidated affiliates. EBITDAre is a key financial measure used

to evaluate the Company’s operating performance but should not be

construed as an alternative to operating income, cash flows from

operating activities or net income, in each case as determined in

accordance with GAAP. The Company believes that EBITDAre is a

useful performance measure commonly reported and will be widely

used by analysts and investors in the Company’s industry. However,

while EBITDAre is a performance measure widely used across the

Company’s industry, the Company does not believe that it correctly

captures the Company’s business operating performance because it

includes non-cash expenses and recurring adjustments that are

necessary to better understand the Company’s business operating

performance. Therefore, in addition to EBITDAre, management uses

Adjusted EBITDAre, a non-GAAP measure.

The Company calculates Adjusted EBITDAre by adjusting EBITDAre

for certain items such as stock-based compensation and incentive,

real estate related acquisition and due diligence costs and

severance expense that the Company considers necessary to

understand its operating performance. The Company believes that

Adjusted EBITDAre provides useful supplemental information to

investors regarding the Company’s ongoing operating performance

that, when considered with net income and EBITDAre, is beneficial

to an investor’s understanding of the Company’s operating

performance. However, EBITDAre and Adjusted EBITDAre have

limitations as analytical tools and should not be considered in

isolation or as a substitute for analysis of the Company’s results

as reported under GAAP.

In prior periods, the Company has presented EBITDA and Adjusted

EBITDA. In accordance with Nareit’s recommendation, beginning with

the Company’s reported results for the three months ended March 31,

2018, the Company is reporting EBITDAre and Adjusted EBITDAre in

place of EBITDA and Adjusted EBITDA.

Net Operating Income (NOI)

The Company calculates net operating income (NOI) as total

operating revenues (rental income, tenant reimbursements, crop

sales and other revenue), less property operating expenses (direct

property expenses and real estate taxes), less cost of goods sold.

Since net operating income excludes general and administrative

expenses, interest expense, depreciation and amortization,

acquisition-related expenses, other income and losses and

extraordinary items, it provides a performance measure that, when

compared year over year, reflects the revenues and expenses

directly associated with owning and leasing farmland real estate,

providing a perspective not immediately apparent from net income.

However, net operating income should not be viewed as an

alternative measure of the Company’s financial performance since it

does not reflect general and administrative expenses, interest

expense, depreciation and amortization costs, other income and

losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219623695/en/

Susan Landi ir@farmlandpartners.com

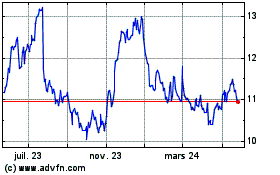

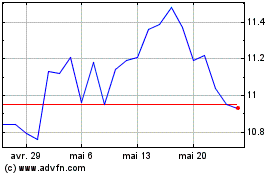

Farmland Partners (NYSE:FPI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Farmland Partners (NYSE:FPI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025