Installed and Commissioned Second Energy

Center

ESS Tech, Inc. (“ESS,” “ESS, Inc.” or the “Company”) (NYSE:

GWH), a leading manufacturer of long-duration energy storage

systems (LDES) for commercial and utility-scale applications, today

announced financial results for its third quarter ended September

30, 2024.

“The core investment thesis for ESS remains as strong as ever –

we have a massive and important emerging market opportunity in

front of us, a top tier, forward-thinking customer base, and a

differentiated, IP-protected, scalable technology tailor made to

serve them. We continue to make strong progress on our key

operational initiatives, but have faced challenges that have

delayed our revenue ramp. Our Australian partner has had great

success signing contracts with major utilities and securing funding

to build a factory to help meet the high demand for long-duration

energy storage in Queensland. However, delays in completion of this

funding affected our ability to ship and recognize revenue in Q3

for units that were already built. We are receiving payments and

are shipping units now so we are optimistic we will get this over

the finish line in the fourth quarter and that, coupled with EC

product shipments, should lead to $9 to $11 million in revenue for

the year, leading to meaningful year-on-year growth,” said Eric

Dresselhuys, CEO of ESS. “On the operational side, our first Energy

Center for Portland General Electric has been operating with high

reliability and availability and we successfully built and are

testing our second EC product on the same site. We’ve been gleaning

valuable insights from these units – from build to test to

operation – to further improve our processes and design as we

prepare for the ramp of our EC products. Optimized for larger scale

deployments to meet the needs of the broader utility industry, our

EC products can provide double the capacity of our Energy

Warehouses with the same footprint. We continue to aggressively

execute on our cost reduction activities as we scale our

operations, efficiently manage our resources and drive to

profitability.”

Recent Business Highlights

- On November 1, ESS executed the credit agreement with the

Export-Import Bank of the United States, or EXIM, for the first $20

million tranche of the $50 million funding package previously

announced, becoming the first energy storage manufacturer to be

supported by the Make More in America Initiative of EXIM. This

funding is long-term, low interest, and non-dilutive capital to

finance expanding manufacturing capacity. For further details, see

the Company’s Current Report on Form 8-K filed with the Securities

and Exchange Commission (“SEC”) on November 5, 2024.

- We have built and installed the second Energy Center for

Portland General Electric and are now in testing. Final hand-off to

PGE is expected in Q4. We've started building and expect to start

shipping our first commercial EC products in the fourth quarter of

2024.

- On August 23, 2024, ESS executed a 1-for-15 reverse split,

following a listing notice from the NYSE received in March,

bringing the Company back into compliance with the listing

requirements and enabling continued operations as a publicly-listed

company.

Conference Call Details

ESS will hold a conference call on Wednesday, November 13, 2024

at 5:00 p.m. EST to discuss financial results for its third quarter

ended September 30, 2024. Interested parties may join the

conference call beginning at 5:00 p.m. EST on Wednesday, November

13, 2024 via telephone by calling (833) 470-1428 in the U.S., or

for international callers, by calling +1 (404) 975-4839 and

entering conference ID 385282. A telephone replay will be available

until November 20, 2024, by dialing (866) 813-9403 in the U.S., or

for international callers, +1 (929) 458-6194 with conference ID

356245. A live webcast of the conference call will be available on

ESS’ Investor Relations website at

http://investors.essinc.com/.

A replay of the call will be available via the web at

http://investors.essinc.com/.

About ESS, Inc.

ESS Inc. (NYSE: GWH) is the leading manufacturer of

long-duration iron flow energy storage solutions. ESS was

established in 2011 with a mission to accelerate decarbonization

safely and sustainably through longer lasting energy storage. Using

easy-to-source iron, salt, and water, ESS iron flow technology

enables energy security, reliability and resilience. We build

flexible storage solutions that allow our customers to meet

increasing energy demand without power disruptions and maximize the

value potential of excess energy. For more information visit

www.essinc.com.

Use of Non-GAAP Financial Measures

In this press release and the accompanying earnings call, the

Company includes Non-GAAP Operating Expenses and Adjusted EBITDA,

which are non-GAAP performance measures that the Company uses to

supplement its results presented in accordance with U.S. GAAP. As

required by the rules of the SEC, the Company has provided herein a

reconciliation of the non-GAAP financial measures contained in this

press release and the accompanying earnings call to the most

directly comparable measures under GAAP. The Company’s management

believes Non-GAAP Operating Expenses and Adjusted EBITDA are useful

in evaluating its operating performance and are similar measures

reported by publicly-listed U.S. companies, and regularly used by

securities analysts, institutional investors, and other interested

parties in analyzing operating performance and prospects. By

providing these non-GAAP measures, the Company’s management intends

to provide investors with a meaningful, consistent comparison of

the Company’s profitability for the periods presented. Adjusted

EBITDA is not intended to be a substitute for net income/loss or

any U.S. GAAP financial measure and, as calculated, may not be

comparable to other similarly titled measures of performance of

other companies in other industries or within the same industry.

Further, Non-GAAP Operating Expenses are not intended to be a

substitute for GAAP Operating Expenses or any U.S. GAAP financial

measure and, as calculated, may not be comparable to other

similarly titled measures of performance of other companies in

other industries or within the same industry.

The Company defines and calculates Non-GAAP Gross Margin as

sales price less direct labor, direct materials, and other direct

costs and includes the benefits of the 45X Advanced Manufacturing

Production Tax Credit. The Company defines and calculates Non-GAAP

Operating Expenses as GAAP Operating Expenses adjusted for

stock-based compensation and other special items determined by

management as they are not indicative of business operations. The

Company defines and calculates Adjusted EBITDA as net loss before

interest, other non-operating expense or income, (benefit)

provision for income taxes, and depreciation and amortization, and

further adjusted for stock-based compensation and other special

items determined by management, including, but not limited to, fair

value adjustments for certain financial liabilities associated with

debt and equity transactions as they are not indicative of business

operations.

Forward-Looking Statements

This communication contains certain forward-looking statements,

including statements regarding ESS and its management team’s

expectations, hopes, beliefs, intentions or strategies regarding

the future. The words “anticipate”, “believe”, “continue”, “could”,

“estimate”, “expect”, “intends”, “may”, “might”, “plan”,

“possible”, “potential”, “predict”, “project”, “should”, “will” and

“would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Examples of forward-looking

statements include, among others, statements regarding the

Company’s manufacturing plans, the Company’s order and sales

pipeline, the Company’s ability to execute on orders, the Company’s

ability to effectively manage costs, the Company’s relationship

with its Australian partner and the development and

commercialization of the EC product. These forward-looking

statements are based on ESS’ current expectations and beliefs

concerning future developments and their potential effects on ESS.

Many factors could cause actual future events to differ materially

from the forward-looking statements in this communication. There

can be no assurance that the future developments affecting ESS will

be those that we have anticipated. These forward-looking statements

involve a number of risks, uncertainties (some of which are beyond

ESS' control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements, which include, but are

not limited to, continuing supply chain issues; delays,

disruptions, or quality control problems in the Company’s

manufacturing operations; the Company’s ability to hire, train and

retain an adequate number of manufacturing employees; issues

related to the shipment and installation of the Company’s products;

issues related to customer acceptance of the Company’s products;

issues related to the Company’s partnerships with third parties;

inflationary pressures; risk of loss of government funding for

customer projects; issues related to raising additional capital;

and the Company’s need to achieve significant cost reductions and

business growth to achieve sustained, long-term profitability.

Except as required by law, ESS is not undertaking any obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise.

ESS Tech, Inc.

Condensed Statements of

Operations and Comprehensive Loss

(unaudited)

(in thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Revenue

$

355

$

1,544

$

2,911

$

4,741

Revenue - related parties

4

1

534

$

3

Total revenue

359

1,545

3,445

$

4,744

Cost of revenue

12,741

10,183

35,615

10,183

Gross profit (loss)

(12,382

)

(8,638

)

(32,170

)

(5,439

)

Operating expenses

Research and development

2,684

1,609

9,066

38,790

Sales and marketing

2,529

2,056

7,274

5,648

General and administrative

6,087

5,831

17,791

16,963

Total operating expenses

11,300

9,496

34,131

61,401

Loss from operations

(23,682

)

(18,134

)

(66,301

)

(66,840

)

Other income, net

Interest income, net

807

1,155

3,097

3,737

Gain on revaluation of common stock

warrant liabilities

343

344

459

917

Other income, net

39

17

2

738

Total other income, net

1,189

1,516

3,558

5,392

Net loss and comprehensive loss to

common stockholders

$

(22,493

)

$

(16,618

)

$

(62,743

)

$

(61,448

)

Net loss per share - basic and

diluted

$

(1.90

)

$

(1.59

)

$

(5.35

)

$

(5.93

)

Weighted-average shares used in per

share calculation - basic and diluted

11,814,580

10,471,738

11,722,378

10,358,503

ESS Tech, Inc.

Condensed Balance

Sheets

(unaudited)

(in thousands, except share

data)

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

12,822

$

20,165

Restricted cash, current

906

1,373

Accounts receivable, net

413

1,990

Short-term investments

42,292

87,899

Inventory

7,037

3,366

Prepaid expenses and other current

assets

5,084

3,305

Total current assets

68,554

118,098

Property and equipment, net

19,857

16,266

Intangible assets, net

4,723

4,923

Operating lease right-of-use assets

1,853

2,167

Restricted cash, non-current

947

945

Other non-current assets

763

833

Total assets

$

96,697

$

143,232

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

10,937

$

2,755

Accrued and other current liabilities

10,178

10,755

Accrued product warranties

3,298

2,129

Operating lease liabilities, current

1,631

1,581

Deferred revenue, current

6,034

2,546

Total current liabilities

32,078

19,766

Operating lease liabilities,

non-current

451

957

Deferred revenue, non-current

—

3,835

Deferred revenue, non-current - related

parties

14,400

14,400

Common stock warrant liabilities

458

917

Other non-current liabilities

109

—

Total liabilities

47,496

39,875

Stockholders' equity:

Preferred stock ($0.0001 par value;

200,000,000 shares authorized, none issued and outstanding as of

September 30, 2024 and December 31, 2023)

—

—

Common stock ($0.0001 par value;

1,000,000,000 shares authorized, 11,882,581 and 11,614,127 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively)

1

1

Additional paid-in capital

808,100

799,513

Accumulated deficit

(758,900

)

(696,157

)

Total stockholders' equity

49,201

103,357

Total liabilities and stockholders'

equity

$

96,697

$

143,232

ESS Tech, Inc.

Condensed Statements of Cash

Flows

(unaudited)

(in thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(62,743

)

$

(61,448

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

3,302

3,187

Non-cash interest income

(2,094

)

(2,438

)

Non-cash lease expense

1,000

916

Stock-based compensation expense

8,538

7,673

Inventory write-down and losses on

noncancellable purchase commitments

5,170

11,422

Change in fair value of common stock

warrant liabilities

(459

)

(917

)

Other non-cash (income) expenses, net

311

(34

)

Changes in operating assets and

liabilities:

Accounts receivable, net

1,352

3,874

Inventory

(9,768

)

(13,132

)

Prepaid expenses and other assets

(1,709

)

3,701

Accounts payable

5,671

275

Accrued and other liabilities

(219

)

(4,305

)

Accrued product warranties

1,169

993

Deferred revenue

(122

)

12,532

Operating lease liabilities

(1,142

)

(1,050

)

Net cash used in operating

activities

(51,743

)

(38,751

)

Cash flows from investing

activities:

Purchases of property and equipment

(3,823

)

(4,209

)

Maturities and purchases of short-term

investments, net

47,709

20,208

Net cash provided by investing

activities

43,886

15,999

Cash flows from financing

activities:

Proceeds from issuance of common stock and

common stock warrants, net of issuance costs

—

27,132

Payments on notes payable

—

(1,733

)

Proceeds from stock options exercised

80

236

Proceeds from contributions to Employee

Stock Purchase Plan

214

332

Repurchase of shares from employees for

income tax withholding purposes

(245

)

(165

)

Other, net

—

(214

)

Net cash provided by financing

activities

49

25,588

Net change in cash, cash equivalents

and restricted cash

(7,808

)

2,836

Cash, cash equivalents and restricted

cash, beginning of period

22,483

36,655

Cash, cash equivalents and restricted

cash, end of period

$

14,675

$

39,491

ESS Tech, Inc.

Condensed Statements of Cash

Flows (continued)

(unaudited)

(in thousands)

Nine Months Ended September

30,

2024

2023

Supplemental disclosures of cash flow

information:

Cash paid for operating leases included in

cash used in operating activities

$

1,306

$

1,246

Non-cash investing and financing

transactions:

Purchase of property and equipment

included in accounts payable and accrued and other current

liabilities

2,844

747

Adjustment to right-of-use assets from

lease modification

686

—

Common stock warrants issued for the

acquisition of intangible assets

—

4,990

Transfers between inventory and property

and equipment, net

1,051

—

Cash and cash equivalents

$

12,822

$

37,173

Restricted cash, current

906

1,373

Restricted cash, non-current

947

945

Total cash, cash equivalents and

restricted cash shown in the condensed statements of cash flows

$

14,675

$

39,491

ESS Tech, Inc.

Reconciliation of GAAP to

Non-GAAP Operating Expenses

(unaudited)

(in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Research and development

$

2,684

$

1,609

$

9,066

$

38,790

Less: stock-based compensation

(614

)

(278

)

(1,923

)

(2,401

)

Non-GAAP research and development

$

2,070

$

1,331

$

7,143

$

36,389

Sales and marketing

$

2,529

2,056

$

7,274

$

5,648

Less: stock-based compensation

(209

)

(211

)

(467

)

(526

)

Non-GAAP sales and marketing

$

2,320

$

1,845

$

6,807

$

5,122

General and administrative

$

6,087

$

5,831

$

17,791

$

16,963

Less: stock-based compensation

(1,306

)

(1,522

)

(4,280

)

(3,868

)

Non-GAAP general and administrative

$

4,781

$

4,309

$

13,511

$

13,095

Total operating expenses

$

11,300

$

9,496

$

34,131

$

61,401

Less: stock-based compensation

(2,129

)

(2,011

)

(6,670

)

(6,795

)

Non-GAAP total operating expenses

$

9,171

$

7,485

$

27,461

$

54,606

ESS Tech, Inc.

Reconciliation of GAAP Net

Loss to Adjusted EBITDA

(unaudited)

(in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(22,493

)

$

(16,618

)

$

(62,743

)

$

(61,448

)

Interest income, net

(807

)

(1,155

)

(3,097

)

(3,737

)

Stock-based compensation

2,658

2,889

8,538

7,673

Depreciation and amortization

781

1,082

3,302

3,187

Gain on revaluation of common stock

warrant liabilities

(343

)

(344

)

(459

)

(917

)

Environmental, Health & Safety

compliance estimate

390

—

390

—

Financing costs

983

—

983

—

Other income, net

(39

)

(17

)

(2

)

(738

)

Adjusted EBITDA

$

(18,870

)

$

(14,163

)

$

(53,088

)

$

(55,980

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113260859/en/

Investors: Erik Bylin investors@essinc.com

Media: Morgan Pitts 503.568.0755

Morgan.Pitts@essinc.com

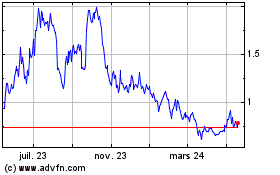

ESS Tech (NYSE:GWH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

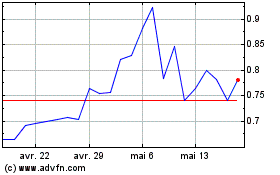

ESS Tech (NYSE:GWH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024