$90 Million Debt Facility Provided by

Consortium of Existing Investors, Led by Kennedy Lewis

Gene Davis Appointed Chairman of the Board,

Which Has Been Refreshed with Addition of Four Experienced

Independent Directors

Bob Madore, Seasoned Finance Executive, Named

as Interim CFO

F45 Training Holdings Inc. (NYSE: FXLV) (“F45” or the “Company”)

today announced the closing of a new $90 million subordinated debt

facility provided by a consortium of existing investors, led by

affiliates of Kennedy Lewis Management LP (the “New Facility”).

This financing will improve the Company’s balance sheet and enhance

liquidity as the strengthened Board and leadership team drive the

business forward and position F45 for long-term sustainable

growth.

“The financing transaction, combined with our recently

implemented operational realignment and cost reduction initiative,

enable us to increase the support we provide our valued franchisee

network and continue to deliver on our mission of offering the

world’s best workout,” said Ben Coates, F45’s Interim Chief

Executive Officer. “We are glad to have secured this significant

financing from investors who share our vision.”

Darren Richman, Co-Founder, Co-Portfolio Manager, and

Co-Managing Partner of Kennedy Lewis, added, “We’re pleased to

deepen our partnership with F45, an innovator with a differentiated

brand that is uniquely positioned to capitalize on the growing

trend of consumers prioritizing health and fitness in their daily

lives. As long-time investors in F45, we have a deep understanding

of, and continued confidence in, the business and the opportunity

ahead for F45 as a disruptor in the fitness space.”

Refreshing Company’s Board of Directors and Strengthening

Leadership Team

In connection with the closing of the transaction, current Board

member Gene Davis – who has more than four decades of strategic

planning, business transformation, and governance expertise – was

appointed Chairman, and four new independent directors were

appointed to the Board: Timothy Bernlohr, Lisa Gavales, Steven

Scheiwe, and Ray Wallander. These new directors, who together bring

a wealth of management and consumer sector experience, replace

Angelo Demasi, Vanessa Douglas, and Lee Wallace, who each resigned

at closing. Remaining on the Board with Mr. Davis are Ben Coates,

Adam Gilchrist, Elizabeth Josefsberg, and Michael Raymond, as well

as F45 investor, enthusiast, and brand ambassador Mark

Wahlberg.

The Company has named Bob Madore as Interim Chief Financial

Officer. Mr. Madore is a seasoned executive with more than 30 years

of management experience and a proven track record of growing

brands in global markets, as well as leading and scaling financial

operations while strengthening business performance to deliver

profitable growth. Prior to joining F45, he served as CFO of Ralph

Lauren, American Eagle Outfitters and, most recently, The Cronos

Group.

Board Chairman Gene Davis said, “With the Company on stronger

financial footing, I look forward to working with my fellow Board

members and the leadership team, including Bob, to refine F45’s

go-forward business strategy to deliver sustainable growth, enhance

opportunities for our franchisees and team, and drive long-term

value for shareholders.”

Biographies can be found on the Board of Directors and Executive

Management pages of the Company’s website.

Transaction Details

The New Facility has a five-and-a-half-year term, with interest

to be paid in kind. Net proceeds will be used for, among other

things, general corporate purposes and a partial paydown of the

Company’s existing Senior Secured Revolving Credit Facility with JP

Morgan Chase Bank, N.A. (the “JPM Facility”). Concurrent with the

closing of the New Facility and the partial paydown, the Company

amended the JPM Facility to be structured as a $70 million senior

secured facility with a two-year term, comprising a $68 million

term loan and a $2 million revolving credit facility. Additional

detail regarding the New Facility and JPM Facility is included in

the transaction documents that are exhibits to the Company’s Form

8-K, which will be filed with the SEC today.

Gibson, Dunn & Crutcher LLP served as legal counsel to F45

on the transaction. Jefferies LLC acted as financial advisor and

Akin Gump Strauss Hauer & Feld LLP served as legal counsel to

Kennedy Lewis.

Strategic Alternatives Update

As an update to the previously announced formation of a Special

Committee to review and evaluate the unsolicited proposal F45

received from Kennedy Lewis and other strategic alternatives, the

Special Committee paused its review and evaluation as the Board

focused on securing this financing to address F45’s liquidity

needs.

The Company has not received anything further from Kennedy Lewis

with respect to its prior proposal or a revised proposal. In the

event Kennedy Lewis engages with the Company on its proposal,

including any revision thereof, the Board will consider such

proposal at the appropriate time and will act in the best interests

of the Company and its shareholders in accordance with its

fiduciary duties.

The Company does not undertake any obligation to provide any

updates with respect to a review of strategic alternatives or any

other transaction, except as required under applicable law.

About F45

F45 offers consumers functional 45-minute workouts that are

effective, fun and community-driven. F45 utilizes proprietary

technologies including a fitness programming algorithm and a

digitally-enabled delivery platform that leverages a rich content

database of thousands of unique functional training movements to

offer new workouts each day and provide a standardized experience

across F45’s global franchise. For more information, please visit

www.f45training.com.

About Kennedy Lewis

Kennedy Lewis is an investment manager founded in 2017 by David

K. Chene and Darren L. Richman with approximately $11 billion under

management across private funds and CLOs. Kennedy Lewis’ private

funds primarily focus on middle-market companies facing disruption,

whether it be cyclical, secular or regulatory related. The firm

also partners with high-growth companies that are causing

disruption, providing structured capital solutions to fit their

needs. For more information, please visit www.klimllc.com.

Forward-Looking Statements

Statements in this press release that refer to F45’s future

plans and expectations are forward-looking statements, within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

that involve a number of risks and uncertainties. Words such as

“may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue” or

negatives of these words and variations of such words and similar

expressions are intended to identify such forward-looking

statements. Statements that refer to or are based on estimates,

forecasts, projections, uncertain events or assumptions, including

statements relating to F45’s strategy, financial outlook, business

plans, and future macroeconomic conditions also identify

forward-looking statements. All forward-looking statements included

in this press release are based on management’s expectations as of

the date of this press release and, except as required by law, F45

disclaims any obligation to update these forward-looking statements

to reflect future events or circumstances.

Forward-looking statements are subject to certain risks,

uncertainties and assumptions relating to factors that could cause

actual results to differ materially from those anticipated in such

statements, including, without limitation, the following: our

dependence on the operational and financial results of, and our

relationships with, our franchisees and the success of their new

and existing studios; our ability to protect our brand and

reputation; our ability to identify, recruit and contract with a

sufficient number of qualified franchisees; our ability to execute

our growth strategy, including through development of new studios

by new and existing franchisees; our ability to manage our growth

and the associated strain on our resources; our ability to

successfully integrate any acquisitions, or realize their

anticipated benefits; the high level of competition in the health

and fitness industry; economic, political and other risks

associated with our international operations; changes to the

industry in which we operate; our reliance on information systems

and our and our franchisees’ ability to properly maintain the

confidentiality and integrity of our data; the occurrence of cyber

incidents or a deficiency in our cybersecurity protocols; our and

our franchisees’ ability to attract and retain members; our and our

franchisees’ ability to identify and secure suitable sites for new

franchise studios; risks related to franchisees generally; our

ability to obtain third-party licenses for the use of music to

supplement our workouts; certain health and safety risks to members

that arise while at our studios; our ability to adequately protect

our intellectual property; risks associated with the use of social

media platforms in our marketing; our ability to obtain and retain

high-profile strategic partnership arrangements; our ability to

comply with existing or future franchise laws and regulations; our

ability to anticipate and satisfy consumer preferences and shifting

views of health and fitness; our business model being susceptible

to litigation; the increased expenses associated with being a

public company; and additional factors discussed in our filings

with the Securities and Exchange Commission (the “SEC”). Further,

many of these factors are, and may continue to be, amplified by the

COVID-19 pandemic. Detailed information regarding these and other

factors that could affect F45’s business and results is included in

F45’s SEC filings, including in the section titled “Risk Factors”

in F45’s Annual Report on Form 10-K and other SEC filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230215005466/en/

Media Contact Kekst CNC Sherri L. Toub / Anntal Silver /

Daniel Hoadley F45MediaInquiries@kekstcnc.com Investor

Contact ICR, Inc. Bruce Williams F45IR@icrinc.com (332)

242-4303

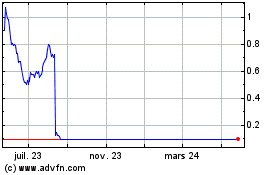

F45 Training (NYSE:FXLV)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

F45 Training (NYSE:FXLV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024