AM Best has downgraded the Financial Strength Rating

(FSR) to B+ (Good) from B++ (Good) and the Long-Term Issuer Credit

Rating (Long-Term ICR) to “bbb-” (Good) from “bbb” (Good) of Humana

Insurance of Puerto Rico, Inc. and Humana Health Plans of Puerto

Rico, Inc. These companies are domiciled in Puerto Rico and

collectively are referred to as Humana Health of Puerto Rico Group.

The outlook of these Credit Ratings (ratings) has been revised to

negative from stable. Concurrently, AM Best has affirmed the FSR of

A (Excellent) and the Long-Term ICRs of “a” (Excellent) for the

health and dental insurance subsidiaries of Humana Inc. (Humana)

(headquartered in Louisville, KY) [NYSE: HUM]. These subsidiaries

collectively are referred to as Humana Health Group. In addition,

AM Best has affirmed the Long-Term ICR of “bbb” (Good) and the

Long-Term Issue Credit Ratings (Long-Term IRs) of Humana Inc.

(Humana). AM Best also has affirmed the Short-Term Issue Credit

Rating of AMB-2 (Satisfactory) for Humana. The outlook of these

ratings is stable. (See below for a detailed listing of Humana

Health Group members and Long-Term IRs.)

The ratings of Humana Health Group reflects its balance sheet

strength, which AM Best assesses as adequate, as well as its strong

operating performance, favorable business profile and appropriate

enterprise risk management (ERM).

Humana Health Group’s balance sheet strength is assessed as

adequate, despite a decline in risk-adjusted capitalization to a

weak level, as measured by Best’s Capital Adequacy Ratio (BCAR).

The decline was primarily driven by strong premium growth in 2023

and related required capital to support these risks. The group’s

premium expansion has outpaced capital growth in recent years, due

largely to dividends from the regulated entities to the parent,

Humana.

The Humana Health Group maintains a conservative invested asset

portfolio that is mainly composed of investment grade fixed income

securities, cash, and short-term investments in order to preserve

capital and to supplement operating gains. Capitalization has

increased annually over the past five years, rising at a 7.5%

compound annual growth rate over the period as the group reported

consistently favorable operating results. Recently, the group’s

operating performance has been pressured by challenges in its core

business line, Medicare Advantage (MA). Not only has the medical

cost trend in MA increased over the past year, but the business has

also been impacted by several regulatory factors related to lower

payment rates and Star Ratings bonus and rebate revenue from the

Centers for Medicare and Medicaid Services (CMS), which will

further impact results in the upcoming years. However, Humana

Health Group exhibited strong operating results prior to the

declines reported in 2024, owing to the steady growth of MA and

lower claims trends that were influenced by COVID-19 pandemic

deferrals of care. AM Best expects MA challenges to persist in the

near to mid-term, but Humana Health Group to continue to report

overall profitability, albeit with some margin compression as it

navigates certain of the challenges in the business.

Humana Health Group generates the majority of its premium base

from MA, but premium income is also sourced from Medicaid managed

care and supplementary lines, including dental and vision.

Effective 2023, Humana exited the commercial market. While its

concentration of business in government health programs makes the

organization susceptible to headwinds in the MA and Medicaid

businesses, Humana benefits from an excellent market position that

spans nationwide, which supports its favorable business profile

assessment. Revenue and earnings are also diversified through

Humana’s non-insurance segment, CenterWell. The CenterWell entities

focus on value-based care initiatives through primary care, home

care and pharmacy services operations. Furthermore, Humana Health

Group holds the TRICARE East contract, which was recently renewed

for an extended period. All of the group’s operations are supported

by a well-developed ERM program to ensure proper oversight and

mitigation of key risks.

The ratings of Humana Health of Puerto Rico Group reflect its

balance sheet strength, which AM Best assesses as weak, as well as

its marginal operating performance, limited business profile and

appropriate ERM.

The ratings downgrade Humana Health of Puerto Rico Group and

outlook revision to negative reflect its weakening risk-adjusted

capitalization measures, driven by significant operating losses

since 2023. These operating losses were predominantly brought on by

a material increase in the MA medical cost trend, its primary

business segment, which has persisted through 2024. This has caused

a substantial deterioration of the group’s surplus, especially at

Humana Health Plans of Puerto Rico, Inc., which reported a net loss

of $63.9 million at year-end 2023 and $16.4 million through the

third quarter of 2024.

Humana Health of Puerto Rico Group maintains the support of its

parent company, Humana, as evidenced by material capital support

within the past year in the form of two $30 million capital

contributions to ensure an appropriate regulatory capital position.

However, AM Best believes this was not enough to support the

business expansion and deterioration in underwriting results

experienced in 2023 and 2024. AM Best expects capital support to

continue as needed to support these regulated entities as Humana

Health of Puerto Rico Group navigates its current operating

challenges. AM Best notes that these entities derive rating lift

from the parent, and continued support is required for this to

continue.

The parent, Humana, has a good level of financial flexibility

due to its strong operating cash flows, subsidiary dividends and

material available cash position. This is further enhanced by its

commercial paper program, revolving credit agreement and access to

a borrowing capacity through the Federal Home Loan Bank of

Cincinnati at its subsidiary, Humana Insurance Company. Similar to

many of the public health insurance carriers, unadjusted financial

leverage was relatively high at 41.8% at year-end 2023. While this

slightly exceeds the entity’s target leverage ratio, interest

coverage ratios remain sufficient to support Humana Inc.’s

debt.

AM Best has affirmed the FSR of A (Excellent) and the Long-Term

ICR of “a” (Excellent) with stable outlooks for the following

health and dental insurance subsidiaries of Humana Inc.:

- Humana Medical Plan, Inc.

- Humana Insurance Company

- Humana Health Plan, Inc.

- Humana Health Benefit Plan of Louisiana, Inc.

- Humana Health Plan of Texas, Inc.

- Humana Health Insurance Company of Florida, Inc.

- Humana Benefit Plan of Illinois, Inc.

- Humana Health Plan of Ohio, Inc.

- Humana Employers Health Plan of Georgia, Inc.

- Humana Insurance Company of New York

- Humana Wisconsin Health Organization Insurance Corporation

- Humana Insurance Company of Kentucky

- Cariten Health Plan Inc.

- CarePlus Health Plans, Inc.

- HumanaDental Insurance Company

- CompBenefits Insurance Company

- CompBenefits Company

- CompBenefits Dental, Inc.

- The Dental Concern, Inc.

- DentiCare, Inc.

The following Long-Term IRs have been affirmed with stable

outlooks:

Humana Inc.- — “bbb” (Good) on $600 million 4.5% senior

unsecured notes, due 2025 — “bbb” (Good) on $500 million 5.7%

senior unsecured notes, due 2026 — “bbb” (Good) on $750 million

1.35% senior unsecured notes, due 2027 — “bbb” (Good) on $600

million 3.95% senior unsecured notes, due 2027 — “bbb” (Good) on

$500 million 5.75% senior unsecured notes, due 2028 — “bbb” (Good)

on $500 million 5.75% senior unsecured notes, due 2028 — “bbb”

(Good) on $500 million 3.125% senior unsecured notes, due 2029 —

“bbb” (Good) on $750 million 3.7% senior unsecured notes, due 2029

— “bbb” (Good) on $500 million 4.875% senior unsecured notes, due

2030 — “bbb” (Good) on $1.25 billion 5.375% senior unsecured notes,

due 2031 — “bbb” (Good) on $750 million 2.15% senior unsecured

notes, due 2032 — “bbb” (Good) on $750 million 5.875% senior

unsecured notes, due 2033 — “bbb” (Good) on $850 million 5.95%

senior unsecured notes, due 2034 — “bbb” (Good) on $250 million

8.15% senior unsecured notes, due 2038 — “bbb” (Good) on $400

million 4.625% senior unsecured notes, due 2042 — “bbb” (Good) on

$750 million 4.95% senior unsecured notes, due 2044 — “bbb” (Good)

on $400 million 4.8% senior unsecured notes, due 2047 — “bbb”

(Good) on $500 million 3.95% senior unsecured notes, due 2049 —

“bbb” (Good) on $750 million 5.5% senior unsecured notes, due 2053

— “bbb” (Good) on $1 billion 5.75% senior unsecured notes, due

2054

The following indicative Long-Term IRs have been affirmed with

stable outlooks for the following shelf registrations:

Humana Inc.— — “bbb” (Good) on senior unsecured debt securities

— “bbb-” (Good) on subordinated debt securities — “bb+” (Fair) on

preferred stock

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205652579/en/

Timothy Willey Financial Analyst +1 908 882

2433 timothy.willey@ambest.com

Joseph Zazzera Director +1 908 882 2442

joseph.zazzera@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

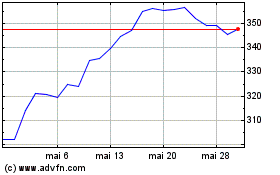

Humana (NYSE:HUM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Humana (NYSE:HUM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024