0001268884falseAsset Coverage per $1,000: Asset coverage per $1,000 of debt is calculated by subtracting the Trust’s liabilities and indebtedness not represented by senior securities from the Trust’s total assets, dividing the result by the aggregate amount of the Trust’s senior securities representing indebtedness then outstanding, and multiplying the result by 1,000. 0001268884 2023-01-01 2023-12-31 0001268884 2019-12-31 0001268884 2020-12-31 0001268884 2021-12-31 0001268884 2022-12-31 0001268884 2023-12-31 0001268884 ck0001268884:MarketDisruptionRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:ConcentrationRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:InvestmentRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:LeverageRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:MarketDiscountRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:DeflationRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:CommonStockRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:StockMarketRisksMember 2023-01-01 2023-12-31 0001268884 ck0001268884:InflationRiskMember 2023-01-01 2023-12-31 0001268884 us-gaap:InterestRateRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:SmallCapRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:EmergingMarketsRisksMember 2023-01-01 2023-12-31 0001268884 ck0001268884:ForeignCurrencyRiskMember 2023-01-01 2023-12-31 0001268884 ck0001268884:ForeignSecuritiesRisksMember 2023-01-01 2023-12-31 xbrli:shares iso4217:USD iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21465

CBRE Global Real Estate Income Fund

(Exact name of registrant as specified in charter)

555 East Lancaster Avenue, Suite 120

(Address of principal executive offices) (Zip code)

Joseph P. Smith, President and Chief Executive Officer

CBRE Global Real Estate Income Fund

555 East Lancaster Avenue, Suite 120

(Name and address of agent for service)

Registrant’s telephone number, including area code:

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form

N-CSR

is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule

30e-1

under the Investment Company Act of 1940 (17 CFR

270.30e-1).

The Commission may use the information provided on Form

N-CSR

in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSR,

and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form

N-CSR

unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| |

(a) |

The Report to Shareholders of CBRE Global Real Estate Income Fund (the “Trust”) is attached herewith. |

Annual Report

CBRE Global Real Estate

Income Fund

2023

CBRE Global Real Estate Income Fund

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

8 |

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

19 |

|

|

|

|

|

|

20 |

|

|

|

|

|

|

21 |

|

|

|

|

|

|

22 |

|

|

|

|

|

|

23 |

|

|

|

|

|

|

24 |

|

|

|

|

|

|

32 |

|

|

|

|

|

|

34 |

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

1 |

|

CBRE Global Real Estate Income Fund (the “Trust”), acting in accordance with an exemptive order received from the Securities and Exchange Commission and with approval of its Board of Trustees (the “Board”), has adopted a managed distribution policy with the purpose of distributing over the course of each year, through periodic distributions as nearly equal as practicable and any required special distributions, an amount closely approximating the total taxable income of the Trust during such year plus, if so desired by the Board, all or a portion of the capital gains and returns of capital from portfolio companies received by the Trust during the year.

In furtherance of its policy, the Trust distributes a fixed amount per common share, currently $0.06, each month to its common shareholders. This amount is subject to change from time to time in the discretion of the Board. In an effort to maintain the Trust’s monthly distribution at a stable level, the Board recognizes that a portion of the Trust’s distributions may be characterized as a return of capital, particularly in periods when the Trust incurs losses on its portfolio securities. Under such circumstances, the Board will not necessarily reduce the Trust’s distribution, but will closely monitor its sustainability, recognizing that losses may be reversed and that, in subsequent periods, gains on portfolio securities may give rise to the need for a supplemental distribution, which the Trust seeks to minimize. In considering sustainability, the Board may consider realized gains that have been offset, for the purposes of calculating taxable income, by capital loss carryforwards. Thus, the level of the Trust’s distributions will be independent of its performance for a particular period, but the Trust expects its distributions to correlate to its performance over time. In particular, the Trust expects that its distribution rate in relation to its net asset value (“NAV”) will correlate to its total return on NAV over time. The Trust’s total return on NAV is presented in the financial highlights table.

Shareholders should not draw any conclusions about the Trust’s investment performance from the amount of the current distribution or from the terms of the Trust’s managed distribution policy. The Board may amend or terminate the policy without prior notice to shareholders. Shareholders should note that the managed distribution policy is subject to change or termination for a variety of reasons. Through its ownership of portfolio securities, the Trust is subject to risks including, but not limited to, declines in the value of real estate held by portfolio companies, risks related to general and local economic conditions, and portfolio company losses. An economic downturn might have a material adverse effect on the real estate markets and the real estate companies in which the Trust invests, which could result in the Trust failing to achieve its investment objectives and jeopardizing the continuance of the managed distribution policy. Please refer to the Trust’s Prospectus for a fuller description of the risks associated with investing in the Trust.

The views expressed represent the opinion of CBRE Investment Management Listed Real Assets LLC (“CBREIM”), which are subject to change and are not intended as investment advice or a guarantee of future results. This material is for informational purposes only. It is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and

non-proprietary

sources which have not been independently verified for accuracy or completeness. While CBREIM believes the information to be accurate and reliable, we do not claim or accept responsibility for its completeness, accuracy, or reliability. Statements of future expectations, forecasts, estimates, projections, and other forward-looking statements are based on CBREIM’s view at the time such statements were made. Accordingly, such statements are inherently speculative, as they are based on assumptions which may involve known and unknown risks and uncertainties. Any discussion of particular securities herein should not be perceived as a recommendation to purchase or sell any of those securities. It should not be assumed that investments in any securities discussed were or will be profitable. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in real estate securities involves risks including the potential loss of principal. Real estate equities are subject to risks similar to those associated with the direct ownership of real estate.

Portfolios concentrated in real estate securities may experience price volatility and other risks associated with

non-diversification.

While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. International

(non-US)

investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Past performance is no guarantee of future results. FINRA compliance services: Foreside Fund Services, LLC.

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

2 |

|

We are pleased to present the 2023 Annual Report for the CBRE Global Real Estate Income Fund (the “Trust”).

Global real estate stocks generated strong performance in the second half of the year (“2H2023”), delivering an +8.6% return. The strong performance in 2H2023 came fourth quarter with global real estate stocks soaring +15.6% as Fed Chair Powell announced the Federal Open Market Committee will cut rates in 2024. For the calendar year (“CY2023”), real estate stocks were up +9.7% but still underperformed the broad market which delivered a +24.4% return for the year.

1

Investment returns during the past two years have been largely driven by the market adapting to higher interest rates, which has resulted in a material drop in commercial real estate pricing from peak valuations in early 2022. Underlying property valuations in the listed market have ‘dislocated’ further from valuations in the private market, with REITs currently trading at a discount to private market valuations. REITs have typically outperformed equities, bonds and private real estate at the end of Fed tightening cycles. In our opinion, real estate stocks remain attractively valued and offer above-average and growing dividend yields as well as resilient earnings growth. We believe investors committing capital to listed real estate at this time have the potential to earn an attractive absolute and relative long-term total return.

For the year, Europe was the best performing region followed by North America and Asia-Pacific. Common stocks underperformed preferred securities.

Global Real Estate Market Performance as of December 31, 2023

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| REGION |

|

|

|

|

|

|

| North America 2 |

|

4.6% |

|

6.7% |

|

11.6% |

| Europe 2 |

|

-6.1% |

|

27.9% |

|

20.0% |

| Asia-Pacific 2 |

|

-4.9% |

|

3.9% |

|

-1.2% |

| Global Real Estate Common Stocks 3 |

|

1.0% |

|

8.6% |

|

9.7% |

| U.S. REIT Preferred Stocks 4 |

|

9.2% |

|

5.2% |

|

14.9% |

| 80/20 Blend of Global Common Stock & U.S. Preferred Stock 5 |

|

2.7% |

|

7.9% |

|

10.8% |

The Trust’s net asset value (“NAV”) return was +11.0% during 2023, outperforming the +10.8% return for an 80/20 mix of global common stock and preferred securities. Although the Trust’s underweight to outperforming preferred stocks detracted from relative performance, the positive selection and allocation elsewhere more than offset the negative impact. We believe that an underweight position to preferred stocks is warranted given the discounted valuations our common stock universe continues to price in. Selection and allocation within the U.S. had a significant impact on the Trust’s outperformance on a relative basis and an absolute basis. Our exposure to the data center, hotel, self-storage and mall sectors were some of the largest absolute contributors for the year, posting returns above +20%. Our material overweight in these sectors during the

1 |

|

Global real estate stocks as measured by FTSE EPRA Nareit Developed Index – Net returned +15.6% during the fourth quarter, +8.6% during the second half of the year and +9.7% for the calendar year. The broader market as measured by the MSCI World Index (USD) returned +24.4% for the calendar year. |

2 |

|

Regional allocations for the FTSE EPRA Nareit Developed Index – Net are determined based on classifications by CBRE Investment Management. North America regional performance excludes U.S. REIT preferred stocks and only represents U.S. common stocks within the FTSE EPRA Nareit Developed Index – Net. |

3 |

|

Represented by the FTSE EPRA Nareit Developed Index – Net. The Index is an unmanaged market-weighted index consisting of real estate companies from developed markets, where greater than 75% of constituents’ EBITDA (earnings before interest, taxes, depreciation, and amortization) is derived from relevant real estate activities and is calculated net of withholding taxes. Investors cannot invest directly in an index. |

4 |

|

Represented by the MSCI REIT Preferred Index, a preferred stock market capitalization-weighted index of certain exchange-traded preferred securities issued by U.S. equity and U.S. hybrid REITs. Investors cannot invest directly in an index. |

5 |

|

Represented by the daily weighted average of the following indices: 80% FTSE EPRA Nareit Developed – Net and 20% MSCI Preferred Index. Investors cannot invest directly in an index. |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

3 |

|

year also contributed significantly on a relative basis. During 2H2023, we made the strategic decision to decrease our exposure to the data center sector, a material overweight at the start of the year, following the strong absolute performance in the first half of the year. Our constant underweight to the net lease sector was also a significant contributor for the year, however we did increase our exposure to the sector in 2H2023. Europe was the strongest region on an absolute basis and also had a positive impact on a relative basis. Our overweight allocation along with superior stock selection in Continental Europe resulted in positive relative performance in that region. Our overweight position to Unibail, up over +40% for the year, significantly contributed to absolute and relative performance. In Asia, we underperformed on a relative basis due most in part to an overweight allocation in Hong Kong. Hong Kong underperformed as weakness in the Chinese economy continued to weigh on Hong Kong markets. Positive stock selection in Australia and Japan REOCS did partially offset the negative impact from Hong Kong allocation.

In April of 2023, the Trust successfully completed a Transferable Rights Offering (the Offering) raising $117.6 million of additional capital. One of the primary goals of the Offering was to enhance the distribution and NAV appreciation potential of the Trust and we believe the capital was raised during a period of favorable market conditions. In the months following the close of the Offering, our portfolio management team patiently invested the capital in securities we believe offered historically attractive valuations and above total return potential.

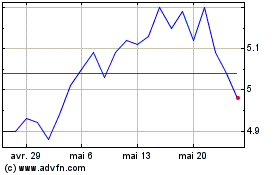

The Trust, acting in accordance with an exemptive order received from the U.S. Securities and Exchange Commission (SEC), utilizes a managed distribution policy under which the Trust’s regular monthly distribution may include both income and, where applicable, realized capital gains. The Trust may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess would be a return of capital distributed from the Fund’s assets. In accordance with its distribution policy, and with the approval of its Board of Trustees (the Board), the Trust made total distributions of $0.72 per share during CY2023. The total annual distribution of $0.72 represents a 13.3% rate on the $5.43 share price and an 11.6% rate on the $6.20 NAV as of December 31

st

, 2023.

6

The Board continues to regularly review the level of the Trust’s distribution and the ability to sustain it.

The Trust continues to utilize leverage with the goal of delivering incrementally higher distributions to shareholders. The Trust’s leverage position was 25% on December 31

st

, 2023, down from 30% on June 30

th

, 2023.

The Trust’s investments remain well-diversified by property type and geography. On December 31

st

, the Trust’s portfolio was approximately 94% invested in common stock securities (63% in the Americas, 19% in Asia-Pacific, and 12% in Europe) with 6% of the portfolio invested in preferred stock of U.S. real estate companies.

|

|

|

Geographic exposure as of December 31, 2023 |

|

Sector exposure as of December 31, 2023 |

|

|

|

|

|

| Source: CBRE Investment Management as of 12/31/2023. |

|

|

Geographic and Sector diversification are unaudited. Percentages presented are based on managed trust assets, which include borrowings. The percentages in the pie charts will differ from those on the Portfolio of Investments because the figures on the Portfolio of Investments are calculated using net assets of the Trust.

6 |

|

The Trust is currently paying distributions in excess of its net investment income and capital gains, which may result in a return of capital. Absent this, the distribution rate would have been lower. The estimated composition of each distribution, including any return of capital, will be provided to shareholders of record and is also available at www.cbreim.com. Final determination of a distribution’s tax character will be made on Form 1099 DIV and sent to shareholders. |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

4 |

|

We believe the listed markets should benefit from central bank rate cuts in 2024 and remain attractively valued relative to fixed income, equities and private real estate. We estimate that REITs are trading at a double digit discount to our assessment of private market values. REITs rarely trade at such a wide discount to the private markets. These indications have typically preceded periods of strong returns.

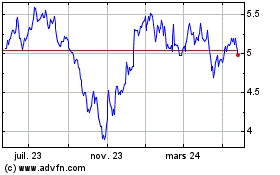

Global Real Estate NAV Premium/Discount

Estimated Net Asset Value is calculated based on individual REIT only stocks followed by the firm’s research team and are considered as investible. Global, Country, and Sector NAV Premium Discounts are calculated using simple average with CBRE Investment Management’s proprietary models. Information is the opinion of CBRE Investment Management as of 12/31/2023, is subject to change and is not intended to be a forecast of future events, or a guarantee of future results, or investment advice. Forecasts and any factors discussed are not indicative of future investment performance.

High occupancies, long-duration leases and staggered lease terms support earnings stability. Higher construction costs support a healthy supply vs demand dynamic. Balance sheets and leverage levels for the public companies are in a position of strength relative to history. We project earnings growth of 3.0% in 2024 and dividend growth at least in line with earnings

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

5 |

|

Global real estate earnings growth forecast by region

Source: CBRE Investment Management as of 12/31/2023. “e” refers to “estimate” and “f” refers to “forecasts.” 2023 is represented by 2023/2022 and 2024 is represented by 2024/2023. The global average does not include the 2022 growth rates for the U.S. hotel sector due to the negative hotel growth in 2020 as a result of the pandemic. Earnings growth forecasts are calculated based on FFO Growth of US Towers and individual stocks followed by the firm’s research team and are considered as investible. Global, Country, and Sector FFO Growth is calculated using weighted averages. Forecasts are the opinion of CBRE Investment Management, which is subject to change and is not intended to be a guarantee of future results or investment advice. Forecasts are not indicative of future investment performance.

As private market asset owners manage the upcoming wall of debt maturities, we expect REITs to benefit from external growth opportunities that are accretive to earnings. Despite tighter lending standards overall, REITs have demonstrated access to capital not available to private real estate investors. M&A transactions have increased as REITs have access to capital as well as a cost of capital advantage compared with private market investors.

We believe real estate dividend yield remains attractive. Current income generated by listed property’s dividend yields remains an attractive investment characteristic of the sector.

We own a well-balanced portfolio of securities that have been screened for their growth prospects in combination with the quality of their business models, assets, balance sheets, and management teams. We are positive on property types, regions, and stocks that offer these qualities at reasonable valuations. In the United States, we are overweight malls, towers, storage, residential, hotels, industrial and healthcare. In Japan, we prefer

mid-cap

diversified

J-REITs

that provide earnings growth and resiliency at very attractive relative valuations. In Hong Kong, we are overweight diversified companies with a commercial bias and

non-discretionary

retail. In Australia, we prefer industrial, retail, and a few select diversified companies. In the U.K., we favor the storage sector, as well as attractively priced diversified companies. Within Continental Europe, we have a positive bias toward retail, office, and select diversified companies.

We believe active management can offer significant relative return potential at this time when investors have a unique opportunity to invest in listed real estate at attractive valuations. We think our “information advantage” and the disciplined use of our proprietary analytical tools will allow us to outperform a passive strategy in a variety of market environments over time. As we look ahead, we believe our portfolio is well-positioned to deliver relative outperformance.

We appreciate your continued faith and confidence.

Sincerely,

CBRE INVESTMENT MANAGEMENT LISTED REAL ASSETS LLC

|

|

|

|

|

|

|

|

|

|

JOSEPH P. SMITH, CFA Portfolio Manager

President & CEO |

|

KENNETH S. WEINBERG, CFA Portfolio Manager |

|

JONATHAN D. MINIMAN, CFA Portfolio Manager |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

6 |

|

IMPORTANT DISCLOSURES AND RISK INFORMATION

Must be preceded or accompanied by a prospectus.

The views expressed represent the opinion of CBRE Investment Management Listed Real Assets LLC (“CBREIM”), which are subject to change and are not intended as investment advice or a guarantee of future results. This material is for informational purposes only. It is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and

non-proprietary

sources which have not been independently verified for accuracy or completeness. While CBREIM believes the information to be accurate and reliable, we do not claim or accept responsibility for its completeness, accuracy, or reliability. Statements of future expectations, forecasts, estimates, projections, and other forward-looking statements are based on CBREIM’s view at the time such statements were made. Accordingly, such statements are inherently speculative, as they are based on assumptions that may involve known and unknown risks and uncertainties. Any discussion of securities herein should not be perceived as a recommendation to purchase or sell any of those securities. It should not be assumed that investments in any securities discussed were or will be profitable. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in real estate securities involves risks including the potential loss of principal. Real estate equities are subject to risks like those associated with the direct ownership of real estate. Portfolios concentrated in real estate securities may experience price volatility and other risks associated with

non-diversification.

While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. International

(non-US)

investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Past performance is no guarantee of future results.

Fund holdings and sector allocations are subject to change. For a complete list of holdings, please see the schedule of investments section.

Distributed by Foreside Funds Services

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

7 |

|

Fees and expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including management fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples in the table are based on an investment of $1,000 invested at the beginning of the

six-month

period and held for the entire period (July 1, 2023 to December 31, 2023).

The first line in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Expenses paid

during the period |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

CBRE GLOBAL REAL ESTATE INCOME FUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual |

|

$ |

1,000.00 |

|

|

$ |

1,122.00 |

|

|

|

4.04 |

% |

|

$ |

21.61 |

|

Hypothetical (5% return before expenses) |

|

$ |

1,000.00 |

|

|

$ |

1,004.84 |

|

|

|

4.04 |

% |

|

$ |

20.42 |

|

(1) |

Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 365. |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

8 |

|

Additional Information – Investment Objectives, Policies, and Risks (unaudited)

The Trust’s primary investment objective is high current income. The Trust’s secondary investment objective is capital appreciation. The Trust’s investment objectives and certain investment policies are considered fundamental and may not be changed without shareholder approval. There can be no assurance that the Trust’s investment objectives will be achieved.

The Trust has a policy of concentrating its investments in the real estate industry and not in any other industry. Under normal market conditions, the Trust will invest substantially all but no less than 80% of its total assets in income-producing global “Real Estate Equity Securities.” Real Estate Equity Securities include common stocks, preferred securities, warrants and convertible securities issued by real estate companies, such as real estate investment trusts (“REITs”). The Trust, under normal market conditions, will invest in Real Estate Equity Securities of companies domiciled primarily in developed countries. However, the Trust may invest up to 15% of its total assets in Real Estate Equity Securities of companies domiciled in emerging market countries. Under normal market conditions, the Trust expects to have investments in at least three countries, including the United States.

The Trust may invest up to 25% of its total assets in preferred securities of global real estate companies. The Trust may invest up to 20% of its total assets in preferred securities that are rated below investment grade or that are not rated and are considered by the Trust’s investment adviser to be of comparable quality. Preferred securities of

non-investment

grade quality are regarded as having predominantly speculative characteristics with respect to the capacity of the issuer of the preferred securities to pay interest and repay principal. Investment grade quality securities are those that are rated within the four highest grades by Moody’s Investors Service, Inc., S&P Global Ratings, or Fitch Ratings at the time of investment or are considered by the Trust’s investment adviser to be of comparable quality. Although it has no present intentions to do so, the Trust may invest up to 15% of its total assets in securities and other instruments that, at the time of investment, are illiquid

(i.e., securities that are not readily marketable).

The Trust defines a real estate company as a company that derives at least 50% of its revenue from the ownership, construction, financing, management or sale of commercial, industrial or residential real estate or has at least 50% of its assets invested in such real estate. A common type of real estate company, a REIT, is a domestic corporation that pools investors’ funds for investment primarily in income-producing real estate or in real estate related loans (such as mortgages) or other interests. Therefore, a REIT normally derives its income from rents or from interest payments and may realize capital gains by selling properties that have appreciated in value. A REIT is not taxed on income distributed to its shareholders if it complies with several requirements of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, REITs tend to pay relatively high dividends (as compared to other types of companies), and the Trust intends to use these REIT dividends in an effort to meet its primary objective of high current income.

Global real estate companies outside the U.S. include, but are not limited to, companies with similar characteristics to the REIT structure, in which revenue primarily consists of rent derived from owned, income-producing real estate properties, dividend distributions as a percentage of taxable net income are high (generally greater than 80%), debt levels are generally conservative and income derived from development activities is generally limited.

The Trust may invest in securities of foreign issuers in the form of American Depositary Receipts (“ADRs”) and European Depositary Receipts (“EDRs”).

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

9 |

|

The Trust may engage in foreign currency transactions, including foreign currency forward contracts, options, swaps, and other strategic transactions in connection with its investments in foreign Real Estate Equity Securities. Although not intended to be a significant element in the Trust’s investment strategy, from time to time the Trust may use various other investment management techniques that also involve certain risks and special considerations, including engaging in interest rate transactions and short sales.

The Trust will invest in Real Estate Equity Securities where dividend distributions are subject to withholding taxes as determined by United States tax treaties with respective individual foreign countries. Generally, the Trust will invest in Real Estate Equity Securities that are excluded from the reduced tax rates as determined by the Jobs and Growth Tax Relief Reconciliation Act of 2003.

The Trust is a diversified,

closed-end

management investment company designed primarily as a long-term investment and not as a trading vehicle. The Trust is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Trust will achieve its investment objectives. Your common shares at any point in time may be worth less than you invested, even after taking into account the reinvestment of Trust dividends and distributions.

GENERAL REAL ESTATE RISKS

Because the Trust concentrates its assets in the global real estate industry, your investment in the Trust will be closely linked to the performance of the global real estate markets. Property values may fall due to increasing vacancies or declining rents resulting from economic, legal, cultural or technological developments. The price of real estate company shares may drop because of falling property values, increased interest rates, poor management of the company or other factors. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates.

There are also special risks associated with particular sectors of real estate investments.

| – |

Retail properties are affected by the overall health of the economy and may be adversely affected by, among other things, the growth of alternative forms of retailing, bankruptcy, departure or cessation of operations of a tenant, a shift in consumer demand due to demographic changes, spending patterns and lease terminations. |

| – |

Office properties are affected by the overall health of the economy, and other factors such as a downturn in the businesses operated by their tenants, obsolescence and non-competitiveness. |

| – |

The risks of hotel properties include, among other things, the necessity of a high level of continuing capital expenditures, competition, increases in operating costs which may not be offset by increases in revenues, dependence on business and commercial travelers and tourism, increases in fuel costs and other expenses of travel, and adverse effects of general and local economic conditions. Hotel properties tend to be more sensitive to adverse economic conditions and competition than many other commercial properties. |

| – |

Healthcare properties and healthcare providers are affected by several significant factors, including federal, state and local laws governing licenses, certification, adequacy of care, pharmaceutical distribution, rates, equipment, personnel and other factors regarding operations, continued availability of revenue from government reimbursement programs, and competition on a local and regional basis. The failure of any healthcare operator to comply with governmental laws and regulations may affect its ability to operate its facility or receive government reimbursements. |

| – |

The value and successful operation of a multifamily property may be affected by a number of factors such as the location of the property, the ability of the management team, the level of mortgage rates, the presence of competing properties, adverse economic conditions in the locale, oversupply and rent control laws or other laws affecting such properties. |

| – |

Community Shopping Centers Community center properties are dependent upon the successful operations and financial condition of their tenants, particularly certain of their major tenants, and could be adversely affected by bankruptcy of those tenants. In some cases, a tenant may lease a significant portion of the space in one center, and the filing of bankruptcy could cause significant revenue loss. Like others in the commercial real estate industry, community centers are subject to environmental risks and interest rate risk. They also face the need to enter into new leases or renew leases on favorable terms to generate rental revenues. Community center properties could be adversely affected by changes in the local markets where their properties are located, as well as by adverse changes in national economic and market conditions. |

| – |

The value and successful operation of a self-storage property may be affected by a number of factors, such as the ability of the management team, the location of the property, the presence of competing properties, changes in traffic patterns, and adverse effects of general and local economic conditions with respect to rental rates and occupancy levels. |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

10 |

|

| – |

Industrial properties typically include warehouses, depots, storage, factories, logistics and distributions. Factors such as vacancy, tenant mix, lease term, property condition and design, redevelopment opportunities and property location could adversely affect the value and operation of industrial properties. |

| – |

Cell towers and wireless services have seen an increased demand in recent years. However, owners and operators of towers may be subject to, and therefore must comply with, environmental laws that impose strict, joint and several liability for the cleanup of on-site or off-site contamination and related personal injury or property damage. |

| – |

Data centers facilities house an organization’s most critical and proprietary assets. Therefore, operation of data centers properties depends upon the demand for technology-related real estate and global economic conditions that could adversely affect companies’ abilities to lease, develop or renew leases. Declining real estate valuations and impairment charges could adversely affect earnings and financial condition of data center properties. |

| – |

Net lease properties require the tenant to pay (in addition to the rent) property taxes, insurance, and maintenance on the property. Tenant’s ability to pay rent, interest rate fluctuations, vacancy, property location, length of the lease are only few of the risks that could affect net lease properties operations. |

Other factors that may contribute to the riskiness of all real estate investments include:

| – |

Certain of the portfolio companies may fail to carry comprehensive liability, fire, flood, earthquake extended coverage and rental loss insurance, or insurance in place may be subject to various policy specifications, limits and deductibles. Should any type of uninsured loss occur, the portfolio company could lose its investment in, and anticipated profits and cash flows from, a number of properties and as a result adversely affect the Trust’s investment performance. |

| – |

Global real estate companies may be highly leveraged and financial covenants may affect the ability of global real estate companies to operate effectively. |

| – |

In connection with the ownership (direct or indirect), operation, management and development of real properties that may contain hazardous or toxic substances, a portfolio company may be considered an owner, operator or responsible party of such properties and, therefore, may be potentially liable for removal or remediation costs, as well as certain other costs, including governmental fines and liabilities for injuries to persons and property. The existence of any such material environmental liability could have a material adverse effect on the results of operations and cash flow of any such portfolio company and, as a result, the amount available to make distributions on shares of the Trust could be reduced. |

| – |

The value of real estate is particularly susceptible to acts of terrorism and other changes in foreign and domestic conditions. |

| – |

Acts of God and Geopolitical Risks The performance of certain investments could be affected by acts of God or other unforeseen and/or uncontrollable events (collectively, “disruptions”), including, but not limited to, natural disasters, public health emergencies (including any outbreak or threat of COVID-19, SARS, H1N1/09 flu, avian flu, other coronavirus, Ebola, or other existing or new pandemic or epidemic diseases), terrorism, social and political discord, geopolitical events, national and international political circumstances, and other unforeseen and/or uncontrollable events with widespread impact. These disruptions may affect the level and volatility of security prices and liquidity of any investments. Unexpected volatility could impair an investment’s profitability or result in it suffering losses. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or securities industry participants in other countries or regions. |

The extent of the impact of any such disruption on the Trust will depend on many factors, including the duration and scope of such disruption, the extent of any related travel advisories and restrictions implemented, the impact of such disruption on overall supply and demand, goods and services, investor liquidity, consumer confidence and levels of economic activity and the extent of its disruption to important global, regional and local supply chains and economic markets, all of which are highly uncertain and cannot be predicted. A disruption may materially and adversely impact the value and performance of any investment, the Adviser’s ability to source, manage and divest investments, and the Adviser’s ability to achieve the Trust’s investment objectives, ultimately resulting in significant losses to investors. In addition, there is a risk that a long disruption will significantly impact the operations of the Adviser, the Trust, and its portfolio investments, or even temporarily or permanently halt their operations.

| – |

REITs are subject to a highly technical and complex set of provisions in the Code. It is possible that the Trust may invest in a real estate company which purports to be a REIT, but which fails to qualify as a REIT. In the event of any such unexpected failure to qualify as a REIT, the purported REIT would be subject to corporate-level taxation, significantly reducing the return to the Trust on its investment in such company. |

A portion of your investment in common shares represents an indirect investment in equity securities owned by the Trust, substantially all of which are traded on a domestic or foreign securities exchange or in the

markets. The value of these securities, like other stock market investments, may move up or down, sometimes rapidly and unpredictably.

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

11 |

|

While common stock has historically generated higher average returns than fixed income securities, common stock has also experienced significantly more volatility in those returns. An adverse event, such as an unfavorable earnings report, may depress the value of common stock held by the Trust. Also, the price of common stock is sensitive to general movements in the stock market. A drop in the stock market may depress the price of common stock held by the Trust.

Although it is not the Trust’s current intent, the Trust may invest up to 100% of its total assets in real estate securities of

non-U.S.

issuers or that are denominated in various foreign currencies or multinational currency units (“Foreign Securities”). Such investments involve certain risks not involved in domestic investments. Securities markets in certain foreign countries are not as developed, efficient or liquid as securities markets in the United States. Therefore, the prices of Foreign Securities often are volatile. In addition, the Trust will be subject to risks associated with adverse political and economic developments in foreign countries, which could cause the Trust to lose money on its investments in Foreign Securities. The Trust may hold any Foreign Securities of issuers in

so-called

“emerging markets” which may entail additional risks.

Although the Trust will report its net asset value and pay dividends in U.S. dollars, Foreign Securities often are purchased with and make interest payments in foreign currencies. Therefore, when the Trust invests in Foreign Securities, it will be subject to foreign currency risk, which means that the Trust’s net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. Certain foreign countries may impose restrictions on the ability of issuers of Foreign Securities to make payment of principal and interest to investors located outside the country, due to blockage of foreign currency exchanges or otherwise.

The Trust may invest in Real Estate Equity Securities of issuers located or doing substantial business in “emerging markets.” Because of less developed markets and economies and, in some countries, less mature governments and governmental institutions, the risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or doing substantial business in emerging market countries. These risks include high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of investors and financial intermediaries; political and social uncertainties; over-dependence on exports, especially with respect to primary commodities, making these economies vulnerable to changes in commodity prices; overburdened infrastructure and obsolete or unseasoned financial systems; environmental problems; less developed legal systems; and less reliable custodial services and settlement practices.

The use of leverage through the use of debt creates an opportunity for increased common share net investment income dividends, but also creates risks for the holders of common shares. The Trust’s leveraging strategy may not be successful. Leverage creates two major types of risks for the holders of common shares:

| – |

the likelihood of greater volatility of net asset value and market price of the common shares because changes in the value of the Trust’s portfolio, including securities bought with the proceeds of the leverage, are borne entirely by the holders of common shares; and |

| – |

the possibility either that common share net investment income will fall if the leverage expense rises or that common share net investment income will fluctuate because the leverage expense varies. |

The Trust may invest in Real Estate Equity Securities of smaller companies which may entail additional risks. There may be less trading in a smaller company’s stock, which means that buy and sell transactions in that stock could have a larger impact on the stock’s price than is the case with larger company stocks. Smaller companies also may have fewer lines of business so that changes in any one line of business may have a greater impact on a smaller company’s stock price than is the case for a larger company. Further, smaller company stocks may perform in different cycles than larger company stocks. Accordingly, shares of these companies can be more volatile than, and at times will perform differently from, large company stocks such as those found in the Dow Jones Industrial Average. In addition, there are relatively few REITs when compared to other types of companies. Even the larger global real estate companies tend to be small to

medium-sized

companies in comparison to many industrial and service companies.

The Trust may invest in preferred securities, which entail special risks, including:

| – |

Preferred securities may include provisions that permit the issuer, at its discretion, to defer distributions for a stated period without any adverse consequences to the issuer. If the Trust owns a preferred security that is deferring its distributions, the Trust may be required to report income for tax purposes although it has not yet received such income. |

| – |

Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure with respect to priority to corporate income and liquidation payments, and therefore will be subject to greater credit risk than more senior debt instruments. |

| – |

Preferred securities may be substantially less liquid than many other securities, such as common stocks or U.S. government securities. |

| – |

Generally, preferred security holders (such as the Trust) have no voting rights with respect to the issuing company unless preferred dividends have been in arrears for a specified number of periods, at which time the preferred security holders may elect a number of directors to the issuer’s board. Generally, once all the arrearages have been paid, the preferred security holders no longer have voting rights. In the case of certain trust preferred securities, |

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

12 |

|

| |

holders generally have no voting rights, except (i) if the issuer fails to pay dividends for a specified period of time or (ii) if a declaration of default occurs and is continuing. In such an event, rights of holders of trust preferred securities generally would include the right to appoint and authorize a trustee to enforce the trust or special purpose entity’s rights as a creditor under the agreement with its operating company. |

| – |

Special Redemption Rights In certain varying circumstances, an issuer of preferred securities may redeem the securities prior to a specified date. For instance, for certain types of preferred securities, a redemption may be triggered by a change in Federal income tax or securities laws. As with call provisions, a redemption by the issuer may negatively impact the return on the security held by the Trust. |

| – |

From time to time, preferred securities, including trust preferred securities, have been, and may in the future be, offered having features other than those described herein. The Trust reserves the right to invest in these securities if the Adviser believes that doing so would be consistent with the Trust’s investment objectives and policies. Since the market for these instruments would be new, the Trust may have difficulty disposing of them at a suitable price and time. In addition to limited liquidity, these instruments may present other risks, such as high price volatility. |

The Trust may invest up to 15% of its total assets in illiquid securities. Illiquid securities are securities that are not readily marketable and may include some restricted securities, which are securities that may not be resold to the public without an effective registration statement under the Securities Act of 1933, (the “Securities Act”) or, if they are unregistered, may be sold only in a privately negotiated transaction or pursuant to an exemption from registration. Illiquid investments involve the risk that the securities will not be able to be sold at the time desired by the Trust or at prices approximating the value at which the Trust is carrying the securities on its books.

The Trust will not invest more than 20% of its total assets in preferred securities rated below investment grade or unrated and considered by the Adviser to be of comparable quality.

The values of lower-rated securities often reflect individual corporate developments and have a higher sensitivity to economic changes than do higher rated securities. Issuers of lower-rated securities are often in the growth stage of their development and/or involved in a reorganization or takeover. The companies are often highly leveraged (have a significant amount of debt relative to shareholders’ equity) and may not have available to them more traditional financing methods, thereby increasing the risk associated with acquiring these types of securities. In some cases, obligations with respect to lower-rated securities are subordinated to the prior repayment of senior indebtedness, which will potentially limit the Trust’s ability to fully recover principal or to receive interest payments when senior securities are in default. Thus, investors in lower-rated securities have a lower degree of protection with respect to principal and interest payments than do investors in higher rated securities.

During an economic downturn, a substantial period of rising interest rates or a recession, issuers of lower-rated securities may experience financial distress possibly resulting in insufficient revenues to meet their principal and interest payment obligations, to meet projected business goals and to obtain additional financing. An economic downturn could also disrupt the market for lower-rated securities and adversely affect the ability of the issuers to repay principal and interest. If the issuer of a security held by the Trust defaults, the Trust may not receive full interest and principal payments due to it and could incur additional expenses if it chose to seek recovery of its investment.

Interest rate risk is the risk that fixed income investments such as preferred securities, and to a lesser extent dividend-paying common stocks such as REIT common stocks, will decline in value because of changes in market interest rates. When market interest rates rise, the market value of such securities generally will fall. The Trust’s investment in such securities means that the net asset value and market price of its common shares will tend to decline if market interest rates rise. Because market interest rates are currently near their lowest levels in many years, there is a greater than normal risk that the Trust’s portfolio will decline in value due to rising interest rates. Your common shares at any point in time may be worth less than what you invested, even after taking into account the reinvestment of Trust dividends and distributions. The Trust utilizes leverage, which magnifies interest rate risk.

For general portfolio management purposes, the Trust may use various other investment management techniques that also involve certain risks and special considerations, including engaging in hedging and risk management transactions, including interest rate swaps and options and foreign currency transactions. These strategic transactions will be entered into to seek to manage the risks of the Trust’s portfolio of securities, but may have the effect of limiting the gains from favorable market movements.

Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the value of money. As inflation increases, the real value of the common shares and distributions can decline and the dividend payments in respect of preferred shares, if any, or interest payments on any borrowings may increase.

Deflation risk is the risk that the Trust’s dividends may be reduced in the future as lower prices reduce interest rates and earning power, resulting in lower distributions on the assets owned by the Trust.

Shares of

closed-end

management investment companies frequently trade at a discount from their net asset value. This characteristic is a risk separate and distinct from the risk that the Trust’s net asset value could decrease as a result of Trust investment activities and may be greater for investors expecting to sell their shares in a relatively short period following the offering of Preferred Shares. Whether investors will realize gains or losses upon the sale of the shares will depend

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

13 |

|

not upon the Trust’s net asset value but entirely upon whether the market price of the shares at the time of sale is above or below the investor’s purchase price for the shares. Because the market price of the shares will be determined by factors such as relative supply of and demand for shares in the market, general market and economic conditions, and other factors beyond the control of the Trust, we cannot predict whether the shares will trade at, below or above net asset value, or at, below or above the initial public offering price.

An investment in the Trust is subject to investment risk, including the possible loss of the entire principal amount that you invest.

The Trust’s Amended and Restated Agreement and Declaration of Trust (the “Agreement and Declaration of Trust”) includes provisions that could limit the ability of other entities or persons to acquire control of the Trust or convert the Trust to

open-end

status. These provisions could deprive the holders of common shares of opportunities to sell their common shares at a premium over the then current market price of the common shares or at net asset value. In addition, if the Trust issues Preferred Shares, the holders of the Preferred Shares will have voting rights that could deprive holders of common shares of such opportunities.

A disruption of the U.S. or world financial markets could impact interest rates, auctions, secondary trading, ratings, credit risk, inflation and other factors relating to the common shares.

The Trust invests a substantial portion of its assets (“concentrates”) in a particular market, industry, group of industries, country, region, group of countries, asset class or sector generally is subject to greater risk than a portfolio that invests in a more diverse investment portfolio. In addition, the value of the Trust’s portfolio is more susceptible to any single economic, market, political or regulatory occurrence affecting, for example, that particular market, industry, region or sector. This is because, for example, issuers in a particular market, industry, region or sector often react similarly to specific economic, market, regulatory, or political developments.

|

|

|

|

|

|

|

CBRE Global Real Estate Income Fund |

|

Confidential & Proprietary |

|

|

14 |

|

Financial

Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Securities* – 125.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

830,420 |

|

|

|

|

|

|

Charter Hall Group |

|

|

|

|

|

$ |

6,822,327 |

|

|

|

|

|

|

| |

1,525,133 |

|

|

|

|

|

|

Dexus |

|

|

|

|

|

|

7,992,400 |

|

|

|

|

|

|

| |

2,931,273 |

|

|

|

|

|

|

Mirvac Group |

|

|

|

|

|

|

4,180,332 |

|

|

|

|

|

|

| |

5,015,696 |

|

|

|

|

|

|

Scentre Group |

|

|

|

|

|

|

10,233,181 |

|

|

|

|

|

|

| |

8,780,872 |

|

|

|

|

|

|

Vicinity Centres |

|

|

|

|

|

|

12,222,951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41,451,191 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

167,362 |

|

|

|

|

|

|

Aedifica SA |

|

|

|

|

|

|

11,767,439 |

|

|

|

|

|

|

| |

93,958 |

|

|

|

|

|

|

Cofinimmo SA |

|

|

|

|

|

|

7,410,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,178,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

176,498 |

|

|

|

|

|

|

Canadian Apartment Properties REIT |

|

|

|

|

|

|

6,532,006 |

|

|

|

|

|

|

| |

728,500 |

|

|

|

|

|

|

Chartwell Retirement Residences |

|

|

|

|

|

|

6,475,064 |

|

|

|

|

|

|

| |

939,900 |

|

|

|

|

|

|

H&R Real Estate Investment Trust |

|

|

|

|

|

|

7,056,734 |

|

|

|

|

|

|

| |

850,000 |

|

|

|

|

|

|

RioCan Real Estate Investment Trust |

|

|

|

|

|

|

12,002,882 |

|

|

|

|

|

|

| |

1,060,471 |

|

|

|

|

|

|

Tricon Residential, Inc. |

|

|

|

|

|

|

9,650,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41,716,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

674,037 |

|

|

|

|

|

|

Klepierre SA |

|

|

|

|

|

|

18,376,194 |

|

|

|

|

|

|

| |

130,279 |

|

|

|

|

|

|

Unibail-Rodamco-Westfield (a) |

|

|

|

|

|

|

9,630,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,006,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

105,598 |

|

|

|

|

|

|

LEG Immobilien SE (a) |

|

|

|

|

|

|

9,252,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hong Kong – 6.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,837,310 |

|

|

|

|

|

|

CK Asset Holdings Ltd. |

|

|

|

|

|

|

9,223,550 |

|

|

|

|

|

|

| |

4,706,470 |

|

|

|

|

|

|

Link REIT |

|

|

|

|

|

|

26,429,838 |

|

|

|

|

|

|

| |

2,348,000 |

|

|

|

|

|

|

New World Development Co. Ltd. |

|

|

|

|

|

|

3,644,436 |

|

|

|

|

|

|

| |

4,382,000 |

|

|

|

|

|

|

Swire Properties Ltd. |

|

|

|

|

|

|

8,866,640 |

|

|

|

|

|

|

| |

1,422,303 |

|

|

|

|

|

|

Wharf Real Estate Investment Co. Ltd. |

|

|

|

|

|

|

4,808,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52,973,141 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

3,139 |

|

|

|

|

|

|

Activia Properties, Inc. |

|

|

|

|

|

|

8,650,174 |

|

|

|

|

|

|

| |

7,321 |

|

|

|

|

|

|

AEON REIT Investment Corp. |

|

|

|

|

|

|

7,342,810 |

|

|

|

|

|

|

| |

11,306 |

|

|

|

|

|

|

Japan Hotel REIT Investment Corp. |

|

|

|

|

|

|

5,549,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

24,096 |

|

|

|

|

|

|

Japan Metropolitan Fund Investment Corp. |

|

|

|

|

|

$ |

17,416,530 |

|

|

|

|

|

|

| |

6,880 |

|

|

|

|

|

|

Kenedix Office Investment Corp. |

|

|

|

|

|

|

7,847,241 |

|

|

|

|

|

|

| |

10,619 |

|

|

|

|

|

|

LaSalle Logiport REIT |

|

|

|

|

|

|

11,449,057 |

|

|

|

|

|

|

| |

10,122 |

|

|

|

|

|

|

Orix JREIT, Inc. |

|

|

|

|

|

|

11,954,270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70,209,629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

3,822,800 |

|

|

|

|

|

|

CapitaLand Ascendas REIT |

|

|

|

|

|

|

8,781,051 |

|

|

|

|

|

|

| |

11,760,444 |

|

|

|

|

|

|

CapitaLand China Trust |

|

|

|

|

|

|

8,291,420 |

|

|

|

|

|

|

| |

9,348,612 |

|

|

|

|

|

|

CapitaLand Integrated Commercial Trust |

|

|

|

|

|

|

14,599,455 |

|

|

|

|

|

|

| |

5,878,600 |

|

|

|

|

|

|

Frasers Logistics & Commercial Trust |

|

|

|

|

|

|

5,125,002 |

|

|

|

|

|

|

| |

8,338,000 |

|

|

|

|

|

|

Keppel REIT |

|

|

|

|

|

|

5,878,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,675,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,142,990 |

|

|

|

|

|

|

Merlin Properties Socimi SA |

|

|

|

|

|

|

12,701,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

891,381 |

|

|

|

|

|

|

Castellum AB (a) |

|

|

|

|

|

|

12,674,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,200,719 |

|

|

|

|

|

|

British Land Co. PLC (The) |

|

|

|

|

|

|

6,116,559 |

|

|

|

|

|

|

| |

2,598,836 |

|

|

|

|

|

|

Land Securities Group PLC |

|

|

|

|

|

|

23,349,901 |

|

|

|

|

|

|

| |

829,603 |

|

|

|

|

|

|

Safestore Holdings PLC |

|

|

|

|

|

|

9,348,950 |

|

|

|

|

|

|

| |

2,668,000 |

|

|

|

|

|

|

Supermarket Income REIT PLC |

|

|

|

|

|

|

2,955,601 |

|

|

|

|

|

|

| |

2,696,061 |

|

|

|

|

|

|

Tritax Big Box REIT PLC |

|

|

|

|

|

|

5,804,965 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47,575,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

178,107 |

|

|

|

|

|

|

Alexandria Real Estate Equities, Inc. |

|

|

|

|

|

|

22,578,624 |

|

|

|

|

|

|

| |

55,905 |

|

|

|

|

|

|

American Tower Corp. |

|

|

|

|

|

|

12,068,771 |

|

|

|

|

|

|

| |

372,093 |

|

|

|

|

|

|

Apartment Income REIT Corp. |

|

|

|

|

|

|

12,922,790 |

|

|

|

|

|

|

| |

154,739 |

|

|

|

|

|

|

AvalonBay Communities, Inc. |

|

|

|

|

|

|

28,970,236 |

|

|

|

|

|

|

| |

791,471 |

|

|

|

|

|

|

Brixmor Property Group, Inc. |

|

|

|

|

|

|

18,417,530 |

|

|

|

|

|

|

| |

652,710 |

|

|

|

|

|

|

Broadstone Net Lease, Inc. |

|

|

|

|

|

|

11,239,666 |

|

|

|

|

|

|

| |

139,875 |

|

|

|

|

|

|

Camden Property Trust |

|

|

|

|

|

|

13,888,189 |

|

|

|

|

|

|

| |

333,020 |

|

|

|

|

|

|

Crown Castle, Inc. |

|

|

|

|

|

|

38,360,574 |

|

|

|

|

|

|

| |

741,425 |

|

|

|

|

|

|

CubeSmart |

|

|

|

|

|

|

34,365,049 |

|

|

|

|

|

|

| |

941,762 |

|

|

|

|

|

|

Empire State Realty Trust, Inc., Class A |

|

|