IQVIA Institute: Innovative Therapies and Strong Pipeline to Combat Rise in Cancer Diagnoses

10 Juin 2024 - 2:00PM

Business Wire

- Cancer incidence is expected to rise significantly through

2050, particularly in lower-income countries, to 32 million new

cases annually – a potential increase of more than 12 million new

annual cases

- Global spending on cancer medicine increased to $223 billion in

2023, $25 billion more than in 2022, and is projected to reach $409

billion by 2028

- In 2023, 25 oncology novel active substances (NASs) were

launched globally, reaching a total of 193 since 2014 – however,

large geographic variations exist in availability of these

medicines

- More than 2,000 new oncology clinical trials started in 2023

with novel modalities and significant promise for cancer treatment,

including cell and gene therapies, antibody-drug conjugates,

multispecific antibodies, and radioligand therapies

- Cancer treatments have increased 9% annually since 2019 but the

pace of bringing novel therapies to patients is uneven due to

differences in biomarker testing rates, adoption of novel therapies

and lack of infrastructure capacity to deliver some of the most

advanced therapies

As cancer incidence continues to rise, it’s being met by wider

use of innovative therapies and a robust pipeline of new drugs,

according to a new report from the IQVIA Institute for Human Data

Science titled, “Global Oncology Trends 2024: Outlook to 2028.”

“The global oncology ecosystem is operating near peak levels to

address increasing challenges. New therapies for advanced cancers,

including some of the most advanced novel science in the industry,

are under development or have been recently launched,” said Murray

Aitken, Executive Director, the IQVIA Institute for Human Data

Science. “These therapies represent the largest area of collective

research and drug spending across all of healthcare. Yet despite

significant advances in treatment and better access to care, the

global oncology community and patients continue to struggle with

disparities in access and care.”

A few key highlights in the report include:

- Trends in cancer incidence and mortality: Cancer

incidence is expected to rise significantly through 2050,

particularly in lower-income countries, to 32 million new cases

annually – a potential increase of more than 12 million new annual

cases. The growing disease burden underscores the urgent need for

new treatments to enhance survival and quality of life. Disparities

in five-year cancer survival across countries with similar GDP

levels indicate that different healthcare strategies may lead to

better outcomes for certain cancers. The variability in cancer

severity and progression, along with healthcare system differences,

suggests that tailored strategies, such as focusing on early

detection or enhancing survivorship and quality of life, could be

more effective for certain cancers.

- Oncology research and development activities: In 2023,

more than 2,000 oncology trials started, fewer than the past two

years of rebounding from the COVID-19 pandemic and 11% higher than

in 2019. Emerging biopharma companies accounted for 60% of these

trials, a significant increase from 33% in 2013. Novel modalities,

including cell and gene therapies, antibody-drug conjugates (ADCs)

and multispecific antibodies, show significant promise for cancer

treatment and represent a growing share of clinical research.

Trials involving PD-1/PD-L1 inhibitors grew 29% over the last five

years, investigating across more tumors and in earlier lines of

therapy. More than 250 trials testing CAR T-cell therapies in

oncology started in 2023 and while the majority investigated for

hematological cancers, the therapies were increasingly viewed

across a range of solid tumors. Fifteen ADCs have been approved

globally and the number of ADC trials grew 26% from 2022 to 2023 as

more companies invested in these targeted chemotherapeutics.

Development of these novel treatments is being accelerated by

regulator and industry initiatives, including the use of artificial

intelligence to advance new therapies.

- Oncology clinical development productivity: The oncology

composite success rate increased to 10% in 2023 from 4% the year

prior, with improvements across all phases, especially in rare

oncology and solid tumor research. While oncology trials remain

complex, their level of complexity – a comparison of a number of

factors, including the number of countries, sites, patients,

eligibility criteria, and clinical endpoints – has decreased by 8%

since 2019, in contrast to a 2% increase in complexity for other

disease areas. The number of subjects enrolled in oncology trials

is down 11% in 2023 from the peak in 2021. Western European

countries are included in trials the most often, although China and

North American country inclusion has increased significantly in

recent years. Despite a reduction in trial durations, the overall

length of all oncology programs was only shortened by an average of

five months due to an increase in the time between trial completion

and starting the next phase. Improved success and declining

complexity resulted in a 23% improvement in productivity in

oncology clinical development in 2023.

- Novel active substances (NASs) in oncology: In 2023, 25

oncology NASs were launched globally, reaching a total of 193 since

2014 – however, large geographic variations exist in the

availability of these medicines. The number of NAS launches in

China over the last five years exceeded those in the U.S. While

many of these new medicines in China are driven by domestic

innovation, most have previously launched globally. New medicine

launches in Europe have slowed, resulting in delays in the

availability of innovative medicines compared to the U.S. – 38% of

U.S. oncology NASs in the past 10 years are not yet available in

Europe. Eighteen new cancer medicines were introduced in the U.S.

in 2023 and these new drugs are largely targeting rare cancers, are

recombinant and are often approved based on a single clinical

trial. The European Medicines Agency approved eight NASs for

hematological cancers and five for solid tumors in 2023, fewer than

the 14 approved in 2022.

- Cancer patient access and use of scientific advances:

The total number of cancer treatment regimens provided globally –

defined as the number of patients treated with a regimen in a time

period, whether one cycle or multiple – has increased by an average

of 9% annually since 2019 due to higher cancer rates and better

access to care. Despite this growth, the pace of novel cancer

therapies arriving to patients is uneven across countries, with

differences in biomarker testing rates, adoption of novel

therapies, and the lack of infrastructure capacity to deliver some

of the most advanced therapies. Treatment of women’s cancers,

prostate cancer and late-stage multiple myeloma has advanced in

recent years as novel modalities, including antibody-drug

conjugates, radiopharmaceuticals, bispecifc antibodies and CAR

T-cell therapies have been introduced – providing better outcomes

for patients.

- Spending on oncology medicines: Global spending on

cancer medicine increased to $223 billion in 2023, $25 billion more

than in 2022, and is projected to rise to $409 billion by 2028.

This growth is attributed to the volume of protected brands and the

introduction of new products in the past five years, despite losses

of exclusivity for some treatments. Biosimilars have been widely

adopted in major markets, leading to significant cost savings.

Notably, six major tumor categories experienced double-digit growth

in spending due to breakthrough medicines and improved patient

access. PD-1/PD-L1 inhibitors, which are widely used in solid tumor

treatments, accounted for $52 billion in spending in 2023, with

expectations to increase to more than $90 billion by 2028. The

future of next-generation biotherapeutics in oncology is marked by

clinical and commercial uncertainties, yet annual spending could

still potentially rise from $4 billion to $23 billion by 2028.

About the IQVIA Institute for Human Data Science

The IQVIA Institute for Human Data Science contributes to the

advancement of human health globally through timely research,

insightful analysis and scientific expertise applied to granular

non-identified patient-level data.

Fulfilling an essential need within healthcare, the Institute

delivers objective, relevant insights and research that accelerate

understanding and innovation critical to sound decision making and

improved human outcomes. With access to IQVIA’s institutional

knowledge, advanced analytics, technology and unparalleled data,

the Institute works in tandem with a broad set of healthcare

stakeholders to drive a research agenda focused on Human Data

Science, including government agencies, academic institutions, the

life sciences industry, and payers. More information about the

IQVIA Institute can be found at www.IQVIAInstitute.org.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced

analytics, technology solutions, and clinical research services to

the life sciences industry. IQVIA creates intelligent connections

across all aspects of healthcare through its analytics,

transformative technology, big data resources and extensive domain

expertise. IQVIA Connected Intelligence™ delivers powerful insights

with speed and agility — enabling customers to accelerate the

clinical development and commercialization of innovative medical

treatments that improve healthcare outcomes for patients. With

approximately 87,000 employees, IQVIA conducts operations in more

than 100 countries.

IQVIA is a global leader in protecting individual patient

privacy. The company uses a wide variety of privacy-enhancing

technologies and safeguards to protect individual privacy while

generating and analyzing information on a scale that helps

healthcare stakeholders identify disease patterns and correlate

with the precise treatment path and therapy needed for better

outcomes. IQVIA’s insights and execution capabilities help biotech,

medical device and pharmaceutical companies, medical researchers,

government agencies, payers and other healthcare stakeholders tap

into a deeper understanding of diseases, human behaviors, and

scientific advances, in an effort to advance their path toward

cures. To learn more, visit www.iqvia.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240610612636/en/

Kerri Joseph, IQVIA Investor Relations (kerri.joseph@iqvia.com)

+1.973.541.3558

Trent Brown, IQVIA Media Relations (trent.brown@iqvia.com)

+1.919.780.3221

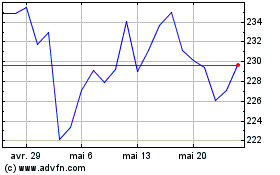

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

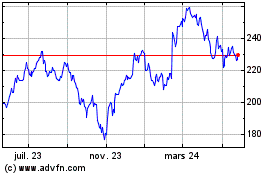

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024